Nitheesh NH

What’s the Story?

We provide an overview of PVH and Ralph Lauren and discuss four key elements of the two retailer’s businesses—comprising revenue, business coverage, brand mix and innovation.Why It Matters

PVH and Ralph Lauren feature among the top 20 apparel companies worldwide, with multiple owned brands and diverse business coverages—making for insightful comparison.PVH vs. Ralph Lauren: Coresight Research Analysis

Business Overview PVH and Ralph Lauren both sell lifestyle accessories, apparel, beauty, footwear and home products. We provide a comparison of key facts and top-line figures for each company in Figure 1.Figure 1. Company Overviews: PVH vs. Ralph Lauren [wpdatatable id=1499]

Source: Company reports

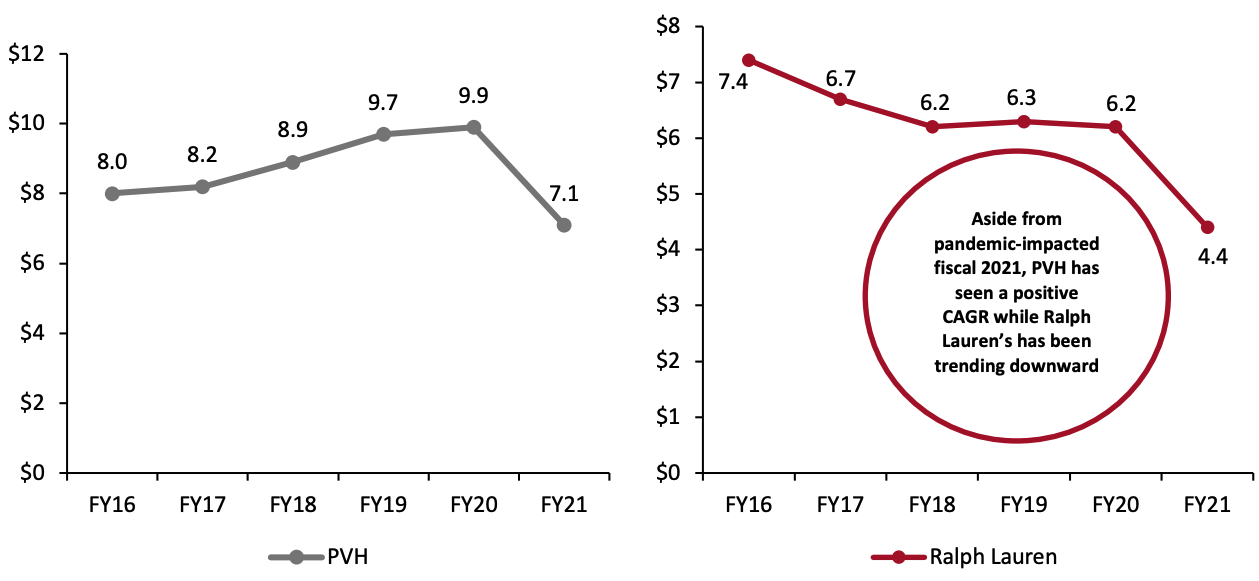

1. Revenue Growth PVH posted revenue of $7.1 billion in fiscal 2021, ended January 31, 2021, marking a year-over-year decline of 28.3%. Seeing similar growth decreases, Ralph Lauren posted a 29% decline in revenue to $4.4 billion in its fiscal 2021, ended March 27, 2021. The major declines in these two companies’ revenues can largely be attributed to the influence of the pandemic. From fiscal 2016 to 2020, PVH’s revenue grew at a CAGR of 5.5%, while Ralph Lauren saw a negative CAGR of (9.9)% over the period. We attribute the sequential revenue decrease at Ralph Lauren to declining sales across brick-and-mortar stores in the US and the increasing casualization trend. Based on PVH’s and Ralph Lauren’s revenues guidance of 24%–26% and 34%–36% growth, respectively, for fiscal 2022, we expect both companies’ revenues to remain below fiscal 2020 levels and likely recover fully in fiscal 2023 if pandemic-related uncertainties subside. E-Commerce Both companies are doubling down on their efforts to improve e-commerce sales and deepen their connections with consumers. PVH’s e-commerce business saw an increase of more than 40% for fiscafl 2021, accounting for around 25% of total company revenue. Ralph Lauren’s e-commerce business was up more than 60% for fiscal 2021, representing around 25% of the company’s total sales. Ralph Lauren attributed its e-commerce growth to new customer acquisition and its focus on personalization. The companies did not disclose specific e-commerce revenue numbers.Figure 2. PVH vs. Ralph Lauren: Revenue, FY16–FY21 (USD Bil.) [caption id="attachment_137106" align="aligncenter" width="700"]

Note: PVH’s fiscal year ends January 31 and Ralph Lauren’s fiscal year ends March 27

