albert Chan

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

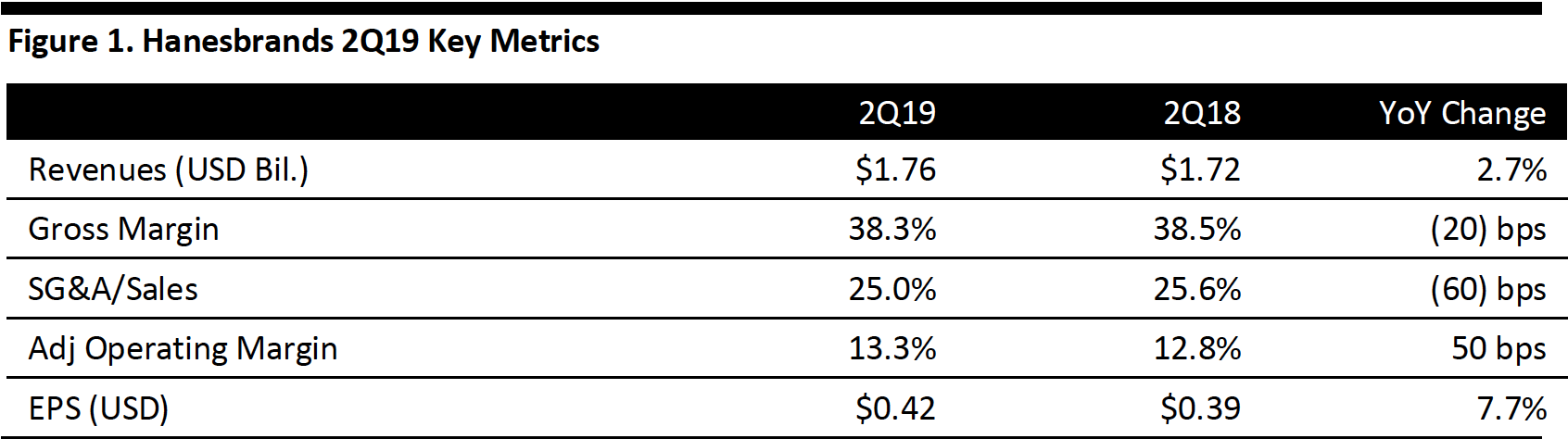

Hanesbrands reported 2Q19 net sales of $1.59 billion, a 2.7% increase from 2Q18 (a 5% increase on a constant-currency basis). 2Q19 EPS increased 7.7% to $0.42.

By segment, innerwear sales decreased 2.3% to $679 million with innerwear basics decreasing 2% and innerwear intimates sales declining less than 3%. Shapewear continues to grow at double digits and the bra revitalization initiative is underway. Activewear sales rose 10.5% to $448 million. International sales increased 4.2% (up more than 10% in constant currency) to $569 million, with double-digit sales growth in Europe and Asia, and high single digit growth in Australia.

Champion achieved double digit-sales growth during the period inclusive of an approximate 3% sales decline in the mass channel as positive comps, more space at existing accounts and new distribution drove incremental sales volume. Excluding the mass channel and on a constant currency basis, Champion revenue increased 50% globally. C9, Champion’s mass business, grew more than 8% in 2Q19, driven by strong sell-through. Hanes is refocusing its activewear business to branded products, so while sales in the non-Champion portion of the activewear section declined, the segment operating margin expanded 120 bps to 15.3% with the exit of commodity product. Excluding C9, the company expects global Champion sales to be in excess of $1.8 billion this year.

Gross margin contracted 10bps offset by SG&A expense leverage of 60 basis points (bps) to 25% of sales, resulting in a 50 bps operating margin expansion, to 13.3% of sales. On a segment basis, the international operating margin expanded 20 bps to 14.3% and innerwear operating margin contracted 130 basis points to 21.6%.

Ending 2Q19, company inventory was $2.2 billion, up 8.7% from December 29, 2018.

Outlook

The company reiterated guidance for FY19 and provided 3Q19 guidance.

- Hanesbrands expects FY19 sales of $6.88-6.98 billion. Growth drivers are expected to be Champion sales in Asia and Europe and increased innerwear sales in Asia, Australia and the Americas. US innerwear sales are expected to decrease about 2% in 2019.

- Adjusted operating profit of $955-985 million in FY19.

- Adjusted EPS of $1.72-1.80 in FY19.

- Net cash from operations of $700-800 million in FY19.

- For 3Q19, the company provided the following guidance: sales growth of 1.5% on an constant currency basis and revenues of $1.84-1.875 billion, adjusted operating profit of $276-286 million and adjusted EPS of $0.52-0.55.