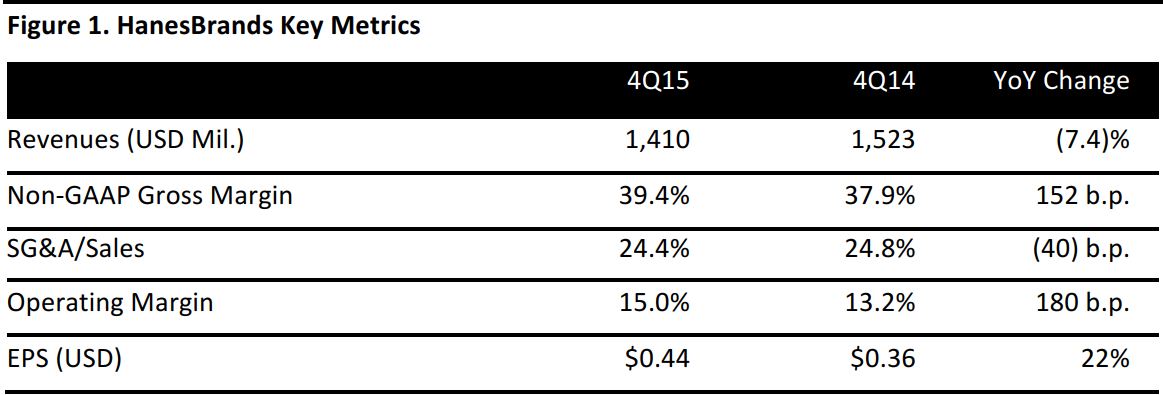

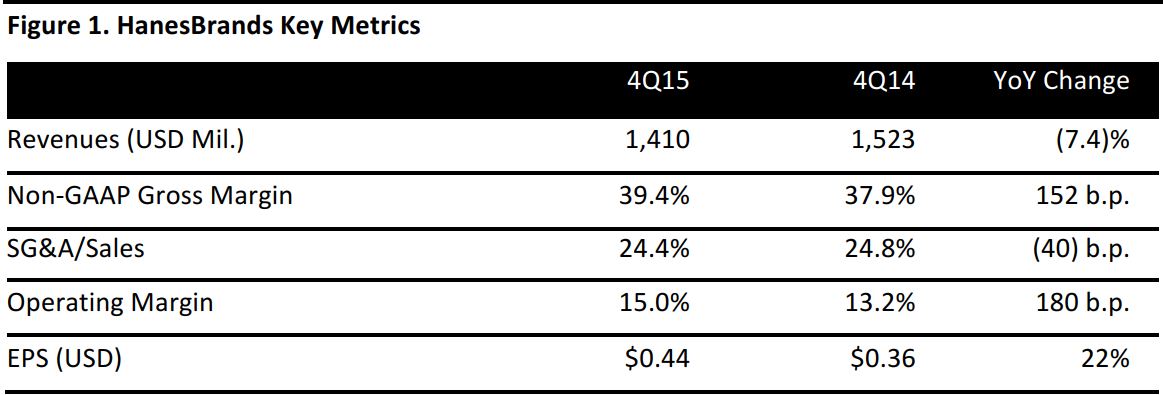

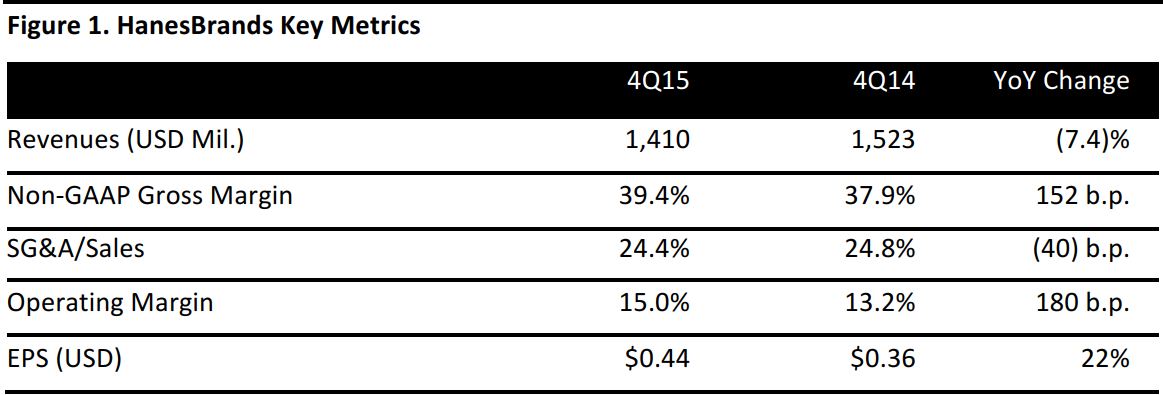

Source: Company reports

HanesBrands reported 4Q15 EPS (ex items) of $0.44 versus consensus of $0.46.

Total revenue decreased by 7.4%, to $1.41 billion, versus consensus of $1.53 billion. By segment, innerwear sales were $658.4 million versus consensus of $695.1 million; activewear sales were $368.1 million versus consensus of $406.6 million; direct-to-consumer sales were $98.6 million versus consensus of $102.6 million; and international sales were $284.4 million versus consensus of $319.0 million.

Domestic retail traffic declined significantly in the period due to unseasonably warm weather in November and December. Retail traffic declined by a high-single-digit percentage, which weighed on point-of-sale trends and caused retailers to pull back on orders, impacting shipments of both replenishment innerwear and cold-weather and replenishment activewear.

Improvement in retail traffic and Hanes’ point-of-sale sell-through in the latter third of December and into January was too late to influence 4Q shipments.

Full-year guidance calls for EPS of $1.85–$1.91 versus consensus of $1.90, which implies year-over-year growth of 11%–15%. Total revenue is expected to be in the range of $5.8–$5.9 billion as compared to consensus of $6.03 billion.