DIpil Das

What’s the Story?

H&M and Inditex (owner of Zara) are the world’s two largest apparel and footwear specialist retailers in terms of revenue. The two retailers are often referenced as fast-fashion intruders—capturing market share from mass-market rivals across the globe. As part of Coresight Research’s Head-to-Head series, we provide insights into five key elements of H&M's and Inditex’s businesses.Why It Matters

The global apparel and footwear specialty market will reach $1.2 trillion by 2025, with a CAGR of 11.7% from 2020, according to Euromonitor International. Inditex and H&M are two of the world’s biggest players and hold market shares of 2.6% and 1.3%, respectively, within a highly fragmented global apparel and footwear specialty market—making for insightful comparison of their business approaches and success.H&M vs. Inditex: A Deep Dive

Overview We provide a comparison of key facts and top-line figures for each company in Figure 1. By revenue, Inditex is 11% larger than H&M and also has a higher store and employee count.Figure 1. Company Overviews: H&M and Inditex [wpdatatable id=1238 table_view=regular]

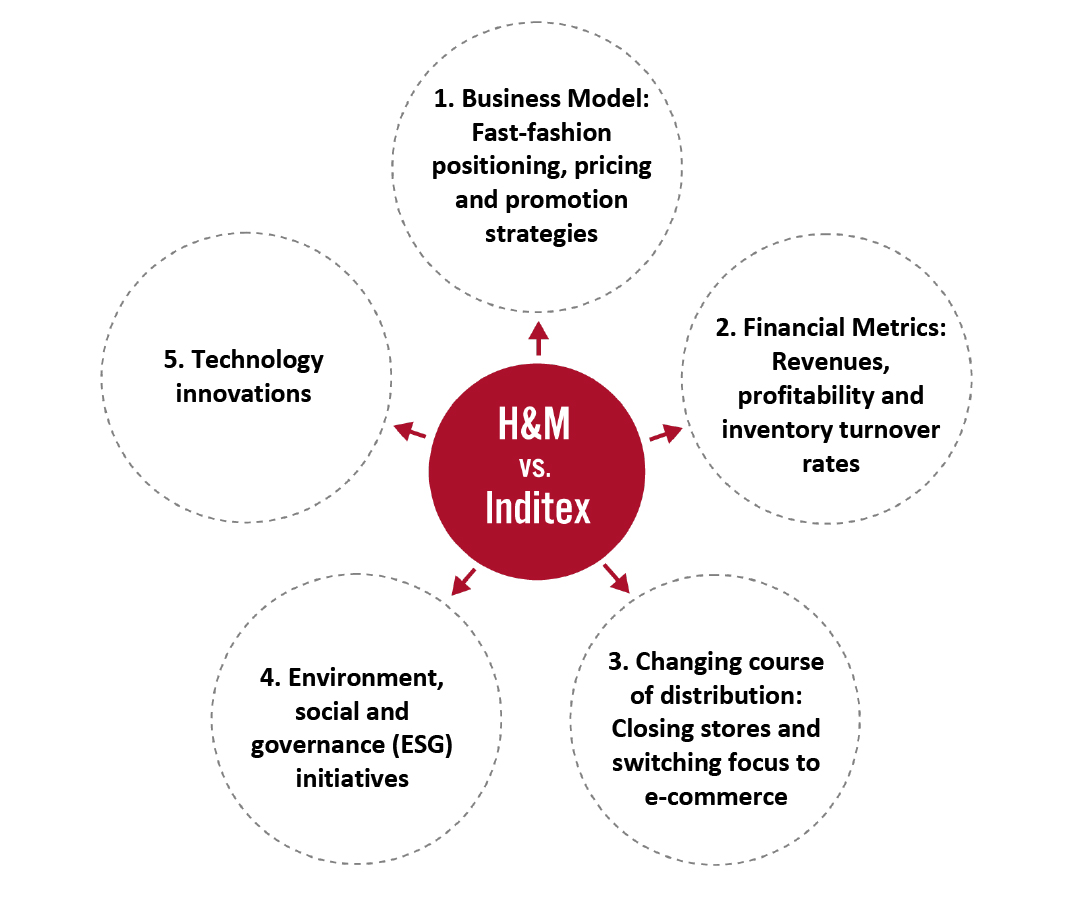

*Latest full-year data available: H&M’s fiscal year 2020 ended November 30, 2020, and Inditex’s fiscal year 2021 ended January 31, 2021 Source: Company reports We cover five key metrics/performance characteristics for each company in the subsequent sections, as mapped out in Figure 2.

Figure 2. Key Metrics/Performance Characteristics: H&M and Inditex Head-to-Head [caption id="attachment_132294" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

1. Business Model: Fast-Fashion Positioning and Pricing and Promotion Strategies

H&M and Inditex employ very different business models to achieve success in the apparel specialty industry. H&M’s brand positioning is broad, appealing to families, millennials and Gen-Z consumers through designer collaborations and very low prices. On the other hand, Inditex focuses on creating aspirational products with elevated price points and subtle discounting during key sales periods.

Fast-Fashion Positioning

Inditex is predominantly a fast-fashion retailer and designs around 50–60% of its products in season, according to Coresight Research analysis of the company’s reported data on factory locations and lead time to market. In contrast, H&M designs around 20% of its clothes in season in response to current trends, while 80% of products are ordered months in advance. We analyze H&M’s and Inditex’s lead time to market, factory locations and in-house sourcing/designs capabilities to provide a detailed picture of the two retailers’ positions in the fast-fashion market.

Lead Time

Fast fashion is manufactured with short lead times in response to fashion trends and consumer demand.

For products manufactured in close to its sale locations, referred to as proximity markets, Inditex takes about three weeks to get items from design to sale, and the company replenishes its stock of existing designs twice a week. On the other hand, H&M takes two to six weeks to get fast-fashion products to market.

