Source: Company reports/Coresight Research

2Q18 Results

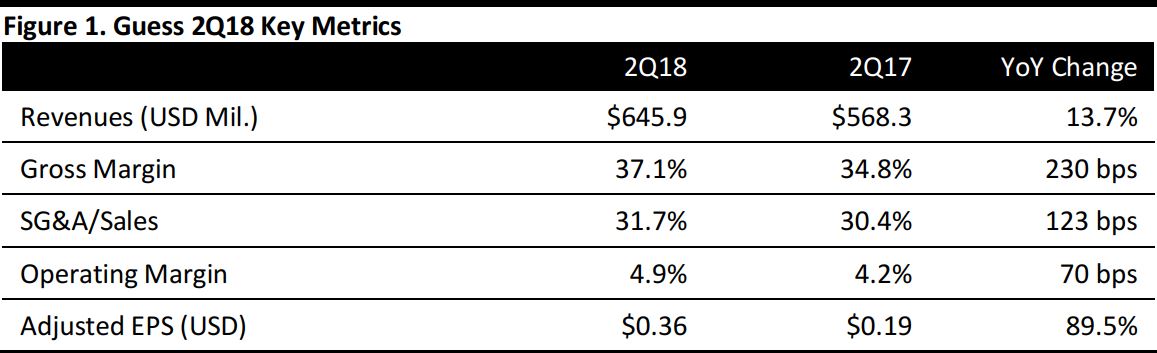

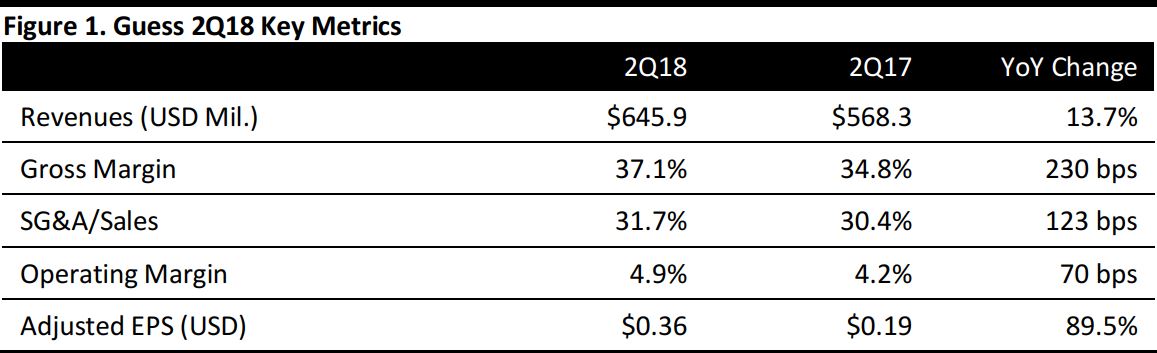

Guess reported 2Q18 adjusted EPS of $0.36, up from $0.19 in the year-ago period and ahead of the $0.32 consensus estimate. Revenues were $645.9 million, up 13.7% year over year and below the $650.6 million consensus estimate. Revenues were driven by continued momentum in Europe and Asia.

Revenues by Segment:

- Americas Retail revenues decreased 2.0% and retail comps including e-commerce were up 3.0%, above the 1.9% consensus estimate.

- Americas Wholesale revenues increased 4.9%.

- Europe revenues increased by 22.2% and retail comps including e-commerce increased 5%.

- Asia revenues increased 32.0% and retail comps including e-commerce increased 17%.

- Licensing revenues increased by 12.2%.

Total company gross margin increased 230 basis points to 37.1%, driven by higher initial markups (IMU), fewer markdowns and lower rents, partially offset for the negative impact of occupancy deleverage from high European logistics costs related to the startup of the company’s new distribution center.

Operating margin increased 70 basis points to 4.9%, compared to 4.2% in the year-ago quarter, driven primarily by the favorable impact from higher European wholesale shipments and lower markdowns in Americas Retail, partially offset by higher distribution costs resulting from the relocation of the company’s European distribution center and higher retail promotions in Europe.

Management commented that it will continue its focus on brand collaborations with influencers and celebrities while investing in social media initiatives to increase brand engagement. The company is investing in live video channels and social media platforms such as YouTube and Instagram to better reach millennial consumers. The company also partnered with Tick-Tock, a video-sharing application with 500 million users.

Outlook

Management pledged to continue to work on improving profitability in the Americas region by executing its cost-reduction and margin-improvement initiatives.

Management raised FY19 guidance and now expects:

- EPS of $0.94–$1.03 up from previous guidance of $0.88–$0.99 and the consensus of $0.99.

- Revenue growth of 9.0%–9.5%, up from previous guidance of 8.5%–9.5%, implying $2.58–$2.59 billion, and above the $2.57 billion consensus estimate.

- Revenues in constant currency to increase 8.0%–8.5%.