Source: Company reports/Fung Global Retail and Technology

2Q17 RESULTS

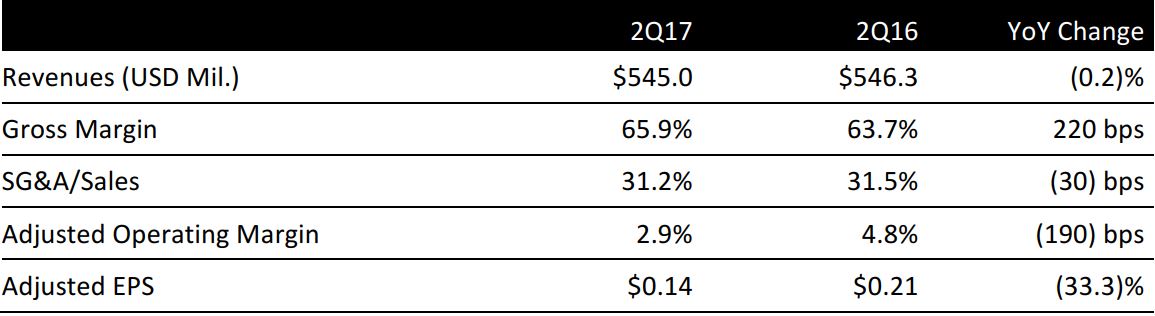

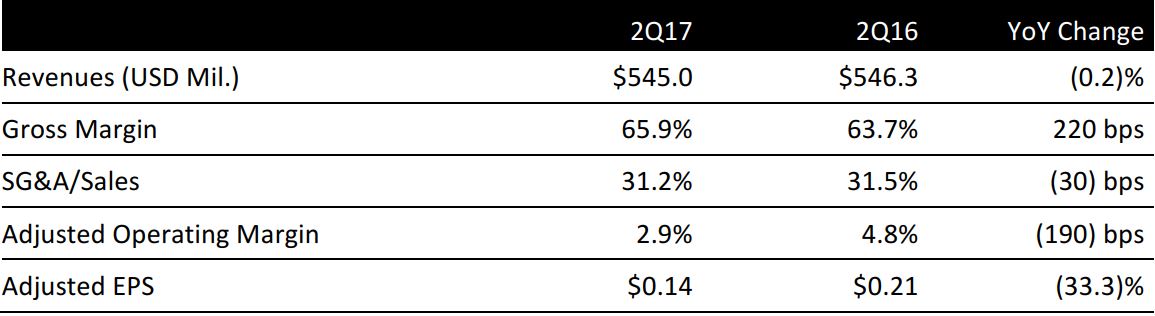

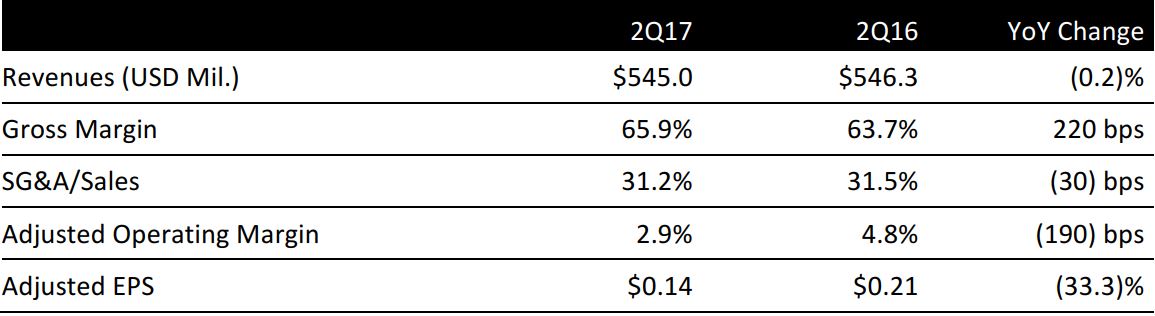

Guess reported 2Q17 adjusted EPS of $0.14, down 33.3% year over year but exceeding its own expectations and beating the consensus estimate of $0.06.

The company reported 2Q17 revenues of $545.0 million, down 0.2% year over year and below the consensus estimate of $550.5 million.

The company’s European division was the strongest performer, with 7% revenue growth in US dollars and 6% growth in constant currency in the quarter. The strong growth was offset by disappointing results from other divisions. In Asia, revenues fell by 6%, while in the Americas retail division, they fell by 3%. Revenues in the Americas wholesale division decreased by 8% and licensing revenues decreased by 13%. The retail business in the US and Canada was affected by decreased tourism due to the strengthening US dollar.

Retail comp sales including e-commerce decreased in both US-dollar and constant-currency terms, to (2.5)%, down from (1.6)% in the year-ago quarter.

The company’s operating margin decreased by 190 basis points, to 2.9%, from 4.8% in the year-ago quarter. This was largely due to higher expenses as a result of retail expansion and the negative impact of exchange rate fluctuations.

2017 Outlook

Guess adjusted its FY17 outlook to account for flat revenues in the second quarter. The company now expects full-year revenues to increase by 3.0%–5.0% in US dollars, down from 5.5%–7.5% previously. Adjusted diluted EPS is expected to be $0.62–$0.75, compared with the $0.55–$0.75 previously. Currency headwinds are expected to impact EPS by approximately $0.11.

The company expects that the investments it made in the first six months of FY17 will begin to generate revenue growth in the third quarter, which should accelerate into the fourth quarter.

The company has initiated a global cost reduction and restructuring plan that is expected to increase revenues in the second half of FY17 as the company better aligns its global cost and organization structure with its current strategic initiatives.

Guess expects low-single-digit same-store sales growth in FY17, driven by mid-to-high-single-digit growth in Asia, flat comps in Europe and a low-single-digit decline in the US.