albert Chan

Introduction

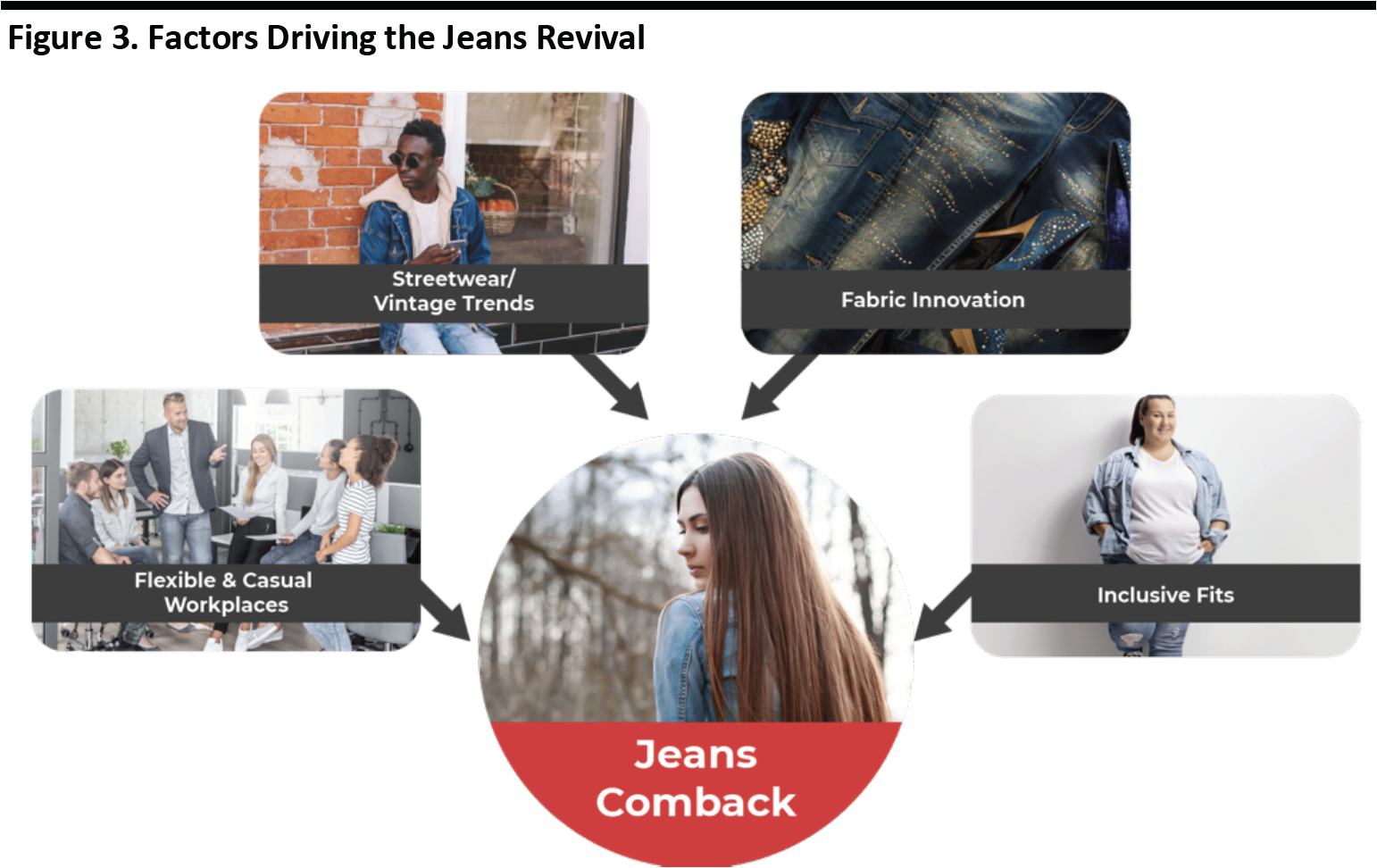

After years of sluggish market growth, denim jeans are bouncing back in consumers’ wardrobes as classic pieces that can be worn year-round for multiple occasions. The global jeans market is experiencing a reinvigoration, driven by current fashion trends in streetwear and vintage styles, an increasing number of fits and silhouettes and the rise of casual dress codes in the workplace. Brands are implementing more sustainable manufacturing practices as well as investing in technological innovation to satisfy consumer needs. As jeans continue to evolve, the market is expected to grow at a steady rate.

How Big Is the Global Jeans Market?

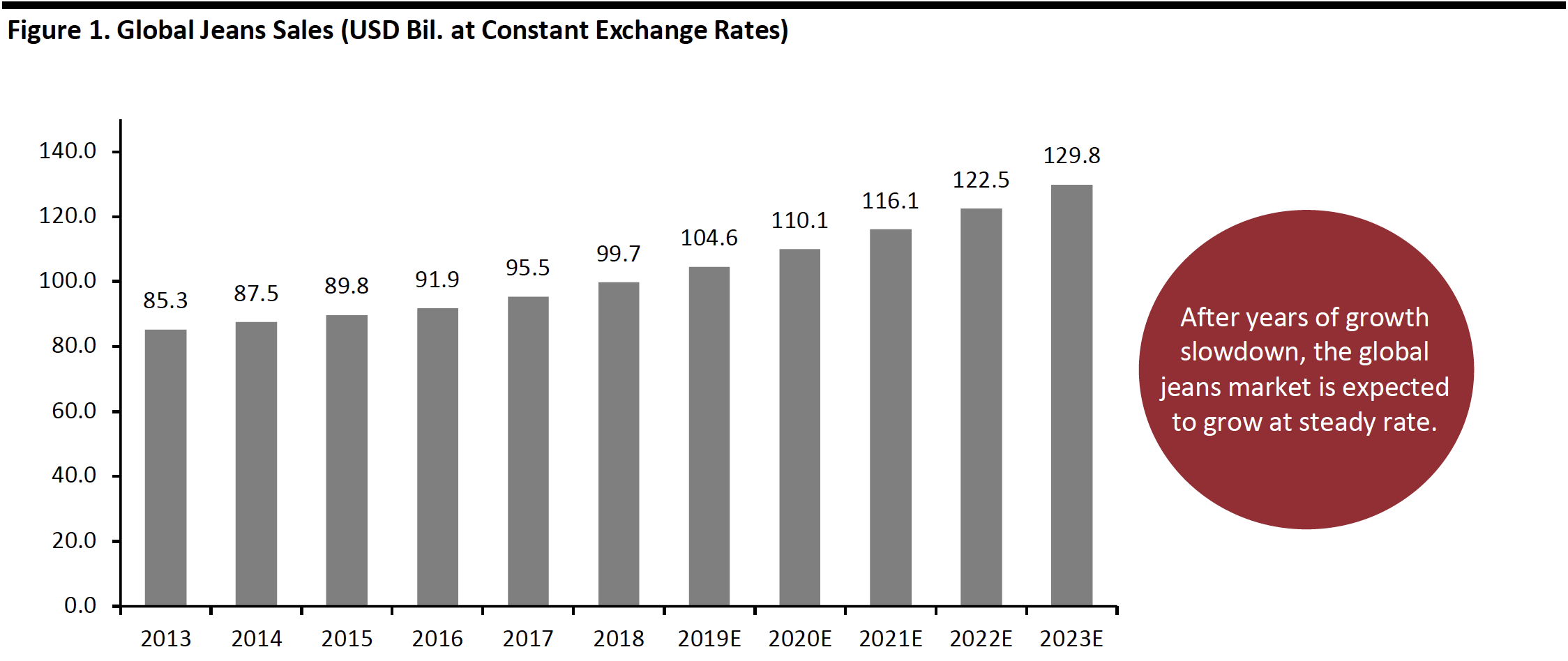

The global jeans market totaled $99.7 billion in 2018 and is expected to grow to $129.8 billion in 2023, according to Euromonitor International, representing a 5.4% compound annual growth rate (CAGR).

- The US is the largest jeans market at $16.7 billion and is expected to grow at a 3.1% CAGR from 2018 to 2023.

- The UK and China are the fastest-growing markets, at 5.5% and 4.7% CAGR respectively from 2018 to 2023.

- Globally, the women’s and men’s jeans markets are of roughly equal size, and both are expected to grow at a 5.4% CAGR from 2018 to 2023.

Source: Euromonitor International Limited 2019 © All rights reserved[/caption]

Source: Euromonitor International Limited 2019 © All rights reserved[/caption]

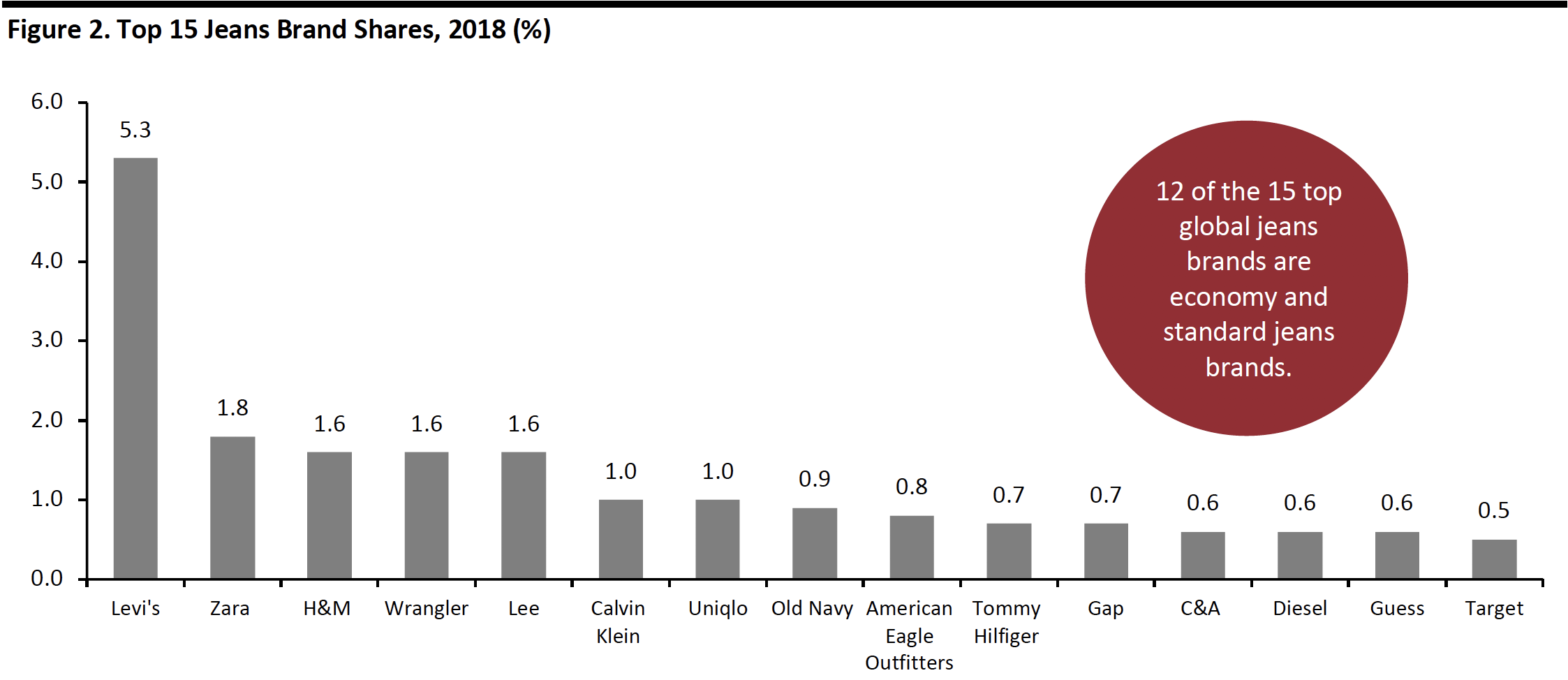

Economy and Standard Jeans Dominate the Market; Premium Jeans Growing in China and Europe

Economy and standard jeans continue to be the market leader, accounting for 67% of the global jeans market in 2018 and expected to grow at a 5.8% CAGR to 2023, according to Euromonitor International. This growth will be driven by consumer demand for quality jeans in an affordable price range. Growing numbers of fast-fashion brands are implementing sustainable practices and adopting new fabrics to appeal to consumers’ needs. High-street brands including H&M, Uniqlo and Zara gained a 1.3% total market share from 2013 to 2018.

Premium and super premium jeans are expected to grow at a lower CAGR of 4.7% worldwide from 2018 to 2023. However, this is expected to outpace the growth of standard and economy jeans in China and Europe—including France, Germany and the UK—as the upper middle-class is booming in China alongside expanding urbanization, and Europe is experiencing slower adoption of fashion trends.

Economy and standard jeans are typically priced in the $20-$150 range. The category includes lower-end retailers such as Forever 21 and Primark, high-street names such as H&M, Uniqlo and Zara, and specialty brands such as Levi’s and Wrangler. Premium and super premium jeans are priced from $150 to thousands of dollars. This category includes premium specialty brands such as AG, Re/Done, G-Star Raw, Diesel and luxury designer brands. Levi’s and Wrangler’s premium lines also fall into this category.

[caption id="attachment_98291" align="aligncenter" width="700"] Source: Euromonitor International Limited 2019 © All rights reserved[/caption]

Source: Euromonitor International Limited 2019 © All rights reserved[/caption]

Global Jeans Resurgence Is Being Driven by New Offerings and Shifts in Consumer Taste

The jeans market experienced a slowdown in the past few years. However, in 2018, it began to see a revival, impacted by a growing acceptance of casual attire in the workplace and the increasing availability of various fits.

In 2019, 62% of US consumers said they wear jeans at least three times a week, and 73% of US consumers said their first choice of casualwear is jeans, according to a survey from Cotton Incorporated Lifestyle Monitor.

We have identified four major factors that are contributing to the resurgence of jeans in the global market.

[caption id="attachment_98292" align="aligncenter" width="701"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Rising popularity of casualwear and streetwear among Gen Zers and millennials

Streetwear, a casual dressing style, has become a disruptor in the fashion industry and has gained huge popularity among younger generations in recent years. By leveraging social media and product exclusiveness strategies, jeans brands such as Supreme and Off-White are driving up consumer demand for streetwear. Retailers are also collaborating with artists, celebrities and luxury brands on limited-edition products.

Driven by the deep penetration of Western fashion in other countries, the streetwear trend is also rapidly expanding worldwide as a way for the younger generations to express individualism, which bodes well for the jeans market. Jeans that reflect the streetwear trend are mid to dark wash and have wider, baggy, looser and high-waisted silhouettes, looking similar to the “mom” and “dad” jeans of the 1980s and ’90s with features that are not gender defined. Rising numbers of non-jeans denim apparel—such as shirts, jackets, skirts and dresses—are also embracing utilitarian aesthetics.

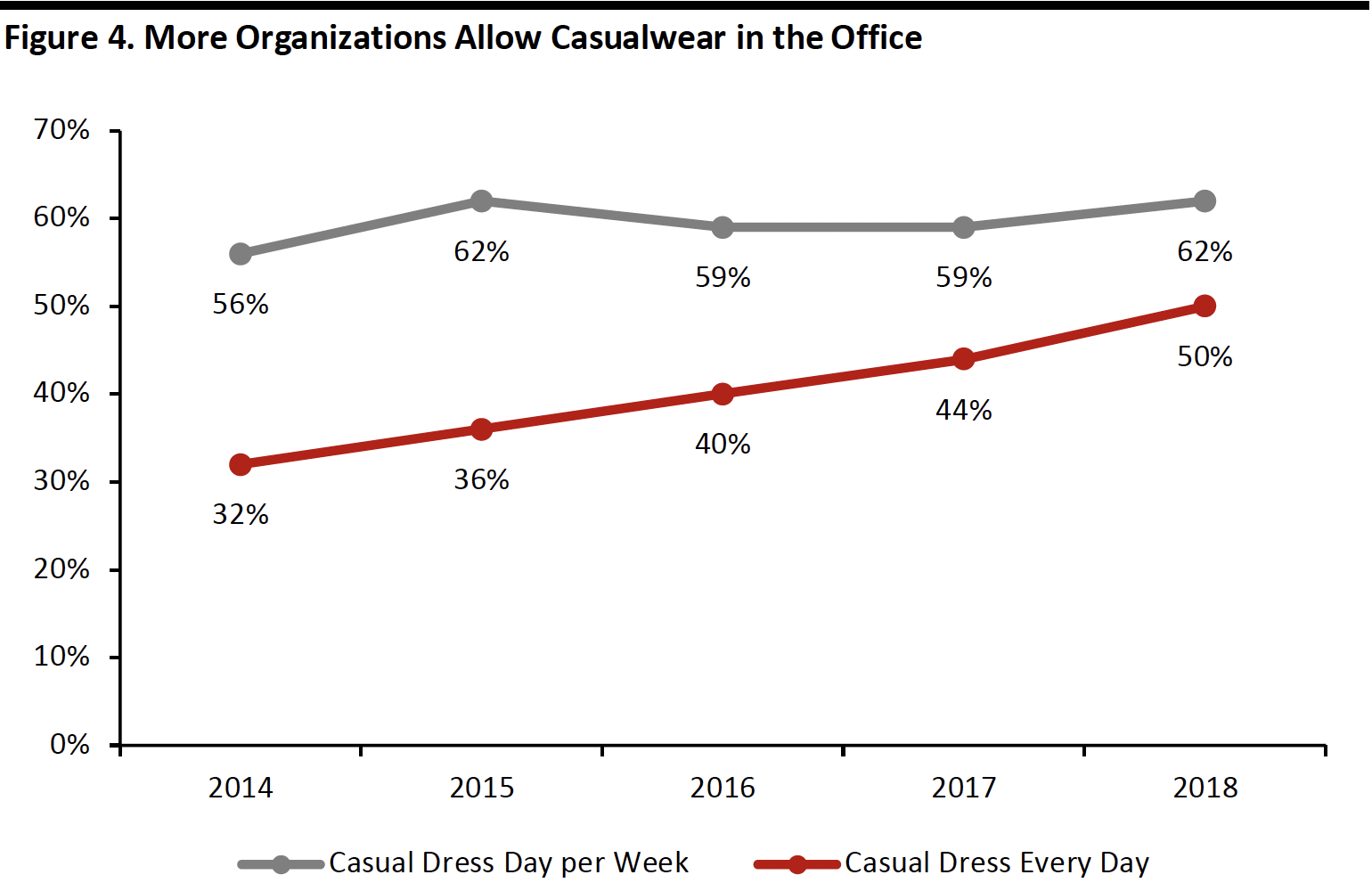

Growing acceptance of jeans as business-casual attire

A casualization trend is changing the public perception of work attire, which has led to a higher acceptance of jeans in the workplace. Companies are relaxing their dress codes to attract millennials and Gen Zers, who prefer casual attire.

Men’s suits comprised 9.2% of the global menswear market in 2018, and this share is expected to decline to 8.5% by 2023, according to Euromonitor International. Suits and ties are no longer required dress code elements for many corporations, including in the most traditional sectors, such as financial services. Some 50% of US organizations allow casual dress every day, according to a report from the Society for Human Resource Management. Exemplifying this, Goldman Sachs announced a new policy in March 2019 that encompasses a more flexible dress code. Smart-casual mix-and-match styles are also becoming popular; shirts can be worn with jeans, and t-shirts can be worn with blazers. This also reflects a widespread desire for consumers to express individualism through their fashion/apparel choices.

[caption id="attachment_98293" align="aligncenter" width="700"] Base: 3,028 US HR professionals from the Society of Human Resource Membership database

Base: 3,028 US HR professionals from the Society of Human Resource Membership databaseSource: The Society of Human Resource 2018 Employee Benefits Report[/caption]

Athleisure trend presents an opportunity for fabric innovation in the jeans market

The global athleisure market continues to grow, driven by consumer desire for comfort, performance and style. This trend presents an opportunity for the jeans sector, as retailers are innovating to meet consumer demand. According to a survey from Cotton Incorporated Lifestyle Monitor, 64% of US shoppers expressed interest in moisture management in their clothing, and 61% are interested in thermal regulation, yet these functions are only available in 9% and 2% of clothing respectively.

More companies are using technological innovation to create synthetic fibers that can offer enhanced functionality for jeans.

- LYCRA’s dualFX technology was developed to address customer requirements for high-stretch jeans that keep their shape. Traditionally, stretchy jeans would become loose and shapeless after multiple wears. LYCRA uses dual-core and bi-component yarns to create a high-stretch fabric that has recovery power.

- FiberVisions’ CoolVisions dyeable polypropylene fiber can move moisture and dry quickly. The fiber is also more durable and abrasion resistant than traditional 100% cotton denim. Invista’s Cordura fabric also provides enhanced abrasion resistance and toughness that makes denim fabric more long-lasting.

- In terms of temperature performance, Nilit has developed Sensil Nylon 6.6, a strong and soft high-performance fiber. Sensil Breeze and Heat fabrics provide cooling and warming functions. Levi Strauss has added its new technology, Thermadapt to men’s Performance Collection jeans. The fiber uses air as insulation to keep the wearer cool in warm conditions and warm in cool conditions.

- Orta’s Biocharge jeans are infused with minerals to support muscle regeneration. Nilit’s Sensil Innergy fabric also incorporates minerals that convert human body’s thermo-energy into far infrared rays to enhance muscle elasticity and improve muscle recovery.

Availability of inclusive fits and new silhouettes are driving demand

Finding a pair of jeans that fit perfectly can be hard, so the availability of a wide range of styles on the market is satisfying different consumer needs. Consumers are able to find low-, mid- and high-rise styles; skinny, cigarette, straight, flared, wide-legged, cropped and cuffed legs; as well as different types of wash and color.

The apparel industry has been embracing inclusivity, particularly in the womenswear category, encouraging body positivity. Coresight Research estimates that the US women’s plus-size market will reach $31.9 billion in 2020, representing an opportunity for brands and retailers.

A number of brands and retailers are now providing inclusive sizes in jeans:

- American Eagle Outfitters launched its Curvy Jeans collection in July 2019, which consists of 12 washes, five lengths and five fits to minimize consumers’ struggles to find the perfect jeans. The company also plans to offer extended sizing in the collection, ranging from 00 to 24. “As the number one denim destination for women, everyone should be able to find a pair of jeans they feel confident in at American Eagle,” said Chad Kessler, Global Brand President at the company.

- Gap launched the “It’s Our Denim Now” campaign in August 2019 with a focus on how its denim jeans embrace inclusivity, with styles and fits for everyone. The campaign highlighted a diverse range of jeans, from the new high-rise cigarette style for women and the men’s skinny style made with GapFlex technology for extra comfort.

Gap’s “It’s Our Denim Now” campaign

Gap’s “It’s Our Denim Now” campaignSource: Gap[/caption]

- Fashion Nova launched 24/7, a new line of size-inclusive (available in sizes 00-22) jeans all priced under $55 in August 2019. The collection includes shorts and basic and distressed jeans in different washes and stretch.

New and Traditional Players to Drive Growth

The competitive landscape of the jeans market is changing, as new players enter and traditional retailers expand their offerings.

- Nautica, now owned by Authentic Brands Group, relaunched its Nautica Jeans Co. line in September 2019. The collection includes three jeans fits with nine washes for women and two fits with two washes for men. The line is available globally on the brand’s ecommerce site as well as in select physical stores across Europe and the US.

- Madewell, a denim-focused casual clothing brand owned by J.Crew, filed to raise $100 million for an initial public offering in September 2019. Jeans represent one the brand’s highest growth categories, with product prices ranging from $75 to $150. Madewell sales reached $613.7 million in fiscal year 2018, of which 29% were tied to jeans. The company noted that its jeans customers tend to repurchase more frequently—demonstrating brand loyalty—so have a higher lifetime value. By entering into new markets, Madewell targets global jeans sales at $500 million annually.

- VF Corp.—which owns Vans, The North Face and Timberland—spun off its jeans brands including Wrangler, Lee and Rock & Republic as a new company, Kontoor Brands, in May 2019. Wrangler and Lee held 4.8% and 3.1% shares of the US jeans market in 2018, respectively, according to Euromonitor International. Kontoor’s sales reached $2.7 billion in 2018. A total of 27% of sales were generated outside of the US in 2018, and the company plans to further expand its geographic footprint with a focus on Asia.

- Levi Strauss had its (second) public offering in March 2019. It first went public in 1971 and was taken private in 1985. As the first company to manufacture blue jeans, Levi’s is the dominant jeans brand globally, with a 5.3% global market share in 2018, according to Euromonitor International. The company intends to grow its presence in underpenetrated emerging markets such as Brazil, China and India.

Nautica relaunched the Nautica Jeans Co. line

Nautica relaunched the Nautica Jeans Co. lineSource: Nautica[/caption]

Consumers Are Looking for More Sustainable Jeans Offerings

As consumers are becoming more conscious of the importance of sustainability, companies are implementing more sustainable practices across their supply chains. More than two-thirds of US consumers said they value product sustainability when making a purchase, according to a 2019 survey by software company CGS; Gen Z led the way, with 68% having made an eco-friendly purchase in the 12 months prior to the survey.

The production of jeans has a considerable environmental impact. Cotton, the primary component of jeans, requires large amounts of water for cultivation and processing. One pair of jeans can use around 1,800 gallons of water, according to sustainability website Treehugger. Furthermore, in order to achieve different washes, jeans manufacturers must use intensive chemicals during production.

Many retailers have been making efforts to follow practices that are better for the environment:

- Levi Strauss has been implementing sustainable initiatives since the 1990s. In 2006, the company launched an initiative to turn old jeans into new insulation for homes and buildings. Levi’s announced its 2025 water action strategy in August 2019, which is aiming to reduce the amount of water used in production in highly stressed areas by 50% by 2025. Levi’s has partnered with dyeing company Tonello to develop the NoStone system, which uses abrasive stainless-steel drums instead of pumice stones in the stonewash process, resulting in the use of less water and fewer chemicals, as well as reduced production costs and time. The most recent Levi’s collection—the result of a collaboration with sustainable clothing brand Outerknown in September 2019—can be fully recycled, as it is made from a new hemp-cotton blend.

- AG Jeans, a premium denim brand, installed a new water filtration system in March 2019 that can recycle 100% of the water used in the company’s factories in Los Angeles and Mexico. Water usage is expected to reduce to 1,200 gallons per day, versus the 380,000 gallons per day used by traditional jeans manufacturers. AG Jeans already adopted ozone technology, which is a more sustainable and efficient bleaching method, to cut water consumption by 50% in 2010. In terms of fabrics, many of the company’s jeans incorporate eco-friendly fibers such as Tencel, which is a cellulose-based fiber that originates from sustainable wood sources.

- Wrangler introduced a sustainable jeans range called Indigood in June 2019. The production of the collection reduced water by 100% compared to the manufacture of a typical jeans range, used 30% recycled cotton and adopted 100% eco-tech finishing. It is the first collection to apply foam-dyeing technology, which uses 60% less energy and 90% fewer chemicals than traditional dyeing processes.

- G-Star RAW has worked with denim mills Artistic Milliners and Dystar to develop Crystal Clear dyeing, a new indigo dyeing technique that uses pre-reduced indigo instead of powder indigo, resulting in 70% fewer chemicals and lower energy consumption.

- Fast-fashion and high-street brands including H&M, Zara and Fast Retailing are also striving to become more sustainable. H&M’s conscious collection of jeans is made with either organic or sustainably sourced cotton. Zara first launched its sustainable Join Life collection in 2016 and plans to expand the collection penetration to 20% of total products by the end of 2019. The jeans in the collection are all made of organic cotton. Fast Retailing developed a new washing process in July 2019 that reduces water usage by 99%. The company plans to use this technology for the manufacturing of all jeans by 2020.

Ongoing Cross-Branding and Celebrity Collaborations for Jeans

There has been a recent uptick in brand mashups in the fashion industry. Brands are partnering with other companies in the same or different industries to launch new products, hoping to create synergies and drive customer purchases. Celebrity collaborations have also become more common as “brand ambassadors” are used to increase brand awareness, and several jeans retailers have followed this trend.

- At the forefront of brand collaboration, Levi Strauss started to collaborate with trendy streetwear brand Stussy back in 2010. The company also formed a long-term collaboration with Supreme in 2011, releasing an annual collection. In addition, luxury street style brands Off-White and Vetements partnered with Levi’s to produce limited-edition denim clothing in 2016 and 2017, respectively. Recent partnerships include with American artist Heron Preston, Justin Timberlake, fictional character Hello Kitty and Nike.

- Sustainable premium jeans brand Re/Done partnered with luxury Italian brand Attico to launch a 1970s and ’80s vintage-inspired collection in May 2019. The collection mostly consists of reworked vintage styles such as floral dresses and embellished denim jeans and jackets, as well as graphic t-shirts and cargo pants, reflecting a blend of the two brands’ aesthetics.

- Tommy Hilfiger, now owned by PVH, teamed up with Formula One World Champion Lewis Hamilton to launch a menswear collection on September 2019. The collection includes jeans with athleisure features and focuses on sustainability by using organic cotton and recycled jeans.

- Besides jeans, denim fabric has also been applied in footwear. New York premium jeans brand 3x1 collaborated with Nike in May 2019 to create Nike Air Force 1 sneakers using two new denim fabrics with unique washes.

Source: Supreme, Re/Done and Nike[/caption]

Source: Supreme, Re/Done and Nike[/caption]

Key Insights

The $99.7 billion global jeans market is undergoing a revival, and we expect it to grow at a steady rate in the future as brands continue to evolve, with an increased focus on sustainability and technological innovation.

- Economy and standard jeans continue to be consumer favorites, accounting for 67% of the global jeans market. Premium and super premium jeans have grown the fastest in China and Germany.

- The streetwear trend is gaining popularity among younger generations and is quickly expanding worldwide, resulting in higher demand for vintage and loose-fitting jeans.

- The rising casualization trend is leading to an increased acceptance of jeans in the workplace. More companies are relaxing their dress code as younger generations are entering the workforce.

- Influenced by the athleisure trend, jeans now are equipped with more performance functions such as moisture management and thermal control to attract consumers.

- A variety of styles and inclusive fits offered in the denim jeans market are able to satisfy different consumer needs.

- As consumers place greater importance on eco-friendly lifestyles, jeans brands are applying sustainable manufacturing practices to reduce water, chemical and energy consumption.

- Cross-brand and celebrity collaborations by jeans retailers continue to grow to drive consumer engagement and increase brand awareness.