albert Chan

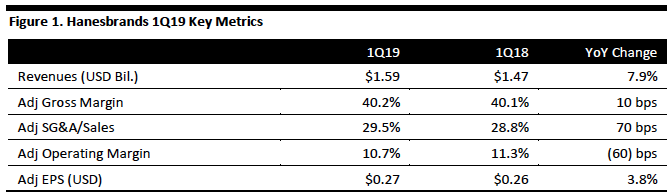

[caption id="attachment_86395" align="aligncenter" width="668"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Hanesbrands reported 1Q19 net sales of $1.59 billion, a 7.9% increase from 1Q18 (a 10.0% increase on a constant currency organic basis) and exceeding company guidance of $1.52-1.55 billion in 4Q18. Adjusted EPS increased 4% to $0.27.

By segment, innerwear sales decreased 3% to $476 million with innerwear basics up nearly 2%. Intimates sales declined 12%, reflecting a planned reduction in bra sales while shapewear revenue grew for the third consecutive quarter, driven by continued positive consumer reception to new product designs and cool comfort innovation. Activewear sales rose 17.1% to $405 million. International sales increased 13.4% to $646 million, with robust sales growth in Europe, Asia, Australia and the Americas.

Champion achieved 80%-plus sales growth during the period, including an approximate 3% sales decline in the mass channel. Excluding the mass channel and on a constant currency basis, Champion revenue increased 75% globally, up from the 50% pace set in 1Q19. Strong growth was driven by business expansion including continued store openings in China and distribution expansion into Australia.

Gross margin expanded 10 bps, offset by SG&A expense deleverage of 70 bps to 29.5% of sales, resulting in a 60 bps operating margin contraction.

Adjusted operating margin decreased 60 bps to 10.7% of sales. On a segment basis, innerwear margins expanded 130 bps to 22% and international operating margins expanded 80 basis points to 14.3%. Activewear operating margin eroded 30 bps to 10.8%.

Ending 1Q19, the company’s inventory was $2.2 billion, up 9.3%.

Hanesbrands is optimizing its supply chain and distribution operations for improved efficiency and service. The company is making efforts to engage directly with consumers, particularly millennials, across various digital platforms with both regional and global campaigns. The company’s strategy involves a detailed segmentation plan to drive differentiation between channels.

The company is committed to returning the US Innerwear business to long-term growth with specific actions in 2019 that include increased marketing investments, particularly in intimates, as well as launching of additional innovations.

Outlook

The company reiterated guidance for FY19.

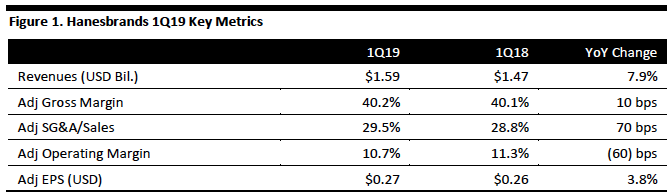

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Hanesbrands reported 1Q19 net sales of $1.59 billion, a 7.9% increase from 1Q18 (a 10.0% increase on a constant currency organic basis) and exceeding company guidance of $1.52-1.55 billion in 4Q18. Adjusted EPS increased 4% to $0.27.

By segment, innerwear sales decreased 3% to $476 million with innerwear basics up nearly 2%. Intimates sales declined 12%, reflecting a planned reduction in bra sales while shapewear revenue grew for the third consecutive quarter, driven by continued positive consumer reception to new product designs and cool comfort innovation. Activewear sales rose 17.1% to $405 million. International sales increased 13.4% to $646 million, with robust sales growth in Europe, Asia, Australia and the Americas.

Champion achieved 80%-plus sales growth during the period, including an approximate 3% sales decline in the mass channel. Excluding the mass channel and on a constant currency basis, Champion revenue increased 75% globally, up from the 50% pace set in 1Q19. Strong growth was driven by business expansion including continued store openings in China and distribution expansion into Australia.

Gross margin expanded 10 bps, offset by SG&A expense deleverage of 70 bps to 29.5% of sales, resulting in a 60 bps operating margin contraction.

Adjusted operating margin decreased 60 bps to 10.7% of sales. On a segment basis, innerwear margins expanded 130 bps to 22% and international operating margins expanded 80 basis points to 14.3%. Activewear operating margin eroded 30 bps to 10.8%.

Ending 1Q19, the company’s inventory was $2.2 billion, up 9.3%.

Hanesbrands is optimizing its supply chain and distribution operations for improved efficiency and service. The company is making efforts to engage directly with consumers, particularly millennials, across various digital platforms with both regional and global campaigns. The company’s strategy involves a detailed segmentation plan to drive differentiation between channels.

