Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

2Q16 RESULTS

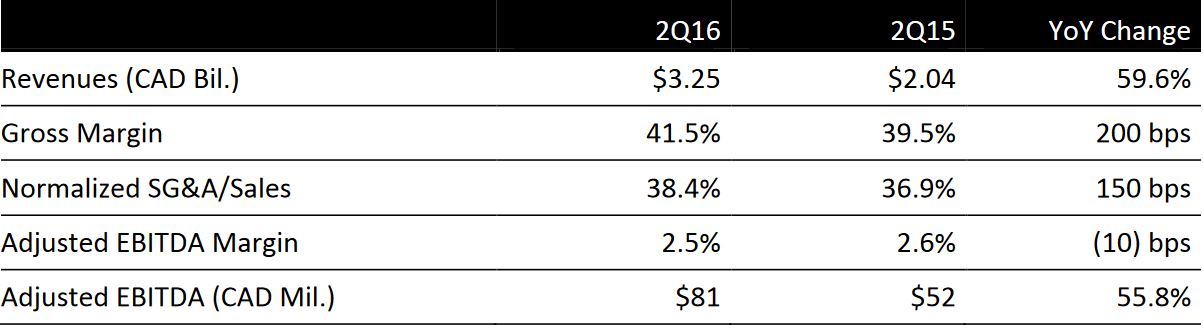

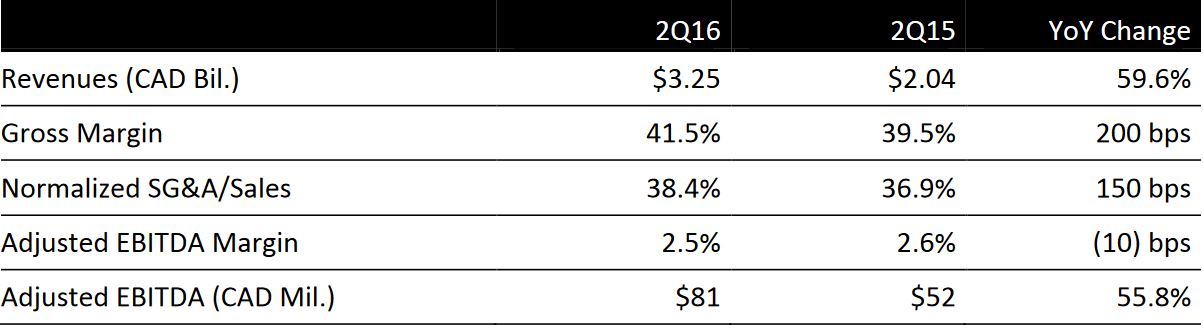

Hudson’s Bay reported 2Q16 adjusted EBITDA of C$81million versus consensus of C$50.6 million. Adjusted EBITDAR was C$263 million and above expectations of C$256 million due to the addition of HBC Europe.

Total revenue was C$3.25 billion versus expectations of C$3.27 billion. Comps increased 1.9%. Comps were up 1.1% on a constant currency basis in the Department Store Group (DSG), offset by declines of 0.9% at HBC Europe, 11.4% at HBC Off Price and 1.3% at Saks Fifth Avenue. This resulted in a total comparable sales decline of 1.3%. Digital sales increased 84.4%, with total digital comps up 1.4% on a constant currency basis. Excluding HBC Off Price, digital comps increased 17.3% on a constant currency basis.

DSG includes Lord & Taylor, Hudson’s Bay and Home Outfitters. HBC Europe includes GALERIA Kaufhof, Galeria INNO and Sportarena. HBC Off Price refers to the Saks Fifth Avenue OFF 5TH and Gilt banners.

Hudson’s Bay significantly pulled back its promotional activity at Saks OFF 5TH compared to the year-ago period, which negatively impacted sales and benefited margins.

The company continued to execute its expansion plans in Europe during the period and brought the Hudson’s Bay brand to the Netherlands. During the quarter, Hudson’s Bay signed long-term lease agreements for 11 locations and has plans to open an additional nine locations. The company also announced the first five Saks OFF 5TH locations will open in Germany next summer. Also on the real estate side, the company closed a US$400 million, 5-year mortgage on the Lord & Taylor flagship location in New York, which valued the property at US$655 million.

During the second quarter, the company opened one Saks Fifth Avenue store in Greenwich, Connecticut and two Saks OFF 5TH stores in Chicago and Plymouth Meeting, Pennsylvania. The company closed one Home Outfitters store in Anjou, Quebec.

2016 OUTLOOK

Management reaffirmed full-year guidance for adjusted EBITDA of C$800–C$950 million versus consensus of C$830.9 million; adjusted EBITDAR is projected to be C$1.56–C$1.71 billion versus consensus of C$1.61 billion. Revenue guidance is also unchanged at C$14.9–C$15.9 billion compared to expectations of C$14.95 billion. The company currently expects sales, adjusted EBITDAR and adjusted EBITDA to trend toward the bottom end of its outlook range.

Company officials said they are monitoring the current retail environment closely and taking steps to ensure the company is best positioned to take advantage of opportunities.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology