Nitheesh NH

Our quarterly Global Tourism series discusses domestic and international tourism themes and trends. In this report, we collaborate with China Luxury Advisors to look at how the coronavirus has affected travel in China and the early signs of recovery in domestic tourism post coronavirus.

Respondents could select multiple options

Respondents could select multiple options

Base: Chinese Internet users aged 16+ who have changed their travel plans

Source: Coresight Research/China Luxury Advisors[/caption] Over One-Third of Chinese Travelers Expect To Spend Less on Retail Purchases We asked all respondents about planned changes in their spending on major categories for their next planned trip (assuming they would be taking a future trip). Base: Chinese Internet users aged 16+

Base: Chinese Internet users aged 16+

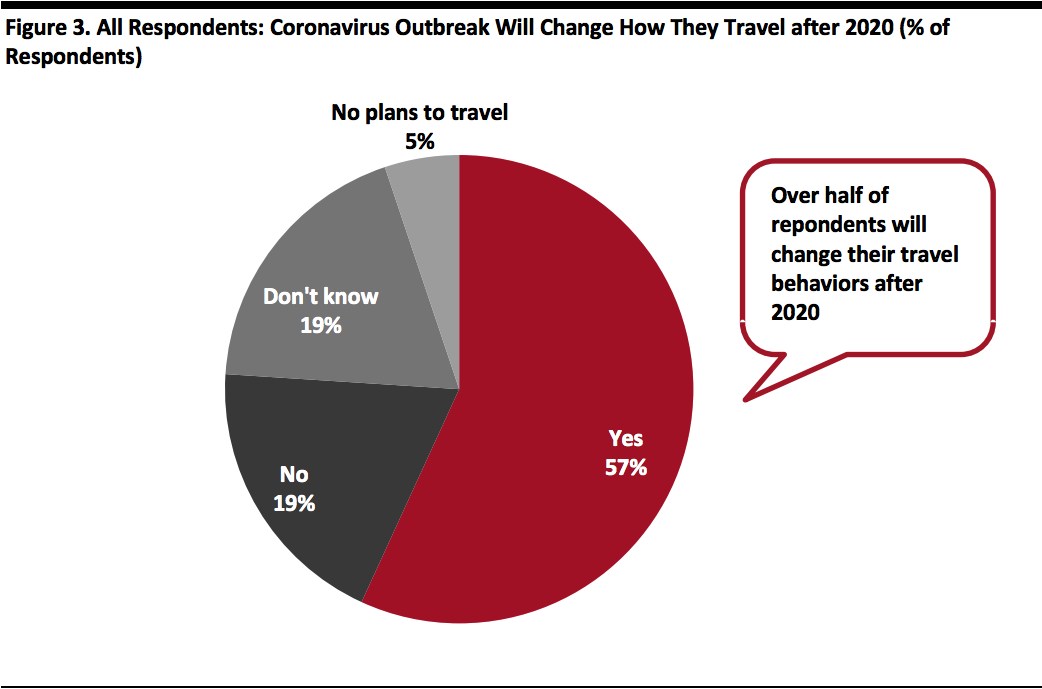

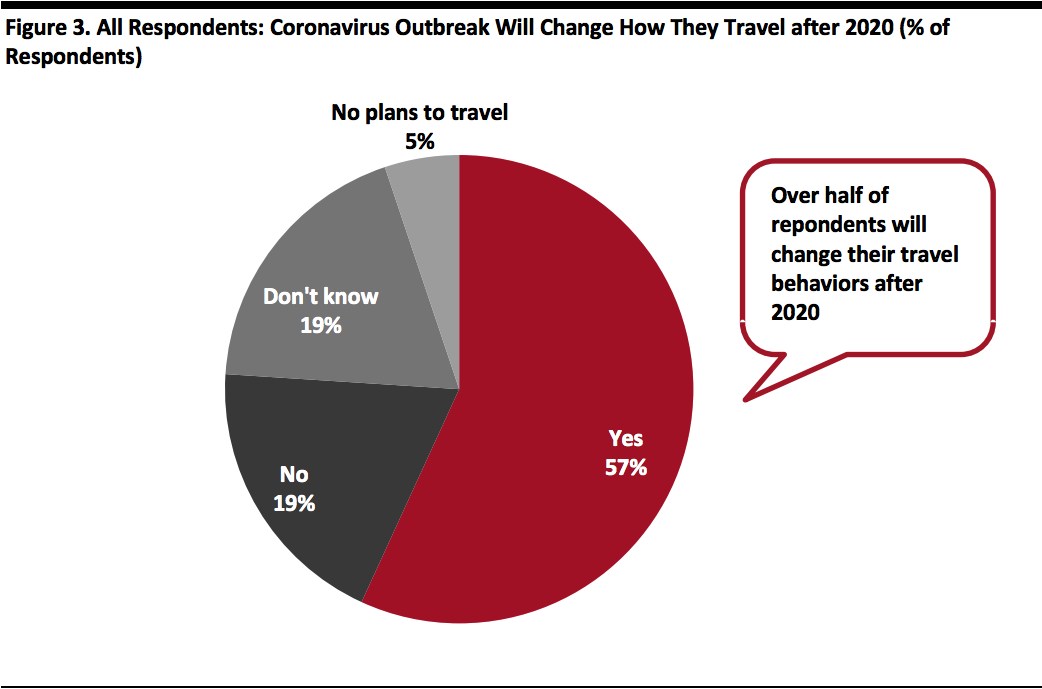

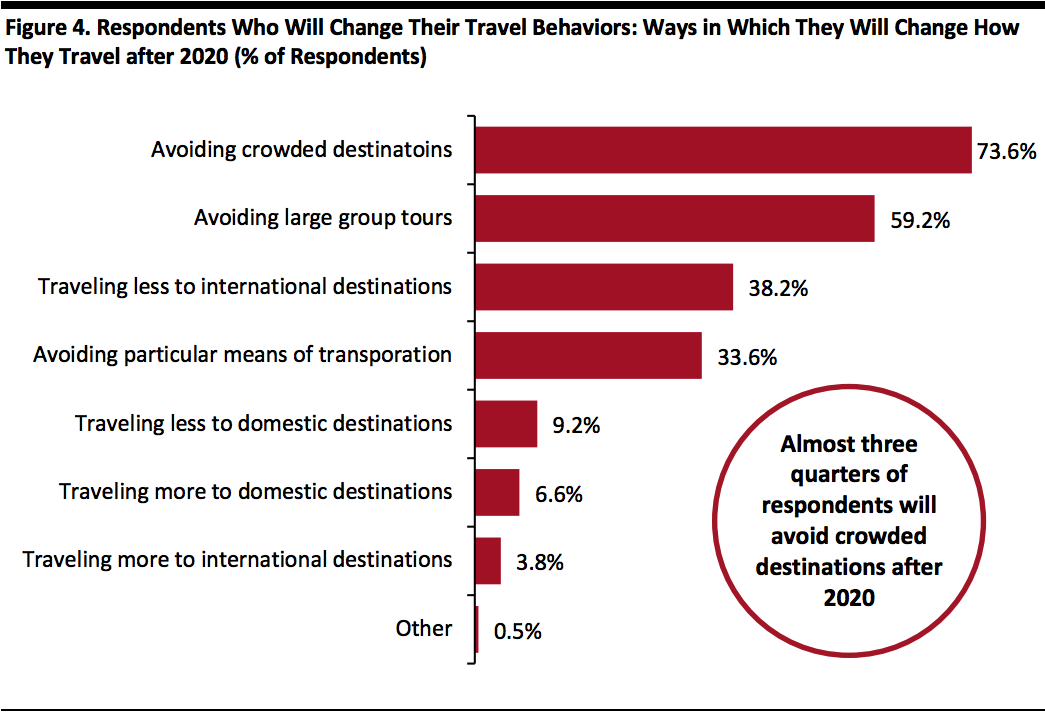

Source: Coresight Research/China Luxury Advisors[/caption] More than Half of Chinese Travelers Expect the Coronavirus Crisis To Change How They Travel after 2020 Even though China is currently recovering from the coronavirus pandemic, its impacts are likely to be seen in Chinese travelers’ behavior in the longer term. A total of 56.8% of respondents reported that the coronavirus outbreak will change how they travel after 2020, and 5.1% said they have no plans to travel. [caption id="attachment_109938" align="aligncenter" width="700"] Base: Chinese Internet users aged 16+

