What’s the Story?

This year’s Hanesbrands Investor Day was held virtually on May 11, 2021. In this report, we present insights from the event, covering the US apparel company’s strategies moving forward under its “Full Potential Plan.”

Hanesbrands Investor Day 2021: Key Insights

Hosting the Investor Day, Stephen Bratspies, CEO at Hanesbrands, offered an overview of the company’s Full Potential Plan, which comprises four pillars driven by five initiatives. We offer insights into each of the pillars and initiatives below, as discussed during the Investor Day.

[caption id="attachment_127194" align="aligncenter" width="720"]

Source: Hanesbrands

Source: Hanesbrands[/caption]

Full Potential Plan: Four Pillars

1. Growing Champion Globally

Jon Ram, Group President of Global Activewear at Hanesbrands, dived into the company’s plans to grow Champion into a $3 billion global brand by 2024, representing a 14% CAGR from projected 2021 sales of approximately $2 billion.

Founded in 1919, Champion is known for its authentic American style and performance, according to Hanesbrands. Ram explained that the company sees significant opportunity to grow Champion in the next three years, as the brand is positioned to meet consumers’ lifestyle and performance needs, according to company research.

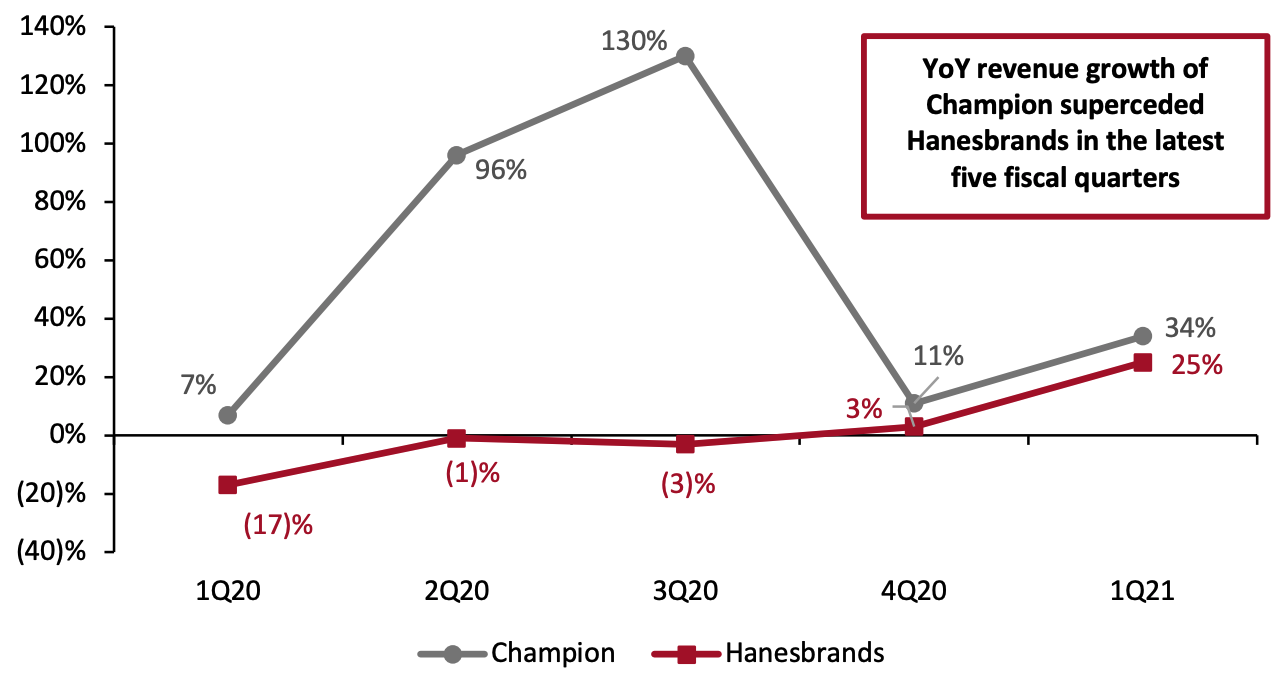

Champion’s year-over-year revenue growth superseded that of Hanesbrands in the latest five fiscal quarters (see Figure 1), showing the momentum of the brand.

