Nitheesh NH

What Is Athleisure?

Athleisure is the trend of wearing clothing designed for athletic workouts both in the gym and outside it—for example, to the office, to the shopping center or to a social gathering. Athleisurewear has become increasingly acceptable to wear in a variety of social situations, and even to work, in some industries, and consumers are quickly jumping on the trend. Many celebrities have been photographed wearing high-end leggings, sweat pants made from nontraditional fabrics, sneakers with graphic prints and stylish backpacks—all examples of elevated athleticwear.

There was a time when wearing anything other than a tailored suit meant one was underdressed and out of place in an office setting. In many industries, that time has passed. Since the 1960s, American youth have been pushing the boundaries of how casually they can get away with dressing. By the 1990s, students were showing up to class in sneakers and sweat pants. Still, graduation from college generally meant transitioning into more “proper” adult clothing that was appropriate for a workplace setting. Now, though, activewear once reserved for more casual settings is considered perfectly appropriate office casualwear in some businesses, and it is commonly worn in all but the most

formal settings. Leggings, hoodies and sneakers, once reserved for the gym, are now worn everywhere—evidence of the strength of the athleisure trend.

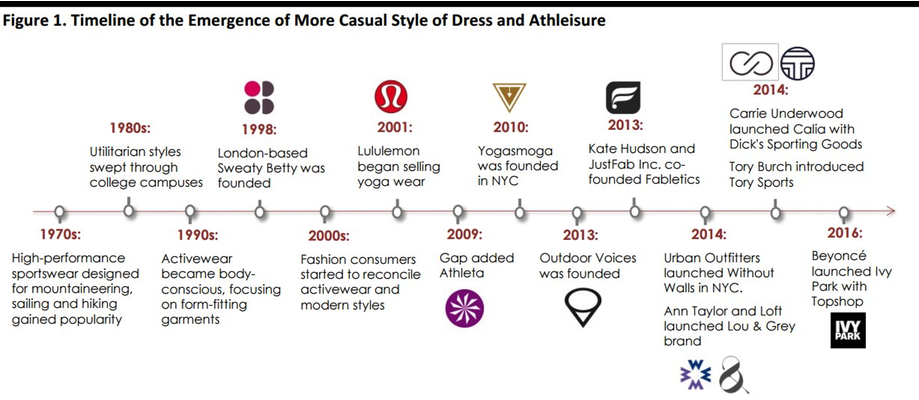

An unprecedented number of fitness apparel lines have sprung up in the last few years. Boutique brands such as Sweaty Betty and Outdoor Voices are competing against established athleticwear giants Under Armour and Nike, while higher-end designers Tory Burch and Stella McCartney, and retailers Gap and Ann Inc., have all ventured into the activewear arena.

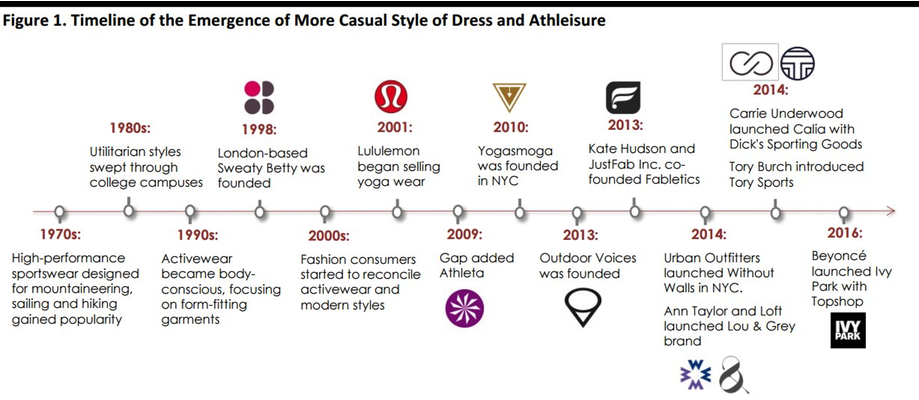

Proprietary, sweat-wicking compression fabrics are standard in athleisurewear, and the array of designs available rival those offered in more formal apparel. Figure 1, below, illustrates the general shift toward more casual clothing and the emergence of the athleisure trend. Athleisure went mainstream in about 2010.

[caption id="attachment_85640" align="aligncenter" width="720"]

There was a time when wearing anything other than a tailored suit meant one was underdressed and out of place in an office setting. In many industries, that time has passed. Since the 1960s, American youth have been pushing the boundaries of how casually they can get away with dressing. By the 1990s, students were showing up to class in sneakers and sweat pants. Still, graduation from college generally meant transitioning into more “proper” adult clothing that was appropriate for a workplace setting. Now, though, activewear once reserved for more casual settings is considered perfectly appropriate office casualwear in some businesses, and it is commonly worn in all but the most

formal settings. Leggings, hoodies and sneakers, once reserved for the gym, are now worn everywhere—evidence of the strength of the athleisure trend.

An unprecedented number of fitness apparel lines have sprung up in the last few years. Boutique brands such as Sweaty Betty and Outdoor Voices are competing against established athleticwear giants Under Armour and Nike, while higher-end designers Tory Burch and Stella McCartney, and retailers Gap and Ann Inc., have all ventured into the activewear arena.

Proprietary, sweat-wicking compression fabrics are standard in athleisurewear, and the array of designs available rival those offered in more formal apparel. Figure 1, below, illustrates the general shift toward more casual clothing and the emergence of the athleisure trend. Athleisure went mainstream in about 2010.

[caption id="attachment_85640" align="aligncenter" width="720"] Source: Company reports/Fung Global Retail & Technology[/caption]

A Look Back: How Demand for Sneakers Gave Birth to the Athleisure Category

We recently had the opportunity to sit down with one of the leading apparel vendors in the activewear category, and we asked our source how athleisure came about in the first place. According to our source, the category’s rise mirrored apparel cycles more broadly. Apparel trends typically last between eight and 10 years, and athleisure and athletic-inspired apparel became more popular as the high- end denim fad began to wane toward the end of the last

decade. At that time, vintage-inspired apparel was prevalent across malls, big box stores and discount stores, and denim was the most popular item in the bottoms category.

As the denim trend evolved and grew stale, Nike refreshed its sneaker offering and added new colors and freshly inspired assortments. The company’s business with Foot Locker and Finish Line flourished. Traditional apparel retailers took notice, and began offering apparel that complemented the footwear that was selling well. Apparel that previously came in only neutral tones began to feature bright colors and, eventually, neon colors. Specialty retailers (particularly “A” retailers) followed suit, as they were looking for a category that could replace the declining denim segment and their collections’ relatively stale themes. The

market shifts led to activewear for everyday people.

The athleisure and athletic-inspired apparel category has performed very well, often posting high double- and triple-digit gains. However, in many cases, the increase in athleisure sales volumes has not been enough to offset the declines in denim, as athleisure generally has a lower price point than high-priced denim does.

New Brands Continue to Enter the Athleisure Space

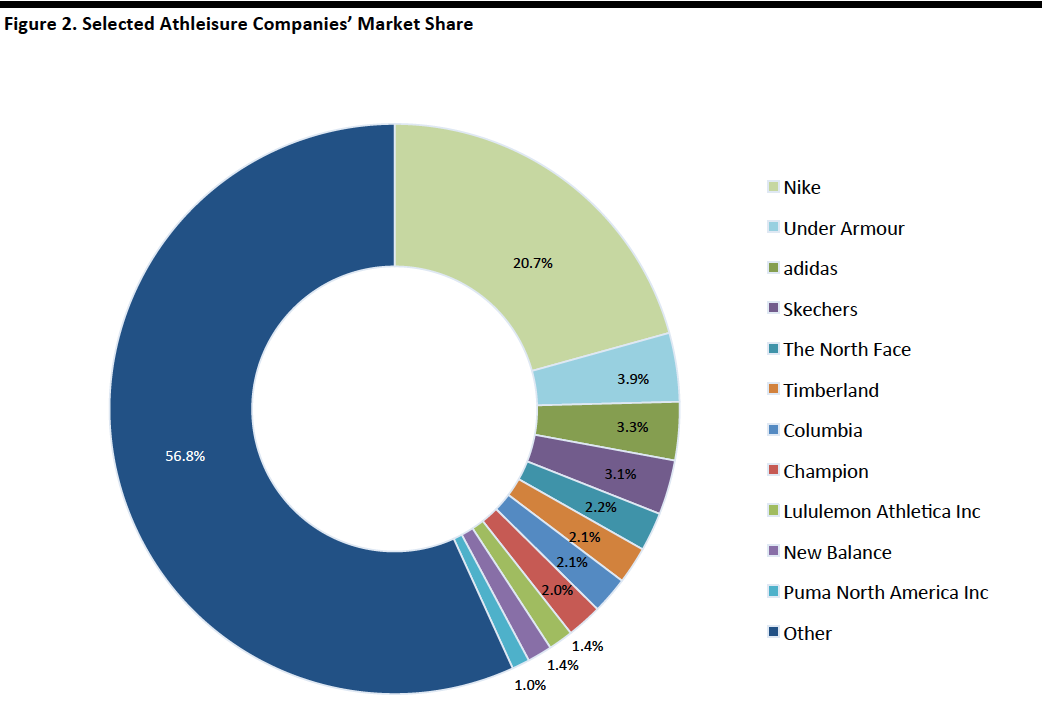

Nonetheless, traditional athleticwear retail players are still expanding into athleisure, and there are also many new brands entering the space that are focused solely on athleisure. We have grouped the various players into three categories: pure-play athleisure brands, which sell only athleisure merchandise; celebrity brands and partnerships; and more traditional athleticwear and mainstream retail companies that have expanded into the athleisure segment. Below, we discuss examples of companies operating in each of the three categories.

Explosive growth in the athleisure universe has made it harder than ever for brands to stand out. The ones that have performed best and seem to have proven they can withstand increasing competition are those that sell not just clothes, but a lifestyle. This makes sense, given that the athleisure trend is as much about a lifestyle concept as it is about fashion.

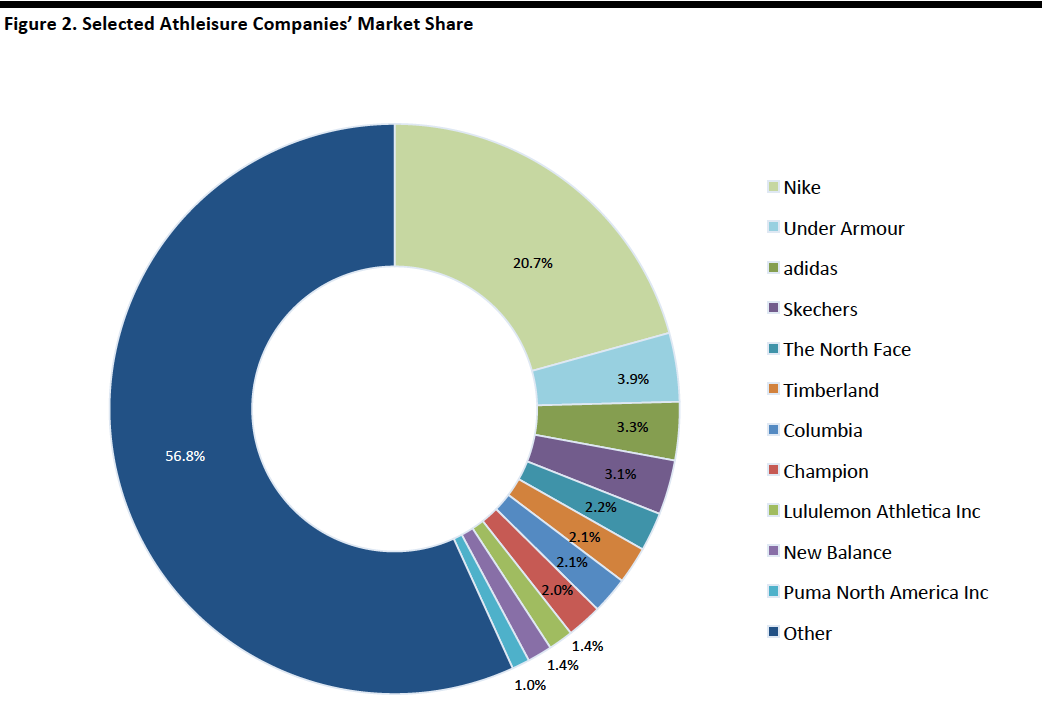

[caption id="attachment_85642" align="aligncenter" width="720"]

Source: Company reports/Fung Global Retail & Technology[/caption]

A Look Back: How Demand for Sneakers Gave Birth to the Athleisure Category

We recently had the opportunity to sit down with one of the leading apparel vendors in the activewear category, and we asked our source how athleisure came about in the first place. According to our source, the category’s rise mirrored apparel cycles more broadly. Apparel trends typically last between eight and 10 years, and athleisure and athletic-inspired apparel became more popular as the high- end denim fad began to wane toward the end of the last

decade. At that time, vintage-inspired apparel was prevalent across malls, big box stores and discount stores, and denim was the most popular item in the bottoms category.

As the denim trend evolved and grew stale, Nike refreshed its sneaker offering and added new colors and freshly inspired assortments. The company’s business with Foot Locker and Finish Line flourished. Traditional apparel retailers took notice, and began offering apparel that complemented the footwear that was selling well. Apparel that previously came in only neutral tones began to feature bright colors and, eventually, neon colors. Specialty retailers (particularly “A” retailers) followed suit, as they were looking for a category that could replace the declining denim segment and their collections’ relatively stale themes. The

market shifts led to activewear for everyday people.

The athleisure and athletic-inspired apparel category has performed very well, often posting high double- and triple-digit gains. However, in many cases, the increase in athleisure sales volumes has not been enough to offset the declines in denim, as athleisure generally has a lower price point than high-priced denim does.

New Brands Continue to Enter the Athleisure Space

Nonetheless, traditional athleticwear retail players are still expanding into athleisure, and there are also many new brands entering the space that are focused solely on athleisure. We have grouped the various players into three categories: pure-play athleisure brands, which sell only athleisure merchandise; celebrity brands and partnerships; and more traditional athleticwear and mainstream retail companies that have expanded into the athleisure segment. Below, we discuss examples of companies operating in each of the three categories.

Explosive growth in the athleisure universe has made it harder than ever for brands to stand out. The ones that have performed best and seem to have proven they can withstand increasing competition are those that sell not just clothes, but a lifestyle. This makes sense, given that the athleisure trend is as much about a lifestyle concept as it is about fashion.

[caption id="attachment_85642" align="aligncenter" width="720"] Source: Euromonitor International[/caption]

Source: Euromonitor International[/caption]

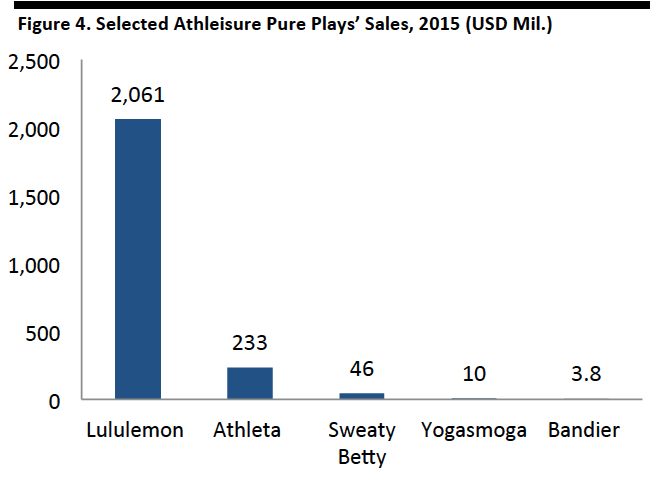

[caption id="attachment_85644" align="aligncenter" width="480"]

[caption id="attachment_85644" align="aligncenter" width="480"] Source: Company reports/Fung Global Retail & Technology[/caption]

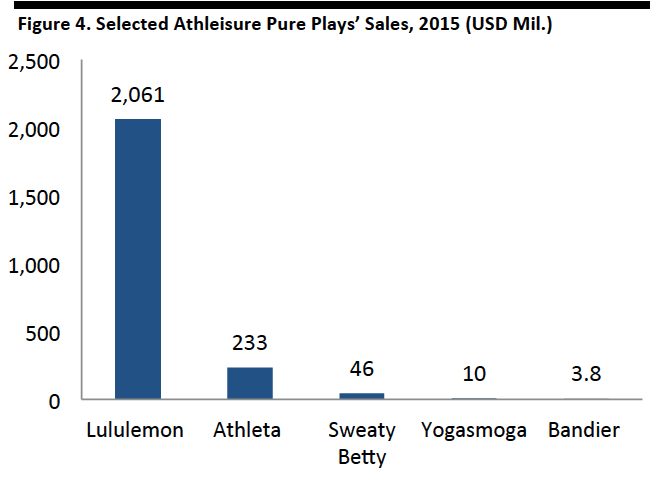

PURE PLAYS

Source: Company reports/Fung Global Retail & Technology[/caption]

PURE PLAYS

Lululemon can be considered the first to market in the athleisure space. Chip Wilson founded the company in 1998, having spent the first 20 years of his career in the surf, ski and skate industries. When he started practicing yoga, he saw an opportunity to bring the more technical, performance-enhancing aspects of surf and ski apparel to the basic cotton clothing that yoga practitioners were wearing. He used word of mouth to sell his products, setting up shop inside yoga studios and enlisting instructors as brand ambassadors—which the company still does today. In 2005, Wilson sold 48% of the company to private equity firms Advent International and Highland Capital Partners, and in 2007, Lululemon went public.

The company has since faced several embarrassing public relations incidents, including a recall of yoga pants that were too sheer and backlash against a number of provocative statements made by Wilson (who stepped down from the board in 2015). The company is now working to restrengthen its business. A big part of the most recent product strategy is to change the way it sells pants. Rather than sorting pants by length, Lululemon now organizes them by fit and feel, categorizing them by what the company calls “sensation”: hugged, naked, relaxed, tight and held-in.

Lululemon can be considered the first to market in the athleisure space. Chip Wilson founded the company in 1998, having spent the first 20 years of his career in the surf, ski and skate industries. When he started practicing yoga, he saw an opportunity to bring the more technical, performance-enhancing aspects of surf and ski apparel to the basic cotton clothing that yoga practitioners were wearing. He used word of mouth to sell his products, setting up shop inside yoga studios and enlisting instructors as brand ambassadors—which the company still does today. In 2005, Wilson sold 48% of the company to private equity firms Advent International and Highland Capital Partners, and in 2007, Lululemon went public.

The company has since faced several embarrassing public relations incidents, including a recall of yoga pants that were too sheer and backlash against a number of provocative statements made by Wilson (who stepped down from the board in 2015). The company is now working to restrengthen its business. A big part of the most recent product strategy is to change the way it sells pants. Rather than sorting pants by length, Lululemon now organizes them by fit and feel, categorizing them by what the company calls “sensation”: hugged, naked, relaxed, tight and held-in.

In March 2016, Lululemon opened a new store in Lower Manhattan called Lululemon Lab. It differs from the brand’s other stores in that it is dedicated to both design and retail. The store is Lululemon’s second design lab (the first is in Vancouver). While some of the pieces in the store are for working out in, many are more modern takes on functional streetwear, and even work as business casualwear. The clothes incorporate the technical fabrics that Lululemon is known for and reflect the brand’s focus on performance, but they can also be worn to dinner without the wearer looking like she has arrived straight from yoga class. The colors are neutral, the clothes are angular and the price points are higher. Each item is made in batches of only about 50 items, giving them an air of exclusivity.

In March 2016, Lululemon opened a new store in Lower Manhattan called Lululemon Lab. It differs from the brand’s other stores in that it is dedicated to both design and retail. The store is Lululemon’s second design lab (the first is in Vancouver). While some of the pieces in the store are for working out in, many are more modern takes on functional streetwear, and even work as business casualwear. The clothes incorporate the technical fabrics that Lululemon is known for and reflect the brand’s focus on performance, but they can also be worn to dinner without the wearer looking like she has arrived straight from yoga class. The colors are neutral, the clothes are angular and the price points are higher. Each item is made in batches of only about 50 items, giving them an air of exclusivity.

Sweaty Betty plans to double its presence in the US by opening six stores here this year. The company was founded in the UK in 1998 by husband and wife Tamara and Simon Hill-Norton, and was originally a multibrand boutique featuring labels sourced predominantly from Scandinavia and Italy. In 2007, the company shifted its business model to produce its own label. It now operates more than 40 stores in the UK, with annual sales of approximately $46 million. The company has also turned its

attention to the US market, where it currently operates six stand- alone stores, an e-commerce site and concessions in two Bloomingdale’s stores. In January 2016, the company hired its first US President and CEO, Erika Serow, from Bain & Company. The company’s sales in the US have doubled over the past year.

Sweaty Betty plans to double its presence in the US by opening six stores here this year. The company was founded in the UK in 1998 by husband and wife Tamara and Simon Hill-Norton, and was originally a multibrand boutique featuring labels sourced predominantly from Scandinavia and Italy. In 2007, the company shifted its business model to produce its own label. It now operates more than 40 stores in the UK, with annual sales of approximately $46 million. The company has also turned its

attention to the US market, where it currently operates six stand- alone stores, an e-commerce site and concessions in two Bloomingdale’s stores. In January 2016, the company hired its first US President and CEO, Erika Serow, from Bain & Company. The company’s sales in the US have doubled over the past year.

Scott Kerslake, a surfer and cyclist turned business executive, founded Athleta in 1998 after listening to female friends complain about a lack of selection in women’s workout clothes. These women were seeking athleticwear that held up on a 10-mile run but was also fashionable enough to wear to the office. Athleta built a loyal following for products sold through its catalogs and website and, in 2008, Gap Inc. bought the company for $150 million to extend its position in women’s premium sports clothing beyond its Gap Body division. Gap has since used its expertise in operating more than 3,000 stores to turn Athleta into a brick-and-mortar retailer.

Scott Kerslake, a surfer and cyclist turned business executive, founded Athleta in 1998 after listening to female friends complain about a lack of selection in women’s workout clothes. These women were seeking athleticwear that held up on a 10-mile run but was also fashionable enough to wear to the office. Athleta built a loyal following for products sold through its catalogs and website and, in 2008, Gap Inc. bought the company for $150 million to extend its position in women’s premium sports clothing beyond its Gap Body division. Gap has since used its expertise in operating more than 3,000 stores to turn Athleta into a brick-and-mortar retailer.

Outdoor Voices was founded in 2013 by Parsons School of Design graduate Tyler Haney. The company’s focus within athleisure is on recreational sports rather than competitive sports. The brand has more of a fashion tilt than some other athleisure players, and A.P.C. Creative Director and Founder Jean Touitou is a strategic investor. Signature pieces in the collection include color blocking and heathered fabric. Outdoor Voices specifically caters to millennials and prides itself on using high-quality, sweat-wicking compression fabrics. The brand manufactures its own clothing in a factory in Los Angeles, and there is an emphasis on creating items that are very soft. This summer, the company will launch its first collaboration with A.P.C. and introduce a new fabric that has been in development for a year and a half.

Outdoor Voices was founded in 2013 by Parsons School of Design graduate Tyler Haney. The company’s focus within athleisure is on recreational sports rather than competitive sports. The brand has more of a fashion tilt than some other athleisure players, and A.P.C. Creative Director and Founder Jean Touitou is a strategic investor. Signature pieces in the collection include color blocking and heathered fabric. Outdoor Voices specifically caters to millennials and prides itself on using high-quality, sweat-wicking compression fabrics. The brand manufactures its own clothing in a factory in Los Angeles, and there is an emphasis on creating items that are very soft. This summer, the company will launch its first collaboration with A.P.C. and introduce a new fabric that has been in development for a year and a half.

According to the company, sales have grown by 800% over the past year. While e-commerce currently makes up about 80% of the business, Outdoor Voices has plans to expand its physical retail footprint over the next year with a new store in New York City.

According to the company, sales have grown by 800% over the past year. While e-commerce currently makes up about 80% of the business, Outdoor Voices has plans to expand its physical retail footprint over the next year with a new store in New York City.

Yogasmoga was founded in 2013 by brother and sister Rishi and Tapasya Bali. Its first collection of athleticwear sold out in three weeks. The company has 12 stores in the US and plans to open 25 more by the end of the year. The goal is to enter into more markets in the US and Canada, and to service the rest of the company’s growing international customer base online. Yogasmoga started out selling only yogawear, but now sells clothes for running and spinning, and daywear as well. Still, dedication to yoga as a lifestyle is a big part of its branding.

Yogasmoga was founded in 2013 by brother and sister Rishi and Tapasya Bali. Its first collection of athleticwear sold out in three weeks. The company has 12 stores in the US and plans to open 25 more by the end of the year. The goal is to enter into more markets in the US and Canada, and to service the rest of the company’s growing international customer base online. Yogasmoga started out selling only yogawear, but now sells clothes for running and spinning, and daywear as well. Still, dedication to yoga as a lifestyle is a big part of its branding.

The company manufactures all of its products in the US—even the yarn is bought in the US—and the fabric is developed in California labs. Another point of differentiation for Yogasmoga is its technical fabric, which the company says is resistant to pilling and offers superior moisture wicking.

The company manufactures all of its products in the US—even the yarn is bought in the US—and the fabric is developed in California labs. Another point of differentiation for Yogasmoga is its technical fabric, which the company says is resistant to pilling and offers superior moisture wicking.

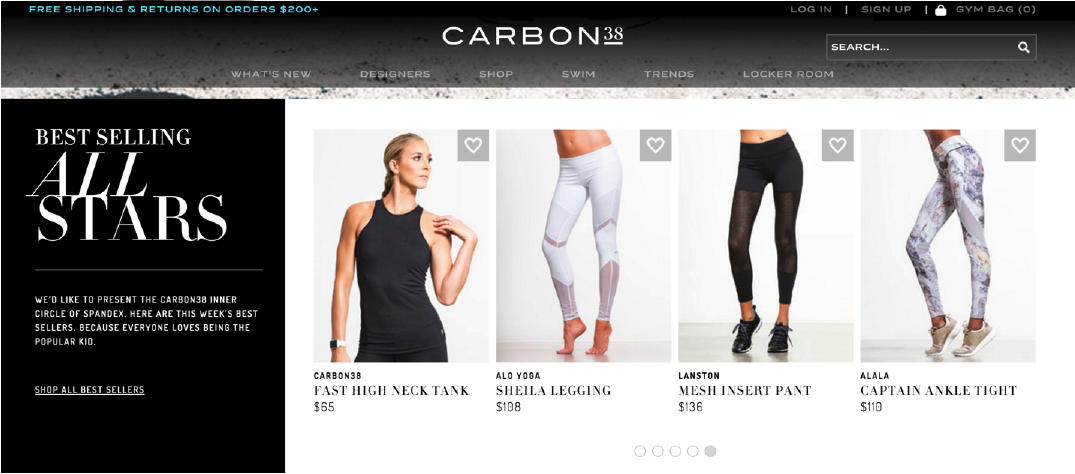

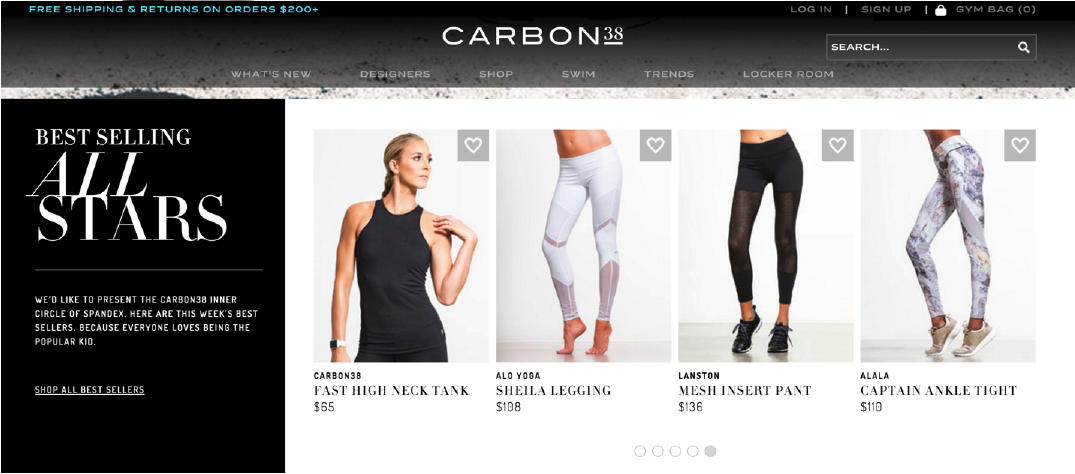

Carbon38 was founded in 2013 by ex-ballet dancers Katie Warner Johnson and Caroline Gogolak. The company operates an e- commerce site that features high-fashion, high-end activewear modeled by fitness instructors. In 2015, Carbon38 introduced an in-house label that was meant to fill the gap between the activewear it sells on its site, from brands such as Lucas Hugh and Alo Yoga, and ready-to-wear apparel. The range features basic leggings, but also blazers and coats made from technical fabrics.

Carbon38 is on track to generate nearly $20 million in sales in 2016. Plans for the current year include collaborating with high- end designers on capsule collections, introducing sport-specific categories and launching a men’s line in September.

Carbon38 was founded in 2013 by ex-ballet dancers Katie Warner Johnson and Caroline Gogolak. The company operates an e- commerce site that features high-fashion, high-end activewear modeled by fitness instructors. In 2015, Carbon38 introduced an in-house label that was meant to fill the gap between the activewear it sells on its site, from brands such as Lucas Hugh and Alo Yoga, and ready-to-wear apparel. The range features basic leggings, but also blazers and coats made from technical fabrics.

Carbon38 is on track to generate nearly $20 million in sales in 2016. Plans for the current year include collaborating with high- end designers on capsule collections, introducing sport-specific categories and launching a men’s line in September.

Kit and Ace was founded in 2014 by JJ and Shannon Wilson, with support from Lululemon founder Chip Wilson, who is JJ’s father and Shannon’s husband. The company aims to outfit its customers in everyday clothes that perform like athletic apparel and can carry them throughout the various activities they participate in on a given day.

Kit and Ace was founded in 2014 by JJ and Shannon Wilson, with support from Lululemon founder Chip Wilson, who is JJ’s father and Shannon’s husband. The company aims to outfit its customers in everyday clothes that perform like athletic apparel and can carry them throughout the various activities they participate in on a given day.

The company currently operates 61 stores in the US, Canada, the UK, Japan and Australia. About 60% of the locations are showrooms or temporary spaces with short-term leases that allow Kit and Ace to test the market before fully committing to a particular space. The company has plans to open another round of showrooms in the second half of this year.

The company currently operates 61 stores in the US, Canada, the UK, Japan and Australia. About 60% of the locations are showrooms or temporary spaces with short-term leases that allow Kit and Ace to test the market before fully committing to a particular space. The company has plans to open another round of showrooms in the second half of this year.

Bandier was founded by former music executive Jennifer Bandier and her husband, Neil Boyarsky, and Barneys Co-op founder Jayne Harkness in 2014. The company is a multibrand retailer carrying a range of athleisurewear and is known for bringing many smaller brands under one roof by curating high-end, fashion-forward women’s activewear created by a range of designers. Bandier sells

close to 400 products from more than 40 different designers, including Human Performance Engineering, Varley and Ultracor. Printed leggings represent 45% of Bandier’s sales.

The company’s Flatiron store in New York features a 3,000-square- foot fitness studio that offers more than 25 classes each week. Bandier is planning to open a West Coast flagship in Los Angeles later this year.

Bandier was founded by former music executive Jennifer Bandier and her husband, Neil Boyarsky, and Barneys Co-op founder Jayne Harkness in 2014. The company is a multibrand retailer carrying a range of athleisurewear and is known for bringing many smaller brands under one roof by curating high-end, fashion-forward women’s activewear created by a range of designers. Bandier sells

close to 400 products from more than 40 different designers, including Human Performance Engineering, Varley and Ultracor. Printed leggings represent 45% of Bandier’s sales.

The company’s Flatiron store in New York features a 3,000-square- foot fitness studio that offers more than 25 classes each week. Bandier is planning to open a West Coast flagship in Los Angeles later this year.

Tracksmith was founded in 2014 by Matt Taylor and Luke Scheybeler, the latter of whom also co-founded cycling brand Rapha. Tracksmith is a running-first brand and is based in Boston. The products are a take on the collegiate track-star gear of the 1970s and 1980s. The brand originally launched with men’s apparel only; a women’s line was introduced nine months later. Currently, the male/female customer ratio is 70%/30%. According to the company, year-over-year sales have doubled.

Tracksmith was founded in 2014 by Matt Taylor and Luke Scheybeler, the latter of whom also co-founded cycling brand Rapha. Tracksmith is a running-first brand and is based in Boston. The products are a take on the collegiate track-star gear of the 1970s and 1980s. The brand originally launched with men’s apparel only; a women’s line was introduced nine months later. Currently, the male/female customer ratio is 70%/30%. According to the company, year-over-year sales have doubled.

CELEBRITY COLLABORATIONS

Ivy Park – Beyoncé and Topshop

Ivy Park is a joint venture between Beyoncé and Sir Philip Green, majority owner of Topshop. The line launched on April 14 in 50 countries at Topshop, Zalando, Net-A-Porter, Selfridges and Hudson’s Bay. According to the company, the collection is aimed at women who love to sweat, whether they are “running, lifting, yoga stretching or kickboxing.” The pieces are meant to fit like a second skin, with built-in support and moisture-wicking fabrics. The collection is meant to perform in and out of sports and workout environments, and has been designed around a variety of body types, with sizes ranging from XXS to XL.

Calia by Carrie Underwood – Carrie Underwood and Dick’s Sporting Goods

In 2014, Carrie Underwood, American Idol winner and current country music artist, announced that she would launch a line of fitness lifestyle apparel to be sold exclusively at Dick’s Sporting Goods beginning in early 2015. Underwood designed the line with women in mind, striving to help them maintain an active lifestyle, while also being fashion forward, at an affordable price point. The line was recently extended to include a swimwear collection.

Fabletics – Kate Hudson and JustFab

Fabletics was founded by Adam Goldenberg, Don Ressler and Kate Hudson in July 2013 and officially launched in October 2013. In June 2015, Fabletics launched FL2, its men’s activewear line with Kate Hudson’s brother, actor Oliver Hudson. In late 2015, Fabletics opened its first brick-and-mortar retail stores. In 2016, the company expanded beyond athleticwear by adding dresses and swimsuits to its line. In February 2016, Forbes reported that 75 to 100 Fabletics stores are scheduled to open over the next three to five years.

Like Underwood’s Calia collection, Fabletics’ apparel is moderately priced. However, Fabletics uses a subscription model: membership costs $49.95 per month, and members receive discounted athleisurewear. Members can choose to skip a month altogether without charge. Upon registering, members are required to complete a survey regarding their workout and lifestyle preferences. At the start of each month, personalized outfits are chosen for each member based on these stated preferences.

CELEBRITY COLLABORATIONS

Ivy Park – Beyoncé and Topshop

Ivy Park is a joint venture between Beyoncé and Sir Philip Green, majority owner of Topshop. The line launched on April 14 in 50 countries at Topshop, Zalando, Net-A-Porter, Selfridges and Hudson’s Bay. According to the company, the collection is aimed at women who love to sweat, whether they are “running, lifting, yoga stretching or kickboxing.” The pieces are meant to fit like a second skin, with built-in support and moisture-wicking fabrics. The collection is meant to perform in and out of sports and workout environments, and has been designed around a variety of body types, with sizes ranging from XXS to XL.

Calia by Carrie Underwood – Carrie Underwood and Dick’s Sporting Goods

In 2014, Carrie Underwood, American Idol winner and current country music artist, announced that she would launch a line of fitness lifestyle apparel to be sold exclusively at Dick’s Sporting Goods beginning in early 2015. Underwood designed the line with women in mind, striving to help them maintain an active lifestyle, while also being fashion forward, at an affordable price point. The line was recently extended to include a swimwear collection.

Fabletics – Kate Hudson and JustFab

Fabletics was founded by Adam Goldenberg, Don Ressler and Kate Hudson in July 2013 and officially launched in October 2013. In June 2015, Fabletics launched FL2, its men’s activewear line with Kate Hudson’s brother, actor Oliver Hudson. In late 2015, Fabletics opened its first brick-and-mortar retail stores. In 2016, the company expanded beyond athleticwear by adding dresses and swimsuits to its line. In February 2016, Forbes reported that 75 to 100 Fabletics stores are scheduled to open over the next three to five years.

Like Underwood’s Calia collection, Fabletics’ apparel is moderately priced. However, Fabletics uses a subscription model: membership costs $49.95 per month, and members receive discounted athleisurewear. Members can choose to skip a month altogether without charge. Upon registering, members are required to complete a survey regarding their workout and lifestyle preferences. At the start of each month, personalized outfits are chosen for each member based on these stated preferences.

TRADITIONAL ATHLETICWEAR COMPANIES

The top three performance brands, Nike, Under Armour and Adidas, all started out targeting men with apparel made from high- performance materials. But they have turned their attention to the women’s market, which they see fueling growth in the next few years.

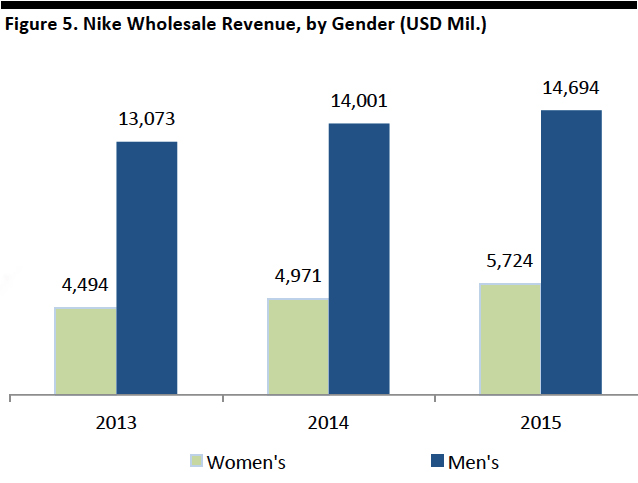

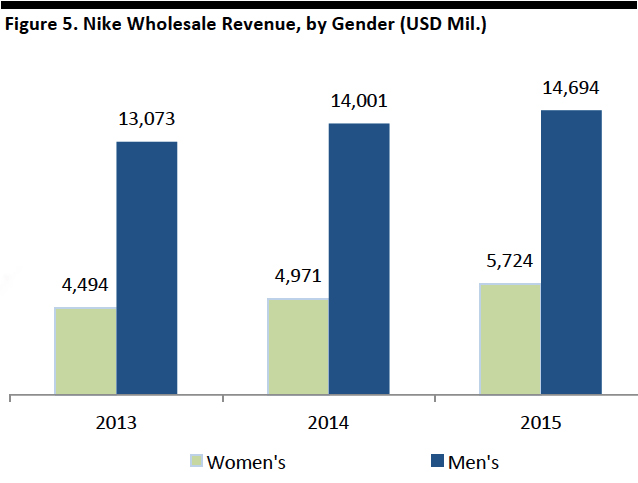

Nike is a major player and the market share leader in athleticwear, so it makes sense that the company is moving into the growing athleisure space. It is actually going all in on the women’s athleisurewear, offering comfortable, fashionable and sporty clothes and footwear. As the graph below illustrates, Nike has long dominated in the menswear category, while its women’s sales have trailed. The athleisure market is a clear opportunity for Nike to grow its women’s business.

[caption id="attachment_85688" align="aligncenter" width="638"]

TRADITIONAL ATHLETICWEAR COMPANIES

The top three performance brands, Nike, Under Armour and Adidas, all started out targeting men with apparel made from high- performance materials. But they have turned their attention to the women’s market, which they see fueling growth in the next few years.

Nike is a major player and the market share leader in athleticwear, so it makes sense that the company is moving into the growing athleisure space. It is actually going all in on the women’s athleisurewear, offering comfortable, fashionable and sporty clothes and footwear. As the graph below illustrates, Nike has long dominated in the menswear category, while its women’s sales have trailed. The athleisure market is a clear opportunity for Nike to grow its women’s business.

[caption id="attachment_85688" align="aligncenter" width="638"] Source: Company reports[/caption]

Nike forecasts that sales of its women’s products will roughly double by 2020, though those products’ share of total sales will remain about the same. In Nike’s last fiscal year, women’s items accounted for about 20% of the brand’s $25.8 billion in sales.

The company’s approach to women’s gear remains performance oriented. Nike said its product design process focuses on addressing its customers’ technical needs, but that that does not necessarily have to come at the expense of design and style. The company has a sizeable audience of buyers primed to purchase its new gear, as 70 million women are connected to Nike’s online community.

Under Armour recently hired new executives to lead its women’s apparel and footwear divisions. Earlier this year, CEO Kevin Plank forecast that the company’s women’s business will eventually outperform its men’s business.

Under Armour has also been aggressively pursuing the social- media-attuned workout junkie with a series of app acquisitions. Most recently, it debuted wearable fitness gear as well as a rebooted app powered by IBM’s Watson supercomputer.

Adidas recently hired Nicole Vollebregt to head its women’s segment, and the company is exploring new retail options, including getting its gear back in some of the shops at Equinox gyms. The company has also brought in former Lululemon CEO Christine Day to help advise on retail strategy and collaborations with smaller brands in the women’s business. Its Reebok brand has teamed up with New York–based graffiti artist Upendo Taylor to make exclusive products for Bandier.

In addition, Foot Locker is paring back its Lady Foot Locker stores to make way for a new model of bigger stores called Six:02. Dick’s Sporting Goods put expansion plans of its new Chelsea Collective boutiques on hold after it had to alter the merchandise in its initial two locations.

Traditional Apparel Brands

Tory Burch added Tory Sport as a complementary line to its main collection in 2015. The Tory Sport line includes a number of sport categories not offered by other athleticwear brands, such as tennis, golf and studio. The company refers to the line as a “top priority.” There is one Tory Sport store in the Flatiron district in New York and the company plans to operate a pop-up shop in downtown New York. In addition, it will convert an existing Tory Burch location in East Hampton to a Tory Sport store. The line’s first wholesale account, Barneys New York, was launched in early April.

Source: Company reports[/caption]

Nike forecasts that sales of its women’s products will roughly double by 2020, though those products’ share of total sales will remain about the same. In Nike’s last fiscal year, women’s items accounted for about 20% of the brand’s $25.8 billion in sales.

The company’s approach to women’s gear remains performance oriented. Nike said its product design process focuses on addressing its customers’ technical needs, but that that does not necessarily have to come at the expense of design and style. The company has a sizeable audience of buyers primed to purchase its new gear, as 70 million women are connected to Nike’s online community.

Under Armour recently hired new executives to lead its women’s apparel and footwear divisions. Earlier this year, CEO Kevin Plank forecast that the company’s women’s business will eventually outperform its men’s business.

Under Armour has also been aggressively pursuing the social- media-attuned workout junkie with a series of app acquisitions. Most recently, it debuted wearable fitness gear as well as a rebooted app powered by IBM’s Watson supercomputer.

Adidas recently hired Nicole Vollebregt to head its women’s segment, and the company is exploring new retail options, including getting its gear back in some of the shops at Equinox gyms. The company has also brought in former Lululemon CEO Christine Day to help advise on retail strategy and collaborations with smaller brands in the women’s business. Its Reebok brand has teamed up with New York–based graffiti artist Upendo Taylor to make exclusive products for Bandier.

In addition, Foot Locker is paring back its Lady Foot Locker stores to make way for a new model of bigger stores called Six:02. Dick’s Sporting Goods put expansion plans of its new Chelsea Collective boutiques on hold after it had to alter the merchandise in its initial two locations.

Traditional Apparel Brands

Tory Burch added Tory Sport as a complementary line to its main collection in 2015. The Tory Sport line includes a number of sport categories not offered by other athleticwear brands, such as tennis, golf and studio. The company refers to the line as a “top priority.” There is one Tory Sport store in the Flatiron district in New York and the company plans to operate a pop-up shop in downtown New York. In addition, it will convert an existing Tory Burch location in East Hampton to a Tory Sport store. The line’s first wholesale account, Barneys New York, was launched in early April.

Urban Outfitters launched its athleisure brand, Without Walls, in 2014. The retailer also began selling merchandise by brands such as Patagonia and The North Face and gear such as yoga mats. Without Walls was advertised as “a community of adventure seekers—fitness enthusiasts, surfers, runners and trail-blazers of all kinds—who play hard and live for the journey.” The assortment is sold primarily online and in select stores.

Also in 2014, Loft, a division of Ann Inc., launched Lou & Grey, a casual brand that is a fusion of activewear and streetwear, or “lifewear,” as it is being called. Initially offered in Loft stores, the Lou & Grey brand now has two stand-alone stores as well. The brand originally grew out of the Loft Lounge concept, and includes loungewear-type clothes in a muted color palette. The store also carries merchandise by other designers that fit the vibe of the store.

Net-A-Porter, the high-end fashion e-commerce site, launched a sister site, Net-A-Sporter, in 2014. Net-A-Sporter features athleisurewear and associated products, and the site is divided into

12 sections based on activities: gym/CrossFit, run, yoga/dance, tennis, equestrian, swim/surf, après, golf, accessories, outdoor, sailing and skiing. The offering is curated across different brands, as it is on the company’s main site.

Kate Spade announced an expansion into the athleisure space through a partnership with Beyond Yoga in spring 2016. The 21- piece, limited-edition collection features Kate Spade’s signature bright colors and Beyond Yoga’s silhouettes. The collaboration marks the first time both companies have collaborated on athleisure. The assortment will be sold at select specialty stores and boutique studios and through both companies’ websites.

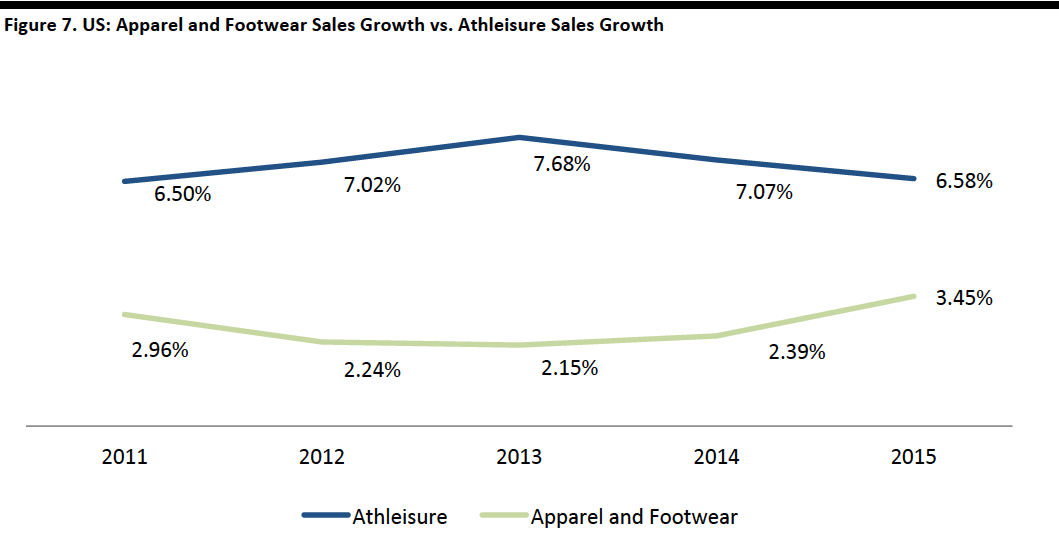

Athleisure Has Outpaced Traditional Apparel Sales Growth, and the Market Continues to Grow

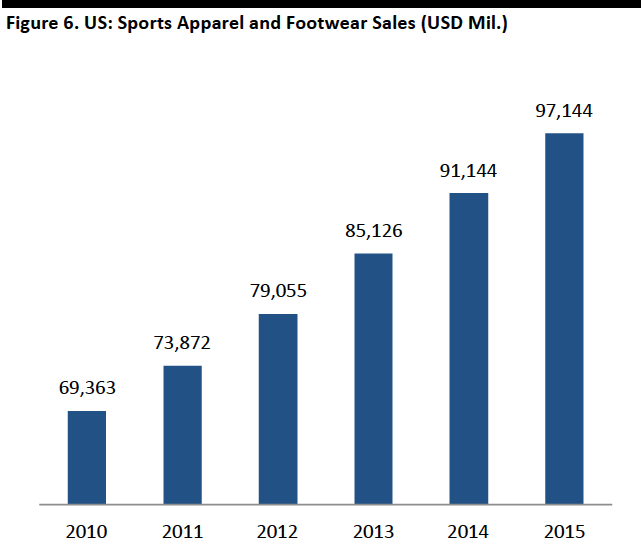

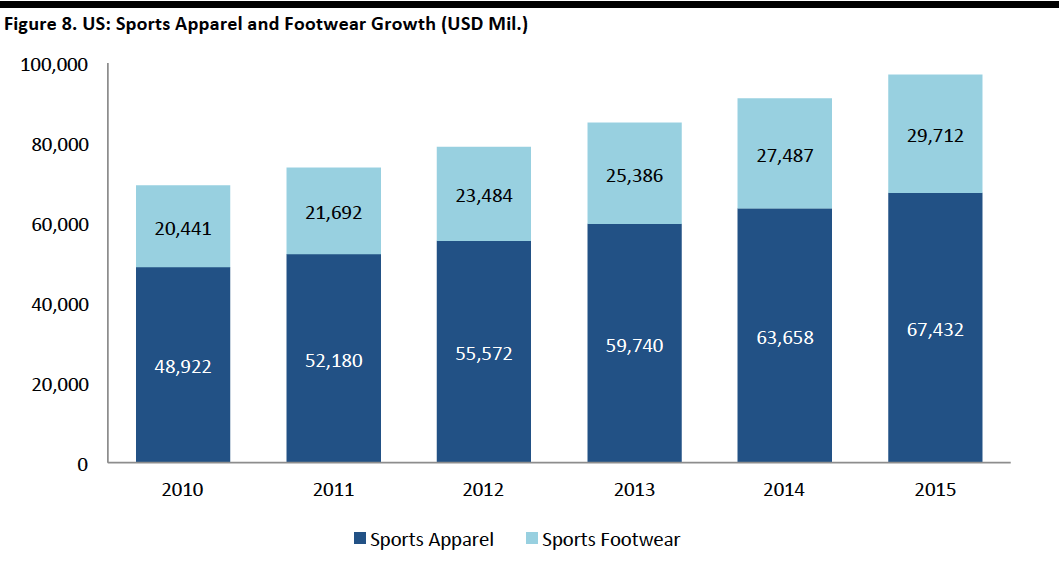

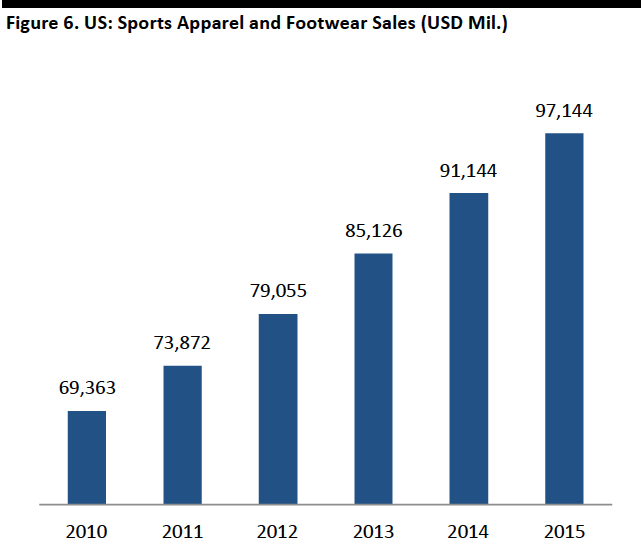

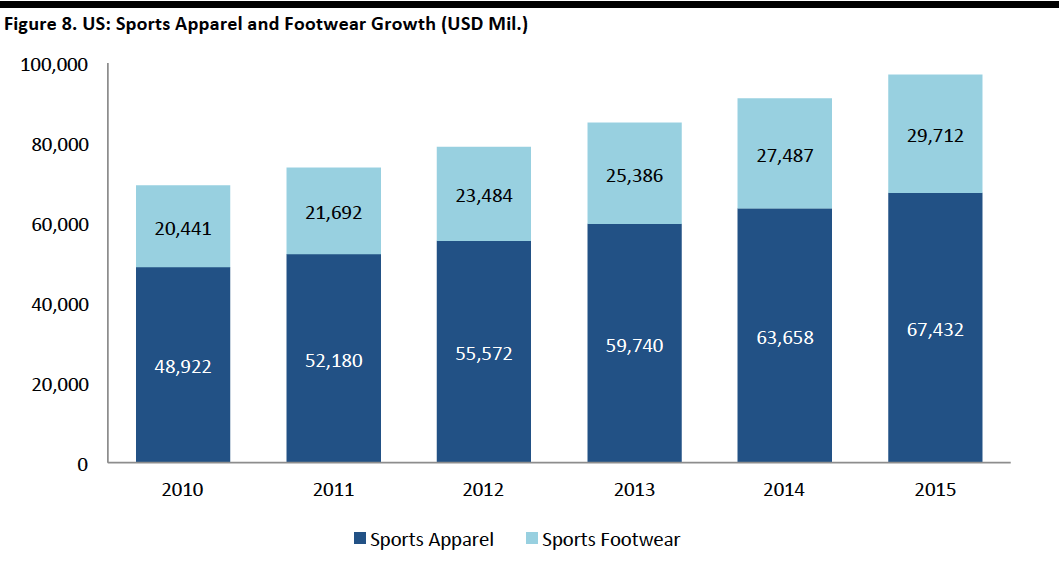

According to Euromonitor International, US sales of performance, outdoor and sports-inspired apparel and footwear totaled $97 - billion in 2015. That was 40% higher than in 2010 and 7% higher than in 2014.

[caption id="attachment_85690" align="aligncenter" width="641"]

Urban Outfitters launched its athleisure brand, Without Walls, in 2014. The retailer also began selling merchandise by brands such as Patagonia and The North Face and gear such as yoga mats. Without Walls was advertised as “a community of adventure seekers—fitness enthusiasts, surfers, runners and trail-blazers of all kinds—who play hard and live for the journey.” The assortment is sold primarily online and in select stores.

Also in 2014, Loft, a division of Ann Inc., launched Lou & Grey, a casual brand that is a fusion of activewear and streetwear, or “lifewear,” as it is being called. Initially offered in Loft stores, the Lou & Grey brand now has two stand-alone stores as well. The brand originally grew out of the Loft Lounge concept, and includes loungewear-type clothes in a muted color palette. The store also carries merchandise by other designers that fit the vibe of the store.

Net-A-Porter, the high-end fashion e-commerce site, launched a sister site, Net-A-Sporter, in 2014. Net-A-Sporter features athleisurewear and associated products, and the site is divided into

12 sections based on activities: gym/CrossFit, run, yoga/dance, tennis, equestrian, swim/surf, après, golf, accessories, outdoor, sailing and skiing. The offering is curated across different brands, as it is on the company’s main site.

Kate Spade announced an expansion into the athleisure space through a partnership with Beyond Yoga in spring 2016. The 21- piece, limited-edition collection features Kate Spade’s signature bright colors and Beyond Yoga’s silhouettes. The collaboration marks the first time both companies have collaborated on athleisure. The assortment will be sold at select specialty stores and boutique studios and through both companies’ websites.

Athleisure Has Outpaced Traditional Apparel Sales Growth, and the Market Continues to Grow

According to Euromonitor International, US sales of performance, outdoor and sports-inspired apparel and footwear totaled $97 - billion in 2015. That was 40% higher than in 2010 and 7% higher than in 2014.

[caption id="attachment_85690" align="aligncenter" width="641"] Source: Euromonitor International[/caption]

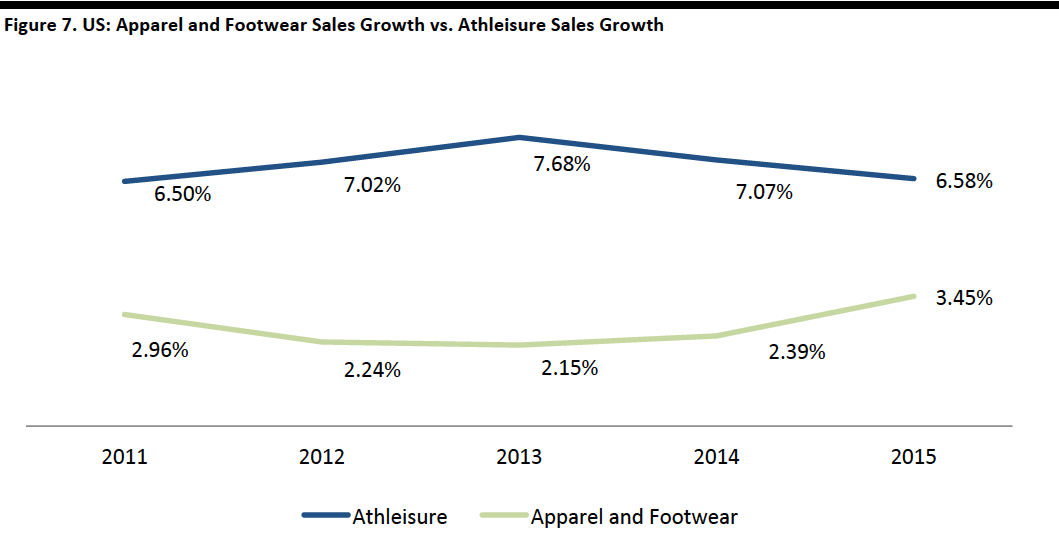

[caption id="attachment_85691" align="aligncenter" width="720"]

Source: Euromonitor International[/caption]

[caption id="attachment_85691" align="aligncenter" width="720"] Source: Euromonitor International[/caption]

In many ways, activewear and athleisurewear have replaced denim. According to The NDP Group, the athleisure bottoms business (particularly leggings) has displaced the jeans business one to one. Denim, specifically premium denim, was a hot commodity around the year 2000. Consumers were willing to shell out upwards of $200–$300 for a pair of jeans at that time; by 2005, the average denim spend was $25.

[caption id="attachment_85692" align="aligncenter" width="720"]

Source: Euromonitor International[/caption]

In many ways, activewear and athleisurewear have replaced denim. According to The NDP Group, the athleisure bottoms business (particularly leggings) has displaced the jeans business one to one. Denim, specifically premium denim, was a hot commodity around the year 2000. Consumers were willing to shell out upwards of $200–$300 for a pair of jeans at that time; by 2005, the average denim spend was $25.

[caption id="attachment_85692" align="aligncenter" width="720"] Source: Euromonitor International[/caption]

Drivers of Category Growth

Millennials’ Focus on Being Active

According to the US Census Bureau, millennials, defined as those born between 1980 and 2000, are currently the largest demographic in the US. As of 2015, they numbered almost 92 million, compared to 61 million Generation Xers and 77 million baby boomers. To put that into perspective, millennials now comprise roughly 28% of the entire US population.

Millennials also now represent the largest segment of the US workforce: they number 53.5 million workers—more than one- third of the total workforce. And that number is expected to increase to 75% within a decade. So, the habits and spending patterns of millennials will be significant to the overall economy as they enter their prime working and spending years. In general, millennials’ spending skews more toward creating a lifestyle and having and sharing experiences than it does on acquiring tangible items.

Source: Euromonitor International[/caption]

Drivers of Category Growth

Millennials’ Focus on Being Active

According to the US Census Bureau, millennials, defined as those born between 1980 and 2000, are currently the largest demographic in the US. As of 2015, they numbered almost 92 million, compared to 61 million Generation Xers and 77 million baby boomers. To put that into perspective, millennials now comprise roughly 28% of the entire US population.

Millennials also now represent the largest segment of the US workforce: they number 53.5 million workers—more than one- third of the total workforce. And that number is expected to increase to 75% within a decade. So, the habits and spending patterns of millennials will be significant to the overall economy as they enter their prime working and spending years. In general, millennials’ spending skews more toward creating a lifestyle and having and sharing experiences than it does on acquiring tangible items.

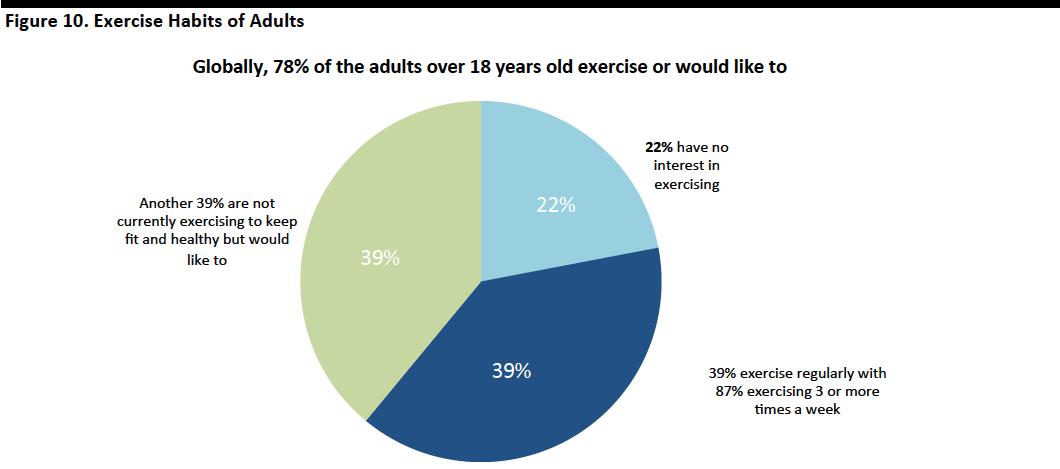

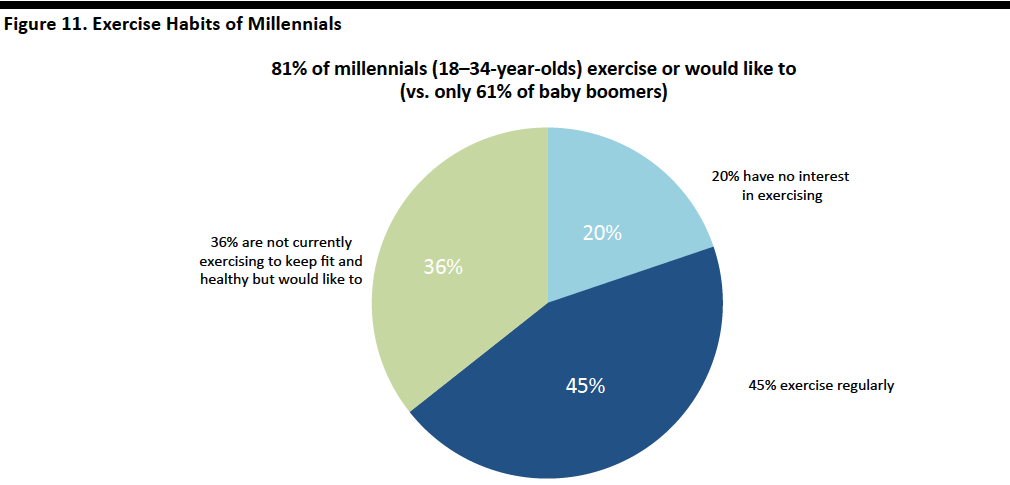

For millennials, health and wellness is a daily, active pursuit. And, for them, being healthy does not just mean not being sick or being in good shape; it means taking a more holistic approach to eating right and exercising. Millennials are exercising more, eating better and smoking less than previous generations.

Digital agency Deep Focus surveyed more than 1,700 Americans for its Cassandra Report on health and wellness, and found that more than one-third of millennials said they had cut back on other spending in order to make more health-related purchases. The survey also found that 46% of women respondents ages 19–34 said they had become more interested in athleisurewear in recent years, and athleisure is a category that millennials are willing to spend their money on.

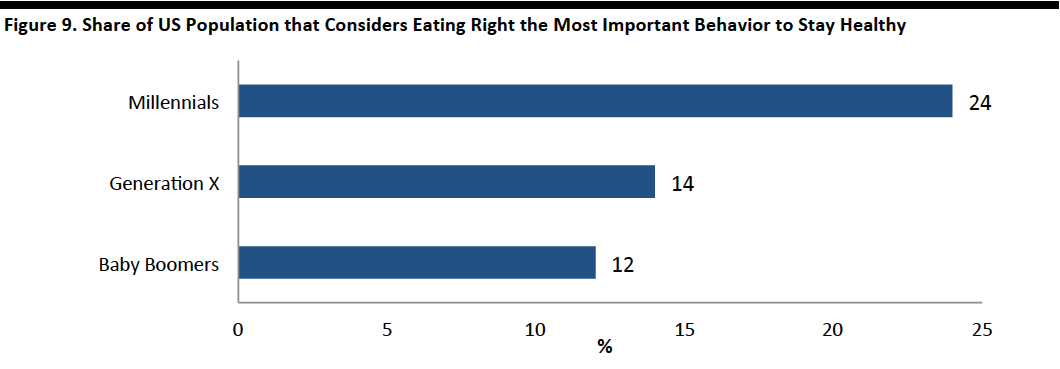

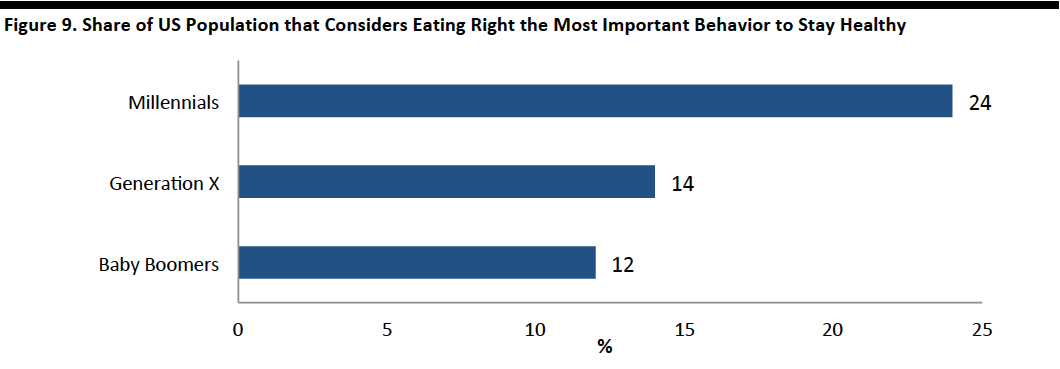

A survey undertaken by Aetna found that millennials are much more concerned about eating right and exercising than previous generations were: 24% of the millennials surveyed said that eating sensibly is the most important aspect to achieving well-being. By contrast, only 12% of baby boomers responded that way. In the US, 40% of millennials look for limited or no artificial ingredients when reading food labels, compared with 33% of baby boomers.

[caption id="attachment_85695" align="aligncenter" width="720"]

For millennials, health and wellness is a daily, active pursuit. And, for them, being healthy does not just mean not being sick or being in good shape; it means taking a more holistic approach to eating right and exercising. Millennials are exercising more, eating better and smoking less than previous generations.

Digital agency Deep Focus surveyed more than 1,700 Americans for its Cassandra Report on health and wellness, and found that more than one-third of millennials said they had cut back on other spending in order to make more health-related purchases. The survey also found that 46% of women respondents ages 19–34 said they had become more interested in athleisurewear in recent years, and athleisure is a category that millennials are willing to spend their money on.

A survey undertaken by Aetna found that millennials are much more concerned about eating right and exercising than previous generations were: 24% of the millennials surveyed said that eating sensibly is the most important aspect to achieving well-being. By contrast, only 12% of baby boomers responded that way. In the US, 40% of millennials look for limited or no artificial ingredients when reading food labels, compared with 33% of baby boomers.

[caption id="attachment_85695" align="aligncenter" width="720"] Source: Aetna[/caption]

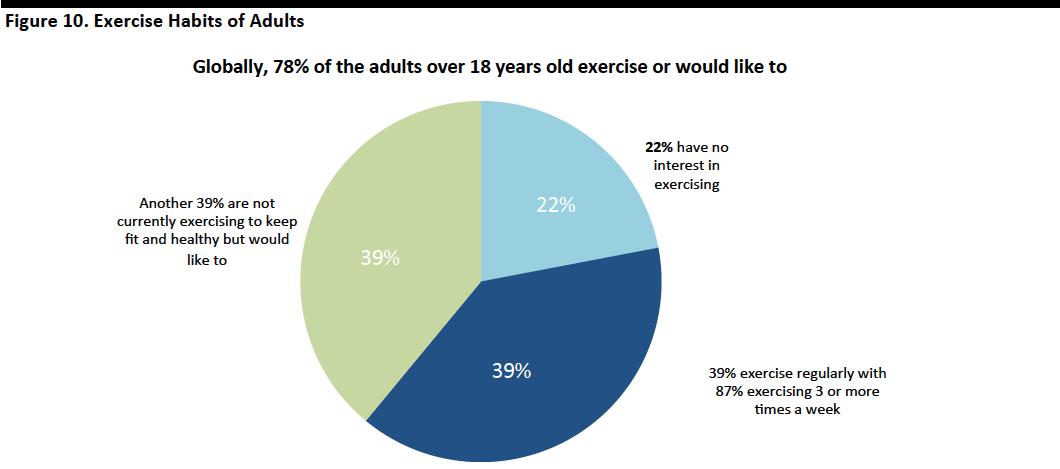

[caption id="attachment_85697" align="aligncenter" width="720"]

Source: Aetna[/caption]

[caption id="attachment_85697" align="aligncenter" width="720"] Source: Nielsen/Les Mills[/caption]

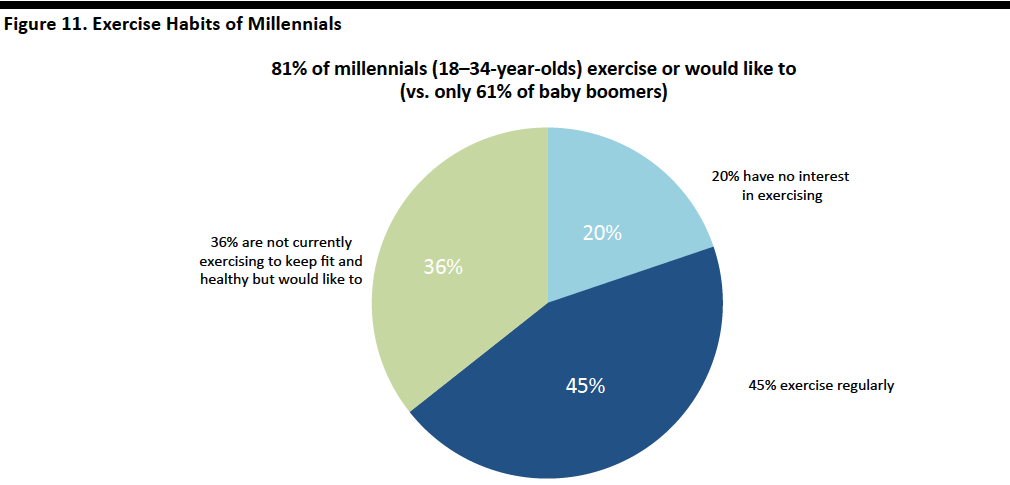

[caption id="attachment_85698" align="aligncenter" width="720"]

Source: Nielsen/Les Mills[/caption]

[caption id="attachment_85698" align="aligncenter" width="720"] Source: Nielsen/Les Mills[/caption]

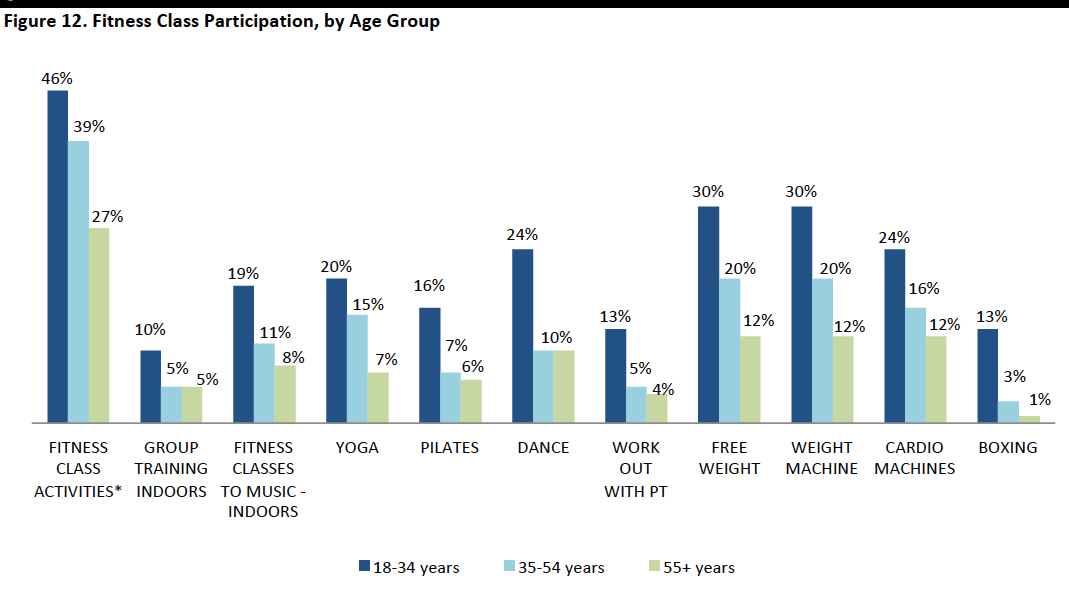

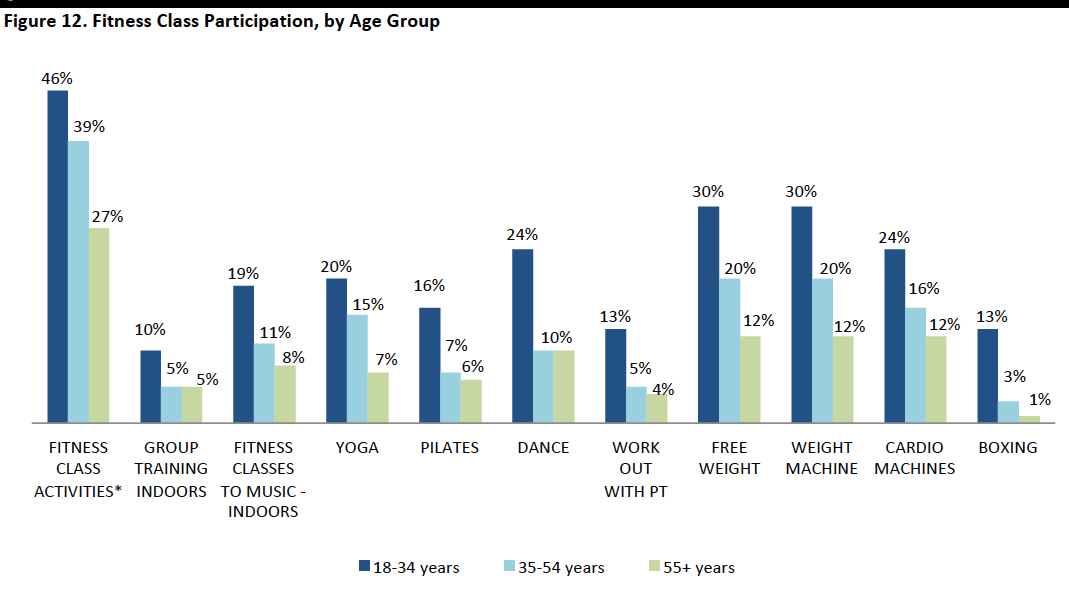

Millennials are as social in their fitness activities as they are in other parts of their lives, unlike many in previous generations, who might have lifted some weights and then left the gym without talking anyone else. Surveys show participation in group fitness and exercise classes is up among young adults in the US and, according to Nielsen, female millennials are particularly fond of classes. As they do with many aspects of their lives, millennials are using social media to share their fitness experiences with their friends. For many younger workers in cities such as New York and Los Angeles, spinning classes are starting to replace cocktail bars as the after-work go-to destination.

Source: Nielsen/Les Mills[/caption]

Millennials are as social in their fitness activities as they are in other parts of their lives, unlike many in previous generations, who might have lifted some weights and then left the gym without talking anyone else. Surveys show participation in group fitness and exercise classes is up among young adults in the US and, according to Nielsen, female millennials are particularly fond of classes. As they do with many aspects of their lives, millennials are using social media to share their fitness experiences with their friends. For many younger workers in cities such as New York and Los Angeles, spinning classes are starting to replace cocktail bars as the after-work go-to destination.

Boutique fitness studios such as SoulCycle, Flywheel, Pure Barre and Barry’s Bootcamp are extremely popular, and many fitness centers now offer a wide variety of exercise classes, including CrossFit, high-intensity training, yoga, Pilates, dance, barre and Zumba.

[caption id="attachment_85700" align="aligncenter" width="720"]

Boutique fitness studios such as SoulCycle, Flywheel, Pure Barre and Barry’s Bootcamp are extremely popular, and many fitness centers now offer a wide variety of exercise classes, including CrossFit, high-intensity training, yoga, Pilates, dance, barre and Zumba.

[caption id="attachment_85700" align="aligncenter" width="720"] Source: Nielsen/Les Mills[/caption]

Increased Focus on Healthy Lifestyle

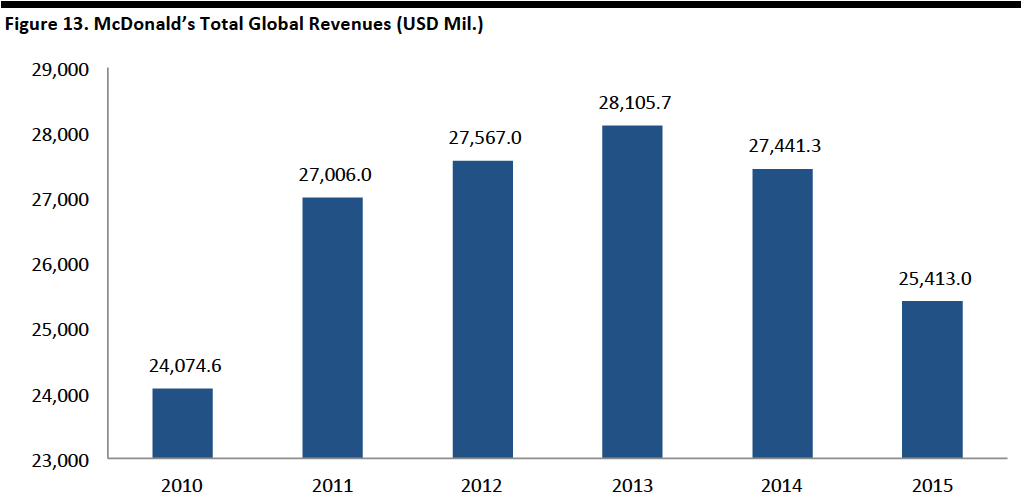

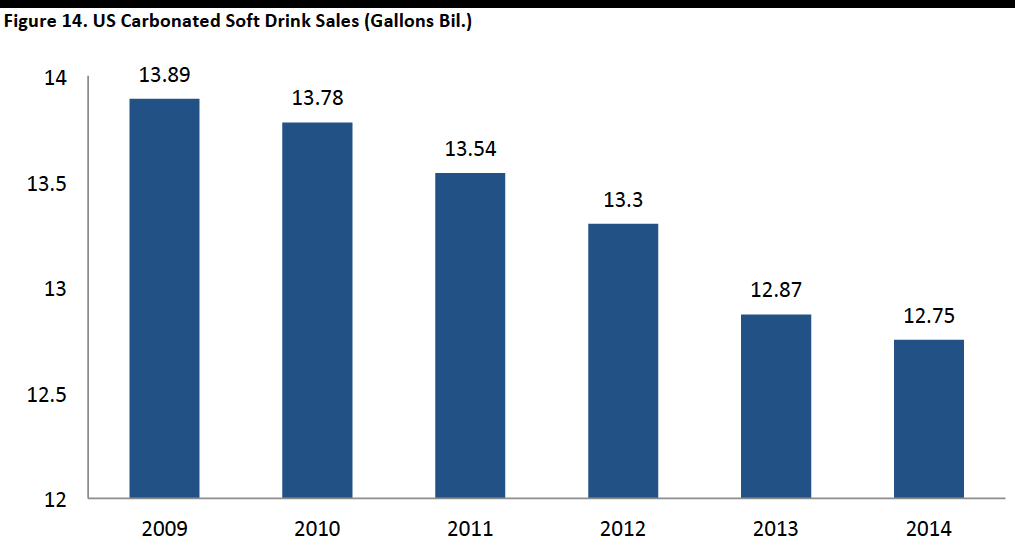

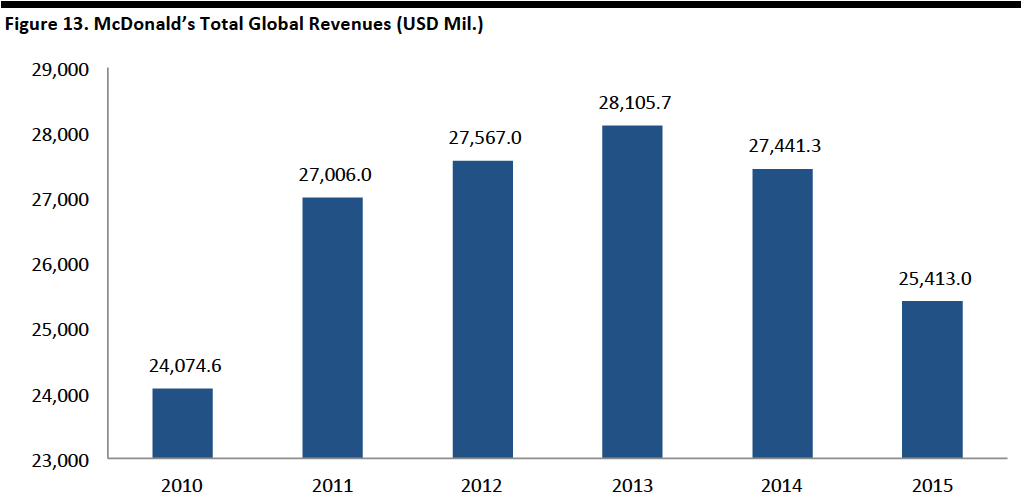

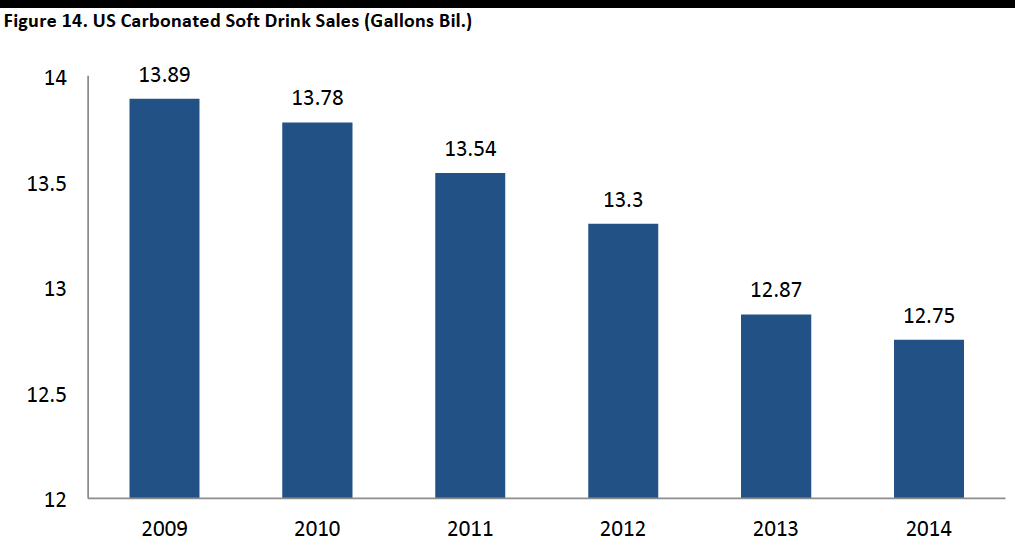

Athleisure companies have also benefited from a general shift in the US toward healthier eating and living. McDonald’s revenue has fallen consecutively for the last two years, but the company has benefited from the addition of healthier options, including new salads, to its menus. Carbonated soft drink sales have also dropped, for at least six consecutive years, as people have focused on eating right and living a healthy lifestyle.

[caption id="attachment_85701" align="aligncenter" width="720"]

Source: Nielsen/Les Mills[/caption]

Increased Focus on Healthy Lifestyle

Athleisure companies have also benefited from a general shift in the US toward healthier eating and living. McDonald’s revenue has fallen consecutively for the last two years, but the company has benefited from the addition of healthier options, including new salads, to its menus. Carbonated soft drink sales have also dropped, for at least six consecutive years, as people have focused on eating right and living a healthy lifestyle.

[caption id="attachment_85701" align="aligncenter" width="720"] Source: S&P Capital IQ[/caption]

[caption id="attachment_85702" align="aligncenter" width="720"]

Source: S&P Capital IQ[/caption]

[caption id="attachment_85702" align="aligncenter" width="720"] Source: Trefis[/caption]

Athleisure brands have been successful in building an emotional connection between product and customer, making it more likely customers will make multiple purchases. Customers want not only the items they are purchasing themselves, but also the active lifestyle that comes with them. They look and feel the part while wearing athleisure garments, which inspires them to embody the characteristics that athleisure brands represent. With health and wellness trending as a lifestyle, athleisurewear’s outperformance versus overall apparel should not be a surprise.

Relaxation of Office Dress Codes and Casualization of General Style of Dress

Since the 1960s, American youth have been pushing the boundaries with regard to casual dress. By the 1990s, students were showing up to class in sneakers and sweat pants. But graduation from college generally meant transitioning into more “proper” adult clothing that was appropriate for a workplace setting. These days, activewear once reserved for the gym is considered, at least in some industries, appropriate office-casual attire. Leggings, hoodies and sneakers are athleisurewear basics, and they are showing up in all but the most formal settings.

Another part of athleisurewear’s attraction is that it meets consumers’ desire for clothing that is both comfortable and functional. Many people are so overscheduled that they do not want to focus on their wardrobe—they would rather spend more time thinking about and doing more important things in their lives. They can wear athleisurewear to the gym, in the gym and from the gym. It allows them to no longer have to worry about the hassle of dragging along multiple changes of clothing for different settings.

Athleisure Trends

Luxury Redefined

As athleisurewear has become more popular and acceptable to wear in various settings, luxury and higher-end designers have become more prevalent in the space. In some cases, consumers are paying several hundred to over a thousand dollars for a pair of leggings. Designers are mixing materials, adding patterns and texture to enhance their offerings, and making them more fashion forward in order to rationalize the price points. Designers such as Donna Karan and Brunello Cucinelli have even offered cashmere leggings.

Ultimately, though, consumers buy athleisure apparel at a higher price point because they are motivated by the perceived lifestyle benefits that come with the clothing. The emotional connection with the brand is what keeps consumers keep coming back. The luxury aspect is not in the garment itself; it is in the lifestyle and the concept.

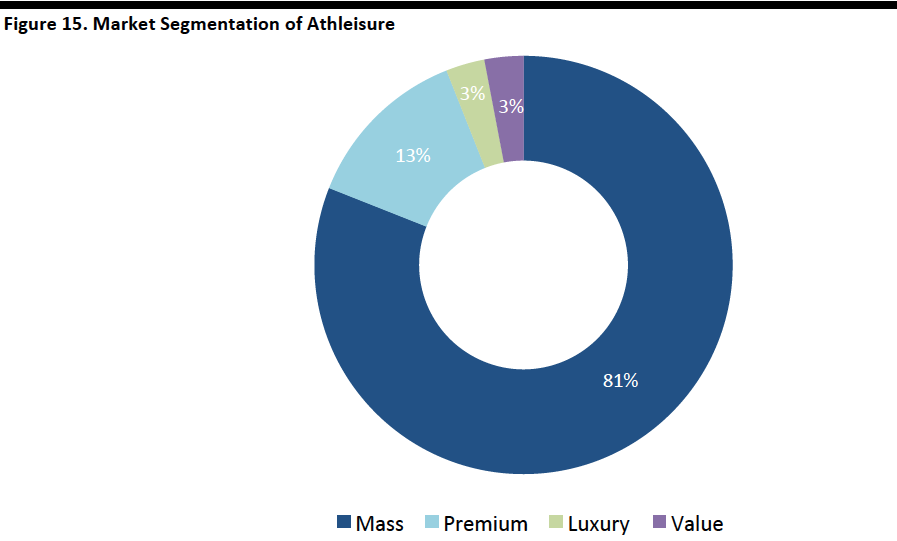

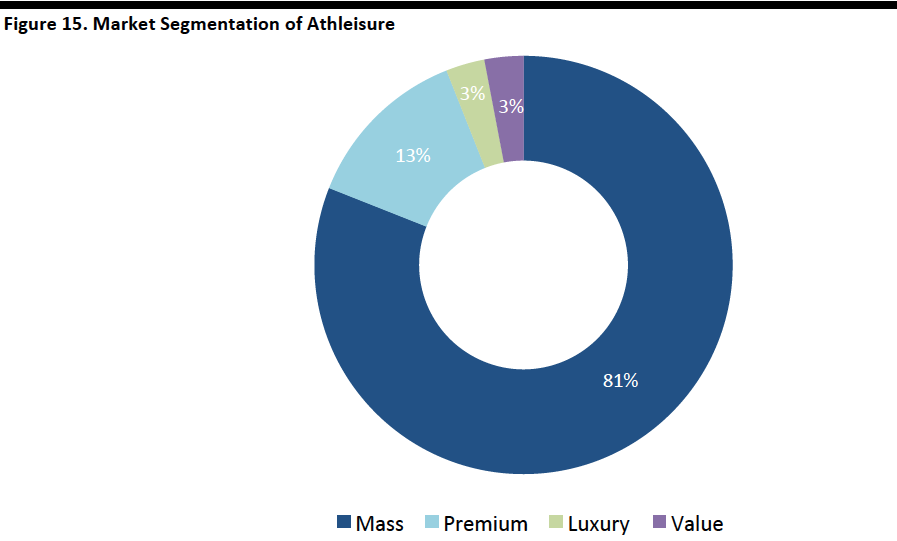

Luxury and premium brands accounted for a combined 16% of the athleticwear market in 2015, according to apparel analytics firm Edited. The majority of the segment, 81%, belongs to mass-market brands.

[caption id="attachment_85703" align="aligncenter" width="640"]

Source: Trefis[/caption]

Athleisure brands have been successful in building an emotional connection between product and customer, making it more likely customers will make multiple purchases. Customers want not only the items they are purchasing themselves, but also the active lifestyle that comes with them. They look and feel the part while wearing athleisure garments, which inspires them to embody the characteristics that athleisure brands represent. With health and wellness trending as a lifestyle, athleisurewear’s outperformance versus overall apparel should not be a surprise.

Relaxation of Office Dress Codes and Casualization of General Style of Dress

Since the 1960s, American youth have been pushing the boundaries with regard to casual dress. By the 1990s, students were showing up to class in sneakers and sweat pants. But graduation from college generally meant transitioning into more “proper” adult clothing that was appropriate for a workplace setting. These days, activewear once reserved for the gym is considered, at least in some industries, appropriate office-casual attire. Leggings, hoodies and sneakers are athleisurewear basics, and they are showing up in all but the most formal settings.

Another part of athleisurewear’s attraction is that it meets consumers’ desire for clothing that is both comfortable and functional. Many people are so overscheduled that they do not want to focus on their wardrobe—they would rather spend more time thinking about and doing more important things in their lives. They can wear athleisurewear to the gym, in the gym and from the gym. It allows them to no longer have to worry about the hassle of dragging along multiple changes of clothing for different settings.

Athleisure Trends

Luxury Redefined

As athleisurewear has become more popular and acceptable to wear in various settings, luxury and higher-end designers have become more prevalent in the space. In some cases, consumers are paying several hundred to over a thousand dollars for a pair of leggings. Designers are mixing materials, adding patterns and texture to enhance their offerings, and making them more fashion forward in order to rationalize the price points. Designers such as Donna Karan and Brunello Cucinelli have even offered cashmere leggings.

Ultimately, though, consumers buy athleisure apparel at a higher price point because they are motivated by the perceived lifestyle benefits that come with the clothing. The emotional connection with the brand is what keeps consumers keep coming back. The luxury aspect is not in the garment itself; it is in the lifestyle and the concept.

Luxury and premium brands accounted for a combined 16% of the athleticwear market in 2015, according to apparel analytics firm Edited. The majority of the segment, 81%, belongs to mass-market brands.

[caption id="attachment_85703" align="aligncenter" width="640"] Source: Edited[/caption]

[caption id="attachment_85705" align="aligncenter" width="720"]

Source: Edited[/caption]

[caption id="attachment_85705" align="aligncenter" width="720"] Source: Company reports/Fung Global Retail & Technology[/caption]

Bringing Fitness Classes into Retail

Several retailers, including Athleta, Bandier, Lululemon and Sweaty Betty, have started offering fitness classes in their stores. Fitness studios are incorporated into their retail locations, and some offer as many as five classes a day. Some classes are free, while others cost about the same as they would at a gym.

Source: Company reports/Fung Global Retail & Technology[/caption]

Bringing Fitness Classes into Retail

Several retailers, including Athleta, Bandier, Lululemon and Sweaty Betty, have started offering fitness classes in their stores. Fitness studios are incorporated into their retail locations, and some offer as many as five classes a day. Some classes are free, while others cost about the same as they would at a gym.

Fitness classes can boost store traffic, and retailers benefit by having health-and-fitness-minded consumers walking through stores filled with merchandise that appeals to those very consumers. In-store fitness and wellness events engage athleisure customers beyond their shopping experience, catering to their overall wellness lifestyle needs.

Bandier offers rewards such as discounts to customers who attend classes at its stores. The company holds four to five classes per day, led by well-known instructors. Class offerings include Nicole Winhoffer’s NW Method, popular SoulCycle instructor Akin Akman’s own Akin’s Army, Yoga for Bad People flow classes and IntenSati.

Sweaty Betty’s Get Fit 4 Free community initiative includes in-store classes as well as online videos of classes, including boxing, HIIT, barre and even boutique classes such as Barry’s Bootcamp.

Nike also makes fitness accessible to everyone. Most major cities have a Nike+ Run Club, which offers a series of workouts aimed at helping runners improve. Expert coaches teach classes for speed training and long runs, among other things, to members of the group.

Adjacent Athleisure Categories

Given the widespread popularity of athleisurewear, new, adjacent categories have emerged to support the lifestyle beyond the garments themselves. Birchbox, the beauty subscription service, recently launched Arrow, a makeup and skincare line targeted to women to wear during and after workouts. The high-performance

line was created to “help you look your best without looking like you are trying too hard” and was inspired by the athleisure fashion trend. The offering currently includes a cheek tint, lip balm and deodorant. In addition, Birchbox plans to add five new Arrow products later in the spring, including a facial mist, a water- resistant mascara, cleansing cloths, a tinted serum and a tinted brow gel.

Conclusion

Some have questioned whether the athleisure trend is sustainable. Does it represent just a fleeting fashion or a more structural, cultural shift in the way people dress? That is the key question relating to the athleisure segment.

Will consumers grow tired of this category and cast it aside when the next trend comes along? No one can say for sure how long the trend will be around, but we believe it has room to grow and could morph into other categories. The case for athleisure’s staying power is underpinned by a larger cultural shift toward a healthy lifestyle and by demand for clothing that is comfortable, functional and versatile.

There has been some recent discussion in the industry about the athleisure segment peaking and athletic products’ sales declining, and we think this is a reflection of the trend having played out (given the 8–10-year cycle that characterizes most apparel trends). We do not think the current rate of growth in the category is sustainable. But we do think the structural changes in the way people live and the way they want to dress to support their lifestyle will ensure that the category continues to exist—and to grow—albeit at a more modest rate.

Fitness classes can boost store traffic, and retailers benefit by having health-and-fitness-minded consumers walking through stores filled with merchandise that appeals to those very consumers. In-store fitness and wellness events engage athleisure customers beyond their shopping experience, catering to their overall wellness lifestyle needs.

Bandier offers rewards such as discounts to customers who attend classes at its stores. The company holds four to five classes per day, led by well-known instructors. Class offerings include Nicole Winhoffer’s NW Method, popular SoulCycle instructor Akin Akman’s own Akin’s Army, Yoga for Bad People flow classes and IntenSati.

Sweaty Betty’s Get Fit 4 Free community initiative includes in-store classes as well as online videos of classes, including boxing, HIIT, barre and even boutique classes such as Barry’s Bootcamp.

Nike also makes fitness accessible to everyone. Most major cities have a Nike+ Run Club, which offers a series of workouts aimed at helping runners improve. Expert coaches teach classes for speed training and long runs, among other things, to members of the group.

Adjacent Athleisure Categories

Given the widespread popularity of athleisurewear, new, adjacent categories have emerged to support the lifestyle beyond the garments themselves. Birchbox, the beauty subscription service, recently launched Arrow, a makeup and skincare line targeted to women to wear during and after workouts. The high-performance

line was created to “help you look your best without looking like you are trying too hard” and was inspired by the athleisure fashion trend. The offering currently includes a cheek tint, lip balm and deodorant. In addition, Birchbox plans to add five new Arrow products later in the spring, including a facial mist, a water- resistant mascara, cleansing cloths, a tinted serum and a tinted brow gel.

Conclusion

Some have questioned whether the athleisure trend is sustainable. Does it represent just a fleeting fashion or a more structural, cultural shift in the way people dress? That is the key question relating to the athleisure segment.

Will consumers grow tired of this category and cast it aside when the next trend comes along? No one can say for sure how long the trend will be around, but we believe it has room to grow and could morph into other categories. The case for athleisure’s staying power is underpinned by a larger cultural shift toward a healthy lifestyle and by demand for clothing that is comfortable, functional and versatile.

There has been some recent discussion in the industry about the athleisure segment peaking and athletic products’ sales declining, and we think this is a reflection of the trend having played out (given the 8–10-year cycle that characterizes most apparel trends). We do not think the current rate of growth in the category is sustainable. But we do think the structural changes in the way people live and the way they want to dress to support their lifestyle will ensure that the category continues to exist—and to grow—albeit at a more modest rate.

There was a time when wearing anything other than a tailored suit meant one was underdressed and out of place in an office setting. In many industries, that time has passed. Since the 1960s, American youth have been pushing the boundaries of how casually they can get away with dressing. By the 1990s, students were showing up to class in sneakers and sweat pants. Still, graduation from college generally meant transitioning into more “proper” adult clothing that was appropriate for a workplace setting. Now, though, activewear once reserved for more casual settings is considered perfectly appropriate office casualwear in some businesses, and it is commonly worn in all but the most

formal settings. Leggings, hoodies and sneakers, once reserved for the gym, are now worn everywhere—evidence of the strength of the athleisure trend.

An unprecedented number of fitness apparel lines have sprung up in the last few years. Boutique brands such as Sweaty Betty and Outdoor Voices are competing against established athleticwear giants Under Armour and Nike, while higher-end designers Tory Burch and Stella McCartney, and retailers Gap and Ann Inc., have all ventured into the activewear arena.

Proprietary, sweat-wicking compression fabrics are standard in athleisurewear, and the array of designs available rival those offered in more formal apparel. Figure 1, below, illustrates the general shift toward more casual clothing and the emergence of the athleisure trend. Athleisure went mainstream in about 2010.

[caption id="attachment_85640" align="aligncenter" width="720"]

There was a time when wearing anything other than a tailored suit meant one was underdressed and out of place in an office setting. In many industries, that time has passed. Since the 1960s, American youth have been pushing the boundaries of how casually they can get away with dressing. By the 1990s, students were showing up to class in sneakers and sweat pants. Still, graduation from college generally meant transitioning into more “proper” adult clothing that was appropriate for a workplace setting. Now, though, activewear once reserved for more casual settings is considered perfectly appropriate office casualwear in some businesses, and it is commonly worn in all but the most

formal settings. Leggings, hoodies and sneakers, once reserved for the gym, are now worn everywhere—evidence of the strength of the athleisure trend.

An unprecedented number of fitness apparel lines have sprung up in the last few years. Boutique brands such as Sweaty Betty and Outdoor Voices are competing against established athleticwear giants Under Armour and Nike, while higher-end designers Tory Burch and Stella McCartney, and retailers Gap and Ann Inc., have all ventured into the activewear arena.

Proprietary, sweat-wicking compression fabrics are standard in athleisurewear, and the array of designs available rival those offered in more formal apparel. Figure 1, below, illustrates the general shift toward more casual clothing and the emergence of the athleisure trend. Athleisure went mainstream in about 2010.

[caption id="attachment_85640" align="aligncenter" width="720"] Source: Company reports/Fung Global Retail & Technology[/caption]

A Look Back: How Demand for Sneakers Gave Birth to the Athleisure Category

We recently had the opportunity to sit down with one of the leading apparel vendors in the activewear category, and we asked our source how athleisure came about in the first place. According to our source, the category’s rise mirrored apparel cycles more broadly. Apparel trends typically last between eight and 10 years, and athleisure and athletic-inspired apparel became more popular as the high- end denim fad began to wane toward the end of the last

decade. At that time, vintage-inspired apparel was prevalent across malls, big box stores and discount stores, and denim was the most popular item in the bottoms category.

As the denim trend evolved and grew stale, Nike refreshed its sneaker offering and added new colors and freshly inspired assortments. The company’s business with Foot Locker and Finish Line flourished. Traditional apparel retailers took notice, and began offering apparel that complemented the footwear that was selling well. Apparel that previously came in only neutral tones began to feature bright colors and, eventually, neon colors. Specialty retailers (particularly “A” retailers) followed suit, as they were looking for a category that could replace the declining denim segment and their collections’ relatively stale themes. The

market shifts led to activewear for everyday people.

The athleisure and athletic-inspired apparel category has performed very well, often posting high double- and triple-digit gains. However, in many cases, the increase in athleisure sales volumes has not been enough to offset the declines in denim, as athleisure generally has a lower price point than high-priced denim does.

New Brands Continue to Enter the Athleisure Space

Nonetheless, traditional athleticwear retail players are still expanding into athleisure, and there are also many new brands entering the space that are focused solely on athleisure. We have grouped the various players into three categories: pure-play athleisure brands, which sell only athleisure merchandise; celebrity brands and partnerships; and more traditional athleticwear and mainstream retail companies that have expanded into the athleisure segment. Below, we discuss examples of companies operating in each of the three categories.

Explosive growth in the athleisure universe has made it harder than ever for brands to stand out. The ones that have performed best and seem to have proven they can withstand increasing competition are those that sell not just clothes, but a lifestyle. This makes sense, given that the athleisure trend is as much about a lifestyle concept as it is about fashion.

[caption id="attachment_85642" align="aligncenter" width="720"]

Source: Company reports/Fung Global Retail & Technology[/caption]

A Look Back: How Demand for Sneakers Gave Birth to the Athleisure Category

We recently had the opportunity to sit down with one of the leading apparel vendors in the activewear category, and we asked our source how athleisure came about in the first place. According to our source, the category’s rise mirrored apparel cycles more broadly. Apparel trends typically last between eight and 10 years, and athleisure and athletic-inspired apparel became more popular as the high- end denim fad began to wane toward the end of the last

decade. At that time, vintage-inspired apparel was prevalent across malls, big box stores and discount stores, and denim was the most popular item in the bottoms category.

As the denim trend evolved and grew stale, Nike refreshed its sneaker offering and added new colors and freshly inspired assortments. The company’s business with Foot Locker and Finish Line flourished. Traditional apparel retailers took notice, and began offering apparel that complemented the footwear that was selling well. Apparel that previously came in only neutral tones began to feature bright colors and, eventually, neon colors. Specialty retailers (particularly “A” retailers) followed suit, as they were looking for a category that could replace the declining denim segment and their collections’ relatively stale themes. The

market shifts led to activewear for everyday people.

The athleisure and athletic-inspired apparel category has performed very well, often posting high double- and triple-digit gains. However, in many cases, the increase in athleisure sales volumes has not been enough to offset the declines in denim, as athleisure generally has a lower price point than high-priced denim does.

New Brands Continue to Enter the Athleisure Space

Nonetheless, traditional athleticwear retail players are still expanding into athleisure, and there are also many new brands entering the space that are focused solely on athleisure. We have grouped the various players into three categories: pure-play athleisure brands, which sell only athleisure merchandise; celebrity brands and partnerships; and more traditional athleticwear and mainstream retail companies that have expanded into the athleisure segment. Below, we discuss examples of companies operating in each of the three categories.

Explosive growth in the athleisure universe has made it harder than ever for brands to stand out. The ones that have performed best and seem to have proven they can withstand increasing competition are those that sell not just clothes, but a lifestyle. This makes sense, given that the athleisure trend is as much about a lifestyle concept as it is about fashion.

[caption id="attachment_85642" align="aligncenter" width="720"] Source: Euromonitor International[/caption]

Source: Euromonitor International[/caption]

[caption id="attachment_85644" align="aligncenter" width="480"]

[caption id="attachment_85644" align="aligncenter" width="480"] Source: Company reports/Fung Global Retail & Technology[/caption]

PURE PLAYS

Source: Company reports/Fung Global Retail & Technology[/caption]

PURE PLAYS

Lululemon can be considered the first to market in the athleisure space. Chip Wilson founded the company in 1998, having spent the first 20 years of his career in the surf, ski and skate industries. When he started practicing yoga, he saw an opportunity to bring the more technical, performance-enhancing aspects of surf and ski apparel to the basic cotton clothing that yoga practitioners were wearing. He used word of mouth to sell his products, setting up shop inside yoga studios and enlisting instructors as brand ambassadors—which the company still does today. In 2005, Wilson sold 48% of the company to private equity firms Advent International and Highland Capital Partners, and in 2007, Lululemon went public.

The company has since faced several embarrassing public relations incidents, including a recall of yoga pants that were too sheer and backlash against a number of provocative statements made by Wilson (who stepped down from the board in 2015). The company is now working to restrengthen its business. A big part of the most recent product strategy is to change the way it sells pants. Rather than sorting pants by length, Lululemon now organizes them by fit and feel, categorizing them by what the company calls “sensation”: hugged, naked, relaxed, tight and held-in.

Lululemon can be considered the first to market in the athleisure space. Chip Wilson founded the company in 1998, having spent the first 20 years of his career in the surf, ski and skate industries. When he started practicing yoga, he saw an opportunity to bring the more technical, performance-enhancing aspects of surf and ski apparel to the basic cotton clothing that yoga practitioners were wearing. He used word of mouth to sell his products, setting up shop inside yoga studios and enlisting instructors as brand ambassadors—which the company still does today. In 2005, Wilson sold 48% of the company to private equity firms Advent International and Highland Capital Partners, and in 2007, Lululemon went public.

The company has since faced several embarrassing public relations incidents, including a recall of yoga pants that were too sheer and backlash against a number of provocative statements made by Wilson (who stepped down from the board in 2015). The company is now working to restrengthen its business. A big part of the most recent product strategy is to change the way it sells pants. Rather than sorting pants by length, Lululemon now organizes them by fit and feel, categorizing them by what the company calls “sensation”: hugged, naked, relaxed, tight and held-in.

In March 2016, Lululemon opened a new store in Lower Manhattan called Lululemon Lab. It differs from the brand’s other stores in that it is dedicated to both design and retail. The store is Lululemon’s second design lab (the first is in Vancouver). While some of the pieces in the store are for working out in, many are more modern takes on functional streetwear, and even work as business casualwear. The clothes incorporate the technical fabrics that Lululemon is known for and reflect the brand’s focus on performance, but they can also be worn to dinner without the wearer looking like she has arrived straight from yoga class. The colors are neutral, the clothes are angular and the price points are higher. Each item is made in batches of only about 50 items, giving them an air of exclusivity.

In March 2016, Lululemon opened a new store in Lower Manhattan called Lululemon Lab. It differs from the brand’s other stores in that it is dedicated to both design and retail. The store is Lululemon’s second design lab (the first is in Vancouver). While some of the pieces in the store are for working out in, many are more modern takes on functional streetwear, and even work as business casualwear. The clothes incorporate the technical fabrics that Lululemon is known for and reflect the brand’s focus on performance, but they can also be worn to dinner without the wearer looking like she has arrived straight from yoga class. The colors are neutral, the clothes are angular and the price points are higher. Each item is made in batches of only about 50 items, giving them an air of exclusivity.

Sweaty Betty plans to double its presence in the US by opening six stores here this year. The company was founded in the UK in 1998 by husband and wife Tamara and Simon Hill-Norton, and was originally a multibrand boutique featuring labels sourced predominantly from Scandinavia and Italy. In 2007, the company shifted its business model to produce its own label. It now operates more than 40 stores in the UK, with annual sales of approximately $46 million. The company has also turned its

attention to the US market, where it currently operates six stand- alone stores, an e-commerce site and concessions in two Bloomingdale’s stores. In January 2016, the company hired its first US President and CEO, Erika Serow, from Bain & Company. The company’s sales in the US have doubled over the past year.