Factory Locations

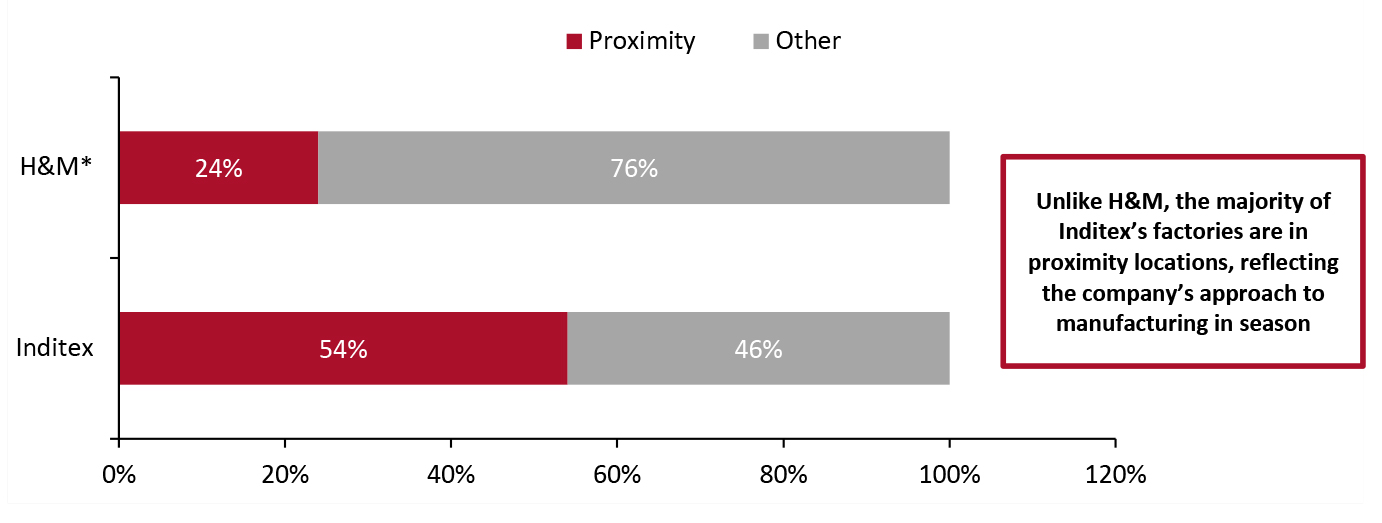

The distribution of factory locations used by H&M and Inditex reflects each company’s in-season fast-fashion production strategy.

While 54% of Inditex’s factories are located close to its headquarters in A Coruña, (elsewhere in Spain, or in Morocco, Portugal and Turkey) only 24% of those used by H&M are in such “proximity” locations. Most of H&M’s manufacturing capacity is in Asia, which is a cheaper sourcing destination compared to Europe but requires greater lead times due to shipping.

Source: Coresight Research[/caption]

1. Business Model: Fast-Fashion Positioning and Pricing and Promotion Strategies

H&M and Inditex employ very different business models to achieve success in the apparel specialty industry. H&M’s brand positioning is broad, appealing to families, millennials and Gen-Z consumers through designer collaborations and very low prices. On the other hand, Inditex focuses on creating aspirational products with elevated price points and subtle discounting during key sales periods.

Fast-Fashion Positioning

Inditex is predominantly a fast-fashion retailer and designs around 50–60% of its products in season, according to Coresight Research analysis of the company’s reported data on factory locations and lead time to market. In contrast, H&M designs around 20% of its clothes in season in response to current trends, while 80% of products are ordered months in advance. We analyze H&M’s and Inditex’s lead time to market, factory locations and in-house sourcing/designs capabilities to provide a detailed picture of the two retailers’ positions in the fast-fashion market.

Lead Time

Fast fashion is manufactured with short lead times in response to fashion trends and consumer demand.

For products manufactured in close to its sale locations, referred to as proximity markets, Inditex takes about three weeks to get items from design to sale, and the company replenishes its stock of existing designs twice a week. On the other hand, H&M takes two to six weeks to get fast-fashion products to market.

Factory Locations

The distribution of factory locations used by H&M and Inditex reflects each company’s in-season fast-fashion production strategy.

While 54% of Inditex’s factories are located close to its headquarters in A Coruña, (elsewhere in Spain, or in Morocco, Portugal and Turkey) only 24% of those used by H&M are in such “proximity” locations. Most of H&M’s manufacturing capacity is in Asia, which is a cheaper sourcing destination compared to Europe but requires greater lead times due to shipping.

Figure 3. H&M and Inditex: Split of Factory Locations–Proximity Locations vs. Other** [caption id="attachment_132295" align="aligncenter" width="724"]

*H&M data are for manufacturing factories only, excluding processing factories and fabric/yarn factories

*H&M data are for manufacturing factories only, excluding processing factories and fabric/yarn factories **Proximity locations include Europe, Turkey and North Africa, while Other comprises Asia, Americas and Oceania

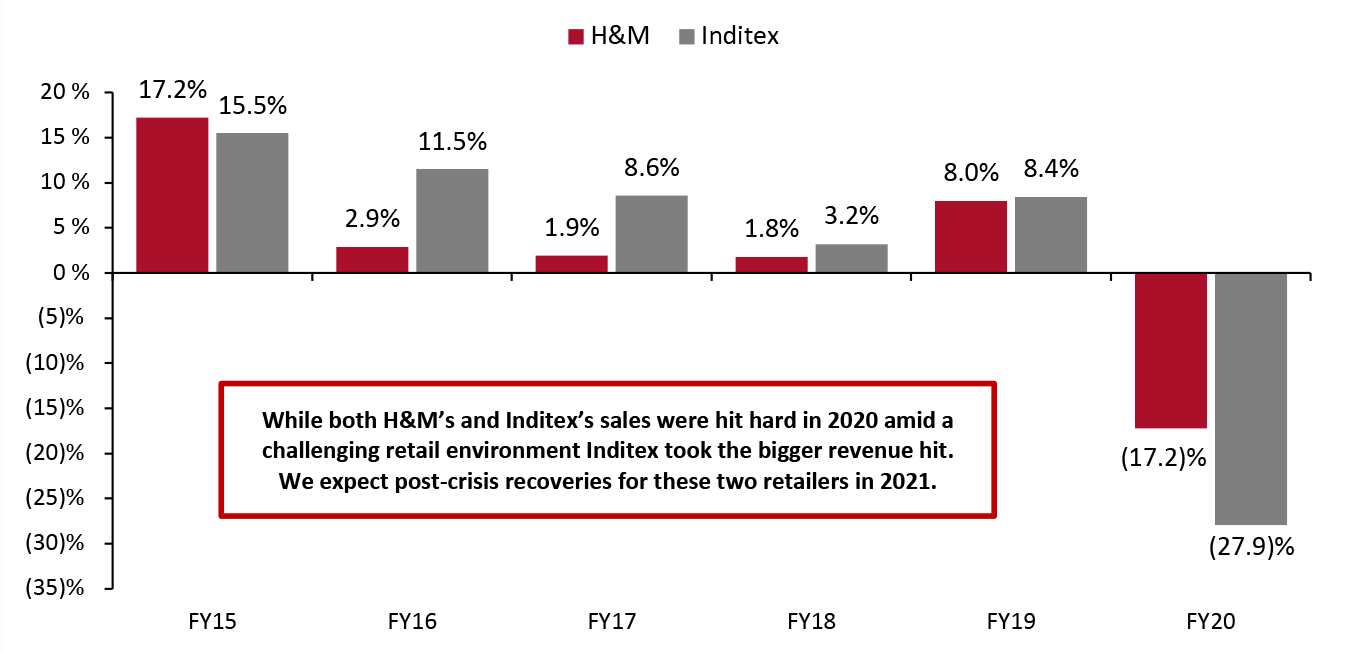

Source: Company reports/Coresight Research [/caption] In-House Sourcing and Design H&M does not own factories, while Inditex is partially vertically integrated. Inditex currently owns 11 factories in Arteixo, where its head office is located, focused on skilled work such as cutting out garment pieces. However, Inditex’s own factories account for only 0.2% of the company’s manufacturing capacity, as of July 2020. In terms of in-house design, Inditex currently has design teams of “over 700 individuals.” H&M, on the other hand, has a much smaller design team, employing 100–200 people. Pricing and Promotion Strategy H&M and Inditex deploy very different pricing and promotion strategies. While H&M keeps product prices very low and makes more frequent and aggressive markdowns, Inditex takes a subtler approach to price reduction. Inditex largely only reduces prices of items during key sales season, for instance, Zara’s biannual sales start in the third week of June and the day after Christmas. In terms of promotion strategy, H&M spends more on advertising than Inditex. H&M mainly focuses on push-marketing strategies centered around traditional paid advertising and designer campaigns to engage shoppers. Comparatively, Inditex does not invest in TV, radio or press ads but has a strong presence on social media platforms such as Instagram. Inditex cultivates its customers as brand evangelists who share their experience about the brand/products through social media channels, driving consumer engagement. As a different form of promotion, we believe that Inditex’s approach to product replenishment is a key competitive advantage. The company drives up sales by limiting its inventory supply of trending and fashionable clothing in its stores, thereby creating artificial scarcity. As a result, consumers shop at Inditex stores more frequently to see what is new or to check stock, with this strategy feeding into the company’s logistic, inventory management and supply chain strategy. 2. Financial Metrics: Revenues, Profitability and Inventory Turnover Rates Revenue Total sales growth at both H&M and Inditex has been supported by new store openings in recent years. Prior to the pandemic, Inditex had been growing faster than H&M, as shown in Figure 4—however, the revenue growth gap between the two substantially narrowed in fiscal 2018 and 2019 as H&M aggressively expanded its store portfolio. We discuss the store estates of the two retailers in detail in the next section. Sales at H&M and Inditex were hit hard amid the pandemic in 2020, with Inditex’s revenue dropping most substantially—likely given that its positioning is more high-end than H&M. The company recorded a year over year revenue growth decline of 10.7 percentage points more than H&M. Coresight Research expects to see post-crisis recovery in the apparel and footwear specialty sectors in the US, the UK and China, where H&M and Inditex hold a dominant position.

Figure 4. H&M vs. Inditex: Revenue Growth (YoY % Change) [caption id="attachment_132296" align="aligncenter" width="725"]

