Web Developers

As Sephora and Ulta Beauty battle it out in the $56 billion US beauty retail market, we take a close look at the results of a July 2018 beauty consumer survey conducted by Prosper Insights & Analytics to see what drives these companies’ customers. We also compare and analyze the two companies’ loyalty programs in this report.

Introduction

Sephora and Ulta Beauty are two leading beauty retail chains in the US and are competing head-to-head in the marketplace. In this report, we compare these two retailers and examine what drives their shoppers. We also compare the monthly skincare and cosmetics spending of shoppers at each, and take an in-depth look at their loyalty programs, both of which have been upgraded this year. For any company, a loyalty program helps drive sales and customer engagement and is, therefore, a core component of the business. In 2016, Bridget Dolan, VP of Sephora’s Innovation Lab, said that members of the Sephora Beauty Insider loyalty program drove over 80% of the company’s sales. At Ulta’s 2018 Analyst and Investor Day on November 8 this year, CEO Mary Dillon said, “Ultamate Rewards is truly one of our most valuable assets, and it’s a key platform for our business as we look forward.” Ulta Chief Merchandising and Marketing Officer David Kimbell added, “Over 95% of our sales go through our loyalty program.”Sephora and Ulta: An Overview

Sephora was founded in 1969 and acquired by LVMH Moët Hennessy Louis Vuitton in 1997. LVMH is one of the largest luxury goods companies in the world and Sephora is one of its Selective Retailing Houses; financial disclosures on Sephora are somewhat limited. As of November 2018, Sephora operated more than 1,004 stores in the Americas, including shop-in-shop locations within JCPenney stores, according to the Sephora website. The company has more than 430 stores across the US and Canada and 574 locations in JCPenney stores. The company operates 2,300 stores in 33 countries worldwide, and the Sephora North American headquarters and an innovation lab are located in San Francisco. Sephora focuses on beauty products in the midmarket to premium segments and offers beauty services and classes at many of its locations. It sells more than 15,000 products from 300 brands as well as the Sephora Collection, its private label, which was launched in 2002. The Sephora Collection is the company’s most affordable line, offering an assortment of more than 500 products across all categories. Sephora shoppers can try products in-store before purchasing them, and sales associates are available to provide recommendations and tutorials. The company also offers beauty classes, which are often free for Sephora Beauty Insider members; arranges store events; and provides beauty services such as mini facials, custom makeovers and in-store hair salons. In October 2018, Sephora held a two-day beauty shopping festival called the Sephoria House of Beauty, which was a social and shopping experience where guests were taken through themed rooms and beauty experiences. More than 50 brands participated in the festival. Sephora launched its Beauty TIP (Teach, Inspire, Play) concept stores in 2015. These stores feature centralized Beauty Workshop workstations, which are tables where shoppers come together to learn via group beauty classes with trained facilitators, leverage tutorials and Sephora Virtual Artist technology on integrated in-store iPads, and gather inspiration from The Beauty Board, a shoppable gallery of user-generated content on a large digital screen. Each workstation is equipped with its own products, iPad, USB port and Wi-Fi, so shoppers can play, browse and share looks on the digital screen and online, right from their seats. In 2017, the company launched Sephora Studios, which are smaller-footprint, freestanding stores—around half the size of a typical Sephora store—that feature digital components and one-on-one beauty services, such as makeovers and mini facials. The studios are located outside malls and offer curated experiences to attract new customers. Ulta was founded in 1990 and operates 1,163 stores, each with a salon, across all 50 states and the District of Columbia in the US. The company plans to open approximately 80 stores next year, and 70–75 stores in each of the following two years, to reach approximately 1,400 stores by the end of 2021. Most Ulta stores (96%) are about 10,000 square feet in size. When asked about international expansion at the company’s Analyst and Investor Day event in November, CEO Mary Dillon said, “We’re studying; we don’t have anything to announce today.” Ulta also announced at its investor event that it was changing its company tagline from “All Things Beauty, All in One Place” to “The Possibilities Are Beautiful.” Ulta offers more than 500 brands and 20,000 SKUs, including mass-market (drugstore items) and mid-range to premium (prestige) beauty products. Ulta reported that it has added more than 250 brands to its offering since 2016, 100 of which are in skincare. The company has added more prestige brands and increased penetration of its prestige portfolio, which includes Chanel, Clinique, Estée Lauder, Kate Somerville, Kiehl’s, Lancôme, MAC, Mario Badescu, NARS and Peter Thomas Roth. The company reported that it is seeing a blurring of the lines between mass-market and prestige brands, with most Ulta customers shopping across both segments. Tara Simon, SVP of Merchandising for Prestige Beauty, said that the company’s customers are exhibiting “mass migration,” meaning they may start at Ulta buying mass-market brands and then, over time, begin buying prestige brands, while continuing to buy just as many, or more, mass-market items. Ulta currently holds 23% of the prestige beauty market, according to The NPD Group, up from 15% in 2016; cosmetics drove the majority of the growth since 2016. Ulta targets the “beauty enthusiast,” who has a high passion for beauty and high expectations in terms of in-store and online shopping experiences. The company estimated at its investor event that beauty enthusiasts comprise 57% of its shoppers and that 77% of their spending is on beauty products (not services). Ulta offers many brand exclusives (available only at Ulta). These include both private-label products and brands that were developed exclusively for Ulta. For example, NYX launched its Can’t Stop Won’t Stop full-coverage foundation exclusively with Ulta and Kim Kardashian West partnered with Ulta as an exclusive brick-and-mortar partner for four scents that launched for holiday 2018. Ulta offers hair, skin, brow and makeup services at its salons, and Dillon said at the William Blair & Company Growth Stock Conference in June 2018 that the company’s in-store services are a differentiator and are growing at a faster rate than the industry average. Salon services represent only 5% of Ulta’s total sales and are used by approximately 6% of its loyalty program members. In the second quarter of 2018, Ulta’s e-commerce business grew by 37.9% year over and represented 9% of total company sales. The company reported that online-only brands and online-only promotions had contributed to this growth.What Drives Sephora and Ulta Shoppers?

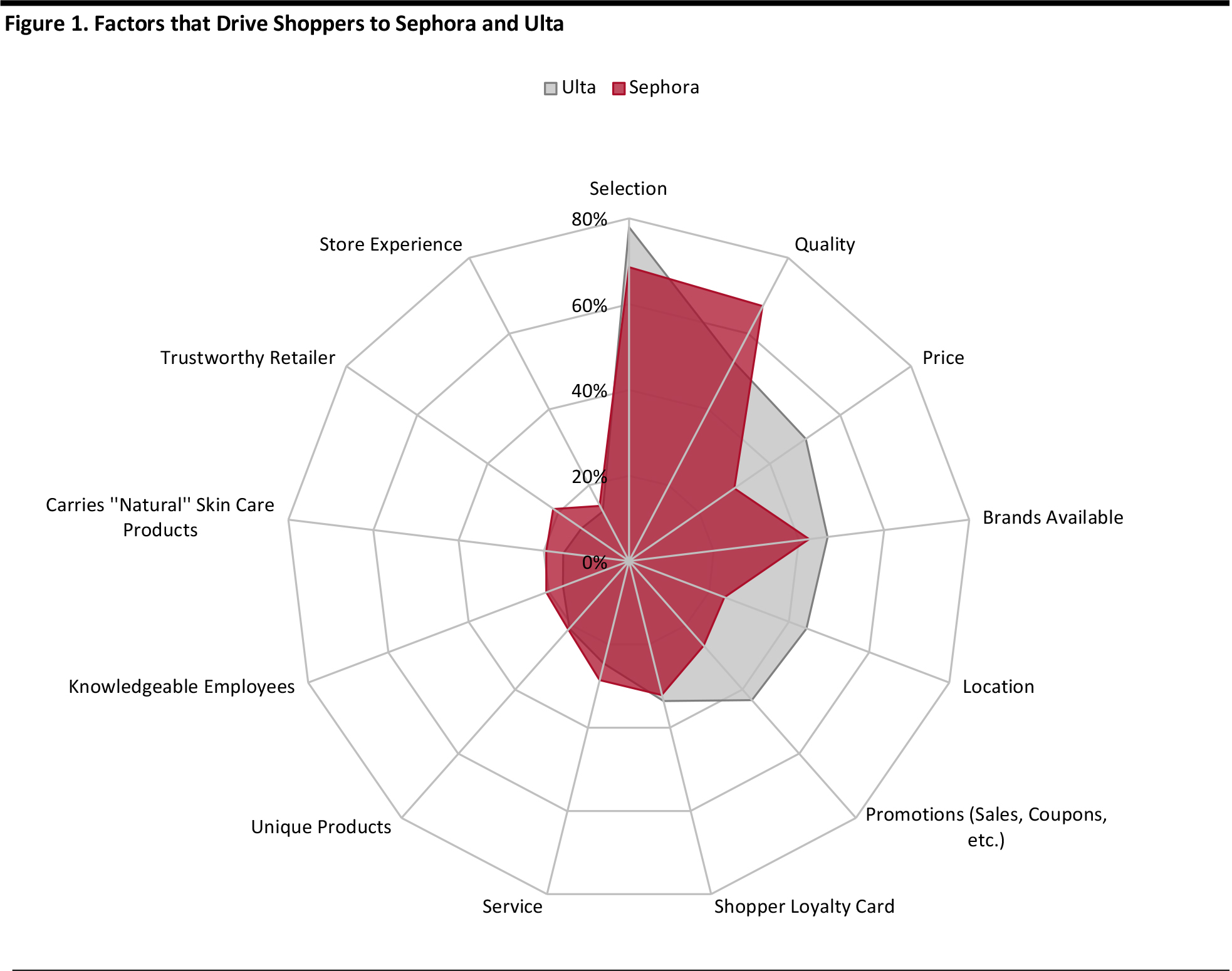

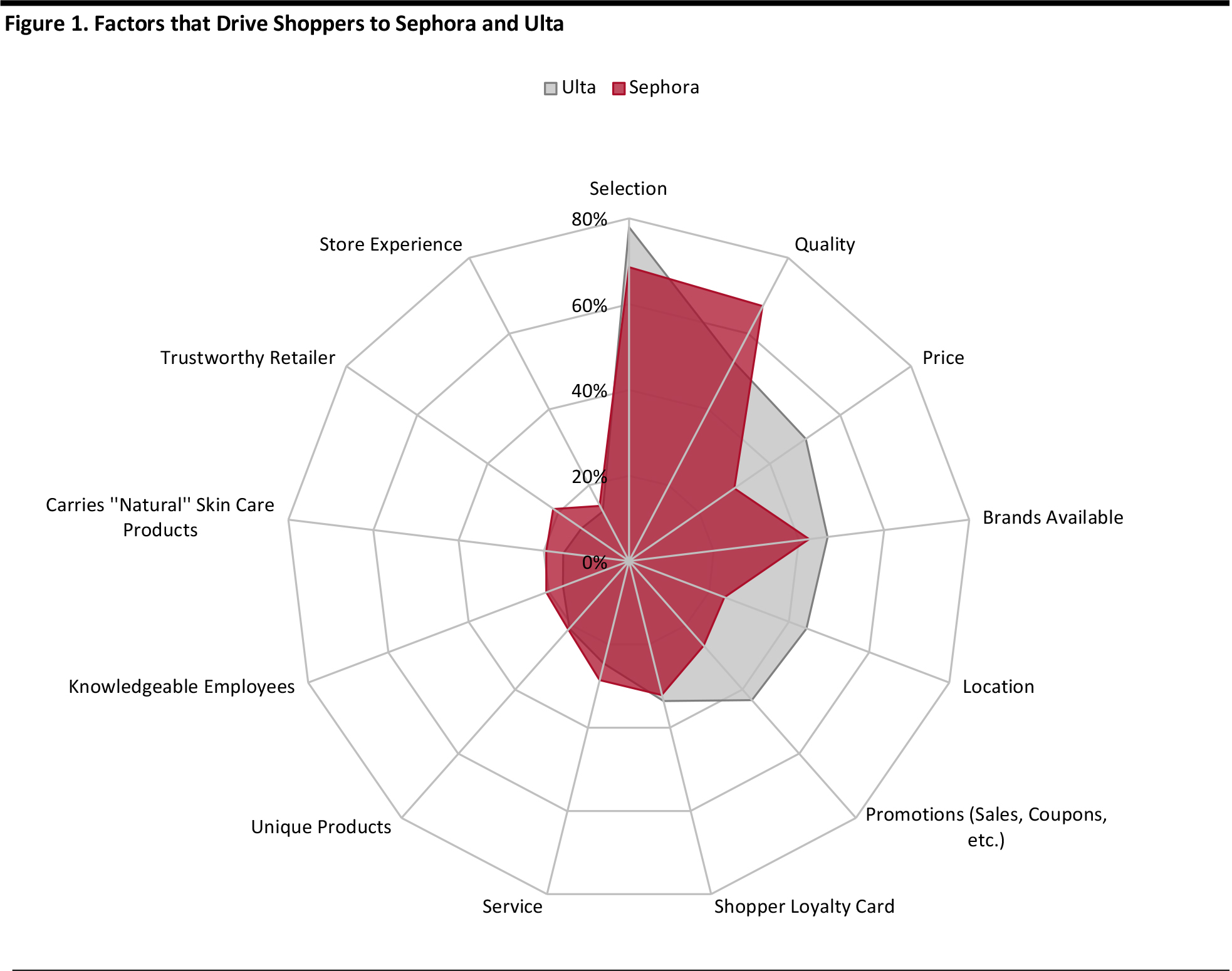

In this section, we take a close look at Prosper’s July 2018 beauty consumer survey and discuss what makes consumers want to shop at Sephora and Ulta. To see whether consumer drivers have changed, we compare findings from Prosper’s latest beauty survey with those from its previous one, conducted in November 2016, which we analyzed in our Beauty Loyalty Programs: Sephora vs. Ulta report in May 2017. The figure below illustrates what drives consumers to shop at the two retailers, according to Prosper’s latest survey.

Base: 200 Ulta shoppers ages 18+ and 163 Sephora shoppers ages 18+; survey published in July 2018 Source: Prosper Insights & Analytics

As the graph above highlights:- Selection, or merchandise mix, is the most significant driver for both Sephora shoppers and Ulta shoppers, and it has increased in importance since Prosper conducted its previous survey in November 2016. In the latest Prosper survey, 69% of Sephora shoppers and 78% of Ulta shoppers said that the available range of products is one of the reasons they choose their preferred beauty retailer. In Prosper’s November 2016 survey, those figures were 65% for Sephora shoppers and 77% for Ulta shoppers.

- In the latest Prosper survey, quality was the next most-popular reason cited for shopping at Sephora and at Ulta. However, the percentage of shoppers choosing this as an important consideration fell for both retailers between 2016 and 2018, from 75% to 67% at Sephora and from 60% to 53% at Ulta.

- Prices and promotions were bigger drivers for Ulta shoppers in both 2016 and 2018, but this year’s survey found that a slightly lower percentage of shoppers at both retailers are driven to them by prices. In the 2018 survey, 30% of Sephora shoppers cited prices as an important consideration, down from 32% in 2016. Meanwhile, just over half of Ulta shoppers cited prices as a reason to shop at Ulta, down from with 53% in 2016.

- Shopper loyalty programs are important to roughly equal percentages of Sephora (32.2%) and Ulta (33.6%) shoppers. However, Sephora has seen a much more substantial rise in this metric, with the percentage of Sephora shoppers citing its loyalty program as a driver increasing from 21% in 2016 to 32.2% this year. The percentage of Ulta shoppers citing its loyalty program as a driver increased from 30.6% to 33.6% in the same period.

- The percentage of respondents citing the availability of unique products as a driver is roughly the same (~21%) at both retailers. This metric has declined in importance since 2016, when the percentage of shoppers citing it as an important driver was 27% for Sephora and 26% for Ulta.

- Location is a much more important consideration for Ulta shoppers than it is for Sephora shoppers. Some 44% of Ulta shoppers consider location an important reason to shop the retailer, while only 24% of Sephora shoppers cite it as a reason to shop Sephora.

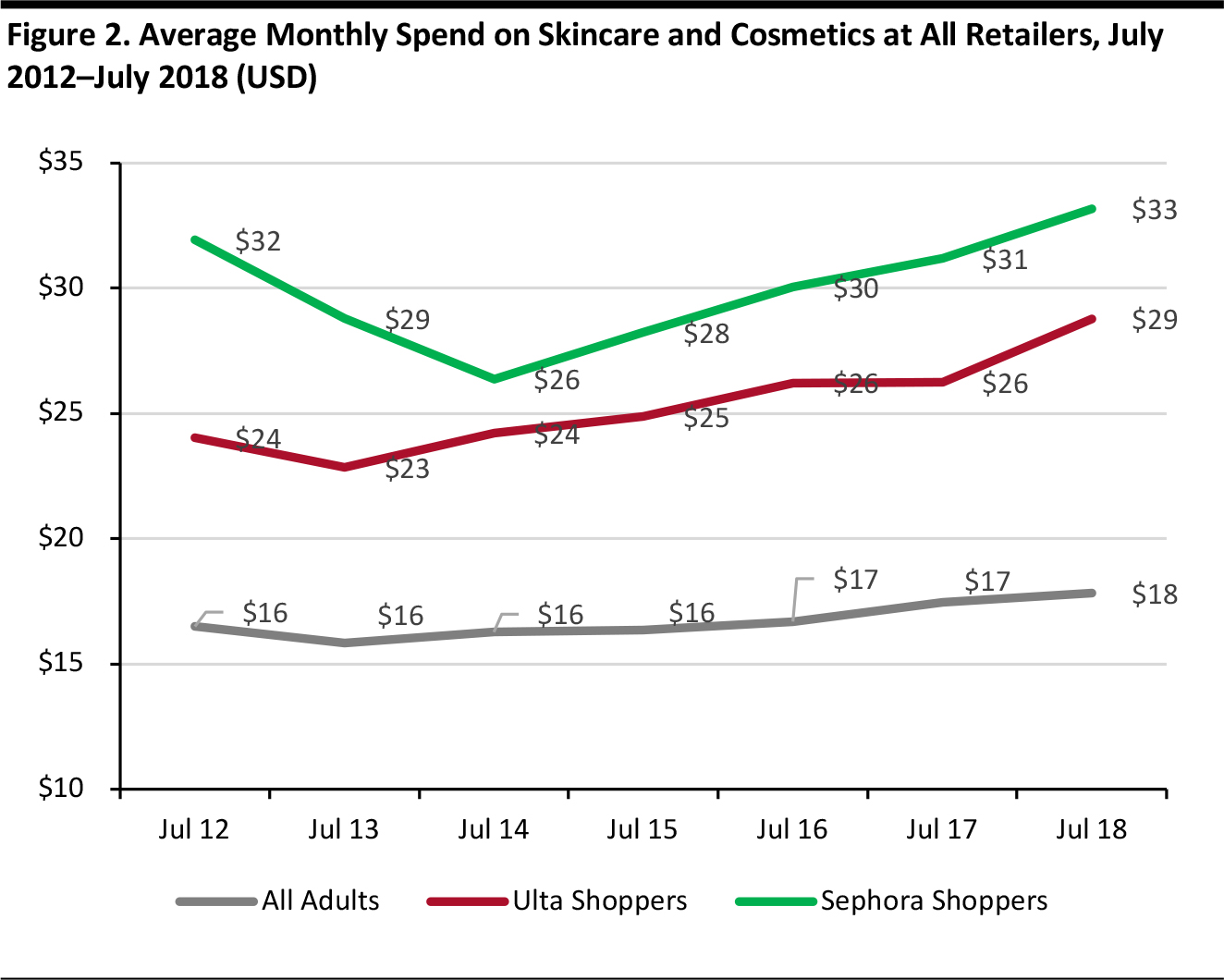

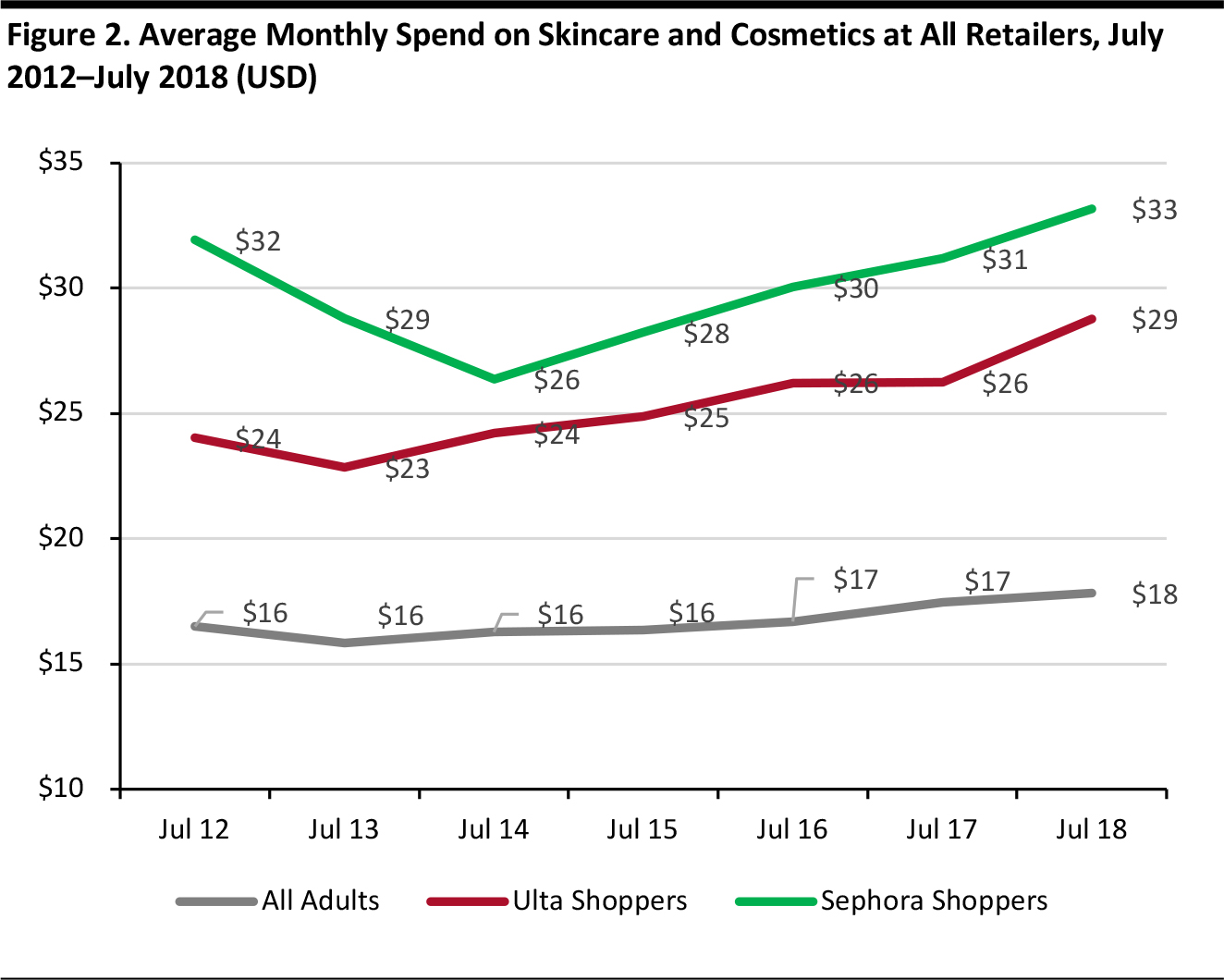

Sephora Shoppers Spend More per Month than Ulta Shoppers

According to the latest Prosper survey, Sephora shoppers spend, on average, $33.17 per month on skincare and cosmetics across all retailers, which is $4.39 more than the corresponding figure for Ulta shoppers, $28.78 across all retailers. Among all survey respondents (not just Sephora and Ulta shoppers), the average monthly expenditure on skincare and cosmetics is $17.83. Compared with 2016, the average monthly skincare and cosmetics spending of both Sephora and Ulta shoppers has increased by 10%, from $30.04 to $33.17 for Sephora shoppers and from $26.23 to $28.78 for Ulta shoppers.