Figure 1. Champion Revenue Growth Versus Total Revenue Growth (YoY %)

[caption id="attachment_127195" align="aligncenter" width="720"]

Source: Hanesbrands

Source: Hanesbrands[/caption]

To successfully deliver on the Champion growth strategy, Hanesbrands intends to take four actions:

- Forge deeper connections with consumers, focusing on three key consumer segments—stylish athletes, trend lovers and culture curators. Hanesbrands’ research shows that these three segments make up over 50% of the activewear market and account for almost 70% of Champion sales.

- Create compelling products through globally coordinated design and innovation, fortifying Champion’s global position as “the king of sweats,” a category that is continuing to trend up. Hanesbrands plans to expand offerings in women’s and kid’s apparel, innerwear and casual athletic footwear, and include functional benefits and thoughtful designs in apparel.

- Grow in key geographies, focusing on North America, China, Japan, South Korea and the “big five” markets in Europe through a combination of digital, wholesale and distribution partners.

- Expand online channels. Hanesbrands sees opportunities in direct-to-consumer channels and expects that champion.com will comprise 25% of its total US business by 2024. The company aims to make Champion.com a premium brand.

2. Reigniting Innerwear Growth

Joe Cavaliere, President of Global Innerwear at Hanesbrands, talked about the company’s plans to reignite growth in its Global Innerwear business and appeal to younger consumers.

Hanesbrands aims to grow the businesses’ sales by around $200 million through 2024, representing a 2% CAGR from projected 2021 sales of approximately $3.7 billion. The company expects this growth to be driven by sales in the US and Australia. In the US, Hanesbrands is implementing a plan to shift the portfolio to target younger consumers through its Bali, Hanes and Maidenform brands. In Australia, Bonds has become the company’s leading innerwear brand; the company plans to fuel continued growth through ongoing investment in the Bonds brand and its e-commerce infrastructure.

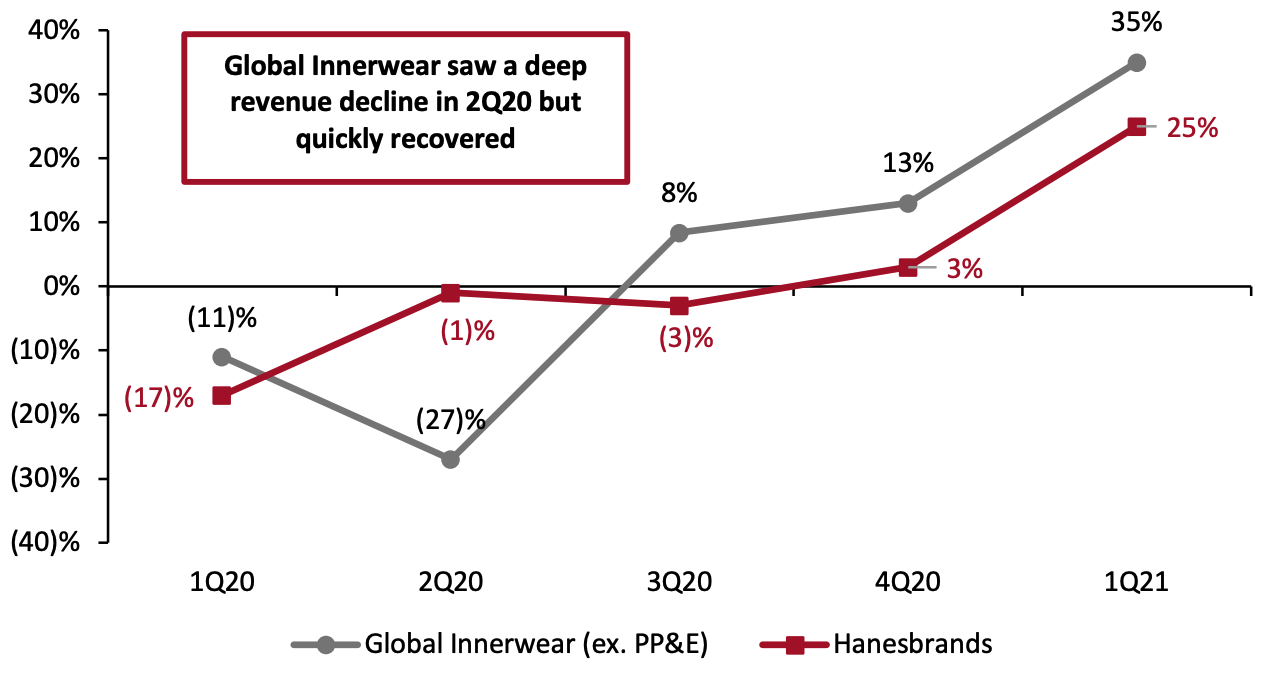

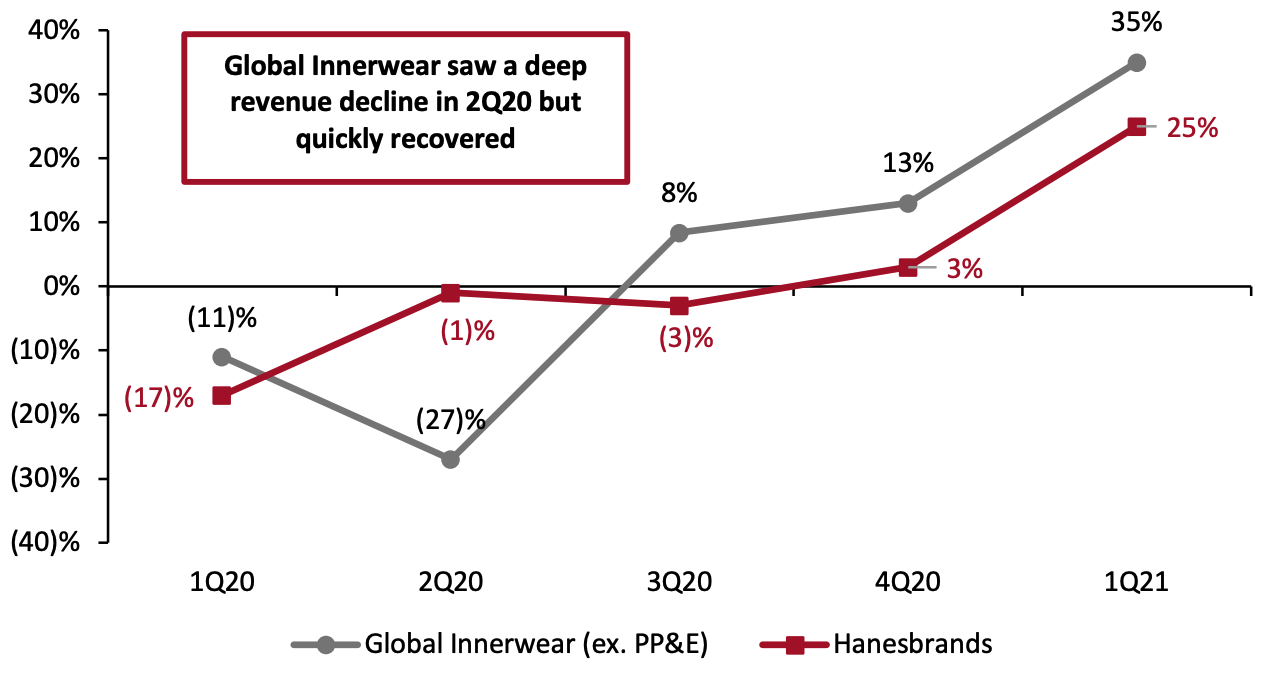

Excluding PPE (personal protective equipment), the innerwear segment of Hanesbrands struggled in the second quarter of fiscal 2020 but quickly recovered in the following months, showing the resilience of the business (see Figure 2).

