DIpil Das

The Coresight Research team is in Las Vegas this week attending and participating in the Groceryshop 2019 conference, which runs September 15-18. The conference brings together over 3,000 attendees and more than 200 speakers talking about the transformation of the retail industry, shifts in consumer behavior and innovations that are helping retailers keep up with fast-changing consumer expectations.

Key themes this year include the transformation of retail across convenience stores, supermarkets and e-commerce, and changes in production and distribution processes in CPG across multiple verticals. Participants are also talking about the rapid shifts in how today’s consumer discovers, shops and buys; how they use new technologies; innovative retail business models; and, the latest trends in consumer behavior, preferences and expectations.

Below we note key insights from the second day at Groceryshop 2019.

Deep Dive: A Buyer’s Guide to AI

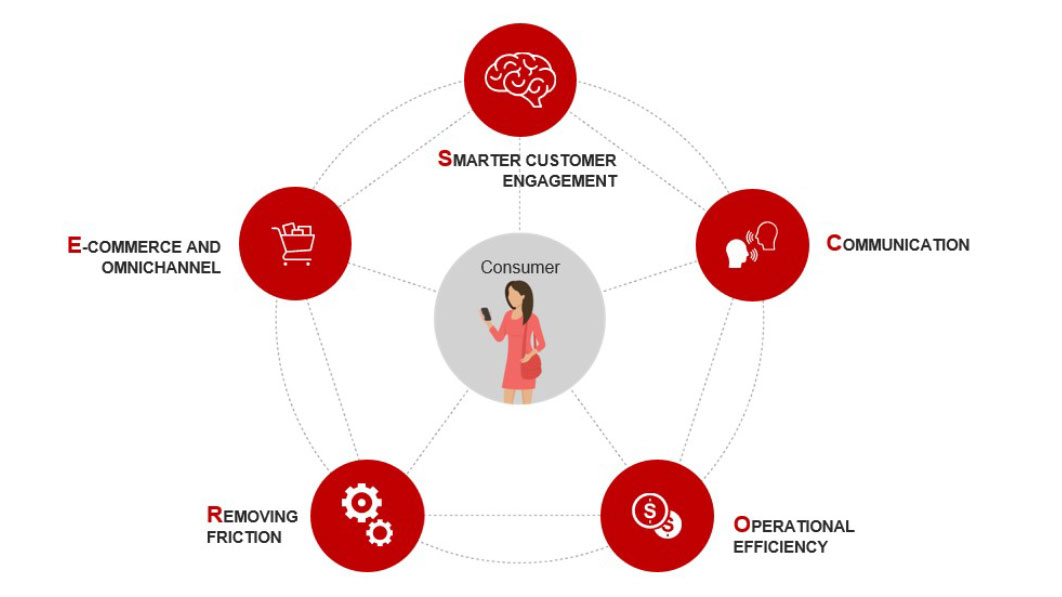

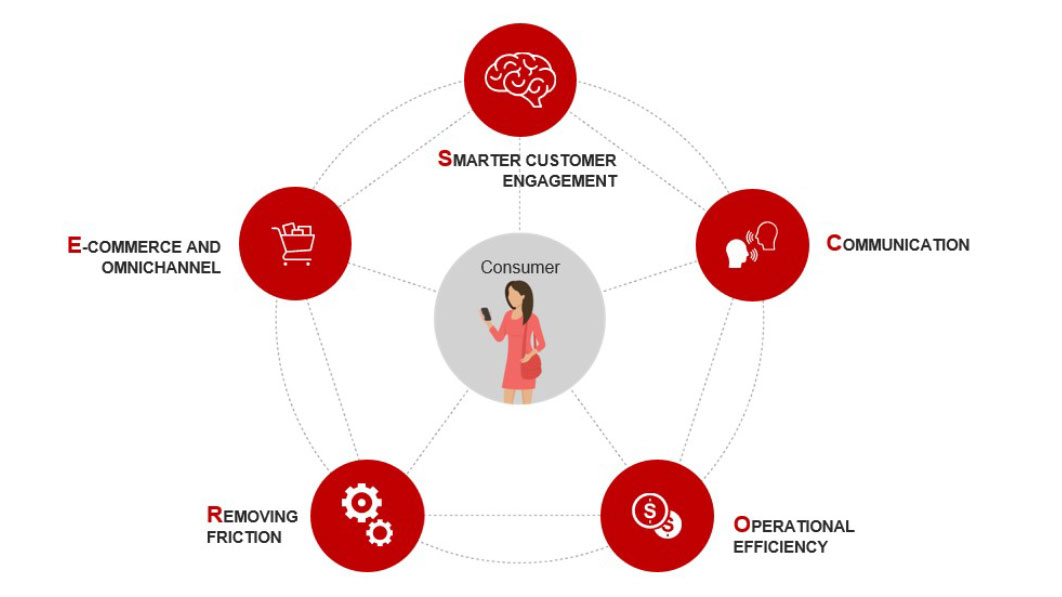

Coresight Research CEO and Founder Deborah Weinswig delivered a presentation about AI in retail and shared the following insights, much driven by Coresight Research proprietary surveys and data:

Source: Coresight Research[/caption]

The session continued with Weinswig interviewing Michael Wilhite, VP in data strategy at Kroger’s 84.51°. He shared that Kroger is more focused on using personalization on customer experiences rather than on operations. Kroger wants to create a better environment for customers when they shop. He added that due to the frequent interaction between customers and grocery retailers, personalization has the biggest potential in grocery. As technology continues to evolve, when making product recommendations, personalization should address the aspirational “me”, instead of simply recommending repeat purchases.

[caption id="attachment_96481" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

The session continued with Weinswig interviewing Michael Wilhite, VP in data strategy at Kroger’s 84.51°. He shared that Kroger is more focused on using personalization on customer experiences rather than on operations. Kroger wants to create a better environment for customers when they shop. He added that due to the frequent interaction between customers and grocery retailers, personalization has the biggest potential in grocery. As technology continues to evolve, when making product recommendations, personalization should address the aspirational “me”, instead of simply recommending repeat purchases.

[caption id="attachment_96481" align="aligncenter" width="700"] Deborah Weinswig interviewing Michael Wilhite.

Deborah Weinswig interviewing Michael Wilhite.

Source: Coresight Research [/caption] Highlights from Keynote Sessions Carolyn Tastad, Group President of North America at Procter & Gamble, emphasized the importance of personalization and praised Nike for raising the bar for personalization. Seth Goldman, Executive Chair at Beyond Meat, pointed out the importance of bringing branded products to consumers. He also shared the common themes of un-doing and re-doing of food: Zia Daniell Wigder presenting Grocery Zeitgeist. Source: Coresight Research [/caption]

Check our Groceryshop Day 1 insights here.

Zia Daniell Wigder presenting Grocery Zeitgeist. Source: Coresight Research [/caption]

Check our Groceryshop Day 1 insights here.

- Real personalization is challenging for retailers.

- 40% of retailers plan to invest in AI/machine learning solutions in next 12 months.

- Retail is leading the spending and adoption of AI. Growing healthy VC funding in AI startups paves the way for a robust future industry.

- Most retailers believe that AI will help solve the problem of waste.

- Cost and accuracy are the two main factors that cause retailers to limit the scope of AI deployment.

Source: Coresight Research[/caption]

The session continued with Weinswig interviewing Michael Wilhite, VP in data strategy at Kroger’s 84.51°. He shared that Kroger is more focused on using personalization on customer experiences rather than on operations. Kroger wants to create a better environment for customers when they shop. He added that due to the frequent interaction between customers and grocery retailers, personalization has the biggest potential in grocery. As technology continues to evolve, when making product recommendations, personalization should address the aspirational “me”, instead of simply recommending repeat purchases.

[caption id="attachment_96481" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

The session continued with Weinswig interviewing Michael Wilhite, VP in data strategy at Kroger’s 84.51°. He shared that Kroger is more focused on using personalization on customer experiences rather than on operations. Kroger wants to create a better environment for customers when they shop. He added that due to the frequent interaction between customers and grocery retailers, personalization has the biggest potential in grocery. As technology continues to evolve, when making product recommendations, personalization should address the aspirational “me”, instead of simply recommending repeat purchases.

[caption id="attachment_96481" align="aligncenter" width="700"] Deborah Weinswig interviewing Michael Wilhite.

Deborah Weinswig interviewing Michael Wilhite. Source: Coresight Research [/caption] Highlights from Keynote Sessions Carolyn Tastad, Group President of North America at Procter & Gamble, emphasized the importance of personalization and praised Nike for raising the bar for personalization. Seth Goldman, Executive Chair at Beyond Meat, pointed out the importance of bringing branded products to consumers. He also shared the common themes of un-doing and re-doing of food:

- Driven by health and/or environment concerns.

- Transparency and authenticity are still important.

- Usually not in the playbook of large food companies.

- Taste is still paramount.

- Dollar stores are opening three stores a day, in regions where there are few value grocery options.

- Small format store is the new trend with Aldi and Trader Joe’s opening stores under 20,000 square feet, sometimes as small as 12,000 square feet.

- Single households are on the rise, representing 28% of total households. This single household phenomenon would drive the need for smaller size product offerings.

Zia Daniell Wigder presenting Grocery Zeitgeist. Source: Coresight Research [/caption]

Check our Groceryshop Day 1 insights here.

Zia Daniell Wigder presenting Grocery Zeitgeist. Source: Coresight Research [/caption]

Check our Groceryshop Day 1 insights here.