Nitheesh NH

Introduction

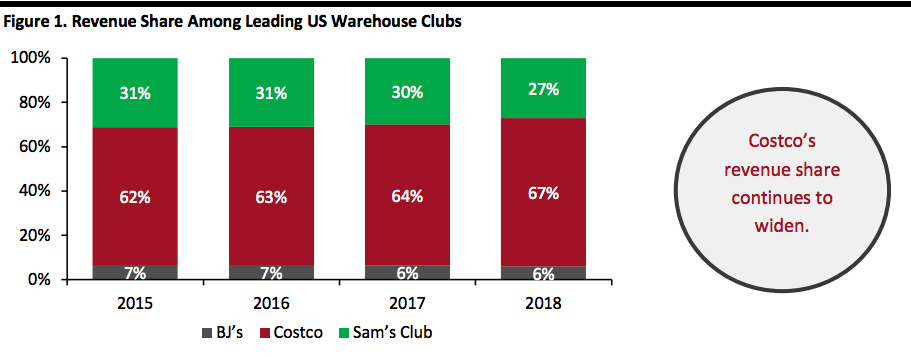

Warehouse clubs have come a long way since 1976 when Sol Price pioneered the discount membership warehouse with Price Club in San Diego. Since then, the basic business model has remained much the same: Attract customers to make bulk purchases in store through paid membership. Until recently, there was limited emphasis on e-commerce. In this report, we discuss warehouse clubs’ growing shift to e-commerce and their various initiatives. Market Landscape We’ll look at the three dominant US warehouse club chains: Costco Wholesale, Sam’s Club (owned by Walmart) and BJ’s Wholesale Club. Costco continues to be the dominant warehouse club, accounting for around two-thirds of the total of the three companies’ revenues and operating income in 2018 – and the company’s lead is widening. The chart below shows Costco’s large and widening lead over the past four years. [caption id="attachment_95299" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Warehouse Clubs Pivot Towards E-Commerce

Warehouse clubs were slow to invest in e-commerce, but the delay in going “full throttle” means there is still significant room for growth – and for them to learn from others’ experiences. As Costco CFO Richard Galanti remarked, there is a lot of “low-hanging fruit” supporting e-commerce growth at the clubs. With grocery a significant component of warehouse club sales, Amazon’s acquisition of Whole Foods in 2017 was a significant development and helped catalyze the warehouse club sector’s shift toward e-commerce. Until then, these companies tended to be reluctant to invest significantly in delivery services. Post the acquisition, all three major warehouse clubs bolstered delivery services – with Instacart being the biggest beneficiary, with lucrative relationships with all three companies. Toward the end of 2017, Costco introduced its own two-day delivery service called CostcoGrocery for shelf-stable products, and partnered with Instacart to provide same-day delivery service for perishable groceries. Sam’s Club followed suit with its own same-day delivery partnership available in 100 additional clubs, for a total of 350 stores. BJ’s announced that by April 2018, all its outlets would offer same-day delivery. The growing emphasis on e-commerce also slowed growth in new warehouse clubs. In 2018, Walmart’s decision to close a number of Sam’s Club outlets brought an end to a period of annual increases in new warehouse clubs that had lasted since 2005. Although more openings are expected in 2019 compared to 2018, with Costco announcing 11 openings so far, growth is likely to remain relatively subdued for the coming years. Warehouse clubs have also been working to improve omnichannel capabilities, but in a manner that does not diminish the appeal of in-store shopping and supports mutual growth. The clubs are investing in technology to enhance their mobile applications. Through these applications, they provide customers with the ability to scan purchases in-store and eliminate the need to wait in checkout lines. The sections below detail the initiatives that each of the three major US warehouse clubs have taken to develop e-commerce capabilities.Costco Steps Up

