Source: Company reports/Fung Global Retail & Technology

On March 31, 2017, Fung Global Retail & Technology attended Golden Eagle’s analyst briefing in Hong Kong, where senior management discussed the company’s full-year results, underlying trends in China’s retail landscape and future strategies.

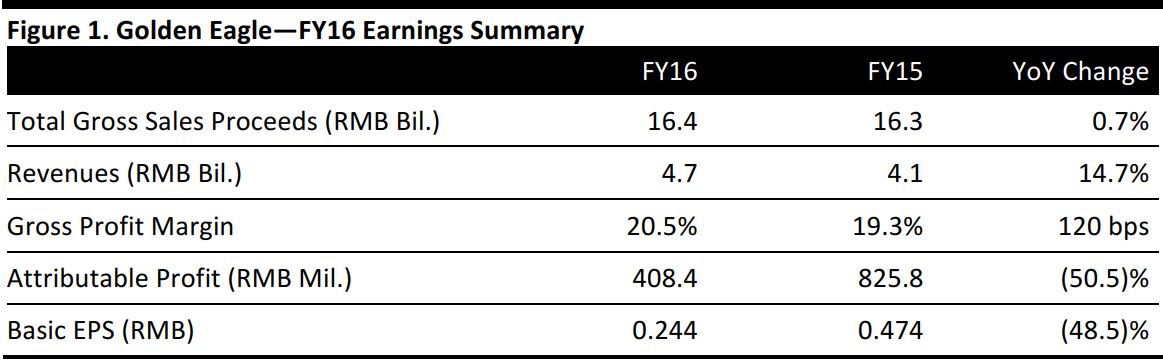

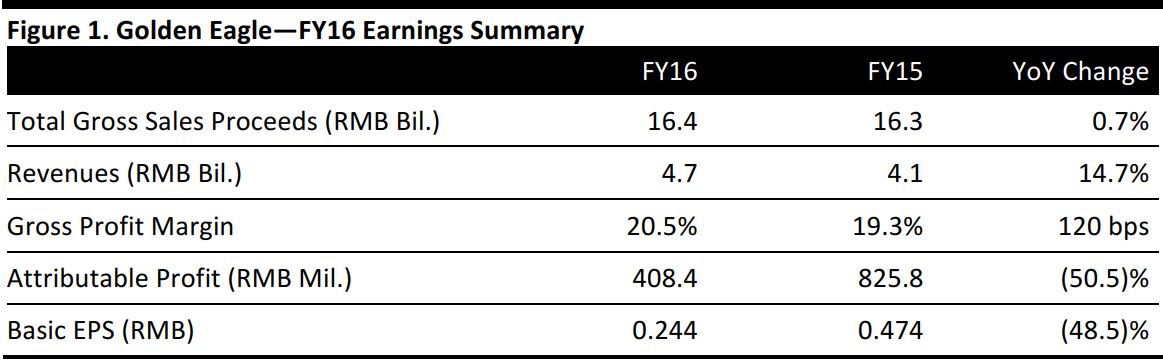

FY16 Results Review

During FY16, total gross sales proceeds of the group amounted to ¥16,399.3 million, up 0.7% year over year, due to the inclusion of full-year sales proceeds of newly operated or acquired stores. Same-store sales growth declined by 4.1% and net profit dropped sharply to ¥401.0 million versus the consensus estimate of ¥765.3 million, mainly due to a 92.2% decrease in other income.

