DIpil Das

Introduction

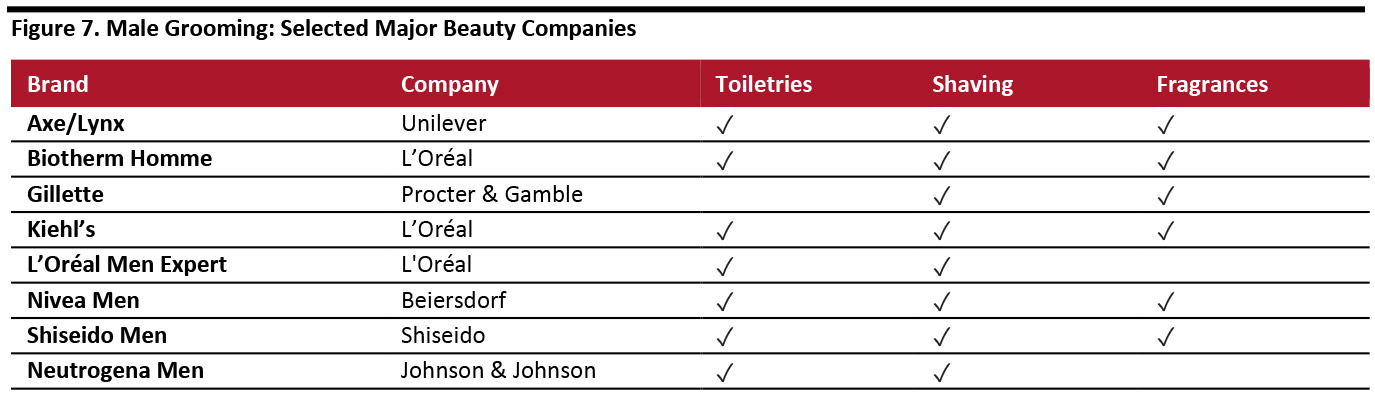

The global male grooming industry is at an inflection point, with leading beauty companies and niche startups alike entering, or building their presence in, the category. In recent years, the market has witnessed the emergence of many online startups, often with organic, vegan and all-natural offerings. The industry includes several subcategories: toiletries (bathing essentials, skin care, hair care and deodorant), shaving products (shaving cream, shaving gel, pre-shave lotion and after-shave lotion) and fragrances.The Global Male Grooming Market Is Worth $51 Billion

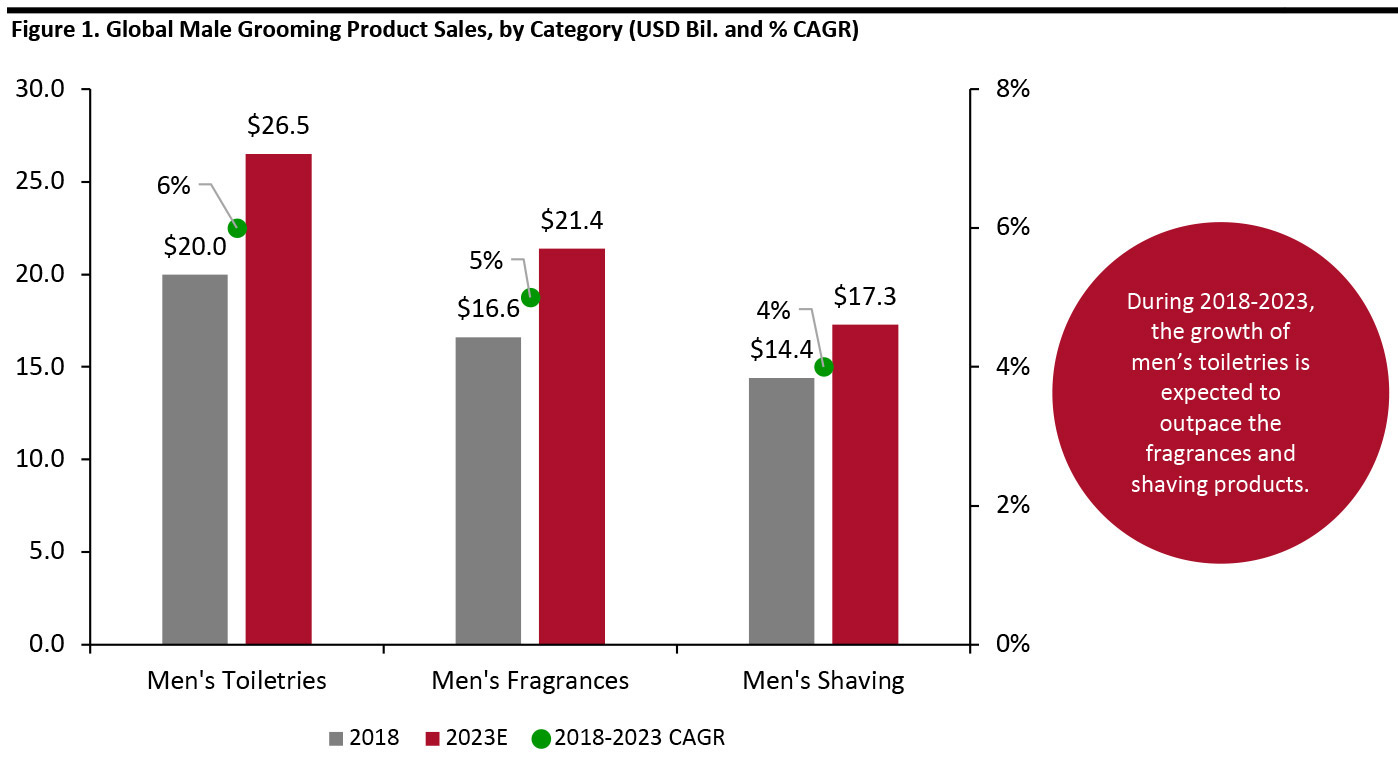

Worldwide, sales of male grooming products are seeing solid, but unspectacular, growth. The global market was worth $51.0 billion in 2018 and is projected to reach $65.2 billion by 2023, representing a CAGR of 5% according to Euromonitor International. Global growth will be driven by developing markets such as China and India, while annual growth in developed markets such as the US and the UK is likely to be in the low single digits.- In 2018, men’s toiletries comprised the largest category, valued at $20.0 billion or 39% of total sales. This category is expected to reach $26.5 billion in 2023, growing at a CAGR of 6% – making it the fastest-growing of the major categories.

- Fragrances and shaving products were valued at $16.6 billion and $14.4 billion, respectively, in 2018. Sales of fragrances are expected to growth at a CAGR of 5% to 2023, while sales of shaving products are expected to increase at a 4% average annual pace.

Source: Euromonitor International Limited 2019 © All rights reserved[/caption]

Source: Euromonitor International Limited 2019 © All rights reserved[/caption]

Factors Contributing to the Steady Growth of the Male Grooming Market

We believe the balanced growth in the male grooming industry is being driven by a number of factors. Traditionally, gender stereotypes for men were much narrower, meaning that they were perceived as more high-maintenance or less masculine if they engaged in activities that were considered “feminine”. However, these stereotypes are changing as men becoming increasingly conscious of personal care and the availability of targeted grooming products that assist with common imperfections, such as blemishes and dark circles. A major source of this cultural shift stems from greater acceptance among men to use grooming products. This is being heavily influenced through social media sites, which are increasing exposure to people’s appearances, particularly through image-focused platforms such as Instagram. With millions of followers and billions of likes and shares between them, male social media influencers are helping to drive male grooming trends and are (arguably) affecting perceptions of how consumers should look: As we noted in a previous report, a 2016 survey sponsored by advertising think tank Credos in the UK found that more than half of young male respondents ranked social media as a source of pressure to look good. Social media is therefore playing a significant role in consumer behavior, as men put more effort into improving their appearance, buying products such as color cosmetics, fragrances and moisturizers. Similarly, celebrity endorsements are encouraging male consumers to follow particular styles. For example, in 2018, popular soccer player David Beckham launched a men’s grooming line, House 99, in collaboration with L'Oréal. The brand is available in over 20 countries worldwide. Furthermore, the rise of e-commerce has increased the penetration of male grooming products online, providing easier accessibility to a rapidly growing product range for male consumers. Finally, developing economies such as China and India have seen recent growth in urbanization, with consumers experiencing higher standards of education and living as well as an overall rise in disposable income. Combined with the expansion of Western culture, this means that men in developing and emerging countries are increasingly buying personal care and grooming products , as well as spending a handsome part of their disposable income on grooming sessions in salons and spas.Skincare and Fragrance Segments Continues To Accelerate

The men’s skincare category is growing in line with increasing demand for anti-aging creams, SPF products, eye creams, tinted moisturizers and exfoliants, for example. In 2018, sales of men’s prestige skincare rose 9% in the US, according to market research firm the NPD Group. We expect to see buoyant demand in the men’s skincare segment in the near future due to its status as a product with more visible effects on personal appearance than some personal-care categories; and as product appeal is increased, through a combination of new, more naturally positioned men’s brands (such as Bulldog) and premium skincare brands (such as Kiehl’s).The Shave Care Business Is Going Through a Transformation

Shaving is the anchor point for male grooming routines, where toiletries are marketed as a pre- or post-shaving products. The global shaving sector is witnessing a massive disruption with the emergence of new brands. For a long time, Gillette (acquired by Procter & Gamble in 2005) dominated the shave care market. However, in recent years, the brand has been facing competitive pressure from new shave subscription service providers such as Dollar Shave Club and Harry’s, and has therefore witnessed a dip in its market share, from 70% in 2010 to 54% in 2019. During the fourth quarter of fiscal year 2019, Procter & Gamble took a non-cash, after-tax charge of $8 billion for the impairment of goodwill and trade name intangible assets in its Gillette shave care business. In the fourth quarter earnings conference call, Procter & Gamble’s COO Jon R. Moeller said that a decline in shaving frequency had condensed the size of the developed blades and razor market. Recently, Dollar Shave Club and Harry’s expanded the box subscription service beyond razors to deodorants and body washes. We see opportunities for such subscription services, which comprise a multi-million-dollar category, to capture further share of male-grooming spend.Europe Remains the Largest Male Grooming Market; Asia-Pacific To Bolster Growth

Europe continues to be the largest regional male grooming market, accounting for roughly 32% of the global market in 2018, according to Euromonitor. Latin America is the second largest at 22%, followed by North America and Asia-Pacific, at 19% and 18%, respectively. While Europe and North America are mature markets, the Asia-Pacific region will witness substantial growth in the male grooming segment in the near future, with China and India playing a major role. During 2019-2027, the Asia-Pacific market is expected to expand at a CAGR of 7.1%, according to market research firm Inkwood Research. In China and India, using grooming products was previously somewhat of a taboo for men. However, that is changing, and the younger generation is more accepting of skin and body care products and even fragrances. As indicated above, we believe that there is a premiumization opportunity in the male grooming market in these two nations due to the growth of the middle class, a rise in disposable income, aspirational spending and a consumer preference for higher-quality products. In addition, there is anticipated to be increasing innovation in product development by personal care companies, which may prove appealing to men in Asia Pacific. In India, male grooming products comprise one of the fastest-growing markets. The Associated Chambers of Commerce and Industry of India (ASSOCHAM) forecasts the sector to reach INR 350 billion ($4.93 billion) by 2020, growing at a CAGR of about 45% during 2018-2020. Presently, the sector in India is dominated by large FMCG players, such as Procter & Gamble, Hindustan Unilever and Emami. These companies rely on mass general trade distribution to drive sales but have a limited range of male grooming products. New-age digital brands, such as Beardo and the Indian Grooming Club, are utilizing the e-commerce channel and disrupting the incumbents by directly selling to their customers and deriving insights on customers’ buying behavior. Online startups use this data to capture trends and launch disruptive products ahead of their large competitors. Euromonitor expects the China male grooming market to grow at a CAGR of 7%, between 2018 and 2023. In China, Alibaba’s Tmall platform witnessed a 50% surge in men’s skincare sales in two consecutive years from 2016 to 2018. The site saw the sales of skincare products tailored for men increase over that period: cosmetics by 89%, cleansers by 51%, facial masks by 58% and by 114%. According to a white paper developed by L'Oréal China and Tmall in 2018, about 62% of Chinese men aged 15-50 said they used male-specific facial skincare products in 2017. The white paper also states that online sales of men’s grooming products in China grew more than 50% over each of the past two years.US Men’s Grooming Habits and Shopping Behaviors

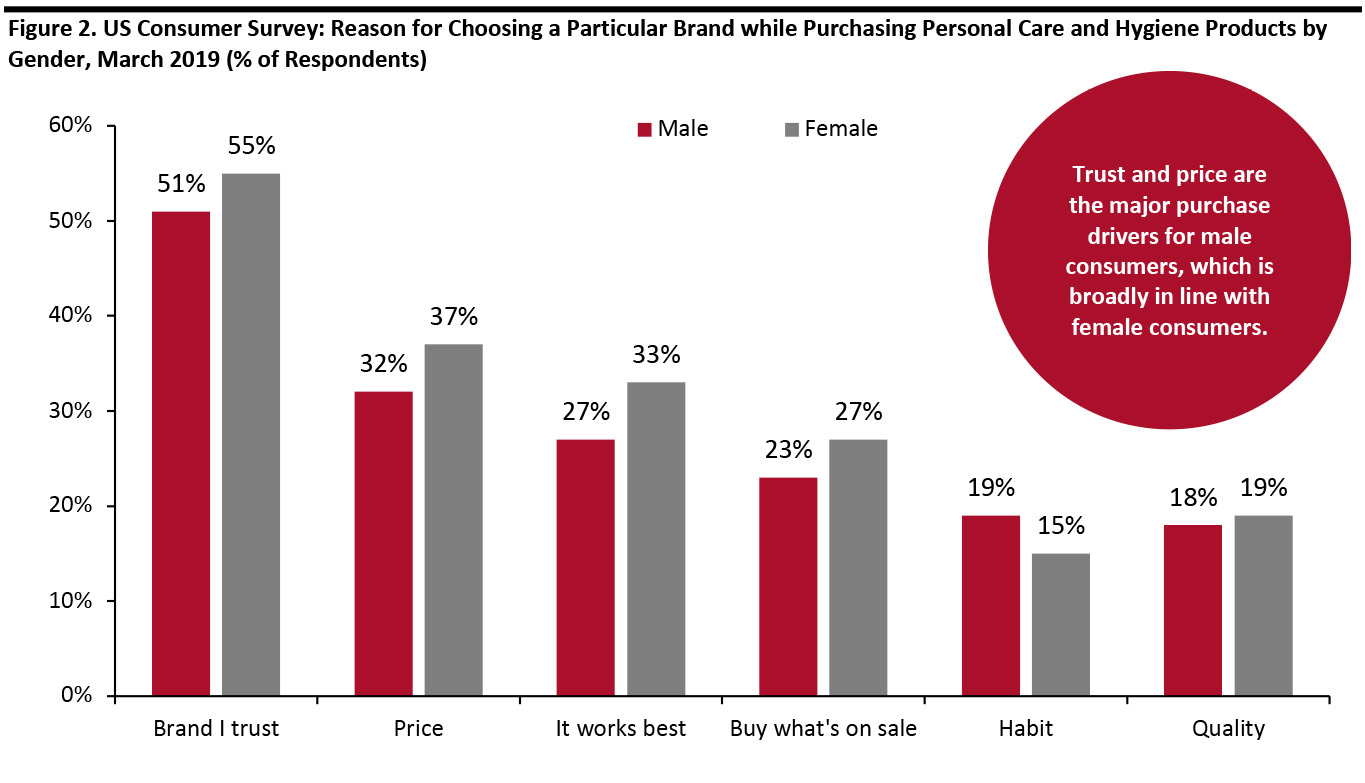

In this section, we use consumer survey data to explore the habits of male grooming shoppers in the US. Trust and Price Are the Major Purchase Drivers for US Men Like women, men in the US value trust more than anything else when selecting personal care and hygiene products, which could be good news for established brands in retaining customer loyalty. Evidence of this was suggested in a US survey by Prosper Insights & Analytics in March 2019, in which more than 50% of male respondents said they would select a personal care product based on trust, which is broadly in line with female respondents. Again showing a similar trend to female consumer habits, men look to price as the second-most important criterion in choosing products. However, men are more likely than women to choose a personal care and hygiene brand based on habit. [caption id="attachment_97782" align="aligncenter" width="700"] *Only more than 15% is shown

*Only more than 15% is shown Base: 3,360 male respondents and 4,028 female respondents aged 18 years and older