Base: Chinese Internet users aged 16+

Source: Coresight Research/China Luxury Advisors[/caption] Among those respondents who think that the coronavirus will change how they travel after 2020: Respondents could select multiple options

Respondents could select multiple options

Base: Chinese Internet users aged 16+ who will change their travel behaviors after 2020

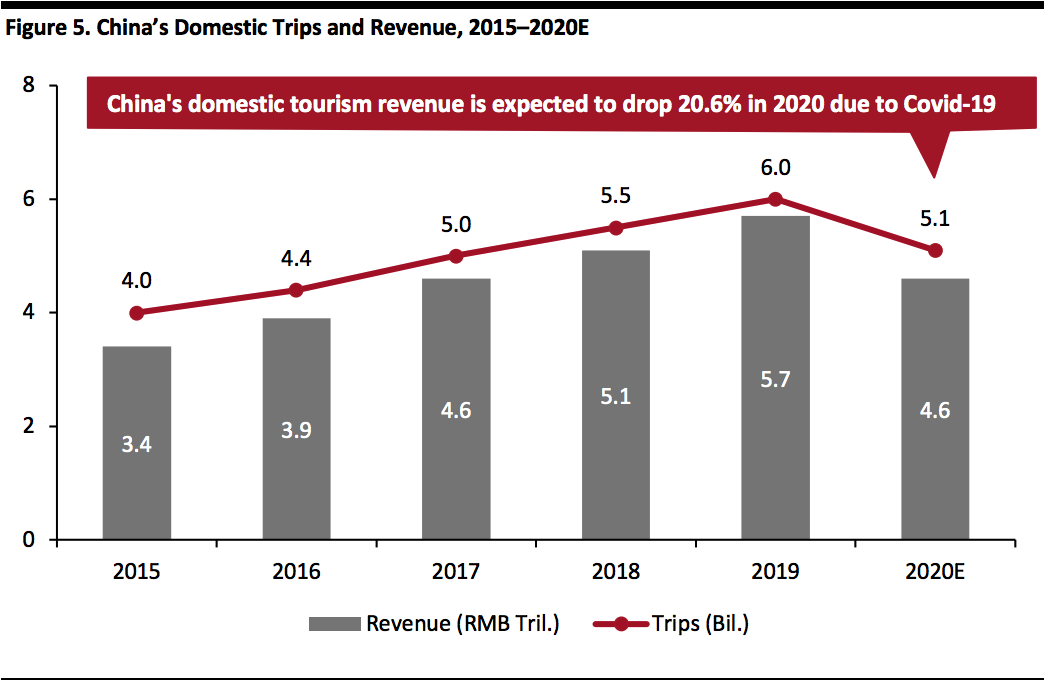

Source: Coresight Research/China Luxury Advisors[/caption] Note: Estimates for 2020 were made in February 2020

Note: Estimates for 2020 were made in February 2020

Source: China Tourism Academy[/caption]

Survey Findings—How the Coronavirus Affect Chinese Travel

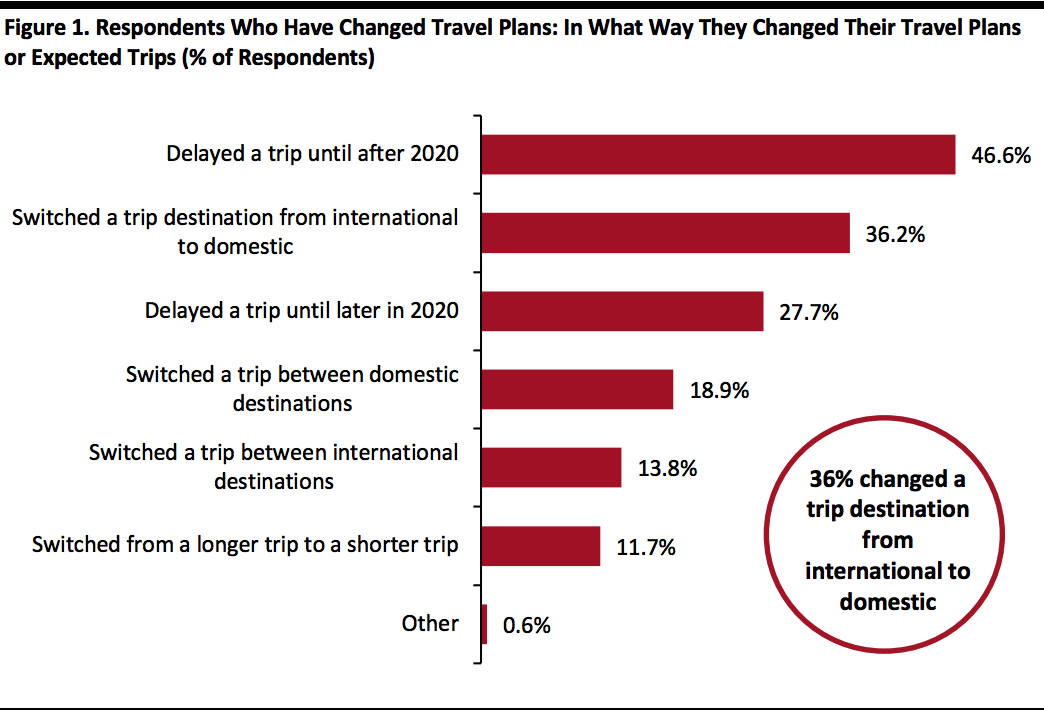

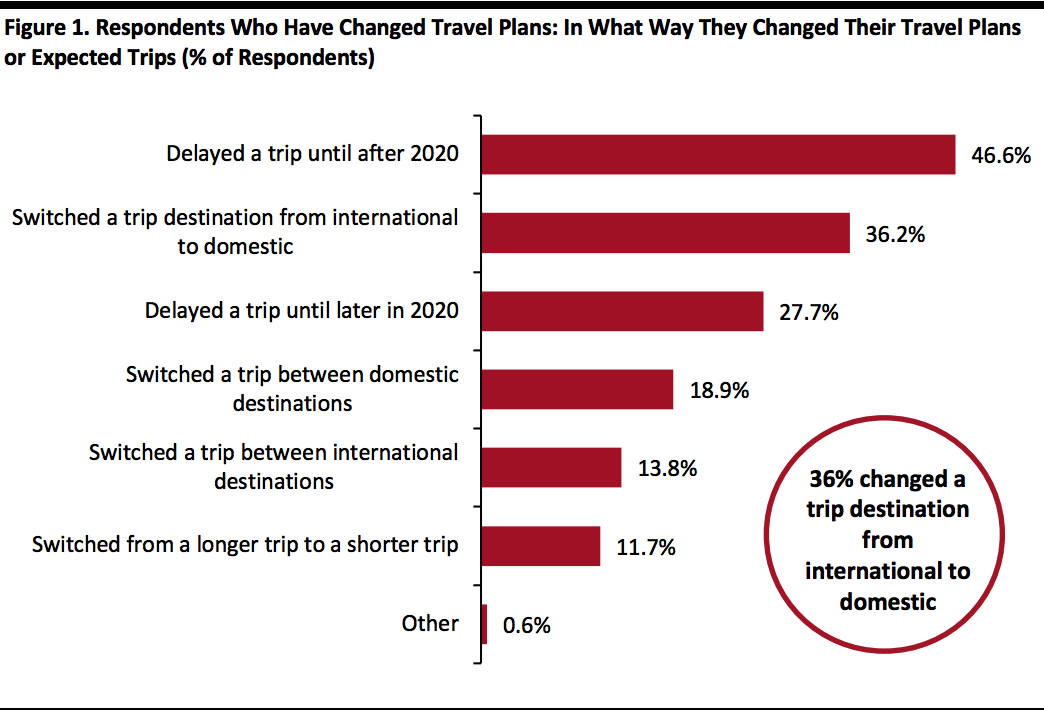

We surveyed 1,147 Chinese Internet users at the end of April 2020—in collaboration with China Luxury Advisors. Based on our findings, we explore how the coronavirus crisis has impacted Chinese tourists’ travel and spending. Almost One-Third of Chinese Travelers Have Switched Their Travel Destinations from International to Domestic The coronavirus outbreak has negatively impacted Chinese tourists’ travel plans: A total of 87.2% of all survey respondents canceled planned vacation trips and 83.4% changed their travel plans in other ways due to the pandemic. Among those who have changed their travel plans:- Almost half delayed a trip until after 2020, suggesting that we may not see a quick bounce back this year.

- Some 36.2% switched their travel destinations from international to domestic, which translates to 30.2% of all respondents—a meaningful pivot to domestic tourism. This could be due to various reasons, such as travel restrictions placed by governments; closures of tourist attractions, restaurants and bars; reduced budget; and the worsening coronavirus situation overseas.

- Some 27.7% delayed a trip to later in 2020, which we think will boost travel during Golden Week, the seven-day national holiday in the beginning of October.

Respondents could select multiple options

Respondents could select multiple optionsBase: Chinese Internet users aged 16+ who have changed their travel plans

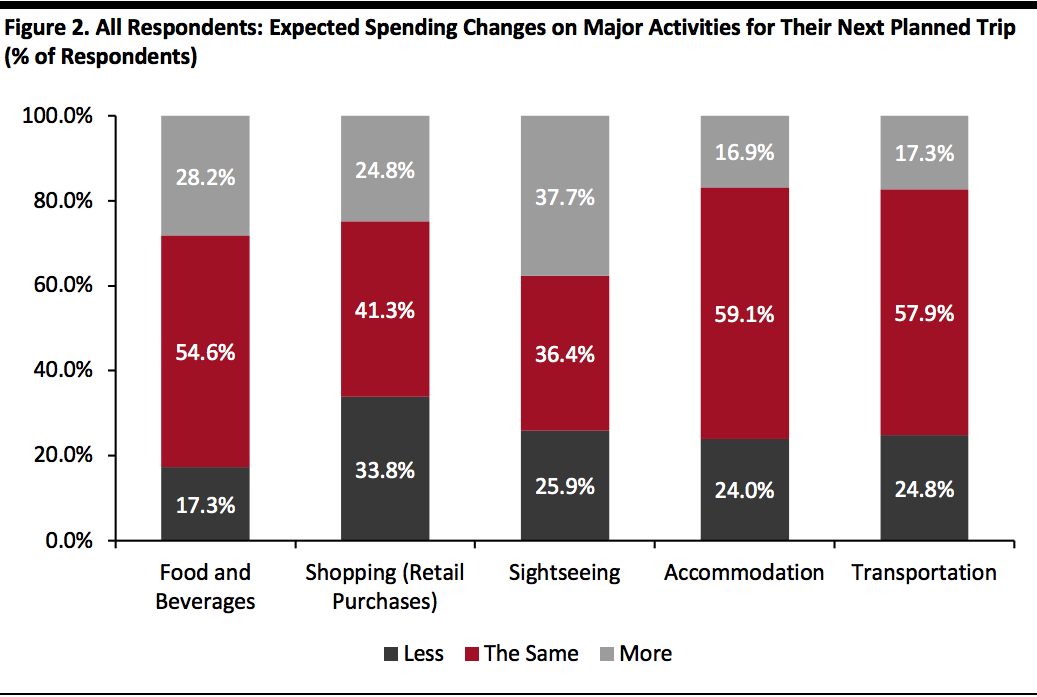

Source: Coresight Research/China Luxury Advisors[/caption] Over One-Third of Chinese Travelers Expect To Spend Less on Retail Purchases We asked all respondents about planned changes in their spending on major categories for their next planned trip (assuming they would be taking a future trip).

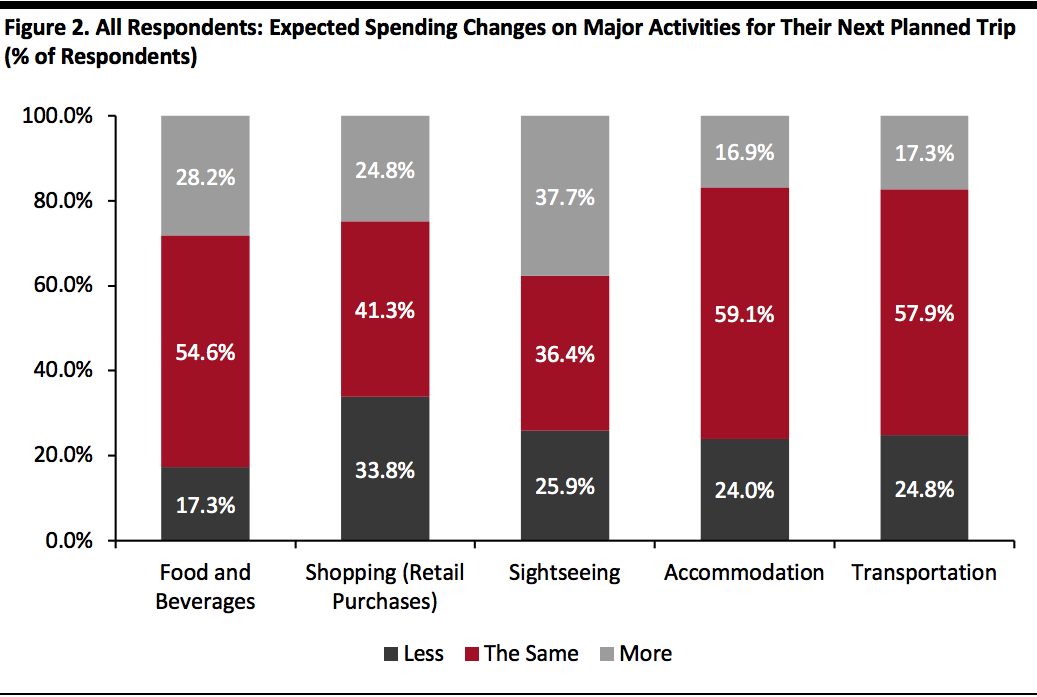

- Even among consumers who intend to travel, retail spending looks set to take a hit: Among travel-related spending categories, retail purchases see the highest number of travelers expecting to cut spending, with 33.8% planning to spend less, compared to around one-quarter or fewer expecting to cut spending on other travel-related activities. This planned reduction in retail spending could be associated with the switch from international to domestic tourism, given that Chinese tourists tend to spend considerable sums in retail when abroad; our 2019 survey found that in total, Chinese travelers spent an estimated $102 billion (¥701 billion) on shopping in overseas markets, for the 12 months ended August 2019.

- Sightseeing sees the highest number of travelers expecting to increase spending—37.7% plan to spend more. This reflects that travelers are more likely to allocate their travel budget toward exploring local experiences.

- Over half of respondents said their spending on food and beverages, accommodation and transportation will remain unchanged.

