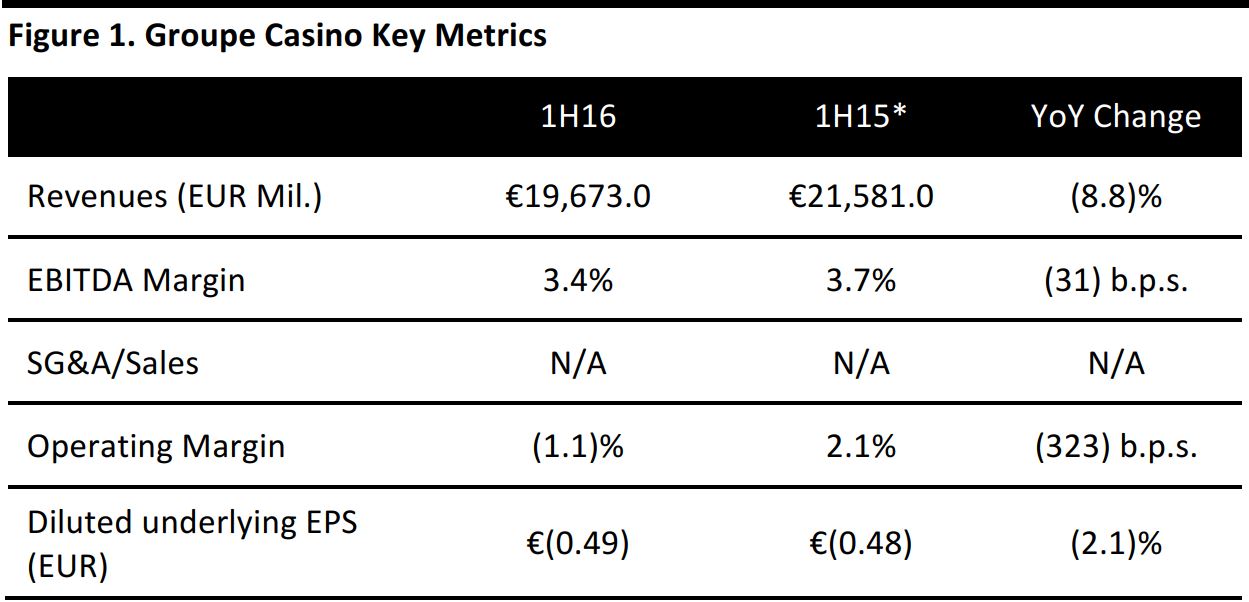

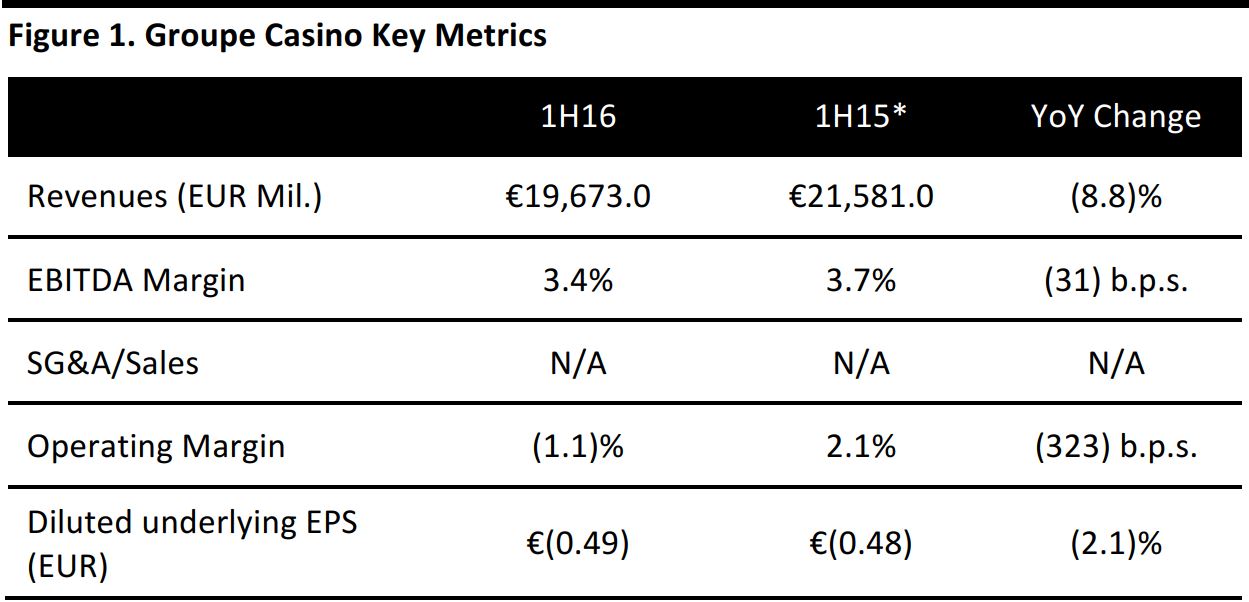

*In accordance with the IFRS 5 standard and to facilitate comparison, Groupe Casino restated 1H15 accounts to reflect the impact of the disposal of its operations in Thailand and Vietnam.

Source: Company reports/Fung Global Retail & Technology

1H16 RESULTS

French retailer Groupe Casino reported a 1H16 consolidated net revenue decline of 8.8%, to €19,673 million. Organic revenue growth (at constant exchange rates and scope of consolidation, excluding fuel and calendar effects) was up 2.7% during the period.

Consolidated net profit jumped more than 30-fold from €79 million to €2,581 million, due to the sales of Groupe Casino’s Asian businesses. The diluted underlying EPS was €(0.49) but the diluted consolidated EPS was €22.6. The diluted underlying EPS reflects the dilutive effects of the Monoprix convertible bonds, and the coupon paid to bearers of undated deeply subordinated notes.

PERFORMANCE BY GEOGRAPHY

In France, total sales were up 1.4%, to €9,264 million and organic sales growth was 2%. The company attributed this growth to market shares achieved by its banners in the region. Excluding fuel effects, Géant Casino recorded the highest comps, up 3.7%. This was followed by increases of 3.2% at Leader Price, 0.9% at Casino Supermarchés, 0.3% at

Franprix and 0.2% at the proximity stores. Monoprix saw comps fall 0.4%, but CEO Jean-Charles Naouri remarked the banner saw resilient food and apparel sales despite a decline in tourism and unfavorable weather in Paris. Naouri noted the value positioning of the banner improved after price cuts at Leader Price.

Sales in the Latin American Retail segment fell by 12.4% to €6,836 million, but same-store sales, excluding fuel, grew 5.4%. The segment recorded strong organic growth of 10%.

The company remarked stores in Colombia, Argentina and Uruguay continued to show satisfactory performance. It added cost reduction plans for this region are underway and will focus on controlling costs related to the number of working hours, marketing expenses, leases and logistics.

Electronic sales in Latin America, under the Via Varejo banner, fell by 25.4%, and same-store sales fell by 5.4%. However, the company highlighted improved sales in the second quarter. CFO Antoine Giscard d’Estaing said a better assortment of products, especially mobile phones, led to the improvement. This segment is separate from the Latin American Retail segment.

E-commerce sales at Groupe Casino fell by 19.1% to €1,391 million but grew by 13.1% on an organic basis. The company said Cdiscount managed to post a satisfactory increase in sales, but Cnova's activity in Brazil was marred by the country's economic environment.

OTHER KEY POINTS

D’Estaing mentioned several significant expenses that impacted reporting during this period:

- New due dates for Tascom, the tax on commercial premises in France, required the company to distribute tax expenses through the year and caused an impact of €22 million in 1H16.

- Accounting corrections and legal expenses related to incidents of fraud at Cnova were recognized in the company’s financial statements and caused an impact of €76 million.

- He also noted currency effects had a significant impact on reported numbers. The Colombian Peso fell by 20.4%, on average against the Euro, and the Brazilian Real fell by 19.8%, on average against the Euro, between 1H15 and 1H16.

OUTLOOK

Naouri said Groupe Casino’s objective for France in 2H16 will be to work toward sales growth and improving profitability. The company reiterated its goal of achieving a trading profit of €500 million in France.

In Latin America, Naouri said the focus will be on the development of Exito across all formats and countries in which it operates.

Sales in the Latin American Retail segment fell by 12.4% to €6,836 million, but same-store sales, excluding fuel, grew 5.4%. The segment recorded strong organic growth of 10%.

The company remarked stores in Colombia, Argentina and Uruguay continued to show satisfactory performance. It added cost reduction plans for this region are underway and will focus on controlling costs related to the number of working hours, marketing expenses, leases and logistics.

Electronic sales in Latin America, under the Via Varejo banner, fell by 25.4%, and same-store sales fell by 5.4%. However, the company highlighted improved sales in the second quarter. CFO Antoine Giscard d’Estaing said a better assortment of products, especially mobile phones, led to the improvement. This segment is separate from the Latin American Retail segment.

E-commerce sales at Groupe Casino fell by 19.1% to €1,391 million but grew by 13.1% on an organic basis. The company said Cdiscount managed to post a satisfactory increase in sales, but Cnova's activity in Brazil was marred by the country's economic environment.

Sales in the Latin American Retail segment fell by 12.4% to €6,836 million, but same-store sales, excluding fuel, grew 5.4%. The segment recorded strong organic growth of 10%.

The company remarked stores in Colombia, Argentina and Uruguay continued to show satisfactory performance. It added cost reduction plans for this region are underway and will focus on controlling costs related to the number of working hours, marketing expenses, leases and logistics.

Electronic sales in Latin America, under the Via Varejo banner, fell by 25.4%, and same-store sales fell by 5.4%. However, the company highlighted improved sales in the second quarter. CFO Antoine Giscard d’Estaing said a better assortment of products, especially mobile phones, led to the improvement. This segment is separate from the Latin American Retail segment.

E-commerce sales at Groupe Casino fell by 19.1% to €1,391 million but grew by 13.1% on an organic basis. The company said Cdiscount managed to post a satisfactory increase in sales, but Cnova's activity in Brazil was marred by the country's economic environment.