Source: Company reports/Fung Global Retail & Technology

3Q17 RESULTS

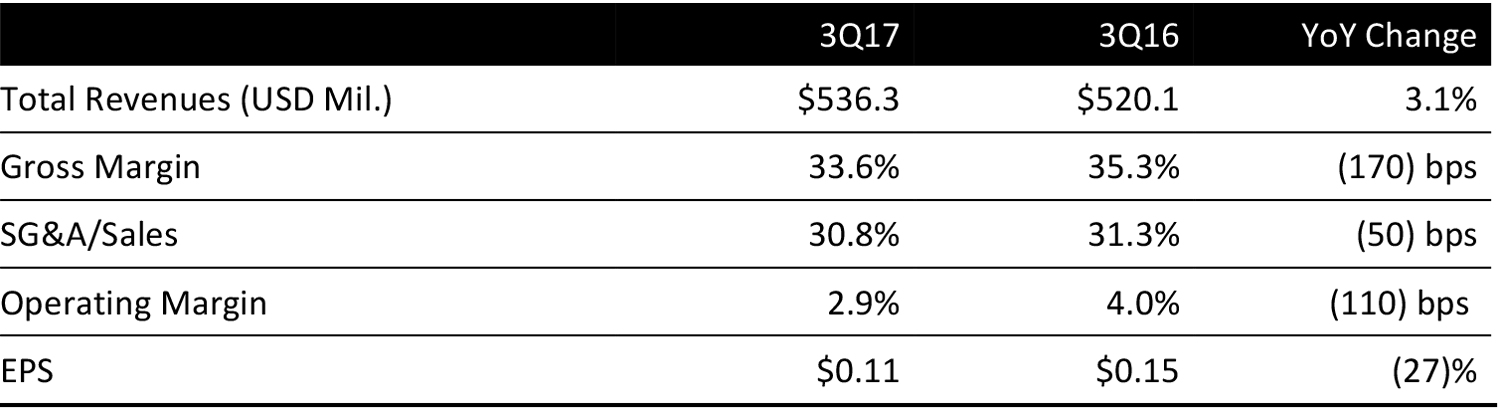

Guess reported 3Q17 revenues of $536.3 million, up 3.1% year over year but below the consensus estimate of $548.8 million. Reported EPS was $0.11, below the $0.14 consensus estimate and down 27% year over year. The figure was at the low end of management’s previous guidance.

Management was pleased with the strong, double-digit growth in Europe and Asia as it continued to focus on improving its North America business. The North America retail segment reported $215.9 million in revenue, missing consensus of $219.0 million. The North America wholesale division reported $44.8 million in revenue, beating the consensus estimate. Reported comps for the region were down 4.9% versus consensus expectations of a 3.3% decline.

The company’s Europe business enjoyed 16% year-over-year revenue growth, driven by new store openings and solid comparable store sales. The Europe wholesale business finished up 1%, marking its second consecutive quarter of growth. Guess’s Asia segment revenue was up 10%, driven by new store openings and strong momentum in comp sales in China.

Management also shared detailed profitability improvement plans for its North America business. The company plans to negotiate rent reductions, close unprofitable stores, improve its supply chain efficiency and enhance its digital capabilities.

OUTLOOK

For 4Q17, the company expects EPS of $0.40–$0.50 and a net sales increase of 3.5%–7.5%, including a negative currency impact of 0.5%. Excluding currency impact, consolidated net revenues are expected to increase by 1%–2%.

The company lowered its guidance for the full fiscal year. EPS is now expected to be $0.59–$0.69. Net revenues are now expected to increase by 0.5%–1.5% in US dollars and by 1%–2% in constant currency. Management noted that its previous full-year guidance was based on better comp and gross margin assumptions for 4Q17.

For 4Q17, the company expects its North America retail business to decline by lower-single to mid-single digits, its Europe business to be up by lower double digits, and its Asia business to increase in the low-to-high-twenties range. For FY17, the company expects its North America retail business to be down by lower-single digits to mid-single digits, its Europe business to be up by high single digits to low double digits, and its Asia business to be up by low single digits.