Nitheesh NH

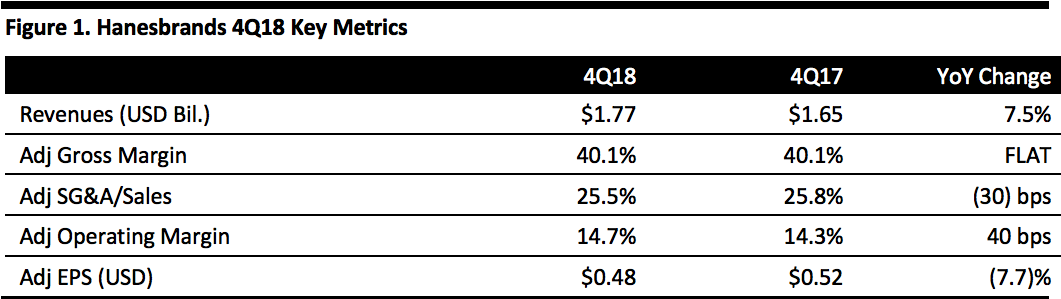

[caption id="attachment_71971" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

Hanesbrands reported 4Q18 adjusted EPS of $0.48, a 7.7% decrease from 4Q17 and above the $0.46 consensus estimate. Total revenues were $1.77 billion, up 7.5% year over year (a 6.3% increase on a constant currency organic basis, which is the highest quarterly growth rate in eight years) and above the $1.71 billion consensus estimate.

By segment, Innerwear sales were flat at $594 million; Activewear sales rose 13.5% to $485 million; and, international sales increased 11.7% to $609 million. Constant-currency organic sales increased 9%. Bras N Things, acquired in February 2018, added $43 million to international sales. Champion brand achieved double digit sales growth during the period, and excluding the U.S. mass channel, Champion revenue increased more than 50% and for 2018, global Champion sales excluding mass were $1.36 billion versus approximately $1 billion in 2017. Champion sales at mass declined nearly 3%. Revenue in the direct-to-consumer channel (DTC) increased 23% and represented 25% of total sales.

Innerwear basics grew 2% during 4Q and sales of innerwear intimates declined 7%, despite double-digit growth of shapewear following the relaunch of Maidenform.

Adjusted operating margin increased 40 bps to 14.7% of sales because of acquisition contributions and a lower SG&A expense ratio.

Outlook

The company provided initial guidance for FY19.

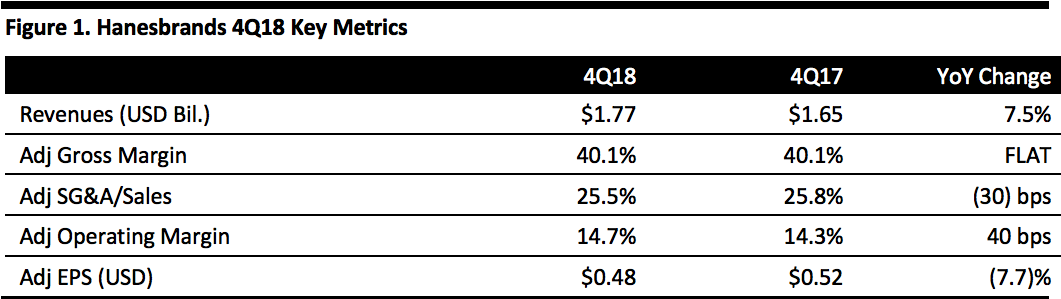

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Hanesbrands reported 4Q18 adjusted EPS of $0.48, a 7.7% decrease from 4Q17 and above the $0.46 consensus estimate. Total revenues were $1.77 billion, up 7.5% year over year (a 6.3% increase on a constant currency organic basis, which is the highest quarterly growth rate in eight years) and above the $1.71 billion consensus estimate.

By segment, Innerwear sales were flat at $594 million; Activewear sales rose 13.5% to $485 million; and, international sales increased 11.7% to $609 million. Constant-currency organic sales increased 9%. Bras N Things, acquired in February 2018, added $43 million to international sales. Champion brand achieved double digit sales growth during the period, and excluding the U.S. mass channel, Champion revenue increased more than 50% and for 2018, global Champion sales excluding mass were $1.36 billion versus approximately $1 billion in 2017. Champion sales at mass declined nearly 3%. Revenue in the direct-to-consumer channel (DTC) increased 23% and represented 25% of total sales.

Innerwear basics grew 2% during 4Q and sales of innerwear intimates declined 7%, despite double-digit growth of shapewear following the relaunch of Maidenform.

Adjusted operating margin increased 40 bps to 14.7% of sales because of acquisition contributions and a lower SG&A expense ratio.

Outlook

The company provided initial guidance for FY19.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Hanesbrands reported 4Q18 adjusted EPS of $0.48, a 7.7% decrease from 4Q17 and above the $0.46 consensus estimate. Total revenues were $1.77 billion, up 7.5% year over year (a 6.3% increase on a constant currency organic basis, which is the highest quarterly growth rate in eight years) and above the $1.71 billion consensus estimate.

By segment, Innerwear sales were flat at $594 million; Activewear sales rose 13.5% to $485 million; and, international sales increased 11.7% to $609 million. Constant-currency organic sales increased 9%. Bras N Things, acquired in February 2018, added $43 million to international sales. Champion brand achieved double digit sales growth during the period, and excluding the U.S. mass channel, Champion revenue increased more than 50% and for 2018, global Champion sales excluding mass were $1.36 billion versus approximately $1 billion in 2017. Champion sales at mass declined nearly 3%. Revenue in the direct-to-consumer channel (DTC) increased 23% and represented 25% of total sales.

Innerwear basics grew 2% during 4Q and sales of innerwear intimates declined 7%, despite double-digit growth of shapewear following the relaunch of Maidenform.

Adjusted operating margin increased 40 bps to 14.7% of sales because of acquisition contributions and a lower SG&A expense ratio.

Outlook

The company provided initial guidance for FY19.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Hanesbrands reported 4Q18 adjusted EPS of $0.48, a 7.7% decrease from 4Q17 and above the $0.46 consensus estimate. Total revenues were $1.77 billion, up 7.5% year over year (a 6.3% increase on a constant currency organic basis, which is the highest quarterly growth rate in eight years) and above the $1.71 billion consensus estimate.

By segment, Innerwear sales were flat at $594 million; Activewear sales rose 13.5% to $485 million; and, international sales increased 11.7% to $609 million. Constant-currency organic sales increased 9%. Bras N Things, acquired in February 2018, added $43 million to international sales. Champion brand achieved double digit sales growth during the period, and excluding the U.S. mass channel, Champion revenue increased more than 50% and for 2018, global Champion sales excluding mass were $1.36 billion versus approximately $1 billion in 2017. Champion sales at mass declined nearly 3%. Revenue in the direct-to-consumer channel (DTC) increased 23% and represented 25% of total sales.

Innerwear basics grew 2% during 4Q and sales of innerwear intimates declined 7%, despite double-digit growth of shapewear following the relaunch of Maidenform.

Adjusted operating margin increased 40 bps to 14.7% of sales because of acquisition contributions and a lower SG&A expense ratio.

Outlook

The company provided initial guidance for FY19.

- Hanesbrands expects sales of $6.885-6.985 billion driven by a 6% increase in international sales. Growth drivers are Champion in Asia and Europe and increased innerwear sales in Asia, Australia and the Americas. U.S. innerwear sales are expected to decrease about 2% in 2019, down 4% in 1Q with an improving trend throughout the year.

- Adjusted operating profit of $955-985 million.

- Adjusted EPS of $1.72-1.80.

- Net cash from operations of $700-800 million.

- For 1Q19, guidance is sales of $1.52-1.55 billion, adjusted operating profit of $135-145 million and adjusted EPS of $0.24-0.26.