Source: Company reports and Bloomberg

4Q15 RESULTS

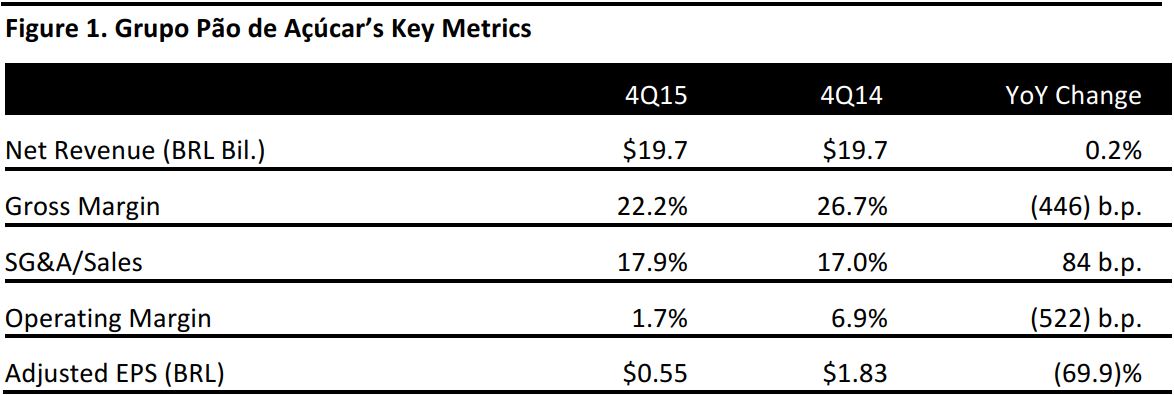

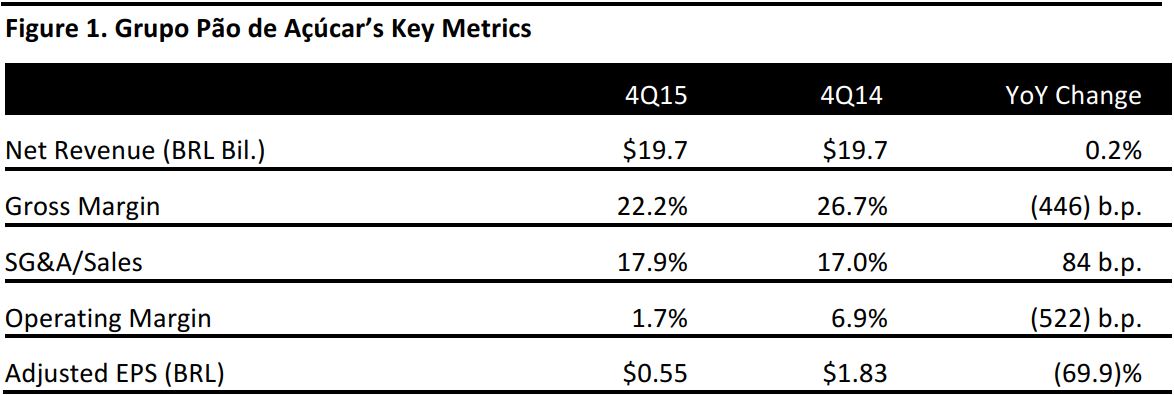

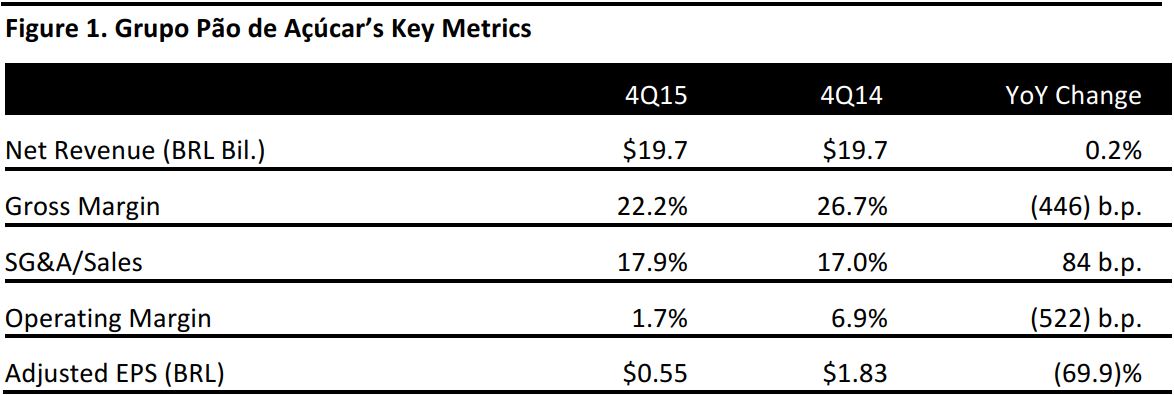

GPA saw a marginal increase in sales despite ongoing macroeconomic difficulties in Brazil. Growth at GPA’s food business, Assai, helped offset some of the declines in other businesses and maintained reported revenue growth of 27.8% year over year. Gross margins declined nearly 5 percentage points year over year due to price competition.

GPA’s consolidated comps were down 1.2% for 4Q15, due in large part to the poor performance of GPA’s Via Varejo stores, which sell mostly nondurable goods. Via Varejo saw a decrease of 15.2% in same-store sales in 4Q15, a decrease of 14.7% in net sales, and the closure of 51 stores since 2Q14.

2015 RESULTS

GPA’s reported revenues for 2015 were BRL$69.1 billion, a 5.5% increase from BRL$65.5 in 2014, driven mostly by nonfood sales. GPA opened 118 stores in 2015, 91 of which were in the food segment, which helped maintain a positive level of sales. Via Varejo’s performance reflected negativity overall, despite growth in other sectors.

EPS in 2015 was BRL$0.94, compared with EPS of $4.79 in 2014.

GUIDANCE

In 2016, the company intends to continue to focus on price competitiveness amid ongoing economic weakness in Brazil. Consensus estimates in 2016 are for revenues of BRL$74.4 billion and EPS of BRL$2.15.