Nitheesh NH

Grocery Outlet

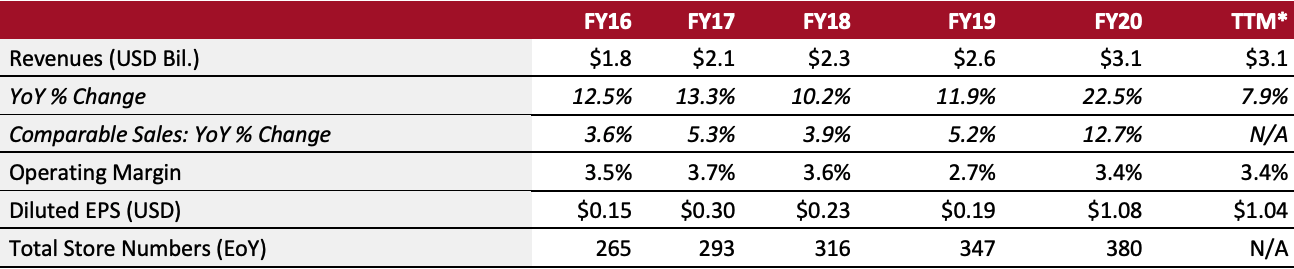

Sector: Food retailers Country of operation: US Key product categories: Food and beverages, general merchandise, health and beauty Annual Metrics [caption id="attachment_131579" align="aligncenter" width="700"] Fiscal year ends on last Saturday of the calendar year

Fiscal year ends on last Saturday of the calendar year*Trailing 12 months ended July 3, 2020[/caption] Summary Founded in 1946 and headquartered in Emeryville, California, Grocery Outlet is a grocery chain offering name-brand consumables and fresh products through a network of independently operated stores. The company offers products in categories including dairy, deli produce, meat and seafood, as well as ambient grocery, beverages, frozen foods, general merchandise, and health and beauty products. As of July 3, 2021, the company operates through 400 stores in California, Idaho, Nevada, Pennsylvania, Oregon and Washington. Company Analysis Coresight Research insight: Grocery Outlet approaches the market differently to its rival discounters. Grocery Outlet sells branded goods, while Aldi and Lidl focus strongly on private-label products. US grocery has traditionally been more inclined toward brands than some other Western markets—which would suggest an underlying advantage for Grocery Outlet—though there are indications that private-label products are gaining a share of grocery sales. A unique aspect of the company’s business is its ever-changing WOW! deals which area made available through opportunistic purchasing from suppliers. The retailer buys canceled orders, factory overruns, products with packaging changes, and products approaching “sell-by” dates, and passes the savings along to its customers. These opportunistic buys have allowed the grocery chain to offer value while also recording higher-than-standard gross margins. Another important characteristic of Grocery Outlet’s business model is its store operations. The stores are operated by Independent Operators (IOs) who are responsible for local marketing, product assortment and recruitment decisions. On average, almost 75% of the assortment in each grocery outlet is selected by IOs based on local preference and shopping history. This allows for greater community outreach and highly localized assortments—but can also result in inconsistent branding and experience from store to store. After resisting incorporating e-commerce in the past, Grocery Outlet management noted on its earnings call on July 3, 2021, that it has begun testing various e-commerce approaches to determine which works best with its unique business model.

| Tailwinds | Headwinds |

|

|

- Deliver more “WOW!” deals and expand offerings: Drive incremental traffic and increase market share by further leveraging its purchasing model, which includes deepening relationships with existing suppliers and developing new ones.

- Implement inventory planning and marketing tools to support IOs in enhancing the customer experience and grow the business further.

- Leverage digital marketing to raise customer awareness, increase engagement with existing customers, and attract new customers to its stores.

- Expand store estate by approximately 10% annually by penetrating existing and contiguous regions. The retailer plans to target new store size of 15,000–20,000 total square feet with an average of 4,000 square feet of non-selling space. It believes that there is a market potential to establish 4,800 locations nationally in the long term.

- Implement productivity improvements through operational initiatives and system enhancements, which will reinforce the value proposition and drive further growth.

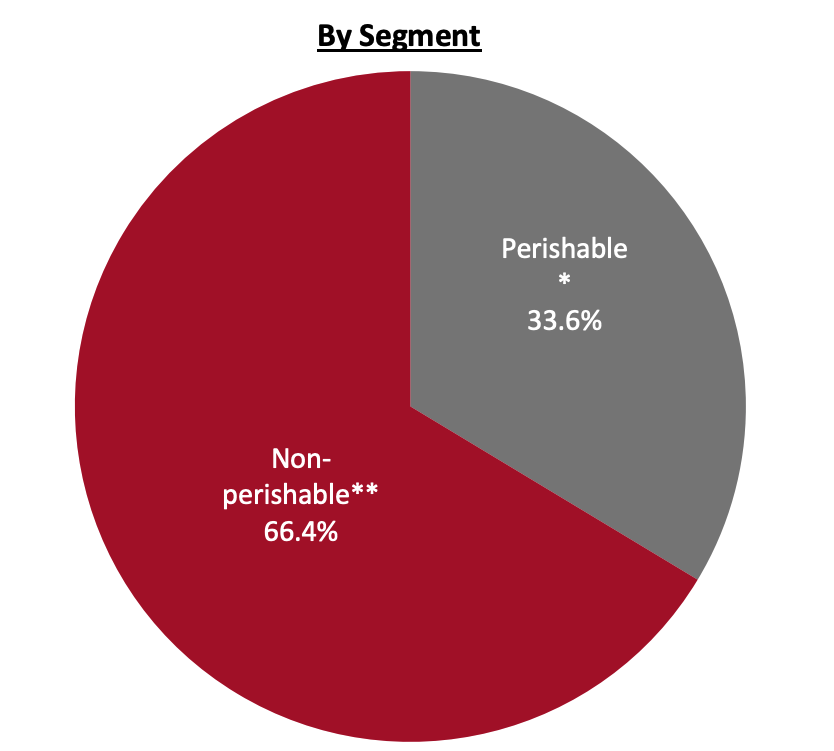

*Includes dairy products, deli produce, flowers, fresh meat and seafood

*Includes dairy products, deli produce, flowers, fresh meat and seafood**Includes beer and wine, frozen foods, general merchandise, grocery, and health and beauty products[/caption] Company Developments

| Date | Development |

| August 4, 2021 | Grocery Outlet announces that it has raised more than $2.8 million during its 11th annual Independence from Hunger Food Drive campaign. |

| January 19, 2021 | Grocery Outlet announces the expansion of the company’s Board of Directors to 12 members with the appointment of Gail Moody-Byrd and Maria Fernanda Mejia. |

| May 27, 2020 | Grocery Outlet’s majority owner, private equity firm Hellman & Friedman, announces that it will sell its remaining shares in the grocery retailer to equity shareholders on May 28. |

| November 19, 2020 | Grocery Outlet announces that it has expanded the company’s Board of Directors to 11 with the appointment of John E. Bachman and Mary Kay Haben. |

| June 10, 2019 | Grocery Outlet files a registration statement with the Securities and Exchange Commission for an initial public offering (IPO). |

- Eric Lindberg—CEO

- S. MacGregor Read, Jr—Vice Chairman and Director

- Charles C. Bracher—CFO

Source: Company reports