Figure 2. Sales Growth of the Global Innerwear Business (ex. PPE) Versus Total Sales Growth (YoY %)

[caption id="attachment_127196" align="aligncenter" width="720"]

Source: Hanesbrands

Source: Hanesbrands[/caption]

To successfully deliver under the “reigniting innerwear growth” pillar, Hanesbrands intends to invest in three critical enablers:

- Winning with e-commerce—building new capabilities to engage more directly with consumers

- Doubling brand-building investment—deepening collaboration with retailers and brands

- Driving category-disruptive innovation—reducing innovation cycle times by leveraging an agile design process

3. Driving Consumer-Centricity

Greg Hall, Chief Consumer Officer at Hanesbrands, highlighted five steps as part of the company’s consumer-centricity strategy, which we summarize below.

- Step 1: Increase investments in key brands. Double brands’ digital and social media investments from today’s 2% of sales to 4% by 2024.

- Step 2: Increase capabilities in digital marketing to build on the strength of brands. Consolidate digital media planning with performance marketing and invest in data-driven media platforms.

- Step 3: Remove friction from the consumer’s path. Double investments in technology. Hanesbrands is spending some of its capital to upgrade its e-commerce sites with a focus on champion.com. The company has recently built a new agile product team focused on increasing conversion on its brand sites, with faster page download speeds for mobile and desktop, improved visual look and ease of use across the sites.

- Step 4: Delight the consumer and earn brand loyalty. Improve service levels, fulfillment and shipping time to create a seamless brand experience.

- Step 5: Develop data-driven understanding of each consumer. Leverage data to understand consumer behaviors and buying patterns.

4. Focusing the Portfolio

The company will continue to simplify all aspects of its business—from global holdings to SKU (stock-keeping unit) counts—to enable investment in its key global brands, categories and growth markets. Hanesbrands highlighted two actions in particular that it will take to focus its portfolio:

- Adjust its business focus—Hanesbrands intends to explore strategic alternatives for its European Innerwear business and move away from PPE businesses.

- Rationalize SKUs—The company plans to remove 20% of underperforming SKUs and improve higher-margin SKUs. It also intends to use its strong network to increase on-shelf availability and improve the shopping experience.

Full Potential Plan: Five Initiatives

Hanesbrands’ four pillars under the Full Potential Plan will be driven by five initiatives:

- Winning with brands and products—enhancing the design and innovation capabilities of products to meet the needs of current and new customers

- Supply chain segmentation—building the capabilities of supply chain to increase product’s speed-to-market and become more agile in serving direct-to-consumer channels

- Simplicity—simplifying the processes, organization and approaches to make decision faster

- Technology modernization—investing in data analytics and technologies to reduce costs, gain actionable insights, improve forecasting and planning ability, and streamline consumer experiences

- Winning organization and culture—investing in people and next-generation talent to increase results

Financial Outlook

Scott Lewis, Chief Accounting Officer at Hanesbrands, presented on the company’s financial ambitions at the Investor Day. Using the midpoint of the company’s 2021 guidance for continuing operations as the base, the company expects its revenues to increase from $6.25 billion to approximately $7.4 billion by 2024, representing an incremental $1.15 billion of revenue, or a 6% CAGR.

Hanesbrands expects to expand operating margins to approximately 14.3% in 2024, compared to the midpoint of the company’s 2021 guidance of 13.3%.

Source: Hanesbrands[/caption]

Full Potential Plan: Four Pillars

1. Growing Champion Globally

Jon Ram, Group President of Global Activewear at Hanesbrands, dived into the company’s plans to grow Champion into a $3 billion global brand by 2024, representing a 14% CAGR from projected 2021 sales of approximately $2 billion.

Founded in 1919, Champion is known for its authentic American style and performance, according to Hanesbrands. Ram explained that the company sees significant opportunity to grow Champion in the next three years, as the brand is positioned to meet consumers’ lifestyle and performance needs, according to company research.

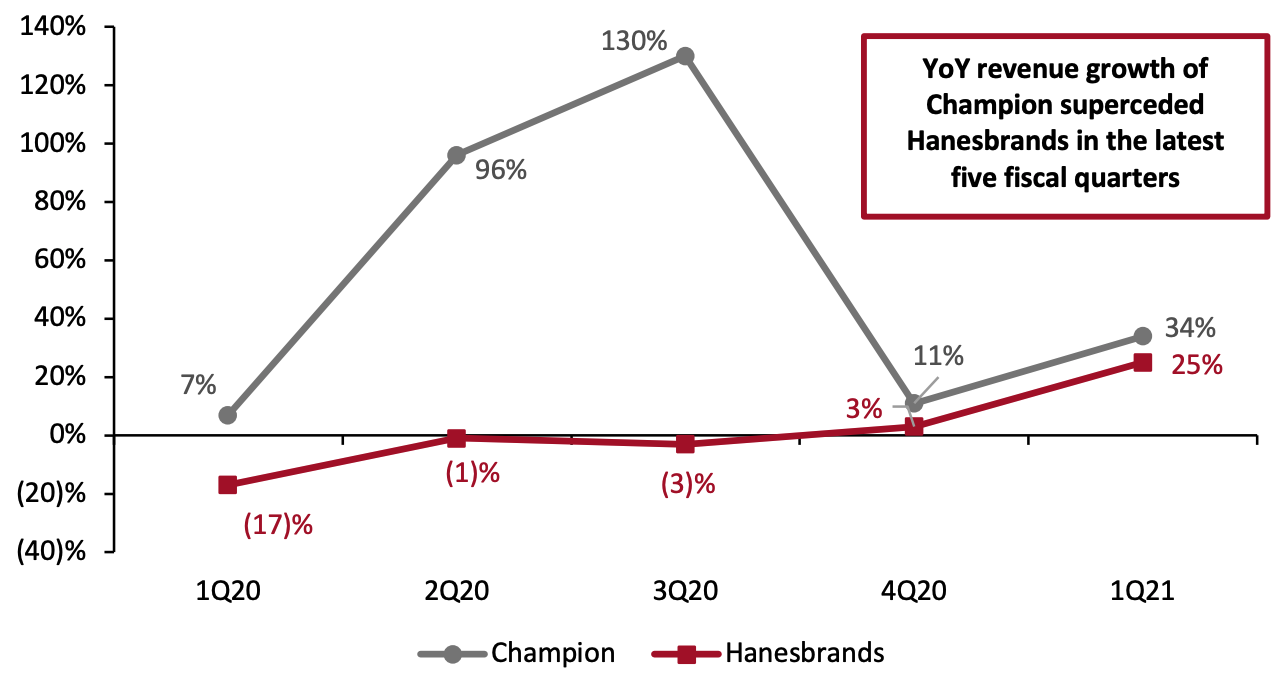

Champion’s year-over-year revenue growth superseded that of Hanesbrands in the latest five fiscal quarters (see Figure 1), showing the momentum of the brand.

Figure 1. Champion Revenue Growth Versus Total Revenue Growth (YoY %)

[caption id="attachment_127195" align="aligncenter" width="720"]

Source: Hanesbrands[/caption]

Full Potential Plan: Four Pillars

1. Growing Champion Globally

Jon Ram, Group President of Global Activewear at Hanesbrands, dived into the company’s plans to grow Champion into a $3 billion global brand by 2024, representing a 14% CAGR from projected 2021 sales of approximately $2 billion.

Founded in 1919, Champion is known for its authentic American style and performance, according to Hanesbrands. Ram explained that the company sees significant opportunity to grow Champion in the next three years, as the brand is positioned to meet consumers’ lifestyle and performance needs, according to company research.

Champion’s year-over-year revenue growth superseded that of Hanesbrands in the latest five fiscal quarters (see Figure 1), showing the momentum of the brand.

Figure 1. Champion Revenue Growth Versus Total Revenue Growth (YoY %)

[caption id="attachment_127195" align="aligncenter" width="720"] Source: Hanesbrands[/caption]

To successfully deliver on the Champion growth strategy, Hanesbrands intends to take four actions:

Source: Hanesbrands[/caption]

To successfully deliver on the Champion growth strategy, Hanesbrands intends to take four actions:

Source: Hanesbrands[/caption]

To successfully deliver under the “reigniting innerwear growth” pillar, Hanesbrands intends to invest in three critical enablers:

Source: Hanesbrands[/caption]

To successfully deliver under the “reigniting innerwear growth” pillar, Hanesbrands intends to invest in three critical enablers: