Nitheesh NH

Introduction

What’s the Story? The pandemic provided luxury department stores with an opportunity to reinvent themselves following pressure from the consumer shift to online and brands’ movement away from wholesale in the department store sector in recent years. In this report, we discuss the global luxury department store sector and examine five key ways that major players are evolving to remain relevant. Why It Matters Luxury has been one of the few bright spots in global retail—luxury retailers saw strong recovery in 2021, with growth set to reach pre-pandemic levels in 2022, we estimate. Amid the return to more normal ways of living and spending, we expect pandemic-weary consumers—many with pent-up savings—to seek exciting retail opportunities at luxury department stores that can provide memorable and unique shopping experiences.Global Luxury Department Stores: Coresight Research Analysis

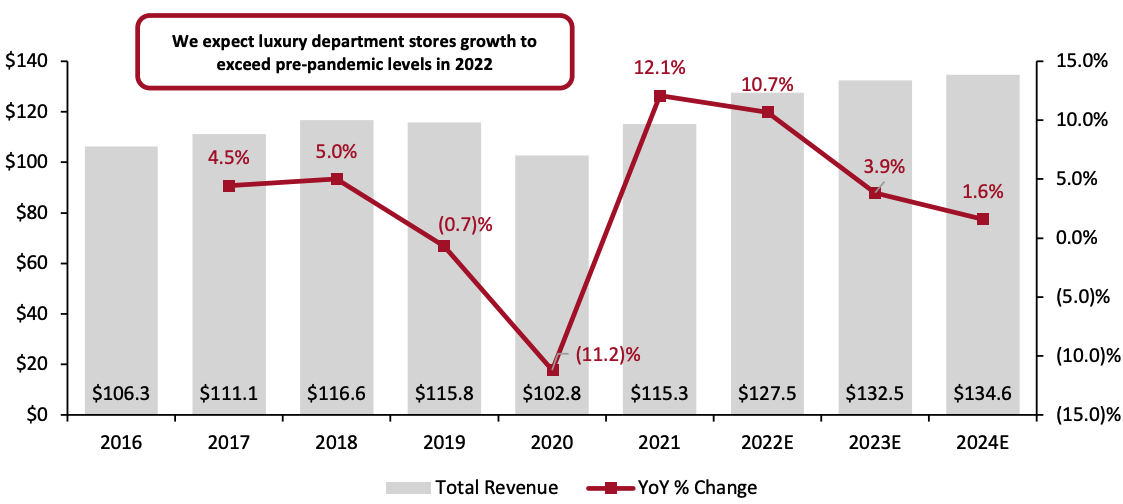

Market Size We expect luxury department store sales to grow 10.7% to reach $127.5 billion in 2022, as shown in Figure 1, marking recovery to pre-crisis levels. 2021 saw 13.0% market growth but not full recovery as travel—a major factor for international department store traffic—did not return to normal and many countries enforced restrictions on local and international travel. Offline revenue by global luxury department stores was up 15.3% from 2020, seeing stronger growth than online revenue, which was up 7.4%, according to Coresight Research estimates based on Euromonitor International data. Even as many countries are opening up and vaccine rollout becoming more widespread, we think that the return to brick-and-mortar global luxury department stores will be weighted toward the second half of the year, leaving online luxury sales to drive growth.Figure 1. Global Luxury Department Store Retailing: Market Size (Left Axis; USD Bil.) and Growth (Right Axis; YoY %) [caption id="attachment_142856" align="aligncenter" width="700"]

The market sizes are at fixed 2021 exchange rates.