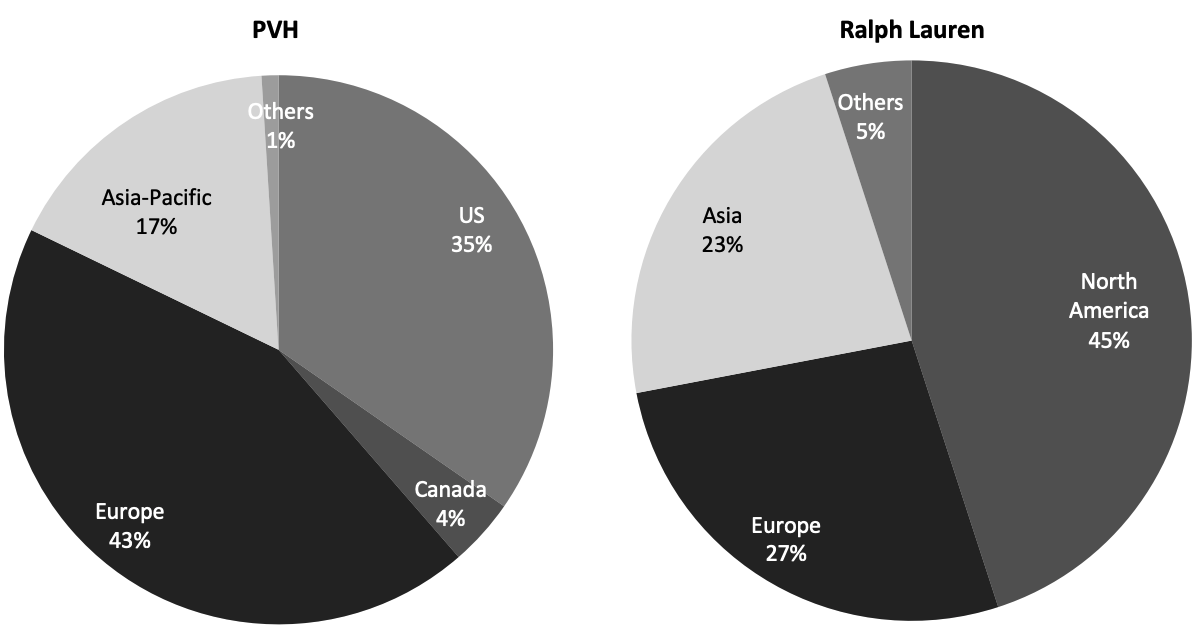

Note: PVH’s fiscal year ends January 31 and Ralph Lauren’s fiscal year ends March 27Source: Company reports[/caption] Geography While PVH generates 39% of its revenue in North America (fiscal 2021) and Ralph Lauren generates 45% of its revenue in the market, PVH’s $2.7 billion in sales compared to Ralph Lauren’s $2.0 billion shows that the former captures a larger share of the market, which can be attributed to its larger scale. Moreover, PVH has higher exposure in Europe, comprising 44% of the company’s total sales in fiscal 2021, compared to Ralph Lauren’s 27%. Although Ralph Lauren entered the European market earlier than PVH, the latter’s $3.2 billion revenue in Europe is not far off being three times greater than Ralph Lauren’s $1.2 billion in fiscal 2021. We think that PVH’s success in Europe is mainly driven by consumer resonance with the company’s key brands Tommy Hilfiger and Calvin Klein, and the company’s more aggressive store expansion strategy. Both companies are expanding their business influence in the Asia-Pacific region, especially in China, by building consumer relationships on Tmall and WeChat mini programs. For example, PVH drove brand excitement through integrated marketing activities around key shopping events, including Tmall’s 6.18 Shopping Festival and China’s Valentine's Day on August 14 this year. Ralph Lauren is also building out its digital ecosystem in China. The company ran a successful campaign for 5.20 (a popular Valentine’s day spin-off for gift giving in China) and hosted livestreaming sessions to promote its products during the 6.18 Shopping Festival. The company hosted the livestream sessions from its newly opened Sanlitun store in Beijing.

Figure 3. PVH vs. Ralph Lauren: Revenue Split by Geography, FY21 [caption id="attachment_137107" align="aligncenter" width="700"]

Note: PVH’s breakdown does not sum due to rounding

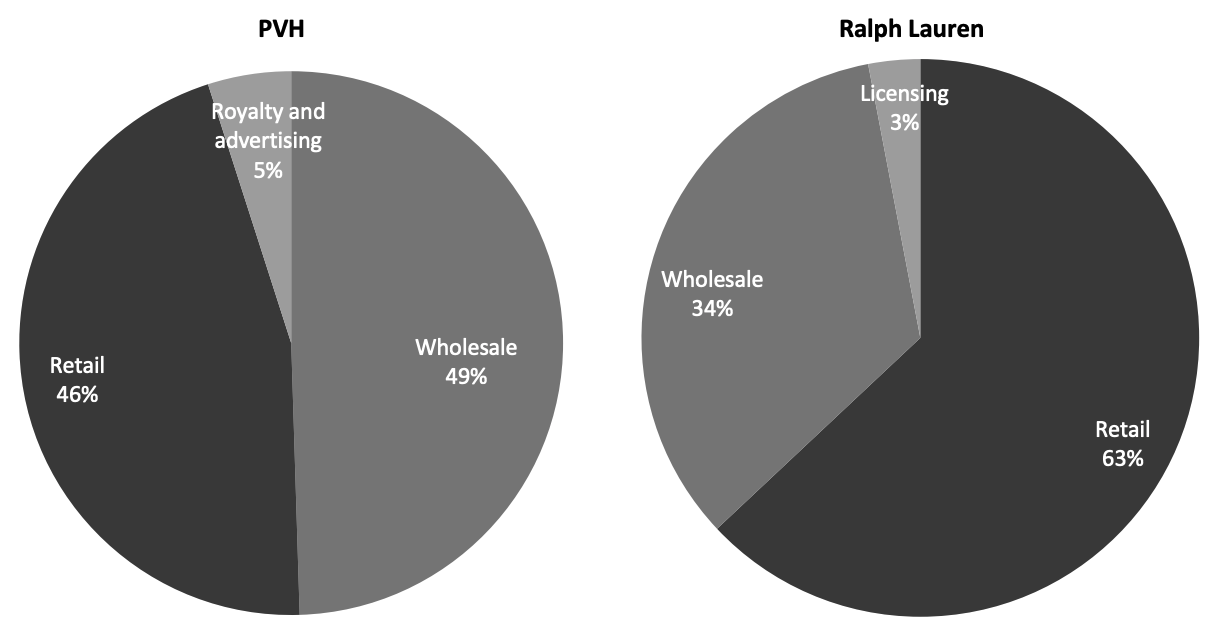

Note: PVH’s breakdown does not sum due to roundingSource: Company reports[/caption] By Channel Both PVH and Ralph Lauren are shifting their sales channels from wholesale to direct-to-consumer (DTC) as the latter offers improved resiliency, greater customer insights and improved top and bottom lines. In fiscal 2021, Ralph Lauren’s wholesale business comprised 34% of its total sales, down from 37% in fiscal 2020. PVH’s wholesale business accounted for 50% of total sales in 2021, compared to 51% in the prior year. We are seeing both companies actively adopting strategies to improve their DTC exposure. For example, in July 2021 Ralph Lauren announced that it will be the official outfitter of G2 Esports, one of the world's premier professional esports organizations. The company stated that it feels confident about this first-of-its-kind partnership in fashion and gaming as it continues to drive new ways of reaching next-generation consumers in key DTC channels where they engage. In the first quarter of fiscal 2022, ended August 3, 2021, Ralph Lauren added more than 1 million new consumers to its DTC channels. In addition, its total social media followers continue to grow, exceeding 46 million globally as of August 2021, boosted by its G2 Esports collaboration. PVH is also expanding its DTC offering through collaborations, which are largely aimed at connecting directly with younger demographics, according to the company. In April 2021, Calvin Klein launched a product range designed in partnership with US artist Heron Preston, which was followed by a second drop in October. The company also released a second installment of its underwear collaboration with premium retailer Kith in September 2021, tapping into the brand’s popularity among Gen Z shoppers. These items are available both online and in store but are only sold by PVH, rather than through third-party retailers.

Figure 4. Revenue by Distribution Channel: PVH vs. Ralph Lauren, FY21 [caption id="attachment_137108" align="aligncenter" width="700"]

Note: PVH’s revenues by distribution channels do not add up to 100% because of rounding

Note: PVH’s revenues by distribution channels do not add up to 100% because of roundingSource: Company reports[/caption] 2. Business Coverage Ralph Lauren has a more diversified business than PVH—as well as retailing merchandise, Ralph Lauren operates a separate custom apparel shop, an apparel rental subscriptions platform and hospitality businesses. In March 2021, Ralph Lauren launched a made-to-order apparel platform, which allows shoppers to customize polo shirts to their exact specifications and add personalized text. The shirts are available in six designs and 25 color combinations. [caption id="attachment_137109" align="aligncenter" width="700"]

Ralph Lauren’s made-to-order polo shirt platform

Ralph Lauren’s made-to-order polo shirt platformSource: Ralph Lauren[/caption] Besides customization, Ralph Lauren launched The Lauren Look in March 2021, a subscription rental program for US shoppers priced at $125 per month. The program enables subscribers to rent dresses, pants, tops and other items from the Ralph Lauren collection. The company stated that it aims to use this rental subscription model to attract next-gen consumers.

- Read more about subscription e-commerce.

Ralph Lauren’s rental subscription service home page

Ralph Lauren’s rental subscription service home pageSource: Ralph Lauren[/caption] Ralph Lauren operates restaurants in Chicago, New York City and Paris as well as a Ralph's Coffee concept café in various cities around the world. The company aims to offer consumers an immersive experience of fashion and live entertainment at its hospitality venues. [caption id="attachment_137111" align="aligncenter" width="580"]

Ralph Lauren’s Polo Bar in New York City

Ralph Lauren’s Polo Bar in New York CitySource: Ralph Lauren[/caption] Keeping its focus within apparel, PVH was one of the first mainstream retailers to offer adaptive clothing for children, men and women. In 2016, PVH’s subsidiary brand Tommy Hilfiger launched its adaptive apparel collection with clothing designed specifically for wheelchair users and people with reduced mobility. Tommy Hilfiger now offers a wide range of adaptive styles with more than 70 designs for men and women and almost 30 for children. We believe that adaptive apparel is one of the biggest opportunities in retail, and one of the most significant. Disabled people represent 12.7% of the US population, according to the US Census Bureau, but remain underserved in terms of market choices that are fashionable and/or functional.

- Click here to read our Think Tank on adaptive apparel.

Figure 5. A Comparison of Selected Brands: PVH vs. Ralph Lauren [wpdatatable id=1500]

Source: Company reports

4. Business Innovations PVH and Ralph Lauren are innovating to stay relevant with their current customers and to reach new audiences. We present key innovations from the two companies below. Innovations at Ralph Lauren- Brand collaborations: Ralph Lauren continues to innovate in brand collaborations to reach younger consumers. In May 2021, Ralph Lauren teamed up with Major League Baseball (MLB) on a limited-edition capsule collection. In addition, in late 2020, the company worked with Clot, a Hong Kong-based streetwear brand aimed at younger shoppers. The products sold out in less than two minutes on the brand’s WeChat mini program, recording 6 billion views on the platform.

- Digital experiences: Ralph Lauren has been strategic in offering digital experiences to improve store environments—often targeted at younger shoppers, too. For example, Ralph Lauren’s latest store in Beijing, opened in April 2021, features virtual try-on facilities, in-store treasure hunt promotions via QR codes and customization stations where consumers can use the brand’s WeChat mini program to order customized products from their mobile phones. The technology is facilitated in partnership with Tencent. The store also houses a Ralph’s Coffee space. Furthermore, in late 2020, Ralph Lauren company held a livestream concert in its Chicago flagship store and introduced an augmented reality (AR) portal on Snapchat. Ralph Lauren has also launched a virtual store experience at its Beverly Hills flagship store, offering a mix of multimedia and AR capabilities.

- Sustainability: Ralph Lauren launched a new sustainability initiative in April 2021, named Color On Demand, which enables the company to recycle and reuse water. By 2025, the company aims to use the Color On Demand platform across more than 80% of its solid cotton products.

- Brand collaborations: PVH has also launched brand collaborations in 2021 which are aimed at connecting with younger consumers. In April this year, PVH’s subsidiary brand Calvin Klein launched a global product collaboration with Hero in Preston, a luxury streetwear brand. The collection focuses on reinvented essentials and has received positive consumer response, according to the company. Denim, trucker jackets and hoodies were the fastest-selling categories, indicating that Calvin Klein is successfully attracting younger consumers. Furthermore, Tommy Hilfiger has collaborated with Amsterdam-based streetwear brand Patta and saw strong sell-through in the first quarter of 2021. PVH reported on its June 2021 earnings call that the company will continue to build out collaborations to fuel brand heat and cultural relevance.

- Livestreaming initiatives: PVH has been innovative in digital marketing initiatives, especially in livestreaming. For example, Tommy Hilfiger launched a Tommy Jeans Looney Tunes capsule in a livestreaming partnership with Tmall in April 2020, which achieved over 45 million views and strong sell-outs, according to the company. Tommy Hilfiger also livestreamed its spring 2021 collections and hosted four celebrity livestreams on short-video platform GoWin, which recorded 1.5 million views and helped the company to convert both new and existing consumers to purchase, PVH reported.

- 3D design: PVH continues to enhance the operational efficiency of its supply chain, incorporating 3D technology to enhance its design capabilities through reduced lead time, improved planning capacity and avoidance of early sample requirements. In order to realize the company’s 3D design goals, Tommy Hilfiger founded tech incubator STITCH in late 2019, dedicated to digitalizing the company’s design practices. Tommy Hilfiger’s Spring 2022 apparel collections will be the first to be fully designed using the 3D design platform, according to the company.