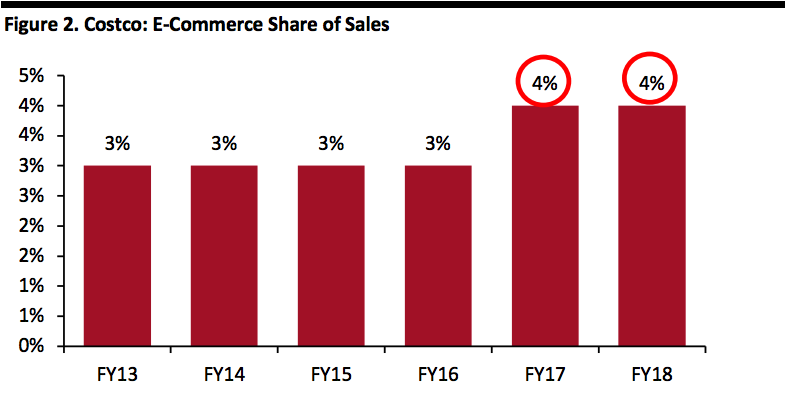

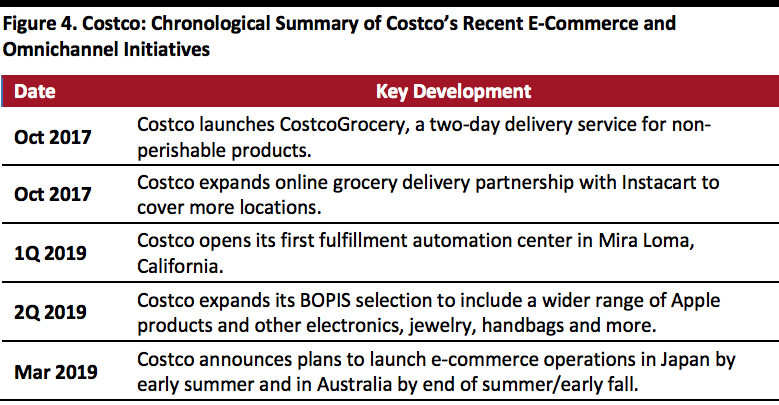

Until recently, Costco was quite comfortable with its diffidence to e-commerce and, arguably, for good reason, considering its business model that centered around membership fees generating profits that allowed low-priced in-store sales worked successfully for a long period. Now, that’s changed and Costco has been making concerted efforts to raise awareness among in-store shoppers about its online channel through in-store promotions and cross-marketing. Two-Day and Same-Day Delivery Service In October 2017, Costco started CostcoGrocery, a two-day delivery service for non-perishable products on any order of $75 or more, and also expanded its partnership with Instacart for online grocery delivery to cover more locations. The company also gave tablets to store associates to facilitate online purchases in around 195 stores. Same-day grocery delivery is now available within short distances of 99% of Costco locations, with two-day grocery delivery available everywhere in the continental US. Costco currently fulfills its two-day grocery delivery service through the nearly a dozen business centers it operates across the US, but is transferring those operations to six of its depots. Fulfillment Automation Centers Costco opened its first fulfillment automation center in Mira Loma earlier this year and plans to open two more by end 2019. These centers are designed to manage small packages for e-commerce. Buy Online Pickup in Store (BOPIS) In the second fiscal quarter of 2019, Costco enlarged its BOPIS selection, offering a wider range of Apple products along with other electronics, jewelry, handbags and more. The retailer has been testing pick-up lockers for BOPIS purchases in 10 locations and plans to extend that to an additional 100 locations before the September-December 2019 holiday season. The share of e-commerce in Costco’s total sales has been steadily rising, as shown below and accounted for 4% of net sales in the year ended September 2, 2018. [caption id="attachment_95300" align="aligncenter" width="700"] Source: Company reports[/caption]

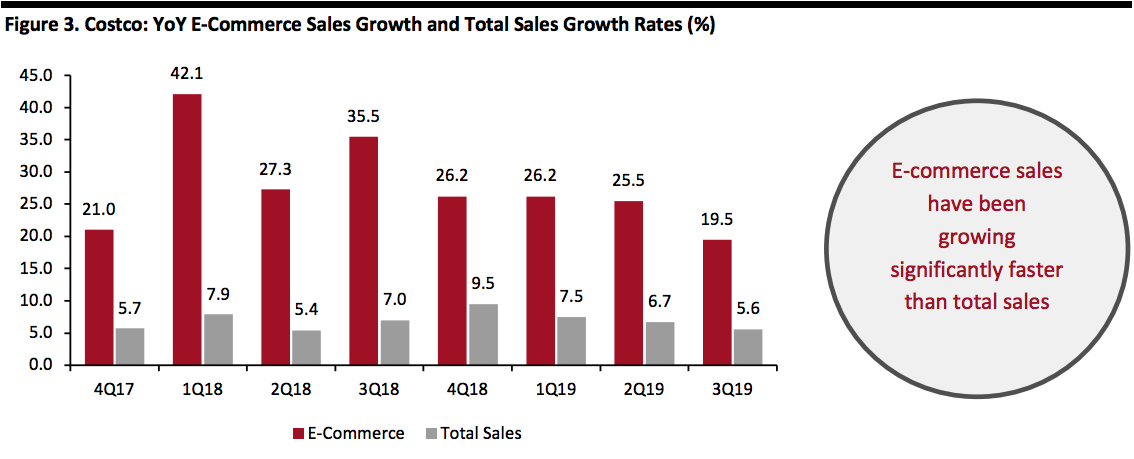

In the third quarter of 2019, Costco’s latest quarter at the time of writing, the company reported 19.5% growth in e-commerce on a comparable basis.

[caption id="attachment_95301" align="aligncenter" width="700"]

Source: Company reports[/caption]

In the third quarter of 2019, Costco’s latest quarter at the time of writing, the company reported 19.5% growth in e-commerce on a comparable basis.

[caption id="attachment_95301" align="aligncenter" width="700"] Source: Company reports[/caption]

US customers have been the primary contributors to e-commerce growth, but there has also been increased online activity from Canada, Mexico, Taiwan, Korea and the UK.

Earlier this year, Costco also announced plans to launch e-commerce operations in Japan by early summer 2019 and in Australia by the end of summer or early fall.

[caption id="attachment_95302" align="aligncenter" width="700"]

Source: Company reports[/caption]

US customers have been the primary contributors to e-commerce growth, but there has also been increased online activity from Canada, Mexico, Taiwan, Korea and the UK.

Earlier this year, Costco also announced plans to launch e-commerce operations in Japan by early summer 2019 and in Australia by the end of summer or early fall.

[caption id="attachment_95302" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Through a well-equipped e-commerce channel, Costco has strengthened its ability to compete with major rivals such as Amazon and Walmart.

Source: Company reports/Coresight Research[/caption]

Through a well-equipped e-commerce channel, Costco has strengthened its ability to compete with major rivals such as Amazon and Walmart.

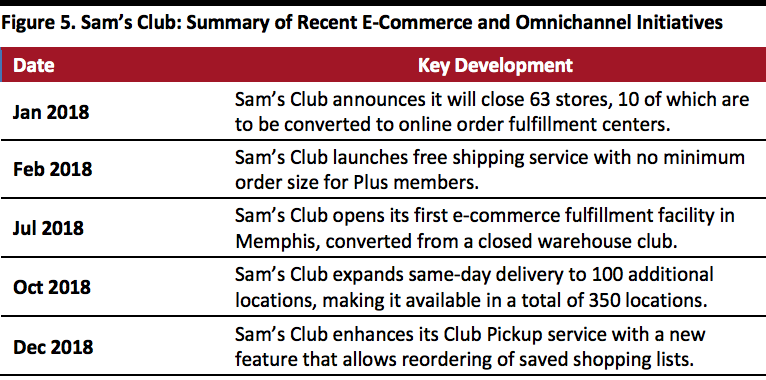

Sam’s Club is Heightening Competition, Too

Through its website, samsclub.com, Sam’s Club offers a range of merchandise, including some products unavailable in clubs. Along with direct-to-home delivery, Sam’s Club provides delivery service at Sam’s Club outlets as well through its “Club Pickup” initiative. Among its omnichannel capabilities, the warehouse club offers a mobile checkout and payment service called “Scan and Go” which enables members to skip the checkout line. The company has also introduced in-store kiosks that let customers browse products online if they can’t find them in store, add items to their shopping carts and have them delivered. In January 2018, Sam’s Club announced it would close 63 stores (including three in Puerto Rico) by the end of the month. Of these, at least 10 were to be converted to fulfilment centers for online orders, highlighting the increased focus on e-commerce. Throughout 2018, the company invested significantly in online delivery capabilities. The store closures translated into a decline in store sales for the year, it positioned the company to better deliver an enhance online offering. In February 2018, Sam’s Club announced free shipping for most items it sells online with no minimum order for Plus members, which costs $100 annually. In October 2018, Sam’s Club expanded its same-day delivery service in partnership with Instacart to cover 100 additional locations, making it available in a total of 350 locations. In December 2018, Sam’s Club enhanced its Club Pickup service by enabling customers to build and save online shopping lists to make it easier to reorder. As part of the service, customers can use an app to notify the warehouse club about expected pickup time. [caption id="attachment_95303" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

The company is also looking to leverage its online platform to introduce new categories and expand the breadth of its existing categories.

In fiscal 2019 ended January 31, e-commerce generated 4.7% of Sam’s Club total net sales.

Source: Company reports/Coresight Research[/caption]

The company is also looking to leverage its online platform to introduce new categories and expand the breadth of its existing categories.

In fiscal 2019 ended January 31, e-commerce generated 4.7% of Sam’s Club total net sales.

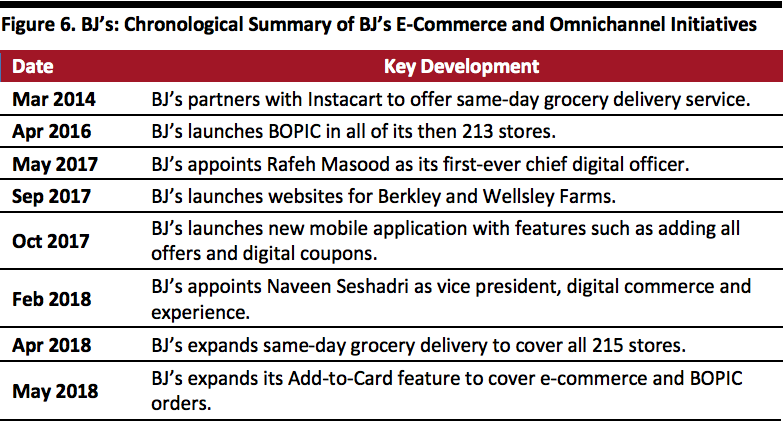

BJ’s is Catching Up

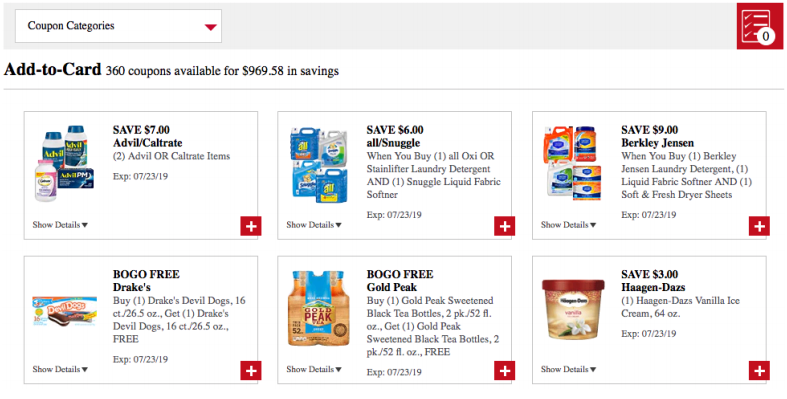

BJ’s pioneered same-day grocery delivery in warehouse clubs when it partnered with Instacart in 2014. Despite the head start, BJ’s did not expand the service to all stores until 2018. In the intervening period, both Costco and Sam’s Club began offering the same service, taking away BJ’s first-mover advantage and left it playing catch up. In April 2016, BJ’s introduced buy online, pick up in club (BOPIC) in all of its then 213 stores. The service, known today as Shop BJs.com, lets allows customers shop online and pick up from any BJ’s club in two hours. In May 2017, BJ’s appointed Rafeh Masood as its first ever chief digital officer as upgrading the e-commerce channel became a key area of strategic focus. In September 2017, the company launched websites for two of its private brands, Berkley Jensen and Wellsley Farms. Through the websites, BJ’s members can use BOPIC to reserve non-perishable products and pick them up in stores in two hours. BJ’s also introduced online-only membership that allows customers to shop online only for just $10 per year. On the omnichannel front, BJ’s launched a new mobile application in October 2017. The application includes a feature that lets customers digitally select and save coupons to the BJ’s membership card, which are automatically applied to in-club purchases without the need for any additional steps from members. The feature was expanded in April 2018 to cover orders placed online or via BOPIC. The figure below shows what the feature looks like: [caption id="attachment_95304" align="aligncenter" width="700"] BJ’s Add-to-Card feature on its mobile application

BJ’s Add-to-Card feature on its mobile applicationSource: BJ’s website[/caption] In February 2018, Naveen Seshadri, former COO of Lonely Planet, joined as vice president, digital commerce and experience – a newly created position. The figure below provides a chronological summary of the key e-commerce and omnichannel initiatives of the company. [caption id="attachment_95305" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

The BJ’s e-commerce website offers a wide range of general merchandise products as well as a sizeable range of additional products not typically found in clubs. Some of the categories the company sells online include electronics, computers, office supplies and equipment, home products, health and beauty aids, sporting goods, outdoor living, baby products, toys and jewelry.

Source: Company reports/Coresight Research[/caption]

The BJ’s e-commerce website offers a wide range of general merchandise products as well as a sizeable range of additional products not typically found in clubs. Some of the categories the company sells online include electronics, computers, office supplies and equipment, home products, health and beauty aids, sporting goods, outdoor living, baby products, toys and jewelry.