Nitheesh NH

Our quarterly Global Tourism series discusses domestic and international tourism themes and trends. In this report, we look at the booming airport retail market.

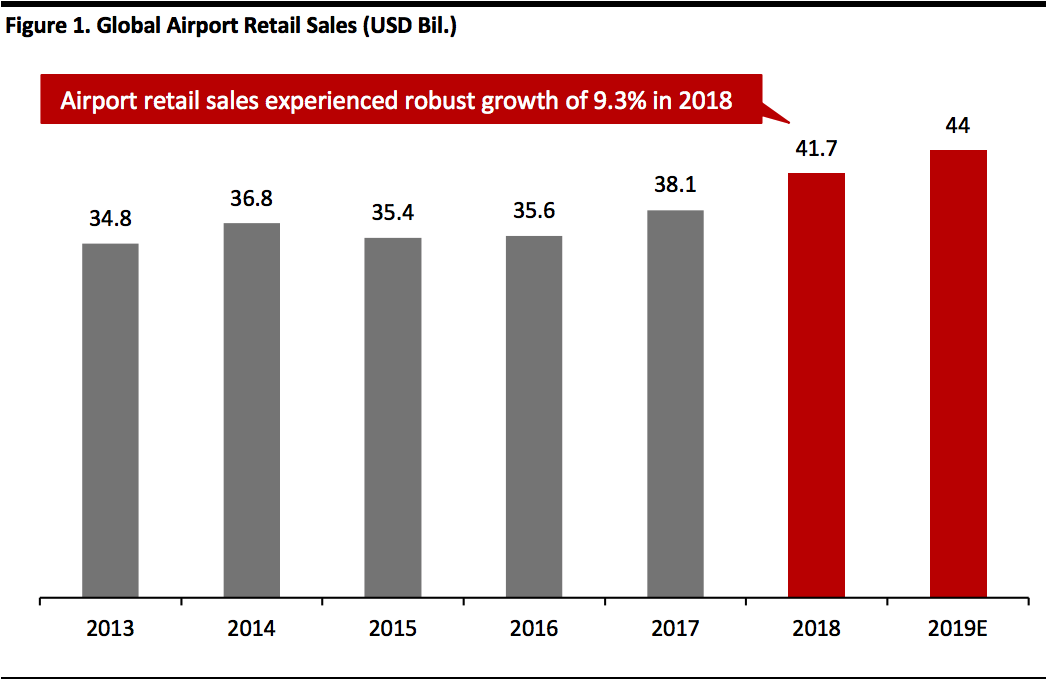

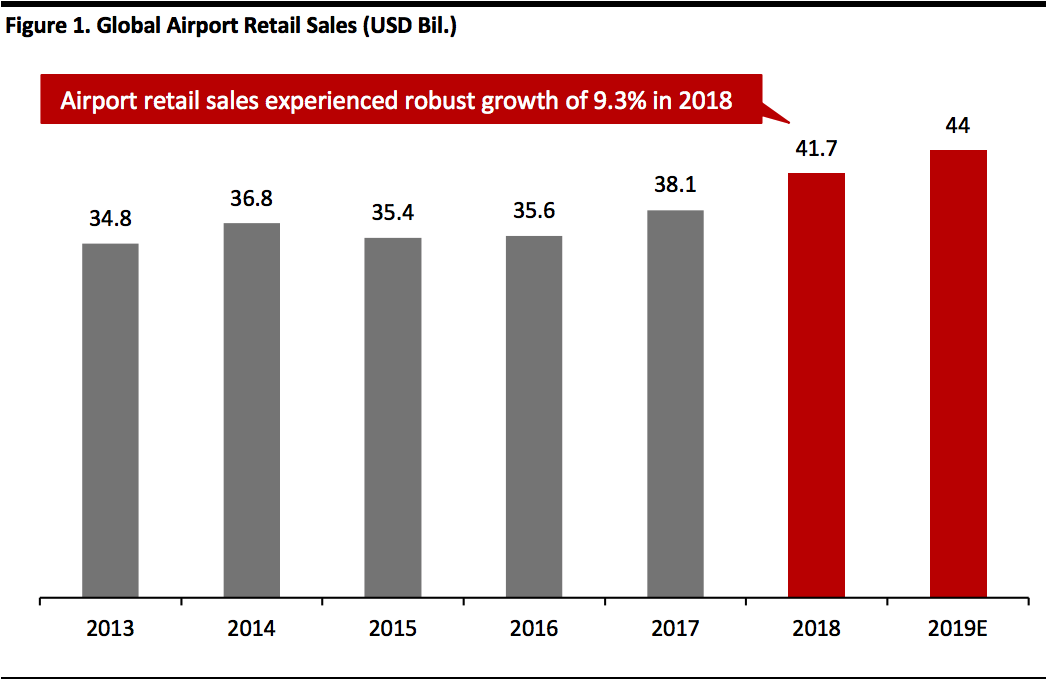

Source: Generation Research/Statista/Coresight Research[/caption]

In January 2020, the UNWTO forecast a 3–4% increase in international tourist arrivals for 2020. However, this estimate was produced before the recent coronavirus outbreak, which could severely affect global airport retail as Chinese consumers avoid traveling and bans on travel into and out of China are imposed.

China has suspended all domestic and international travel group tours that are scheduled after January 27. Airlines including Air Canada, American Airlines, British Airways, Delta Air Lines, KLM, Lufthansa and United Airlines have banned service to and from many Chinese cities. Australia, Italy, Singapore and the US have imposed entry restrictions for travelers that have visited China. On February 1, the US announced that it would deny entry to foreign nationals who have been in China within the past 14 days.

According to travel analytics company ForwardKeys, travel bookings in the lead up to the Chinese New Year holiday were up 7.3% on January 19, compared with figures from 2019. However, bookings for the Chinese holiday period fell 6.8% behind by January 26, after the travel ban came into effect and Wuhan Tianhe International Airport closed.

To put this into context, Chinese travelers have recently been buoying the airport retail market. Our 2019 survey of outbound tourists found that duty-free stores accounted for an estimated 26.7% of overseas retail spending by Chinese travelers, up from an estimated 25.5% in 2018. This resulted in duty free once again being the top retail format for spending by Chinese tourists, ahead of department stores in second place.

Chinese travelers made 150 million trips outside of Mainland China in 2018, with Hong Kong and Macau accounting for 76.3 million of these. We estimate that the total number of trips (including Hong Kong and Macau) rose to around 166 million in 2019. Although we expect that the coronavirus outbreak will hit traveler numbers in 2020, the extent of the impact remains to be seen.

Source: Generation Research/Statista/Coresight Research[/caption]

In January 2020, the UNWTO forecast a 3–4% increase in international tourist arrivals for 2020. However, this estimate was produced before the recent coronavirus outbreak, which could severely affect global airport retail as Chinese consumers avoid traveling and bans on travel into and out of China are imposed.

China has suspended all domestic and international travel group tours that are scheduled after January 27. Airlines including Air Canada, American Airlines, British Airways, Delta Air Lines, KLM, Lufthansa and United Airlines have banned service to and from many Chinese cities. Australia, Italy, Singapore and the US have imposed entry restrictions for travelers that have visited China. On February 1, the US announced that it would deny entry to foreign nationals who have been in China within the past 14 days.

According to travel analytics company ForwardKeys, travel bookings in the lead up to the Chinese New Year holiday were up 7.3% on January 19, compared with figures from 2019. However, bookings for the Chinese holiday period fell 6.8% behind by January 26, after the travel ban came into effect and Wuhan Tianhe International Airport closed.

To put this into context, Chinese travelers have recently been buoying the airport retail market. Our 2019 survey of outbound tourists found that duty-free stores accounted for an estimated 26.7% of overseas retail spending by Chinese travelers, up from an estimated 25.5% in 2018. This resulted in duty free once again being the top retail format for spending by Chinese tourists, ahead of department stores in second place.

Chinese travelers made 150 million trips outside of Mainland China in 2018, with Hong Kong and Macau accounting for 76.3 million of these. We estimate that the total number of trips (including Hong Kong and Macau) rose to around 166 million in 2019. Although we expect that the coronavirus outbreak will hit traveler numbers in 2020, the extent of the impact remains to be seen.

Singapore Changi Airport

Singapore Changi Airport

Source: changiairport.com[/caption] Enhanced shopping experiences and customer engagement Retailers are upping their games to capture a share of the attractive airport retail market. Estée Lauder’s travel retail sector saw strong double-digit growth in its first and second quarters of fiscal year 2020. L’Oréal’s travel retail sales increased by 25.3% in 2019. Furthermore, liquor brand Bacardi, Kering (the parent company of French luxury brands Gucci and Yves Saint Laurent) and personal care company Shiseido have all recently revealed plans to increase their presence in duty-free stores. Colgate-Palmolive acquired French skincare brand Filorga Cosmétiques in July 2019. The brand has become a strong player in airports and its products are well-received in Asian markets. Colgate’s President and CEO Noel Wallace said that the acquisition marked its entry into the travel retail channel, particularly in Asia. Furthermore, brands are becoming more creative to compete for customer attention and engagement. Shiseido’s Red Ginza Street pop-up

Shiseido’s Red Ginza Street pop-up

Source: China Duty Free Sanya Weibo[/caption] Source: Best Buy/Benefit Cosmetics[/caption]

Source: Best Buy/Benefit Cosmetics[/caption]

Airport Retail Is Thriving Despite Struggling Brick-and-Mortar Stores

Brick-and-mortar stores in many mature markets continue to face decreasing store traffic: In the US, store traffic declined by 6.5% in 2019, according to analytics company RetailNext. In this context, brands and retailers are turning to international airports, which have evolved into shopping destinations. The global duty-free and travel retail market increased 12.9% year over year to $78.96 billion in 2018, according to travel retail data provider Generation Research; this total includes sales through airport stores, on airplanes and ferries, and through other duty-free stores. Airport shop sales grew 9.3% year over year to $41.7 billion in the same year, contributing the most (around 53%) to global duty-free and travel retail sales. Fragrances and cosmetics drove growth, with a 23.5% increase in sales. In the travel retail market, the Asia-Pacific region experienced the highest sales growth of 23.3% year over year. Sales growth in airports is being supported by a higher average retail spend per traveler, as well as increasing traveler numbers. The UNWTO estimates that the total number of tourist arrivals worldwide increased by 6% in 2018—airport retail sales increased by 9.3% in the same year. The growth in tourist arrivals slowed in 2019 to 4%, according to the UNWTO. We therefore estimate that airport retail sales totaled around $44 billion last year, an increase of around 6% over 2018. [caption id="attachment_103417" align="aligncenter" width="580"] Source: Generation Research/Statista/Coresight Research[/caption]

In January 2020, the UNWTO forecast a 3–4% increase in international tourist arrivals for 2020. However, this estimate was produced before the recent coronavirus outbreak, which could severely affect global airport retail as Chinese consumers avoid traveling and bans on travel into and out of China are imposed.

China has suspended all domestic and international travel group tours that are scheduled after January 27. Airlines including Air Canada, American Airlines, British Airways, Delta Air Lines, KLM, Lufthansa and United Airlines have banned service to and from many Chinese cities. Australia, Italy, Singapore and the US have imposed entry restrictions for travelers that have visited China. On February 1, the US announced that it would deny entry to foreign nationals who have been in China within the past 14 days.

According to travel analytics company ForwardKeys, travel bookings in the lead up to the Chinese New Year holiday were up 7.3% on January 19, compared with figures from 2019. However, bookings for the Chinese holiday period fell 6.8% behind by January 26, after the travel ban came into effect and Wuhan Tianhe International Airport closed.

To put this into context, Chinese travelers have recently been buoying the airport retail market. Our 2019 survey of outbound tourists found that duty-free stores accounted for an estimated 26.7% of overseas retail spending by Chinese travelers, up from an estimated 25.5% in 2018. This resulted in duty free once again being the top retail format for spending by Chinese tourists, ahead of department stores in second place.

Chinese travelers made 150 million trips outside of Mainland China in 2018, with Hong Kong and Macau accounting for 76.3 million of these. We estimate that the total number of trips (including Hong Kong and Macau) rose to around 166 million in 2019. Although we expect that the coronavirus outbreak will hit traveler numbers in 2020, the extent of the impact remains to be seen.

Source: Generation Research/Statista/Coresight Research[/caption]

In January 2020, the UNWTO forecast a 3–4% increase in international tourist arrivals for 2020. However, this estimate was produced before the recent coronavirus outbreak, which could severely affect global airport retail as Chinese consumers avoid traveling and bans on travel into and out of China are imposed.

China has suspended all domestic and international travel group tours that are scheduled after January 27. Airlines including Air Canada, American Airlines, British Airways, Delta Air Lines, KLM, Lufthansa and United Airlines have banned service to and from many Chinese cities. Australia, Italy, Singapore and the US have imposed entry restrictions for travelers that have visited China. On February 1, the US announced that it would deny entry to foreign nationals who have been in China within the past 14 days.

According to travel analytics company ForwardKeys, travel bookings in the lead up to the Chinese New Year holiday were up 7.3% on January 19, compared with figures from 2019. However, bookings for the Chinese holiday period fell 6.8% behind by January 26, after the travel ban came into effect and Wuhan Tianhe International Airport closed.

To put this into context, Chinese travelers have recently been buoying the airport retail market. Our 2019 survey of outbound tourists found that duty-free stores accounted for an estimated 26.7% of overseas retail spending by Chinese travelers, up from an estimated 25.5% in 2018. This resulted in duty free once again being the top retail format for spending by Chinese tourists, ahead of department stores in second place.

Chinese travelers made 150 million trips outside of Mainland China in 2018, with Hong Kong and Macau accounting for 76.3 million of these. We estimate that the total number of trips (including Hong Kong and Macau) rose to around 166 million in 2019. Although we expect that the coronavirus outbreak will hit traveler numbers in 2020, the extent of the impact remains to be seen.

What Drives the Airport Retail Market?

Rise of budget airlines and international travel With the emergence of budget airlines—such as Ryanair, Spirit and Wizz Air—more people can now afford to fly internationally. According to the UNWTO, there were 1.5 billion international tourists in 2019, a 4.0% increase over the total from 2018. This represents the 10th consecutive year of growth in travel, despite the slowing of global economic growth. Europe continues to be the most popular international travel destination, while Middle East and Asia Pacific became two of the fastest-growing regions for international tourism, growing at 8% and 5% year over year, respectively. Improved airport infrastructure More cities and countries are investing in developing and improving airport infrastructure to keep pace with growing travel interests. Several airports in the US have been going through expansion and renovations. In New York, LaGuardia Airport’s $8 billion renovation project is expected to be completed by 2022. The newly opened concourse features new retailers such as FAO Schwarz and McNally Jackson, New York City’s independent bookstore. Airports Council International estimates that US airports will need $128 billion in upgrades by 2023, suggesting that there will be opportunities in the near future for retailers to penetrate the airport retail sector as airports look to improve travelers’ experience. Asia Pacific is the busiest region for airport development: It accounts for 48.5% of the $500 billion global spend on renovations and 57% of the $267 billion that was invested in new airports in 2018, according to Airport Council International. China plans to grow the number of its commercial airports from 229 to 260 by the end of 2020 and to 400 by 2035. Beijing Daxing International Airport opened in October 2019, with a wide variety of duty-free offerings including 36 international brands. Singapore Changi Airport’s new hub, Jewel, opened in April 2019 and features an indoor jungle and waterfall. It also has more than 280 restaurants and retail stores. [caption id="attachment_103459" align="aligncenter" width="700"] Singapore Changi Airport

Singapore Changi AirportSource: changiairport.com[/caption] Enhanced shopping experiences and customer engagement Retailers are upping their games to capture a share of the attractive airport retail market. Estée Lauder’s travel retail sector saw strong double-digit growth in its first and second quarters of fiscal year 2020. L’Oréal’s travel retail sales increased by 25.3% in 2019. Furthermore, liquor brand Bacardi, Kering (the parent company of French luxury brands Gucci and Yves Saint Laurent) and personal care company Shiseido have all recently revealed plans to increase their presence in duty-free stores. Colgate-Palmolive acquired French skincare brand Filorga Cosmétiques in July 2019. The brand has become a strong player in airports and its products are well-received in Asian markets. Colgate’s President and CEO Noel Wallace said that the acquisition marked its entry into the travel retail channel, particularly in Asia. Furthermore, brands are becoming more creative to compete for customer attention and engagement.

- LVMH’s premium cognac brand Hennessy X.O. unveiled its Chinese New Year pop-up at Singapore Changi Airport in January 2020. The brand welcomed travelers to explore the product through an AI digital screen and a scent area. Hennessy also offered a personalization station where consumers could purchase custom-engraved bottles.

- Luxury fashion house Moncler is working to design products exclusively for sale at airports. The brand is experimenting with different ways of displaying its products in smaller airport stores, such as pop-ups.

- Shiseido launched a series of experiential pop-ups across airports in China in September 2019. The pop-ups offered opportunities for travelers to engage with the brand, through augmented reality, digital walls, skin consultations and vending machine games.

Shiseido’s Red Ginza Street pop-up

Shiseido’s Red Ginza Street pop-upSource: China Duty Free Sanya Weibo[/caption]

- China’s tech giant Tencent leverages its WeChat app to improve travelers’ shopping experience. Amsterdam Schiphol Airport partnered with the company to set up a WeChat official account, mini program and WeChat Pay. The airport also offers a dedicated pick-up point for Chinese consumers who shop through WeChat. Moreover, WeChat launched a mini program called Wetaxrefund, which enables Chinese consumers to receive their tax refund directly to their WeChat Pay account. Shoppers can now use this immediate tax refund service in 85 international airports, providing convenience for travelers.

- Benefit Cosmetics was an early adopter of retail vending machines. It now has over 50 kiosks in more than 30 US airports, selling 30 of the brand’s bestselling products.

- Best Buy has added Best Buy Express kiosks to more than 50 US airports, selling headphones, chargers and other travel necessities.

- Dallas/Fort Worth International Airport offers a vending machine selling socks from Stance, a popular brand among millennials.

- At the newly renovated Terminal B of New York’s LaGuardia Airport, passengers can find vending machines that sell Uniqlo puffer jackets and sample kits from direct-to-consumer brand Dollar Shave Club.

Source: Best Buy/Benefit Cosmetics[/caption]

Source: Best Buy/Benefit Cosmetics[/caption]