Nitheesh NH

What’s the Story?

Our quarterly Global Tourism series discusses domestic and international tourism themes and trends. In this report, we look at the impact of the coronavirus pandemic on the US tourism market—both domestic and international—with findings from a Coresight Research proprietary survey of US consumers.Why It Matters

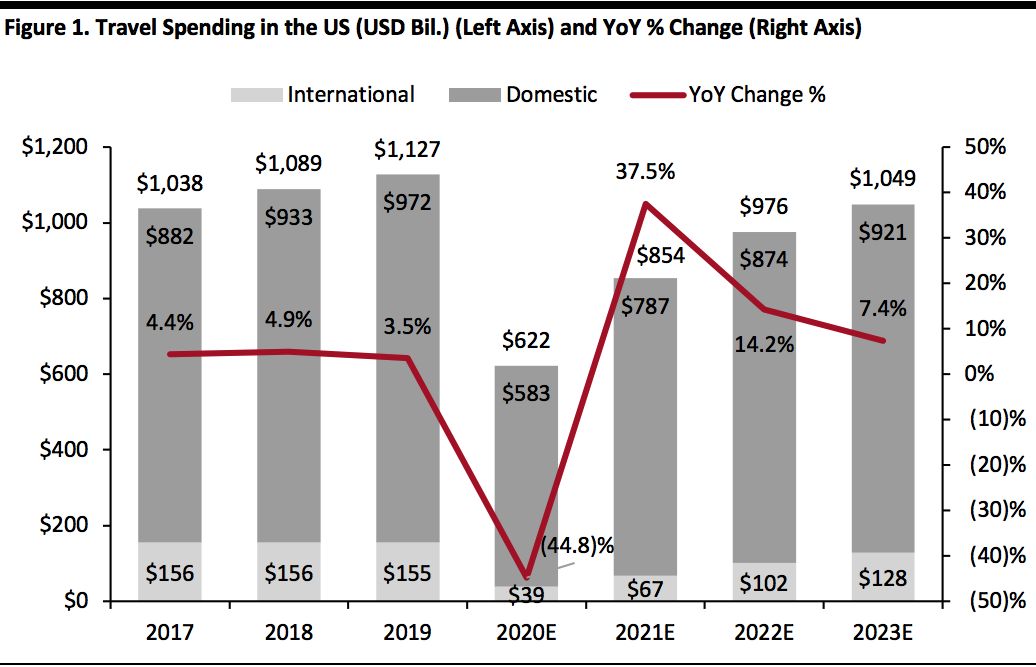

The US travel sector continues to endure the negative impacts of the coronavirus pandemic, which started to spread across the country in March. As one of the hardest-hit industries, tourism in the US—including spending on food service, accommodation, recreation, transportation (excluding international passenger fares on US airlines) and retail by both international inbound and domestic travelers—was down $341 billion year over year between the first week of March and the week end August 15, compared to the year-ago period. Travel research company Tourism Economics expects a $505 billion year-over-year reduction in US travel spend through the end of 2020, which equates to a 44.8% decline year over year—and the market is not expected to recover to pre-crisis levels until 2024. [caption id="attachment_115891" align="aligncenter" width="700"] Estimates for 2020–2023 were made in July 2020

Estimates for 2020–2023 were made in July 2020Source: US Travel Association/Tourism Economics[/caption]

Survey Findings: US Travelers’ Sentiment

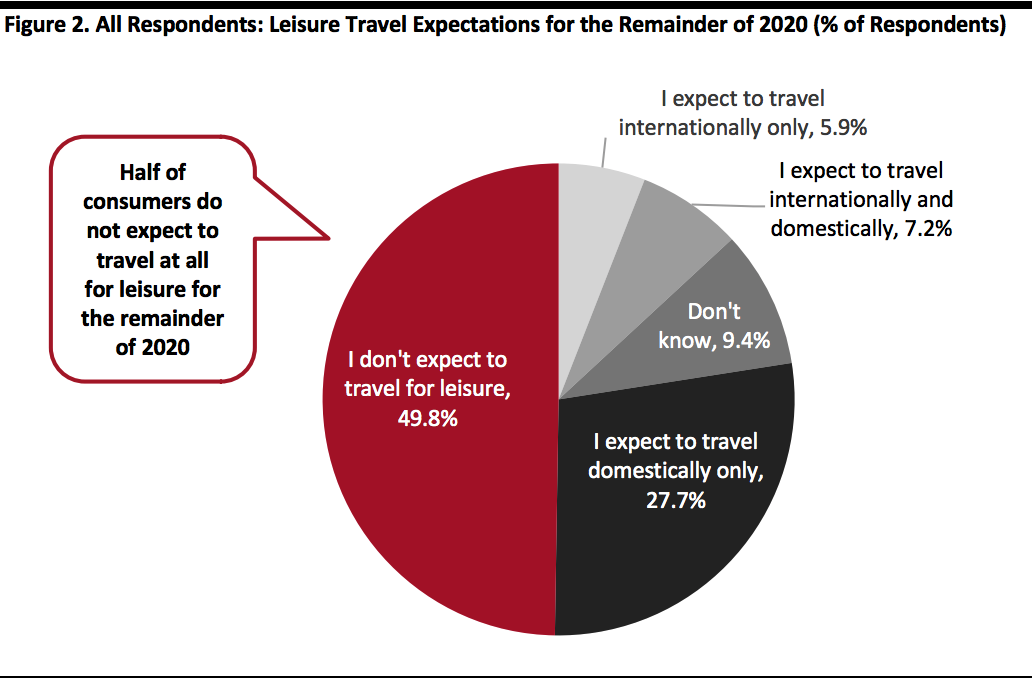

Coresight Research conducted a survey of US consumers on July 22, 2020, to assess how the Covid-19 crisis has impacted leisure travel behaviors and travel expectations for 2021. We present and discuss three key findings below. 1. Half Do Not Expect To Travel At All for the Remainder of 2020 As the number of coronavirus cases remains high across the country, consumers are still cautious about travel. Half of all respondents said that they do not expect to travel at all for leisure for the remainder of 2020, and by demographic, the proportion that reported this peaked among consumers aged over 60.- Some 27.7% of all respondents expect to travel only domestically for the remainder of 2020, versus only 5.9% that plan to travel internationally only. This result is aligned with our finding that post crisis, domestic travel will gradually pick up before international travel (which we discuss later in this report).

- Almost one in 10 do not know their travel plans for the rest of 2020—their decisions could depend on the containment of the virus as well as travel restrictions.

Base: 404 US Internet users aged 18+

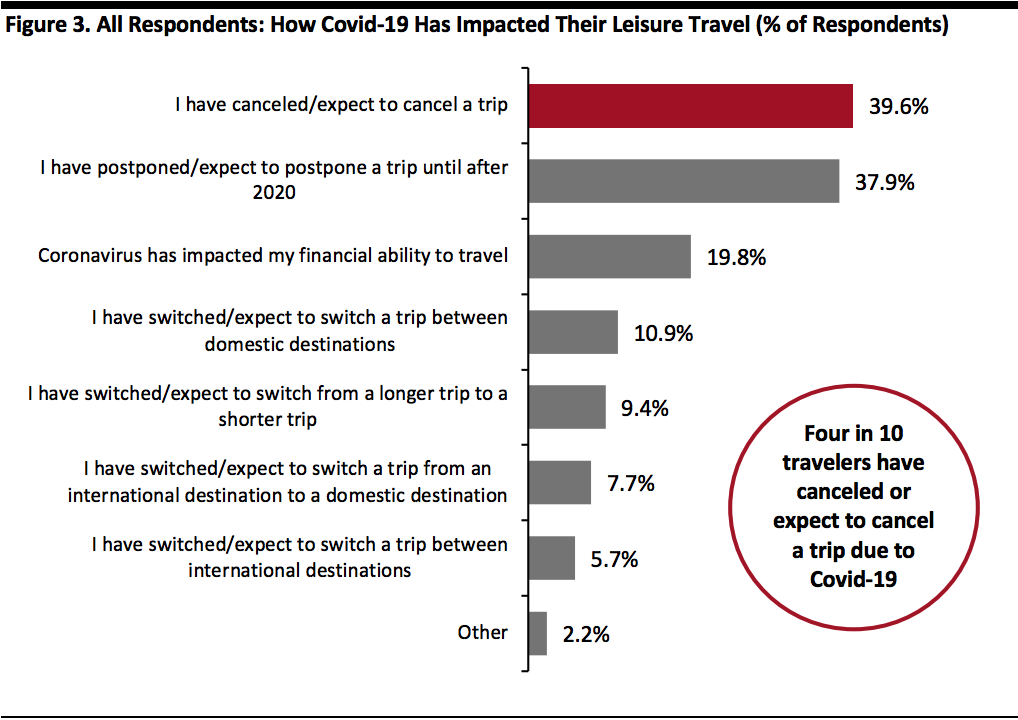

Base: 404 US Internet users aged 18+Source: Coresight Research[/caption] 2. Four in 10 Have Canceled or Expect To Cancel a Trip Due to Covid-19 We asked respondents how the coronavirus outbreak has impacted their leisure travel, including expected impacts.

- Four in 10 said they have canceled or expect to cancel a trip. Some 37.9% have postponed or expect to postpone a trip until after 2020, in line with the continued depressed level of travel in the past few months. The postponement of trips further suggests that travel demand will remain low for the remainder of 2020.

- Almost one-fifth of respondents said that the pandemic has impacted their financial ability to travel, as the US has entered recession amid the crisis.

- Around one in 10 have switched, or expect to switch, a trip between domestic destinations, which indicate that they plan to visit locations that are closer to home or are seeing declines in the number of coronavirus cases.

Base: 404 US Internet users aged 18+

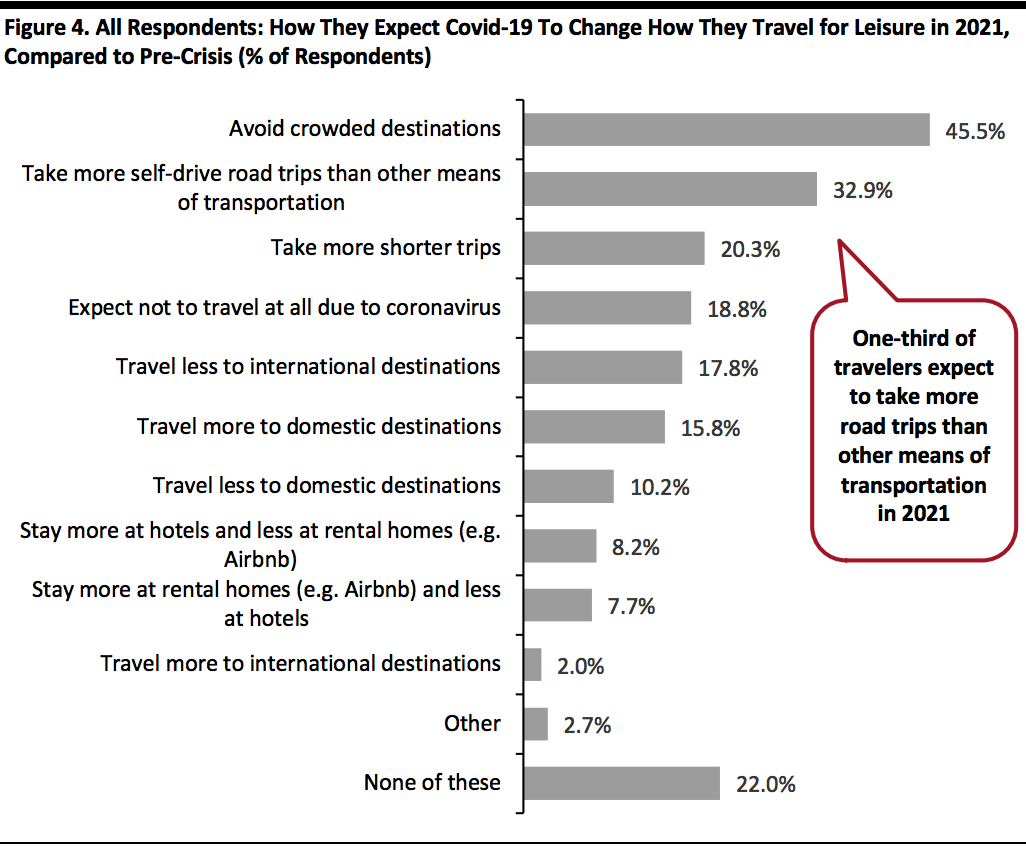

Base: 404 US Internet users aged 18+Source: Coresight Research[/caption] 3. Covid-19 To Change How Consumers Travel in 2021 Even though most states in the US are seeing a decline in new coronavirus cases, consumers’ travel behavior is expected to be different going forward. We asked respondents how they expect the crisis to change how they travel for leisure in 2021, compared to before the crisis.

- Some 45.5% said they plan to avoid crowded destinations—this could mean fewer visits to densely populated urban areas and a preference toward outdoor and open-air attractions in remote locations. By age, we again saw the highest proportion in the oldest consumer age group, with 57% of consumers aged over 60 expecting to avoid crowded destinations for travel next year.

- One-third expect to take more self-drive road trips than other means of transportation next year, which is likely to negatively affect airport retail. In addition, one-fifth plan to take more shorter trips compared to pre-crisis. We have seen a rise in closer-to-home road trips, as consumers saw this as a popular and safe option for vacation during summer this year (which we discuss later in this report).

- Some 18.8% said they do not plan to travel at all in 2021, suggesting a slow recovery of the travel sector, which is aligned with the estimation by Tourism Economics that we previously outlined.

- Some 8.2% of respondents said they expect to stay more at hotels and less at rental homes, which is almost equal to the proportion that plan to stay more at rental homes and less at hotels, suggesting relative consumer confidence in staying in hotels and reflecting that consumers’ choice of accommodation types is less affected by the pandemic.

Base: 404 US Internet users aged 18+

Base: 404 US Internet users aged 18+Source: Coresight Research[/caption]

Domestic Tourism Slowly Picks Up

Domestic travel saw a slow pickup in August. According to Tourism Economics, in the week ended August 15, national weekly travel spending increased for the fifth consecutive week (although was still 44% below the prior-year levels). Monthly travel spending in August 2020 is also expected to have improved by 10% month over month from July. Travelers are turning to self-drive road trips amid Covid-19. Based on travel data company Arrivalist’s weekly travel index, the number of road trips—defined as trips of 50 miles or more in all 50 US states—in the week ended August 15 was roughly the same as the pre-pandemic level in February. We saw a peak during the Independence Day holiday, when the number of road trips was 11.7% higher in the week ended July 4 compared to the pre-crisis level. Travel group AAA estimated that road trips will make up 97% of summer travel this year, compared to the five-year average of 87%. Driven by the road-trip trend is the spike of interests in RVs. As travelers practice social distancing and show concern about sanitation, RV sales and rentals have both soared. The RV Industry Association reported that RV shipments in July went up 53.5% year over year. RV rental marketplace RVShare expects the surge in demand for RV rentals to continue through the fall, which has traditionally seen a slowdown in vehicle reservations: As of August 6, RVShare’s Labor Day bookings had already increased 50% year over year. By contrast, air travel continues to remain significantly depressed compared to 2019. According to passenger screening numbers from the Transportation Security Administration, air traffic for domestic and outbound travel started to pick up after collapsing by 95% in April, but this recovery has recently stalled—air travel was down 74% year over year in July and 72% in the first half of August. We expect a slow and choppy recovery in air travel, beginning with shorter-haul and domestic flights. US hotels have seen a slow recovery—occupancy reached 50.2% for the week ended August 15, up from the nadir of 17.5% in the last week of March, based on data from analytics company STR. However, the company said that hotel demand will not recover to pre-crisis levels until 2023.International Inbound Travel to US Plunges Significantly

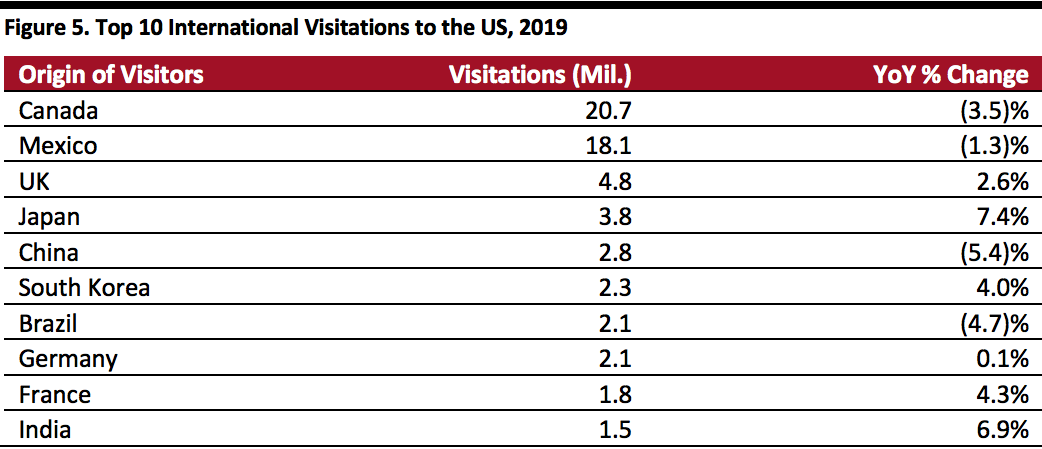

Before the pandemic, the US was the third-largest destination for overall global travel. However, its share of total international arrivals gradually fell to 5.4% in 2019 from 6.4% in 2015. Visitations from five of the top 10 international markets experienced declines year over year. As a result, total international visitations dropped by 0.6% in 2019, according to the US Department of Commerce. Overseas arrivals (all international visits except from Canada and Mexico) accounted for about half of all international arrivals in 2019 and contributed 84% of total international travel spending. Travel disruptions and restrictions due to Covid-19 have severely affected US inbound tourism: Total international visitations fell by 60.1% in the first half of 2020 and have shown no signs of recovery in recent months, with travel bans in many countries still in effect. In July, visitations from the top 10 international markets were still down around 97% on average year over year. [caption id="attachment_115895" align="aligncenter" width="700"] Origin of visitors is based on country of residence

Origin of visitors is based on country of residenceSource: US Department of Commerce[/caption]

Travel Industry Doubles Down on Technology in Response to Covid-19

As safety becomes top of mind for travelers, the tourism industry has been deploying contact-light practices powered by technology to improve the travel experience. In addition to masks and personal protective equipment, the aviation industry is using robots for hygiene and infection prevention. For example, Pittsburgh International Airport is working with startup Carnegie Robotics to adopt autonomous robots that disinfect the floor with UV light. Numerous airports were investing in contactless technology to expedite the boarding process before the pandemic, and now the trend continues to accelerate. Advanced biometrics and facial recognition at security checkpoints helps minimize contact between travelers and staff. The pandemic has also forced US hotels to ramp up their adoption of automation technology to ensure the safety of their customers. Guests can use their mobile devices for contactless check-in, access to digital room keys, touchless payments and room-service ordering. Some hotels have also installed voice assistants, such as Amazon’s Alexa, in guests’ rooms. The AI-based devices enable guests to control lighting or curtain settings, as well as request room service. [caption id="attachment_115896" align="aligncenter" width="700"] Contactless room-key technology

Contactless room-key technologySource: MGM Resorts[/caption]