albert Chan

Company Overview

Grocery Outlet Holding calls itself an “extreme value” retailer that sells name-brand consumables and fresh produce through its 323 stores in the US approximately 40% lower than conventional grocers and approximately 20% lower than other leading discounters. The company sources its products from over 1,500 suppliers, with no supplier representing over 5% of sales. The company’s products include grocery, produce, refrigerated and frozen foods, beer and wine, fresh meat and seafood, general merchandise, and health and beauty products.

Initial Public Offering

On June 10, 2019, the company filed a registration statement with the Securities and Exchange Commission for an IPO of 17,187,500 shares of common stock at a price of $15-17 per share listed on the NASDAQ under the symbol “GO.” The company will use the funds to repay a term loan under second lien credit, then first lien credit and the remainder of the proceeds for store expansion. First lien term loan is a senior form of debt which gives lenders first priority in repayment. Second lien lenders are paid only after first lien lenders but before subordinated debts and common equity holders. In an updated S-1/A filing on June 18, the company increased its price offering to between $18 and $19, increasing the IPO value to about $381.02 million, assuming pricing at the midpoint of the quoted price range. On June 20, the offer price was further increased to $22 per share.

The company’s stock surged in the first day of trading, rising as much as 41% to $31.50, before closing at $28.50. Since then, the stock has held its levels at around the $30 mark, reflecting investor confidence in the company’s business prospects. The company has grown its store count about 10% per year since 2015 and sees a potential for 2,000 stores in states adjacent to current locations. However, strong competition, the razor-thin margins discount retailers glean and aggressive pricing can put downward pressure on valuations.

