Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Activewear, International and Consumer Directed Businesses Lead 3Q Results; Innerwear Weighs on Results

Champion was a bright light in a rather weak quarter, with sales up 30%, 40% excluding the mass channel and lapping 33% in the comparable year ago quarter. Global Champion sales growth was broad-based, up double digits in all regions and across all global channels of trade—wholesale, owned retail and online.

Activewear sales grew 6.8% to $555 million; International sales grew 11.3% to $619 million; and Innerwear sales declined 6.9% to $600 million.

All regions contributed to International sales growth despite a $22 million headwind related to foreign currency effects, and segment operating margin expanded 200 basis points (bps) to 16.1% due to a favorable mix principally reflecting Champion and contributions from recently acquired (February 2018) Bras N Things.

Activewear segment margin was flat at 16.9% and Innerwear segment margin contracted 170 bps to 22.1% mirroring the de-leveraging related to decreased volume and higher input costs.

Revitalization within intimates is incrementally gaining traction, with market share beginning to stabilize after multiple quarters of decline. Point-of-sale trends are rebounding at key accounts where new product offerings were recently launched. Shapewear experienced low double-digit point-of-sale growth since the reset. Innerwear trends improved in October and management sees flat segment sales in 4Q.

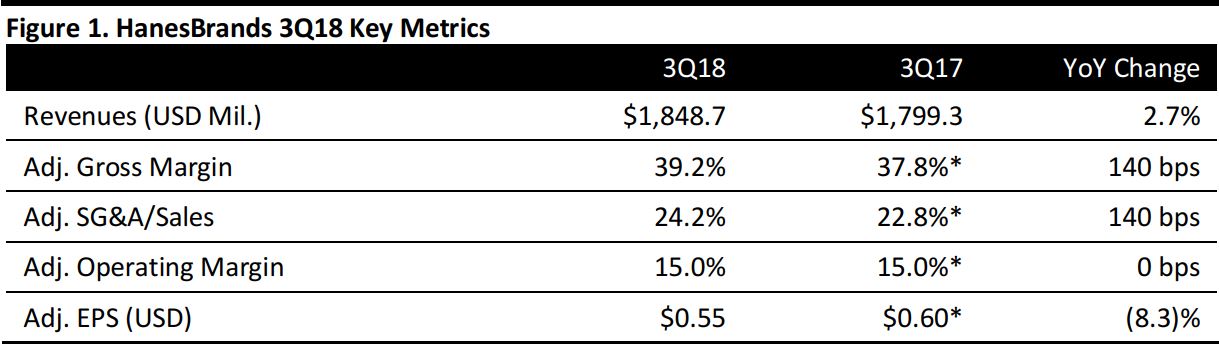

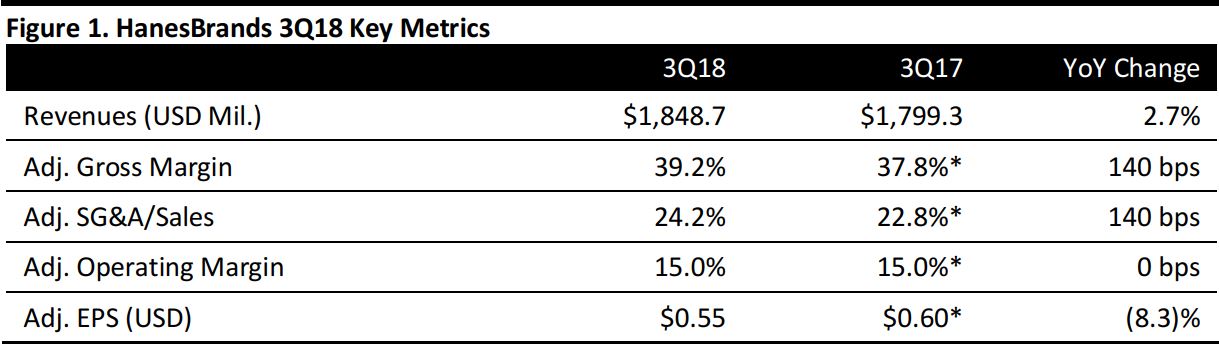

Adjusted EPS of $0.55 versus adjusted EPS of $0.60, down 8.3%. Inventory levels increased more rapidly than sales, rising 9.5% to $2.1 billion,as HanesBrands invests to support Champion's global growth.

Outlook

HanesBrands updated and narrowed its 2018 guidance, taking a proactive approach to the Sears bankruptcy, which represents about 1% of revenue, or approximately $65 million. In addition to the $14 million charge taken in 3Q to reserve for the Sears bankruptcy, HandsBrands adjusted 4Q revenue and operating profit $15 million and $5 million, respectively, due to Sears.

- Projected net sales are $6,735–$6,775 million, versus $6,471 million in 2017.

- Adjusted operating profit is$940–$955 million.

- Adjusted EPS is$1.60–$1.73, which includes the $0.05 adverse effect of the Sears bankruptcy.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research