Groceryshop 2018

The Coresight Research team is in Las Vegas this week to participate in Groceryshop 2018, being held October 28–31, which is a new Shoptalk program for the grocery and CPG Industries. The event features more than 150 speakers and is being attended by 2,200 people from established retailers and brands, startups and technology companies, as well as investors and media professionals.

Topics of discussion at Grocery talk will include the transformation of the retail industry (across convenience stores, supermarkets and e-commerce)and changes in the production and distribution processes of CPG across multiple retail verticals. Participants in the event will also discuss the rapid shifts in how today’s consumer discovers, shops and buys, along with the use of new technologies, business models in retail,and the latest trends in consumer behaviors, preferences and expectations.

Groceryshop Founder and Chairman Anil Aggarwal said in his opening day remarks that “The food industry is changing, but these changes should not be surprising as they are going through similar structural changes as other retail industries. Grocery and CPG is now moving from the disruptive period to the new normal.” These transformative changes, Aggarwal continued,will have a big impact on both front-end customer experiences and backend retail operations. Groceryshop’s goal, just like Money2020’s and Shoptalk’s (bothfounded by Aggarwal), is to provide an ecosystem for innovation.

Aggarwal presenting his opening keynote at Groceryshop 2018.

Source: Coresight Research

Aggarwal presenting his opening keynote at Groceryshop 2018.

Source: Coresight Research

Aggarwal’s keynote remarks were followed by commentary from Groceryshop Cofounder and Chief Content Officer Zia Daniell Wigder, who noted that “Groceryshop was created to meet the needs of a sector on the verge of a massive shift.” She told the audience that the percentage of grocery sales made online in the US is only 2%–3%, significantly lower than for other categories,such as apparel and electronics, where e-commerce accounts for about 20% of total sales.Grocery e-commerce penetration is likely to accelerate in coming years, and Wigder said that consumers could be spending 10%–20% of their grocery budget online in the next 10 years.

The US significantly lags behind other countries in grocery e-commerce penetration due to low population density and the fragmented nature of the US grocery market and supply chains. Consumer preferences are also changing, Wigder said, and consumers are today demanding more healthy and locally sourced curated products along with a wider range, convenience and “instagrammable experiences” in-store.

Groceryshop 2018’s opening keynote.

Source: Coresight Research

Groceryshop 2018’s opening keynote.

Source: Coresight Research

Our notes from the first day of Groceryshop2018 are given below.

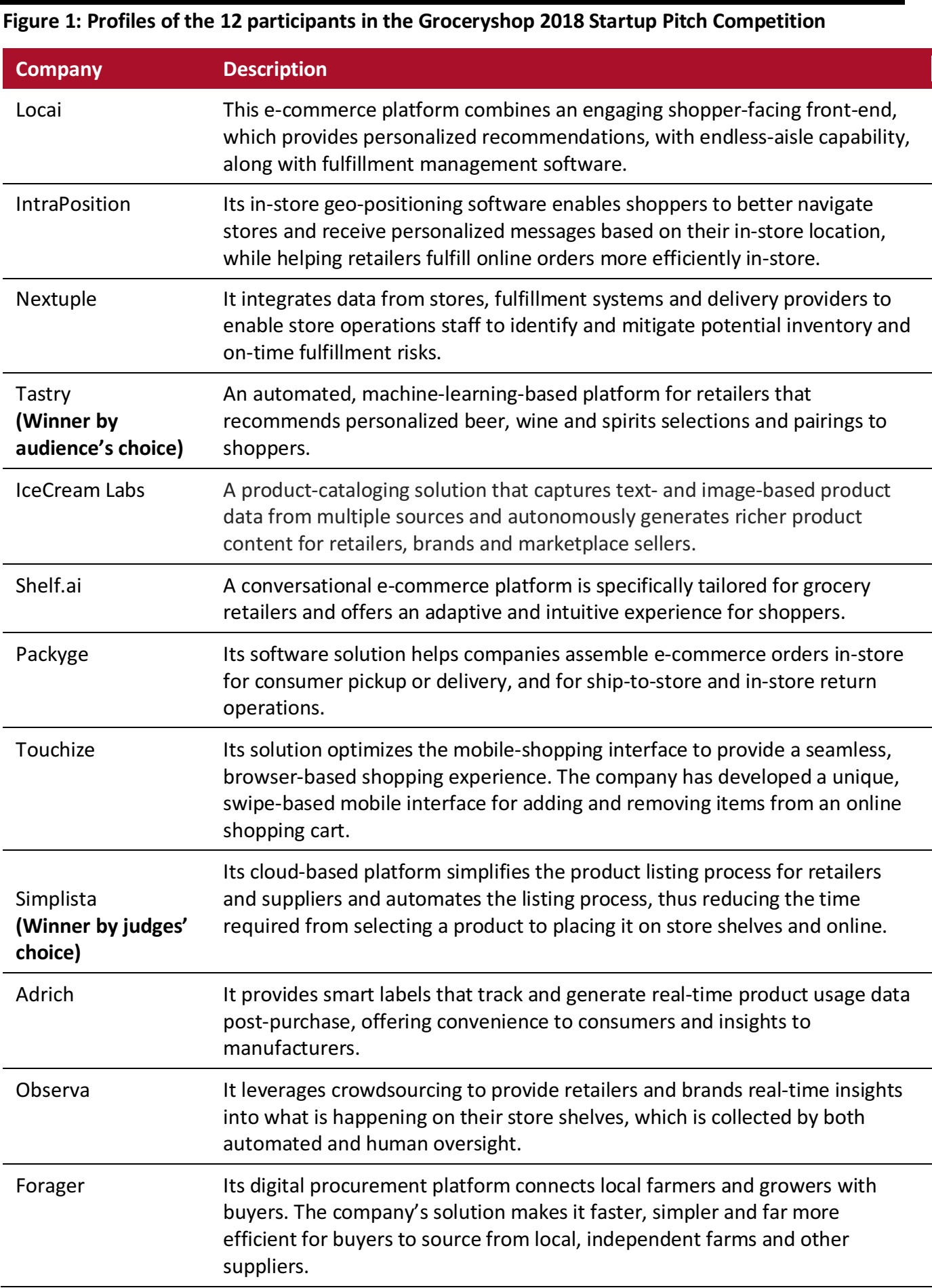

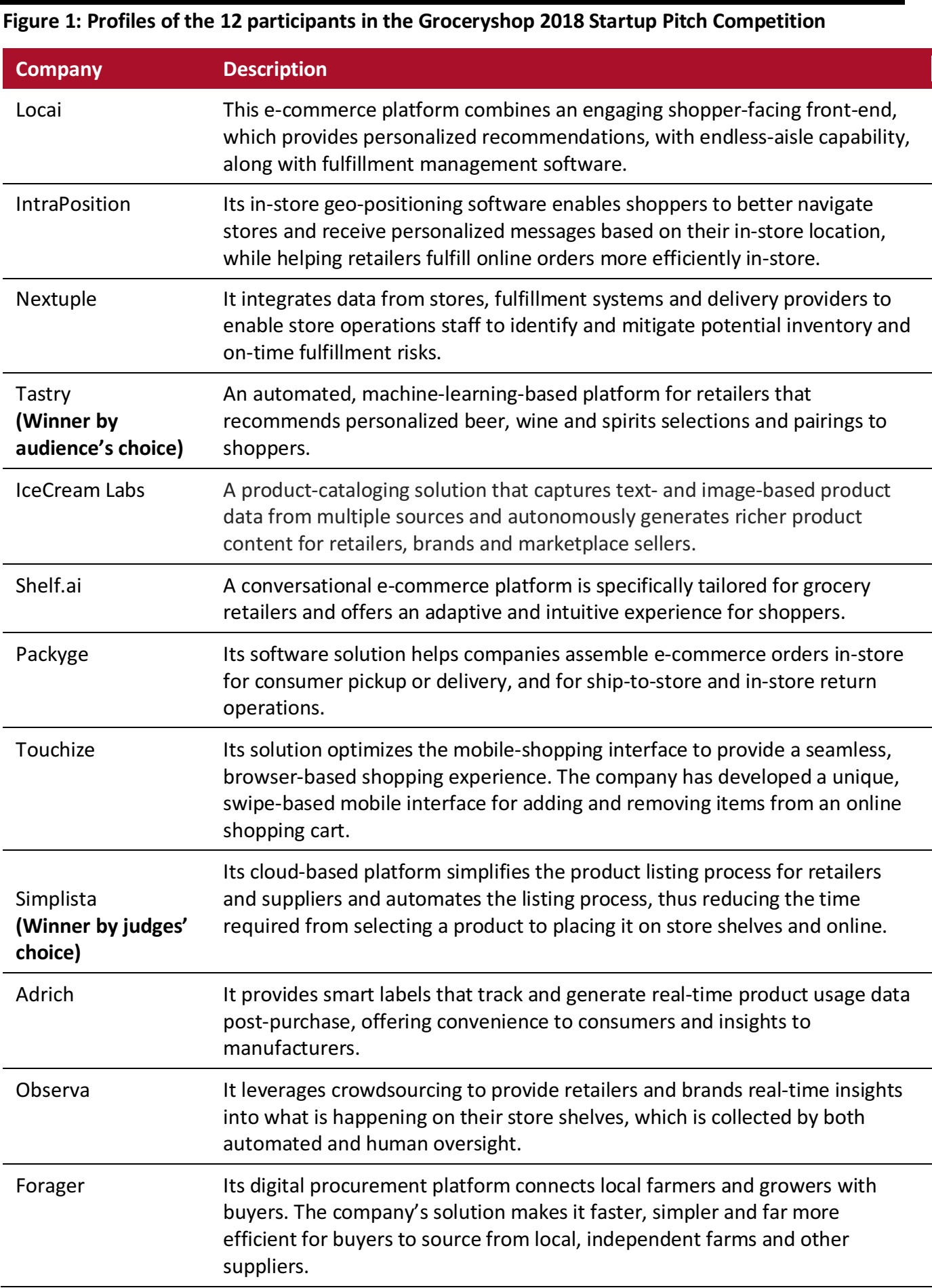

Startup Pitch Competition

Weinswig kicked off the event by emceeing the Startup Pitch Competition that saw 12 innovative companies vying for two cash prizes of $10,000 each.Leaders from the startups pitched their businesses to a three-judge panel that comprised:

- Skyler Fernandes, who is Cofounder and General Partner at Venture University, a multi-stage investment fund that also serves as a trade school for angel investing, venture capital and private equity.

- Gulrez (aka Gary) Arora, who is Global Lead, Launchpad at Mars Wrigley Confectionery. Launchpad is a Mars Inc. initiative that promotes innovation via partnerships with startups and other technology companies.

- Rob Trice, who is Founder and Partner at Better Food Ventures, a firm that invests exclusively in companies that are leveraging information and communications technology to transform the food and agriculture sectors.

Companies from Five Countries Competed in the Groceryshop Startup Pitch Competition

Groceryshop shortlisted the 12 participating startups based on the e-commerce and in-store solutions they have developed for grocery, food and CPG companies. To qualify for participation, the startups had to: have less than $3 million in funding;be providing business-to-business (B2B) solutions; and,be founded in 2014 or later.

General Information on the Participants

The 12 participating startups were: Adrich, Forager, IceCream Labs, IntraPosition, Locai Solutions, Nextuple, Observa, Packyge, Shelf.ai, Simplista, Tastry and Tochize.

- Their countries of origin: The 12 startups were from the US, Canada, Israel, Portugal and Sweden.

- Their areas of disruption: The participating startups focus on one of four areas of retail disruption, which are: Sourcing, Merchandising and Cataloging; Grocery E-Commerce Enablers; Improved Shopping Experiences;and,Tracking Measurement and Insights.

- Their funding: Of the 12 competing startups, seven (58%) have raised their seed round of funding, two (17%) are in their post-seed/pre-series A funding stage and one (8%) is in its pre-seed stage of funding.

The four buckets in which Weinswig categorized the Startup Pitch Competition participants.

Source: Coresight Research

The four buckets in which Weinswig categorized the Startup Pitch Competition participants.

Source: Coresight Research

Two prizes of $10,000 each were awarded to the two winning startups, one of which was chosen by the three-panel judge and the other was chosen by members of the audience who voted for their favorite using the Shoptalk app.

Each startup was assessed on the basis of whether it addresses a big problem or area of opportunity and on the feasibility and scalability of its business model. Other parameters for choosing the winners were the confidence of the team (or presenter) that made the presentation and whether the judge (or members of the audience) would feel confident in investing in it.

Weinswig presiding over the Startup Pitch Competition at Groceryshop 2018.

Source: Coresight Research

Weinswig presiding over the Startup Pitch Competition at Groceryshop 2018.

Source: Coresight Research

The Winners

- Judges’ choice: Simplista

- Audience choice: Tastry

Startup Pitch winners (left to right): Rob Trice, Katerina Axelsson (Founder and CEO, Tastry) J. Skyler Fernandes, Evan Silver (Founder and CEO Simplista), Deborah Weinswig, Gary Arora.

Source: Coresight Research

Startup Pitch winners (left to right): Rob Trice, Katerina Axelsson (Founder and CEO, Tastry) J. Skyler Fernandes, Evan Silver (Founder and CEO Simplista), Deborah Weinswig, Gary Arora.

Source: Coresight Research

Brief Profiles of the Participants

Given in the table below is a brief profile of each participant.

Below, we provide in-depth company profiles of each of the 12 participating startups.

Locai Solutions

Company Description

Company Description

Locai Solutions offers a turnkey e-commerce platform specifically designed for grocery retail. The fully customizable, end-to-end solution combines an engaging shopper-facing front end with fulfillment management software. The front end provides personalized product and recipe recommendations as well as endless-aisle capability. Some of Locai’s features are also available via APIs for integration into other e-commerce platforms.

Market Overview

Online grocery sales represent a relatively small part of the overall grocery retail market, but e-commerce is among the fastest-growing segments in grocery.Most online suppliers in the US provide same-day delivery options. In recent years, more and more firms have tried to enter the e-grocery industry, where existing operators include AmazonFresh, FreshDirect, NetGrocer, Target, Walmart and Safeway. According to Nielsen, in as few as five to seven years, 70% of consumers will be grocery shopping online. By 2022 or 2024, US shoppers are expected to spend an estimated $100 billion, or $850 per household, per year on online grocery purchases.

What Problem Is the Company Solving?

Online grocery is growing and evolving quickly. Retailers need to reassess the entire digital grocery experience and have full control of their brands through every aspect of the customer journey in order to retain customers and profitably scale their operations. Selling food is vastly different than selling other types of products, yet most e-grocery platforms are built on an antiquated, transactional experience that few shoppers consider very engaging or personal.

The Locai platform is designed to make personalization an integral part of the customer experience. Product listings, search results, promotions and recipes are all tailored to each customer’s dietary preferences, likes/dislikes, past purchase data and shopping behavior. Locai’s meal-planning feature, for example, offers customers one-click convenience when shopping a grocer’s online catalog.

As demand for online grocery offerings increases, success depends on efficiently scaling beyond current in-store fulfillment models, while also increasing customer satisfaction. For retailers, the infrastructure and resources required to deliver goods are complex and expensive. For example, perishable items require more investment in storage and delivery infrastructure (refrigeration). Grocery retailers need diverse fulfillment options to meet shifting consumer demands. Locai’s SaaS platform can supporta spectrum of fulfillment formats and provide shoppers with a real-time view of a retailer’s inventory.

Headquarters

Denver, CO

Funding Stage

Seed

Business Model

Locai’s fee structure includes nominal integration and setup fees based on the level of platform customization as well as recurring monthly platform license fees based on the retailer’s online volume.

Management Team

CEO and Founder Mike Demko has more than 15 years of senior management experience in digital and e-commerce businesses. COO Scott DeGraeve has more than 20 years of executive management experience in the e-commerce grocery space.

Company Outlook

The Locai tech stack is proven, with more than 1 million orders delivered. In terms of product development, the company plans to continue to use the abundance of data available in online grocery to inform its artificial intelligence and machine learning algorithms in order to further enhance the customer experience and improve its operational tools to drive down fulfillment and delivery costs.

IntraPosition

Company Description

Company Description

IntraPosition offers an in-store geopositioning solution that uses ultra-wideband wireless technology. The company’s in-store location infrastructure and software offers pinpointing with 12-inch accuracy, enabling shoppers to better navigate stores and receive personalized messaging based on their in-store location, while also helping retailers fulfill online orders more efficiently in-store and providing them with granular analytics data on shopper behavior.

Market Overview

Indoor positioning and navigation systems use a network of devices to locate people and objects inside a building wirelessly, whereas indoor positioning systems use lights, radio waves, magnetic fields, acoustic signals or other sensory information collected by mobile devices. According to Market Research Future, the indoor positioning and navigation system market is expected to grow at a CAGR of roughly 30% from 2016 to 2022, to about $25 billion.

What Problem Is the Company Solving?

IntraPosition addresses three problems with indoor shopping.

First, grocery stores and supermarkets often have difficulty providing one-on-one assistance to customers. IntraPosition’s technology provides in-store shoppers with step-by-step navigation help and enables retailers to send shoppers personalized messages on the shelf level. IntraPosition helps make the in-store shopping experience more like the online experience, enabling shoppers to easily search for and find products in stores and making shopping more personal and engaging.

Second, retailers are looking to cut online order fulfillment costs, in part by designing the best pickup routes for staff collecting orders in stores. IntraPosition helps solve this problem by integrating its positioning services with retailers’ in-store picking apps, helping cut picking time by as much as 30%, according to the company.

Third, retailers want to know more about their customers’ in-store shopping behavior, but collecting that data can be challenging. IntraPosition’s Internet of Things system, which is powered by its positioning capabilities, can provide retailers with valuable customer data and insights.

Headquarters

Binyamina, Israel

Funding Stage

Seed funding of $500,000 in December 2016 and pre-series A funding of $1.5 million in May 2018.

Business Model

The company charges an initial installation fee and then a recurring monthly charge based on usage or number of tags in each store.

Management Team

IntraPosition is led by Founder and CEO Yaron Shavit. Harel Gutgold is the company’s Head of Software Development.

Nextuple

Company Description

Company Description

Nextuple helps online grocers achieve high levels of customer engagement and loyalty by using data science to measure and manage post purchase experiences. The company’s ControlTower solution integrates data from stores, fulfillment systems and delivery providers in real time to enable store operations staff to identify and mitigate potential inventory and on-time fulfillment risks. The solution leverages predictive analytics to help grocers manage shopper expectations and allocate resources while constantly monitoring on-the-ground conditions.

Source: Nextuple.com

Market Overview

E-commerce represents an emerging opportunity for grocers. The online grocery market is estimated to reach $17.5 billion this year and grow to $100 billion by 2025, according to a study conducted by Nielsen. A key driver of customer retention is on-time fulfillment of online grocery orders: according to Nextuple, one study conducted by a leading grocer suggests that a fulfillment delay of more than 60 minutes will cause a customer to be about 15%–20% less likely to order again. Given the growing competition in this sector, it is critical for grocers to proactively manage their fulfillment operations in order to reduce customer attrition.

