Source: Company reports/FGRT

4Q17 Results

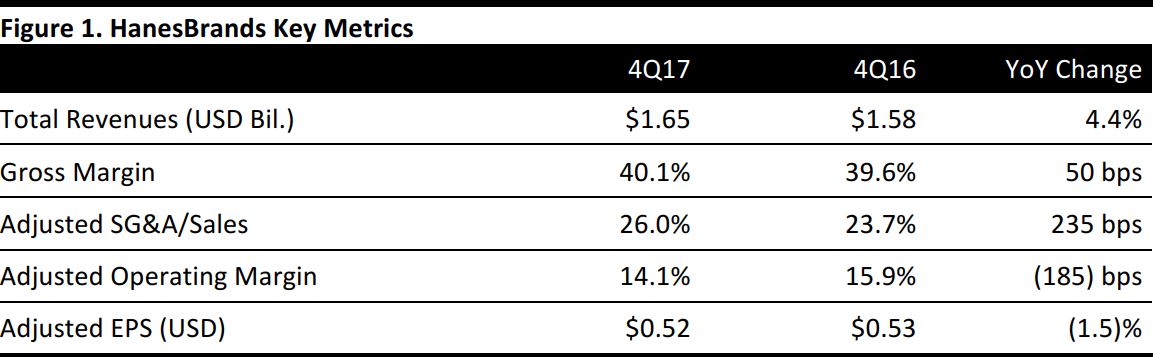

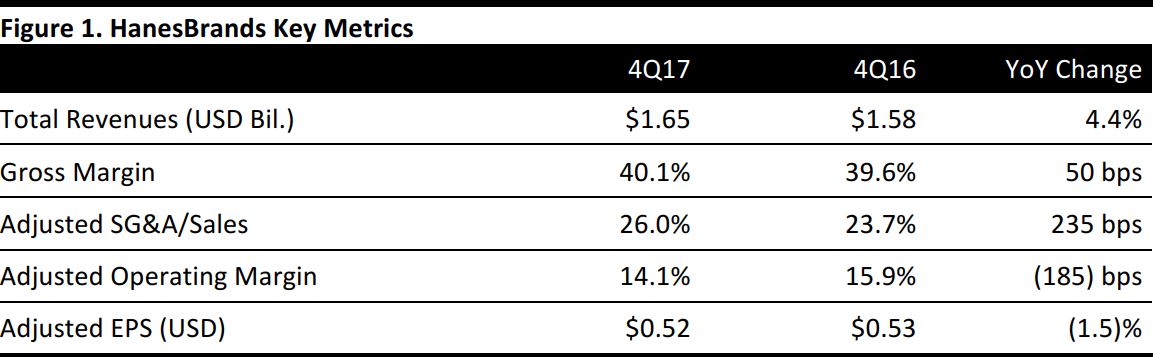

Hanes Brands reported 4Q17 revenues of $1.65 billion, up 4.4% year over year and roughly in line with the $1.63 billion consensus estimate.

Adjusted EPS was $0.52, versus $0.53 in the year-ago quarter and in line with consensus. GAAP EPS from continuing operations was $(1.06), compared with $0.41 in the year-ago quarter.

Separately, the company has entered into a definitive agreement to acquire Bras N Things, a leading specialty retailer and online seller of intimate apparel in Australia, New Zealand, and South Africa. In 2017, Bras N Things had net sales of approximately $144 million. The all-cash transaction has an enterprise value of approximately $400 million and is expected to be accretive to earnings in 2018.

Details from the Quarter

- Sales of innerwear totaled $594.6 million, up 0.8% year over year, driven by strong men’s and children’s underwear growth. For the full year, segment sales decreased by 3.2%. Online channel sales increased by 12%.

- Sales of outerwear totaled $427.7 million, up 8.7% year over year. Sales for the full year increased by 3.3%. Core Champion performance and higher sports apparel sales, including strong sales of the Champion Life line of products and reverse-weave fleece products, drove quarterly growth. Online channel sales for the segment increased by 27%.

- International sales totaled $545.3 million, up 8.0% year over year. For the full year, international sales were up 34.1%. Space gains, including new store openings, and

- strong consumer demand at retail and online drove performance across all geographies.

- Other sales totaled $77.6 million, down 10.8% year over year. Sales in the segment decreased by 14.8% for the year.

Full-Year Results

Hanes Brands reported revenues of $6.47 billion in 2017, up 7.4%. Adjusted EPS was $1.93, versus $1.85 in the prior year. GAAP EPS from continuing operations was $0.17, compared with $1.40 in the prior year.

Outlook

2018 Guidance

For 2018, the company expects:

- Net sales of $6.72–$6.82 billion, above the consensus estimate of $6.63 billion.

- GAAP EPS of $1.54–$1.62.

- Adjusted EPS of $1.72–$1.80, below the $2.04 consensus estimate.

1Q18 Guidance

For 1Q18, the company expects:

- Net sales of $1.42–$1.44 billion, in line with the consensus estimate of $1.43 billion.

- GAAP EPS of $0.17–$0.20.

- Adjusted EPS of $0.23–$0.25, below the $0.30 consensus estimate.