EXECUTIVE SUMMARY

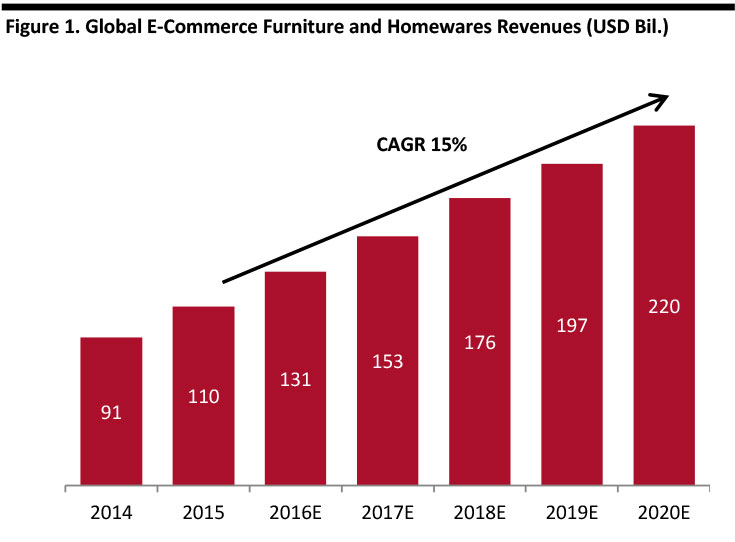

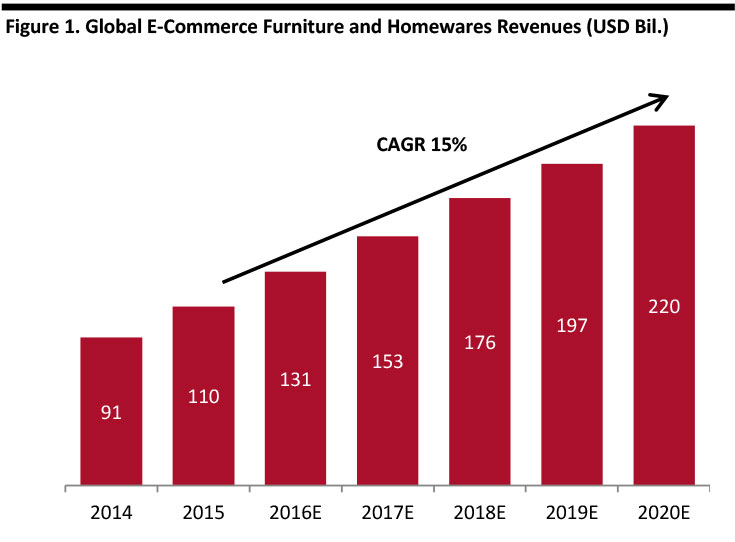

The online furniture and homewares market is highly competitive and growing at a very rapid pace. According to Statista, global online furniture and homewares revenues are expected to increase by a five-year CAGR of 15% to US$220 billion in 2020.

Among major Western markets, the UK has the highest penetration of online furniture and homewares sales and is expected to experience the fastest online growth in the category going forward.

Although traditional brick-and-mortar home furnishings retailers still generate the largest chunk of industry revenue, these stores are losing market share to specialty chains, mass merchants, big-box and off-price retailers, and dedicated Internet-only retailers.

In the last few years, numerous innovative pure-play furniture and home furnishings retailers were established across the world, but few have reached critical mass. US-based Wayfair is the only online pure-play furniture and homewares company of significant size.

The online channel makes it easy and convenient to research hundreds of varying designs and products, and makes it unnecessary to visit an endless round of stores.

INTRODUCTION

In this report, we explore global online furniture and homewares retailing, the size of the market, forecast growth rates, and the proportion of furniture and homewares sales generated online compared to total sector sales.

We will closely examine online furniture and homewares retailing in leading e-commerce markets including the US, UK and Continental Europe.

We will also profile retail formats and focus on leading furniture and homewares retailers that have built large e-commerce businesses, as well as pure-play and innovative startup online retailers

The online furniture and homewares market will continue to experience robust growth globally because the Internet is a very suitable channel for research and purchasing given the hundreds of customization options available online versus in-store.

GLOBAL ONLINE HOMEWARES AND FURNITURE E-COMMERCE MARKET

Set to Double in Size

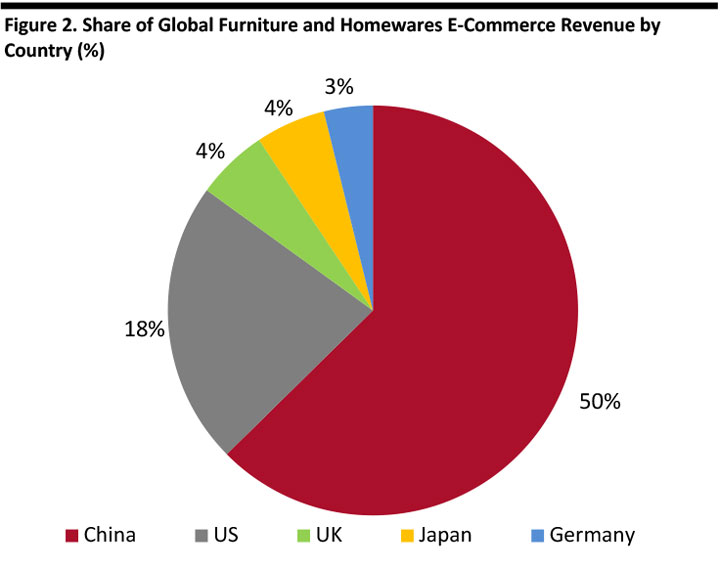

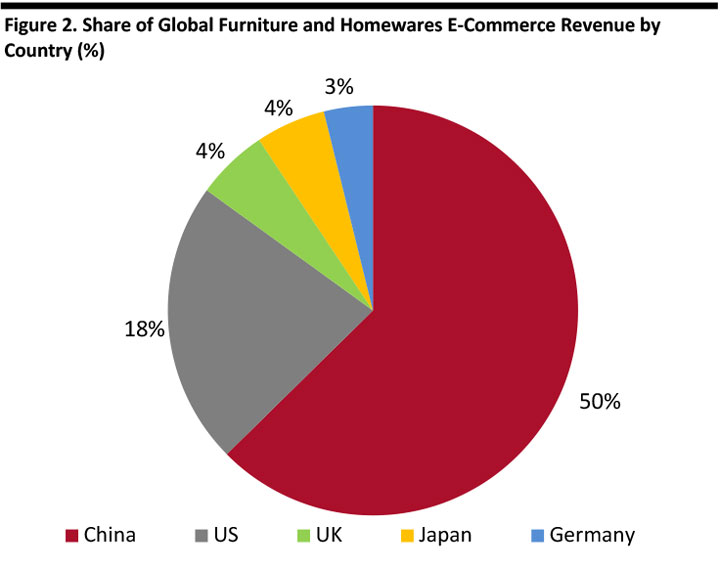

The online homewares and furniture market is global, fragmented, highly competitive and growing at a very rapid pace. According to Statista, global online furniture and homewares revenues totaled approximately US$110 billion in 2015. China generates almost half of the total global market revenues.

Global furniture and homewares market revenue is expected to increase by a five-year CAGR of 15% to US$220 billion in 2020. The percentage of online furniture and homewares retailing is increasing worldwide; the UK, US, France and Germany all report solid year-on-year growth.

[caption id="attachment_84804" align="aligncenter" width="720"]

Source: Digital Market Outlook, Statista

Source: Digital Market Outlook, Statista[/caption]

[caption id="attachment_84805" align="aligncenter" width="720"]

Source: Digital Market Outlook, Statista

Source: Digital Market Outlook, Statista[/caption]

There are several factors driving the robust e-commerce growth in furniture and homewares compared to traditional brick-and-mortar stores.

Many traditional furniture and homewares retailers such as Williams-Sonoma and Restoration Hardware have invested heavily in building out Internet businesses and now derive a large portion of total revenues through their online channel. Although traditional brick-and-mortar home furnishings retailers still generate the largest chunk of industry revenue, these stores are losing market share to specialty chains, mass merchants, big-box and off-price retailers, and dedicated Internet-only retailers that offer wide ranges and low prices. Various retailers have launched homeware product collections and expanded their offerings both in-store and online.

Numerous innovative pure-play furniture and homewares retailers have launched, but few have reached critical mass or even reported a profit. Wayfair is the only US publicly-traded online pure-play furniture and homewares company of significant size. Although the retailer has grown revenues rapidly, the company is still unprofitable, which gives testament to the fact that the online channel can be a difficult one, regardless of the product category.

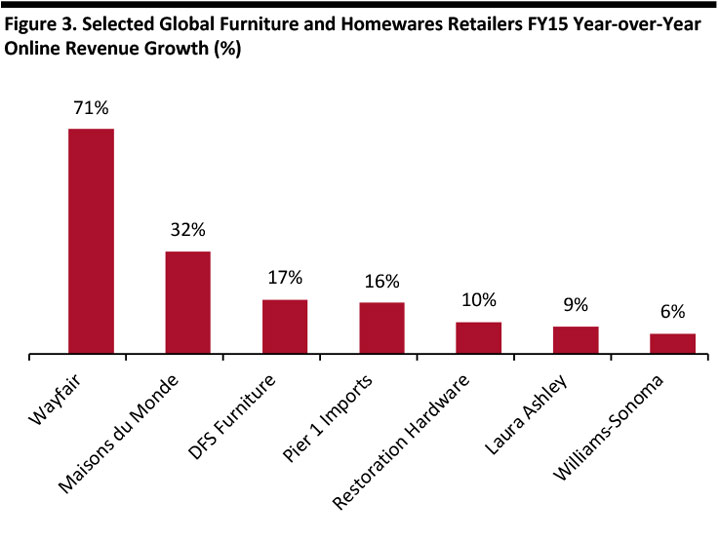

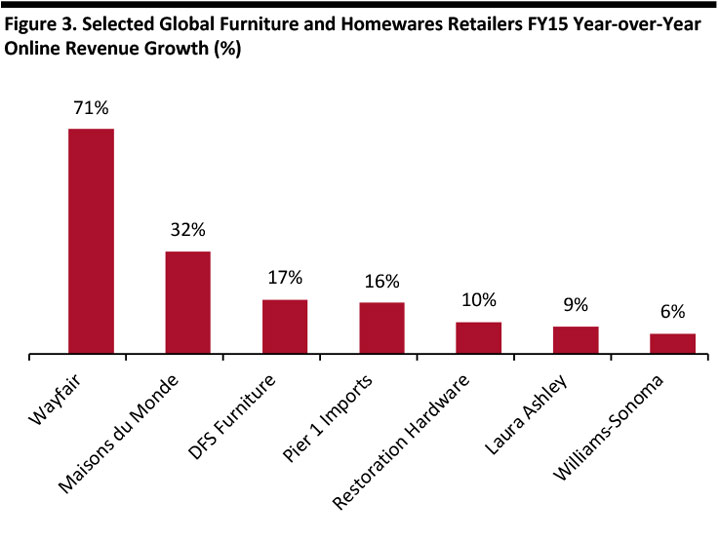

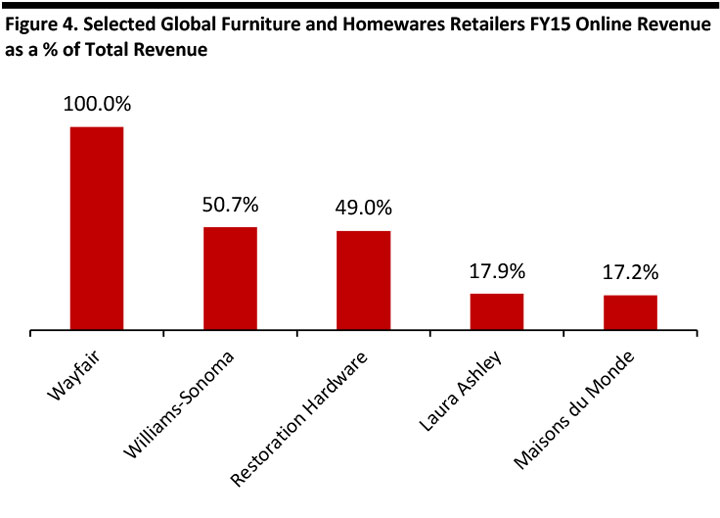

The furniture and homewares retailers presented in the charts below are those major stores that disclose the amount of online sales or the year-over-year growth rate of their online revenues.

[caption id="attachment_84806" align="aligncenter" width="720"]

Source: Company reports

Source: Company reports[/caption]

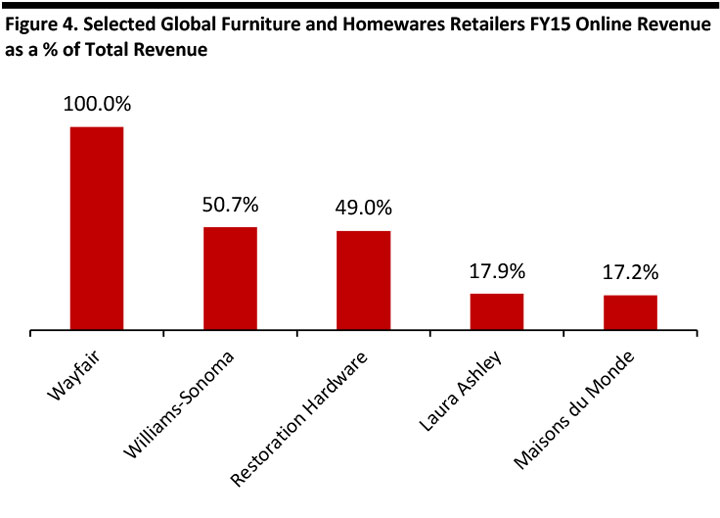

Among the biggest brick-and-mortar retailers, Williams-Sonoma and Restoration Hardware lead in online contribution to revenues, both with around half of total sales from e-commerce in 2015.

[caption id="attachment_84807" align="aligncenter" width="720"]

Source: Company reports

Source: Company reports [/caption]

What Is The Appeal of Buying Furniture Online?

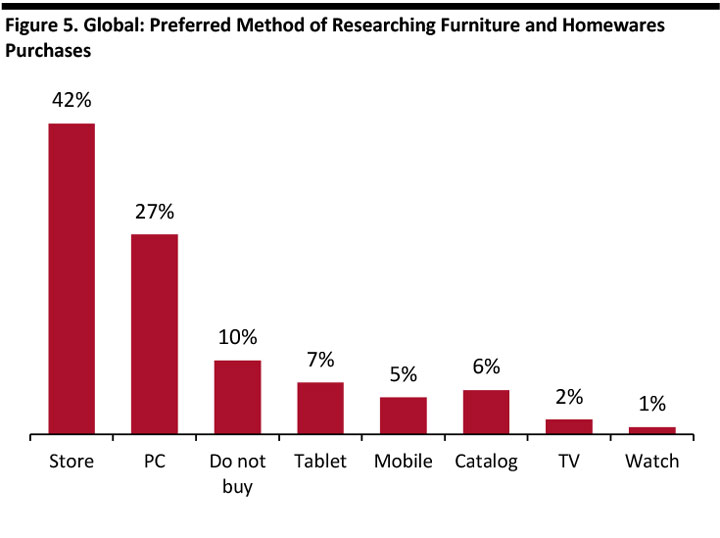

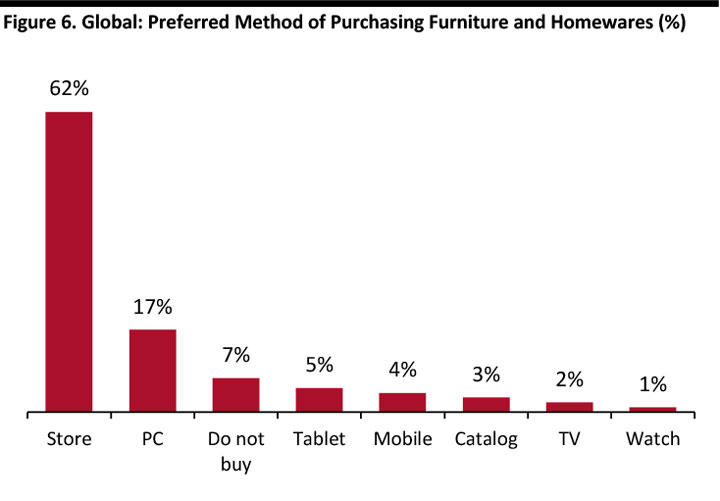

The process of purchasing furniture or homewares differs from shopping for many other product categories. Consumers tend to seek unique and original merchandise and often have a hard time articulating precisely the exact product and design they are looking for. Additionally, many furniture and homeware purchases are items that will be used over the long-term. This leads customers to conduct more research and comparisons, processes which are far simpler and quicker online. Customer reviews found on some sites also provide another informative service for consumers.

The online channel is very suitable for researching hundreds varying designs and products, without the need to visit an endless round of stores. More customization options are available online and allow for a level of differentiation not available in-store. Tools such as Pinterest and design blogs provide inspiration and curation. Several new resale sites have cropped up and provide the consumer with new design and product ideas. Multiple companies have launched technology platforms that help facilitate room visualization and provide 3D tools so consumers can see what particular products or designs would look like in their homes.

Many e-commerce companies offer discounts, free shipping and even free items with orders over a certain value. These special offers lure customers to the online channel because promotions like these are less common in brick-and-mortar shops.

The global online home goods market will likely grow further as tech-savvy millennials age and start families, and baby boomers become more comfortable purchasing online. As the online channel matures, customers are also becoming more comfortable making large purchases online.

Consumers tend to spend on homewares during a healthy housing market. Owner-occupiers are the most active group of purchasers for home products, especially for large projects such as extensions and retrofits.

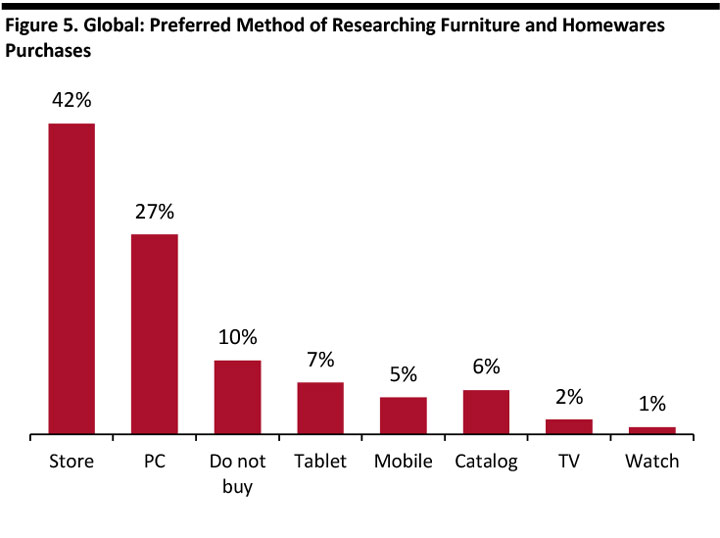

[caption id="attachment_84808" align="aligncenter" width="720"]

Source: PWC, “They Say They Want a Revolution,” Total Retail 2016

Source: PWC, “They Say They Want a Revolution,” Total Retail 2016[/caption]

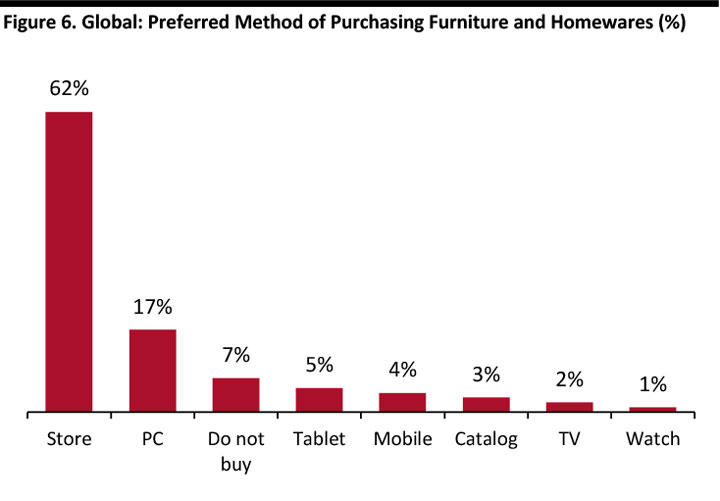

[caption id="attachment_84809" align="aligncenter" width="720"]

Source: PWC, “They Say They Want a Revolution,” Total Retail 2016

Source: PWC, “They Say They Want a Revolution,” Total Retail 2016[/caption]

US ONLINE HOMEWARES AND FURNITURE MARKET

Market Growing at 7.6% Per Year

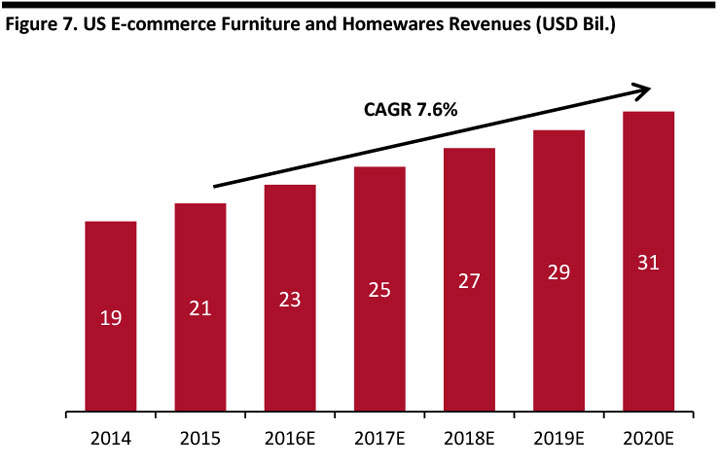

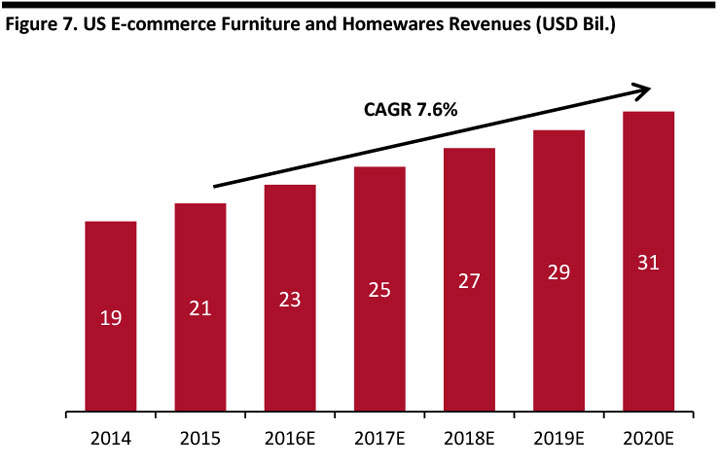

According to Statista, furniture and homewares e-commerce revenues in the US totaled US$21 billion in 2015. Revenues are expected to grow at a five-year CAGR of 7.6% to US$31 billion in 2020. However, furniture and homewares online sales will grow slower than total US online retail sales, which will grow at a five-year CAGR of 10%, according to Forrester research.

US online home goods sales made up 8.6% of total home goods sales in 2015, according to Euromonitor and Wayfair.

[caption id="attachment_84810" align="aligncenter" width="720"]

Source: Digital Market Outlook, Statista

Source: Digital Market Outlook, Statista[/caption]

Selected Top Retailers

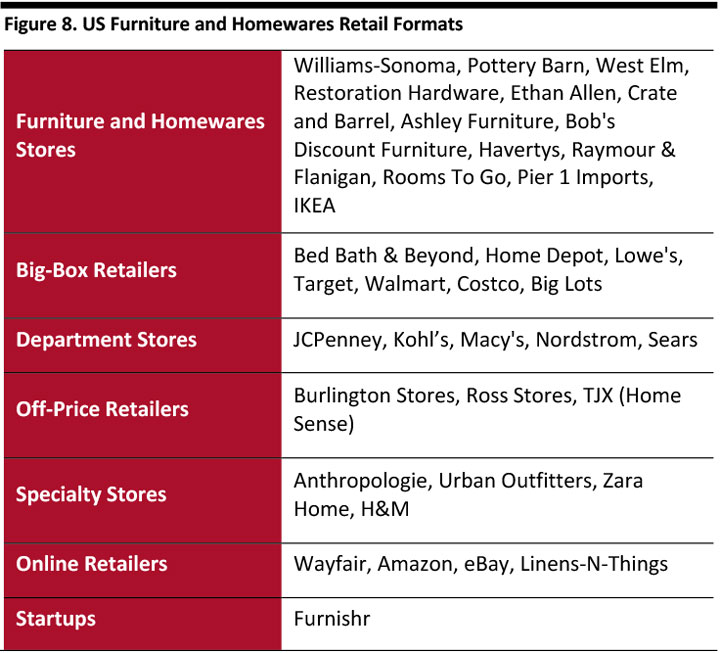

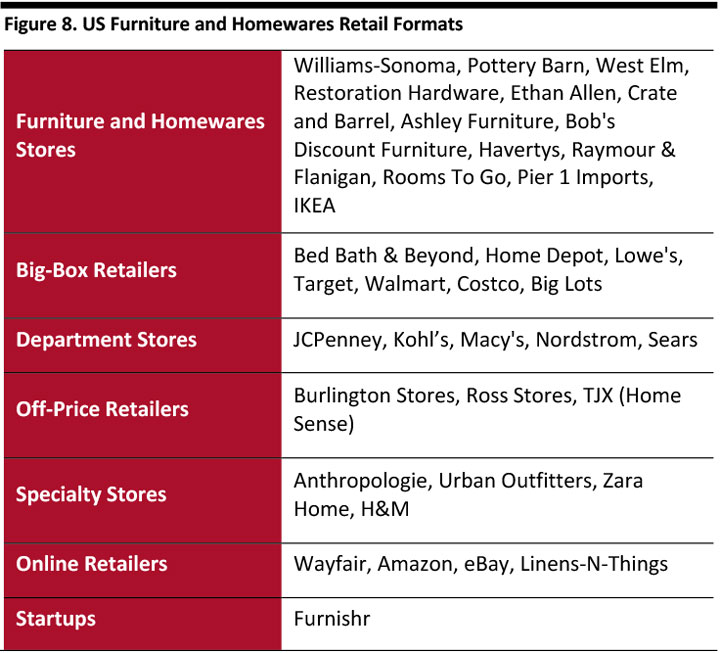

In the US, homewares and furniture are sold in a variety of retail formats including: furniture stores, big-box retailers, department stores, specialty and online retailers. According to

Digital Marketing Magazine, the top-five homewares retailers in the US are: Walmart, Costco, Target, Bed, Bath & Beyond and Sam’s Club.

The vast majority of retailers mentioned in Figure 8 below have extensive online platforms that include furniture and homewares product lines.

[caption id="attachment_84811" align="aligncenter" width="720"]

Source: Coresight Research

Source: Coresight Research[/caption]

Wayfair

US-based Wayfair is the world's largest pure-play online homewares retailer and distributes more than 7 million products from more than 7,000 suppliers across five distinct brands. Product categories include furniture, décor, decorative accents, housewares, seasonal décor and other home goods. Many suppliers are small, family-run businesses without well-known brands and without established distribution channels to a large customer base.

The company is focused primarily on the mass-market price segment. Women represented 75% of Wayfair home goods customers in 2015. According to the company, the typical Wayfair customer is a 35- to 65-year-old woman with an annual household income of $50,000 to $250,000.

The retailer has been growing very rapidly in the past few years; net revenues increased 71% year over year in FY15 to $US 2.2 billion. Wayfair’s average customer order value in FY15 was $US 222. In FY15, the company had an active customer base of 5.4 million and delivered 9.2 million orders. Active customers are defined as those who have purchased at least once in the past 12 months. Purchase growth from repeat customers continues to outpace that of new customers. However, Wayfair is not profitable yet. Outside of the US, Wayfair delivers products to customers in the UK, Canada and Germany.

Williams-Sonoma

Since they launched e-commerce in 2000, Williams-Sonoma has grown its online sales to almost US$2.5 billion, a fifteen-year CAGR of 27%. Online sales represented 51% of total revenues, and slightly surpassed retail store revenues, in 2015.

Linens-N-Things

The brick-and-mortar Linens-N-Things chain went bankrupt, and after ownership changes, the brand was re-launched as an online business.

Bed Bath & Beyond

The retailer recently acquired the e-commerce website, One Kings Lane, which specializes in home furnishings.

UK ONLINE HOMEWARES AND FURNITURE MARKET

Market Growing at 13.7% Per Year

The UK is one of the most developed online retail markets in the world. Online sales comprised 13.4% of total retail sales in the UK in 2015, according to Euromonitor. Our analysis of this data suggests the online share of nonfood categories was much higher, around 21.9% last year.

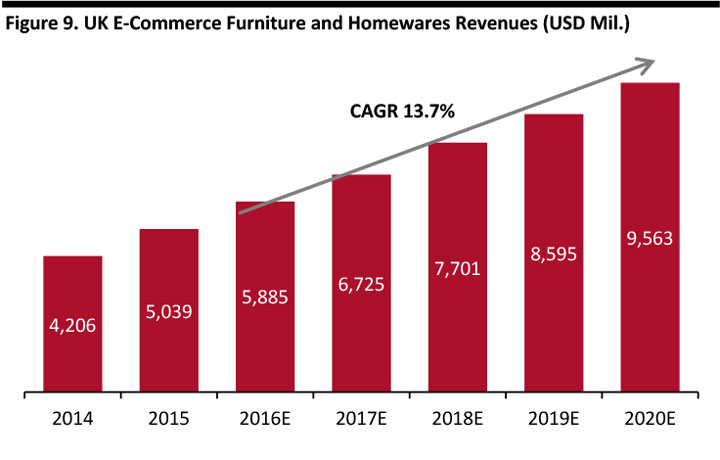

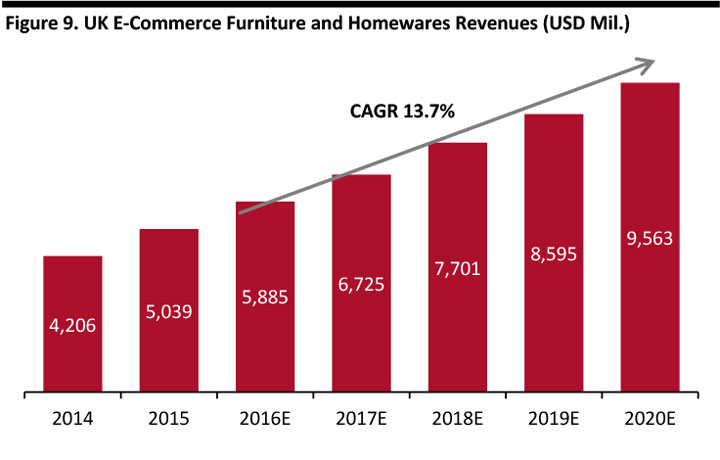

According to Statista, UK e-commerce furniture and homewares revenues totaled US$5 billion in 2015. Revenues are expected to grow at a five-year CAGR of 13.7% to US$9.6 billion in 2020. Online is taking a greater share of furniture and floorcoverings revenues in the UK and accounted for 12.1% of sector expenditures in 2015, according to Verdict Retail.

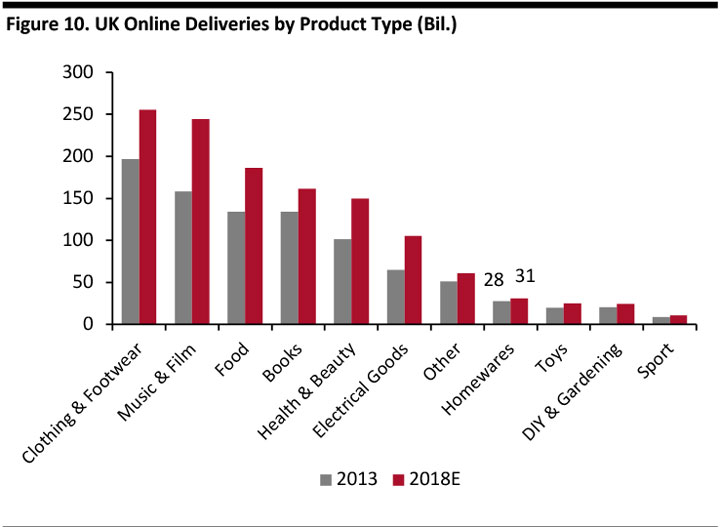

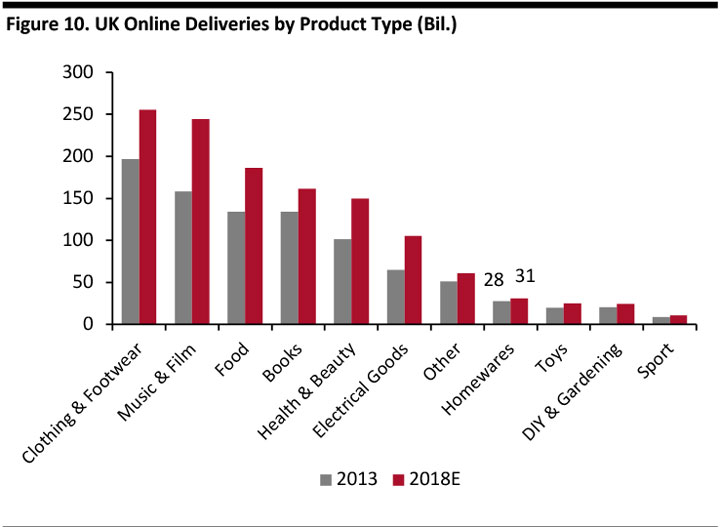

Conlumino forecasts the number of online-purchased homewares deliveries in the UK is expected to grow by a CAGR of 2.5% between 2013 and 2018, from 27.5 million to 31.1 million. According to Webloyalty, the share of mobile retail spending of the total retail spending on homewares in the UK in 2014 was estimated at 2.2% and it is expected to grow to 8.5% by 2019.

According to Mintel however, the proportion of renters versus home owners has been increasing, particularly among millennials in the UK, and encourages shorter term and lower price furniture and homewares purchases.

[caption id="attachment_84812" align="aligncenter" width="720"]

Source: Digital Market Outlook, Statista

Source: Digital Market Outlook, Statista[/caption]

[caption id="attachment_84813" align="aligncenter" width="720"]

Source: Conlumino

Source: Conlumino[/caption]

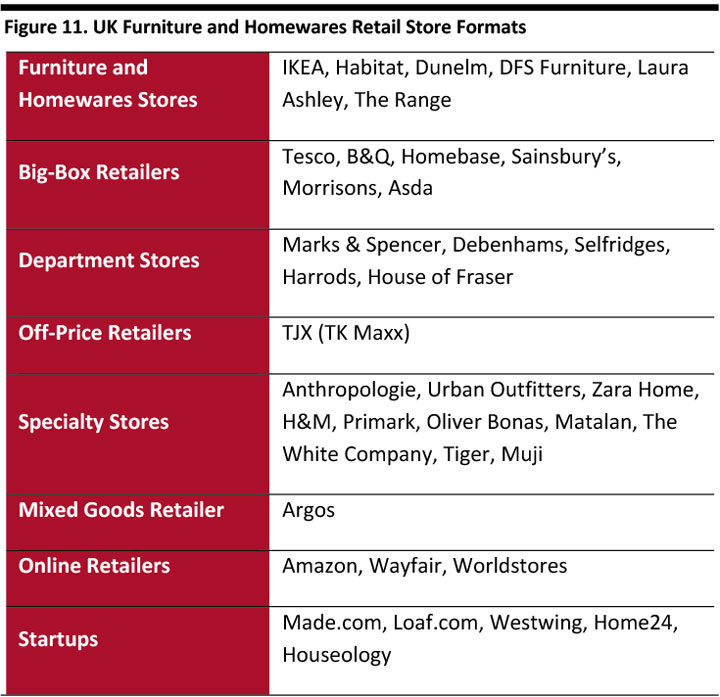

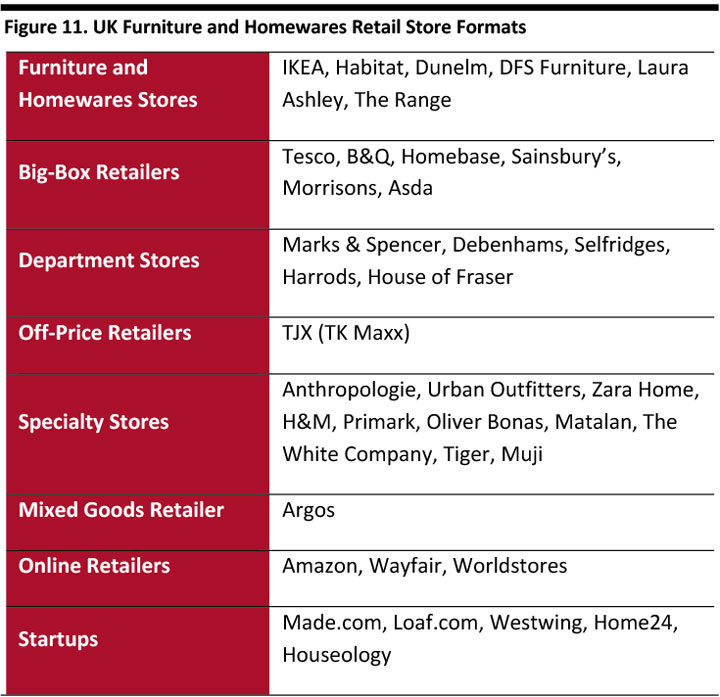

Selected Top Retailers

The UK homewares market is very fragmented and, apart from dedicated homewares and furniture retailers, housewares can also be purchased at a variety of retail store formats including big-box retailers and department stores.

According to 2015 data from Conlumino, Ikea is the UK’s top homewares and furniture retailer, with 6% market share; John Lewis is in second place, with 5.8% of the market, and in 2015 its Managing Director Andy Street announced an intention to gain first position within four years.

Numerous apparel specialist retailers have branched out into homewares: Next was one of the earliest, and it has been followed by Zara, H&M, Primark and Anthropologie. E-commerce platforms such as Amazon and numerous innovative online pure-play furniture and home furnishings retailers have also been established in the past few years.

In the UK, 12 out of 20 prominent homewares retailers offer click-and-collect, but 71% of surveyed shoppers rarely use the option, according to

Digital Marketing Magazine.

We note some of the major UK retailers in the table below.

[caption id="attachment_84814" align="aligncenter" width="720"]

Source: Coresight Research

Source: Coresight Research [/caption]

Wayfair

In the UK, Wayfair’s direct retail revenues increased more than 200% year over year in FY15.

DFS Furniture

The DFS Furniture website continues to attract more than 40% of all UK upholstery web traffic and generates double-digit percentage growth in online sales, according to company management. More than 70% of the company’s customers begin their furniture and homewares research online. In FY15, DFS grew online sales 17% year over year.

Laura Ashley

Total e-commerce and mail order sales accounted for 17.9% of total UK retail sales in 2015, and increased 8.6% year over year. The number of registered Laura Ashley e-commerce customers grew 14% year over year to 2.4 million for the financial year ended January 31, 2015.

Habitat

In the past year, Habitat has seen a 35% jump in online customer traffic. The retailer plans to launch a click-and-collect service. More than half of the retailer’s e-commerce sales are completed through mobile or tablet devices.

Worldstores

Founded in 2000, the online retailer sells both branded and unbranded products. The company posted estimated sales growth of approximately 12% year over year in FY14, but is not yet profitable.

EUROPEAN ONLINE HOMEWARES AND FURNITURE MARKET

Market Growing at 11% Per Year

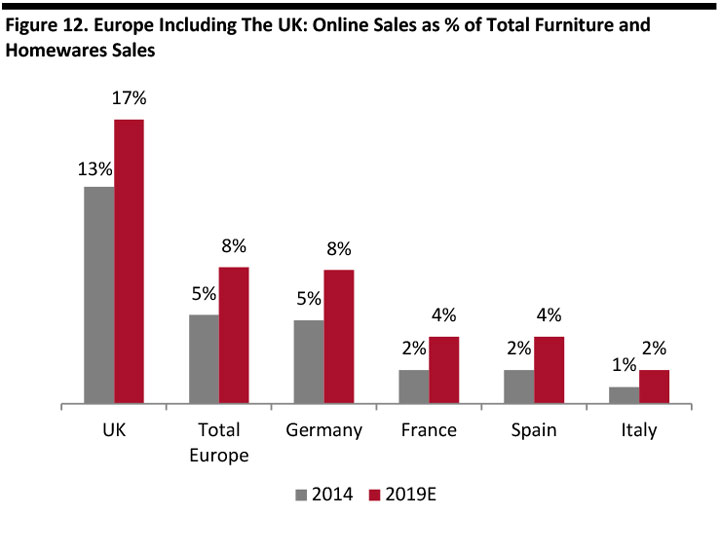

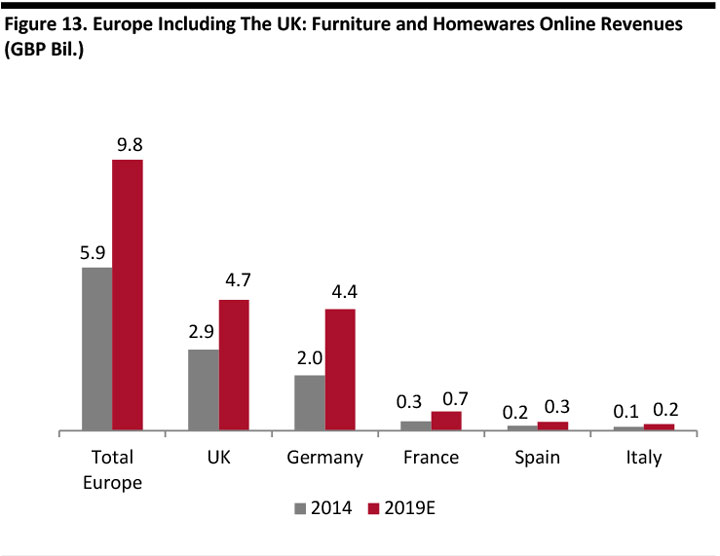

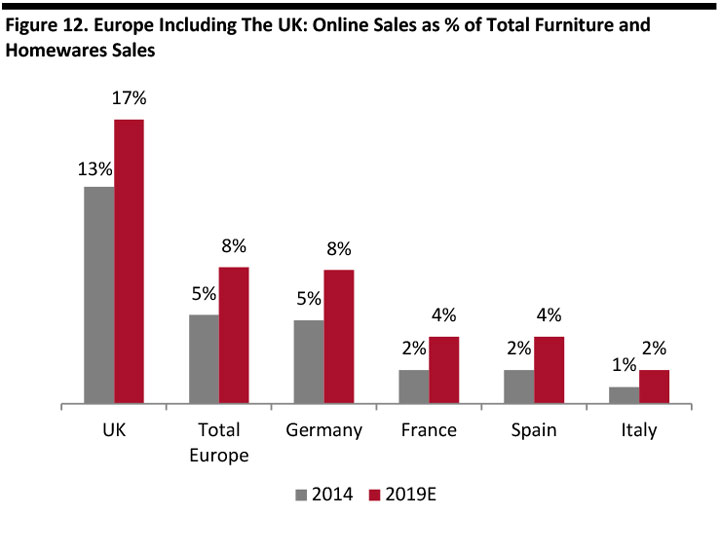

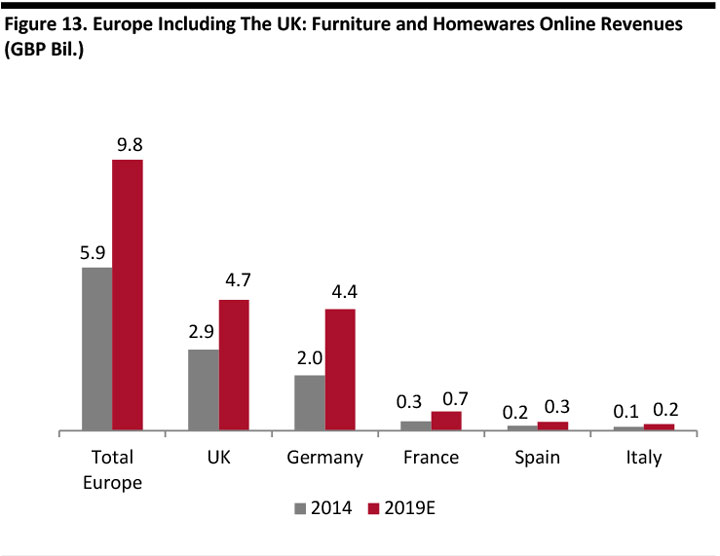

Elsewhere in Europe, e-commerce is a rapidly growing channel for furniture According to Maisons du Monde, online decoration and furniture revenues in Europe, including the UK, are forecast to grow at a five-year CAGR of 11% to €9.8 billion (US$10.9 billion) in 2019. Strong growth is forecast for the same period in France (10% CAGR), Italy (17% CAGR), Spain (16% CAGR), Switzerland (11% CAGR) and Germany (11% CAGR).

Online penetration for furniture and home decor is still significantly lower than for many other nonfood product categories. According to Maisons du Monde, in France, online penetration of furniture and decor was just 2%, which was offset by 18% for electronics and appliances, and 14% for apparel and footwear in 2014.

The online share of total furniture and décor sales in France is forecast to double from the current level to 4% by 2019. French customers who make purchases both online and in stores tend to spend more and buy more frequently.

In Germany, online furniture and homewares sales made up a smaller percentage than overall German nonfood online retail revenues of 15.3% in 2014, according to market-research firm GfK.

[caption id="attachment_84815" align="aligncenter" width="720"]

Source: Maisons du Monde

Source: Maisons du Monde[/caption]

[caption id="attachment_84816" align="aligncenter" width="720"]

Source: Maisons du Monde

Source: Maisons du Monde[/caption]

Selected Top Retailers

French furniture and homewares retailer Maisons du Monde completed an Initial Public Offering (IPO) in 2016. In France, Maisons du Monde is one of the top-three online decoration and furniture retailers in terms of revenues. The firm launched e-commerce sales in 2006 and features the majority of its product range online, and displays an average of approximately 8,700 stock keeping units (SKUs) at any given time. Furniture accounted for 78% of Maisons du Monde online customer sales, and decoration accounted for 22%, in 2015.

The company has an online presence in France, UK, Austria, the Netherlands and Portugal and hosts 11 e-commerce websites. Approximately 40% of Maisons du Monde total online customer sales were generated outside of France.

In FY15, Maisons du Monde’s online sales increased 32% year over year to €121 million (US$135 million), and online revenues represented 17% of total sales. The company aims to increase online sales to more than 25% of total sales by 2017–20.

INNOVATIVE ONLINE STARTUPS

In the last few years, numerous innovative pure-play furniture and home furnishings retailers have been established across the world.

European pure-play online retailers focused on decoration and furniture include Made.com, Westwing and Home24, which are all accessible from multiple European jurisdictions.

Houseology

The luxury homeware e-tailer, Houseology, was founded in 2010 and offers more than 200 designer furniture and homeware brands through its website. The company raised more than £1 million in equity crowdfunding in December 2015 and had a turnover of £3.7 million in FY14, and more than 30,000 customers in 100 countries, according to Crowdfund Insider.

Made.com

Made.com is an online startup that cuts out the middleman and enables bespoke purchases of designer furniture directly from manufacturers. The customer is directly connected with designers and can receive savings up to 70%. Made.com grew its sales by 63% to £42.8 million in 2014, according to Verdict Retail. Made.com participated in three rounds of funding and initially raised £2.5 million, an additional £6 million in 2012 and £38million in the last round, in 2015.

Loaf.com

Loaf.com, another UK privately owned online startup, offers a similar service. Loaf had sales of £27 million, including value added tax (VAT) in FY15 and plans to grow sales to £100 million over the next five years according to

Retail Gazette. Loaf.com plans to open 10 stores in the south east by 2018, according to Verdict Retail.

Furnishr

Furnishr is a Toronto-based startup that offers a full-service turn-key solution for moving and furnishing. The startup is part interior designer, part furniture store.

Zaozuo Zaohua Zworks

Chinese online furniture startup Zaozuo Zaohua Zworks opened its first outlet in an upscale mall. Zaozuo lets customers vote on the design and style of furniture items at the prototype stage before mass production. This strategy reduces inventory and costs. Online furniture companies in China currently hold a small slice of the market, but are growing rapidly. Privately-held Zaozuo said sales are increasing 40% annually, although the company is still unprofitable. MZGF Furniture Studio, another Chinese online furniture retailer, stated sales grew about 200% year over year in some months last year.

KEY TAKEAWAYS

What follows are the key takeaways from our assessment of the highly competitive and rapidly growing furniture and homewares e-commerce market:

- There are several factors driving the robust e-commerce growth in furniture and homewares compared to stores, including demographics and the endless customization options available online.

- Global furniture and homewares market revenue is expected to increase by a five-year CAGR of 15%. The US and UK is expected to experience 7.6% and 13.7% growth for the same time period, respectively.

- The UK had the highest percentage of furniture and homewares purchases made online in Europe at approximately 12.1% in FY15, even higher than the 8.6% in the US.

- In the last few years, numerous innovative pure-play furniture and home furnishings retailers have been established across the world, including Made.com and Loaf.com in the UK market.

Source: Digital Market Outlook, Statista[/caption]

[caption id="attachment_84805" align="aligncenter" width="720"]

Source: Digital Market Outlook, Statista[/caption]

[caption id="attachment_84805" align="aligncenter" width="720"] Source: Digital Market Outlook, Statista[/caption]

There are several factors driving the robust e-commerce growth in furniture and homewares compared to traditional brick-and-mortar stores.

Many traditional furniture and homewares retailers such as Williams-Sonoma and Restoration Hardware have invested heavily in building out Internet businesses and now derive a large portion of total revenues through their online channel. Although traditional brick-and-mortar home furnishings retailers still generate the largest chunk of industry revenue, these stores are losing market share to specialty chains, mass merchants, big-box and off-price retailers, and dedicated Internet-only retailers that offer wide ranges and low prices. Various retailers have launched homeware product collections and expanded their offerings both in-store and online.

Numerous innovative pure-play furniture and homewares retailers have launched, but few have reached critical mass or even reported a profit. Wayfair is the only US publicly-traded online pure-play furniture and homewares company of significant size. Although the retailer has grown revenues rapidly, the company is still unprofitable, which gives testament to the fact that the online channel can be a difficult one, regardless of the product category.

The furniture and homewares retailers presented in the charts below are those major stores that disclose the amount of online sales or the year-over-year growth rate of their online revenues.

[caption id="attachment_84806" align="aligncenter" width="720"]

Source: Digital Market Outlook, Statista[/caption]

There are several factors driving the robust e-commerce growth in furniture and homewares compared to traditional brick-and-mortar stores.

Many traditional furniture and homewares retailers such as Williams-Sonoma and Restoration Hardware have invested heavily in building out Internet businesses and now derive a large portion of total revenues through their online channel. Although traditional brick-and-mortar home furnishings retailers still generate the largest chunk of industry revenue, these stores are losing market share to specialty chains, mass merchants, big-box and off-price retailers, and dedicated Internet-only retailers that offer wide ranges and low prices. Various retailers have launched homeware product collections and expanded their offerings both in-store and online.

Numerous innovative pure-play furniture and homewares retailers have launched, but few have reached critical mass or even reported a profit. Wayfair is the only US publicly-traded online pure-play furniture and homewares company of significant size. Although the retailer has grown revenues rapidly, the company is still unprofitable, which gives testament to the fact that the online channel can be a difficult one, regardless of the product category.

The furniture and homewares retailers presented in the charts below are those major stores that disclose the amount of online sales or the year-over-year growth rate of their online revenues.

[caption id="attachment_84806" align="aligncenter" width="720"] Source: Company reports[/caption]

Among the biggest brick-and-mortar retailers, Williams-Sonoma and Restoration Hardware lead in online contribution to revenues, both with around half of total sales from e-commerce in 2015.

[caption id="attachment_84807" align="aligncenter" width="720"]

Source: Company reports[/caption]

Among the biggest brick-and-mortar retailers, Williams-Sonoma and Restoration Hardware lead in online contribution to revenues, both with around half of total sales from e-commerce in 2015.

[caption id="attachment_84807" align="aligncenter" width="720"] Source: Company reports [/caption]

What Is The Appeal of Buying Furniture Online?

The process of purchasing furniture or homewares differs from shopping for many other product categories. Consumers tend to seek unique and original merchandise and often have a hard time articulating precisely the exact product and design they are looking for. Additionally, many furniture and homeware purchases are items that will be used over the long-term. This leads customers to conduct more research and comparisons, processes which are far simpler and quicker online. Customer reviews found on some sites also provide another informative service for consumers.

The online channel is very suitable for researching hundreds varying designs and products, without the need to visit an endless round of stores. More customization options are available online and allow for a level of differentiation not available in-store. Tools such as Pinterest and design blogs provide inspiration and curation. Several new resale sites have cropped up and provide the consumer with new design and product ideas. Multiple companies have launched technology platforms that help facilitate room visualization and provide 3D tools so consumers can see what particular products or designs would look like in their homes.

Many e-commerce companies offer discounts, free shipping and even free items with orders over a certain value. These special offers lure customers to the online channel because promotions like these are less common in brick-and-mortar shops.

The global online home goods market will likely grow further as tech-savvy millennials age and start families, and baby boomers become more comfortable purchasing online. As the online channel matures, customers are also becoming more comfortable making large purchases online.

Consumers tend to spend on homewares during a healthy housing market. Owner-occupiers are the most active group of purchasers for home products, especially for large projects such as extensions and retrofits.

[caption id="attachment_84808" align="aligncenter" width="720"]

Source: Company reports [/caption]

What Is The Appeal of Buying Furniture Online?

The process of purchasing furniture or homewares differs from shopping for many other product categories. Consumers tend to seek unique and original merchandise and often have a hard time articulating precisely the exact product and design they are looking for. Additionally, many furniture and homeware purchases are items that will be used over the long-term. This leads customers to conduct more research and comparisons, processes which are far simpler and quicker online. Customer reviews found on some sites also provide another informative service for consumers.

The online channel is very suitable for researching hundreds varying designs and products, without the need to visit an endless round of stores. More customization options are available online and allow for a level of differentiation not available in-store. Tools such as Pinterest and design blogs provide inspiration and curation. Several new resale sites have cropped up and provide the consumer with new design and product ideas. Multiple companies have launched technology platforms that help facilitate room visualization and provide 3D tools so consumers can see what particular products or designs would look like in their homes.

Many e-commerce companies offer discounts, free shipping and even free items with orders over a certain value. These special offers lure customers to the online channel because promotions like these are less common in brick-and-mortar shops.

The global online home goods market will likely grow further as tech-savvy millennials age and start families, and baby boomers become more comfortable purchasing online. As the online channel matures, customers are also becoming more comfortable making large purchases online.

Consumers tend to spend on homewares during a healthy housing market. Owner-occupiers are the most active group of purchasers for home products, especially for large projects such as extensions and retrofits.

[caption id="attachment_84808" align="aligncenter" width="720"] Source: PWC, “They Say They Want a Revolution,” Total Retail 2016[/caption]

[caption id="attachment_84809" align="aligncenter" width="720"]

Source: PWC, “They Say They Want a Revolution,” Total Retail 2016[/caption]

[caption id="attachment_84809" align="aligncenter" width="720"] Source: PWC, “They Say They Want a Revolution,” Total Retail 2016[/caption]

Source: PWC, “They Say They Want a Revolution,” Total Retail 2016[/caption]

Source: Digital Market Outlook, Statista[/caption]

Selected Top Retailers

In the US, homewares and furniture are sold in a variety of retail formats including: furniture stores, big-box retailers, department stores, specialty and online retailers. According to Digital Marketing Magazine, the top-five homewares retailers in the US are: Walmart, Costco, Target, Bed, Bath & Beyond and Sam’s Club.

The vast majority of retailers mentioned in Figure 8 below have extensive online platforms that include furniture and homewares product lines.

[caption id="attachment_84811" align="aligncenter" width="720"]

Source: Digital Market Outlook, Statista[/caption]

Selected Top Retailers

In the US, homewares and furniture are sold in a variety of retail formats including: furniture stores, big-box retailers, department stores, specialty and online retailers. According to Digital Marketing Magazine, the top-five homewares retailers in the US are: Walmart, Costco, Target, Bed, Bath & Beyond and Sam’s Club.

The vast majority of retailers mentioned in Figure 8 below have extensive online platforms that include furniture and homewares product lines.

[caption id="attachment_84811" align="aligncenter" width="720"] Source: Coresight Research[/caption]

Wayfair

US-based Wayfair is the world's largest pure-play online homewares retailer and distributes more than 7 million products from more than 7,000 suppliers across five distinct brands. Product categories include furniture, décor, decorative accents, housewares, seasonal décor and other home goods. Many suppliers are small, family-run businesses without well-known brands and without established distribution channels to a large customer base.

The company is focused primarily on the mass-market price segment. Women represented 75% of Wayfair home goods customers in 2015. According to the company, the typical Wayfair customer is a 35- to 65-year-old woman with an annual household income of $50,000 to $250,000.

The retailer has been growing very rapidly in the past few years; net revenues increased 71% year over year in FY15 to $US 2.2 billion. Wayfair’s average customer order value in FY15 was $US 222. In FY15, the company had an active customer base of 5.4 million and delivered 9.2 million orders. Active customers are defined as those who have purchased at least once in the past 12 months. Purchase growth from repeat customers continues to outpace that of new customers. However, Wayfair is not profitable yet. Outside of the US, Wayfair delivers products to customers in the UK, Canada and Germany.

Williams-Sonoma

Since they launched e-commerce in 2000, Williams-Sonoma has grown its online sales to almost US$2.5 billion, a fifteen-year CAGR of 27%. Online sales represented 51% of total revenues, and slightly surpassed retail store revenues, in 2015.

Linens-N-Things

The brick-and-mortar Linens-N-Things chain went bankrupt, and after ownership changes, the brand was re-launched as an online business.

Bed Bath & Beyond

The retailer recently acquired the e-commerce website, One Kings Lane, which specializes in home furnishings.

Source: Coresight Research[/caption]

Wayfair

US-based Wayfair is the world's largest pure-play online homewares retailer and distributes more than 7 million products from more than 7,000 suppliers across five distinct brands. Product categories include furniture, décor, decorative accents, housewares, seasonal décor and other home goods. Many suppliers are small, family-run businesses without well-known brands and without established distribution channels to a large customer base.

The company is focused primarily on the mass-market price segment. Women represented 75% of Wayfair home goods customers in 2015. According to the company, the typical Wayfair customer is a 35- to 65-year-old woman with an annual household income of $50,000 to $250,000.

The retailer has been growing very rapidly in the past few years; net revenues increased 71% year over year in FY15 to $US 2.2 billion. Wayfair’s average customer order value in FY15 was $US 222. In FY15, the company had an active customer base of 5.4 million and delivered 9.2 million orders. Active customers are defined as those who have purchased at least once in the past 12 months. Purchase growth from repeat customers continues to outpace that of new customers. However, Wayfair is not profitable yet. Outside of the US, Wayfair delivers products to customers in the UK, Canada and Germany.

Williams-Sonoma

Since they launched e-commerce in 2000, Williams-Sonoma has grown its online sales to almost US$2.5 billion, a fifteen-year CAGR of 27%. Online sales represented 51% of total revenues, and slightly surpassed retail store revenues, in 2015.

Linens-N-Things

The brick-and-mortar Linens-N-Things chain went bankrupt, and after ownership changes, the brand was re-launched as an online business.

Bed Bath & Beyond

The retailer recently acquired the e-commerce website, One Kings Lane, which specializes in home furnishings.

Source: Digital Market Outlook, Statista[/caption]

[caption id="attachment_84813" align="aligncenter" width="720"]

Source: Digital Market Outlook, Statista[/caption]

[caption id="attachment_84813" align="aligncenter" width="720"] Source: Conlumino[/caption]

Selected Top Retailers

The UK homewares market is very fragmented and, apart from dedicated homewares and furniture retailers, housewares can also be purchased at a variety of retail store formats including big-box retailers and department stores.

According to 2015 data from Conlumino, Ikea is the UK’s top homewares and furniture retailer, with 6% market share; John Lewis is in second place, with 5.8% of the market, and in 2015 its Managing Director Andy Street announced an intention to gain first position within four years.

Numerous apparel specialist retailers have branched out into homewares: Next was one of the earliest, and it has been followed by Zara, H&M, Primark and Anthropologie. E-commerce platforms such as Amazon and numerous innovative online pure-play furniture and home furnishings retailers have also been established in the past few years.

In the UK, 12 out of 20 prominent homewares retailers offer click-and-collect, but 71% of surveyed shoppers rarely use the option, according to Digital Marketing Magazine.

We note some of the major UK retailers in the table below.

[caption id="attachment_84814" align="aligncenter" width="720"]

Source: Conlumino[/caption]

Selected Top Retailers

The UK homewares market is very fragmented and, apart from dedicated homewares and furniture retailers, housewares can also be purchased at a variety of retail store formats including big-box retailers and department stores.

According to 2015 data from Conlumino, Ikea is the UK’s top homewares and furniture retailer, with 6% market share; John Lewis is in second place, with 5.8% of the market, and in 2015 its Managing Director Andy Street announced an intention to gain first position within four years.

Numerous apparel specialist retailers have branched out into homewares: Next was one of the earliest, and it has been followed by Zara, H&M, Primark and Anthropologie. E-commerce platforms such as Amazon and numerous innovative online pure-play furniture and home furnishings retailers have also been established in the past few years.

In the UK, 12 out of 20 prominent homewares retailers offer click-and-collect, but 71% of surveyed shoppers rarely use the option, according to Digital Marketing Magazine.

We note some of the major UK retailers in the table below.

[caption id="attachment_84814" align="aligncenter" width="720"] Source: Coresight Research [/caption]

Wayfair

In the UK, Wayfair’s direct retail revenues increased more than 200% year over year in FY15.

DFS Furniture

The DFS Furniture website continues to attract more than 40% of all UK upholstery web traffic and generates double-digit percentage growth in online sales, according to company management. More than 70% of the company’s customers begin their furniture and homewares research online. In FY15, DFS grew online sales 17% year over year.

Laura Ashley

Total e-commerce and mail order sales accounted for 17.9% of total UK retail sales in 2015, and increased 8.6% year over year. The number of registered Laura Ashley e-commerce customers grew 14% year over year to 2.4 million for the financial year ended January 31, 2015.

Habitat

In the past year, Habitat has seen a 35% jump in online customer traffic. The retailer plans to launch a click-and-collect service. More than half of the retailer’s e-commerce sales are completed through mobile or tablet devices.

Worldstores

Founded in 2000, the online retailer sells both branded and unbranded products. The company posted estimated sales growth of approximately 12% year over year in FY14, but is not yet profitable.

Source: Coresight Research [/caption]

Wayfair

In the UK, Wayfair’s direct retail revenues increased more than 200% year over year in FY15.

DFS Furniture

The DFS Furniture website continues to attract more than 40% of all UK upholstery web traffic and generates double-digit percentage growth in online sales, according to company management. More than 70% of the company’s customers begin their furniture and homewares research online. In FY15, DFS grew online sales 17% year over year.

Laura Ashley

Total e-commerce and mail order sales accounted for 17.9% of total UK retail sales in 2015, and increased 8.6% year over year. The number of registered Laura Ashley e-commerce customers grew 14% year over year to 2.4 million for the financial year ended January 31, 2015.

Habitat

In the past year, Habitat has seen a 35% jump in online customer traffic. The retailer plans to launch a click-and-collect service. More than half of the retailer’s e-commerce sales are completed through mobile or tablet devices.

Worldstores

Founded in 2000, the online retailer sells both branded and unbranded products. The company posted estimated sales growth of approximately 12% year over year in FY14, but is not yet profitable.

Source: Maisons du Monde[/caption]

[caption id="attachment_84816" align="aligncenter" width="720"]

Source: Maisons du Monde[/caption]

[caption id="attachment_84816" align="aligncenter" width="720"] Source: Maisons du Monde[/caption]

Selected Top Retailers

French furniture and homewares retailer Maisons du Monde completed an Initial Public Offering (IPO) in 2016. In France, Maisons du Monde is one of the top-three online decoration and furniture retailers in terms of revenues. The firm launched e-commerce sales in 2006 and features the majority of its product range online, and displays an average of approximately 8,700 stock keeping units (SKUs) at any given time. Furniture accounted for 78% of Maisons du Monde online customer sales, and decoration accounted for 22%, in 2015.

The company has an online presence in France, UK, Austria, the Netherlands and Portugal and hosts 11 e-commerce websites. Approximately 40% of Maisons du Monde total online customer sales were generated outside of France.

In FY15, Maisons du Monde’s online sales increased 32% year over year to €121 million (US$135 million), and online revenues represented 17% of total sales. The company aims to increase online sales to more than 25% of total sales by 2017–20.

Source: Maisons du Monde[/caption]

Selected Top Retailers

French furniture and homewares retailer Maisons du Monde completed an Initial Public Offering (IPO) in 2016. In France, Maisons du Monde is one of the top-three online decoration and furniture retailers in terms of revenues. The firm launched e-commerce sales in 2006 and features the majority of its product range online, and displays an average of approximately 8,700 stock keeping units (SKUs) at any given time. Furniture accounted for 78% of Maisons du Monde online customer sales, and decoration accounted for 22%, in 2015.

The company has an online presence in France, UK, Austria, the Netherlands and Portugal and hosts 11 e-commerce websites. Approximately 40% of Maisons du Monde total online customer sales were generated outside of France.

In FY15, Maisons du Monde’s online sales increased 32% year over year to €121 million (US$135 million), and online revenues represented 17% of total sales. The company aims to increase online sales to more than 25% of total sales by 2017–20.