What Problem Is the Company Solving?

Omnichannel retailers, including many grocers, often utilize stores to fulfill customers’ online orders. However, unlike traditional fulfillment centers, stores are highly unpredictable environments, and factors such as varying customer footfall, replenishment schedules, temporary staffing and physical layout impact stores’ ability to consistently meet customer expectations.

Nextuple’s ControlTower solution is designed to bring predictability to store-based fulfillment by enabling retailers to monitor transactions and store operations in real time and predict potential risks regarding the customer experience. The product also uses predictive analytics to recommend risk-mitigation strategies. For example, if a store team is unable to pick orders at the rate required to fulfill all orders on time, ControlTower may suggest a staffing change in the picking department.

Headquarters

Andover, Massachusetts

Funding Stage

Seed round ($1.5 million)

Business Model

Nextuple’s ControlTower platform is hosted in the cloud and made available to clients on a subscription basis. Nextuple also offers architecture and data analytics services.

Management Team

CEO Darpan Seth is an entrepreneur and angel investor with more than 20 years of retail, consumer goods and supply chain experience. Head of Customer Solutions Laxman Mandayam has more than two decades of experience in global enterprise software and consulting. Head of Product Devadas Pattathil is a product management and technology leader with more than 20 years of experience in retail/omnichannel commerce, online grocery and supply chain operations.

Company Outlook

Nextuple is actively working on a beta pilot of its product with customers.

Tastry

Company Description

Company Description

Tastry is a virtual platform that drives retail sales with targeted wine, beer and spirits recommendations and pairings. Tastry’s patented technology combines analytical chemistry, flavor preferences and machine learning to identify individual consumer preferences for sensory-based products, leading to highly personalized in-store and online recommendations that support high conversion. Tastry’s platform further serves manufacturers and retailers with data-driven insights and guidance for product development and demand forecasting.

Market Overview

The wine market is divided into distribution channels that include supermarkets and hypermarkets, specialty stores, convenience stores and e-commerce. According to Zion Market Research, the global wine market was valued at approximately $302.02 billion in 2017 and is expected to grow at a CAGR of around 5.8% to 2023, to reach approximately$423.59 billion.Supermarkets and hypermarkets are expected to dominate the global wine market in the near term.

The global market for artificial intelligence–based recommendation engines is expected to grow at a 40.7% CAGR from 2017 to 2022, from $801.1 million to $4,414.8 million, according to market research firm Markets and Markets.

What Problem Is the Company Solving?

While the typical wine aisle offers hundreds, and sometimes thousands, of choices, the average consumer lacks the necessary experience to choose a bottle of wine that matches his or her palate preference. Retailers have traditionally assisted shoppers by providing expert ratings and descriptions of wines. More modern attempts involve using software-based recommendation engines. However, these sometimes fail to provide accurate matches because they cannot always account for shoppers’ individual taste preferences.

Tastry helps solve this challenge by producing accurate recommendations of in-stock products within seconds. Suggestions are filterable by price, wine type, food pairing and other criteria. Tastry’s solution further enhances the shopper experience through food and recipe pairings and retailer-optional coupons.

Headquarters

San Luis Obispo, California

Funding Stage

Seed

Business Model

Tastry offers its Singularized Recommendation System (SRS) recommendation platform via a SaaS model.

Consumers can try a free beta version of Tastry’s recommender service at www.tastry.com. For brands and manufacturers, Tastry offers licensing and engagement projects that apply the company’s intelligence in the development of sensory-based products, based on either market segmentation or flavor preference.

Management Team

Cofounder and CEO Katerina Axelsson graduated from California Polytechnic State University (Cal Poly) with a BS in Chemistry and conceived Tastry through her work experiences at a local custom-crush facility. Cofounder Eric Thorndike is responsible for core technology and holds a BS in Computer Science from Cal Poly. Cofounder Tim Scott oversees operations and holds an MS in Mechanical Engineering from Cal Poly.

Company Outlook

Tastry is set to expand sales in 2019 while investing in product development and a number of in-flight customer and partnership initiatives. The company is also developing additional techniques to leverage the Tastry technology in the flavor-development space.

IceCream Labs

Company Description

Company Description

IceCream Labs offers an automated product-cataloging solution powered by machine learning. The company’s solution captures text- and image-based product data from multiple sources and autonomously generates richer product content for retailers, brands and marketplace sellers. This enriched product content is easily delivered to existing e-commerce and product information management platforms, where it can improve product search capabilities and help shoppers navigate large and complex catalogs, so they can select the optimal product for their needs.

Market Overview

The global market for catalog management systems is divided into three segments: component, deployment and vertical. The component segment is subdivided into solutions and services. In the vertical segment, companies in a number of industries—including banking, financial services and insurance; retail and e-commerce; and IT and telecom—are adopting catalog management systems at an escalating rate. Research firm MarketsandMarkets expects the global market for catalog management systems to grow at a CAGR of 7.0% from 2018 to 2023, from $846.6 million to $1,190.0 million.

What Problem Is the Company Solving?

IceCream Labs addresses three problems. First, when products and SKU counts grow, retailers often find it difficult to establish connections among categories, products and groupings and then match those to customer intentions. IceCream Labs is solving this problem by using artificial intelligence to collect and analyze product data and then generate product insights that help boost sales performance and shopper satisfaction.

Second, brand managers usually find it time-consuming and overwhelming to create product content and then push it out to sales channels. IceCream Labs helps on this front by automatically generating titles and descriptions for products.

Third, IceCream Labs developed CatalogIQ to help catalog managers automate and complete most of the tasks involved with publishing new data in product catalogs.

Headquarters

San Francisco, CA

Funding Stage

Seed ($400,000 in October 2015)

Business Model

IceCream Labs offers its solution via either SaaS or interface.

Management Team

Cofounder and CEO Madhu Konety has more than 20 years of experience as an entrepreneur, investor and technology professional working with startups and large software companies. Cofounder and CTO Mike Mian has an extensive background in the IT and services industry and is skilled in the areas of patent law, SaaS, Scrum, big data and recruiting. VP of Engineering LathaIyer has more than 15 years of experience working with companies across the globe in engineering and management roles. VP of Marketing and Product Mike Oitzman is a product and marketing leader with nearly two decades of experience in all facets of the product lifecycle.

Company Outlook

IceCream Labs plans to broaden its product offering in order to solve more problems for existing customers and add new solutions to the mix. In 2017, the company achieved 100% year-over-year growth. This year, Konety and his team have set their sights on 300%–400% growth.

Shelf.ai

Company Description

Company Description

Shelf.ai provides retailers with conversational commerce capabilities that are optimized for grocery. The company’s multi modal, device-agnostic, conversational e-commerce platform helps grocery retailers take advantage of voice assistants such as Amazon Alexa and Google Home to offer shoppers a personalized, multichannel shopping experience.

Retailers can connect their existing e-commerce and loyalty systems with Shelf.ai’s artificial intelligence system. The company’s solution uses customer purchase history and contextual knowledge to learn a shopper’s behavior and preferences, helping eliminate the need for the shopper to specify what kind of “milk” or “eggs” he or she might want when placing an order.

Market Overview

Although voice shopping is still in its nascent days, millions of users are buying smart speaker devices and starting to search for products using voice assistants. Voice shopping is expected to account for $40 billion in sales by 2022, up from $2 billion today, according to data from OC&C Strategy Consultants. In addition, online grocery shopper numbers have more than doubled in a little over a year, according to a study by the Food Marketing Institute and Nielsen. Voice-based commerce is shaping up to be the next major disruptive force in retail.

What Problem Is the Company Solving?

Voice commerce offers a unique opportunity for businesses to deliver faster, easier and more convenient experiences. To capitalize on the opportunity, retailers should begin designing strategies to add voice-shopping capabilities to their e-commerce programs.

Consumers are already demanding a personalized, simplified shopping experience, and retailers are working to deliver it both online and in stores. With the right strategy in place, voice shopping will fit naturally within a retailer’s overall omnichannel approach.

Headquarters

Porto, Portugal

Funding Stage

$700,000 in public funding and seed capital

Business Model

Shelf.ai offers SaaS and licensing models, either on premises or via the cloud.

Management Team

Founder and CEO Silvio Macedo has participated in several EU R&D projects and has provided consulting services to companies that include the BBC and Rolls-Royce. He has managed and founded five companies, including Xarevision and Shelf.ai, and has spent the last 12 years working on technology for grocery retail.

Company Outlook

Shelf.ai has launched its platform at a retailer with $7 billion in annual sales. Shelf.ai aims to become the market leader in conversational commerce in Europe and the US within the next two years.

Packyge

Company Description

Company Description

Packyge provides an e-commerce solution for complex grocery products, offering analytics, services and APIs that enable consumer interactions with stores. Packyge’s patent-pending technology uses consumers’ mobile phones, data and browser-based, retailer-facing screens to facilitate interactions for both retail associates and shoppers.

The company’s white-label software solutions simplify food-related e-commerce, enabling the fulfillment of complex grocery orders such as custom-decorated cakes, high-end butcher cuts or made-to-order deli platters. Packyge’s cloud software helps companies assemble e-commerce orders in-store for consumer pickup or delivery and for ship-to-store and return in-store operations. The software is also designed to integrate with or implement retailers’ loyalty programs by building add-on sales around interactions using client data,artificial intelligence and analytics.

Market Overview

Online grocery sales represent a relatively small part of the overall grocery retail market, but e-commerce is among the fastest-growing channels in grocery.Most online suppliers in the US already provide same-day delivery options. In recent years, more and more firms have tried to enter the e-grocery industry, where existing operators include AmazonFresh, FreshDirect, NetGrocer, Safeway and Walmart. According to Nielsen, in as few as five to seven years, 70% of consumers will be grocery shopping online. By 2022 or 2024, US shoppers are expected to spend an estimated $100 billion, or $850 per household, per year on online grocery purchases.

The retail business environment has become multichannel,and the increased volume of marketing and merchandising data that companies must process in order to make crucial decisions has increased demand for cloud services in the retail market. Market research firm Mordor Intelligence expects the global retail cloud market to grow at a CAGR of 20.61% from 2018 to 2023, to reach $40.75 billion.

What Problem Is the Company Solving?

As more food ordering moves online, grocery stores and traditional meal providers risk losing share to food delivery companies and national quick-serve restaurant chains, both of which often provide rich digital interactions to consumers. Grocers can’t afford to be noncompetitive in this experience-driven segment, especially in higher-margin, experiential retail categories.

Packyge provides cloud-based analytics, services and APIs that enable consumer interactions with the store as a hub. The company’s solutions integrate with a retailer’s existing e-commerce, in-store and loyalty systems to create engaging experiences within the retailer’s brand context that rival those offered by restaurants and food delivery services.

Headquarters

Naperville, IL

Funding Stage

Preseed, angel

Business Model

Packyge clients pay for a full-service implementation of the company’s SaaS platform, and then pay $50/month/store for the functionality provided by the platform.

Store rollout is predicated on jointly owned, predefined success outcomes that align the interests of the client and Packyge. The company is open to other performance-based pricing models that may work for clients.

Management Team

Cofounder and CEO Abhi Dhar has spent 20 years in corporate environments in the US and as an expatriate in the UK. He has worked in the digital space since 1998, most recently running technology and digital operations for a Fortune 50 retail chain. Cofounder and CTO Chandra Shetty has been a founding member of multiple ventures and previously spent more than eight years at Cisco Systems engineering three brand new product lines.Head of Product Management Chhaya Dave has more than 20 years of experience building product strategies and creating software products.

Company Outlook

Packyge is integrating its platform with popular e-commerce solutions such as Shopify, Magento and Commerce tools as well as with industry standard ERP platforms such as SAP. The company will extend and improve these integrations as it adds clients.

Using real-time data, Packyge is implementing prediction-based insights for supply reordering, trend anomalies, and client experiences and satisfaction. The company also intends to connect to home delivery companies, so food orders can be delivered to consumers’ homes on demand.

Touchize

Company Description

Company Description

Swedish company Touchize offers a progressive web application that optimizes the mobile shopping user interface in order to provide a more seamless, browser-based mobile shopping experience. The company has developed a unique, swipe-based mobile interface for adding and removing items from an online shopping cart. The solution is compatible with iOS, Android and Windows mobile devices.

The app’s “DragtoBuy” feature improves the mobile shopping experience by shortening the time between inspiration and purchase. According to Touchize, shortening the mobile purchasing journey can increase loyalty, basket size and conversion.

Source: Touchize.com

Market Overview

Mobile commerce refers to the buying and selling of goods and services through wireless handheld devices. It enables users to access the Internet without needing to find a place to plug in. In countries such as China, South Korea and India, mobile commerce’s share of total e-commerce sales already exceeds 50%, according to Research And Markets, and it continues to grow.

According to Research And Markets, these countries also have the largest share of digital users who complete purchases through apps, a trend that is gaining traction worldwide: digital users in Asia, North America and Europe also prefer to purchase via apps over mobile browsers. According to research from Motor Intelligence, the global mobile commerce market is expected to grow at a CAGR of 24.41% between 2018 and 2023.

What Problem Is the Company Solving?

According to market intelligence firm SimilarWeb, mobile devices’ share of total online traffic in the US grew from 57% in 2016 to 63% in 2017, and mobile is becoming consumers’ preferred channel for shopping and discovering products.However, according to comScore, mobile accounted for only about 24% of total online spending in the US as of the fourth quarter of 2017, meaning that desktops still account for the majority of online spending.

When comparing conversion rates, mobile devices’ rate is typically only one-third that of desktops, according to Touchize. The company believes that this “mobile gap” is largely a result of bad user experiences. Providing a user experience that is optimized for the mobile touch interface can make mobile shopping faster and simpler and, ultimately, result in increased basket size, conversion and customer retention.

Headquarters

Malmö, Sweden

Funding Stage

Not disclosed

Business Model

Touchize’s business model is based on two main parts: a subscription model that depends on the sales going through the solution and a licensing model for enterprise customers using the Touchize product as a framework for e-commerce on touch-based devices.

Management Team

CEO Jesper Deleuran has spent 25 years in leadership roles in operations, innovation and technology. Founder and CTO Tom Gajdos has 20 years of experience in mobile development and holdsa number of patents in mobile technology and interactive solutions. Founder and Product Manager Stefan Mumm has 25 years of experience in business development, communications and user-interface development at IBM and other Internet companies.

Company Outlook

The company seeks to help close the mobile gap with its solution, so mobile traffic converts into sales at the same rate that desktop traffic does.

Simplista

Company Description

Company Description

Simplista offers a cloud-based, B2B product-listing platform that helps retailers get new items onboarded from suppliers through to back-end systems in days rather than weeks or months. Specifically designed for SKU-intensive grocery retailers, Simplista enables weeks of additional sales of grocers’ items by improving the product-listing process. The company’s next-generation platform on boards items from any source, automatically integrates supplier and retailer data, and then publishes accurate listings directly into back-end systems, all in real time.

Market Overview

Business process management efforts are primarily designed to increase process efficiency and standardization by properly allocating business focus and resources as required by the task at hand. According to research from Mordor Intelligence, the business process management market was valued at $3.01 billion in 2017 and is expected to grow at a CAGR of 6.22% until 2023, to reach $4.3 billion.

What Problem Is the Company Solving?

Today’s retail product–listing process is often slow, complicated and costly, resulting in $300 billion in missed revenue opportunities each year. It takes thousands of data attributes and teams of people to capture the product information needed to put a single product on store shelves. For example, for a retailer with seven divisions, moving a bottle of ketchup from supplier to shelf requires about 2,400 data attributes and approximately 30 human touch points. Large grocery retailers list several hundred thousand new products per year, which can make the listing process very costly.

Meanwhile, suppliers are frustrated because their revenue is delayed until their product hits the shelves. They often have no visibility into the listing process, and the process seems to take much too long.

Headquarters

Toronto, Canada

Funding Stage

Seed ($2.8 million)

Business Model

Simplista operates on a SaaS subscription model.

Management Team

Founder and CEO Evan Silver has more than 20 years of technology delivery experience. He previously founded a successful analytics consulting firm and has also worked with Canadian retail giant Loblaw Companies; major telecom companies such as Rogers Communications, Telus and Bell; and financial services firms CIBC and BMO. Chief Technical Architect Peter Norris has more than 35 years of experience in ERP integration and Internet architecture. Key Advisor Bruce Burrows is the former CIO and EVP of IT at Loblaw Companies.

Company Outlook

Simplista aims to accelerate the product-listing process across all retail sectors, and then enable new product discovery, giving suppliers additional channels to sell new products.

Adrich

Company Description

Company Description

Adrich is a post purchase engagement platform that draws information from smart labels on products. The company’s proprietary labels generate product usage insights after a consumer has purchased an item and taken it home. Once a consumer has provided consent, Adrich’s labels and custom software create a stream of real-time product usage data that enables manufacturers to increase sales, automate reordering, predict order lead times more accurately, and identify opportunities for product improvements and targeted communications.

Market Overview

Customer analytics refers to the use of customer behavioral information to help make key business decisions. The systematic study of this information enables companies to respond appropriately to customers’ behavior and product interactions. According to Market Research Future, the customer analytics market is expected to grow at a CAGR of 15% between 2017 and 2023, to approximately $7.3 billion.

What Problem Is the Company Solving?

Retailers know very little about what happens to their products after those products leave a store, as it’s difficult to collect post purchase data from consumers. This general lack of data, and the fact that most post purchase data that is collected is self-reported by consumers, means that retailers miss opportunities to improve customer conversion through need-based, targeted communications.

Adrich is solving this problem by enabling two-way communication between retailers and consumers. The company’s smart labels can track how much of a product people use, and when. Sensors embedded in the labels can detect movement and determine how much of a product remains in a package. Adrich collects that information and then uses a proprietary algorithm to make sense of it.

Headquarters

Pittsburgh, PA

Funding Stage

Seed

Business Model

Adrich operates on a project basis. All Adrich projects include the use of its smart-label technology and access to data through the Adrich dashboard. The company’s component-based solution allows partners to “build their own bundle” to fit their individual needs.

Management Team

Founder and CEO Adhithi Aji has more than six years of related industry experience, including product management and technical research and development experience.

Company Outlook

Adrich will soon deliver its solution to a Fortune 100 food-manufacturing company based in Chicago. In addition, Adrich has begun consumer-facing project work with a Fortune 500 manufacturer and marketer of consumer products and with a major manufacturer of consumer cleaning products.

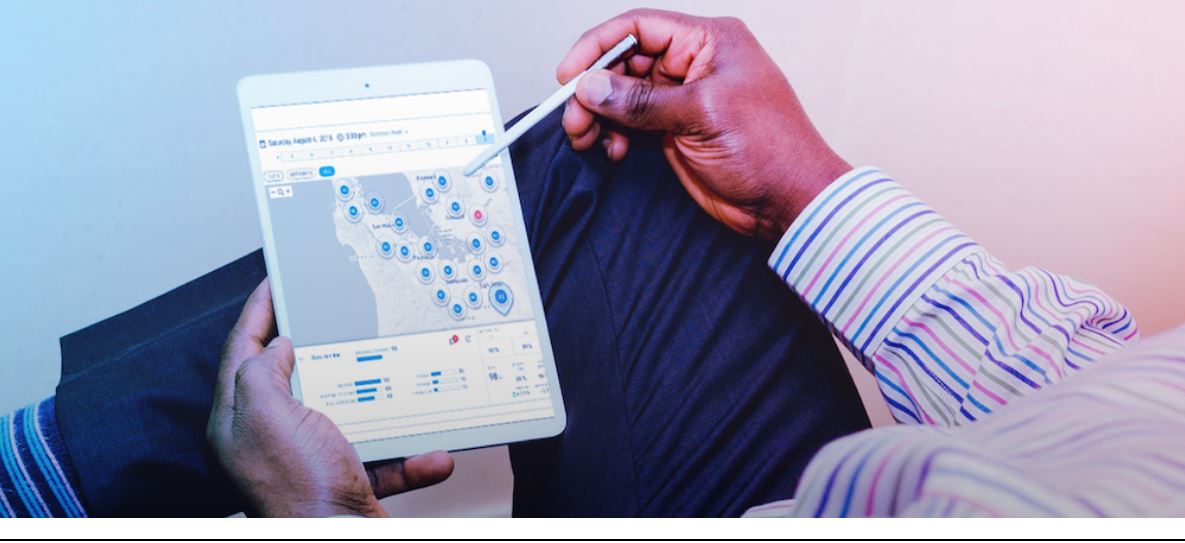

Observa

Company Description

Company Description

Observa offers brands and retailers real-time access to qualitative and quantitative insights into what is happening on their store shelves, with no capital costs. The company’s platform enables clients to immediately gauge the effectiveness of their marketing and sales efforts. The company’s crowd of on-demand human data collectors (“Observers”) or clients’ own employees are deployed to collect data in stores, so brands and retailers can see what their customers are seeing. The company uses artificial intelligence (AI) for image recognition to deliver sales-increasing insights to clients and to direct human Observers to take immediate actions such as gathering more data, delivering sales material or scheduling a follow-up visit.

Market Overview

The customer relationship management (CRM) analytics market is broadly segmented by type: marketing analytics, customer analytics, contact center analytics, sales analytics, and web and social analytics. CRM analytics enables organizations to easily access their data and modernizes business decision making. It can also be applied in online analytical processing via data mining. Research firm Market Research Future predicts that the CRM analytics market will grow at CAGR of 13% between 2016 and 2023, to approximately $9 billion.

What Problem Is the Company Solving?

Brick-and-mortar stores are not keeping up with the elevated expectations of consumers who are used to convenient online experiences. Business leaders often make decisions based on stale or incomplete information, leading to actions that are too late to be effective or are inconsistent. Improving store execution by ensuring product availability and promotional compliance, and by reducing out-of-stocks, is one of the biggest opportunities in retail.

Headquarters

Seattle, WA

Funding Stage

Seed ($1.1 million)

Business Model

Observa’s clients pay for the collection and analysis of shelf images and data. When Observa’s crowd of Observers collect data, each observation is charged on a per-transaction basis; when brands and retailers use Observa’s app and their own workforce to collect data, they are charged a monthly subscription fee. When images are fed from other systems or devices (cameras, handheld devices, robots or drones), clients are charged an image-processing fee.

Management Team

CEO and Cofounder Hugh Holman has years of experience in driving strategy, innovation, and sales and in managing retail execution. CTO and Cofounder Erik Chelstad’s experience includes serving as senior engineering manager during a public offering, profitably merging acquired technology companies and creating digital marketplaces.

Company Outlook

Observa’s first phase focused on crowdsourced retail audits using manual data entry into mobile apps for small to medium-sized CPG brands, with reporting via Observa’s dashboard. The company is now in its second phase and is integrating its platform with sales data and reporting systems. Observa is currently focusing on AI-driven insights and actions for CPG brands and retailers using image recognition, with collection via its crowd of Observers, field reps, store employees or other devices. In its next phase, Observa will work to offer a complete view of any store shelf in real time.

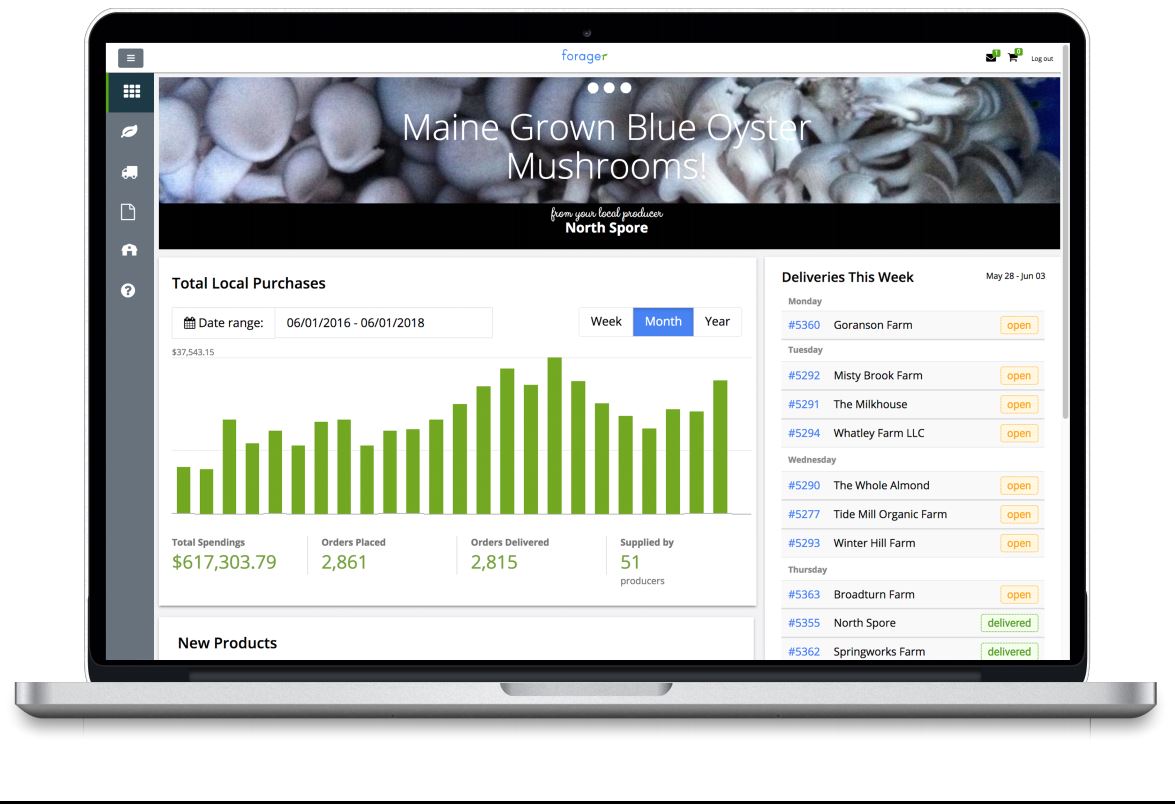

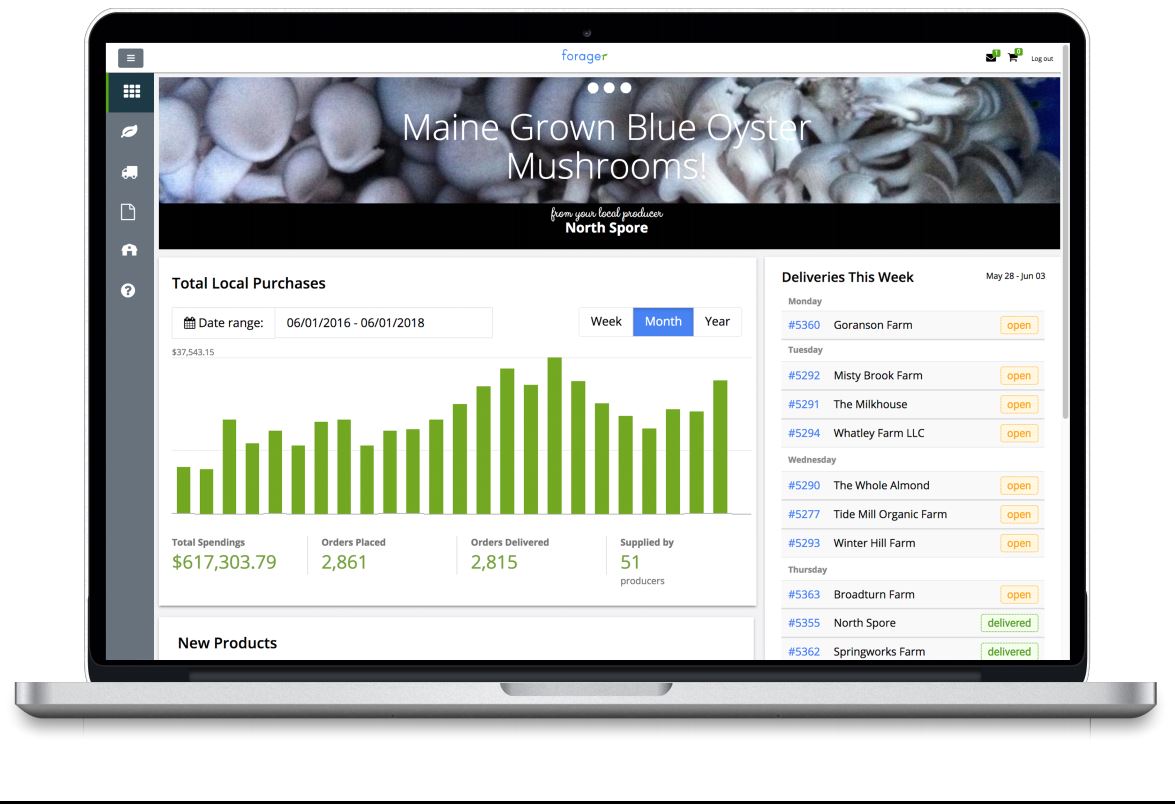

Forager

Company Description

Company Description

Forager has created a digital procurement platform that improves and streamlines the local food procurement process so that grocers and other companies can source local food products more easily and in greater quantities. The web and mobile application digitizes the discovery, ordering, receiving, invoicing and payments process end to end, saving grocers tens of thousands of dollars while enabling increased local sourcing.

Source: GoForager.com

Market Overview

Local food is the fastest-growing segment of the food market, with sales growth outpacing total food and beverage sales growth in the US, according to A.T. Kearney analysis in a study titled:

Firmly Rooted, the Local Food Market Expands. In fact, demand is so strong that 67% of consumers say they will switch grocers in order to purchase local food, according to the same study by A.T. Kearney.

In the wake of the massive disruption occurring in the grocery industry as a result of Amazon’s acquisition of Whole Foods Market and the dramatic rise in home delivery services and meal kits, grocers are scrambling to find a competitive edge. Offering more fresh local products is proving to be one highly effective strategy in winning and keeping customers.

What Problem Is the Company Solving?

Consumers are increasingly demanding fresh local food, but grocers and distributors struggle to source locally because the procurement process is labor intensive and highly complex. Due to inefficiencies, locally sourced food accounts for only 3% of all food consumed.

Local produce has the most complex supply chain of all categories, and sourcing local produce is an expensive, time-consuming and error-prone process. It can take retailers up to 80 hours a week to procure local produce, which prevents many retailers from offering more local foods. Furthermore, discovering, establishing and maintaining a reliable network of local producers is difficult and often limits how much stores can source locally.

Forager is simplifying the local-food sourcing process by providing a platform that offers quick ordering, easy communication, accurate receiving, simple payment and e-invoicing, and better insights. In just 18 months, the company has built a client base of 20 grocers, distributors and restaurants and a supplier network of 175 farms, meat and dairy purveyors, and makers of artisanal grocery products. Forager has expanded into five states in the last 12 months.

Headquarters

Portland, ME

Funding Stage

Venture

Business Model

Forager charges a transaction fee to buyers and a commission for new supplier introductions to wholesalers such as grocers.

Management Team

Founder and CEO David D. Stone has more than 20 years of executive management experience at Fortune 500 and emerging-growth technology companies with a strong emphasis on innovative payment systems and loyalty solutions.

Company Outlook

As Forager expands to more communities, its platform will enable more grocers, distributors, restaurants and institutions to source many different types of food, and even beverages, locally.

Aggarwal presenting his opening keynote at Groceryshop 2018.

Source: Coresight Research

Aggarwal presenting his opening keynote at Groceryshop 2018.

Source: Coresight Research Groceryshop 2018’s opening keynote.

Source: Coresight Research

Groceryshop 2018’s opening keynote.

Source: Coresight Research The four buckets in which Weinswig categorized the Startup Pitch Competition participants.

Source: Coresight Research

The four buckets in which Weinswig categorized the Startup Pitch Competition participants.

Source: Coresight Research Weinswig presiding over the Startup Pitch Competition at Groceryshop 2018.

Source: Coresight Research

Weinswig presiding over the Startup Pitch Competition at Groceryshop 2018.

Source: Coresight Research Startup Pitch winners (left to right): Rob Trice, Katerina Axelsson (Founder and CEO, Tastry) J. Skyler Fernandes, Evan Silver (Founder and CEO Simplista), Deborah Weinswig, Gary Arora.

Source: Coresight Research

Startup Pitch winners (left to right): Rob Trice, Katerina Axelsson (Founder and CEO, Tastry) J. Skyler Fernandes, Evan Silver (Founder and CEO Simplista), Deborah Weinswig, Gary Arora.

Source: Coresight Research Below, we provide in-depth company profiles of each of the 12 participating startups.

Below, we provide in-depth company profiles of each of the 12 participating startups.

Company Description

Locai Solutions offers a turnkey e-commerce platform specifically designed for grocery retail. The fully customizable, end-to-end solution combines an engaging shopper-facing front end with fulfillment management software. The front end provides personalized product and recipe recommendations as well as endless-aisle capability. Some of Locai’s features are also available via APIs for integration into other e-commerce platforms.

Market Overview

Online grocery sales represent a relatively small part of the overall grocery retail market, but e-commerce is among the fastest-growing segments in grocery.Most online suppliers in the US provide same-day delivery options. In recent years, more and more firms have tried to enter the e-grocery industry, where existing operators include AmazonFresh, FreshDirect, NetGrocer, Target, Walmart and Safeway. According to Nielsen, in as few as five to seven years, 70% of consumers will be grocery shopping online. By 2022 or 2024, US shoppers are expected to spend an estimated $100 billion, or $850 per household, per year on online grocery purchases.

What Problem Is the Company Solving?

Online grocery is growing and evolving quickly. Retailers need to reassess the entire digital grocery experience and have full control of their brands through every aspect of the customer journey in order to retain customers and profitably scale their operations. Selling food is vastly different than selling other types of products, yet most e-grocery platforms are built on an antiquated, transactional experience that few shoppers consider very engaging or personal.

The Locai platform is designed to make personalization an integral part of the customer experience. Product listings, search results, promotions and recipes are all tailored to each customer’s dietary preferences, likes/dislikes, past purchase data and shopping behavior. Locai’s meal-planning feature, for example, offers customers one-click convenience when shopping a grocer’s online catalog.

As demand for online grocery offerings increases, success depends on efficiently scaling beyond current in-store fulfillment models, while also increasing customer satisfaction. For retailers, the infrastructure and resources required to deliver goods are complex and expensive. For example, perishable items require more investment in storage and delivery infrastructure (refrigeration). Grocery retailers need diverse fulfillment options to meet shifting consumer demands. Locai’s SaaS platform can supporta spectrum of fulfillment formats and provide shoppers with a real-time view of a retailer’s inventory.

Headquarters

Denver, CO

Funding Stage

Seed

Business Model

Locai’s fee structure includes nominal integration and setup fees based on the level of platform customization as well as recurring monthly platform license fees based on the retailer’s online volume.

Management Team

CEO and Founder Mike Demko has more than 15 years of senior management experience in digital and e-commerce businesses. COO Scott DeGraeve has more than 20 years of executive management experience in the e-commerce grocery space.

Company Outlook

The Locai tech stack is proven, with more than 1 million orders delivered. In terms of product development, the company plans to continue to use the abundance of data available in online grocery to inform its artificial intelligence and machine learning algorithms in order to further enhance the customer experience and improve its operational tools to drive down fulfillment and delivery costs.

Company Description

Locai Solutions offers a turnkey e-commerce platform specifically designed for grocery retail. The fully customizable, end-to-end solution combines an engaging shopper-facing front end with fulfillment management software. The front end provides personalized product and recipe recommendations as well as endless-aisle capability. Some of Locai’s features are also available via APIs for integration into other e-commerce platforms.

Market Overview

Online grocery sales represent a relatively small part of the overall grocery retail market, but e-commerce is among the fastest-growing segments in grocery.Most online suppliers in the US provide same-day delivery options. In recent years, more and more firms have tried to enter the e-grocery industry, where existing operators include AmazonFresh, FreshDirect, NetGrocer, Target, Walmart and Safeway. According to Nielsen, in as few as five to seven years, 70% of consumers will be grocery shopping online. By 2022 or 2024, US shoppers are expected to spend an estimated $100 billion, or $850 per household, per year on online grocery purchases.

What Problem Is the Company Solving?

Online grocery is growing and evolving quickly. Retailers need to reassess the entire digital grocery experience and have full control of their brands through every aspect of the customer journey in order to retain customers and profitably scale their operations. Selling food is vastly different than selling other types of products, yet most e-grocery platforms are built on an antiquated, transactional experience that few shoppers consider very engaging or personal.

The Locai platform is designed to make personalization an integral part of the customer experience. Product listings, search results, promotions and recipes are all tailored to each customer’s dietary preferences, likes/dislikes, past purchase data and shopping behavior. Locai’s meal-planning feature, for example, offers customers one-click convenience when shopping a grocer’s online catalog.

As demand for online grocery offerings increases, success depends on efficiently scaling beyond current in-store fulfillment models, while also increasing customer satisfaction. For retailers, the infrastructure and resources required to deliver goods are complex and expensive. For example, perishable items require more investment in storage and delivery infrastructure (refrigeration). Grocery retailers need diverse fulfillment options to meet shifting consumer demands. Locai’s SaaS platform can supporta spectrum of fulfillment formats and provide shoppers with a real-time view of a retailer’s inventory.

Headquarters

Denver, CO

Funding Stage

Seed

Business Model

Locai’s fee structure includes nominal integration and setup fees based on the level of platform customization as well as recurring monthly platform license fees based on the retailer’s online volume.

Management Team

CEO and Founder Mike Demko has more than 15 years of senior management experience in digital and e-commerce businesses. COO Scott DeGraeve has more than 20 years of executive management experience in the e-commerce grocery space.

Company Outlook

The Locai tech stack is proven, with more than 1 million orders delivered. In terms of product development, the company plans to continue to use the abundance of data available in online grocery to inform its artificial intelligence and machine learning algorithms in order to further enhance the customer experience and improve its operational tools to drive down fulfillment and delivery costs.

Company Description

IntraPosition offers an in-store geopositioning solution that uses ultra-wideband wireless technology. The company’s in-store location infrastructure and software offers pinpointing with 12-inch accuracy, enabling shoppers to better navigate stores and receive personalized messaging based on their in-store location, while also helping retailers fulfill online orders more efficiently in-store and providing them with granular analytics data on shopper behavior.

Market Overview

Indoor positioning and navigation systems use a network of devices to locate people and objects inside a building wirelessly, whereas indoor positioning systems use lights, radio waves, magnetic fields, acoustic signals or other sensory information collected by mobile devices. According to Market Research Future, the indoor positioning and navigation system market is expected to grow at a CAGR of roughly 30% from 2016 to 2022, to about $25 billion.

What Problem Is the Company Solving?

IntraPosition addresses three problems with indoor shopping.

First, grocery stores and supermarkets often have difficulty providing one-on-one assistance to customers. IntraPosition’s technology provides in-store shoppers with step-by-step navigation help and enables retailers to send shoppers personalized messages on the shelf level. IntraPosition helps make the in-store shopping experience more like the online experience, enabling shoppers to easily search for and find products in stores and making shopping more personal and engaging.

Second, retailers are looking to cut online order fulfillment costs, in part by designing the best pickup routes for staff collecting orders in stores. IntraPosition helps solve this problem by integrating its positioning services with retailers’ in-store picking apps, helping cut picking time by as much as 30%, according to the company.

Third, retailers want to know more about their customers’ in-store shopping behavior, but collecting that data can be challenging. IntraPosition’s Internet of Things system, which is powered by its positioning capabilities, can provide retailers with valuable customer data and insights.

Headquarters

Binyamina, Israel

Funding Stage

Seed funding of $500,000 in December 2016 and pre-series A funding of $1.5 million in May 2018.

Business Model

The company charges an initial installation fee and then a recurring monthly charge based on usage or number of tags in each store.

Management Team

IntraPosition is led by Founder and CEO Yaron Shavit. Harel Gutgold is the company’s Head of Software Development.

Company Description

IntraPosition offers an in-store geopositioning solution that uses ultra-wideband wireless technology. The company’s in-store location infrastructure and software offers pinpointing with 12-inch accuracy, enabling shoppers to better navigate stores and receive personalized messaging based on their in-store location, while also helping retailers fulfill online orders more efficiently in-store and providing them with granular analytics data on shopper behavior.

Market Overview

Indoor positioning and navigation systems use a network of devices to locate people and objects inside a building wirelessly, whereas indoor positioning systems use lights, radio waves, magnetic fields, acoustic signals or other sensory information collected by mobile devices. According to Market Research Future, the indoor positioning and navigation system market is expected to grow at a CAGR of roughly 30% from 2016 to 2022, to about $25 billion.

What Problem Is the Company Solving?

IntraPosition addresses three problems with indoor shopping.

First, grocery stores and supermarkets often have difficulty providing one-on-one assistance to customers. IntraPosition’s technology provides in-store shoppers with step-by-step navigation help and enables retailers to send shoppers personalized messages on the shelf level. IntraPosition helps make the in-store shopping experience more like the online experience, enabling shoppers to easily search for and find products in stores and making shopping more personal and engaging.

Second, retailers are looking to cut online order fulfillment costs, in part by designing the best pickup routes for staff collecting orders in stores. IntraPosition helps solve this problem by integrating its positioning services with retailers’ in-store picking apps, helping cut picking time by as much as 30%, according to the company.

Third, retailers want to know more about their customers’ in-store shopping behavior, but collecting that data can be challenging. IntraPosition’s Internet of Things system, which is powered by its positioning capabilities, can provide retailers with valuable customer data and insights.

Headquarters

Binyamina, Israel

Funding Stage

Seed funding of $500,000 in December 2016 and pre-series A funding of $1.5 million in May 2018.

Business Model

The company charges an initial installation fee and then a recurring monthly charge based on usage or number of tags in each store.

Management Team

IntraPosition is led by Founder and CEO Yaron Shavit. Harel Gutgold is the company’s Head of Software Development.

Company Description

Nextuple helps online grocers achieve high levels of customer engagement and loyalty by using data science to measure and manage post purchase experiences. The company’s ControlTower solution integrates data from stores, fulfillment systems and delivery providers in real time to enable store operations staff to identify and mitigate potential inventory and on-time fulfillment risks. The solution leverages predictive analytics to help grocers manage shopper expectations and allocate resources while constantly monitoring on-the-ground conditions.

Company Description

Nextuple helps online grocers achieve high levels of customer engagement and loyalty by using data science to measure and manage post purchase experiences. The company’s ControlTower solution integrates data from stores, fulfillment systems and delivery providers in real time to enable store operations staff to identify and mitigate potential inventory and on-time fulfillment risks. The solution leverages predictive analytics to help grocers manage shopper expectations and allocate resources while constantly monitoring on-the-ground conditions.

Company Description

Tastry is a virtual platform that drives retail sales with targeted wine, beer and spirits recommendations and pairings. Tastry’s patented technology combines analytical chemistry, flavor preferences and machine learning to identify individual consumer preferences for sensory-based products, leading to highly personalized in-store and online recommendations that support high conversion. Tastry’s platform further serves manufacturers and retailers with data-driven insights and guidance for product development and demand forecasting.

Market Overview

The wine market is divided into distribution channels that include supermarkets and hypermarkets, specialty stores, convenience stores and e-commerce. According to Zion Market Research, the global wine market was valued at approximately $302.02 billion in 2017 and is expected to grow at a CAGR of around 5.8% to 2023, to reach approximately$423.59 billion.Supermarkets and hypermarkets are expected to dominate the global wine market in the near term.

The global market for artificial intelligence–based recommendation engines is expected to grow at a 40.7% CAGR from 2017 to 2022, from $801.1 million to $4,414.8 million, according to market research firm Markets and Markets.

What Problem Is the Company Solving?

While the typical wine aisle offers hundreds, and sometimes thousands, of choices, the average consumer lacks the necessary experience to choose a bottle of wine that matches his or her palate preference. Retailers have traditionally assisted shoppers by providing expert ratings and descriptions of wines. More modern attempts involve using software-based recommendation engines. However, these sometimes fail to provide accurate matches because they cannot always account for shoppers’ individual taste preferences.

Tastry helps solve this challenge by producing accurate recommendations of in-stock products within seconds. Suggestions are filterable by price, wine type, food pairing and other criteria. Tastry’s solution further enhances the shopper experience through food and recipe pairings and retailer-optional coupons.

Headquarters

San Luis Obispo, California

Funding Stage

Seed

Business Model

Tastry offers its Singularized Recommendation System (SRS) recommendation platform via a SaaS model.

Consumers can try a free beta version of Tastry’s recommender service at www.tastry.com. For brands and manufacturers, Tastry offers licensing and engagement projects that apply the company’s intelligence in the development of sensory-based products, based on either market segmentation or flavor preference.

Management Team

Cofounder and CEO Katerina Axelsson graduated from California Polytechnic State University (Cal Poly) with a BS in Chemistry and conceived Tastry through her work experiences at a local custom-crush facility. Cofounder Eric Thorndike is responsible for core technology and holds a BS in Computer Science from Cal Poly. Cofounder Tim Scott oversees operations and holds an MS in Mechanical Engineering from Cal Poly.

Company Outlook

Tastry is set to expand sales in 2019 while investing in product development and a number of in-flight customer and partnership initiatives. The company is also developing additional techniques to leverage the Tastry technology in the flavor-development space.

Company Description

Tastry is a virtual platform that drives retail sales with targeted wine, beer and spirits recommendations and pairings. Tastry’s patented technology combines analytical chemistry, flavor preferences and machine learning to identify individual consumer preferences for sensory-based products, leading to highly personalized in-store and online recommendations that support high conversion. Tastry’s platform further serves manufacturers and retailers with data-driven insights and guidance for product development and demand forecasting.

Market Overview

The wine market is divided into distribution channels that include supermarkets and hypermarkets, specialty stores, convenience stores and e-commerce. According to Zion Market Research, the global wine market was valued at approximately $302.02 billion in 2017 and is expected to grow at a CAGR of around 5.8% to 2023, to reach approximately$423.59 billion.Supermarkets and hypermarkets are expected to dominate the global wine market in the near term.

The global market for artificial intelligence–based recommendation engines is expected to grow at a 40.7% CAGR from 2017 to 2022, from $801.1 million to $4,414.8 million, according to market research firm Markets and Markets.

What Problem Is the Company Solving?

While the typical wine aisle offers hundreds, and sometimes thousands, of choices, the average consumer lacks the necessary experience to choose a bottle of wine that matches his or her palate preference. Retailers have traditionally assisted shoppers by providing expert ratings and descriptions of wines. More modern attempts involve using software-based recommendation engines. However, these sometimes fail to provide accurate matches because they cannot always account for shoppers’ individual taste preferences.

Tastry helps solve this challenge by producing accurate recommendations of in-stock products within seconds. Suggestions are filterable by price, wine type, food pairing and other criteria. Tastry’s solution further enhances the shopper experience through food and recipe pairings and retailer-optional coupons.

Headquarters

San Luis Obispo, California

Funding Stage

Seed

Business Model

Tastry offers its Singularized Recommendation System (SRS) recommendation platform via a SaaS model.

