Source: Company reports

Source: Company reports

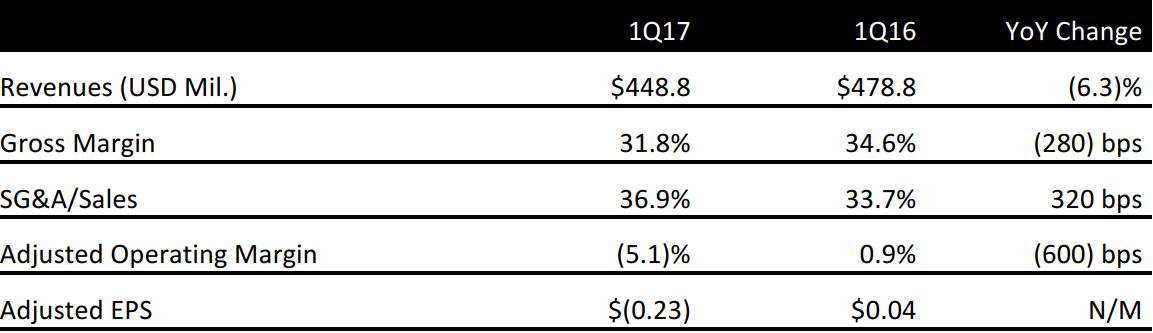

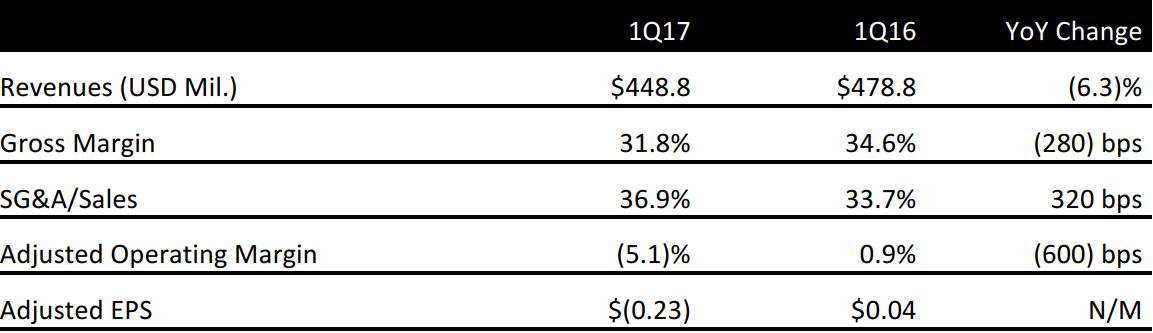

1Q17 RESULTS

Guess reported adjusted 1Q17 EPS of $(0.23) versus the consensus estimate of $(0.19).

Total revenues were $448.8 million versus consensus of $464.2 million. Sales for the period were below management’s expectations. In the Americas region, the retail business was challenging, particularly in the month of April. Comps in the Americas were down 4.2% (down 3.1% in constant currency) versus consensus of a 1.6% decline.

In Europe, the retail business performed strongly and comps were up in the mid-teens, carrying through a favorable trend from 2H16. In Asia, comps were positive in South Korea, while performance in Greater China was below expectations, as the company is continuing to build out its infrastructure there and transitioning to a direct business model.

2017 OUTLOOK

Management provided 2Q17 guidance for EPS of $0.04–$0.08 versus consensus of $0.11. Revenues are expected to increase by 0.5%–2.5% in both US-dollar and constant-currency terms. In the quarter, comps are expected to:

- Decline by low- to mid-single digits in the Americas Retail business.

- Increase by high-single to low-double digits in Europe.

- Be flat to up by mid-single digits in Asia.

- Increase by low-single digits in the Americas Wholesale business.

For FY17, guidance is for EPS of $0.55–$0.75 versus $0.65–$0.85 previously. Consensus is for EPS of $0.77. Revenues are expected to increase by 5.5%–7.5% in US-dollar terms. Currency tailwinds are expected to positively impact consolidated revenue growth by about 0.5%. For the full year, comps are expected to:

- Be down by low-single digits to up by low-single digits in the Americas Retail division.

- Climb by high-single digits to low-double digits in Europe.

- Increase by low-double to low-teens digits in Asia.

- Increase by mid-single digits in the Americas Wholesale division.

Source: Company reports

Source: Company reports