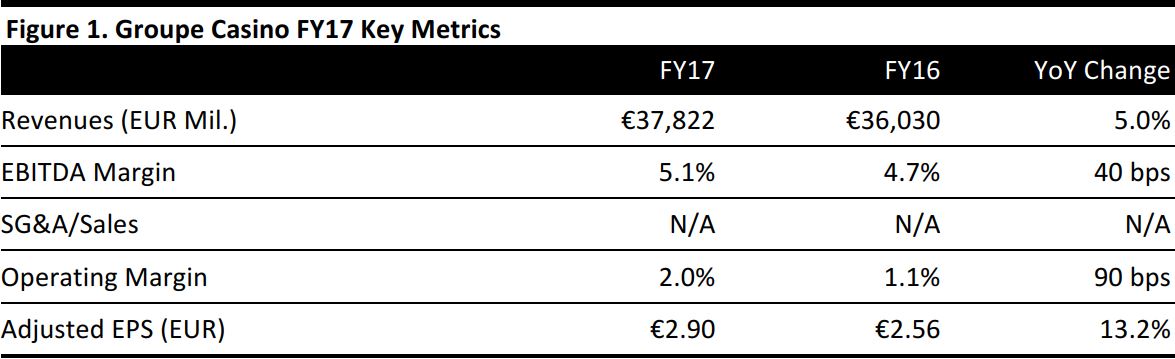

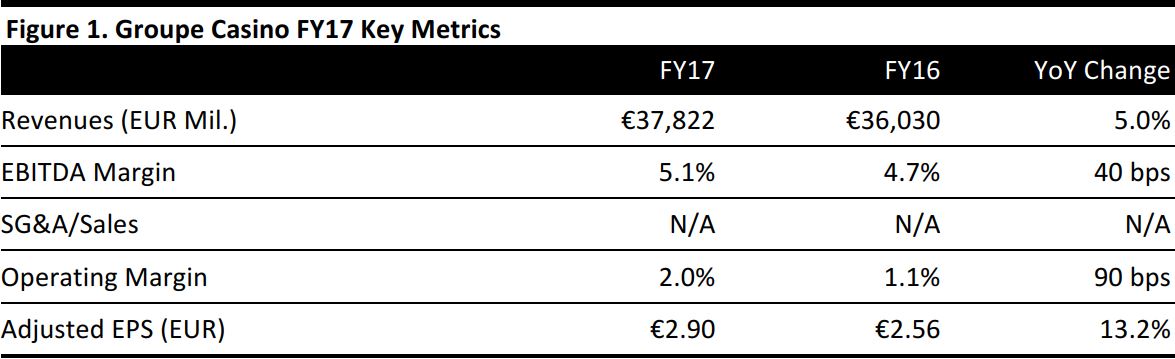

Note: Groupe Casino completed the sale of its Thailand and Vietnam businesses in 1H16, and began the process of selling Via Varejo and its subsidiary, Cnova Brazil, in November 2016. The company has restated its financial statements from 1Q15 to 4Q16 to exclude the impact of these events.

Source: Company reports/Coresight Research

FY17 Results

Groupe Casino announced absolute sales and profit data for FY17 on March 8. The company had already announced FY17 revenue growth

in January. Groupe Casino reported revenue growth of 5.0% to €37,822 million, missing the consensus estimate of €38,187 million as recorded by S&P Capital IQ. It also reported comparable sales growth of 2.4% and organic sales growth (growth at constant scope of consolidation and exchange rates) of 3.2% in FY17.

Both organic and comparable sales changes exclude petrol and calendar effects.

The latest announcement provided the following additional details:

- EBITDA was €1,930 million, up by 13.7% year over year and above analysts’ expectations of €1,892 million. This yielded an EBITDA margin of 5.1%, up by 40 basis points from the previous year.

- Operating income was €762 million, up by 86% year over year, and resulting in a margin of 2.0%, which was up by 90 basis points from FY16.

- Underlying net income for the group was up by 9.1% to €372 million. Adjusted EPS was €2.90, beating the €2.72 consensus estimate, and up from €2.56 in FY16.

Management observed “good performances across all businesses,” as it improved its formats in France during the year. The company also expanded its product offering and developed its delivery services for its e-commerce business, Cdiscount.

Results by Segment

France: Comparable sales growth was 0.8% and organic growth was 0.1%, led by its premium and service-led banners Franprix, Monoprix and Casino Supermarkets. Slow performance by Géant stemmed results in France. Cdiscount’s gross merchandise volume (GMV) was up by 10% and comparable sales grew by 9.5%.

Latin America: Organic growth was 6.4%, as decelerating food inflation continued across the region.

Outlook

Groupe Casino expects organic growth in excess of 10% in FY18 group trading profit. In France, it intends to achieve over 10% organic growth in trading profit in the food business.

The company hopes to reduce group net debt and realize “significant potential effect from the sale of Via Varejo,” during the year. It anticipates free cash flow from continuing operations excluding exceptional items to be above €1 billion and capex of around €1 billion.

For FY18, analysts expect Groupe Casino to grow revenues by 2.2%, EBITDA by 2.0% and adjusted EPS by 12.4%.