Consumers can try a free beta version of Tastry’s recommender service at www.tastry.com. For brands and manufacturers, Tastry offers licensing and engagement projects that apply the company’s intelligence in the development of sensory-based products, based on either market segmentation or flavor preference.

Management Team

Cofounder and CEO Katerina Axelsson graduated from California Polytechnic State University (Cal Poly) with a BS in Chemistry and conceived Tastry through her work experiences at a local custom-crush facility. Cofounder Eric Thorndike is responsible for core technology and holds a BS in Computer Science from Cal Poly. Cofounder Tim Scott oversees operations and holds an MS in Mechanical Engineering from Cal Poly.

Company Outlook

Tastry is set to expand sales in 2019 while investing in product development and a number of in-flight customer and partnership initiatives. The company is also developing additional techniques to leverage the Tastry technology in the flavor-development space.

Company Description

Shelf.ai provides retailers with conversational commerce capabilities that are optimized for grocery. The company’s multi modal, device-agnostic, conversational e-commerce platform helps grocery retailers take advantage of voice assistants such as Amazon Alexa and Google Home to offer shoppers a personalized, multichannel shopping experience.

Retailers can connect their existing e-commerce and loyalty systems with Shelf.ai’s artificial intelligence system. The company’s solution uses customer purchase history and contextual knowledge to learn a shopper’s behavior and preferences, helping eliminate the need for the shopper to specify what kind of “milk” or “eggs” he or she might want when placing an order.

Market Overview

Although voice shopping is still in its nascent days, millions of users are buying smart speaker devices and starting to search for products using voice assistants. Voice shopping is expected to account for $40 billion in sales by 2022, up from $2 billion today, according to data from OC&C Strategy Consultants. In addition, online grocery shopper numbers have more than doubled in a little over a year, according to a study by the Food Marketing Institute and Nielsen. Voice-based commerce is shaping up to be the next major disruptive force in retail.

What Problem Is the Company Solving?

Voice commerce offers a unique opportunity for businesses to deliver faster, easier and more convenient experiences. To capitalize on the opportunity, retailers should begin designing strategies to add voice-shopping capabilities to their e-commerce programs.

Consumers are already demanding a personalized, simplified shopping experience, and retailers are working to deliver it both online and in stores. With the right strategy in place, voice shopping will fit naturally within a retailer’s overall omnichannel approach.

Headquarters

Porto, Portugal

Funding Stage

$700,000 in public funding and seed capital

Business Model

Shelf.ai offers SaaS and licensing models, either on premises or via the cloud.

Management Team

Founder and CEO Silvio Macedo has participated in several EU R&D projects and has provided consulting services to companies that include the BBC and Rolls-Royce. He has managed and founded five companies, including Xarevision and Shelf.ai, and has spent the last 12 years working on technology for grocery retail.

Company Outlook

Shelf.ai has launched its platform at a retailer with $7 billion in annual sales. Shelf.ai aims to become the market leader in conversational commerce in Europe and the US within the next two years.

Company Description

Shelf.ai provides retailers with conversational commerce capabilities that are optimized for grocery. The company’s multi modal, device-agnostic, conversational e-commerce platform helps grocery retailers take advantage of voice assistants such as Amazon Alexa and Google Home to offer shoppers a personalized, multichannel shopping experience.

Retailers can connect their existing e-commerce and loyalty systems with Shelf.ai’s artificial intelligence system. The company’s solution uses customer purchase history and contextual knowledge to learn a shopper’s behavior and preferences, helping eliminate the need for the shopper to specify what kind of “milk” or “eggs” he or she might want when placing an order.

Market Overview

Although voice shopping is still in its nascent days, millions of users are buying smart speaker devices and starting to search for products using voice assistants. Voice shopping is expected to account for $40 billion in sales by 2022, up from $2 billion today, according to data from OC&C Strategy Consultants. In addition, online grocery shopper numbers have more than doubled in a little over a year, according to a study by the Food Marketing Institute and Nielsen. Voice-based commerce is shaping up to be the next major disruptive force in retail.

What Problem Is the Company Solving?

Voice commerce offers a unique opportunity for businesses to deliver faster, easier and more convenient experiences. To capitalize on the opportunity, retailers should begin designing strategies to add voice-shopping capabilities to their e-commerce programs.

Consumers are already demanding a personalized, simplified shopping experience, and retailers are working to deliver it both online and in stores. With the right strategy in place, voice shopping will fit naturally within a retailer’s overall omnichannel approach.

Headquarters

Porto, Portugal

Funding Stage

$700,000 in public funding and seed capital

Business Model

Shelf.ai offers SaaS and licensing models, either on premises or via the cloud.

Management Team

Founder and CEO Silvio Macedo has participated in several EU R&D projects and has provided consulting services to companies that include the BBC and Rolls-Royce. He has managed and founded five companies, including Xarevision and Shelf.ai, and has spent the last 12 years working on technology for grocery retail.

Company Outlook

Shelf.ai has launched its platform at a retailer with $7 billion in annual sales. Shelf.ai aims to become the market leader in conversational commerce in Europe and the US within the next two years.

Company Description

Packyge provides an e-commerce solution for complex grocery products, offering analytics, services and APIs that enable consumer interactions with stores. Packyge’s patent-pending technology uses consumers’ mobile phones, data and browser-based, retailer-facing screens to facilitate interactions for both retail associates and shoppers.

The company’s white-label software solutions simplify food-related e-commerce, enabling the fulfillment of complex grocery orders such as custom-decorated cakes, high-end butcher cuts or made-to-order deli platters. Packyge’s cloud software helps companies assemble e-commerce orders in-store for consumer pickup or delivery and for ship-to-store and return in-store operations. The software is also designed to integrate with or implement retailers’ loyalty programs by building add-on sales around interactions using client data,artificial intelligence and analytics.

Market Overview

Online grocery sales represent a relatively small part of the overall grocery retail market, but e-commerce is among the fastest-growing channels in grocery.Most online suppliers in the US already provide same-day delivery options. In recent years, more and more firms have tried to enter the e-grocery industry, where existing operators include AmazonFresh, FreshDirect, NetGrocer, Safeway and Walmart. According to Nielsen, in as few as five to seven years, 70% of consumers will be grocery shopping online. By 2022 or 2024, US shoppers are expected to spend an estimated $100 billion, or $850 per household, per year on online grocery purchases.

The retail business environment has become multichannel,and the increased volume of marketing and merchandising data that companies must process in order to make crucial decisions has increased demand for cloud services in the retail market. Market research firm Mordor Intelligence expects the global retail cloud market to grow at a CAGR of 20.61% from 2018 to 2023, to reach $40.75 billion.

What Problem Is the Company Solving?

As more food ordering moves online, grocery stores and traditional meal providers risk losing share to food delivery companies and national quick-serve restaurant chains, both of which often provide rich digital interactions to consumers. Grocers can’t afford to be noncompetitive in this experience-driven segment, especially in higher-margin, experiential retail categories.

Packyge provides cloud-based analytics, services and APIs that enable consumer interactions with the store as a hub. The company’s solutions integrate with a retailer’s existing e-commerce, in-store and loyalty systems to create engaging experiences within the retailer’s brand context that rival those offered by restaurants and food delivery services.

Headquarters

Naperville, IL

Funding Stage

Preseed, angel

Business Model

Packyge clients pay for a full-service implementation of the company’s SaaS platform, and then pay $50/month/store for the functionality provided by the platform.

Store rollout is predicated on jointly owned, predefined success outcomes that align the interests of the client and Packyge. The company is open to other performance-based pricing models that may work for clients.

Management Team

Cofounder and CEO Abhi Dhar has spent 20 years in corporate environments in the US and as an expatriate in the UK. He has worked in the digital space since 1998, most recently running technology and digital operations for a Fortune 50 retail chain. Cofounder and CTO Chandra Shetty has been a founding member of multiple ventures and previously spent more than eight years at Cisco Systems engineering three brand new product lines.Head of Product Management Chhaya Dave has more than 20 years of experience building product strategies and creating software products.

Company Outlook

Packyge is integrating its platform with popular e-commerce solutions such as Shopify, Magento and Commerce tools as well as with industry standard ERP platforms such as SAP. The company will extend and improve these integrations as it adds clients.

Using real-time data, Packyge is implementing prediction-based insights for supply reordering, trend anomalies, and client experiences and satisfaction. The company also intends to connect to home delivery companies, so food orders can be delivered to consumers’ homes on demand.

Company Description

Packyge provides an e-commerce solution for complex grocery products, offering analytics, services and APIs that enable consumer interactions with stores. Packyge’s patent-pending technology uses consumers’ mobile phones, data and browser-based, retailer-facing screens to facilitate interactions for both retail associates and shoppers.

The company’s white-label software solutions simplify food-related e-commerce, enabling the fulfillment of complex grocery orders such as custom-decorated cakes, high-end butcher cuts or made-to-order deli platters. Packyge’s cloud software helps companies assemble e-commerce orders in-store for consumer pickup or delivery and for ship-to-store and return in-store operations. The software is also designed to integrate with or implement retailers’ loyalty programs by building add-on sales around interactions using client data,artificial intelligence and analytics.

Market Overview

Online grocery sales represent a relatively small part of the overall grocery retail market, but e-commerce is among the fastest-growing channels in grocery.Most online suppliers in the US already provide same-day delivery options. In recent years, more and more firms have tried to enter the e-grocery industry, where existing operators include AmazonFresh, FreshDirect, NetGrocer, Safeway and Walmart. According to Nielsen, in as few as five to seven years, 70% of consumers will be grocery shopping online. By 2022 or 2024, US shoppers are expected to spend an estimated $100 billion, or $850 per household, per year on online grocery purchases.