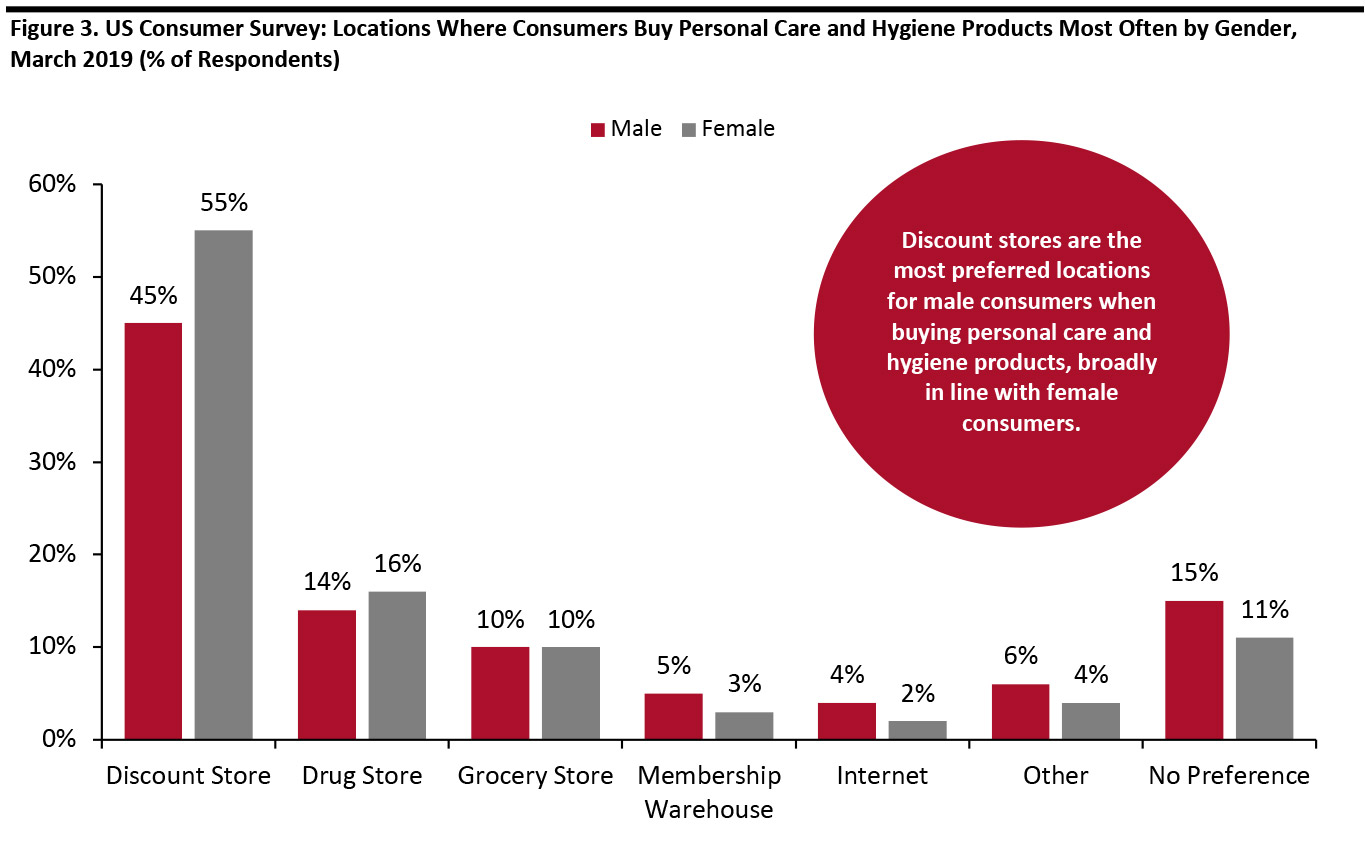

Source: Prosper Insights & Analytics [/caption] Most US Male Shoppers Research Grooming Products Online but Prefer To Buy In-store Male shoppers browse, research and gain knowledge about grooming products online, but when it comes to purchasing, they most often buy in-store. A survey by Prosper in March asked respondents to specify the retail channel they most frequently used to buy personal care and hygiene products:

- Some 45% of US male shoppers most often buy personal care and hygiene products from a discount store—a lower proportion than female shoppers, at 55%.

- Drug stores are the second-most-preferred locations for millennials when buying personal care and hygiene products. However, only 14% of male shoppers said they buy items from drug stores, compared to 16% of female shoppers.

- Like female shoppers, relatively few male shoppers buy personal care and hygiene products online; only 4% of the male respondents agreed that they buy such goods most often through online platforms, although this is a higher percentage than was the case for female shoppers.

Base: 3,360 male respondents and 4,028 female respondents aged 18 years and older

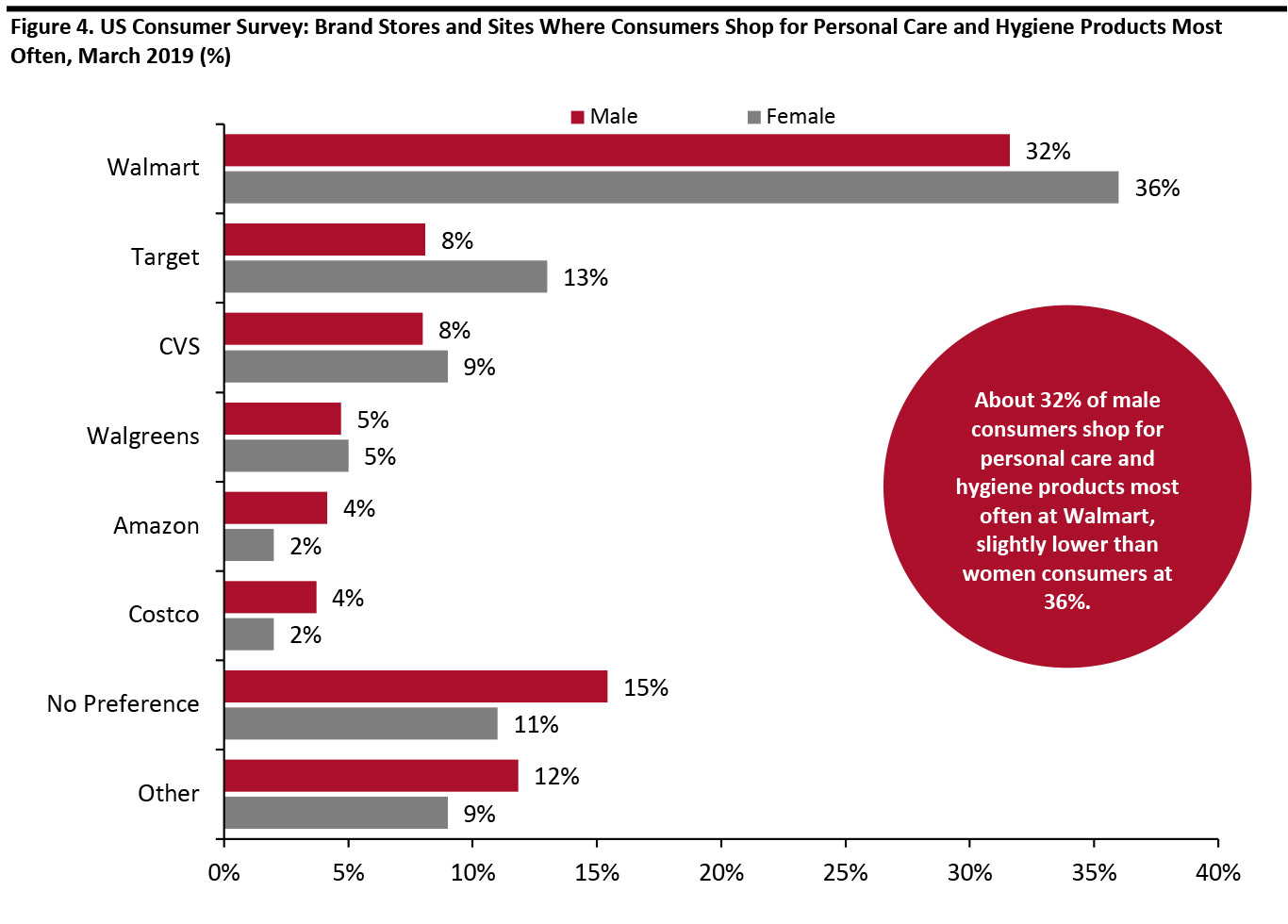

Base: 3,360 male respondents and 4,028 female respondents aged 18 years and older Source: Prosper Insights & Analytics [/caption] About One-Third of American Men Shop Most Often at Walmart for Personal Care and Hygiene Products When it came to specifying suppliers, Walmart is the top destination for personal care and hygiene product purchases among men in the US, according to Prosper’s survey data, with about 32% of survey respondents saying they shop there most often for such products, a slightly lower percentage than American women. Target and CVS were each identified as preferred suppliers by nearly 8% of male respondents, versus 13% and 9% of female respondents, respectively. Some 12% of male respondents named “other” as the location where they most frequently buy personal care and hygiene products, while about 15% indicated “no preference”. Nearly 5% of men said that they buy these items most often at Walgreens, 4% at Amazon and 4% at Costco. The top four retailers named above accounted for 53% of male consumer responses. [caption id="attachment_97784" align="aligncenter" width="700"]

*Only more than 3% is shown for the male consumer

*Only more than 3% is shown for the male consumer Base: 3,360 male respondents and 4,028 female respondents aged 18 years and older

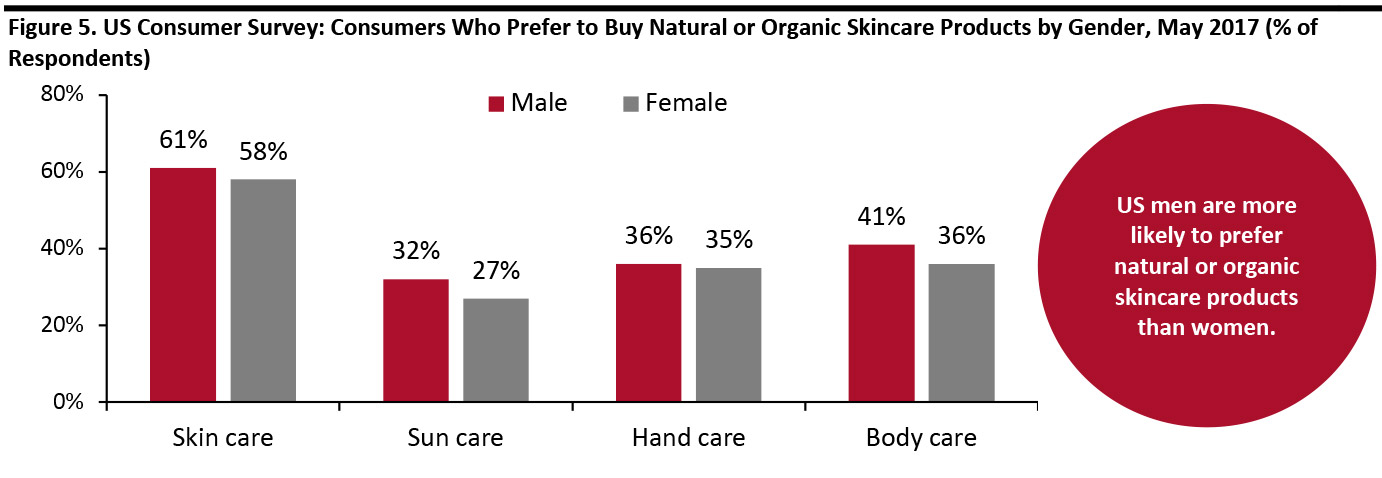

Source: Prosper Insights & Analytics [/caption] Men Follow a Green Approach to Grooming Grooming products with natural and organic properties are attracting consumers, which are influencing demand for toiletries, especially skincare. In a 2017 survey by Statista, 61% of US male respondents said that they prefer to buy skincare products that are natural or organic, whereas the study found that the preference for natural or organic products among female consumers stood at 58%. According to Mintel, 32% of new male personal care product developments in North America claim to include natural ingredients. The market research company also stated that about 33% of men in the UK agree that it is important that men’s haircare products contain natural or organic ingredients. We believe that the strict industry regulations surrounding product composition and a growing consumer preference toward natural ingredients and organic products are likely to play an important role in the development of the male grooming market in the near future. [caption id="attachment_97785" align="aligncenter" width="700"]

