Source: Company reports/FGRT

Source: Company reports/FGRT

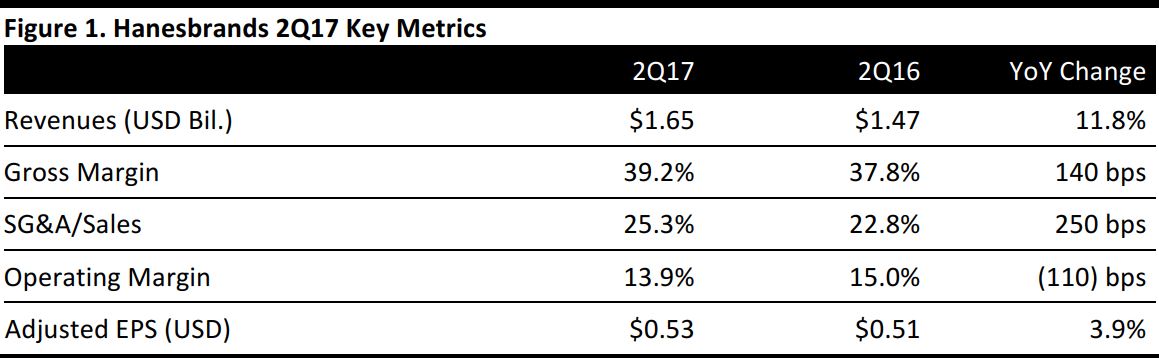

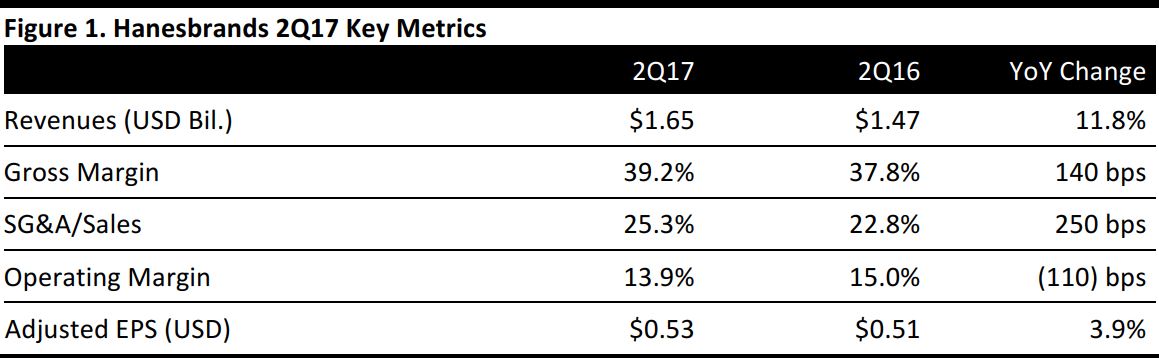

2Q17 Results

Revenue growth for Hanesbrands in 2Q17 was driven primarily by contributions from acquisitions, including Champion Europe and Hanes Australasia, which were acquired in 2016 and contributed approximately $220 million in net sales in the quarter. Organic sales trends improved for the second quarter in a row, and the company expects them to contribute to growth in the second half of the year.

By business segment, the company saw the decline in its Innerwear sales slow. Sales in the segment declined by less than 3% in 2Q17 compared with declines of 6% in 1Q17 and 8% in 4Q16. Within the segment, the company saw sequential improvement in the basics and intimates businesses.

The Activewear category had mixed results, with sales increasing by 1% due to the benefits of acquisitions. Sales growth for Hanes retail was offset by later-than-expected shipments in the licensed sports channel and the effect of retailer bankruptcies.

In the International segment, sales increased by 76% as a result of acquisitions and strong performance in Asia.

Outlook

For 3Q17, the company expects total net sales of approximately $1.8 billion, a year-over-year increase of approximately 2.5%. This projected increase is attributed to back-to-school shipments that are expected to be higher than in the year-ago period due to retailers timing orders closer to sales events this year. The company now expects 3Q17 adjusted EPS of $0.59–$0.61.

Hanesbrands reaffirmed its full-year guidance. The company expects net sales of $6.45–$6.55 billion, compared with the consensus estimate of $6.44 billion. The company expects GAAP EPS for continuing operations of $1.70–$1.82 and adjusted EPS for continuing operations, excluding actions, of $1.93–$2.03, in line with the consensus estimate of $1.97.

Source: Company reports/FGRT

Source: Company reports/FGRT