The company is committed to returning the US Innerwear business to long-term growth with specific actions in 2019 that include increased marketing investments, particularly in intimates, as well as launching of additional innovations.

Outlook

The company reiterated guidance for FY19.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Hanesbrands reported 1Q19 net sales of $1.59 billion, a 7.9% increase from 1Q18 (a 10.0% increase on a constant currency organic basis) and exceeding company guidance of $1.52-1.55 billion in 4Q18. Adjusted EPS increased 4% to $0.27.

By segment, innerwear sales decreased 3% to $476 million with innerwear basics up nearly 2%. Intimates sales declined 12%, reflecting a planned reduction in bra sales while shapewear revenue grew for the third consecutive quarter, driven by continued positive consumer reception to new product designs and cool comfort innovation. Activewear sales rose 17.1% to $405 million. International sales increased 13.4% to $646 million, with robust sales growth in Europe, Asia, Australia and the Americas.

Champion achieved 80%-plus sales growth during the period, including an approximate 3% sales decline in the mass channel. Excluding the mass channel and on a constant currency basis, Champion revenue increased 75% globally, up from the 50% pace set in 1Q19. Strong growth was driven by business expansion including continued store openings in China and distribution expansion into Australia.

Gross margin expanded 10 bps, offset by SG&A expense deleverage of 70 bps to 29.5% of sales, resulting in a 60 bps operating margin contraction.

Adjusted operating margin decreased 60 bps to 10.7% of sales. On a segment basis, innerwear margins expanded 130 bps to 22% and international operating margins expanded 80 basis points to 14.3%. Activewear operating margin eroded 30 bps to 10.8%.

Ending 1Q19, the company’s inventory was $2.2 billion, up 9.3%.

Hanesbrands is optimizing its supply chain and distribution operations for improved efficiency and service. The company is making efforts to engage directly with consumers, particularly millennials, across various digital platforms with both regional and global campaigns. The company’s strategy involves a detailed segmentation plan to drive differentiation between channels.

The company is committed to returning the US Innerwear business to long-term growth with specific actions in 2019 that include increased marketing investments, particularly in intimates, as well as launching of additional innovations.

Outlook

The company reiterated guidance for FY19.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Hanesbrands reported 1Q19 net sales of $1.59 billion, a 7.9% increase from 1Q18 (a 10.0% increase on a constant currency organic basis) and exceeding company guidance of $1.52-1.55 billion in 4Q18. Adjusted EPS increased 4% to $0.27.

By segment, innerwear sales decreased 3% to $476 million with innerwear basics up nearly 2%. Intimates sales declined 12%, reflecting a planned reduction in bra sales while shapewear revenue grew for the third consecutive quarter, driven by continued positive consumer reception to new product designs and cool comfort innovation. Activewear sales rose 17.1% to $405 million. International sales increased 13.4% to $646 million, with robust sales growth in Europe, Asia, Australia and the Americas.

Champion achieved 80%-plus sales growth during the period, including an approximate 3% sales decline in the mass channel. Excluding the mass channel and on a constant currency basis, Champion revenue increased 75% globally, up from the 50% pace set in 1Q19. Strong growth was driven by business expansion including continued store openings in China and distribution expansion into Australia.

Gross margin expanded 10 bps, offset by SG&A expense deleverage of 70 bps to 29.5% of sales, resulting in a 60 bps operating margin contraction.

Adjusted operating margin decreased 60 bps to 10.7% of sales. On a segment basis, innerwear margins expanded 130 bps to 22% and international operating margins expanded 80 basis points to 14.3%. Activewear operating margin eroded 30 bps to 10.8%.

Ending 1Q19, the company’s inventory was $2.2 billion, up 9.3%.

Hanesbrands is optimizing its supply chain and distribution operations for improved efficiency and service. The company is making efforts to engage directly with consumers, particularly millennials, across various digital platforms with both regional and global campaigns. The company’s strategy involves a detailed segmentation plan to drive differentiation between channels.

The company is committed to returning the US Innerwear business to long-term growth with specific actions in 2019 that include increased marketing investments, particularly in intimates, as well as launching of additional innovations.

Outlook

The company reiterated guidance for FY19.

- Hanesbrands expects sales of $6.885-6.985 billion. Growth drivers are expected to be Champion sales in Asia and Europe and increased innerwear sales in Asia, Australia and the Americas. US innerwear sales are expected to decrease about 2% in 2019.

- Adjusted operating profit of $955-985 million.

- Adjusted EPS of $1.72-1.80.

- Net cash from operations of $700-800 million.

- For 2Q19, the company provided the following guidance: sales of $1.74-1.77 billion, adjusted operating profit of $223-233 million and adjusted EPS of $0.43-0.45.