Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

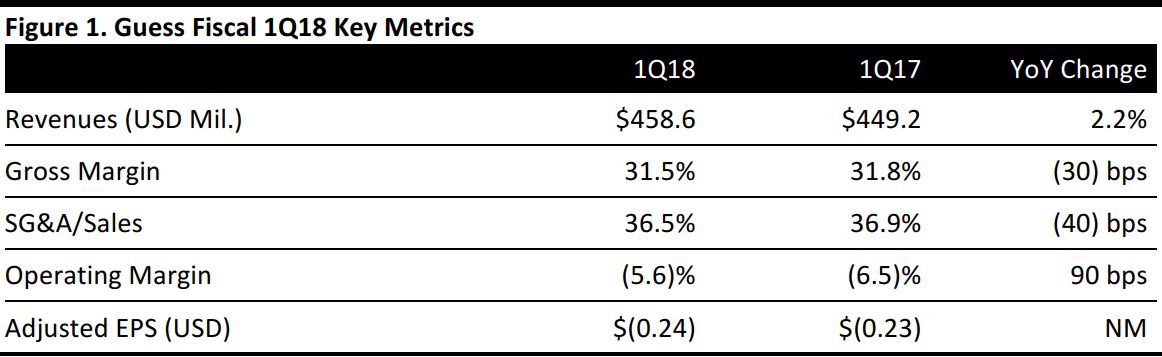

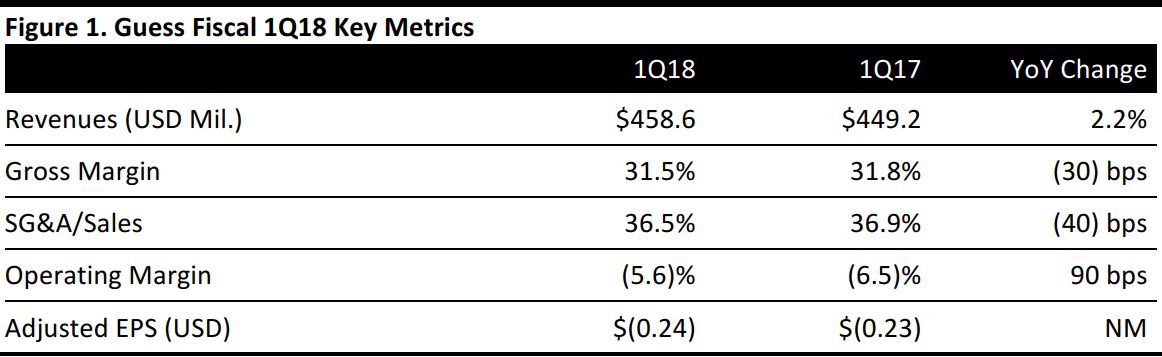

Fiscal 1Q18 Results

Guess reported fiscal 1Q18 adjusted EPS of $(0.24), down slightly from $(0.23) in the year-ago quarter, but above the $(0.32) consensus estimate. The company reported total revenue of $458.6 million, above the $449.2 million consensus estimate and up 2.2% from the year-ago quarter.

Management was disappointed with the performance of its North America business, but was pleased with business expansion in Europe and Asia. The company will focus on shrinking its store footprint and increasing its profitability in North America.

By business segment, revenues from the Americas retail business were down 14.9%, while revenues from the Europe and Asia businesses were up 23.2% and 16.9%, respectively. Americas wholesale revenues increased by 5.7% and licensing revenues were down 9.3%.

North America same-store sales (including e-commerce) decreased by 15%, beating the consensus estimate of a 16.4% decline for the quarter. Europe retail comps were up 5% and Asia comps were up 4%.

Outlook

The company expects 2Q18 adjusted EPS of $0.08–$0.11 and expects total revenues to increase by 2%–4%, or by 3.5%–5.5% on a constant currency basis. By business segment, North America retail revenues are expected to decline by low double to high single digits on a constant currency basis. Revenues are expected to increase by a mid-to-high-teens percentage for both the Europe and Asia businesses. Americas wholesale revenue is expected to be down by low single digits.

In terms of comparable store sales, the company expects Americas retail comps to decline by low double to high single digits in 2Q18. Europe and Asia comps are expected to be positive.

For fiscal year 2018, the company expects adjusted EPS of $0.34–$0.44. Revenues for the year are expected to be up 4%–5% on a constant currency basis. By business segment, Americas retail revenues are expected to be down by low double to high single digits on a constant currency basis. Europe revenues are expected to be up by a low twenties percentage. Asia revenues are expected to increase by a mid-to-high-teens rate. Americas wholesale revenues are expected to be down by low single digits.

In terms of comparable store sales for the fiscal year, Americas retail comps are expected to decline by low double to high single digits. Europe comps are expected to be up by high single digits and Asia comps are expected to be up mid-to-high single digits.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology