What’s the Story?

The Coresight Research team participated in the Groceryshop 2021 conference, which was held from September 19 to 22 in Las Vegas. Featuring more than 150 CEOs and over 200 speakers, the event focused on recent transformation in the retail environment, and technology and innovation in the CPG, food and grocery sectors. Groceryshop 2021 had around 2,100 attendees.

The overall tone of the conference was positive, with many attendees relieved to be able to attend such an event in person again, following the pandemic-led disruption over the past 18 months. In this report, we present highlights from the four-day conference, presenting industry insights into key topics and themes from across multiple sessions.

Top 10 Highlights from Groceryshop 2021

1. Industry Leaders Are Taking on the Issue of Food Waste

The importance of food waste was a major topic in several keynote addresses during Groceryshop 2021.

- In the Unilever keynote, the company disclosed that it is implementing several related initiatives under its “Force for Good” commitments, including nature-positive production, which regenerates the soil; producing €1 billion (£900 million) in sales of plant-based food; doubling positive nutrition by adding nutrients to food; and halving food waste.

- Kroger’s CEO, Rodney McMullen, stated that 40% of food waste occurs in the supply chain. He underscored the company’s purpose: “To feed the human spirit.” Kroger has donated more than 1.6 billion meals since 2017, including 640,000 meals in 2020, and the company donated 10 meals for every Groceryshop attendee to a food bank in Nevada (the state in which the conference was held). Kroger aims to achieve zero food waste in its operations by 2025.

Several of the innovators that presented at the conference mentioned closed-loop systems, which generate little or no waste and are prevalent in Europe. For example, one provider of lettuces and herbs mentioned that surplus basil was used to make pesto sauce, and surplus parsley to make chimichurri.

In connection with the conference, Coresight Research published a research preview titled

Dispelling Five Myths About Food Waste in Grocery and hosted a livestreamed event from Groceryshop in partnership with materials science and manufacturing company Avery Dennison.

2. Sustainability Resonates with Grocers and CPG Companies

Sustainability was mentioned across many sessions and keynotes as a theme in grocery, from retailers and brands saying their shoppers were demanding sustainable products and prioritizing products that had a positive impact on their health/wellbeing and the planet, to discussions around food waste and cost savings with improved and more sustainable business processes and packaging, all the way to zero plastic.

We heard from CPG brands and grocery retailers that they are transforming their supply chains to be regenerative, including efforts to protect and restore the environment, use renewable resources and source products from suppliers that have a shared mission.

Some of the more interesting one-off examples of grocers/CPGs and tech companies trying to act sustainably include the following:

- Farmstead, an AI-powered digital micro-grocer, has developed a GroceryOS that predicts demand and reduces food waste to <3%, according to the company.

- Gotham Greens, a fresh-food and urban agricultural company, has built a network of regional climate-controlled greenhouse facilities that provide a longer shelf life for products and thus reduce food waste. This addresses a key retail challenge: Most retailers experience 10%–12% spoilage (shrink) on fresh produce, and what they buy is already a week old when it arrives on shelves, according to Gotham Greens. However, there is a trade-off: The company’s model is highly capital-intensive and has a greater carbon footprint.

- Canada-based online grocery shopping and food-delivery provider SPUD is educating consumers and encouraging them to be part of the sustainability solution. In Canada, 89% of packaging goes into a landfill, according to the company. SPUD uses gamification to involve shoppers and provide rewards for recycling and implementing sustainable practices. SPUD finds that when you give consumers the choice, they accept sustainable practices, and this can also drive loyalty.

- Picnic, a grocery delivery service based in the Netherlands, deploys a suite of sustainable technologies. The company operated 1,000+ electric Picnic vehicles (ePVs) in 120 cities. The distribution system is efficient and optimizes delivery routes to ensure that Picnic only visits the same street once a day, making the last mile greener.

Read more Coresight Research coverage of

sustainability in retail.

3. Instant Needs/Rapid Delivery Is Becoming Mainstream

Given the apparent sprouting up of an army of rapid-delivery grocery startups in the last six months, this delivery model was unsurprisingly a hot topic of conversation at Groceryshop.

Founded eight years ago, consumer goods and food-delivery service

Gopuff defined the Instant Needs Category of fast delivery, expanding from 800 stock-keeping units (SKUs) to more than 4,000 today. The company is vertically integrated, which gives it certain advantages:

- Fast, controlled delivery, which ensures food service and protects margins

- Transparent pricing, without the need to pay an intermediary

- The ability to advertise to consumers at the point of purchase—which drives a high conversion rate of 40% and a 3:1 return on investment, according to the company.

- Ownership of its own liquor retailer, Bevmo

Gopuff considers itself both an e-commerce service and a platform for local entrepreneurs to sell their products. Looking ahead, the company’s priorities include international expansion, innovation and a relentless focus on the customer.

4. Delivery Versus Pickup: Alternative Fulfillment Requires New Store Formats

Pickup and delivery both fall under the umbrella of alternative fulfillment models. Quick delivery was the subject of much discussion at Groceryshop, but it is most relevant for urban dwellers, whereas pickup remains more relevant for people living in suburban and rural areas.

One panel declared that, in the long term, “pickup wins supreme.” This is due to two key reasons: It is cheaper, and it gives the customer control over the time of fulfillment. Shoppers’ preferred pickup times are typically concentrated in the early morning or evening—i.e., when consumers traveling between work and home. One panelist mentioned that the average order size for pickup is $47–$50, versus $25 for delivery orders; the retailer can have pickup orders ready in as little as five minutes, compared to 30 minutes for delivery.

Still, there is much room for innovation on the pickup front.

- Walmart has announced that its pickup orders would be ready within two hours of an order being placed.

- Target said in its Groceryshop keynote that it has installed hundreds of coolers in its stores, with 1,500 stores offering pickup between the Memorial and Labor Day holidays. In addition, Target’s take-and-bake garlic bread can be brought to the consumer in the parking lot in less than two minutes.

The surge in pickup and delivery orders has implications for store formats as well: In addition to dark stores (stores used solely for fulfillment rather than shopping), store layouts can be redesigned to offer better access for pickers and shoppers. It makes sense to put pickup counters near the front door, for easy and quick access, and to allocate parking spots for pickup near store doors or fulfillment areas. Similarly, the location of the ship-from-store fulfillment area should be optimized for shipping.

5. Partnerships Are Emerging Among Disparate Retail Segments

Albertsons stressed that grocers should focus on their core strengths—particularly in developing technology. The company has engaged in several partnerships that demonstrate this strategy: with DoorDash for delivery, Takeoff Technologies for micro-fulfilment centers, and Google Maps to reach new customers.

At Groceryshop 2021, the retailer announced DoubleDash, another partnership with DoorDash, which enables consumers to select items from Albertsons and one other company for delivery—for example, from a restaurant for a pizza for tonight’s dinner and from Albertsons for milk and cereal for breakfast tomorrow. This offering multiplies the number of options available to consumers—dramatically increasing convenience—and gives Albertsons the opportunity to make an incremental sale. Last year, DoorDash announced DashMart, which enables consumers to piggyback items from convenience stores onto restaurant delivery orders.

DoorDash described its offerings through partnerships as both a marketplace (for its own products) and a platform (for third-party items). The company emphasized that the 24/7 nature of delivery enables it to help retailers offer items beyond their normal business hours. Finally, with regard to DoubleDash, CEO Tony Xu observed that people eat 20–25 times a week, which offers numerous opportunities for retailers to make contact with consumers.

6. Data Is Key in Dynamic CPG-Retailer Relationships

Although the CPG-retailer relationship is symbiotic, the parties also compete each other—with CPG items vying for shelf space versus private-label brands, and vice versa.

At present, retailers and CPG brands still need each other, as less than 5% of CPG revenues coming from the direct-to-consumer (DTC) channel, according to one panelist. With the majority of revenues coming from the joint relationship, both parties can benefit from sharing data with each other. One panelist explained that there are many “win-wins” to be realized from collaborations, including in terms of food waste and technology—for example, every retailer does not have to make the enormous investment to develop robots. Albertsons’ Chief Digital Officer (who has a background in technology) declared that the retailer is not a technology company.

In the liquor industry, direct data sharing is prohibited by law, and liquor vendors have to collect their own data from delivery and web-scraping companies. Data are then shared with wholesaler and retailer customers to determine pricing, availability and promotions. Alcohol was mentioned a few other times at the conference: Target stated that 1,200 locations offer adult-beverage pickup; and DoorDash recently announced that it would start delivering alcohol.

7. Technology Is Set To Transform Grocery

During the Groceryshop conference, we saw a great deal of technology that can advance grocery, including from the following innovators:

- Cooler Screens transforms retail cooler surfaces into IoT (Internet of Things)-enabled screens, digitizing point-of-sale data. The company operates 10,000 screens in more than 30 markets.

- Ox is an order-fulfillment platform that leverages machine learning to assist retailers in supply chain optimization.

- Phononic offers a solid-state, intelligent frozen tote to meet the cold-chain challenge to reduce the chemicals used in refrigeration, cold storage and transportation.

- Robomart runs a fleet of van-based retail stores that bring the store to the consumer. The company launched a delivery platform for retail offering stores focused on grocery, snacks, pharmacy, café, ice cream and fast food.

- Shopic offers a data-collection device that clips onto the shopping cart to increase convenience for the consumer in the checkout process.

- Stor.ai offers a handheld fulfillment solution that provides accurate product location and optimized picking routes, zone-batch picking, artificial intelligence (AI)-based personalized replacements and real-time communication.

- Wisy uses AI with real-time data to understand shelf replenishment, as well as category management, demand forecasting and product assortment.

Read our

Groceryshop 2021: Day One Insights report for more information on 12 early-stage US retail-technology startups that participated in the Groceryshop 2021 “Shark Reef” Startup Pitch Competition.

Google offered a vision of the future of retail, commenting that despite all the technological advances, shopping still contains a great deal of friction. The company is working on technology—conversational commerce in particular—aimed at taking the work out of shopping, restoring the fun and increasing the understanding of the customer (e.g., retailers knowing that a consumer requires gluten-free products when they shop through an online store).

8. The Grocery/CPG Sector Is Enhancing Retail by Enabling Store Associates

Store associates work on the front line, and retailers are increasingly considering their safety and wellbeing as well as arming them with technology to make their jobs easier and offer better customer service.

- Chris Rupp, EVP and Chief Customer Officer at Albertsons, joined the company in December 2019, a few months before the outbreak of Covid-19 in the US, with the initial goal of scaling the company’s online grocery business. As would be expected, Albertsons’ priorities changed dramatically following the outbreak, with the company’s first concern turning to the safety of its associates and customers by constructing plastic barriers, implementing stricter cleaning and disinfecting measures, enforcing social distancing and offering contactless payment and delivery options.

- McMullen disclosed that Kroger had already invested $850 million in its associates, and invested a further $350 million last year to pay associated an average of $16 per hour, including $5 of benefits. According to the company, 70% of its store managers started as hourly associates. Kroger further invests in its associates via technology, in order to make their jobs easier.

- Google outlined a technology roadmap for associate enablement: Associates today use handheld devices to track an order, but in the future, they will use hands-free devices that enable them to move quickly throughout the store, support picking and training, improve visibility of on-shelf inventory availability and offer frictionless checkout for customers.

9. Retail Media Networks Present a New Way To Advertise

The Groceryshop conference highlighted that retail media networks present a new source of profitable growth, with larger grocers selling ads to CPG brands. As retailers’ margins are squeezed with higher e-commerce fulfilment, labor and supply chain costs, the lucrative advertising industry offers retailers a new profit center. As an example, e-commerce giant

Amazon has become the third-highest-ranking company in terms of advertising revenue (behind Google and Facebook), generating about $26 billion annually.

Instacart plans to grow its ad revenue from $300 million in 2020 to $1 billion in 2022.

We attended a panel presentation by Katherine Black, Partner at Kearney, in which she stated that these fast-growing networks are expected to generate up to $20 billion in revenue in the US by 2024. CPG companies spend about $250 billion on advertising (about 25% of sales), and online retail media is an effective way drive sales and conversion, according to Black. She explained that it is difficult to grow media budgets, but CPG companies are shifting their ad spend budgets from the (retail) trade ($135 billion) to digital ($65 billion), which is cannibalizing traditional trade media.

To address the opportunity in retail media networks, retailers must effectively compete with alternative media partners, Google and Facebook, which have technical acumen combined with advertising and client servicing know-how. However, retailers have a potential competitive advantage if they integrate real-time inventory data with retail media and thus optimize media funding. Online retailers can provide CPG brands with robust product pages to explain, educate and inform shoppers about product nuances and thus differentiate their client services.

10. Grocery Shoppers Want Experiences

What delights today’s grocery shoppers? According to Melissa Gonzalez, CEO and Founder of consulting agency The Lionesque Group, 55% of US consumers cite a diverse selection of quality goods, the ease of shopping, and product discovery through taste tests as top features that drive shoppers’ delight, based on the company’s “Understanding the Modern Grocery Shopper” survey. Shoppers want more than groceries at their grocer, too: 26% of survey respondents stated that they want a pharmacy; 26% want a coffee bar; 18% want a restaurant; and 16% want a florist. Other desirable features include nail salons, cannabis /CBD shops and cooking classes. The majority of these features are experiential in nature.

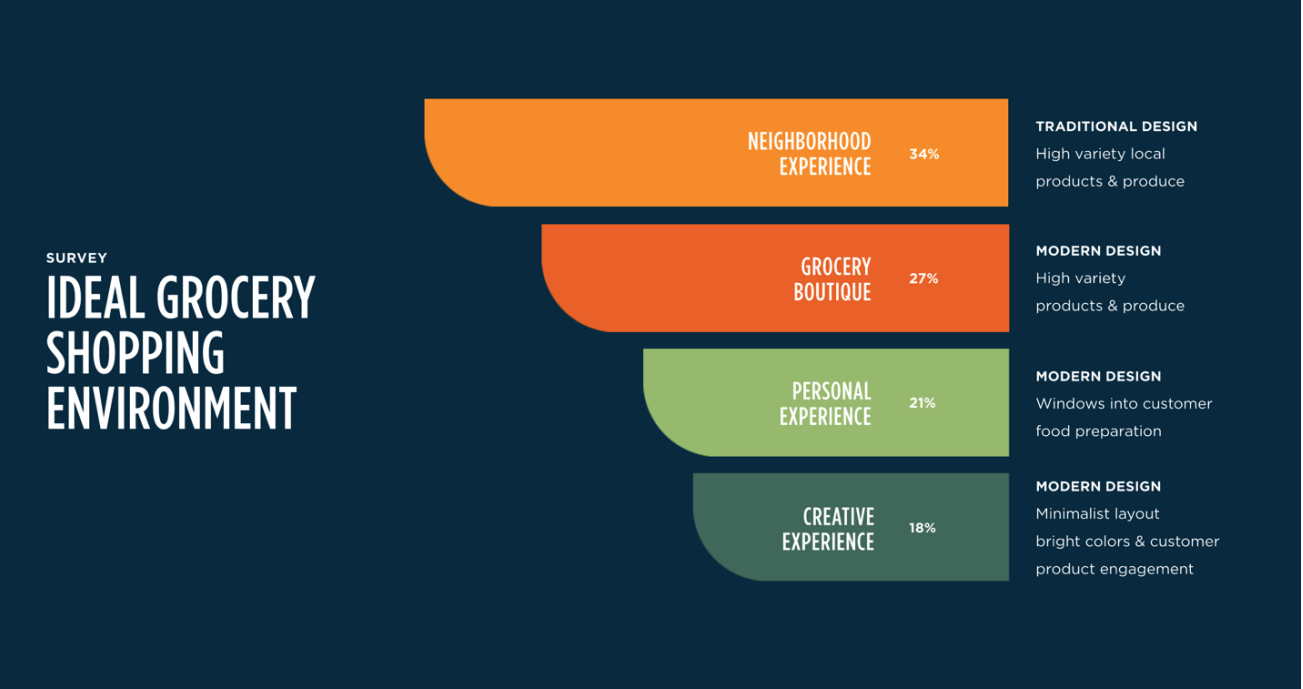

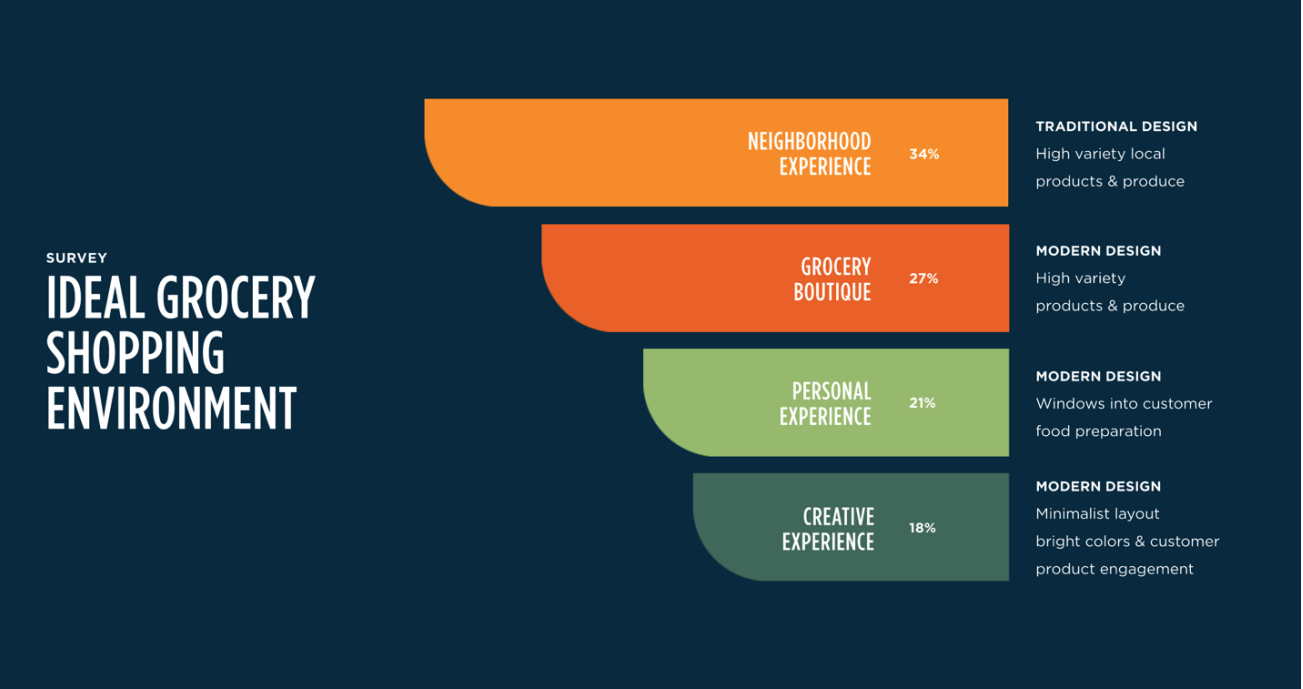

In terms of the ideal grocery shopping environment, The Lionesque Group’s survey found that the neighborhood experience is preferred by more than one-third of shoppers—making the traditional design the most popular, with plenty of local products and produce (see the image below). Gonzalez said the pandemic hasn’t dampened consumers’ interest in the tactile grocery experience, but function remains very important: Layouts should be familiar and easy to navigate, and checkout should be seamless. She advised the Groceryshop audience that shoppers want and expect a lifestyle experience when grocery shopping, so retailers should elevate the experience with inspiration, education and connectivity. Gonzalez closed the session by saying, “Grocers can succeed by balancing shopping efficiency with an experience that inspires consumes in the kitchen and beyond.”

[caption id="attachment_133689" align="aligncenter" width="700"]

Source: The Lionesque Group

Source: The Lionesque Group[/caption]

Source: The Lionesque Group[/caption]

Source: The Lionesque Group[/caption]