Source: Prosper Insights & Analytics

Sephora’s and Ulta’s Loyalty Programs

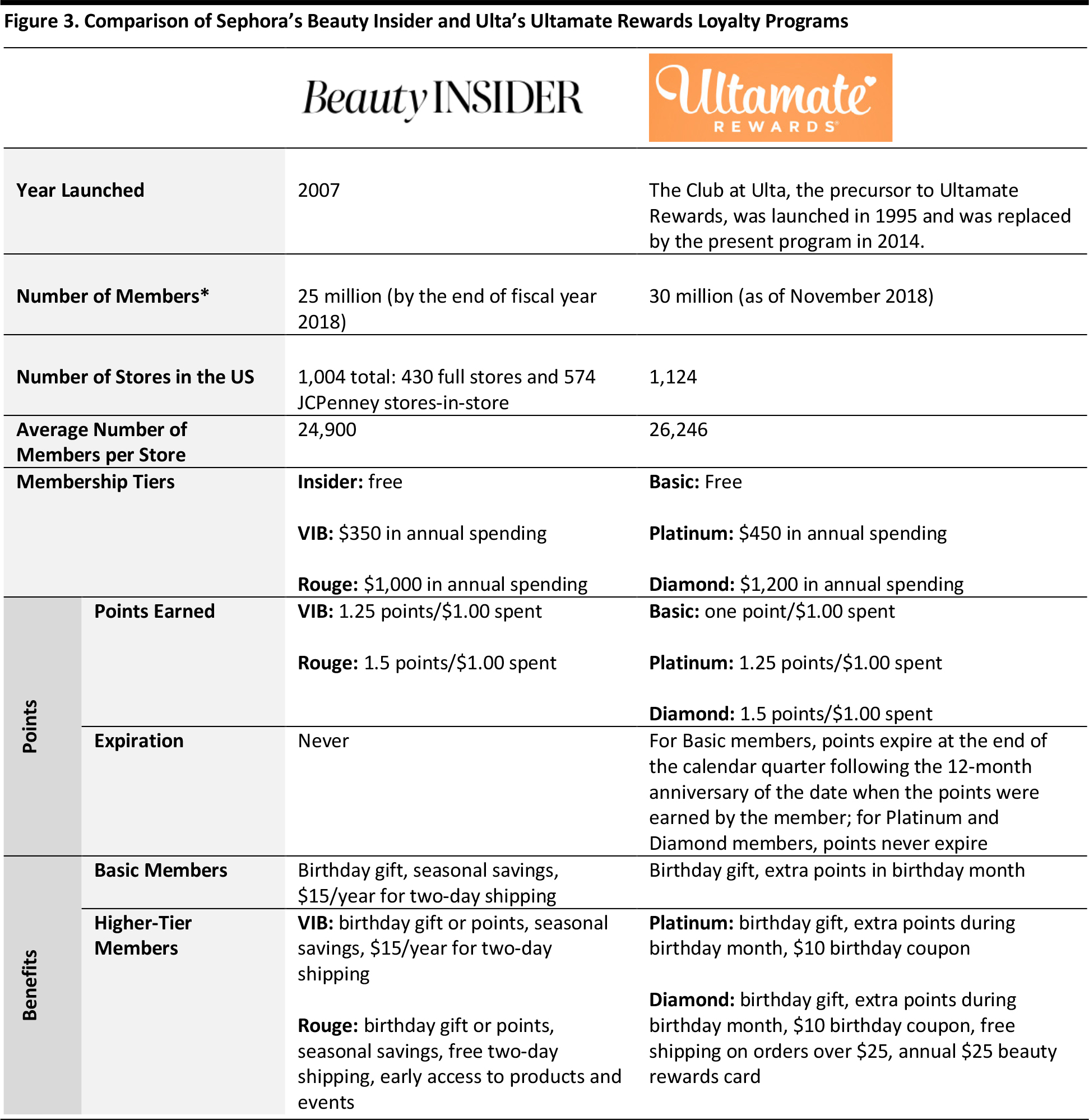

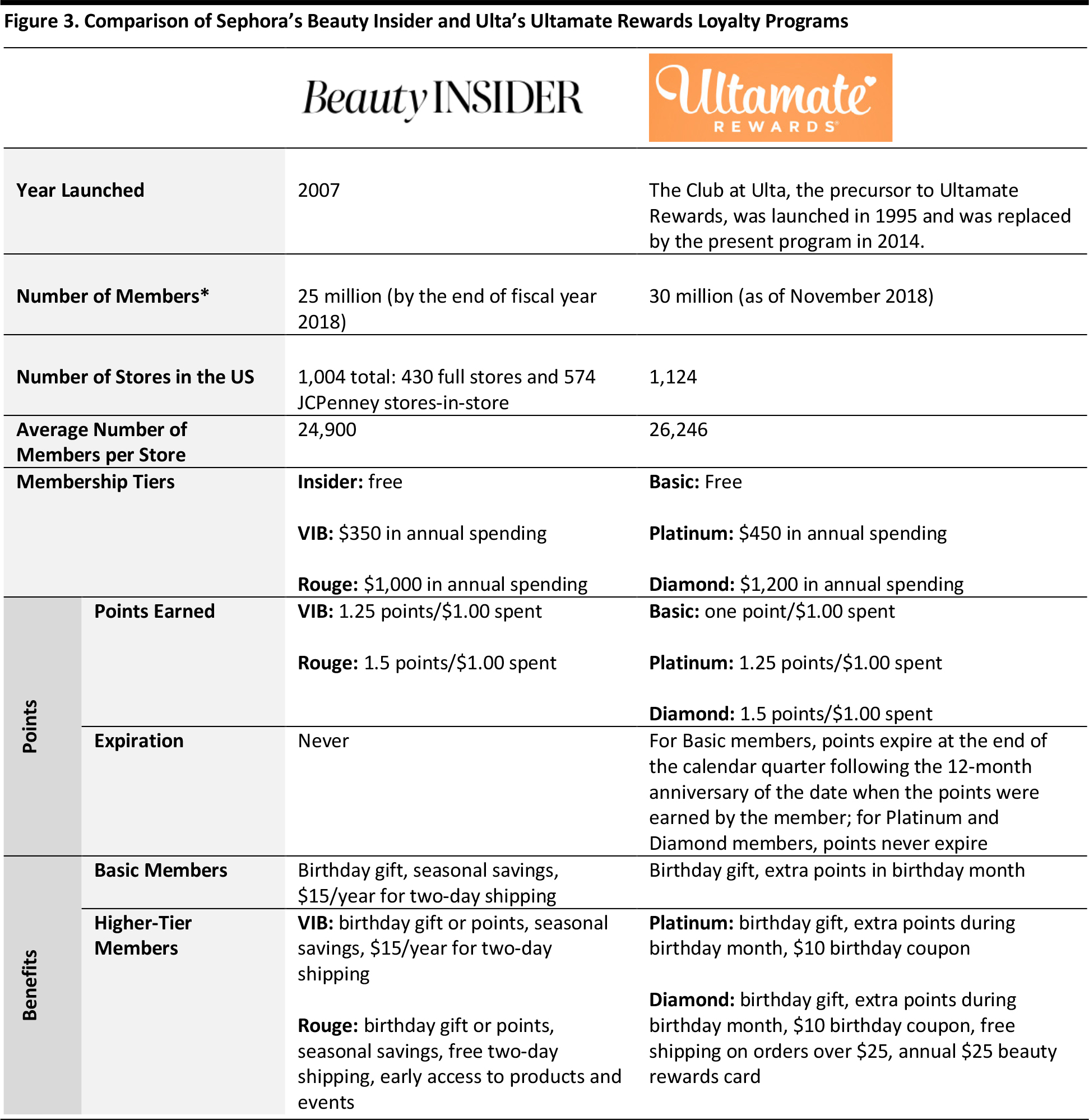

Sephora and Ulta both offer loyalty programs that reward members with points based on how frequently they shop and the amount they spend. Sephora’s Beauty Insider loyalty program and Ulta’s Ultamate Rewards program both allow members to accumulate points and use them to pay for selected items and services, and both retailers’ programs are available in stores across the US and on their websites. This year, both retailers have revamped and enhanced their loyalty programs:- Sephora: In August 2018, Sephora enhanced its Beauty Insider program to target its higher membership tiers, called VIB and Rouge, and expanded the range of products available to these members when they redeem their loyalty points. VIB members earn 25% more points and Rouge members earn 50% more points for every purchase made. Sephora added a $100 Rouge Reward gift card for members who accumulate 2,500 points and now gives VIB and Rouge members the choice of a receiving a birthday gift or 250 points on their birthdays.

- Ulta: In January 2018, Ulta added a third tier, Diamond, to its Ultamate Rewards program. Diamond members must spend a minimum of $1,200 annually at Ulta. They earn 1.5 points for every dollar spent and are also eligible for free shipping on orders over $25 and a $25 gift card for any beauty service available at the store.

*Sephora Beauty Insider figure is an estimate, according to a July 31, 2018, Women’s Wear Daily article; Ulta Ultamate Rewards figure is actual as of November 2018. Source: Company reports/WWD.com

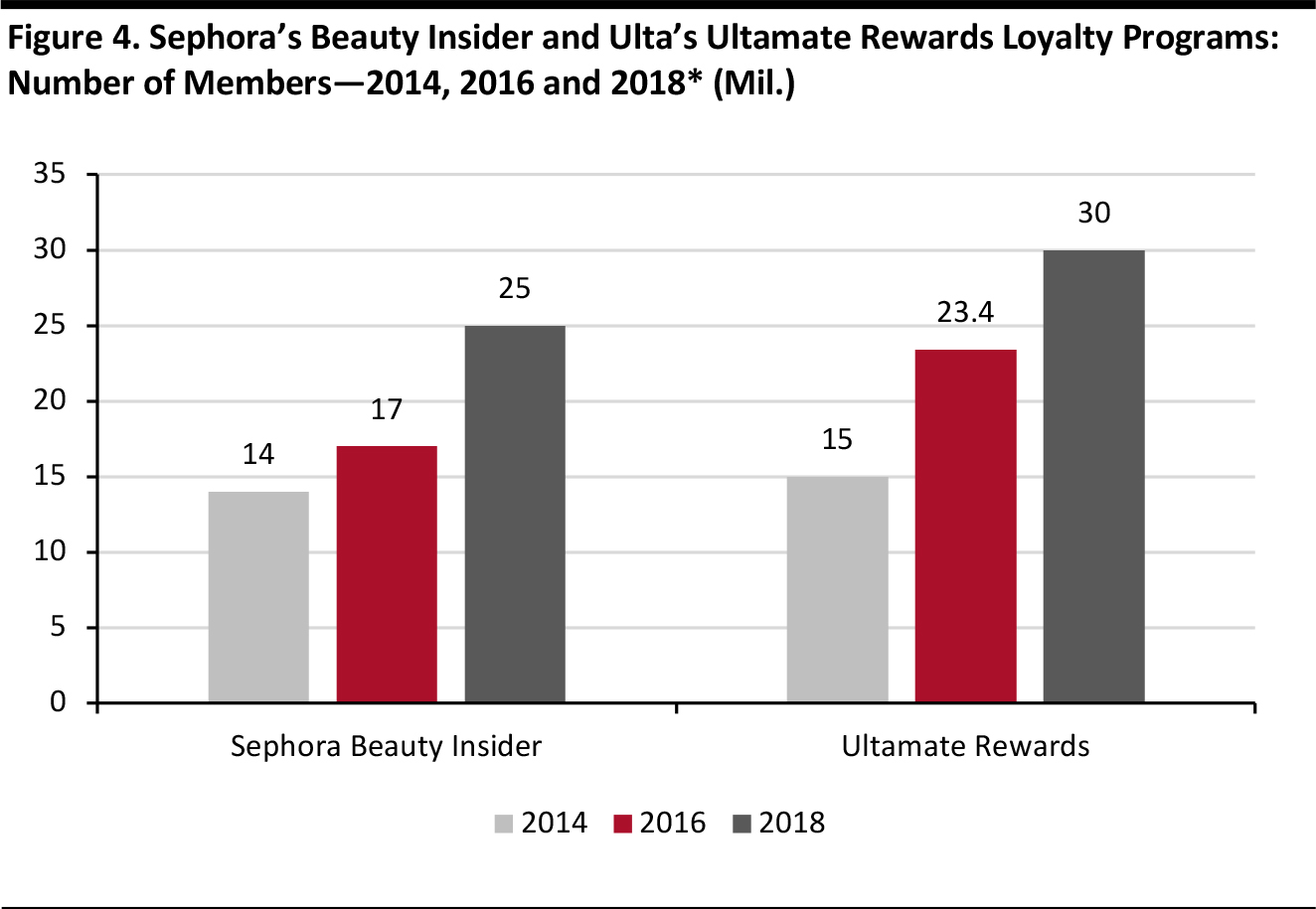

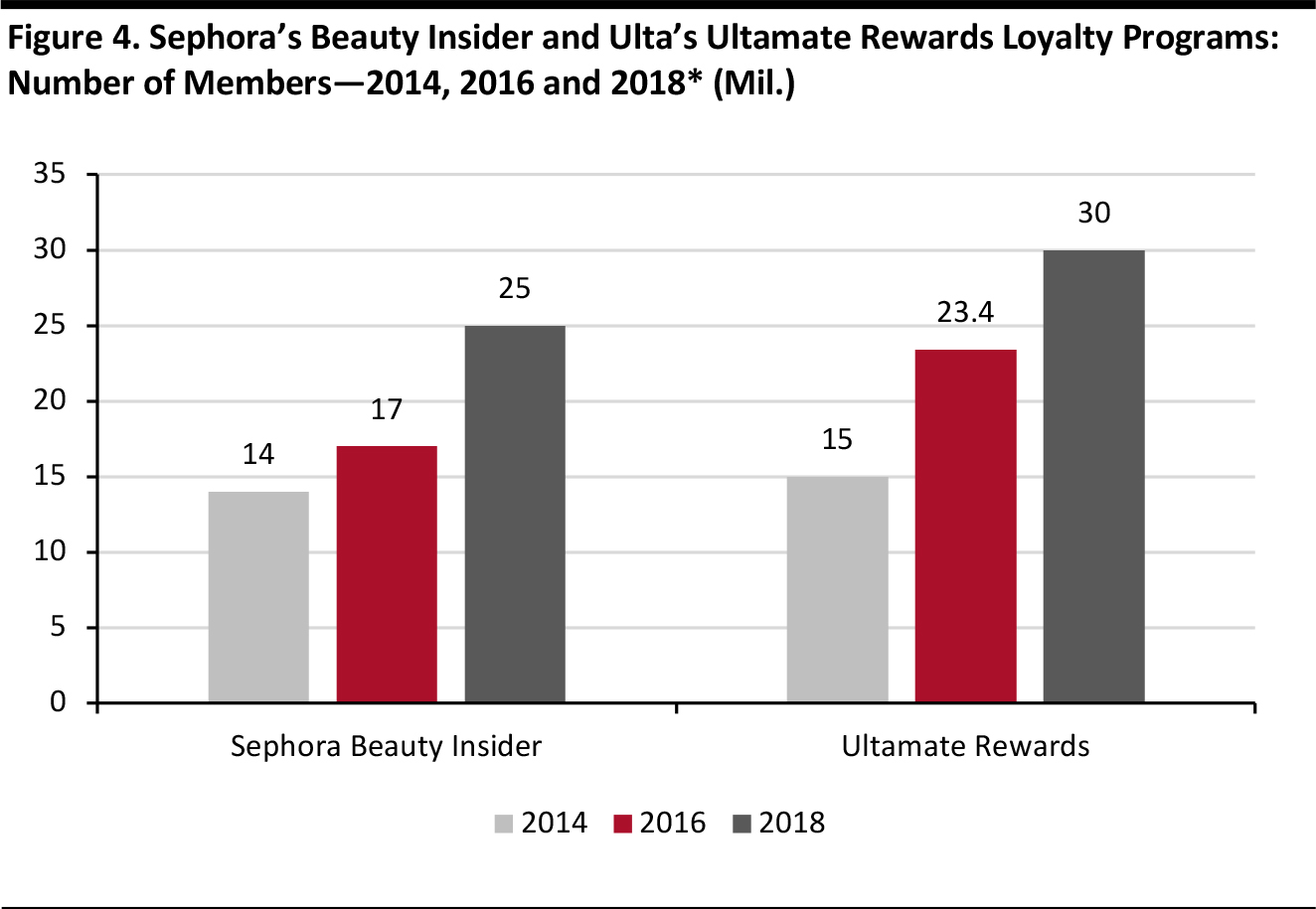

Sephora’s Loyalty Program Is Growing Faster, but Ulta’s Has More Members

Sephora’s loyalty program is growing faster than Ulta’s, but Ulta’s has more members. According to an estimate in a July 2018 article in Women’s Wear Daily, Sephora Beauty Insider membership will grow by 47% from 2016 through the end of the company’s 2018 fiscal year, from 17 million to 25 million. Ultamate Rewards membership has grown by 28.2% since 2016, from 23.4 million to 30 million as of November 2018, according to Ulta. These figures represent a change from the 2014–2016 period, when loyalty program membership was growing much faster at Ulta than at Sephora. Ultamate Rewards had 15 million members in 2014, and membership grew by 56%, to 23.4 million, in 2016. Sephora’s Beauty Insider membership base grew by a much slower 21% between 2014 and 2016, from 14 million to 17 million.

*2018 figure for Sephora Beauty Insider is an estimate, according to a July 31, 2018, Women’s Wear Daily article; Ultamate Rewards figure is actual as of November 2018. Source: Company reports/WWD.com

Comparing the Two Loyalty Programs’ Rewards and Benefits

Sephora’s Beauty Insider program is geared toward services and Ulta’s Ultamate Rewards program focuses on value, in alignment with the brands’ respective positionings. Sephora offers free beauty classes and custom makeovers to its higher-tier loyalty program members, along with early access to, and special offers at, events such as Sephoria House of Beauty. Ulta’s program, on the other hand, drives members to spend more by providing extra points for each purchase.Use of Tiers and Exclusive Services to Drive Sales

The two retailers’ loyalty programs are more similar than they were two years ago. Ulta has added an additional tier to its loyalty program and Sephora has expanded its gift redemption offerings and services by adding full-size products and increasing the range of items covered under the Beauty Insider program. According to a March 2018 study by Bond Brand Loyalty, paid loyalty programs and tiers are associated with higher spending by members, higher advocacy and longer-term brand loyalty. The study found that 37% of consumers are now willing to pay a fee for enhanced loyalty program benefits, versus 30% in 2017. According to the study:- RH (formerly Restoration Hardware) offers a paid membership program that is credited with 95% of the company’s sales. The program also helps reduce returns and increase inventory accuracy.

- GameStop offers its loyalty program members access to exclusive sales, expedited shipping and more points per dollar spent. The company reported that the benefits led to PowerUp Pro members making purchases that were three times higher than those made by nonmembers.

Leveraging Customer Loyalty Data to Personalize Experiences

Both Sephora and Ulta are leveraging loyalty program data to provide personalized experiences to members. These data provide the retailers with customer insights, including individual customers’ preferences, and help them make informed decisions across different touchpoints. For example:- Sephora launched a clean beauty section based on Sephora Beauty Insider data. Artemis Patrick, the company’s CMO, was quoted in Women’s Wear Daily as saying, “We know over 60% of women that buy beauty read the label before they do, and over 54% want to know if it’s natural or clean and what ingredients are in there.”

- Sephora is leveraging data and technology to personalize recommendations. The company tied for fifth place in a Salesforce mystery shopping study that found that the retailer was especially strong in personalization. Shoppers can obtain Skincare IQ, Color IQ and Fragrance IQ results at in-store cosmetics kiosks and then sync the results with their Sephora digital account. The Sephora app also recommends in-store products to shoppers based on purchases made.

- Ulta launched GlamLab, where shoppers can virtually try on makeup products in order to offer a better customer experience. CEO Mary Dillon talked about Ulta’s use of data and technology at the company’s Analyst Day in November and said that Ulta is focusing on personalization as a driver of loyalty and “leveraging guest insights and data to create more real-time, relevant and meaningful interactions. She said, “We are also focused on experience-specific platforms, GlamLab, a virtual try-on mobile capability and conversational commerce, two-way and voice-enabled interactions with our guests.”

Key Takeaways

Sephora’s and Ulta’s product offerings and loyalty programs are becoming more similar. Both retailers now offer three loyalty tiers and Ulta’s offering is shifting more toward services and prestige makeup, two areas that have traditionally been Sephora strongholds. The factors that drive shoppers to these retailers still differ somewhat, however.- Sephora shoppers spend, on average, $33.17 per month on skincare and cosmetics across all retailers, according to consumer survey data from Prosper. This average has increased by 10% since 2017, and has consistently trended upwards since 2014.

- Beauty shoppers cite selection, quality and service as top reasons for shopping at Sephora, which is consistent with the brand’s image, according to the survey.

- Sephora’s Beauty Insider loyalty program has grown faster than Ulta’s Ultamate Rewards program since 2016 and is expected to grow by 47%, from 17 million members to 25 million by the end of Sephora’s fiscal 2018 year.

- Sephora’s loyalty program offers personalized services and recommendations in conjunction with its Sephora TIP beauty workstations. The program also offers access to Sephora Workshops and Sephora Studios, and exclusive invitations to beauty events. Sephora continues to develop events and personalized content that will encourage shoppers to spend more and further drive Sephora’s premium market positioning.

- Ulta shoppers spend, on average, $28.78 per month on skincare and cosmetics across all retailers, according to Prosper’s most recent consumer survey, $4.39 less than the average that Sephora shoppers spend.

- Selection and quality are the top reasons beauty shoppers cite for shopping at Ulta, but Ulta shoppers place significantly more weight on prices and promotions than Sephora shoppers do.

- With 30 million members as of November 2018, the Ultamate Rewards program is bigger than Sephora’s Beauty Insider program. Ulta’s new tagline, “The Possibilities Are Beautiful,” appeals to both mainstream and prestige beauty shoppers, consistent with its larger loyalty program membership base.

- As Ulta expands its offerings in mass-market and prestige makeup, beauty exclusives and services, and personalized initiatives, we expect to see growth in both its Ultamate Rewards program and sales.