H&M’s fiscal year ends on November 30 and Inditex’s ends on January 31

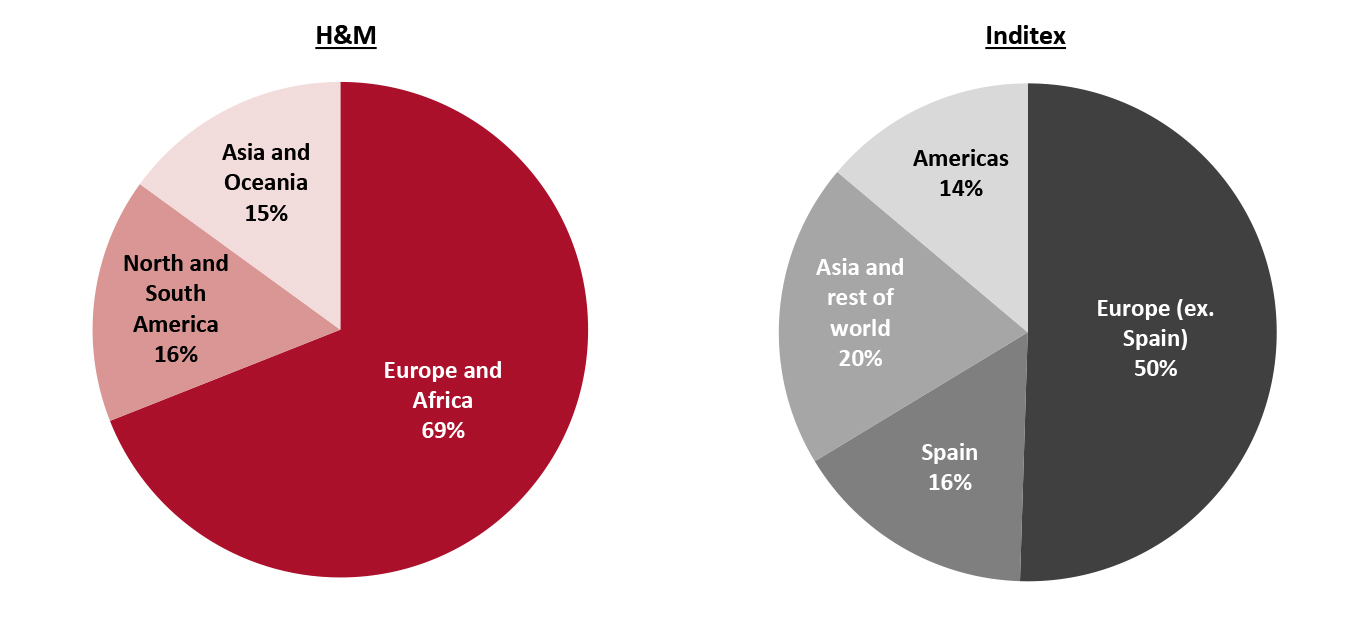

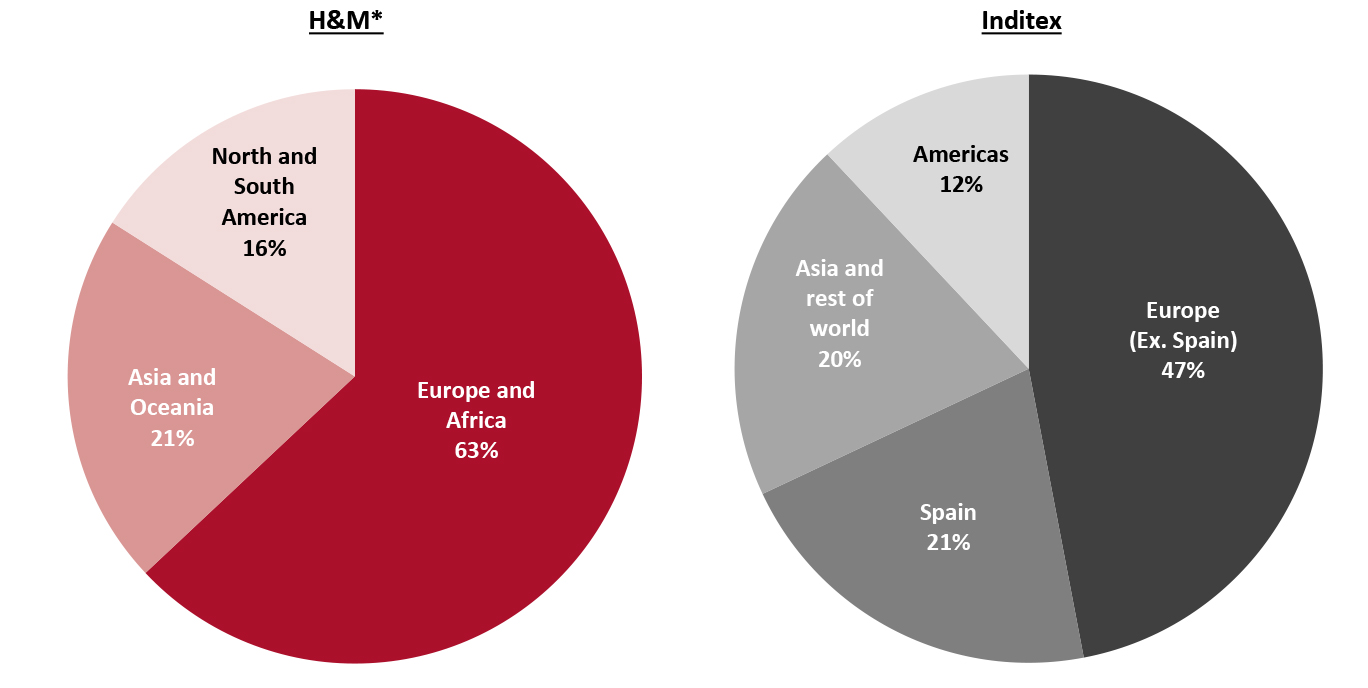

H&M’s fiscal year ends on November 30 and Inditex’s ends on January 31 Source: Company reports [/caption] Revenue by Geographical Area The regional sales split is one area of relative commonality between the two companies. In its latest fiscal year, H&M generated 69% of its total revenue from Europe and Africa, while Inditex generated 66% of its total revenues from Europe (including Spain), as shown in Figure 5.

Figure 5. H&M vs. Inditex: Revenue Breakdown by Geographic Region (FY20) [caption id="attachment_132297" align="aligncenter" width="724"]

Source: Company reports[/caption]

Revenue by Banner

Both Inditex and H&M are multi-banner groups, although H&M was traditionally a mono-brand retailer and launched its additional banners from 2000 onward. At present, H&M owns eight banners: & Other Stories, Afound, ARKET, COS, H&M, H&M Home, Monki and Weekday. H&M does not split out revenues by banner.

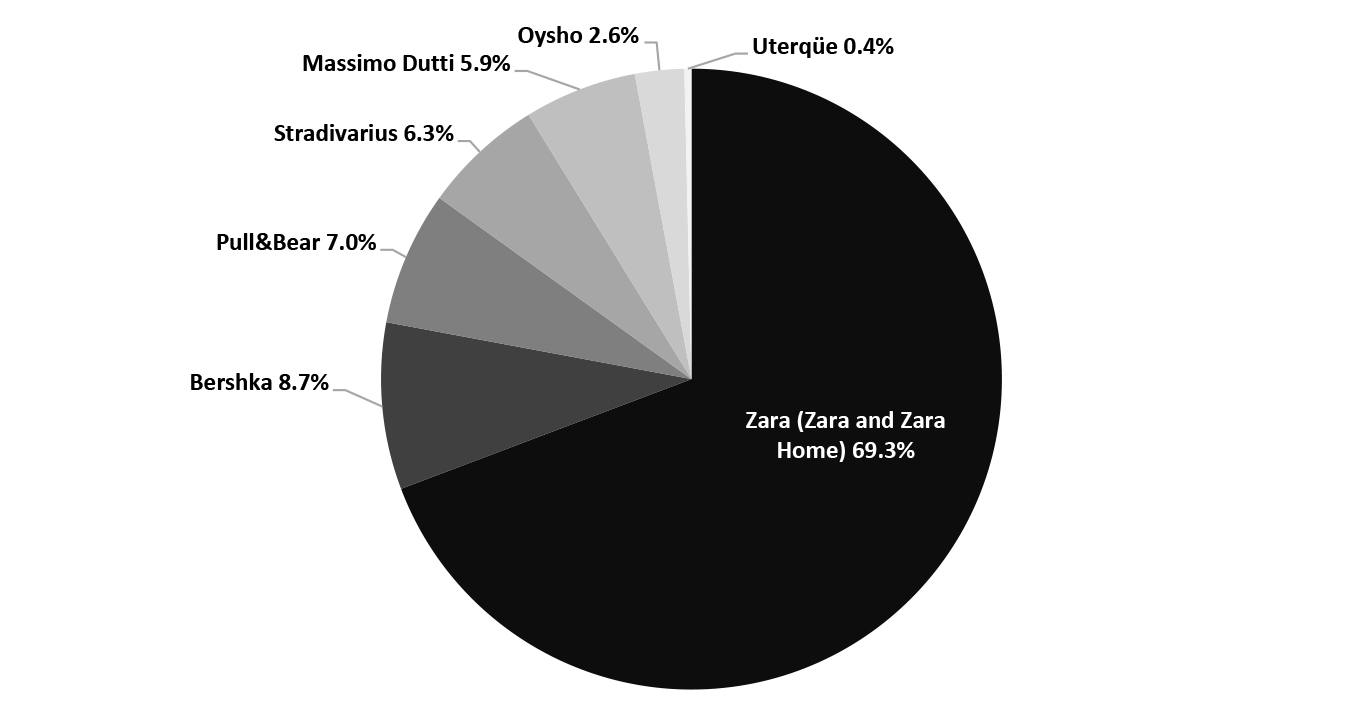

On the other hand, Inditex splits out revenues by banner. Its Zara banner continues to dominate, accounting for more than two-thirds of Inditex’s revenues in its fiscal 2020, as charted in Figure 6.

The Zara banner has been at forefront of the company’s product expansion. On May 12, 2021, Zara launched a cosmetics line Zara Beauty, which offers a full range of beauty products. Zara Beauty is available to purchase online in Europe, Australia, Canada, China, Japan, Mexico, New Zealand and South Korea, along with 22 stores across Australia, Belgium, China, France, Germany, Italy, Japan, the Netherlands, Russia, Serbia, South Korea, Spain, Switzerland, Turkey, the UK and the US.

Source: Company reports[/caption]

Revenue by Banner

Both Inditex and H&M are multi-banner groups, although H&M was traditionally a mono-brand retailer and launched its additional banners from 2000 onward. At present, H&M owns eight banners: & Other Stories, Afound, ARKET, COS, H&M, H&M Home, Monki and Weekday. H&M does not split out revenues by banner.

On the other hand, Inditex splits out revenues by banner. Its Zara banner continues to dominate, accounting for more than two-thirds of Inditex’s revenues in its fiscal 2020, as charted in Figure 6.

The Zara banner has been at forefront of the company’s product expansion. On May 12, 2021, Zara launched a cosmetics line Zara Beauty, which offers a full range of beauty products. Zara Beauty is available to purchase online in Europe, Australia, Canada, China, Japan, Mexico, New Zealand and South Korea, along with 22 stores across Australia, Belgium, China, France, Germany, Italy, Japan, the Netherlands, Russia, Serbia, South Korea, Spain, Switzerland, Turkey, the UK and the US.

Figure 6. Inditex Revenue Breakdown, by Banner (FY20) [caption id="attachment_132298" align="aligncenter" width="736"]

Source: Company reports[/caption]

Profitability

Like revenue growth, operating margin (operating profit as a percentage of revenue) is a strong indicator of the business performance for large retailers, given the continual need to spend large sums of money on operating expenses, such as rent utilities and interest on debt, as well as transportation costs and marketing expenses, among others.

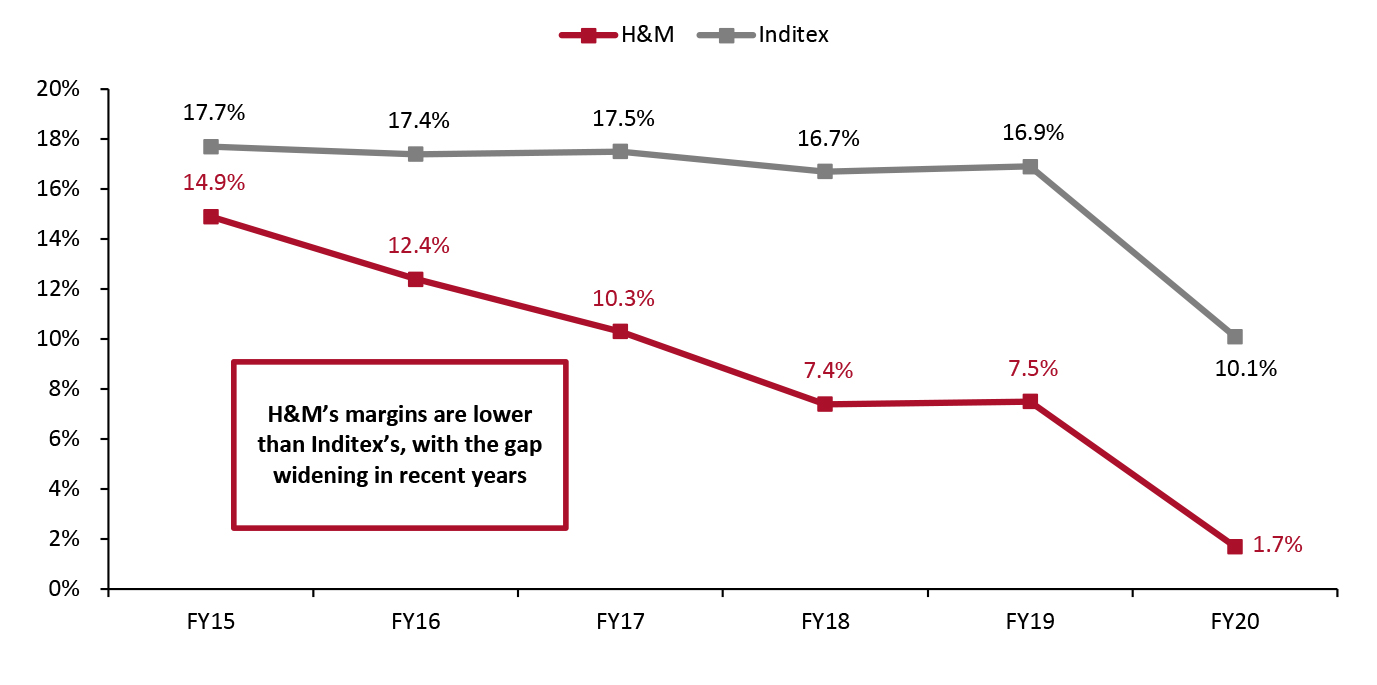

While opening new stores gave H&M an easy path to sales growth, it did not help the Swedish retailer’s profit margins, which have been deteriorating consistently since fiscal 2015. In the last six fiscal years, H&M’s margins were lower than Inditex's, with the gap widening recently. In fiscal 2020, H&M reported an operating margin of just 1.7%, which was less than one-fifth of the operating margin reported by Inditex in the same period.

In recent years, H&M’s margins have been impacted by underperformance in the company’s comparable store sales, mainly within the H&M brand. This has resulted in a high stock-in-trade level and high markdowns, with a negative leverage on its costs. Furthermore, owing to longer lead time, the Swedish retailer usually orders excess inventory from South Asian countries, mainly for seasonal categories. However, if clothes are not sold during the season, H&M typically offers deep discounts to get rid of the inventory, which impacts the company’s margins, eradicating the competitive advantage of procuring low-cost inventory from countries such as Bangladesh and India. H&M has been reducing its short-term debt over the past few years, which has significantly reduced its interest expenses (fixed cost portion of operating expenses).

By contrast, Inditex benefits from selling a large proportion of high-end apparel products at the full or near-full price, thereby preserving its margins. Furthermore, Inditex keeps operating expenses, such as advertising costs, tightly under control. The closer proximity of its factories has also helped the Spanish retailer to minimize logistics and fulfillment costs.

Going forward, we believe that cost management will be a critical factor for H&M and Inditex to bolster profitability. We expect revenue growth—the other factor in operating margins—to come under pressure at both retailers owing to growing competition from online-only retailers, including ASOS, Boohoo and Zalando.

Source: Company reports[/caption]

Profitability

Like revenue growth, operating margin (operating profit as a percentage of revenue) is a strong indicator of the business performance for large retailers, given the continual need to spend large sums of money on operating expenses, such as rent utilities and interest on debt, as well as transportation costs and marketing expenses, among others.

While opening new stores gave H&M an easy path to sales growth, it did not help the Swedish retailer’s profit margins, which have been deteriorating consistently since fiscal 2015. In the last six fiscal years, H&M’s margins were lower than Inditex's, with the gap widening recently. In fiscal 2020, H&M reported an operating margin of just 1.7%, which was less than one-fifth of the operating margin reported by Inditex in the same period.

In recent years, H&M’s margins have been impacted by underperformance in the company’s comparable store sales, mainly within the H&M brand. This has resulted in a high stock-in-trade level and high markdowns, with a negative leverage on its costs. Furthermore, owing to longer lead time, the Swedish retailer usually orders excess inventory from South Asian countries, mainly for seasonal categories. However, if clothes are not sold during the season, H&M typically offers deep discounts to get rid of the inventory, which impacts the company’s margins, eradicating the competitive advantage of procuring low-cost inventory from countries such as Bangladesh and India. H&M has been reducing its short-term debt over the past few years, which has significantly reduced its interest expenses (fixed cost portion of operating expenses).

By contrast, Inditex benefits from selling a large proportion of high-end apparel products at the full or near-full price, thereby preserving its margins. Furthermore, Inditex keeps operating expenses, such as advertising costs, tightly under control. The closer proximity of its factories has also helped the Spanish retailer to minimize logistics and fulfillment costs.

Going forward, we believe that cost management will be a critical factor for H&M and Inditex to bolster profitability. We expect revenue growth—the other factor in operating margins—to come under pressure at both retailers owing to growing competition from online-only retailers, including ASOS, Boohoo and Zalando.

Figure 7. H&M vs. Inditex: Operating Margin from FY15–20 (%) [caption id="attachment_132299" align="aligncenter" width="726"]

H&M’s fiscal year ends on November 30 and Inditex’s ends on January 31

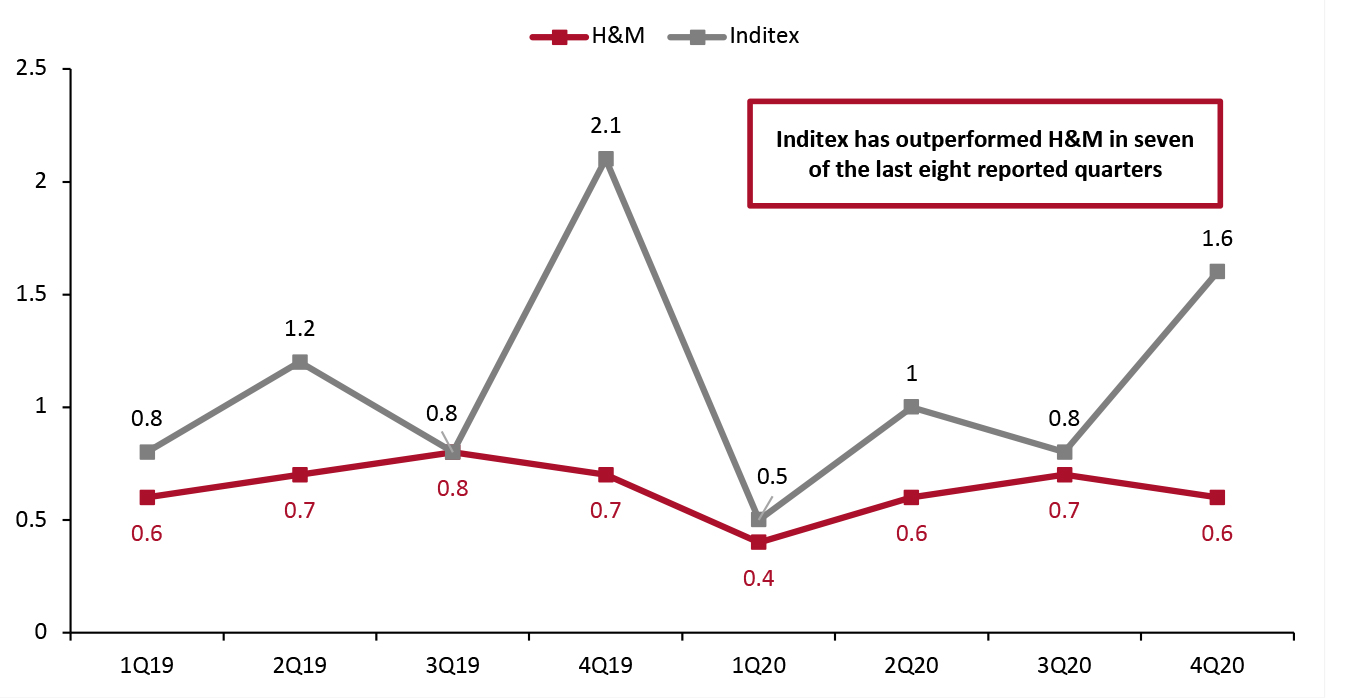

H&M’s fiscal year ends on November 30 and Inditex’s ends on January 31 Source: Company reports [/caption] Inventory Turnover Rates Inventory turnover ratio is a strong indicator of how efficiently a retailer manages its stock, showing how many times inventory turns over in a particular period. This is calculated as the cost of goods sold (i.e., the amount of goods sold at wholesale prices) divided by the amount of inventory held at the end of the period. A high inventory turnover tends to be positive for a retailer, while low or slowing inventory turnover rates may indicate lower sales and challenges in inventory management. Inditex has outperformed H&M in seven of the last eight reported quarters in its inventory turnover ratio. This is largely due to Inditex’s product centralization strategy and shorter time-to-market, which helps the company to better control inventory by limiting how much of each product is manufactured, thereby ensuring stock-to-sales parity. On the other hand, H&M has not managed its inventory well in response to consumer demand. One of the key reasons for its low rate is the company’s longer lead time to get fashion products to market amid the pandemic, as well as the ensuing supply chain disruptions.

Figure 8. H&M and Inditex: Inventory Turnover Ratios by Quarter [caption id="attachment_132300" align="aligncenter" width="725"]

H&M’s fiscal year ends on November 30 and Inditex’s ends on January 31

H&M’s fiscal year ends on November 30 and Inditex’s ends on January 31 Source: Company reports/Coresight Research [/caption] 3. Changing Course of Distribution: Shrinking Store Estates and Switching Focus to E-commerce

While past sales growth at both H&M and Inditex has been largely led by physical store expansion, the retailers have ramped up their e-commerce initiatives in recent years, with online demand seeing a strong boost amid the pandemic. Going forward, both H&M and Inditex plan to shrink their store footprints and focus more on e-commerce. Both retailers are also looking to utilize some of their larger stores as distribution hubs for online sales.

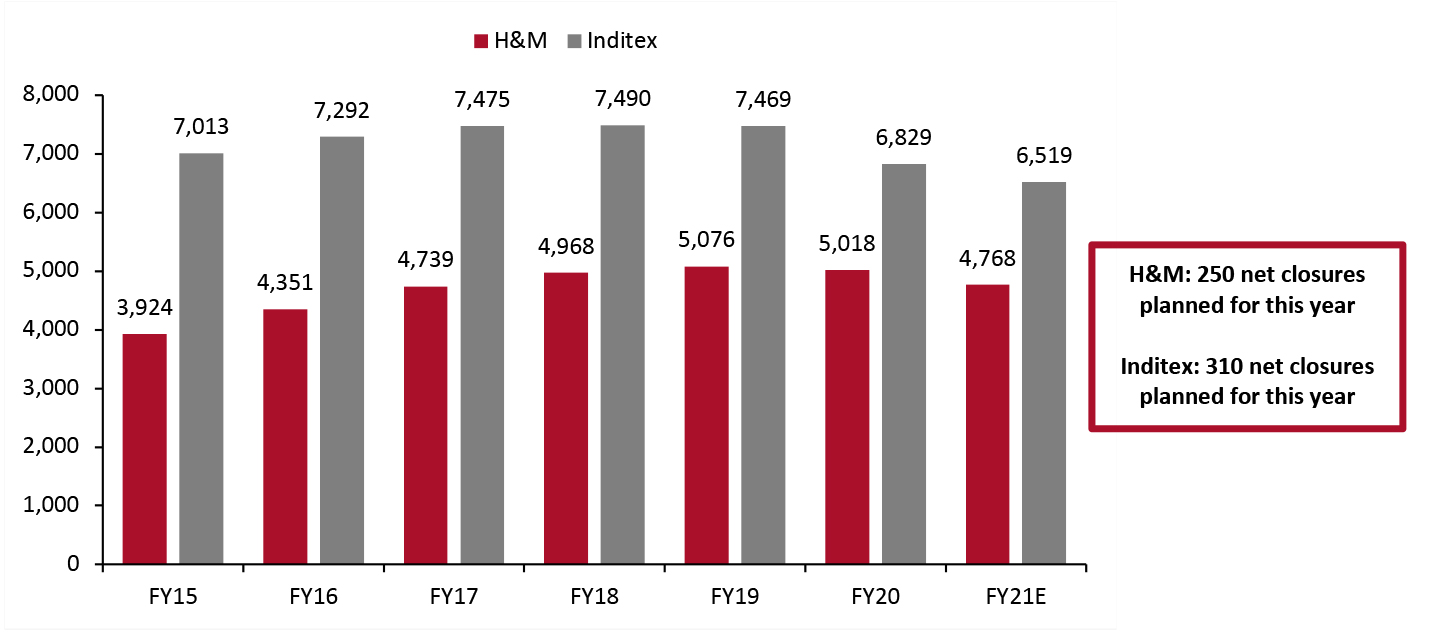

Shrinking Store Estates Prior to the pandemic, both H&M and Inditex substantially expanded their store estates, with H&M taking the most aggressive approach to expansion. Between fiscal 2015 and 2019, H&M’s store portfolio has grown at a CAGR of 6.6%, while Inditex’s store count saw a CAGR of 1.6%. However, in early 2020, both H&M and Inditex began shrinking their store estates and switched focus to e-commerce, mainly due to coronavirus-related restrictions and to capitalize on consumers’ shift to online retail. In fiscal 2020, Inditex closed 640 stores, while H&M closed 58 stores. The two retailers have continued to reduce their store bases so far in 2021. For the year ending November 2021, H&M expects to close around 350 stores and open 100 stores, resulting in a net decline of 250 stores. Similarly, we expect to see a net decline of 310 Inditex stores in the year ending January 2022. Most of Inditex’s store closures will focus on Europe and Asia, leaving its US and the UK store fleet largely intact. H&M did not disclose the locations of its net 250 store closures.Figure 9. H&M and Inditex Worldwide Store Numbers, FY2015–2021E [caption id="attachment_132301" align="aligncenter" width="724"]

H&M’s fiscal year ends on November 30 and Inditex’s ends on January 31

H&M’s fiscal year ends on November 30 and Inditex’s ends on January 31 Source: Company reports/Coresight Research [/caption] Store Split by Region The regional store split is an area of relative cohesion between H&M and Inditex. As of fiscal 2020, around 63% of H&M’s stores are located in Europe and Africa, and 68% of Inditex’s stores are in Europe (including Spain), as shown in Figure 9. Overall, Inditex has stores in 96 markets across the globe as of January 31, 2021, while H&M has stores in 74 markets as of February 28, 2021. In recent years, both retailers have expanded their push into physical retail in the Americas and Asia, particularly in China. Inditex operates 388 stores in China as of January 31, 2021, while H&M operates 502 stores as of February 28, 2021. H&M has recently decided to stop using cotton sourced from Xinjiang owing to concerns of human rights abuses and forced labor. As a response, the company has faced backlash from the Chinese government and in March 2021, major Chinese e-commerce platforms, including Alibaba and JD.com, dropped H&M’s products from their platforms. Furthermore, in April 2021, H&M was forced by its landlords to close 20 stores in China. Behind Germany, the US and the UK, China is H&M’s fourth-largest market, comprising around 5% of the retailer’s sales.

Figure 10. H&M vs. Inditex: Numbers of Stores, by Geographic Region (FY20) [caption id="attachment_132302" align="aligncenter" width="726"]

*Breakdown by geography for only company-owned stores as H&M does not segregate franchised stores by region

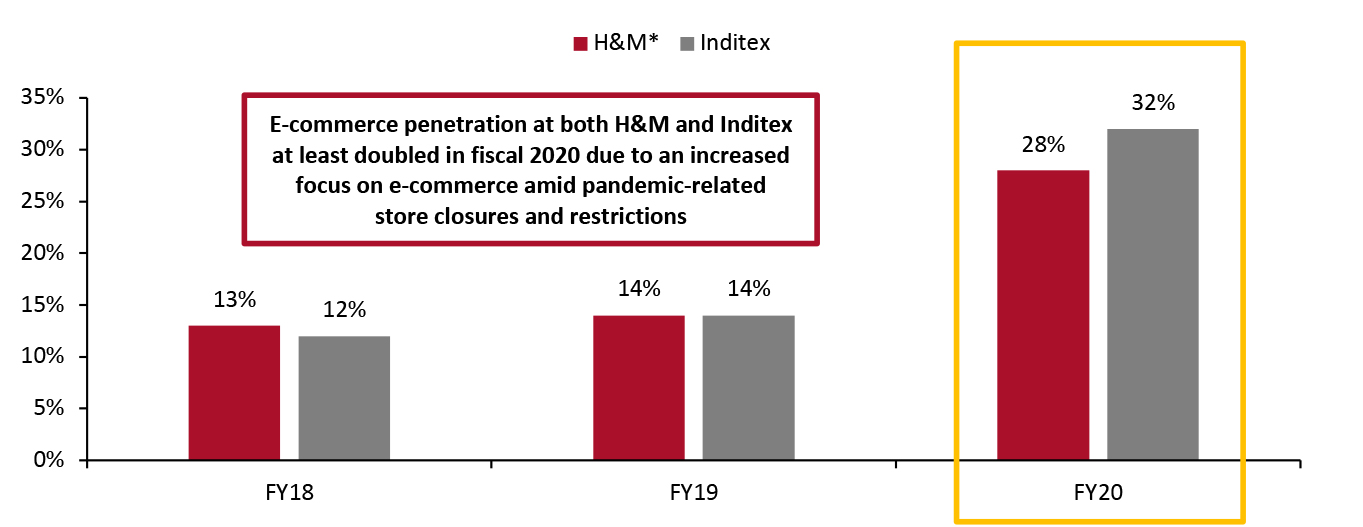

*Breakdown by geography for only company-owned stores as H&M does not segregate franchised stores by region Source: Company reports [/caption] Switching Focus to E-Commerce Both H&M and Inditex lagged behind apparel competitors in the scope and quality of their digital offerings, and are now playing catchup. In fiscal 2020, e-commerce penetration at Inditex surged to 32%, with H&M’s rate reaching 28%, we estimate, up from 14% for each retailer in fiscal 2019. Amid the pandemic, both retailers have learned that they can retain more sales than expected through e-commerce and without stores. As a result, H&M and Inditex have accelerated their digitalization, such as offering curbside pickup and buy online pick up in stores (BOPIS) and automating their fulfillment centers. As part of its shift toward e-commerce, Inditex is investing substantially in integrating online and offline channels to improve the customer experience and enhance engagement. The company plans to incur capital expenditure of €2.7 billion ($3.0 billion) by 2022, comprising €1.0 billion ($1.1 billion) dedicated to bolstering its online capabilities and €1.7 billion ($1.9 billion) to upgrade its integrated store platform through new advanced technology solutions. Similarly, H&M has also been ramping up the integration of its physical and online stores—as well as partnering with e-commerce platforms to extend its footprint. In April 2021, H&M announced its collaboration with Philippines-based e-retailer Zalora, enabling it to reach 400 million shoppers across Indonesia, Malaysia, Singapore and the Philippines. The Regional Manager of H&M South Asia and Pacific Oldouz Mirzaie stated in a company press release:

Zalora complements our extensive physical store portfolio as well as our digital stores at hm.com. We see great potential for substantial future growth and Zalora will be an important part of this to cater to the evolving needs and demands of our customers, so we can shape a more sustainable future for fashion and be even more locally relevant.

Figure 11. H&M vs. Inditex: E-Commerce Penetration (% of Total Sales), FY18–20 [caption id="attachment_132303" align="aligncenter" width="724"]

*Coresight Research estimate of H&M’s e-commerce penetration

*Coresight Research estimate of H&M’s e-commerce penetration Source: Company reports/Coresight Research [/caption] 4. Environment, Social and Governance (ESG) Initiatives In recent years, both H&M and Inditex have ramped up their environment, social and governance (ESG) initiatives. We believe that these initiatives will help both retailers to attract customers, investors and employees. H&M Sustainability has become a key priority for H&M in recent years. In February 2020, H&M’s former Head of Sustainability, Helena Helmersson, took on the role of CEO. Helmersson’s strong ties to H&M’s sustainability work suggests that the fashion retailer is likely to continue working towards its sustainability goals as planned. By 2030, H&M aims to use 100% recycled or sustainably sourced materials for its fashion products, compared to 57% in 2019. On the path to this goal, H&M reached a multi-year partnership with a Swedish textile recycling company to supply H&M with thousands of tons of Circulose fibers made from unusable textile waste In November 2020. Furthermore, in December 2020, in partnership with The Hong Research Institute of Textiles and Apparel, the H&M Foundation announced plans to invest $100 million over five years in the Planet First program, an initiative aimed at finding sustainable solutions for the fashion industry. In May 2021, H&M launched Innovation Stories, a sustainability lab where the global apparel brands and retailers can experiment with sustainable innovations, designs and fabrics before scaling them up for general product inventory. The company expects to see a range of sustainable collections launch throughout 2021 thanks to its Innovation Stories lab. Beyond sustainable sourcing, H&M has been working toward social causes and investing in supporting communities. For instance, in April 2021, the company launched worldwide digital initiatives to identify and give a platform to young people who are making a difference in education, equality and sustainability. H&M will support their causes by donating from the proceeds of its new sustainable H&M Kids line. As we discussed above, in 2020, H&M took a stand against concerns of alleged forced labor in cotton production in the Xinjiang Uyghur Autonomous Region (XUAR), noting that the Swedish retailer would not source cotton from the region and added that it terminated its relationship with a Chinese yarn company accused of using Uyghur Muslims in forced labor. Following the backlash and boycott from the Chinese government, H&M released a conciliatory statement in March 2021, stating that the retailer wants to be a “responsible buyer, in China and elsewhere” and that it is looking to work with stakeholders to build a more sustainable fashion industry. Inditex In June 2020, Inditex unveiled its plans to convert all of its stores and e-commerce websites into “sustainability hubs” by 2022. Under the initiative, the company’s stores and online platforms will eliminate single-use plastic, use renewable energy, incorporate more recycled materials and promote garment reuse. The Spanish retailer also aims to use 100% sustainable fabrics in all of its collections by 2025. Moreover, Inditex is taking measures to reduce its carbon footprint. In January 2021, the company joined the MIT Climate and Sustainability Consortium, which aims to accelerate the large-scale implementation of solutions to address the threat of climate change. As part of its social responsibility commitments, Inditex has been aggressively investing in supporting communities. For example, in early 2020, Inditex allocated €71 million ($85 million) toward the creation of community wellbeing and education programs and humanitarian aid. The retailer claims that the initiative has benefited 3.3 million people as of May 27, 2021. 5. Technology Innovations Inditex has been slightly more aggressive than H&M in incorporating innovative technologies, including artificial intelligence (AI), robotics and big data, into its business strategy and supply chain. From 2018, the company has been expanding its tech-driven initiatives—for instance, in collaboration with US-based AI consumer behavior forecasting platform Jetlore and Spanish big data company El Arte de Medir. In the same year, the retailer also partnered with Intel on tech innovations for gauging clothing volume in boxes, as well as with micro-chip provider Tyco for tracking product data and locations along the supply chain and with US-based Fetch Robotics on robot deployment for stock inventory. In 2020, Inditex implemented radio frequency identification (RFID) technology across all of its brands, having used the technology for some time at its Zara and Massimo Dutti brand. Over the past years, RFID has helped Zara in inventory tracking and management and in reducing shrinkage. In addition to back-office optimization, the company has been focusing on developing virtual assistants to assist consumers while shopping in-store and online. While H&M has proved slower in adopting innovative technologies, the retailer is quickly catching up. H&M employs AI-based predictive analytics to automate its distribution centers and enhance order fulfillment. The retailer also utilizes algorithms to forecast market demand, avoid overproduction of merchandise and determine competitive prices. Lately, the Swedish retailer has been ramping up its AR- and VR-based offerings. In January 2021, H&Mbeyond, one of the company’s innovation labs, collaborated with AR and VR solution company Nexr Technologies to develop a virtual fitting room service for shoppers, with the prototype set to launch later in 2021. The technology scans a customer’s body and creates a personal avatar, in the form of their exact digital image. The digital avatar will also facilitate buying decisions by assigning styles and outfits. H&M expects this technology to not only improve customers’ shopping experiences but also help the retailer in analyzing returns patterns.