Source: Company reports/Fung Global Retail & Technology

Note: Groupe Casino completed the sale of its Asian businesses in 1H16 and began the process to sell Via Varejo and its subsidiary Cnova Brazil in November 2016. Considering these events, Casino has restated its statements from 1Q15 to 4Q16, to exclude their impact. As consensus estimates are based on the previously reported and not restated numbers, we have not included them in our discussion below.

FY16 Results

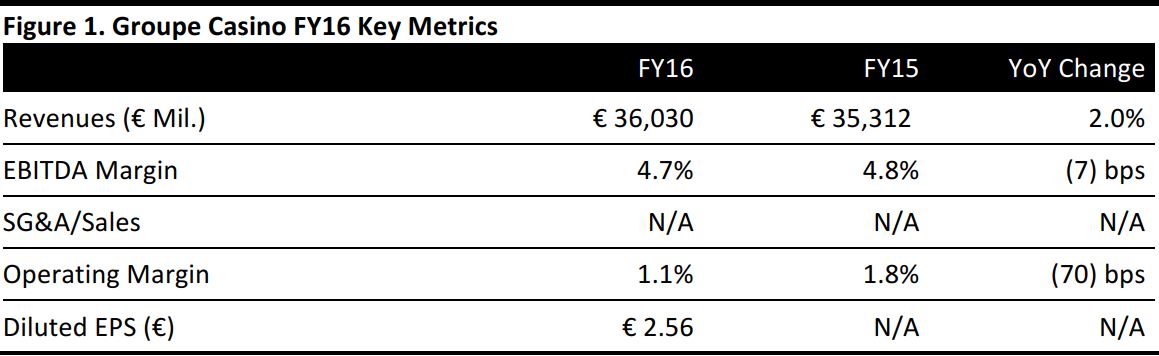

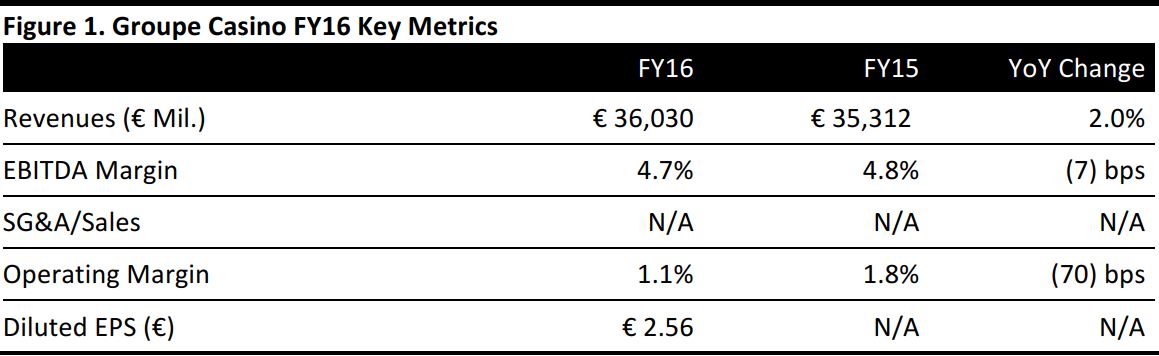

Groupe Casino’s revenues grew by 2.0% year over year, to €36,030 million, in the fiscal year ended December 31, 2016. Organic revenue growth (growth at constant scope of consolidation and exchange rates, excluding petrol and calendar effects) was 5.7% during the period.

The EBITDA margin declined slightly, by seven basis points, to 4.7%. The operating margin dropped by 70 bps to 1.1%.

Net profit from continuing operations in FY16 was €33 million versus a net loss of €65 million in FY15. These figures exclude profits from the operations in Asia, gains from their disposal and Via Varejo’s operations. Including the discontinued operations, total net profit in FY16 was €2,679 million and net loss in FY15 was €43 million.

Underlying net profit declined by 4.5% to €341 million. This measure refers to net profit from continuing operations adjusted for the impact of other operating income and expenses and nonrecurring financial items. Diluted underlying EPS in FY16 was €2.56; Casino did not reveal FY15’s diluted underlying EPS.

Performance by Segment

France Retail

- Net sales grew by 0.3% to €18,939 million, organic sales grew by 0.8% and comps rose by 0.3%.

- Casino stated that this represents a turnaround for the French business, as FY16 was the second consecutive year of growth in sales, after two years of declines.

- Among the banners in this segment, Casino highlighted Géant’s performance in food retail as it posted comps up 7%.

Latin America Retail

- Net sales increased by 3.6% to €15,247 million, while organic sales grew by 11.4%.

- Casino mentioned that the strong development of the cash–and-carry business, the success of the hypermarkets’ refit in Brazil and robust performances in Colombia, Uruguay and Argentina drove growth in this segment.

E-Commerce

This includes all of Casino’s e-commerce operations, including fascias that may fall under the segments discussed above.

- Net sales through e-commerce grew by 7.9% to €1,843 million.

- Comps grew by 13.6%, while Cdiscount’s gross merchandise volume grew “satisfactorily.”

Other Highlights

Groupe Casino affirmed that it cut its net financial debt by nearly half to €3,367 million in FY16, thanks to free-cash-flow generation and asset disposals during the year. As a result, the net debt to EBITDA ratio of continuing operations fell to 2.0x from 2.6x (net debt to EBITDA ratio as reported in 2015), implying an improvement in Casino’s leverage.

Outlook

In terms of business operation goals, Groupe Casino will continue to work on adapting its formats to cater to consumer trends.

For FY17, Groupe Casino has outlined the following three financial goals:

- To further improve the net financial debt to EBITDA ratio.

- To grow the trading profit in France food retail by roughly 15% and achieve a contribution of €60 million from property development activities in the region.

- To increase group trading profit by 10%, assuming no change in exchange rates.