Base: Chinese Internet users aged 16+

Base: Chinese Internet users aged 16+Source: Coresight Research/China Luxury Advisors[/caption] More than Half of Chinese Travelers Expect the Coronavirus Crisis To Change How They Travel after 2020 Even though China is currently recovering from the coronavirus pandemic, its impacts are likely to be seen in Chinese travelers’ behavior in the longer term. A total of 56.8% of respondents reported that the coronavirus outbreak will change how they travel after 2020, and 5.1% said they have no plans to travel. [caption id="attachment_109938" align="aligncenter" width="700"]

Base: Chinese Internet users aged 16+

Base: Chinese Internet users aged 16+Source: Coresight Research/China Luxury Advisors[/caption] Among those respondents who think that the coronavirus will change how they travel after 2020:

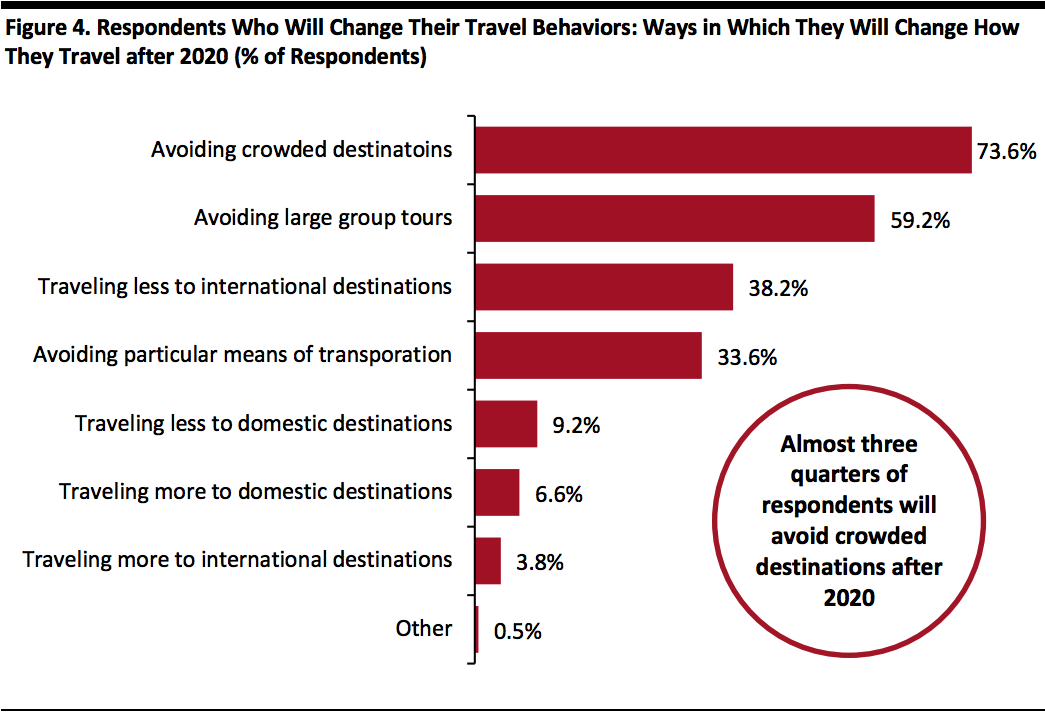

- Almost three quarters said they will avoid crowded destinations—this could translate to fewer visits to crowded malls or shopping centers, dealing a further blow to retail.

- Some 59.2% will avoid large group tours. We are likely to see more independent travel or small tours in the future. Ctrip.com, China’s largest online travel agency, has begun offering smaller tour groups of three to six people to cater to cautious travelers in a post-Covid environment, especially those with family.

- Some 38.2% said they will travel less to international destinations, suggesting that Chinese outbound tourism will not recover quickly.

- Some 33.6% will avoid particular means of transportation. During the Labor Day holiday on May 1–5, 2020, we saw daily traffic volume for trains, buses, ships and airplanes drop by more than 50% year over year, according to China’s Ministry of Transport. Rather than take public transport over longer distances, travelers are instead choosing to drive themselves to nearby locations. Ctrip.com reported that car rental reservations rose 10% from last year’s Labor Day holiday.

Respondents could select multiple options

Respondents could select multiple optionsBase: Chinese Internet users aged 16+ who will change their travel behaviors after 2020

Source: Coresight Research/China Luxury Advisors[/caption]

Tourism Hit Hard by the Coronavirus

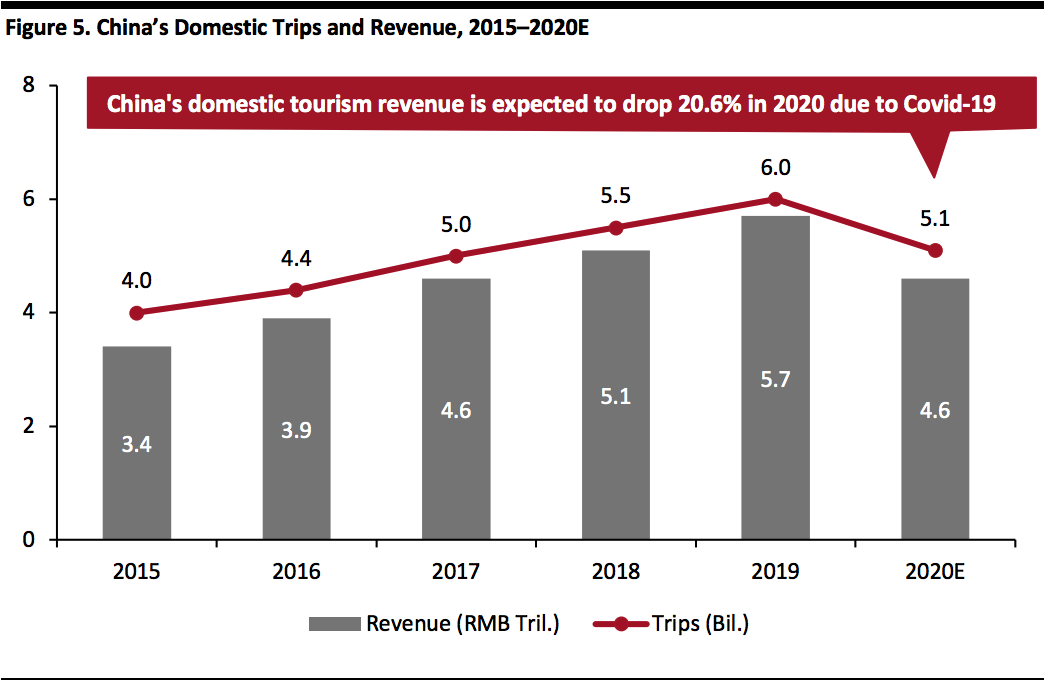

Tourism has been hit hard by the coronavirus pandemic, as countries implemented lockdown measures and people stayed at home. The unprecedented nature of the crisis makes it hard to predict when people will be comfortable traveling again, even once restrictions are lifted. The World Travel & Tourism Council projected on April 24, 2020 that global revenue losses in the tourism industry could reach $2.7 trillion in 2020. China is the world’s largest market for outbound travel, and its travelers are the biggest international spenders. Due to the coronavirus, flights between China and the rest of the world were heavily reduced—and remain so at the current time. China says it has now brought the pandemic under control, and although there are signs of recovery in the tourism market on the back of this, its rebound largely rests on domestic tourism. China’s domestic tourism sector was thriving last year, having contributed 11% of China’s total GDP in 2019, according to China Tourism Academy. Domestic trips (which includes some day trips) increased 8.4% year over year to 6.0 billion, accounting for 95% of total Chinese trips. Domestic tourism revenue totaled ¥5.7 trillion ($822 billion) in 2019, up 11.7% from the prior year. However, the coronavirus pandemic halted the booming industry during one of the peak travel periods—the Chinese New Year holiday at the end of January 2020. In late February, China Tourism Academy predicted a 69.0% decline in domestic tourism revenue in the first quarter of 2020 and a decrease of 20.6% for the full year. [caption id="attachment_109940" align="aligncenter" width="700"] Note: Estimates for 2020 were made in February 2020

Note: Estimates for 2020 were made in February 2020Source: China Tourism Academy[/caption]