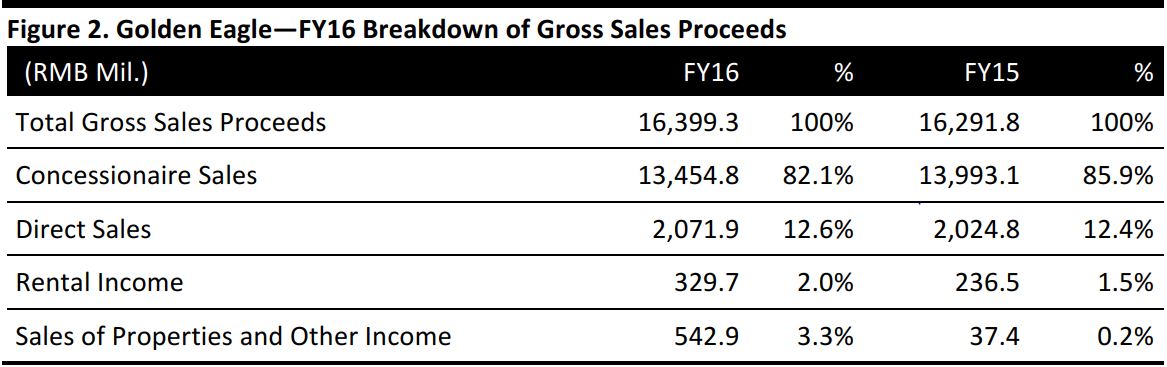

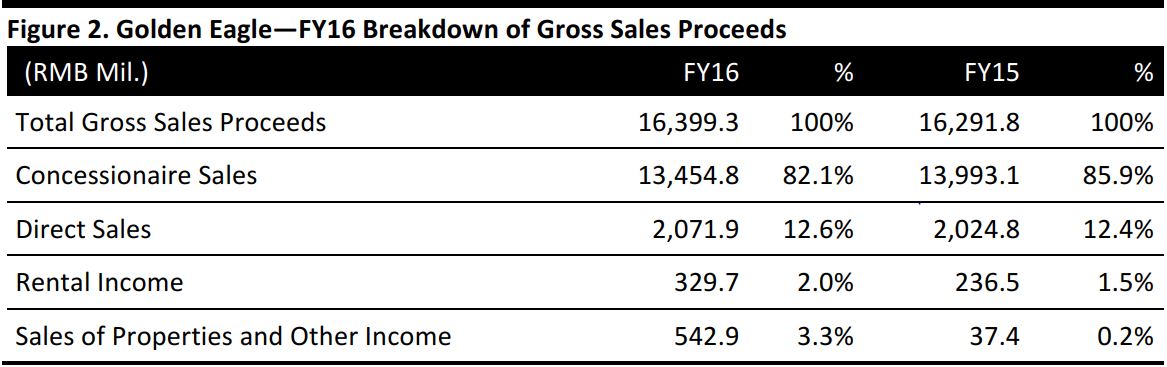

Breakdown of Gross Sales Proceeds

Concessionaire sales totaled ¥13,454.8 million, which accounted for 82.1% of the group’s total gross sales proceeds, dropping 3.8% from 2015. Direct sales amounted to ¥2,071.9 million, representing 12.6% of total gross sales proceeds.

Source: Company reports/Fung Global Retail & Technology

FY16 Sales Performance by Category

By product category, athleisure and consumer appliances outperformed, while menswear and womenswear underperformed.

Apparel and accessories contributed 50.9% the gross sales proceeds, down from 51.4% the previous year. Gold, jewelry and timepieces contributed 16.9% in FY16, compared to 17.9% in FY15. Cosmetics contributed 9.6%, up from 8.9% in FY15, and outdoor and sportswear contributed 7.1%, up 1.1% from the previous year.

Commission Rate and Gross Profit Margin

The overall gross profit margin increased to 20.5% in FY16 from 19.3% in FY15.

The gross profit margin from concessionaire sales and direct sales increased 0.1% to 17.8% in FY16. The modest margin improvement was attributable to management’s focus on productive sales with a reasonable profit margin. This was partially offset by an increase in the sales contribution from younger stores that carry a lower commission rate.

Other Income

Other income, gains and losses decreased by 92.2% to ¥30.4 million for FY16, largely driven by a net foreign exchange loss, a decrease in gains on disposals of the Group’s securities investments and the absence of one-off gains due in part to the acquisition of the Global Era Group in 2015. The fluctuations in the renminbi exchange rate during the year contributed to a net foreign exchange loss of ¥522.0 million.

FY17 Outlook and Future Strategies

The group is striving to become a high-quality and integrated services operator, with an emphasis on a seamless customer experience and products with a high gross margin and market potential.

The company’s strategies include:

- Open new stores: Golden Eagle will open three new stores in 2017 and 2018—in Nanjing, Yangzhou and Jiangsu. By the end of 2019, it will have 34 stores throughout China with a GFA of over 3 million square meters. As of March 31, 2017, it operates 31 stores in China.

- Curate high-quality,brand-named products that are reasonably priced: To satisfy customers’ demands for comprehensive lifestyle services and experiences, Golden Eagle will focus on its G.Life series, which includesG•MART supermarket, G•TAKAYA bookstores, G•BABY children’s products, G•BEAUTY, G•HEALTH and G•QUTE pet products.

- Further develop omnichannel retailing: Golden Eagle will tap the potential of the e-commerce platform, by further enhancing the Goodee Mobile App with newly launched functions.