Nitheesh NH

Global Pet E-Commerce: A Dynamic Channel In a Growing Market

PET E-COMMERCE: GROWING GLOBALLY

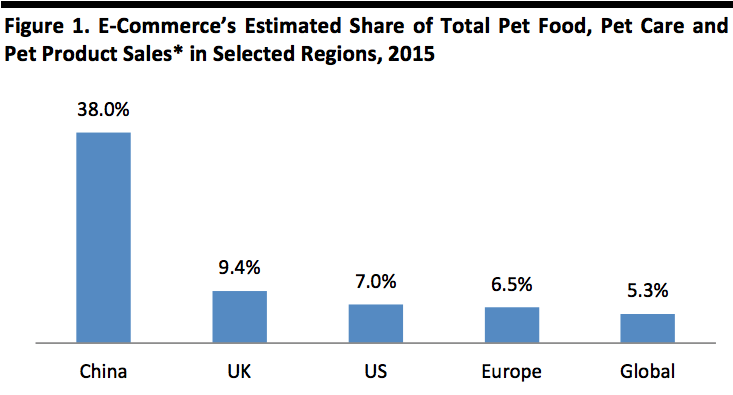

Spending on pets is increasing globally and, in many regions, e-commerce sales growth in the pet category is outpacing both total category sales growth and total e-commerce growth. In this report, we analyze some of the leading pet e-commerce companies in the US and selected international markets. The Internet’s share of pet product and food sales is still relatively low in many regions. Although precise definitions of the category vary, in most Western markets, e-commerce accounts for single-digit shares of pet category sales. According to Euromonitor International, e-commerce accounted for only 4.4% of total pet care sales globally in 2014 (latest confirmed); we estimate this rose to around 5.3% in 2015. However, Chinese pet owners have flocked to the Internet to purchase pet food: GfK estimates that e-commerce represented fully 38% of total pet food sales in the country in 2015, and it predicts that figure will rise to around 43% in 2016. [caption id="attachment_86924" align="aligncenter" width="720"] *Share of pet food sales in China, pet care sales in the US and global, and pet product sales in the UK and Europe.

*Share of pet food sales in China, pet care sales in the US and global, and pet product sales in the UK and Europe.Source: Euromonitor International/GfK/Pets at Home/Zooplus/Fung Global Retail & Technology[/caption] According the American Pet Products Association (APPA), total US pet care expenditure, including nonfood categories, surpassed $60 billion for the first time in 2015.

- In 2014, research company Forrester Research estimated that $3.7 billion, or around 6.4%, of US pet care sales went online.

- In 2015, we estimate that the Internet’s share of US pet care sales grew to around 7.0%, or $4.2 billion.

IN CONTEXT: THE WORLD’S BIGGEST MARKETS

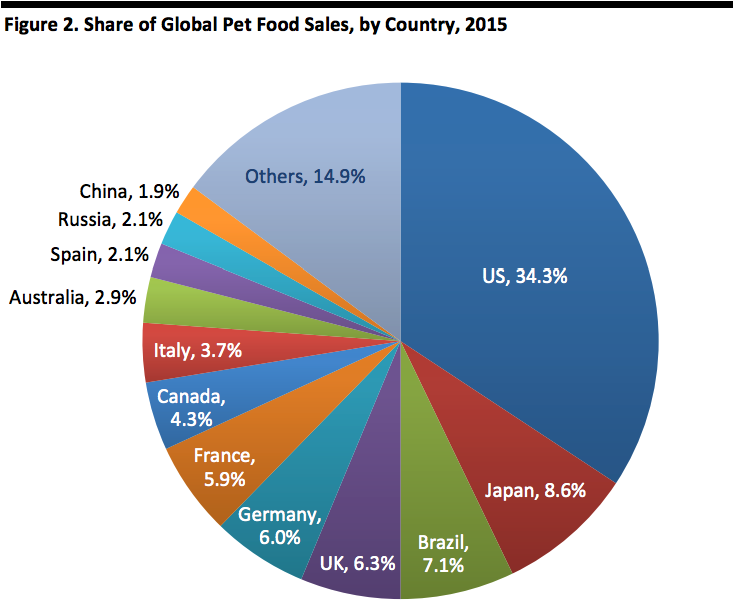

According to research company GfK, total pet food sales globally grew 4% year over year to $70 billion in 2015. As we show below, the US accounted for more than one-third of this. Petfood Industry notes pet food sales in Japan, the second largest market globally, have shown signs of stagnation, while significant growth is expected through 2020 in other Asian countries, including China, India and Taiwan. [caption id="attachment_86925" align="aligncenter" width="720"] Source: GfK/Fung Global Retail & Technology[/caption]

Source: GfK/Fung Global Retail & Technology[/caption]

IN FOCUS: AMERICANS’ LOVE FOR PETS BOOSTS PET E-COMMERCE

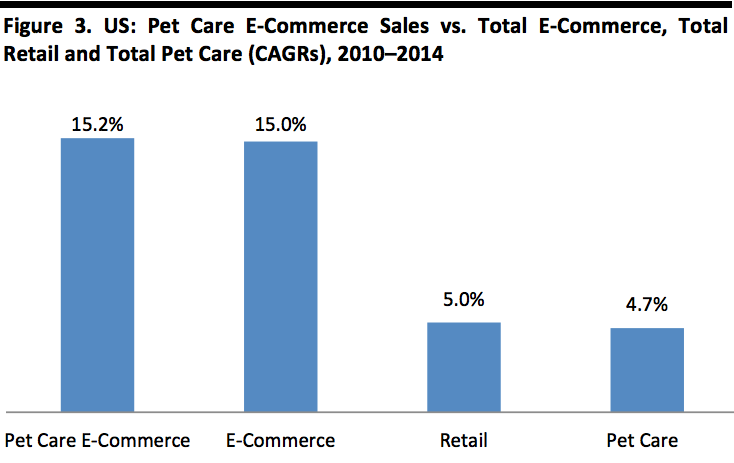

As noted in our Pet Technology report from December 2015, many Americans treat their pets like family members, and they have shown a willingness to increase their spending on their pets. According to Pet Product News, baby boomers were the first generation to truly “humanize” pets, which has fueled the growth of the pet product industry. Subsequent generations are following the boomers’ lead, and GfK says millennials have now overtaken boomers as the largest pet-owning population in the US. This shift is impacting how consumers buy for their pets and is also driving e-commerce growth in pet product sales. As we discussed in our Millennials and Grocery report, millennials are highly adept at using technology to research and buy products, and they look for convenience when shopping. These habits carry over into their spending on their pets. Several factors drive the impressive e-commerce growth in the pet products category, and they point to continued growth in the future:

Several factors drive the impressive e-commerce growth in the pet products category, and they point to continued growth in the future:

- Total Internet sales of consumer packaged goods (CPGs) are booming. Online sales of CPGs, which include pet products, grew by 42% in 2015 year over year, outpacing the 30% growth seen for total e-commerce sales over the same period, according to research firm 1010data. The company notes, however, that e-commerce growth for CPGs is from a relatively low base compared to that of other product categories.

- Consulting company Thistle Insight notes that direct delivery benefits pet owners who have to buy a high volume of products.

- A relatively low proportion of all pet food sold is fresh, allowing owners to buy larger quantities that last for a longer period of time. Online shopping is ideally suited to branded, packaged, ambient products—and it is especially useful for consumers when they need to buy heavier cupboard basics such as cans or large bags of pet food.

Source: APPA/Forrester Research/US Census Bureau/Fung Global Retail & Technology[/caption]

Source: APPA/Forrester Research/US Census Bureau/Fung Global Retail & Technology[/caption]

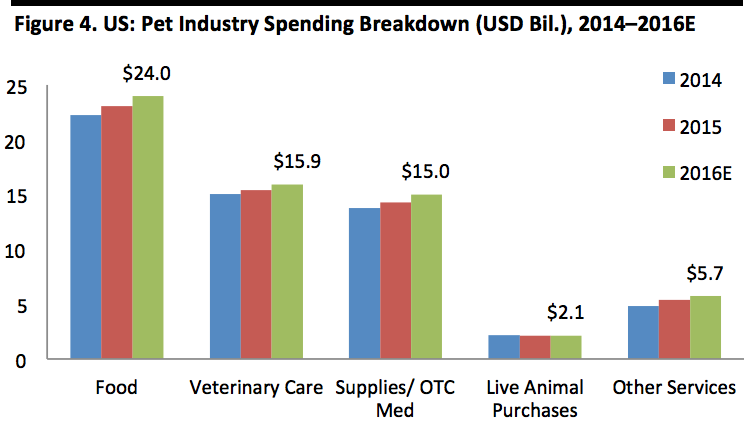

Pet Food Is the Largest Category by Value

So what pet categories are consumers spending on? It is not just pet food, although food is the largest pet product category by value in the US. According to the APPA, spending on services and supplies is growing, too. The only category where spending is declining is live animals; value sales in that category declined by 1.4% between 2014 and 2015, and they are expected to decline marginally in 2016. The APPA estimates that total spending on pet products will increase by 4.1% in 2016, to a total of $62.8 billion. [caption id="attachment_86928" align="aligncenter" width="720"] Source: APPA[/caption]

Source: APPA[/caption]

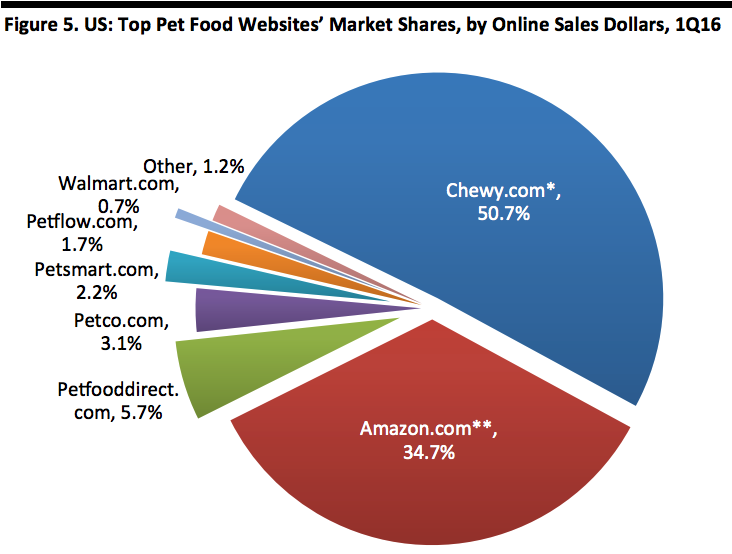

Two Companies Dominate Pet Food E-Commerce in the US

Two companies—Chewy.com and Amazon—stand apart in terms of pet food e-commerce in the US, according to analytics firm 1010data. They took a combined market share of over 85% in the category in the first quarter of 2016, 1010data says. Note that this market share is for pet food only, although both online retailers also sell pet supplies. [caption id="attachment_86929" align="aligncenter" width="720"] *Chewy.com’s share includes 40.5% share for Chewy.com and 10.2% share for the company’s subscription service.

*Chewy.com’s share includes 40.5% share for Chewy.com and 10.2% share for the company’s subscription service.**Amazon.com’s share includes 23.5% for the direct channel, 7.6% for the subscription channel and 3.6% for the market channel.

Source: 1010data [/caption] Regular e-commerce is not the only force driving sales at these two retailers. According to Petfood Industry, the pet food online subscription model is growing rapidly, with Chewy.com’s and Amazon’s subscription sales of pet food having nearly tripled year over year in the first quarter of 2016. Subscription services appear to be a good fit for pet food, given that it is typically a routine purchase for which shoppers can predict need. America’s Online Pet Retailers Below, we provide a rundown of the major players in the US pet e-commerce market.

- Privately owned online pet retailer com launched in 2011.

- Customers can save up to 20% on products when they subscribe to the company’s Autoship service, through which they can set up a schedule for products to be home delivered regularly.

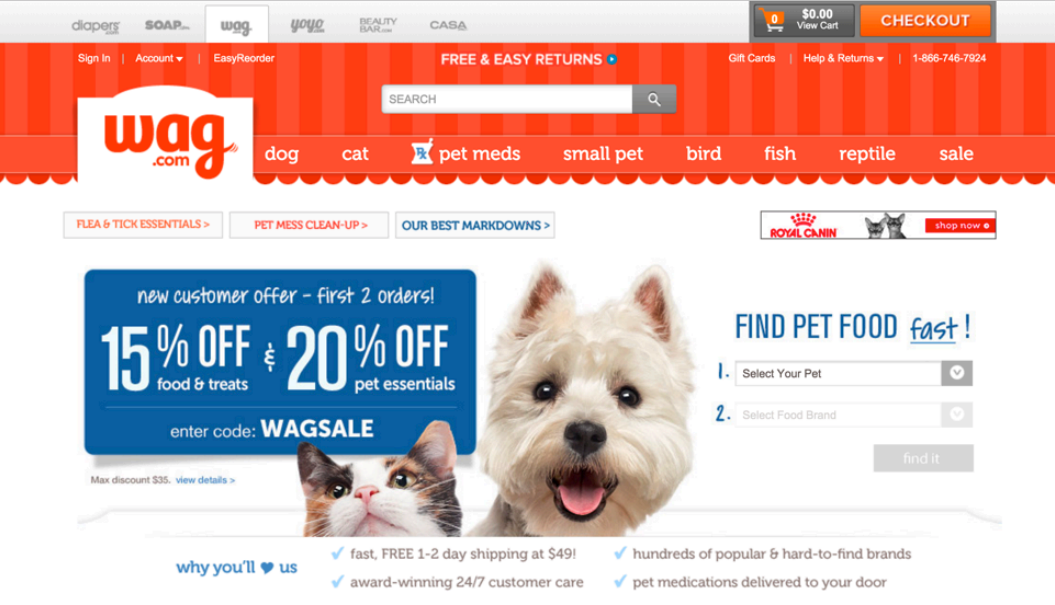

- Amazon sells pet products through its own website as well as through e-commerce site Wag.com, which is owned by Quidsi, a company Amazon acquired in 2011.

- com offers automatic product shipments through a service that is similar to Amazon’s Subscribe and Save; customers can save up to 15% on pet products when they purchase them regularly. According to 1010data, Amazon’s sales from Subscribe and Save grew by 200% year over year in 2015.

- According to eMarketer, 21% of Amazon’s Prime Now US subscribers purchased pet products in January 2016.

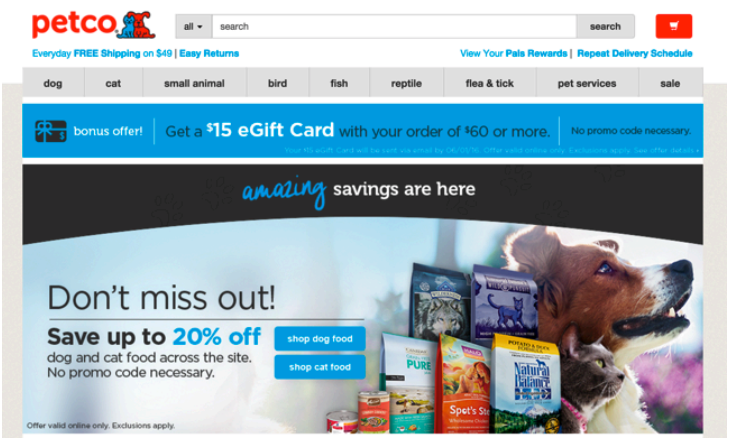

Leading US-based specialty pet retailers PetSmart and Petco both have a strong network of stores across the country. Online, however, neither has been able to match the success of pure plays Chewy.com and Amazon, according to the market-share data shown above.

Leading US-based specialty pet retailers PetSmart and Petco both have a strong network of stores across the country. Online, however, neither has been able to match the success of pure plays Chewy.com and Amazon, according to the market-share data shown above.

- PetSmart went private in 2015, after BC Partners acquired it.

- Net sales in 2014 were $6.9 billion (up 2.3% year over year), according to the company’s 10-K filing.

- The company operates more than 1,430 stores in the US, Canada and Puerto Rico.

- In order to gain market share online, in 2014, PetSmart acquired online pet products retailer Pet360, which runs more than 30 pet websites, including Petfooddirect.com.

- Pet360’s online stores offer an Auto Ship service, through which customers can set up a schedule for products to be home delivered. Customers can save up to 10% when they buy Auto Ship Bonus Brands through the sites.

- Customers can also choose to collect orders made online from selected PetSmart stores.

- Petco was acquired by CVC Capital Partners and Canada Pension Plan Investment Board in January 2016 from TPG (formerly Texas Pacific Group) and Leonard Green & Partners.

- According to CVC, Petco’s annual turnover is $4.4 billion.

- The company operates more than 1,430 stores in the US, Mexico and Puerto Rico.

- According to Internet Retailer, Petco’s online sales grew by 38.3% from 2010 to 2014, reaching $83.1 million.

- Petco offers a Repeat Delivery service, through which customers can save up to 20% when they subscribe for home delivery of products shipped on a schedule they can create online.

Despite having lower online market shares than Chewy.com and Amazon, PetSmart and Petco, thanks to their strong store networks, can compete with pet e-tailers by offering services that range from grooming to pet hotels. Petco and Pet360 offer subscription services online that offer savings to customers who make regular purchases. Petco also sells on Amazon, whereas PetSmart no longer does.

Despite having lower online market shares than Chewy.com and Amazon, PetSmart and Petco, thanks to their strong store networks, can compete with pet e-tailers by offering services that range from grooming to pet hotels. Petco and Pet360 offer subscription services online that offer savings to customers who make regular purchases. Petco also sells on Amazon, whereas PetSmart no longer does.

IN FOCUS: PET E-COMMERCE INTERNATIONALLY

Neither the growth in overall spending on pets nor the growth in pet e-commerce has been confined to the US. Below, we look at some of the other leading pet product markets worldwide and how they have adapted to pet e-commerce. Australia According to Australian business magazine INTHEBLACK, pet supplies is one of the fastest-growing e-commerce sectors in Australia, which has one of the highest pet ownership rates in the world. Analytics company SPS Commerce estimates that the online pet food market in Australia grew at an annualized rate of 16.6% between 2010 and 2015, compared to annualized growth of just 1.7% for the total pet food market during the same period.- Established in 2011, Pet Circle is the largest online pet supply retailer in Australia, according to the company.

- INTHEBLACK says Pet Circle’s revenues in the year ended June 2015 were A$145 million (US$123 million) and that the company expects annual growth of 15% over the next three years.

- Pet Circle offers an Auto Delivery service at lower cost for customers who order regular product deliveries.

China

Consumer research company Kantar Worldpanel reports that raising pets has become increasingly popular in China, due to urbanization and changing lifestyles. E-commerce’s share of pet product sales is relatively high in China compared to most other regions. GfK estimates that e-commerce will grow its share of total pet product sales in the country from 38% in 2015 to 43% in 2016.

China

Consumer research company Kantar Worldpanel reports that raising pets has become increasingly popular in China, due to urbanization and changing lifestyles. E-commerce’s share of pet product sales is relatively high in China compared to most other regions. GfK estimates that e-commerce will grow its share of total pet product sales in the country from 38% in 2015 to 43% in 2016.

- Tmall is a business-to-consumer platform for companies selling directly to consumers. Also owned by Alibaba Group, Taobao is a consumer-to-consumer and business-to-consumer online marketplace.

- According to China Daily, Nestlé, which sells on Tmall and Taobao, reports that pet food is one of its fastest-growing e-commerce categories in China.

- Established in 1999 in Germany, Zooplus says it is the leading online pet supply retailer in Europe in terms of sales, shipping to 28 countries. The company also says it is the third-largest pet supply retailer in Europe overall, including brick-and-mortar chains.

- The company’s net sales increased by 30% year over year in 2015, reaching €742.7 million (US$824 million).

