DIpil Das

What’s the Story?

Why It Matters

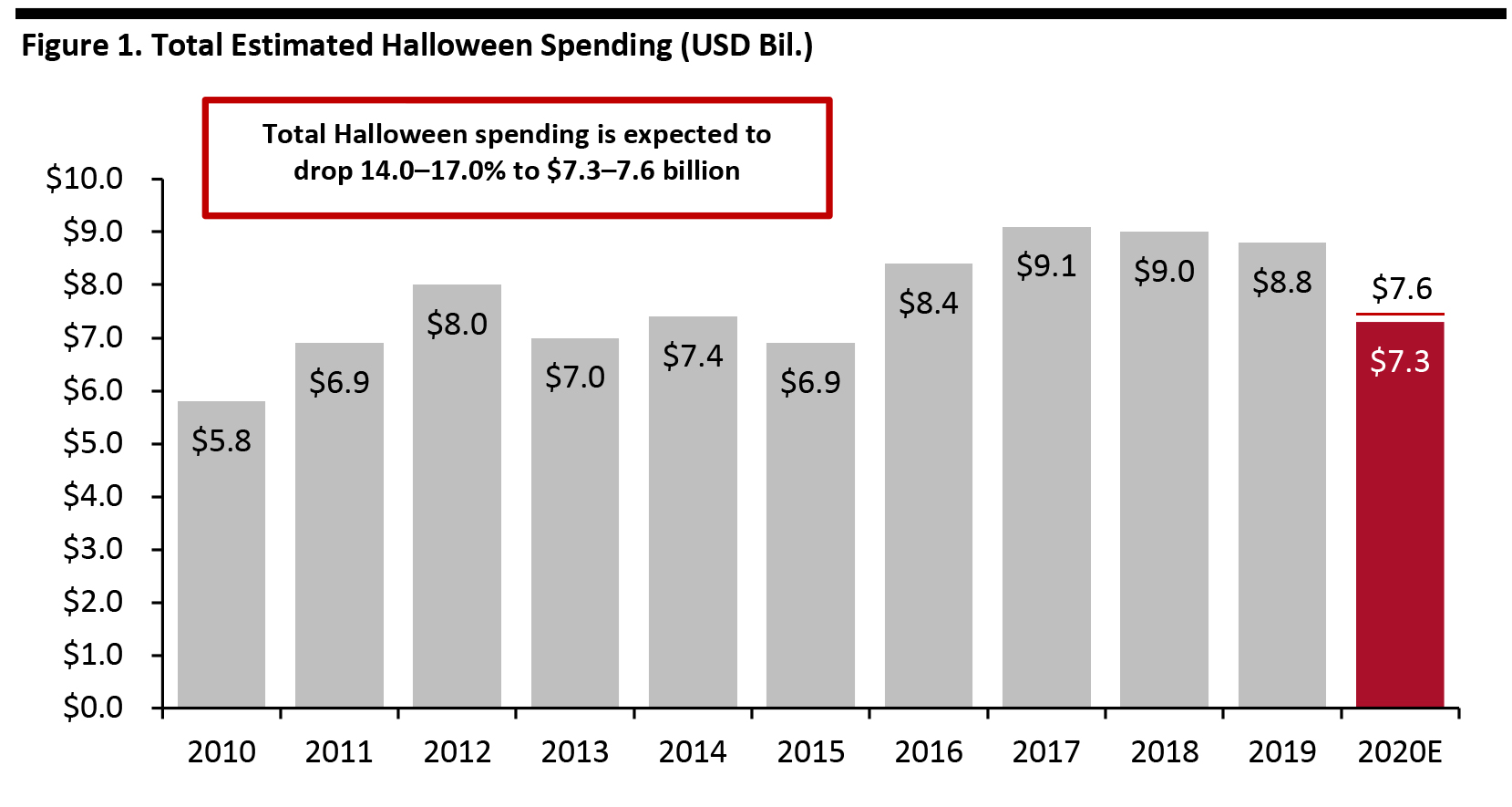

Coresight Research estimate that US consumer spending on Halloween will drop 14.0–17.0% to $7.3–7.6 billion due to lower holiday participation this year. Costumes and candy purchases usually constitute over half of Halloween spending—we expect spending on both categories to be depressed this year due to:- Lower holiday participation from consumers in relation to local and state coronavirus-related restrictions

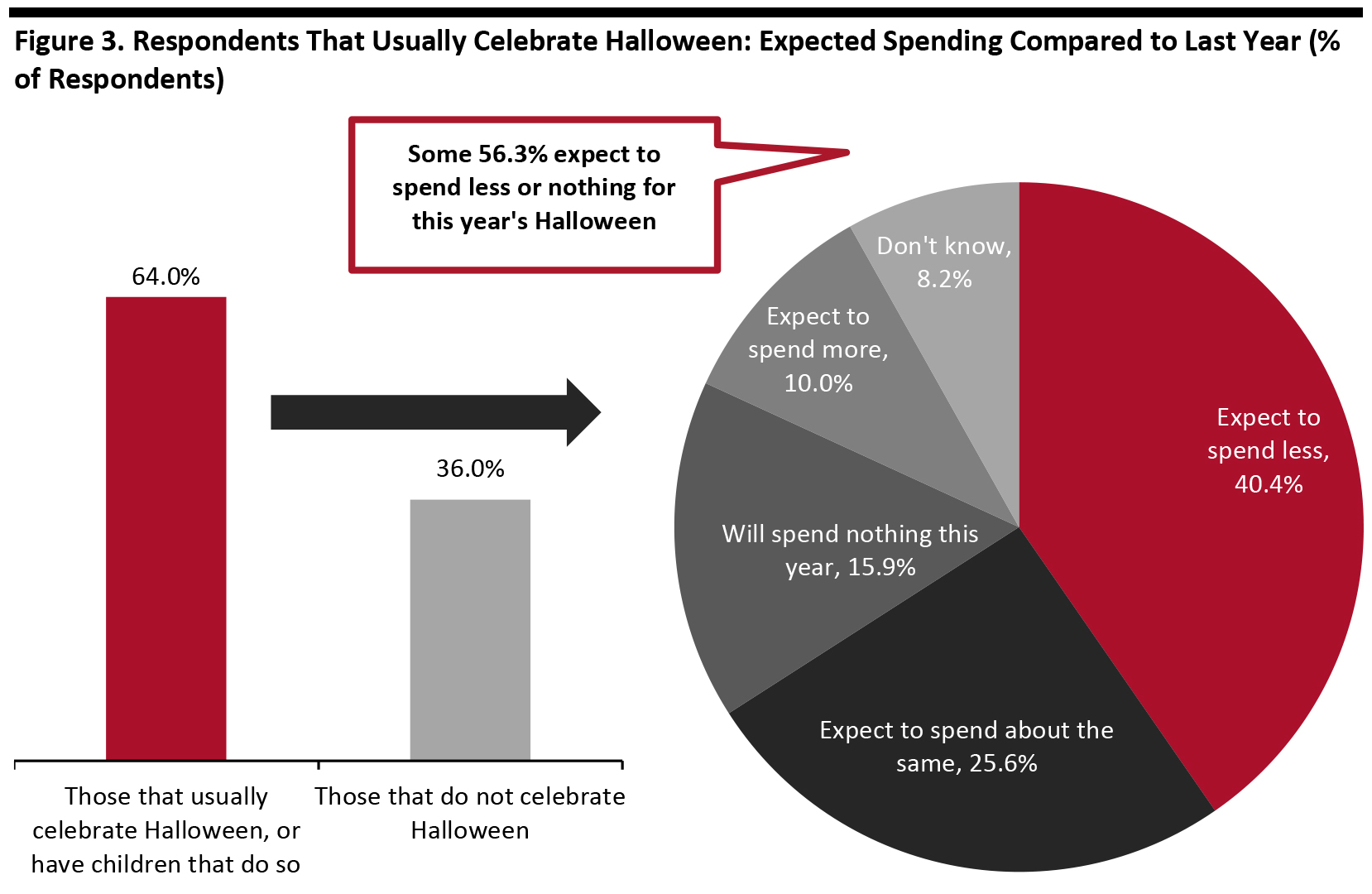

- Reduced spending on celebrations—of the 64.0% of consumers that usually participate in Halloween, some 16.0% expect to spend nothing on Halloween this year, while approximately 40.0% will spend less than they did last year, according to Coresight Research’s consumer survey from September 22

- The threat of contracting the coronavirus

Source: NRF/Prosper Insights & Analytics/Coresight Research[/caption]

Source: NRF/Prosper Insights & Analytics/Coresight Research[/caption]

Halloween Celebration Guidelines: Large Gatherings Limited, Public Event Spaces Closed

The Centers for Disease Control and Prevention (CDC) has outlined several measures that people should adopt when celebrating holidays, including:- Considering community levels of Covid-19: Celebrators should look at the number of cases and risk levels among their local communities before organizing parties.

- Assessing location and curbing gathering durations: Closed spaces put people at greater risk of contracting the virus, or longer durations can increase risk of exposure to infected people. A combination of long durations of time spent in closed spaces further heightens the risk of infection. The CDC has advised against going to indoor haunted houses or on tractor hayrides where people may be in close proximity to others from outside their own households.

- Restricting number of attendees: Having a large number of attendees poses an infection risk.

- Avoiding travel: Events with people that have travelled from different locations increase the risk of infection.

- Avoiding traditional trick-or-treat activities: Moving between houses to collect candy and giving candy to trick-or-treating children increases the risk of infection to children participating as well as those handing out candy.

- New York: The Greenwich Village Halloween Parade—one of the largest public participatory events in New York City—has been canceled. The governor stated that he will not ban trick-or-treating but advises parents to use discretion.

- California: Los Angeles county has not permitted outdoor Halloween gatherings, events and parties, including carnivals, festivals, live entertainment and haunted house attractions. While door to door trick-or-treating or car to car trunk-or-treating is allowed, the county does not recommend participating. Universal Studios in Hollywood has canceled its Halloween Horror Nights event.

- Florida: Walt Disney World’s Mickey’s Not So Scary Halloween event and Universal Studios’ Halloween Horror Nights events in Orlando, have been canceled.

- Massachusetts: Trick-or-treating is banned in the city of Springfield.

Halloween Celebrations To Center Around the Home

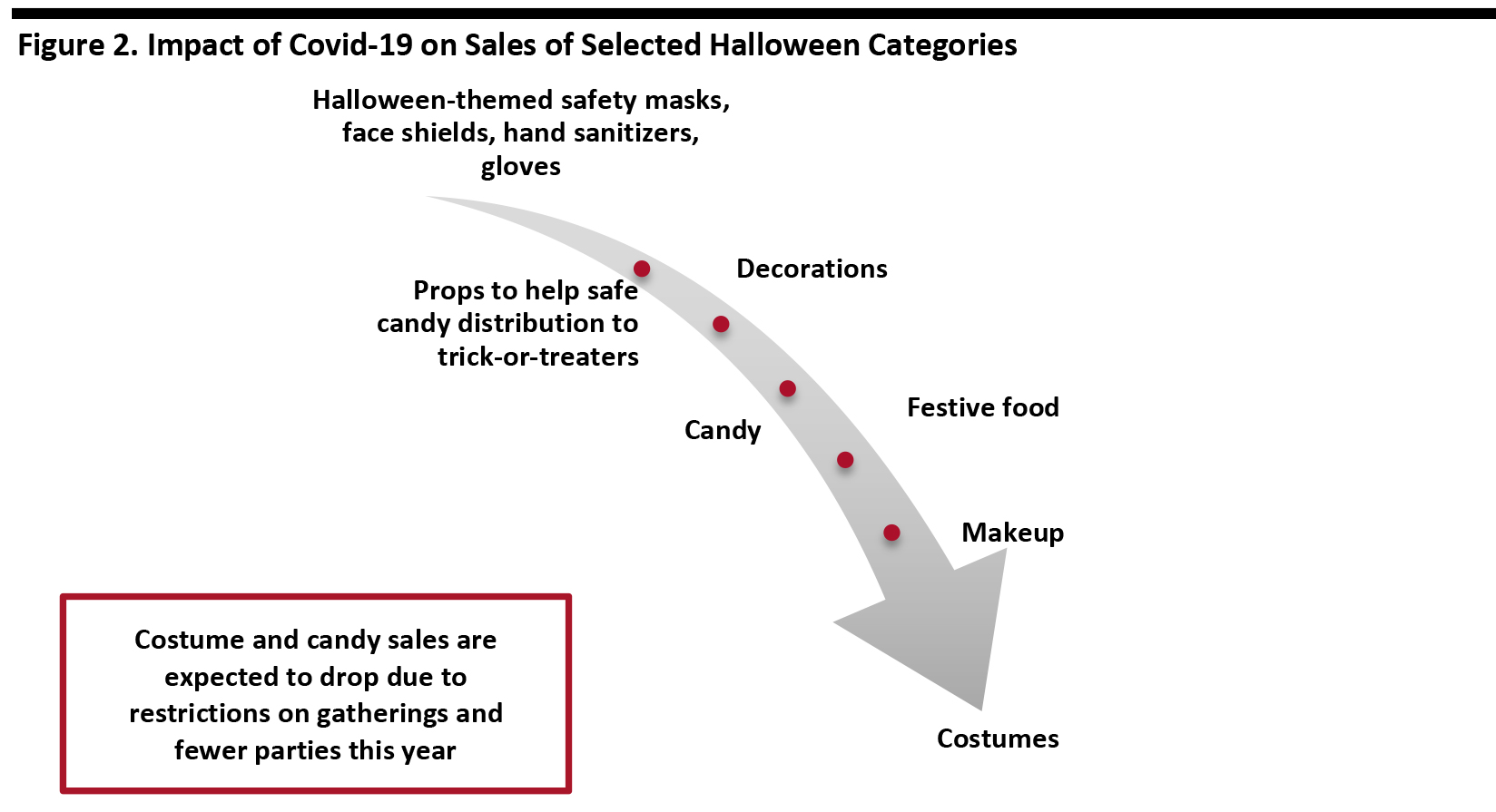

There is room for creativity in Halloween festivities and celebrations can still be held safely. Consumers may wish to make this celebration particularly special to break the monotony of stay-at-home measures and to ring in the 2020 holiday season. We expect candy to be the most affected category as parents may have safety concerns about their children receiving it or people may be concerned about coming to contact with others when handing out candy. Nevertheless, in its earnings call on July 23, 2020, chocolate manufacturer Hershey pointed out that around half of Halloween candy purchased is actually for self-consumption while the other part is for trick-or-treat distribution. Besides the candy category, we expect Halloween costumes, makeup and festive food to experience the strongest sales declines. As people typically want to wear costumes and Halloween makeup to parties or social events where they can be seen and such occasions are unlikely this year, we think costumes will see the greatest sales decline among the aforementioned categories. The smaller likelihood of festive gathering or restricted party sizes is also likely to induce a decline in candy and festive food sales compared to last year. Consumers may decide to reallocate some of the dollars typically spent on candy, costumes and outdoor Halloween activities to buying decorations for their homes. We therefore expect decorations to experience a weaker sales decline than the candy and costume categories, as people are likely to want to make the most of small, at-home celebrations. Celebrators may also seek out Halloween-themed ways to stay safe. The CDC has advised against using costume masks in place of a safety masks but encouraged people to find Halloween-themed ones instead. Novelty retailer Johnnie Brock’s Dungeon Party Warehouse has created a collection of Halloween themed safety masks. Consumers may also look for props to help distribute candy safely, such as Halloween-themed pre-packed candy bags or a candy chute to slide candy into trick-or-treat bags while maintaining a safe distance. [caption id="attachment_116824" align="aligncenter" width="700"] Source: Coresight Research [/caption]

Source: Coresight Research [/caption]

Survey Insights

We surveyed consumers about how they plan to spend, celebrate and stay safe through Halloween, on September 22. Here is what we found.- Four in 10 Expect To Cut Back On Halloween Spending This Year

Base: 270 US Internet users aged 18+ who usually celebrate Halloween, or have children that do so

Base: 270 US Internet users aged 18+ who usually celebrate Halloween, or have children that do so Source: Coresight Research [/caption]

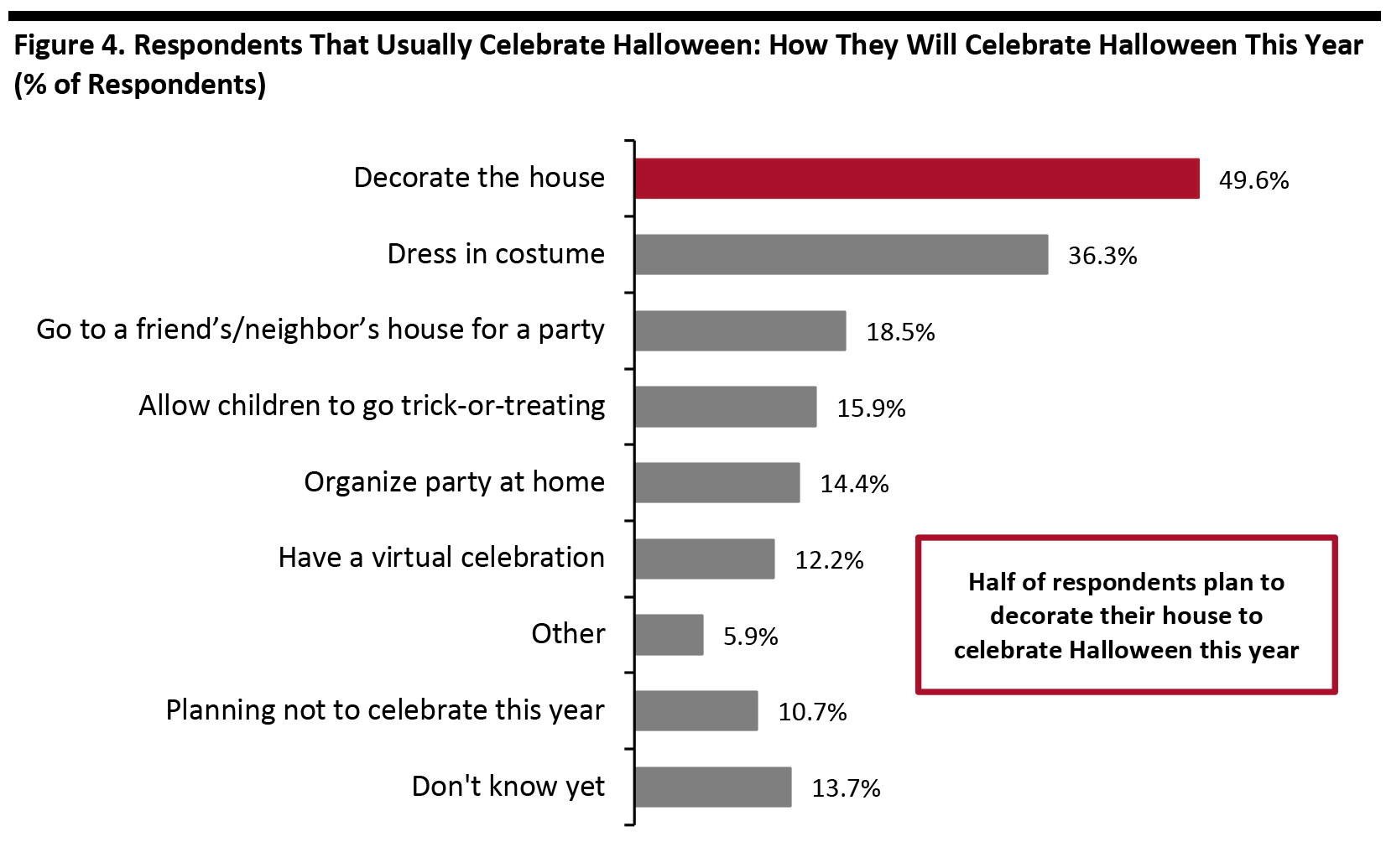

- House Decorations and At-Home Activities Rank Highest among Celebration Plans

Respondents could select multiple options or “Planning not to celebrate this year” or “Don’t know yet”

Respondents could select multiple options or “Planning not to celebrate this year” or “Don’t know yet” Base: 270 US Internet users aged 18+ who usually celebrate Halloween, or have children that do so

Source: Coresight Research [/caption]

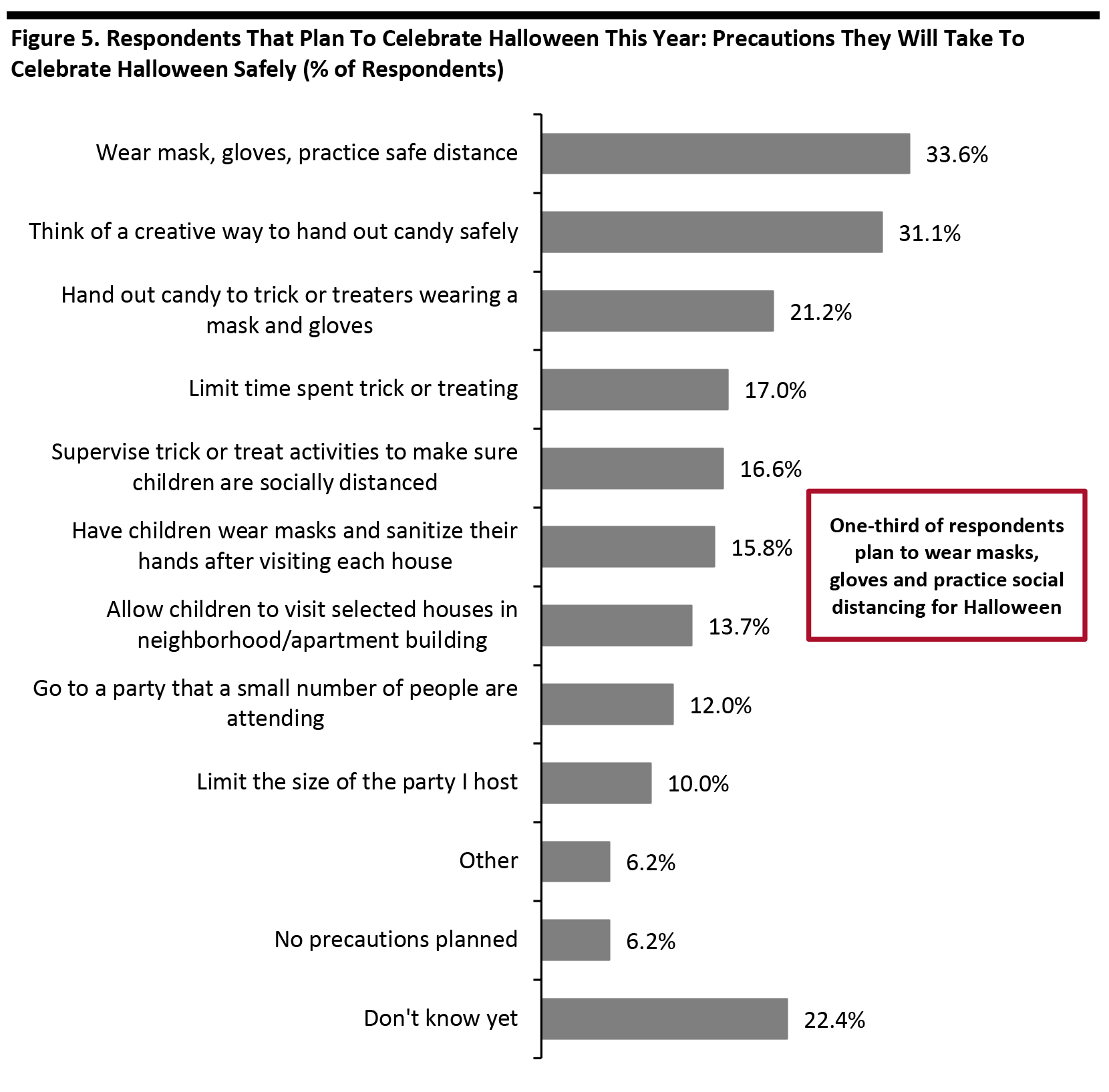

- Planned Safety Precautions among Celebrators

Respondents could select multiple options or “No precautions planned” or “Don’t know yet”

Respondents could select multiple options or “No precautions planned” or “Don’t know yet” Base: 241 US Internet users aged 18+ who plan to celebrate Halloween 2020

Source: Coresight Research [/caption]

Some Retailers Brace for a Spooked Halloween, Others See Encouraging Early Signs

As Halloween sales are likely to be subdued, retailers are taking a more cautious approach to the holiday this year. We discuss Halloween plans disclosed by several key retailers:- Big Lots: On its August 28, 2020 earnings call, Big Lots said that its early reads of Halloween have been positive. The retailer believes that the holiday season will come earlier this year based on what it is seeing with Halloween.

- Costco: Costco said on its September 25, 2020 earnings call that it has reduced the amount of costumes stocked to 80–90.0% of what it normally stocks. The retailer has increased stocks of some basic candy items.

- Dollar Tree: On its August 27, 2020 earnings call, Dollar Tree stated that “in March, (its) merchant team took action to make adjustments in Halloween buys and de-risk the category, (with) much less focus on traditional trick-or-treating and large gatherings and more focus on decorations and customs.”

- Five Below: On its September 3, 2020 earnings call, Five Below said that its online store was “already up and running” because Halloween purchasing “takes off sooner online than it does in the stores.” The company also said that launching online first helps it to “get a better read” on what is likely to sell in stores.

- Party City: Party City, one of the go-to retailers for party supplies and costumes, is opening 25 pop-up stores under its Halloween City banner this year—91.0% fewer than last year. On its August 6, 2020 earnings call, the retailer’s management stated that it is upbeat about its amended Halloween go-to-market strategy and the significant changes to its assortment, in-store merchandising, pricing, marketing, and digital and in-store customer experience—which includes new curbside pickup and delivery options.

- Target: Target noted on its August 19, 2020 earnings call that it will continue to feature costumes and decorations for Halloween, but will adjust its candy assortment in anticipation of reduced trick-or-treat activities. The retailer is giving its curbside pickup customers surprise “boo bags” containing gifts as well as tips and suggestions for celebrating the season.

- Walmart: On its August 18, 2020 earnings call, Walmart mentioned that it is “carefully thinking through each of the different holidays and how they may change as a result of what is happening,” and is planning inventory and assortment closer to the holidays. At a virtual analyst conference on September 8, 2020, Walmart EVP and CFO Brett Briggs was asked about the company’s just-in-time inventory planning system and the role of its merchants in assortment planning. Briggs explained that Walmart’s inventory planning algorithms are efficient enough to plan inventory by store and that merchants have the ability to override the algorithms to make a fair assessment for holiday planning in advance if necessary. Walmart’s shopping site has highlighted decorations and supplies for at-home parties on its Halloween page.

What We Think

While Halloween celebrations may not be big social events this year, those that are planning to celebrate are likely to want to make it special to counter the coronavirus pandemic. Implications for Brands/Retailers- Our survey shows around half of consumers want to decorate their home for Halloween, while over a fifth of respondents said that they will go to a friend’s or neighbor’s house for a party, with 14.4% planning to organize a party at home. As celebrations seem to be centered around the home, retailers should highlight decorations and Halloween-themed party food and cutlery.

- While costume sales may be subdued, retailers could highlight Halloween-themed masks and gloves that serve the dual functions of staying safe and celebrating the holiday.

- Retail properties, malls and parks are likely to be most impacted as government regulations restrict the number of attendees allowed at gatherings. With many public events and parades already canceled, retail properties that generally host Halloween events will see less traffic.