Source: Company reports/Coresight Research

2Q18 Results

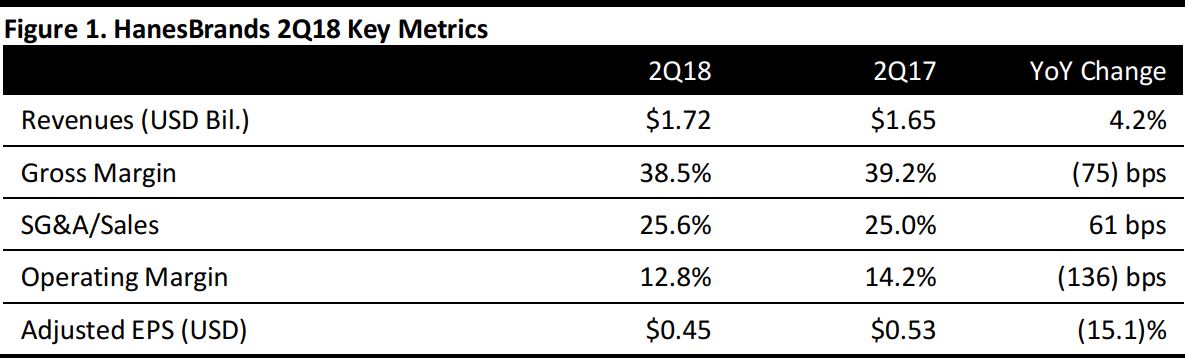

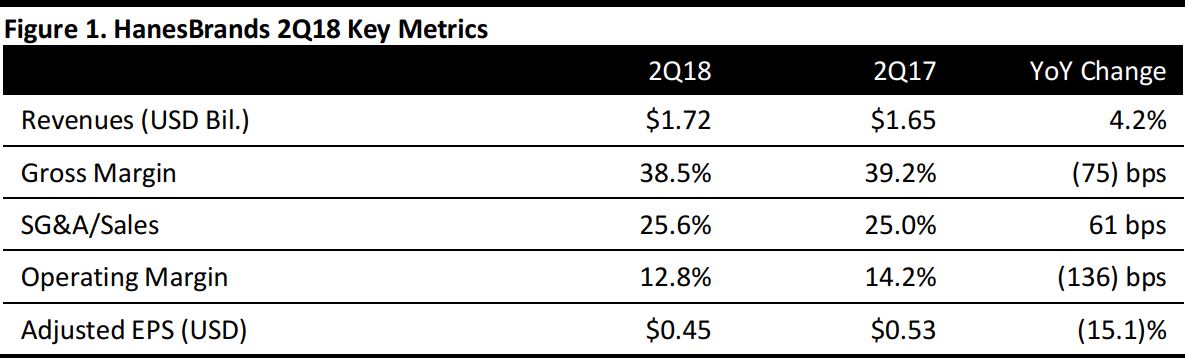

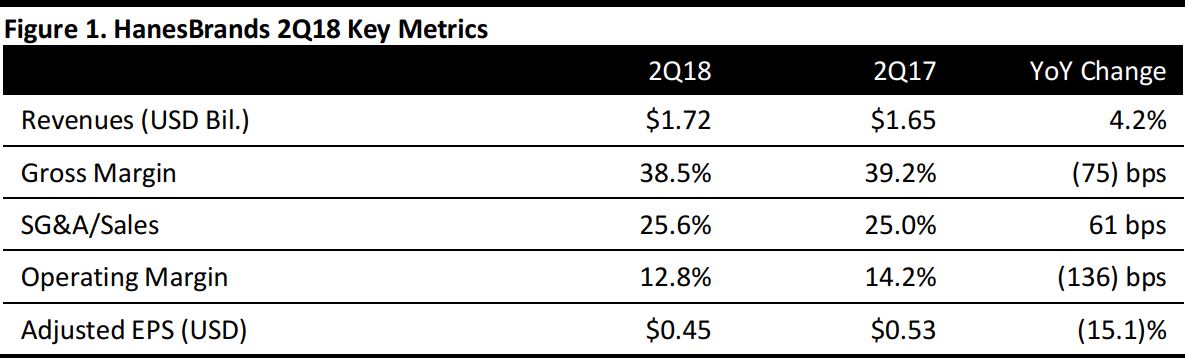

HanesBrands reported 2Q18 revenues of $1.72 billion, up 4.2% year over year and beating the $1.71 billion consensus estimate. Adjusted EPS of $0.45 was down from $0.53 in the year-ago quarter, slightly below the $0.46 consensus estimate and at the midpoint of the company’s $0.44–$0.46 guidance range.

Organic sales, which exclude acquisition contributions, increased slightly in constant currency. Revenues were driven primarily by acquisitions, global growth of the Champion brand and increased direct-to-consumer sales. Net sales for Bras N Things, acquired in February 2018, and Alternative Apparel, acquired in October 2017, totaled $52 million in the quarter (or 75% of the total sales increase), while Champion sales increased by 18% year over year. Direct-to-consumer sales, which accounted for 22% of total sales, increased by 20% from the year-ago quarter.

By segment, the international business saw sales increase by 14.9% from the year-ago quarter, to $545.86 million, benefiting from foreign exchange rates, strength in the Champion brand in Europe and Asia, and the acquisition of Bras N Things in Australia. On a constant-currency basis, international organic sales increased by 5%. The segment’s operating margin increased by 140 basis points, to 14%, benefiting from organic growth and realization of acquisition synergies.

Global activewear sales increased by 12% year over year, including a 1.5% increase in organic sales, driven by growth of the Champion brand and the licensed sports apparel business, along with the acquisition of Alternative Apparel, despite space constraints in the mass channel. Sales in the US activewear segment increased by 6.9% in the quarter, to $405.79 million. The acquisition of Alternative Apparel contributed $20 million in sales. The activewear division’s operating margin declined by 140 basis points, to 14.2%, driven by higher raw material costs, manufacturing inefficiencies and higher distribution costs.

Global innerwear sales increased by 1% from the year-ago quarter, driven by acquisition contributions and currency benefits. On an organic, constant-currency basis, global innerwear sales declined by roughly 2.5%, driven by a 3.4% decline in US sales, to $694.69 million. Sales of innerwear basics increased slightly, driven by a low-single-digit increase in men’s underwear sales and a return to growth in women’s underwear sales. These increases more than offset the expected short-term pressure from store closures.

Outlook

HanesBrands reiterated its FY18 net sales guidance of $6.72–$6.82 billion, versus the consensus estimate of $6.77 billion. The company expects full-year adjusted EPS of $1.72–$1.80, in line with the consensus estimate of $1.76.

The company previously expected foreign exchange rates to have a neutral impact in the second half of the year, but it now expects the strengthening US dollar to reduce revenue growth by $30 million and operating growth by $5 million.

The company said that Target will not renew its contract to sell HanesBrands’ exclusive line as part of the Champion brand (C9 by Champion). The contract expires in January 2020. HanesBrands said that it earned about $380 million in sales from the C9 line over the past year. The company said that it continues to expect Champion sales of more than $2 billion by 2022 despite the Target development.

In 3Q18, the company expects net sales of $1.85–$1.90 billion, representing roughly 4% year-over-year growth at the midpoint. The company expects adjusted EPS of $0.54–$0.57 in the third quarter.