- Pets at Home, which has over 400 stores in the UK plus an online shop, is the country’s market-leading pet specialist retailer. The company had a 19.6% market share of total pet care sales in the UK in 2014, ahead of Tesco (16%) and Asda (9.5%), according to Conlumino.

- In 2015, Pets at Home accounted for 45% of UK pet retail online traffic, according to website-monitoring company Hitwise.

- Pets at Home reports that its home delivery service has been more popular than its click-and-collect service (which is available at over 400 of the company’s stores), but that the latter is growing significantly faster.

IN FOCUS: ONLINE GROCERY HELPS DRIVE PET E-COMMERCE

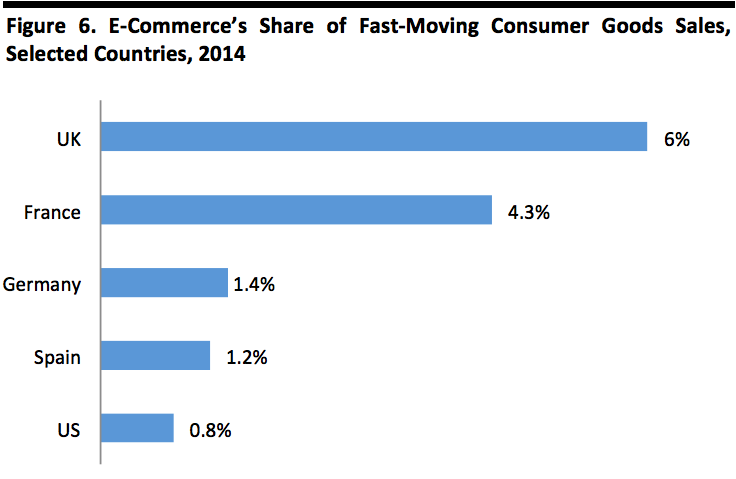

As an everyday CPG, pet food is, for many consumers, a grocery store purchase. That means the growth in pet food e-commerce is tied to some degree to the growth in grocery e-commerce. Pet food products represent a good fit with online grocery shopping because of their ambient, branded nature and the fact that they are often heavy and hard to get home from the store. Grocery retailers account for major shares of offline pet-food sales already: as we noted above, supermarket chains Tesco and Asda are in second and third place, respectively, in the UK pet care market. And, in markets such as France and the UK, which have established online grocery sectors, we expect grocery retailers to account for a sizable share of online pet food sales. In the US, which is a nascent market for e-grocery, online grocery sales are expected to ramp up in coming years, and that growth should drive more of America’s pet food spending online. [caption id="attachment_86935" align="aligncenter" width="720"] Source: Kantar Worldpanel[/caption]

So, the battle in e-commerce is not just between brick-and-mortar pet chains and pure-play pet specialists; grocery retailers will likely account for a growing share of pet product e-commerce, too.

Source: Kantar Worldpanel[/caption]

So, the battle in e-commerce is not just between brick-and-mortar pet chains and pure-play pet specialists; grocery retailers will likely account for a growing share of pet product e-commerce, too.

KEY TAKEAWAYS

- Millennials already own more pets than any other age group in the US, and the demographic is known for valuing convenience and being willing to look for good deals—both of which are likely to boost pet product e-commerce sales.

- Globally, pet product e-commerce growth rates have been impressive, albeit from low base figures: in 2014, e-commerce’s share of the global pet food market was only 4.4%, and even in many leading economies, it is still less than 10%.

- China has a major lead in pet product e-commerce: 43% of pet product sales in the country are expected to be made online this year.

- com and Amazon have both increased sales through subscription services that allow customers to buy pet products regularly in order to save money in the long run. Other pet specialist retailers with physical stores, such as Petco, have added such services to their offerings.

- Subscription services appear to be a good fit for the pet food category, given that pet food is typically a routine purchase for which shoppers can predict their need.

- Since pet food is a grocery purchase for many shoppers, the growth in online grocery sales is contributing to the migration of pet spending online. In the US particularly, grocery e-commerce is growing rapidly, from a small base, which will mean that more pet product spending will shift to the Internet.