Base: 906 respondents aged 18-65 years, who use skincare products at least once per month

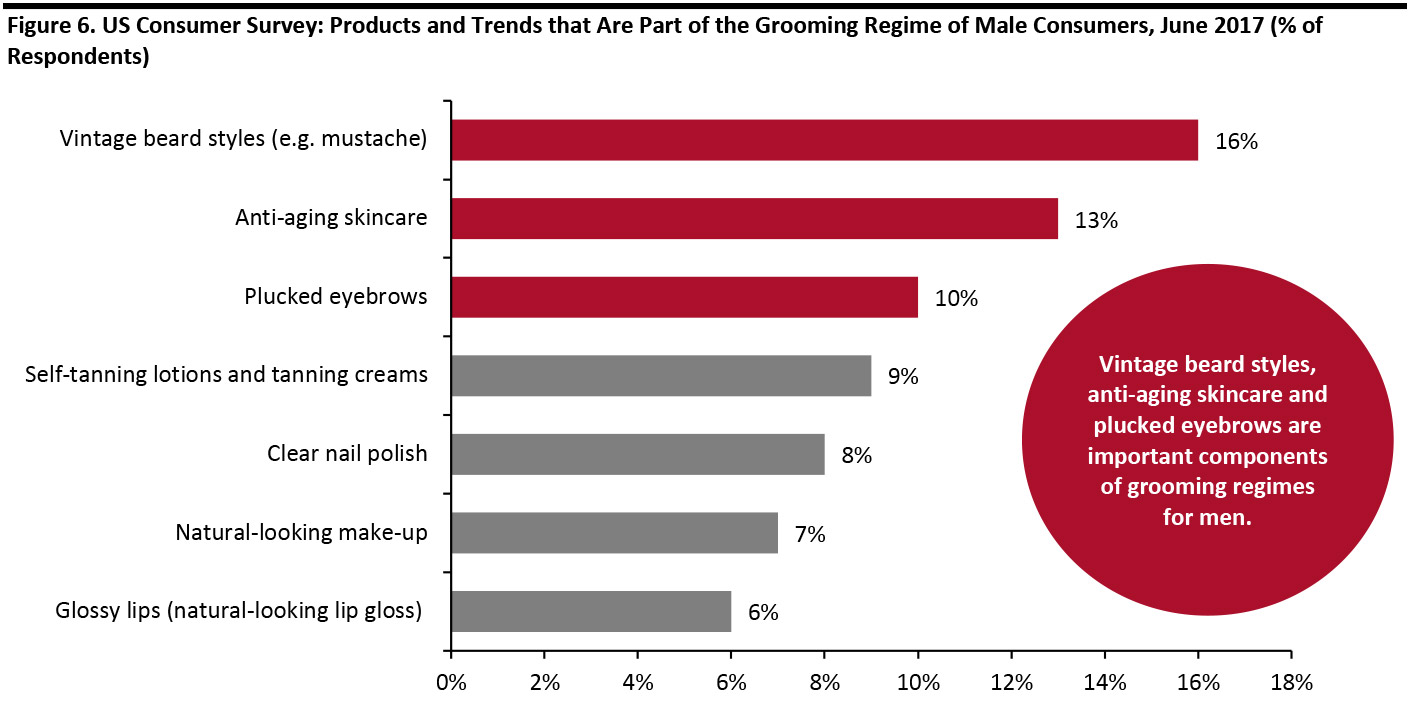

Base: 906 respondents aged 18-65 years, who use skincare products at least once per month Source: Statista [/caption] US Male Grooming Products and Trends A survey by Statista in June 2017 asked male respondents in the US to identify the products that were part of their grooming regime:

- 16% said that products designed to care for vintage beard styles, such as a mustache, factored into part of their grooming regime.

- Anti-aging skincare products were found to be used by 13% of respondents. specified.

- 10% said that they regularly used eyebrow products, while 9% confirmed that self-tanning lotions and tanning creams were part of their grooming regime.

Base: 1,032 Male US respondents aged 18 years and older; only box part of male grooming regime

Base: 1,032 Male US respondents aged 18 years and older; only box part of male grooming regime Source: Statista [/caption] Major Players in the Male Grooming Market Some of the leading beauty and personal care product companies have expanded their portfolios to incorporate dedicated brands for male grooming products, such as Procter & Gamble’s Gillette and Unilever’s Axe, or sub-brands such as Shiseido Men and L'Oréal Men Expert, among others. [caption id="attachment_97787" align="aligncenter" width="700"]

Source: Company reports[/caption]

Source: Company reports[/caption]

Leading Beauty and Personal Care Product Companies Are Collaborating and Focusing on Expansion in the Male Grooming Segment

In 2017, Beiersdorf’s Nivea Men signed a five-year contract with the football club Real Madrid to extend their partnership in 70 countries. Nivea Men and Real Madrid initially entered into partnership in 2013 in select countries. Real Madrid has over 500 million fans across the globe. In the press release, Beiersdorf’s European executive board member Thomas Ingelfinger said, “men around the world share a big passion for football, and positioning Nivea Men and its care products in this environment enables a powerful, emotional bond with the male target group.” A 2017 survey by Statista revealed that 71% of men have more trust in the performance and quality of brands if they are being used by professionals. Shiseido launched a new, male-only grooming program in Shanghai in July 2019. Under the program, the company will offer a range of salon care for men (such as facial care, shaving and scalp care) at over half of their salons in Shanghai. During the launch, Tang Yun, Education Consultant at Shiseido Professional, said that this new grooming service could be used for home treatments and in-salon care, and would allow consumers to complete their haircut, shaving, scalp care and facial care in one place in a short time. Yun added that this new, comprehensive grooming program was being welcomed by many male customers. L’Oréal China entered into a partnership with Tmall to access the male grooming market in the country in September 2018. As part of the agreement, Tmall has helped L’Oreal China to identify target customers for men-only personal care, hair care and other related products. Under the terms of the partnership, Tmall will also help L'Oréal China speed up its consumer-to-business approach by providing data insights and trends generated from Alibaba’s platforms. In addition, Tmall will assist L'OréalChina in establishing new value chains to connect consumers, products and channels. Unilever, through its Indian subsidiary Hindustan Unilever, collaborated with Amazon in 2018 to develop a line of hair care products for men—including beard wash, beard oil and hair cream—to be exclusively sold on the online marketplace. This move marked Unilever’s entry into the beard grooming category, and is the first partnership of its kind for the personal care company.Some Emerging Male Grooming Brands Are Causing Disruption for Incumbents

A number of emerging male grooming brands and retailers are targeting a share of the booming market. As the young, urban male spends increasingly more on grooming, niche startups dealing in men's personal care and hygiene are mushrooming fast and developing specialized products. Bevel, a brand of Walker & Company (acquired by Procter & Gamble in December 2018) raised the bar in the shave care business with its product formulations and end-to-end shaving system. The brand is primarily targeted at reducing and preventing razor bumps and irritation. In January 2019, Bevel launched a skincare collection for men of color, which features four products: a face wash, spot corrector, toner and gel moisturizer. According to Walker & Co.’s CEO Tristan Walker, the new product range will not only deepen the brand’s relationship with current customers but will cater to potential customers who do not shave. Bevel sells its products through its website and the physical stores of Target. [caption id="attachment_97788" align="aligncenter" width="700"] Source: Bevel[/caption]

Birchbox Grooming (earlier BirchboxMan) started offering men’s grooming subscriptions from 2012. In 2017, the company introduced a lower-priced, $10-per-month subscription plan that led to 100% year-over-year growth across the brand. The subscription box includes anti-aging moisturizers, hair styling essentials and beard care supplies, among other products. Skin care is Birchbox’s best-selling and most popular category.

Christian Wallin, former Director of Product at the company, in a 2017 interview with Retail TouchPoints, said that over 50% of all subscribers purchase full-size products online. The average order value of Birchbox’s male subscribers is over 10% higher than female subscribers, according to Wallin. Wallin also states that the brand’s male subscribers are 25% more likely to activate in the first 90 days than female subscribers.

Bulldog Skincare was launched by two friends, Simon Duggy and Rhodri Ferrier, in 2006, with the aim of tapping into the male grooming market in the UK by selling natural products. The brand was acquired by Edgewell Personal Care in 2016. The company’s products are specifically built for men, rather than being a men’s version of a women’s brand, according to Duggy. Bulldog Skincare states that all of its male grooming products are suitable for vegetarians and vegans, and the brand is certified by Cruelty Free International.

In 2018, the company launched its Original Bamboo Razor, which was developed using natural bamboo instead of regular plastic and is packed in fully recycled packaging. Bulldog has also started making packaging tubes from Brazilian sugarcane, minimizing the impact on food suppliers or biodiversity. The brand has won awards in the UK for its Original Bamboo Razor and sugarcane packaging.

Also last year, Bulldog launched grooming products in 13 new markets, almost doubling its industry presence. Currently, the brand is available in 27 countries across the globe. According to Duggy, the brand has held the top position in the men’s facial skincare market in Sweden since 2016.

The Man Company is an India-based subscription e-commerce platform for male grooming products, launched in 2015. The brand’s website states that all of its products, including shave gels, face wash, shampoo and body wash, contain 100% natural oils and are free of SLS and Paraben. The startup claims to have recorded a monthly turnover of INR 40 million and expects to break even by the end of 2020.

In 2017, The Man Company received its first tranche of investment of $3 million from India-based FMCG company Emami, according to India media platform Inc42. In February 2019, The Man Company received its second tranche of funding, increasing Emami’s stake in the startup to 30%. According to Inc42, the investments came at a time when The Man Company was looking to expand its presence across Tier 2 and Tier 3 cities.

Ursa Major is an all-natural, gender-neutral skincare brand that was launched in 2010. It provides a low-maintenance skincare program for all skin types and offers an unscented baking soda-free formula for those with sensitive skin. Ursa Major’s e-commerce website accounts for 40% of the company’s sales, while wholesale partnerships with retailers (such as Credo, Follain and The Detox Market) and Amazon make up another 40% and 20% of the business, respectively.

In December 2018, Ursa Major made its first foray into the haircare category with its new line of Go Easy Daily shampoos and conditioners. The co-founder of the brand Oliver Sweatman said that the company is anchoring these products “in skin care because there are not many brands that are treating hair, the body and the face as one.” Ursa Major projects its haircare products to contribute about 10% of sales in 2019.

[caption id="attachment_97789" align="aligncenter" width="700"]

Source: Bevel[/caption]

Birchbox Grooming (earlier BirchboxMan) started offering men’s grooming subscriptions from 2012. In 2017, the company introduced a lower-priced, $10-per-month subscription plan that led to 100% year-over-year growth across the brand. The subscription box includes anti-aging moisturizers, hair styling essentials and beard care supplies, among other products. Skin care is Birchbox’s best-selling and most popular category.

Christian Wallin, former Director of Product at the company, in a 2017 interview with Retail TouchPoints, said that over 50% of all subscribers purchase full-size products online. The average order value of Birchbox’s male subscribers is over 10% higher than female subscribers, according to Wallin. Wallin also states that the brand’s male subscribers are 25% more likely to activate in the first 90 days than female subscribers.

Bulldog Skincare was launched by two friends, Simon Duggy and Rhodri Ferrier, in 2006, with the aim of tapping into the male grooming market in the UK by selling natural products. The brand was acquired by Edgewell Personal Care in 2016. The company’s products are specifically built for men, rather than being a men’s version of a women’s brand, according to Duggy. Bulldog Skincare states that all of its male grooming products are suitable for vegetarians and vegans, and the brand is certified by Cruelty Free International.

In 2018, the company launched its Original Bamboo Razor, which was developed using natural bamboo instead of regular plastic and is packed in fully recycled packaging. Bulldog has also started making packaging tubes from Brazilian sugarcane, minimizing the impact on food suppliers or biodiversity. The brand has won awards in the UK for its Original Bamboo Razor and sugarcane packaging.

Also last year, Bulldog launched grooming products in 13 new markets, almost doubling its industry presence. Currently, the brand is available in 27 countries across the globe. According to Duggy, the brand has held the top position in the men’s facial skincare market in Sweden since 2016.

The Man Company is an India-based subscription e-commerce platform for male grooming products, launched in 2015. The brand’s website states that all of its products, including shave gels, face wash, shampoo and body wash, contain 100% natural oils and are free of SLS and Paraben. The startup claims to have recorded a monthly turnover of INR 40 million and expects to break even by the end of 2020.

In 2017, The Man Company received its first tranche of investment of $3 million from India-based FMCG company Emami, according to India media platform Inc42. In February 2019, The Man Company received its second tranche of funding, increasing Emami’s stake in the startup to 30%. According to Inc42, the investments came at a time when The Man Company was looking to expand its presence across Tier 2 and Tier 3 cities.

Ursa Major is an all-natural, gender-neutral skincare brand that was launched in 2010. It provides a low-maintenance skincare program for all skin types and offers an unscented baking soda-free formula for those with sensitive skin. Ursa Major’s e-commerce website accounts for 40% of the company’s sales, while wholesale partnerships with retailers (such as Credo, Follain and The Detox Market) and Amazon make up another 40% and 20% of the business, respectively.

In December 2018, Ursa Major made its first foray into the haircare category with its new line of Go Easy Daily shampoos and conditioners. The co-founder of the brand Oliver Sweatman said that the company is anchoring these products “in skin care because there are not many brands that are treating hair, the body and the face as one.” Ursa Major projects its haircare products to contribute about 10% of sales in 2019.

[caption id="attachment_97789" align="aligncenter" width="700"] Source: Ursa Major[/caption]

Source: Ursa Major[/caption]

Some Retailers Are Redesigning Stores and Developing Retail Outlets

Kiehl’s, a premium skincare brand owned by L’Oréal, has a large male clientele that accounts for nearly half of its total customers. The brand has over 250 retail stores worldwide. In March 2019, Kiehl’s opened a new flagship store in Senayan City, Indonesia, marking the company’s biggest boutique in Asia Pacific. The store has adjacent designated men’s product corners, a nod to the brand’s New York roots. Kiehl’s recently released a new limited packaging of the Rare Earth Deep Pore Cleansing Masque in China as a part of the 10th year of its campaign in the country. To appeal to male millennial consumers, Kiehl’s also invited Chinese actor Liu Haoran to design the new limited packaging for 2019. Nordstrom opened its first standalone men’s store in April 2018. The 47,000 sq. ft store, located in New York City, offers products across various categories, as well as convenient customer services. It has a dedicated section for male grooming, which includes fragrances, shave care and other grooming products. The store also features a barber chair, where barbers from UK-based Murdock London make special appearances. Murdock London provides barbering services and offers male grooming tools and accessories. In May 2019, Target expanded its men’s apparel and accessories brand, Goodfellow & Co, to include male grooming products. The brand was launched two years ago, and Target expects it to reach $1 billion in revenue by 2020. Goodfellow & Co offers an array of products, developed through technical designers, chemists and beauty designers. According to Target, the brand is 20% more affordable than comparable premium brands. The company’s move to grow its private labels will generate higher profit margins and provide Target with a competitive edge. In the press release, Target’s Executive Vice President and Chief Merchandising Officer Mark Tritton said that the company’s male grooming products are being created under the guidelines of Target’s 2020 chemical strategy and are formulated with recognizable plant-based ingredients that are free from toxins and unwanted chemicals.Key Insights

We believe that the global male grooming market will maintain a steady growth trajectory in line with the rising interest of male consumers in appearance and grooming, as well as ongoing product innovation, particularly in the developing and emerging markets.- Owing to the growing demand for skincare and haircare products, we believe that the growth in the men’s toiletries category will outpace that of shaving products and fragrances. However, shave care will remain an important segment, as it is the anchor point for male grooming routines.

- Physical stores will continue to be the primary distribution channel for male grooming products and comprise the bulk of sales in the near future. More retailers will redesign stores and offer grooming experiences to specifically target male customers.

- We believe Internet retailing will continue to thrive along with physical distribution channels, through increasing numbers of online startups, grooming blogs and websites dedicated to male grooming products.

- The challenge that many beauty brands will face is to capture the loyalty of male consumers. Men are more likely to seek instant gratification and convenience; they like natural and organic products; and brand trust and price are often key purchase drivers for them.