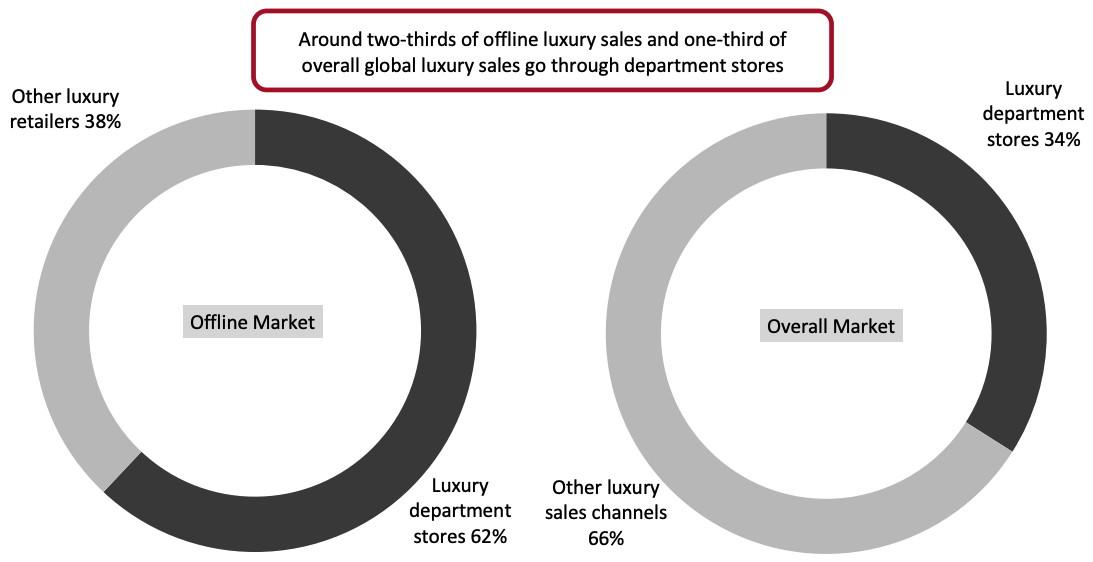

The market sizes are at fixed 2021 exchange rates.Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption] Luxury department stores are the biggest offline luxury retail channel—albeit with a decline in their share to 61.7% in 2021 from 66.7% in 2016, based on data from Euromonitor International. Coresight Research estimates that the global luxury market was worth $342 billion (at retail selling prices) as of 2021, making it three times larger than the global luxury department store market. As such, we calculate that the luxury department store channel accounts for 34% of overall global luxury sales.

Figure 2. Global: Luxury Department Store Sales Within Offline Luxury Retail (Left) and Within the Overall Market (Right), 2021 [caption id="attachment_142857" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/company reports/Coresight Research[/caption]

Competitive Landscape

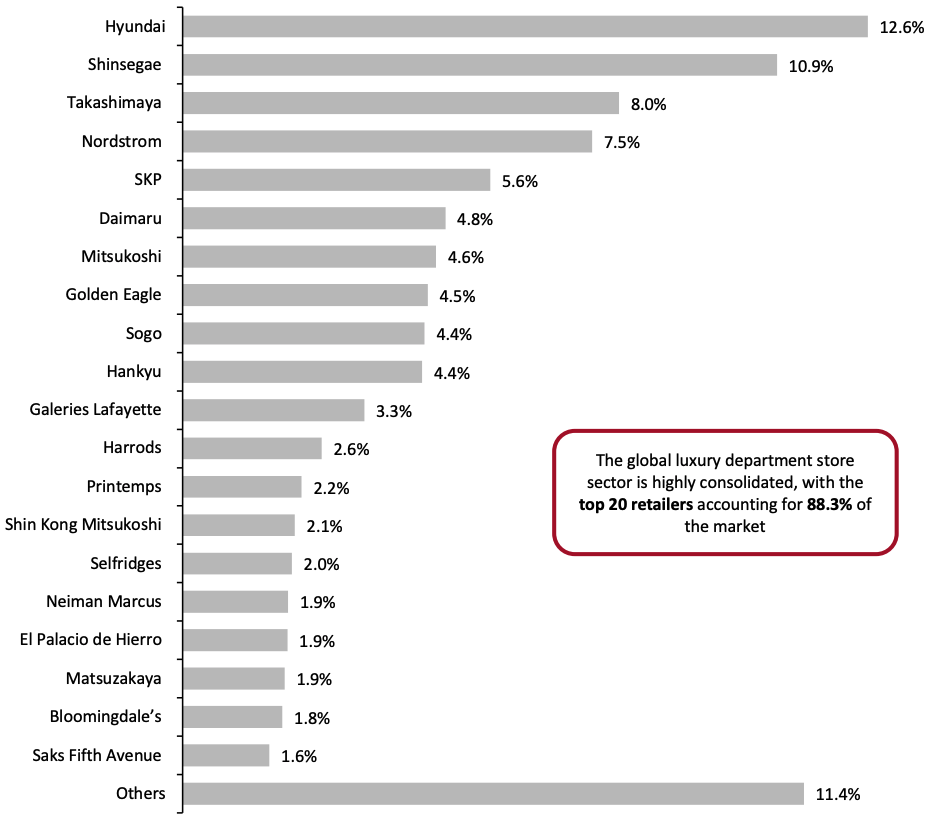

The global luxury department stores sector is highly consolidated, with the top 20 retailers accounting for 88.3% of all offline sales, as shown in Figure 3. Many of them are headquartered in and serve the Asia market primarily—we expect this region to experience high growth in coming years, driven by the strength of the Chinese luxury consumer.

Market share leader Hyundai Department Store and runner-up Shinsegae are both headquartered in South Korea while Takashimaya is based in Japan.

Source: Euromonitor International Limited 2022 © All rights reserved/company reports/Coresight Research[/caption]

Competitive Landscape

The global luxury department stores sector is highly consolidated, with the top 20 retailers accounting for 88.3% of all offline sales, as shown in Figure 3. Many of them are headquartered in and serve the Asia market primarily—we expect this region to experience high growth in coming years, driven by the strength of the Chinese luxury consumer.

Market share leader Hyundai Department Store and runner-up Shinsegae are both headquartered in South Korea while Takashimaya is based in Japan.

Figure 3. Global: Market Share of Top 20 Luxury Department Stores, 2021 [caption id="attachment_142858" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

As department stores are such a significant channel for luxury retail, we examine five key ways that global luxury retail players are exploring to reinvent themselves and draw in consumers following the pandemic and faced with current global uncertainty.

Five Ways Global Luxury Department Stores Are Evolving

1. Reducing Dependence on Wholesale Distribution

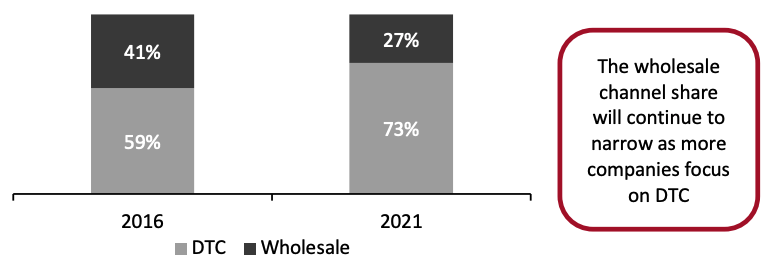

As brands get more accustomed to selling directly to consumers and consumers continue to adjust, too, we expect brands to shift their focus away from working with department stores for distribution. Our analysis of major global luxury brands in the Coresight 100 indicates that retail (DTC) revenue comprised the majority share of total luxury revenues in 2021, continuing the upward trend in its dominance over wholesale revenue, as shown in Figure 4. We expect this channel to expand further in 2022.

With the proliferation of e-commerce in luxury in 2020, many brands expanded their e-commerce services and offerings, which led to the development of DTC as a channel. This accelerated the shift—along what may have been its natural course anyway—presenting a threat to department stores’ relevance.

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

As department stores are such a significant channel for luxury retail, we examine five key ways that global luxury retail players are exploring to reinvent themselves and draw in consumers following the pandemic and faced with current global uncertainty.

Five Ways Global Luxury Department Stores Are Evolving

1. Reducing Dependence on Wholesale Distribution

As brands get more accustomed to selling directly to consumers and consumers continue to adjust, too, we expect brands to shift their focus away from working with department stores for distribution. Our analysis of major global luxury brands in the Coresight 100 indicates that retail (DTC) revenue comprised the majority share of total luxury revenues in 2021, continuing the upward trend in its dominance over wholesale revenue, as shown in Figure 4. We expect this channel to expand further in 2022.

With the proliferation of e-commerce in luxury in 2020, many brands expanded their e-commerce services and offerings, which led to the development of DTC as a channel. This accelerated the shift—along what may have been its natural course anyway—presenting a threat to department stores’ relevance.

Figure 4. Luxury: Selected Major Companies’ DTC and Wholesale Revenue Split [caption id="attachment_142859" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Many department stores are looking to reduce their dependence on wholesaling by brands with the launch of private labels to get ahead of this challenge—Nordstrom, for example, aims to bring down its wholesale concentration from over 85% of sales in 2021 to 50% by 2025 by introducing its own brands as well as partner or shared brands.

Unlike the mass market, however, a greater portion of luxury purchases are driven by the power of the brand—so, in categories such as fashion, luxury department stores will not be able to replicate the scale of private labels seen in the mass market.

While brands are reducing their wholesale exposure, department stores can continue to rely on the concession model to house brands under their roof and draw customers. Concessions offer brands a distinctive association with well-known retailers without the commitment of having to establish physical stores while offering department stores traffic-driving brands without the inventory risks associated with direct retailing.

2. Increasing Resale Initiatives

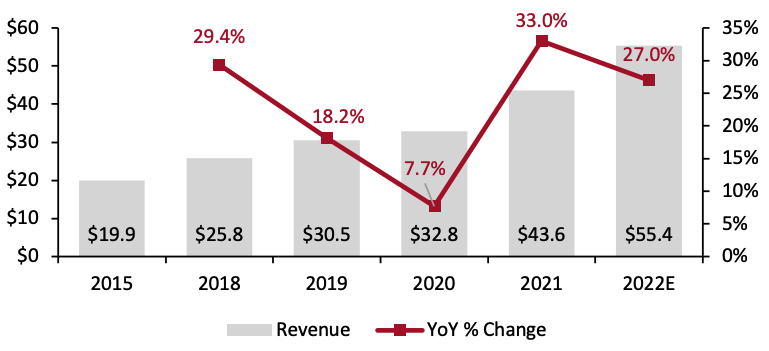

The global luxury resale market grew 33.0% to reach $43.6 billion in 2021, and will grow by a still-strong 27.0% year over year to $55.4 billion in 2022, Coresight Research estimates based on Bain & Company data. Companies in the luxury sector previously shied away from the resale market but have taken a greater interest in resale over the last year, as consumers increasingly seek pre-owned items amid the rise of conscious consumption trends and value seeking.

Source: Company reports/Coresight Research[/caption]

Many department stores are looking to reduce their dependence on wholesaling by brands with the launch of private labels to get ahead of this challenge—Nordstrom, for example, aims to bring down its wholesale concentration from over 85% of sales in 2021 to 50% by 2025 by introducing its own brands as well as partner or shared brands.

Unlike the mass market, however, a greater portion of luxury purchases are driven by the power of the brand—so, in categories such as fashion, luxury department stores will not be able to replicate the scale of private labels seen in the mass market.

While brands are reducing their wholesale exposure, department stores can continue to rely on the concession model to house brands under their roof and draw customers. Concessions offer brands a distinctive association with well-known retailers without the commitment of having to establish physical stores while offering department stores traffic-driving brands without the inventory risks associated with direct retailing.

2. Increasing Resale Initiatives

The global luxury resale market grew 33.0% to reach $43.6 billion in 2021, and will grow by a still-strong 27.0% year over year to $55.4 billion in 2022, Coresight Research estimates based on Bain & Company data. Companies in the luxury sector previously shied away from the resale market but have taken a greater interest in resale over the last year, as consumers increasingly seek pre-owned items amid the rise of conscious consumption trends and value seeking.

Figure 5. Global Luxury Secondhand Goods Market Size (Left Axis; USD Bil.) and Growth (Right Axis; YoY %) [caption id="attachment_142860" align="aligncenter" width="700"]

Source: Bain & Company/Fondazione Altagamma/Coresight Research[/caption]

Almost one-third of global luxury consumers would consider buying secondhand luxury items, according to a September 2020 survey by consulting firm BCG and luxury brands committee Altagamma. Among them, three-quarters would like to have luxury brands certify the items sold via resellers and 70% would like to buy secondhand products directly from luxury brands themselves.

This demonstrates consumers’ strong preferences for authenticity when purchasing secondhand luxury products they buy, indicating opportunities for luxury brands to develop further involvement in this space.

Below, we present examples of innovative resale partnerships or resale services in luxury department store retail.

Source: Bain & Company/Fondazione Altagamma/Coresight Research[/caption]

Almost one-third of global luxury consumers would consider buying secondhand luxury items, according to a September 2020 survey by consulting firm BCG and luxury brands committee Altagamma. Among them, three-quarters would like to have luxury brands certify the items sold via resellers and 70% would like to buy secondhand products directly from luxury brands themselves.

This demonstrates consumers’ strong preferences for authenticity when purchasing secondhand luxury products they buy, indicating opportunities for luxury brands to develop further involvement in this space.

Below, we present examples of innovative resale partnerships or resale services in luxury department store retail.

- In Paris, Galeries Lafayette launched a new space in its stores in September 2021 that is dedicated to fashion circularity and features pre-owned items.

Le (Re)Store at Galeries Lafayette Haussmann featuring sustainable and secondhand fashion

Le (Re)Store at Galeries Lafayette Haussmann featuring sustainable and secondhand fashionSource: Groupe Galeries Lafayette[/caption]

- Harrods has a fine watch exchange service, where consumers can exchange luxury watches they no longer want for store credit. Harrods also offers a rental service, The Rental Edit, where shoppers can rent gowns and dresses from the store. Rental options often appeal to resale shoppers, with both services typically marketed as reducing the environmental impact of fashion consumption.

- In the UK, Harvey Nichols announced a partnership with resale tech provider Reflaunt in August 2021 to launch the Reflaunt Resell Service across the retailer’s department stores. Luxury customers bring items for resale into stores or have them collected and Reflaunt then oversees the authentication, pricing and sale of the items.

- Selfridges has a service for buying and selling secondhand items, including, accessories, eyewear, jewelry and shoes.

- Harrods launched a beauty space in July 2021 that features Japanese-inspired “scalp facials,” a hair extension “library” and other treatments. This salon adds 17,000 square feet of space to its beauty halls. It also offers beauty masterclasses and has beauty suites with treatments ranging from £40 to £420 ($55 to $576).

- LVMH unveiled its newly renovated 150-year-old department store La Samaritaine in July 2021. We think La Samaritaine is an indicator of the future department store, merging retail spaces, a luxury hotel, daycare and offices into one location. The retail spaces within La Samaritaine include “over 600 brands, 12 restaurants, a boutique spa, an artistic collective, a lifestyle boutique dedicated to locally made and exclusive products, and the largest beauty hall in Europe,” according to the company.

Christmas at La Samaritaine, Paris

Christmas at La Samaritaine, ParisSource: La Samaritaine[/caption]

- Selfridges unveiled a gaming space in June 2021 to attract Gen Z consumers. At its “Playhouse” space, gaming enthusiasts can explore the latest in gaming consoles and other technology and also attend exclusive product launches.

The “Playhouse” at Selfridges, London

The “Playhouse” at Selfridges, LondonSource: Selfridges[/caption] Luxury department stores must provide more innovative store experiences to attract consumers into brick-and-mortar spaces and reduce their focus on pure retail. 4. Developing “Pop-Up” Relationships with DTC Brands For new and unestablished brands, being sold at reputed retailers could be a form of validation from a consumer-trusted household name. As such, department stores are increasingly presenting themselves as an important channel for DTC brands looking for a boost in their offline search and discovery. Up-and-coming brands benefit from the visibility of being stationed alongside known brands within a department store, presenting an alternative to the limitations of opening a standalone store. For example, luxury department store Selfridges recently partnered with British premium fashion brand Farai London, which became an instant hit after celebrity Kylie Jenner posted photos of herself on social media wearing the brand’s clothes. In May 2021, the brand opened a pop-up store Selfridges in London, bringing Farai London to a new audience of offline shoppers through its flagship retail space. 5. Helping Luxury Brands Reach Suburban Consumers While we expect to see a shift away from wholesale, department stores are, nevertheless, a practical channel for brands unable to open their own stores to reach physical shoppers. As the returns of setting up individual stores in smaller cities and suburban areas would likely not justify the up-front costs. As such, setting up stores in suburban neighborhoods may be unviable but selling to customers via established department store retailers with an existing presence in those areas, such as Nordstrom in the US, can help broaden brands’ customer bases. On its August 2021 second-quarter earnings, Nordstrom CEO Peter Nordstrom stated that its stores in urban markets are recovering slowly. He outlined that three factors drive sales at these stores: consumers that live in the vicinity; consumers that work close to these stores and come from other regions; and tourists. He said that since the last two factors are not back to pre-pandemic levels yet, these stores have been slow to recover, while suburban stores have fared better. CEO and North American President of LVMH, Anish Melwani, told analysts at Nordstrom’s February 2021 Investor Day that LVMH looks for retail partners with an extensive physical reach. This helps LVMH sell to customers in places such as Troy, Michigan or Austin, Texas, as they shop “closer to home” due to the travel and movement restrictions in cities like New York and Los Angeles.

What We Think

As consumer preferences continue to change, luxury department stores must continually reinvent themselves. They should be able to cater to consumers at both ends of the spectrum—those that want to enjoy being at a store for the ambience as well as its products, to those that simply want convenient access to luxury goods. Global luxury department stores are squarely positioned to capitalize on the pandemic-weary, experience-hungry and high-spending consumer. Implications for Brands/Retailers- Luxury brands should partner with department stores and identify high-growth neighborhoods where their customers and potential customers live, to achieve more targeted sales.

- Brands and retailers should build their service offerings now in preparation for a full return to consumer traffic at department stores, as consumers will have pent-up demand for products and experiences alike.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved