Nitheesh NH

Introduction

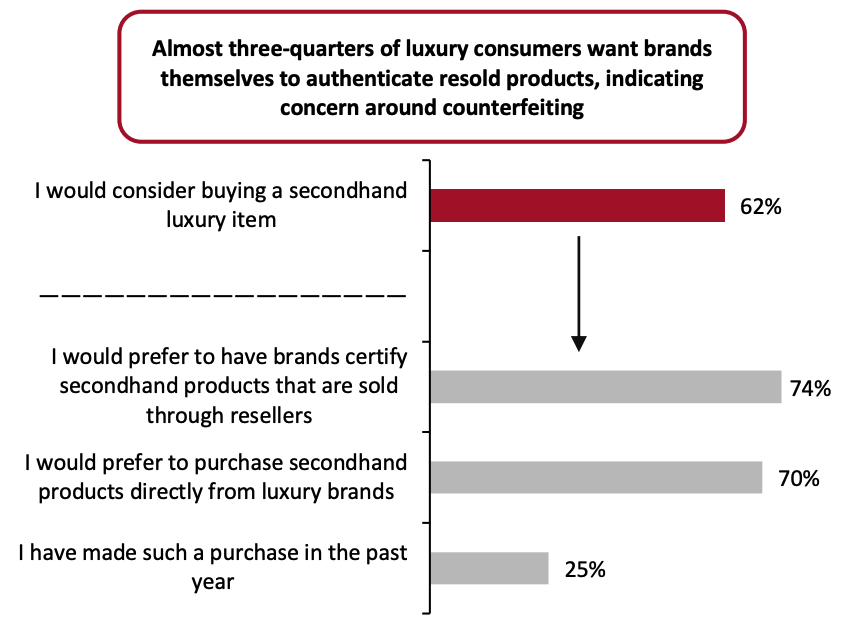

What’s the Story? Luxury resale traditionally denoted the buying and selling of secondhand items either in thrift shops or at auction houses, but increasing consumer demand and the proliferation of online platforms for secondhand goods has democratized luxury resale. In this report, we explore the size and trajectory of the global luxury resale market, including key players, drivers and challenges for luxury resale and what luxury brands are doing to better serve this market. Why It Matters The pandemic has brought sustainability and conscious shopping to the fore, and shoppers—particularly Gen Zers—are becoming increasingly aware of the ethical and environmental implications of their shopping choices. Some 62% of global luxury consumers would consider buying secondhand luxury items, according to a September 2020 survey by consulting firm BCG and Italian luxury group Altagamma, indicating that there is a sizeable opportunity in the resale market. Secondhand luxury items also provide a means for aspirational luxury shoppers to own luxury items, and we believe this segment will contribute to secondhand luxury’s growing customer base.The Global Luxury Resale Market: Coresight Research Analysis

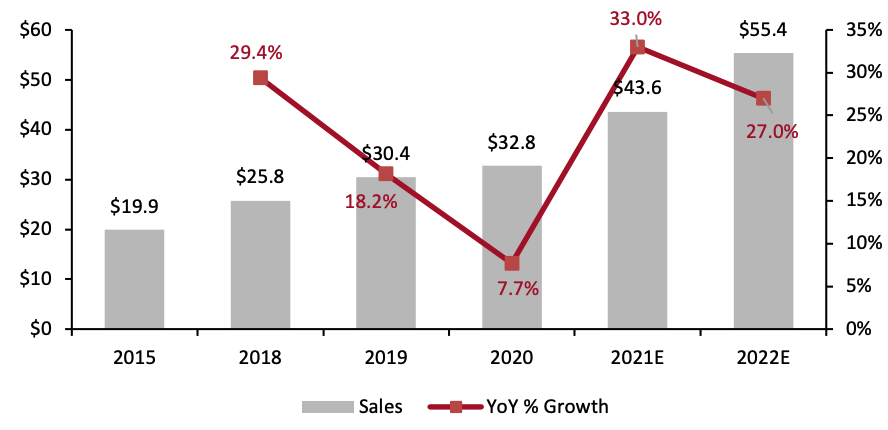

Market Size and Composition The global secondhand luxury goods market grew by 33.0% year over year to $43.6 billion in 2021, and will grow by a still-strong 27.0% year over year to $55.4 billion in 2022, Coresight Research estimates based on Bain & Company data (see Figure 1). We expect the global luxury resale market to equate to 14.9% of the size of the global luxury market for new goods in 2022 (see Figure 2). The pandemic prompted a negative downturn in growth across many markets, but the growing secondhand luxury market was an exception: In 2020, the secondhand luxury market saw positive growth of 7.7% to $32.8 billion, according to Bain & Company—although this was lower than the double-digit growth seen in previous years. We expect near-term growth to be driven by pent-up demand, an increase in supply and a willingness to use secondhand items as the threat of Covid-19 subsides, while long-term growth will be driven by younger shoppers increasingly purchasing secondhand items amid the rise of the conscious consumer.Figure 1. Global Personal Luxury Secondhand Goods Market: Total Sales (Left Axis; USD Bil.) and Growth (Right Axis; YoY % Change) [caption id="attachment_141481" align="aligncenter" width="700"]

Source: Bain & Company/Coresight Research[/caption]

Source: Bain & Company/Coresight Research[/caption]

Figure 2. Global Personal Luxury Goods Markets: Sales of Secondhand Products vs. Sales of New Products* (USD Bil.) [caption id="attachment_141482" align="aligncenter" width="700"]

*May include sales where major luxury groups have some holdings in resale platforms

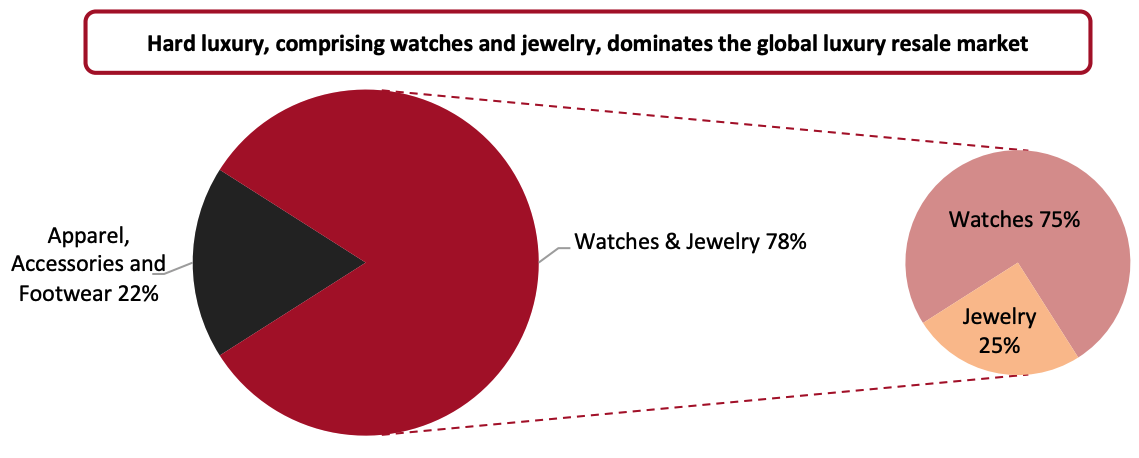

*May include sales where major luxury groups have some holdings in resale platformsSource: Bain & Company/Coresight Research[/caption] Hard luxury, comprising watches and jewelry, dominates the global luxury resale market, accounting for more than three-quarters of product offerings in 2019 (latest data available), according to Bain & Company (see Figure 3). Hard luxury items often have a higher original sale price and are more durable than soft luxury items, and thus retain their value over a longer period of time. Components or materials of hard luxury products, such as precious gems or metals, also contain intrinsic value that can appreciate over time, allowing watches and jewelry to recover a greater share of original prices than soft luxury products typically do. There are exceptions in soft luxury, such as handbags from limited collections or from big names such as Chanel and Hermès, which could see greater price recovery than other soft luxury products.

Figure 3. Global Secondhand Luxury Goods Market: Breakdown of Category Share [caption id="attachment_141483" align="aligncenter" width="700"]

Data in the left chart are from 2019; data in the right chart are from 2020 (latest data available)

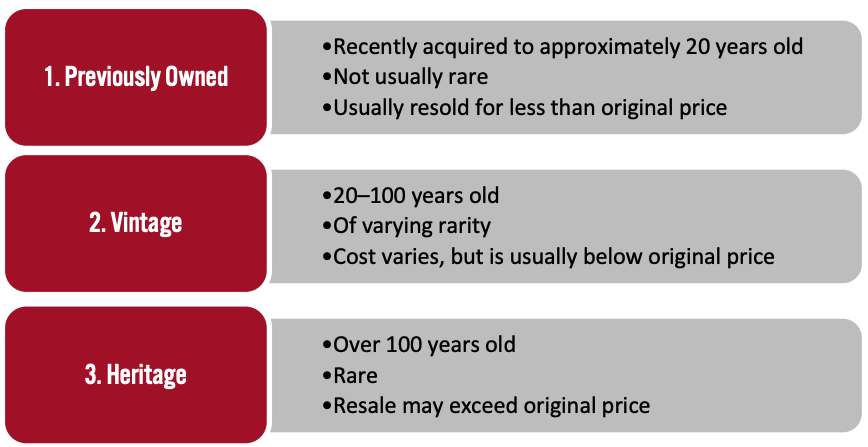

Data in the left chart are from 2019; data in the right chart are from 2020 (latest data available)Source: Bain & Company/BCG/Altagamma/Coresight Research[/caption] Market Segmentation There are three key segments of secondhand luxury products based on rarity, newness and price. We summarize these segments in Figure 4 and discuss each in more detail below.

- Previously owned and vintage items’ resale price may exceed the original in exceptional cases, such as limited-edition products or hard luxury products containing gems and materials whose price has appreciated over time.

Figure 4. Secondhand Luxury Market Segmentation [caption id="attachment_141484" align="aligncenter" width="700"]

Source: Hemswell-antiques.com/Coresight Research[/caption]

1. Previously Owned

Items that have been recently bought, are unused or only gently used, and are in saleable condition generally fetch a lower price than the original retail price, and can thus serve to recover some part of the price paid if the consumer no longer has use for the item. However, the brand, rarity of, and demand for, the item can increase the resale price, and some previously owned items are bought as investments.

Source: Hemswell-antiques.com/Coresight Research[/caption]

1. Previously Owned

Items that have been recently bought, are unused or only gently used, and are in saleable condition generally fetch a lower price than the original retail price, and can thus serve to recover some part of the price paid if the consumer no longer has use for the item. However, the brand, rarity of, and demand for, the item can increase the resale price, and some previously owned items are bought as investments.

- The Louis Vuitton City Steamer MM Crocodile Bag, which was part of the 2016 Cruise Collection, retailed at $55,500 on the brand’s US site when it was launched. It is currently unavailable on the US site, but a “very good” version with “minor wear” is available for $13,000 on resale platform The RealReal, and a new one with the box for $47,000 on resale and auction site 1stDibs.com as of October 6, 2021. These two listings denote a recovery of 24% and 85%, respectively, of the original price.

- The Niloticus Crocodile Himalaya Birkin 30 from Hermès, encrusted with gold and diamonds, is one of the most expensive handbags ever sold: At an auction in Hong Kong in 2017, the bag sold for over $380,000. A version of this bag from the 2014 collection with palladium hardware, described as having “faint scuffs,” was available for $195,000 on The RealReal, while a similar bag in “excellent” condition was listed for $219,999 on 1stDibs.com.

Hermès Niloticus Crocodile Himalaya Birkin 30 with palladium hardware (left) and encrusted with gold and diamonds (right)

Hermès Niloticus Crocodile Himalaya Birkin 30 with palladium hardware (left) and encrusted with gold and diamonds (right)Source: The RealReal/Christie’s[/caption] 2. Vintage Items Items that are 20–100 years old are considered vintage. Consumers may wish to buy items in this category as collectables or investments, or simply because the models no longer exist.

- Rolex’s Jean-Claude Killy line of watches, released in the late 1950s and early 1960s, have become rare collectors’ items. On resale platform Vestiaire Collective, a pink gold Oyster Chronograph watch was offered for £257,054 ($348,630). On auction site Christie’s, a watch from this line was listed for auction in November 2020 for offers of between $220,000 and $440,000, finally selling for $312,500.

A 1950s Rolex Oyster Chronograph Jean Claude Killy pink gold watch

A 1950s Rolex Oyster Chronograph Jean Claude Killy pink gold watchSource: Vestiaire Collective[/caption] 3. Heritage Items that are over 100 years old and have historic value fall into the “Heritage” category, otherwise known as “antiques.” These items are sought after due to their historic relevance, which determines value. For example, several art pieces and other objects from between the 17th and 19th century are up for auction for prices from a few hundred dollars to up to $1.2 million at Sotheby’s. These items are purchased as part of public collections at museums or by private collectors. In the following sections of this report, we focus on the pre-owned and vintage segments of the secondhand luxury market. Competitive Landscape The global luxury resale market is very fragmented, with the top 10 online platforms accounting for 16.6% of the total market in 2020, according to industry data and Coresight Research calculations. We estimate that 50% of luxury resale takes place through offline resellers and 8%–10% through auction houses. In Figure 5, we present the top 10 major global luxury resale platforms (by 2020 revenue). We detail the top three platforms below.

Figure 5. Major Global Luxury Resale Platforms [wpdatatable id=1715]

*These platforms also sell non-luxury brands. Source: 1stDibs.com/ Growjo.com/Poshmark/S&P Capital IQ/The RealReal/ThredUp/Watchpro.com/ Coresight Research

The RealReal- Established: 2011

- Funding raised: $288 million before IPO (initial public offering) in June 2019

- Categories: accessories, beauty, fashion, home décor, jewelry and pet products

- Established: 2011

- Funding raised: $153 million before IPO in January 2021

- Categories: Clothing, fine art, fine jewelry, home décor and watches

- Established: 2002

- Funding raised: $10 million; acquired by Richemont in 2018

- Categories: Watches

- Read our separate report for further discussion of the various models in operation in the US resale market.

- Alexander McQueen launched a platform called McQ for the brand’s consumers to buy and sell pre-owned products of the brand. McQ collections are designed by a group of like-minded emerging creators handpicked by the Alexander McQueen team. Each item of clothing in the collection carries an NFC (near-field communication) chip, which allows the garments to be tracked through blockchain technology and sold on its peer-to-peer platform, MYMCQ. Alexander McQueen also partnered with Vestiaire Collective to collect and resell pre-owned pieces from the label for which sellers (its customers) receive store credit.

- Galeries Lafayette in Paris has unveiled a new space, (Re)Store, dedicated to circular fashion and upcycled items.

- Kering and investment firm Tiger Global Management invested $216 million in luxury resale platform Vestiaire Collective in March 2021, which will give the luxury group greater control over its brands sold through the platform.

- In the UK, Harvey Nichols announced a partnership with resale tech provider Reflaunt in August 2021, to roll out the Reflaunt Resell Service across the retailer’s department stores. Luxury customers can bring in items to the stores or have them picked up. Reflaunt oversees the authentication, pricing and sale of the items.

- In April 2021, LVMH launched an online resale platform, Nona Source, for dead stocks or unused fabrics, leathers and other materials from its collections. As its warehouse is in France, the materials are currently only available for delivery to Europe and the UK.

- In October 2021, Richemont-owned Yoox Net-A-Porter announced a partnership with Reflaunt. As with the services that Reflaunt is offering Harvey Nichols, Net-A-Porter customers can have the products they want to sell picked up from their homes. Reflaunt will authenticate the products and provide pricing recommendations and professional photography services.

- Selfridges, under its Project Earth initiative, launched its “Resellfridges” program, through which consumers can buy and sell pre-owned items. In 2019, Vestiaire Collective set up a permanent concession for previously owned luxury items at Selfridges, offering products for sale at its Oxford Street, London store as well as online.

- Increasing Consumer Demand

Figure 6. Global Luxury Consumers: Agreement with Statements Regarding Luxury Resale [caption id="attachment_141487" align="aligncenter" width="700"]

Base: 12,000 luxury consumers from 10 countries

Base: 12,000 luxury consumers from 10 countriesSource: BCG/Fondazione Altagamma[/caption]

- Gen Z Shoppers’ Interest in Resale

- Rising Demand in China and a Market Driven by Younger Consumers

- Initiatives by Luxury Companies To Curb Counterfeiting and Improve Traceability

- Unpredictability in Consumer Demand and Supply

- Counterfeiting

- A Promotional Retail Environment

What We Think

The luxury resale market is at a nascent stage and is modest in size, at about a tenth of the global personal luxury goods market. Consumers are increasingly aware of the impact of their shopping choices and advancements in technology are not only democratizing luxury consumption but also helping buyers and sellers authenticate goods. With the resurgence in consumer demand, growing acceptance of secondhand products, the development of technologies to prevent counterfeiting and the proliferation of online resale platforms, the market is primed for strong growth in the coming years. Implications for Brands/Retailers- Brands and retailers must seize this opportunity to proactively participate in the secondhand luxury market. If brands take on the task of authenticating items that are resold, they will instill greater faith in buyers to make those purchases.

- Luxury companies must control the narrative of their brands by actively partnering with resale platforms: If these brands are being sold through third-party resellers that they have no relationship with, they cannot control the customer service for their brands and have no oversight over their brand perception.

- Technology vendors should look to make integrating resale processes convenient for luxury brands and retailers.

- Vendors that provide authentication technology and resale pricing recommendations will be in high demand among luxury brands and retailers that are looking into expanding their presence in the resale market.