Business Model

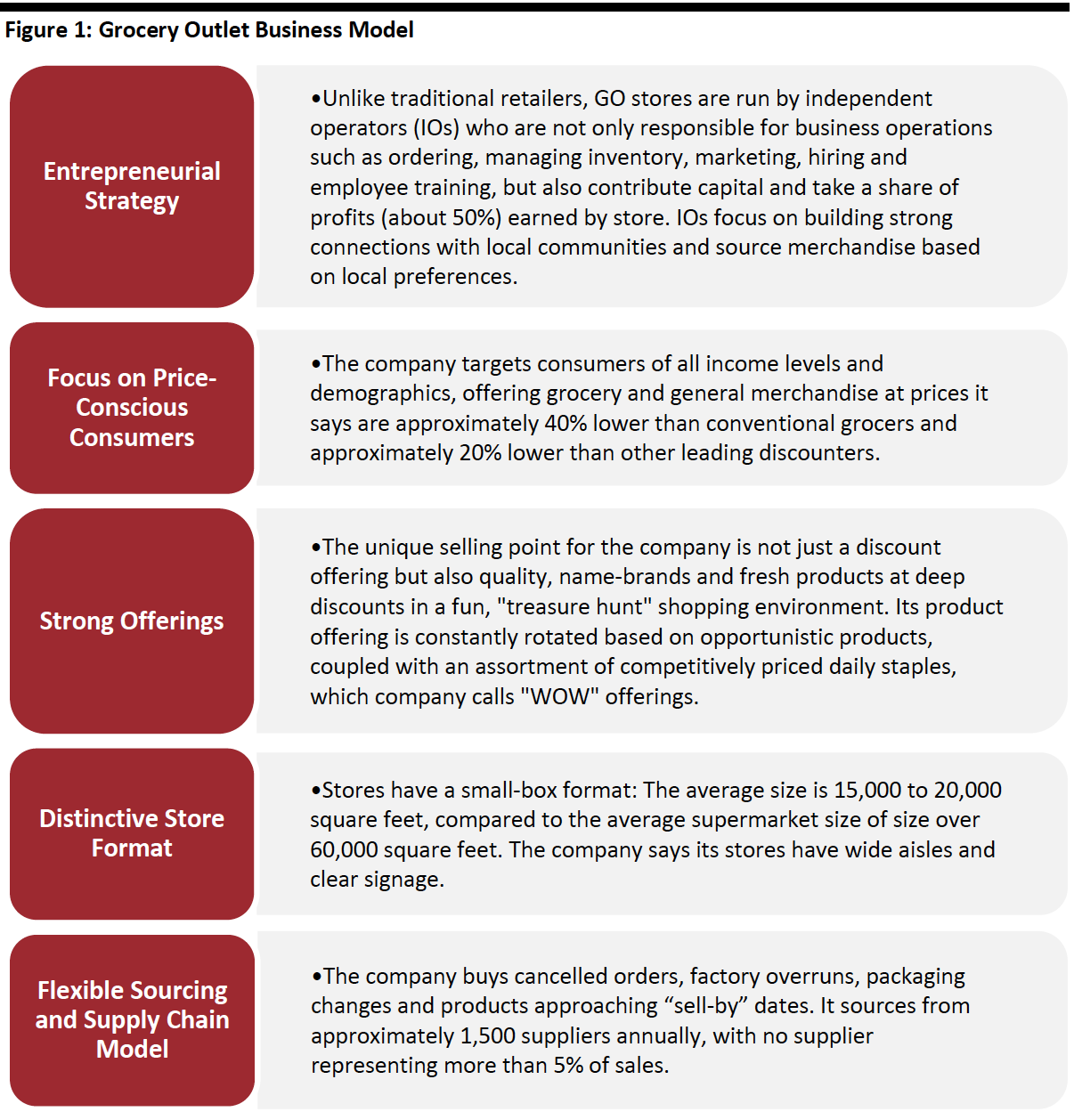

The company has unique a business model compared to other players in the grocery discounters segment – which has driven strong store expansion and revenue growth.

[caption id="attachment_92088" align="aligncenter" width="700"] Source: Company/Coresight Research[/caption]

Source: Company/Coresight Research[/caption]

Financial Snapshot

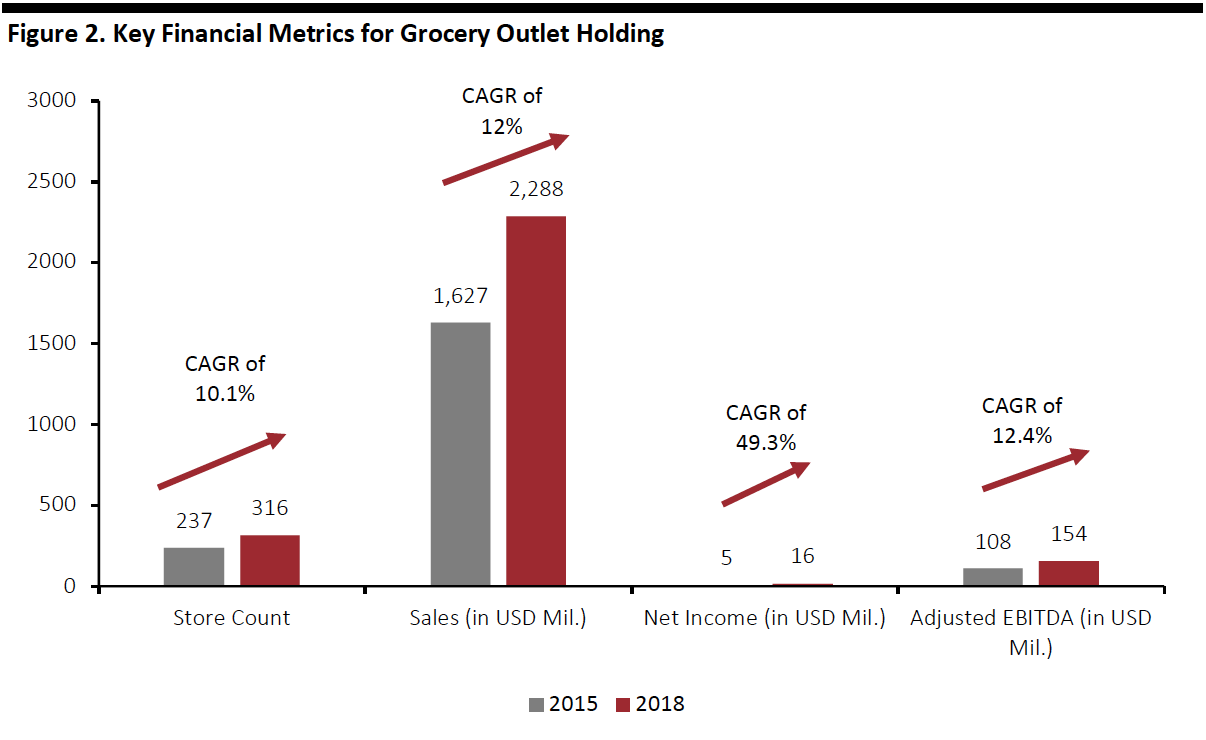

The company has grown its store count at a CAGR of 10.1% from 237 stores in 2015 to 316 in 2018. As of March 30, 2019, the company operated 323 stores that had an average size of approximately 14,000 square feet and has closed only six stores since 2014. Grocery Outlet plans to open 32 new stores in 2019, with a target average store size of between 15,000 and 20,000 square feet and average net cash investment of approximately $2 million, including store buildout (net of contributions from landlords), inventory (net of payables) and cash pre-opening expenses. Grocery Outlet usually targets sales of $5.5 million per store during the first year with estimated sales increases of 25% to 30% cumulatively until reaching maturity in four to five years.

Since 2015, the company has grown comparable sales at an average rate of 4.2%. However, comparable-store sales growth will have been flattered by the annual 10.1% increase in store numbers: As we noted above, stores take a number of years to reach maturity, but will be included in the base for comparable sales just one year after opening. The company has maintained consistent annual gross margin between 30.2% and 30.6%.

[caption id="attachment_92089" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Paying Off Debt

The company plans to use the estimated net proceeds of $346 million from the IPO to pay down debt. It expects to incur one-time costs of $3.8 million related to the write-off of deferred financing costs and $1.4 million related to the write-off of unamortized debt discounts. Grocery Outlet will also recognize stock-based compensation expense of $22.5 million in connection with vested time-based options. These expenses could hurt profit margins in the current year. However, the company will also be able to cut interest payments and improve margins in the coming years. The influx of cash will also strengthen the balance sheet: Shareholder equity will increase, the cash balance will increase and debt will decline.

The Discount Retail Industry and Competitor Landscape

Young consumers such as millennials and Gen Zers are impacting the grocery retail landscape — including their apparent preference for low-price retailers. Our report US Millennials and Grocery highlights that older millennials tend to be the peak demographic for traditional-format supermarkets, such as Kroger and Albertsons, as well as Aldi. Younger millennials also exhibit thrifty characteristics and millennials aged under 30 are the peak demographic for shopping at mass merchandisers Walmart and Target. Acosta’s 14th edition of The Why? Behind The Buy report noted that 48% of surveyed millennials agreed they are not brand loyal and switch to any brand when they can find a better deal.

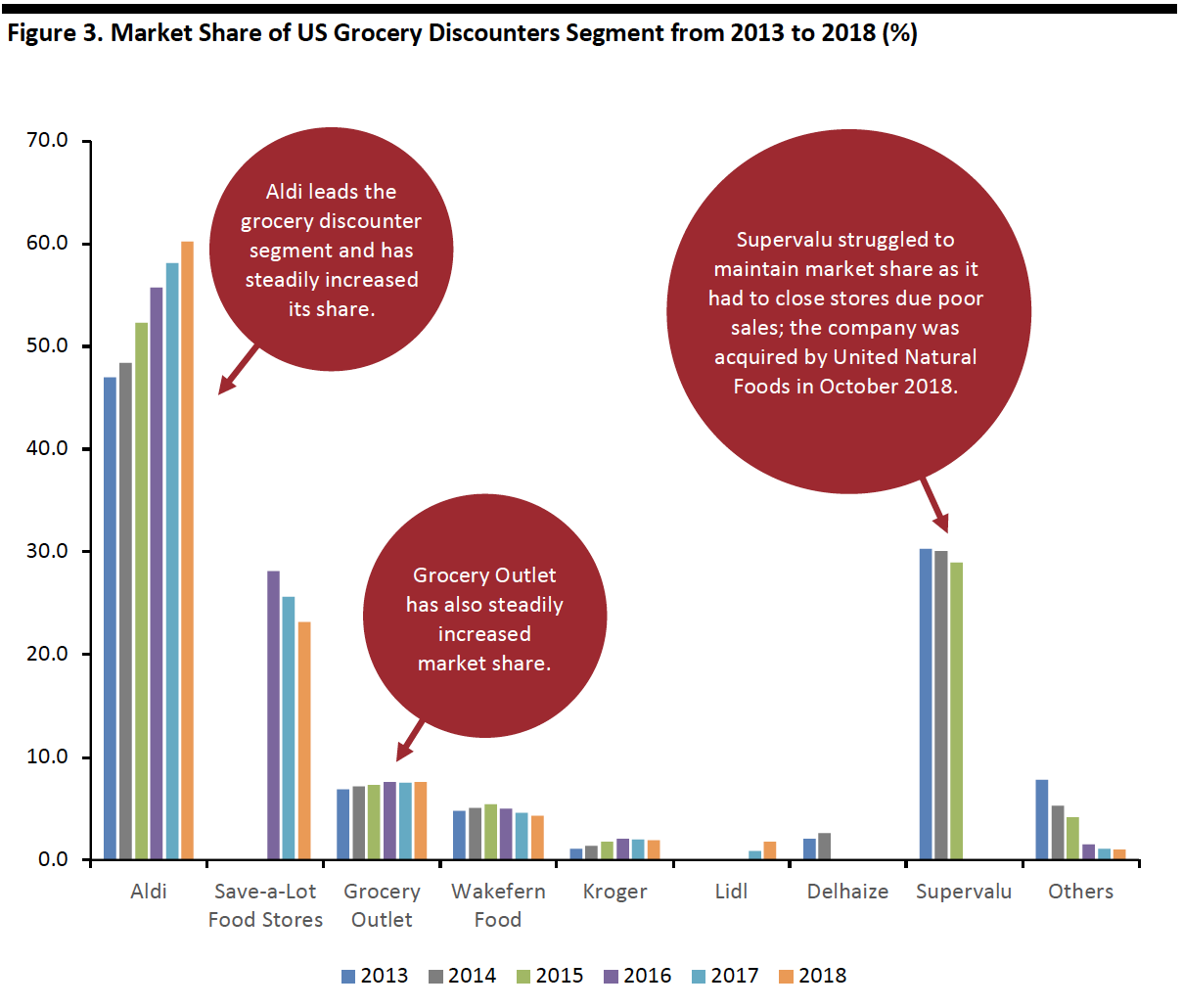

According to Euromonitor International, in 2018, Aldi held a 60.2% share of the US grocery discounter market, followed by Save-a-Lot at 23.2%, Grocery Outlet with 7.6%, Wakefern Food (which operates under many banners) at 4.3%, Kroger (which operates price-focused stores under the Food 4 Less and Foods Co banners as well as Ruler Foods discount stores) 1.9% and Lidl with 1.8%.

[caption id="attachment_92090" align="aligncenter" width="700"] Source: Euromonitor International[/caption]

Source: Euromonitor International[/caption]

Comparing Industry Players

Aldi

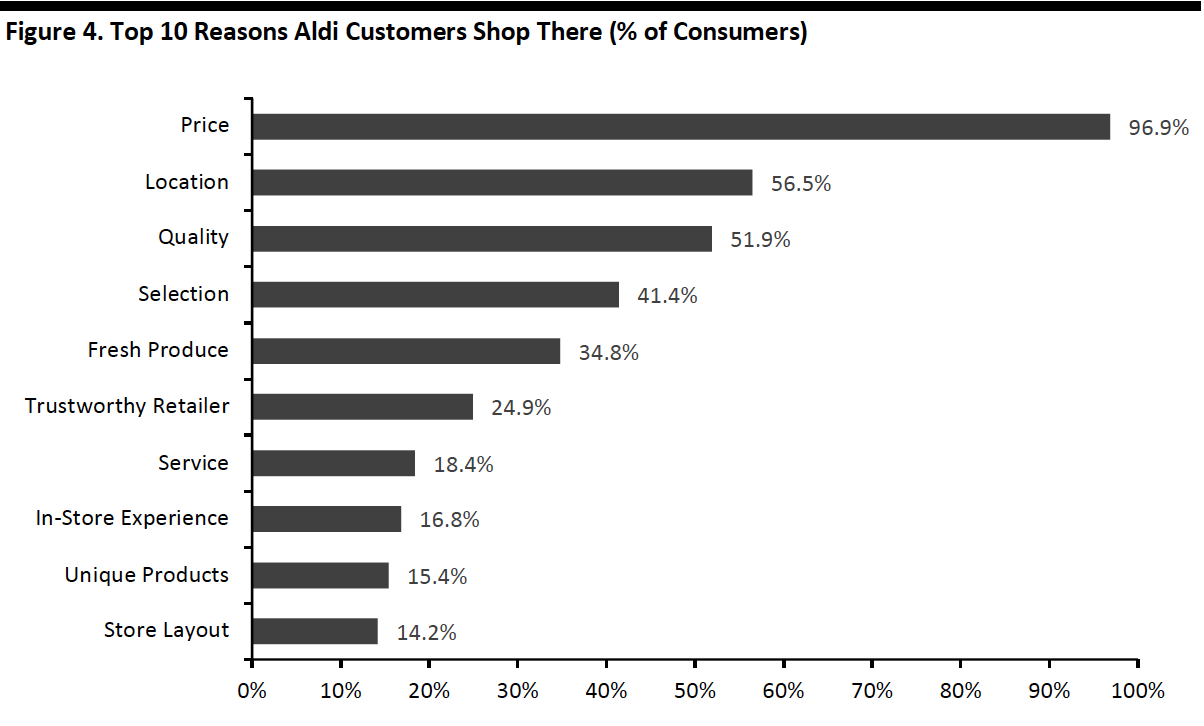

Aldi is the eighth-biggest grocery retailer in the US by estimated 2018 revenues, according to Euromonitor International. It has grown revenues an estimated CAGR of 12.7% over the past five years. Our Who Shops Where for Groceries report found Aldi ranked sixth in the grocery sector by number of respondents who had bought from the retailer in the past year.

Approximately 90% of products sold in Aldi stores are private label. They also sell only a limited range of any item, which means a smaller selling space and lower rental cost. Because the company carries a very limited range of SKUs but buys them in large volumes, it has more negotiating power. The average floor size of Aldi stores is around 12,000 square feet, compared to average size of 45,000 square feet for American grocery stores. Aldi is a highly sophisticated operator within the discount grocery segment, having honed its low-cost, no-frills model over several decades and across multiple international markets.

In June 2017, Aldi announced a $3.4 billion program of capital investment intended to grow its US presence by around 50%, expanding to 2,500 stores nationwide by the end of 2022 from its store base of “more than 1,600 stores” at the time of the announcement.

[caption id="attachment_92091" align="aligncenter" width="700"] Base: 369 US Internet users aged 18+ who shop for groceries at Aldi most often, surveyed in August 2018

Base: 369 US Internet users aged 18+ who shop for groceries at Aldi most often, surveyed in August 2018Source: Prosper Insights & Analytics[/caption]

Save-a-Lot

Save-a-Lot Food Stores is the second largest grocery discounter in the US, according to Euromonitor. It is headquartered in St. Ann, Missouri. In October 2016, SuperValu sold Save-a-Lot to Onex Corporation. Even though Save-a-Lot holds a considerable share in the discount grocer market, its share slid from 28.1% in 2016 to 23.2% in 2018. The company is also carrying substantial debt on its balance sheet, which is hurting net profit margins due to high interest payments. According to Progressive Grocer ranking which ranks 50 grocery stores each year based on annual sales, store count, top banners and employee counts, Aldi was 22nd while SuperValu, Save-a-Lot's parent company, was at number 4. In the 2018 ranking, Aldi’s ranking surged to No. 9 while Save-a-Lot ranked 29.

The company recently launched a new store format in Tampa, Florida, designed to meet changing consumer expectations. The new store has wide aisles, bright lighting, bold signage, more selection of fresh foods and pay-and-use cart system that costs 25 cents. The company also plans to increase its private label offering, remodel stores and convert itself from deep-discount to extreme-value retailer.

Grocery Outlet

Grocery Outlet grew its share of the discount grocer market from 6.9% in 2013 to 7.6% in 2018, according to Euromonitor. The company believes it has an opportunity to set up over 400 additional locations in states in which the company currently operates and approximately 1,600 additional locations in neighboring states. The company plans to expand its store base by approximately 10% annually and believes the market could support 4,800 locations in the US in the future.

Unlike Aldi, which has a mostly private label offering, Grocery Outlet sources branded products from over 1,500 suppliers, looking for opportunities buy order cancellations, manufacturer overruns, packaging changes or products close to their “sell-by” dates.

Other Competitors in the Value Space

Walmart has achieved US market leadership in grocery through its consistently strong focus on low prices. Walmart held a share of slightly over one-quarter of the overall grocery retailer sector in 2018, according to Euromonitor, having grown its share over each of the five prior years. Our Who Shops Where for Groceries report found 70% of US grocery shoppers had bought from Walmart in store in the past year.

Lidl is jump-starting its US store-opening plans: In May, it announced it would open 25 new stores by spring 2020. This would take the still-nascent chain close to 100 US stores — well behind its initial plans for 100 stores by summer 2018, a target that Lidl now expects to hit by the end of 2020. It is small fry compared to the 1,894 total that rival Aldi operated in the US as of May 2019. The new stores include some conversions from the Best Market format, following Lidl’s acquisition of the 27-store chain in late 2018 (Best Market has stores in New Jersey and New York). Lidl’s new store openings will be on the east coast including Maryland, New Jersey, New York, North Carolina, Pennsylvania, South Carolina and Virginia. Our monitoring of Lidl’s store count suggests the retailer has been opening between five and nine stores every six months.

And, the major dollar-store chains are adding new competitive pressure in the discount grocery space, increasing their food offerings and opening new stores. During fiscal year 2019, Dollar General plans to execute approximately 2,075 real estate projects, including 975 new store openings, 1,000 mature store remodels, and 100 store relocations. For fiscal year 2018 ended on February 1, 2019, consumables accounted for 77.5% of total sales, seasonal 11.9%, home products 5.9% and apparel 4.7%. Consumables, which formed a major part of sales, include paper and cleaning products, packaged food such as cereals, canned soups and vegetables, condiments, spices, sugar and flour, perishables, snacks, health and beauty, pet and tobacco products. In fiscal 2018, the company registered its 29th consecutive year of positive same-store sales growth. Also in the dollar stores segment, in March, Dollar Tree announced plans to open 350 new Dollar Tree stores and 200 new Family Dollar stores this year. The retailer also plans to close around 390 underperforming Family Dollar stores and renovate at least 1,000 Family Dollar stores.

While discount grocers such as Aldi, Lidl, Dollar General and Grocery Outlet have outlined their expansion plans, discount chain Fred’s is closing stores. The retailer recently announced it will shut 49 stores in what is its third batch of store closures this year. The chain previously announced the closure of 264 stores. Following the completion of the latest round of closures, Fred’s will continue to operate 244 stores.

In the discount segment, Kroger owns the Ruler Foods banner whose average store size is 20,000 square feet, as well as the Food 4 Less and Foods Co banners.

Key Insights

Planned expansion by Grocery Outlet, Aldi, Lidl and the dollar stores is intensifying competition in the value segment of the grocery market.

- Grocery Outlet and Aldi are both expanding apace, but are opposites in terms of brand offering: Grocery Outlet sells branded goods while Aldi (and Lidl) focuses very strongly on private-label products. US grocery has traditionally been more focused on brands than some other Western markets — which would suggest an underlying advantage for Grocery Outlet — though there are indications that private label is gaining share of grocery sales.

- The US grocery market remains unusually fragmented. This means that strong growth at discount chains does not simply mean shoppers are trading down; it can also mean consolidation in the value segment. One apparent example of this are ongoing store closures by discount chain Fred’s. This also means discount players such as Grocery Outlet have the opportunity to drive consolidation within value retail and attract price-conscious shoppers from more expensive competitors.