- In this report, we look at the global eyewear market, an industry being reshaped by emerging startups and innovations from established industry players. We examine market size, the evolving landscape, competion and the startups disrupting the industry.

Eyewear: A $127 Billion Market

The eyewear industry consists of four main segments, namely: lenses (for glasses), contact lenses, frames and sunglasses. Research firm Statista estimates the value of the global eyewear market at $127 billion in 2018, and forecasts it will grow 11.0% to $141 billion by 2023, equating to a relatively low CAGR of 2.1% due to minimal unit-volume increases and modest inflation.

According to Statista, global eyewear sales grew just 2.5% in 2018, with a unit volume increase of only 1.4%.

Despite low growth rates, Coresight Research believes there are pockets of opportunity in the eyewear market.

The lenses segment: Lenses for glasses represent the largest eyewear category at $54 billion in 2018, though it is also the slowest growing at just 2.2% in 2018, and is expected to grow 9.8% to $59 billion by 2023. Product developments such as innovations in eyeglasses that offer improved UV protection, fog resistance and anti-glare properties are helping to add value and create opportunities for greater growth.

The contact lenses segment: The contact lenses segment was valued at $16 billion in 2018, an increase of 2.7% year over year. The category is estimated to grow 11.4% to $18 billion by 2023. Rising preference for daily disposable lenses, rising popularity of fashionable contact lenses, and growing innovations in contact lenses are expected to continue to drive demand in this segment.

The eyewear frames segment: The eyewear frame segment was valued at $36 billion in 2018, up 2.5% year over year. The category is estimated to grow 11.5% to $40 billion by 2023. Consumers’ preferences for different types of frames such as thin, customizable and lightweight frames will continue to fuel growth in this segment.

The sunglasses segment: The sunglasses segment was valued at $21 billion in 2018, having increased 3.0% year over year. The category is estimated to grow 12.8% to $24 billion by 2023. The rising use of sunglasses as a fashion accessory and consumers’ growing awareness towards protection against UV light are transforming the eyewear market, and will continue to fuel growth of this segment.

Eyewear Market Landscape

Online Eyewear Sales Are Experiencing Steady Growth

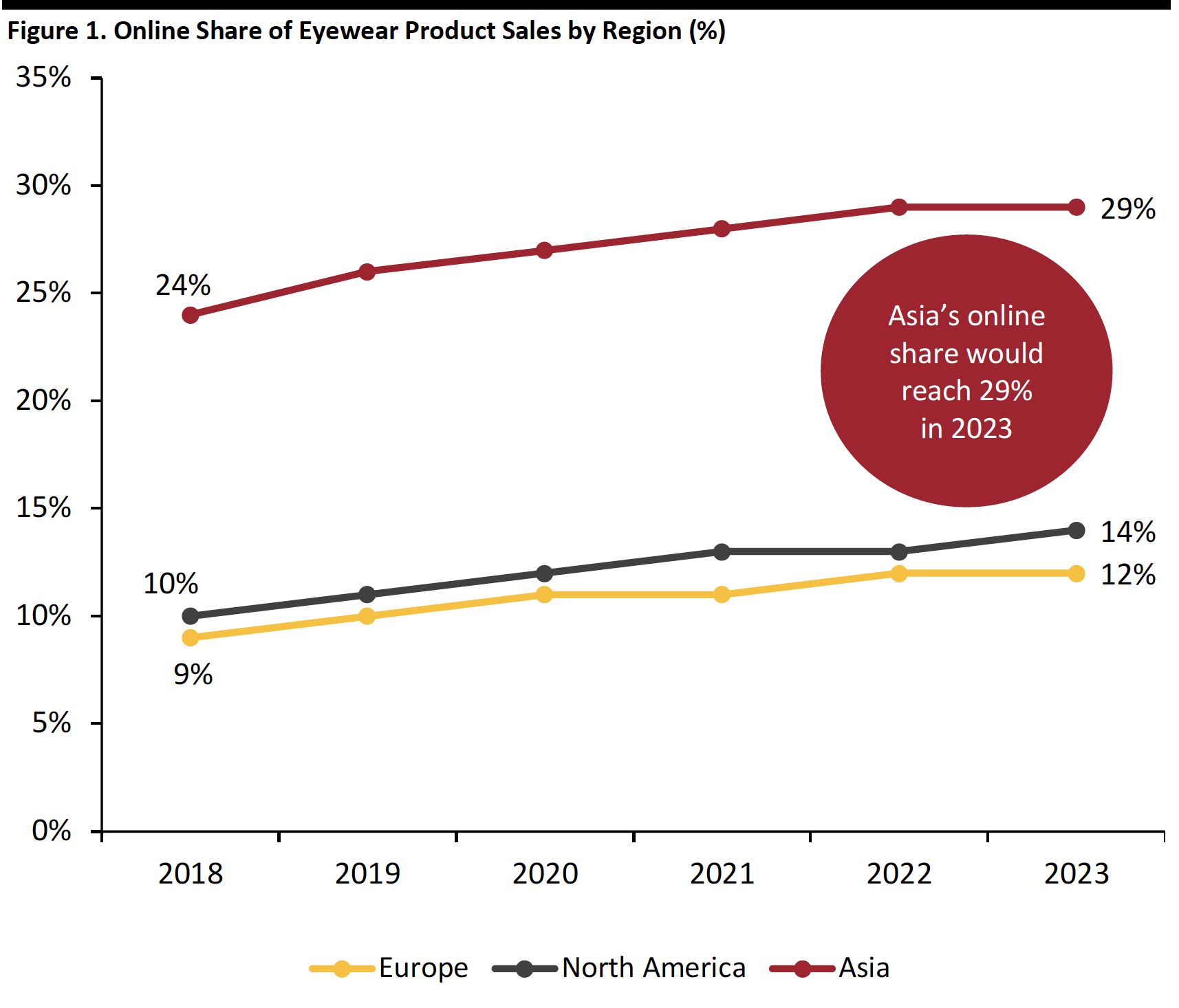

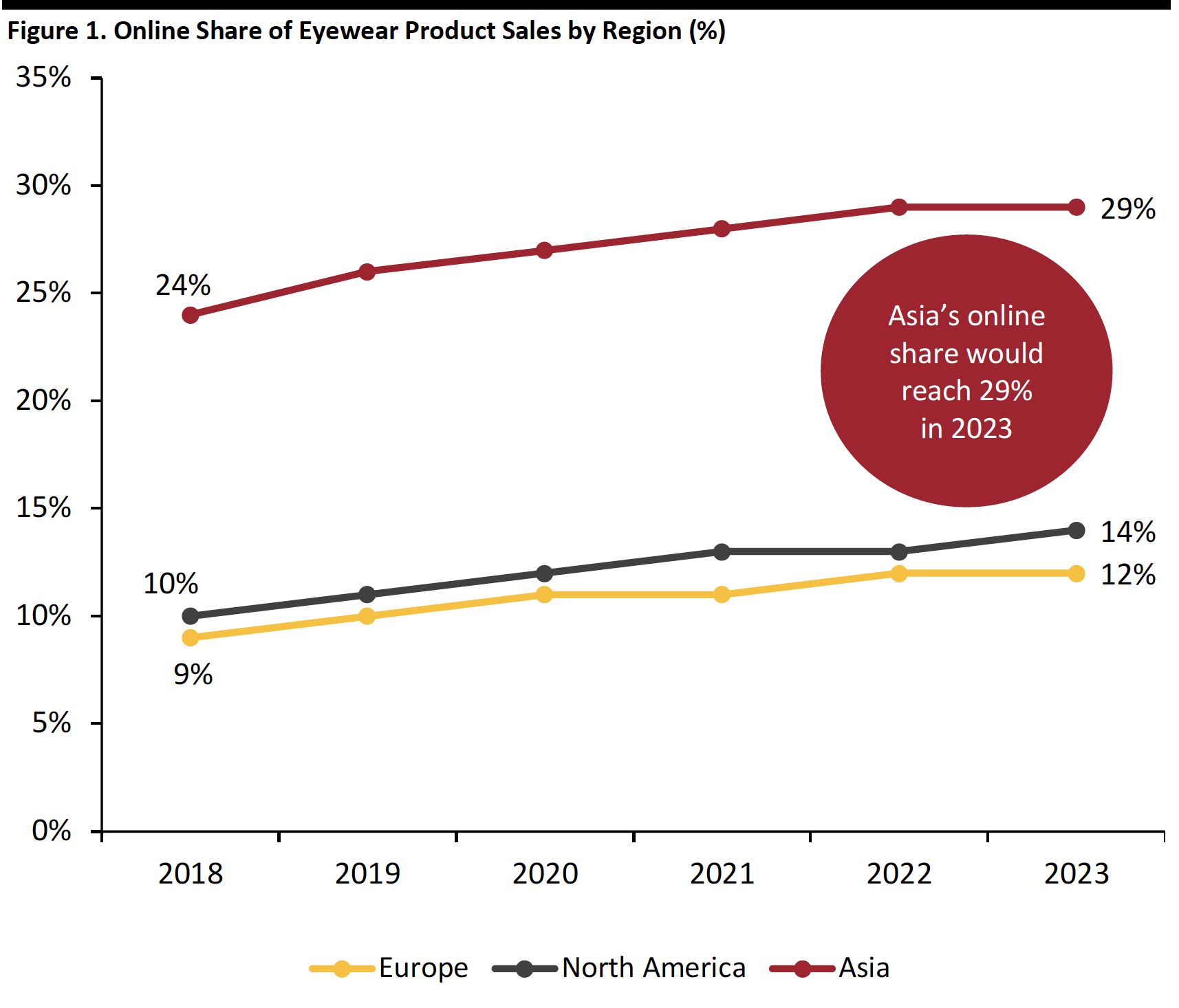

While most eyewear is still sold through brick-and-mortar retail channels, online platforms have been taking more market share, with established market leaders joining some of the digital startups in offering DTC delivery.

Online sales accounted for around 13% of global eyewear sales in 2018, and e-commerce is expected to grow 7% annually from 2018 to 2021, according to Statista. By region, Asia will have the highest online penetration at 29% by 2023, followed by North America at 14% and Europe at 12%.

[caption id="attachment_98946" align="aligncenter" width="700"]

Source: Statista

Source: Statista[/caption]

Competitive Landscape

The eyewear market is dominated by a few key players, including EssilorLuxottica, GrandVision, Johnson & Johnson and Alcon. Most have relied on product innovation and development, partnerships and joint ventures to remain competitive in the slow-growing space.

EssilorLuxottica is a French-Italian ophthalmic optics company founded in 2018 via the merger of Italian company Luxottica and French company Essilor. The company designs, produces and markets ophthalmic lenses, optical equipment, prescription glasses and sunglasses. The company operates a multitude of brands, including Essilor, Luxottica, Oakley, LensCrafters and more.

In 2018, EssilorLuxottica reported adjusted pro-forma revenue of €16.2 billion ($18.1 billion), a 3.2% year-over-year increase at constant exchange rates. In late March 2019, EssilorLuxottica announced launch of Advanced Vision Accuracy (AVA), an integrated solution that includes new refraction technology, intelligence and advanced lenses that help eye care professionals. Later in April, EssilorLuxottica also launched Visioffice X, a digital measuring device designed to create a custom experience for patients and help independent practices differentiate themselves and drive customer loyalty.

Apart from product innovations, EssilorLuxottica also announced plans to acquire GrandVision to expand its global presence, after its acquisition of German online optics retailer Brille24 in February.

EssilorLuxottica is a French-Italian ophthalmic optics company founded in 2018 via the merger of Italian company Luxottica and French company Essilor. The company designs, produces and markets ophthalmic lenses, optical equipment, prescription glasses and sunglasses. The company operates a multitude of brands, including Essilor, Luxottica, Oakley, LensCrafters and more.

In 2018, EssilorLuxottica reported adjusted pro-forma revenue of €16.2 billion ($18.1 billion), a 3.2% year-over-year increase at constant exchange rates. In late March 2019, EssilorLuxottica announced launch of Advanced Vision Accuracy (AVA), an integrated solution that includes new refraction technology, intelligence and advanced lenses that help eye care professionals. Later in April, EssilorLuxottica also launched Visioffice X, a digital measuring device designed to create a custom experience for patients and help independent practices differentiate themselves and drive customer loyalty.

Apart from product innovations, EssilorLuxottica also announced plans to acquire GrandVision to expand its global presence, after its acquisition of German online optics retailer Brille24 in February.

GrandVision is an optical retailer founded in 2011 in Amsterdam, and belongs to investment company HAL Holding. GrandVision offers a range of services, prescription glasses including frames and lenses, contact lenses, contact lens care products and sunglasses. The company sells through leading optical retail banners in more than 40 countries across Europe, the Americas, the Middle East and Asia. GrandVision operates a variety of retail banners, including MultiOpticas, Nissen, McOptic and more. The company reported revenue of $4.2 billion worldwide in 2018, growing about 8% year over year. Unlike EssilorLuxottica, there are no recent notable acquisitions, partnerships or product innovations from GrandVision.

GrandVision is an optical retailer founded in 2011 in Amsterdam, and belongs to investment company HAL Holding. GrandVision offers a range of services, prescription glasses including frames and lenses, contact lenses, contact lens care products and sunglasses. The company sells through leading optical retail banners in more than 40 countries across Europe, the Americas, the Middle East and Asia. GrandVision operates a variety of retail banners, including MultiOpticas, Nissen, McOptic and more. The company reported revenue of $4.2 billion worldwide in 2018, growing about 8% year over year. Unlike EssilorLuxottica, there are no recent notable acquisitions, partnerships or product innovations from GrandVision.

Johnson & Johnson Vision, a subsidiary of Johnson & Johnson (J&J), sells contact lenses, contact lens products, eyecare product and optical surgery products. Contact lens sales generated revenue of more than US$3.3 billion in 2018. Between late May and early June 2019, Johnson & Johnson Vision highlighted its latest eye-care innovations and clinical data at the 2019 British Contact Lens Association (BCLA) Conference in Manchester, UK. One of its innovations was its ACUVUE OASYS with Transitions Light Intelligent Technology, which offers benefits beyond vision correction, for example, by reducing exposure to bright light, both indoors and outdoors.

Johnson & Johnson Vision, a subsidiary of Johnson & Johnson (J&J), sells contact lenses, contact lens products, eyecare product and optical surgery products. Contact lens sales generated revenue of more than US$3.3 billion in 2018. Between late May and early June 2019, Johnson & Johnson Vision highlighted its latest eye-care innovations and clinical data at the 2019 British Contact Lens Association (BCLA) Conference in Manchester, UK. One of its innovations was its ACUVUE OASYS with Transitions Light Intelligent Technology, which offers benefits beyond vision correction, for example, by reducing exposure to bright light, both indoors and outdoors.

Alcon is a global medical company specializing in eye care products based in Fort Worth, Texas. The company was recently spun off from Novartis, and in 2018 reported vision care sales of $3.1 billion. In June 2019 Alcon announced the launch of a new collection of contact lenses with four colors designed to make eyes look bigger and brighter, serving both corrective and aesthetic purposes within the same product.

Alcon is a global medical company specializing in eye care products based in Fort Worth, Texas. The company was recently spun off from Novartis, and in 2018 reported vision care sales of $3.1 billion. In June 2019 Alcon announced the launch of a new collection of contact lenses with four colors designed to make eyes look bigger and brighter, serving both corrective and aesthetic purposes within the same product.

Emerging Trends and Startups Disrupting the Eyewear Market

While established players in the eyewear market expand through mergers and acquisitions, partnerships and by launching product innovations, we also see startups disrupting the market, tapping into emerging trends such as greater convenience, price sensitivity, increasing interest in eco-friendly products and the opportunities in by 3D customizable eyewear and smart eyewear.

DTC Startups offering Affordable Quality Eyewear

With faster replacement cycles but preferences for lower price points, demand for affordable quality eyewear is increasing. Compared with traditional retailers that sell at high profit margins, DTC brands can offer cheaper alternatives. US DTC company Warby Parker which offers prescription glasses and sunglasses was founded in 2010, and has been so successful it has attracted more DTC eyewear startups into the space.

Pair Eyewear offers customizable eyeglasses for kids using a DTC model, and opened in late 2017. Pair Eyewear sells $95 frames for kids at PairEyewear.com. Beyond frames, Pair Eyewear also sells customizable clip-on top frames for glasses for $25 each, prescription and non-prescription sunglasses for $35. For every pair of glasses purchased, Pair Eyewear donates a pair of glasses to The Eyelliance, a non-profit organization that gives glasses to children in the developing world.

Pair Eyewear offers customizable eyeglasses for kids using a DTC model, and opened in late 2017. Pair Eyewear sells $95 frames for kids at PairEyewear.com. Beyond frames, Pair Eyewear also sells customizable clip-on top frames for glasses for $25 each, prescription and non-prescription sunglasses for $35. For every pair of glasses purchased, Pair Eyewear donates a pair of glasses to The Eyelliance, a non-profit organization that gives glasses to children in the developing world.

EyeBuyDirect, founded in 2005, is a DTC eyewear brand that offers over 1,200 frames starting as low as $6. EyeBuyDirect makes and sells its own brand of prescription eyeglasses and sunglasses, and has a 14-day return policy. EyeBuyDirect also has a “fit and style eyewear quiz” feature to help consumers narrow down style selection and an online try-on feature on the website that lets people upload a photo superimpose an image of any pair of frames to see how they would look on the face.

Startups offering Eco-Friendly Eyewear

With increasing awareness of environmental issues, more consumers look to sustainability, corporate social responsibility and other ethics issues when deciding where to shop – and eyewear is no exception. This has created opportunities for startups to differentiate themselves from the mass-market rivals.

EyeBuyDirect, founded in 2005, is a DTC eyewear brand that offers over 1,200 frames starting as low as $6. EyeBuyDirect makes and sells its own brand of prescription eyeglasses and sunglasses, and has a 14-day return policy. EyeBuyDirect also has a “fit and style eyewear quiz” feature to help consumers narrow down style selection and an online try-on feature on the website that lets people upload a photo superimpose an image of any pair of frames to see how they would look on the face.

Startups offering Eco-Friendly Eyewear

With increasing awareness of environmental issues, more consumers look to sustainability, corporate social responsibility and other ethics issues when deciding where to shop – and eyewear is no exception. This has created opportunities for startups to differentiate themselves from the mass-market rivals.

Ukrainian start-up

Ochis has developed an eyewear range called Ochis Coffee, which it says is the first eco-friendly range of sunglasses made from coffee. The frames have a faint aroma of freshly roasted coffee and has a soft texture.

Dresden Vision makes frames it believes are sturdier (and less easy to break) more sustainably made. Innovations so far include frames made from old beer keg caps sourced from local Sydney brewing companies, marine debris, “ghost” fishing nets found on coastlines and milk bottle tops from cafés. Its business model prioritizes accessibility, affordability and sustainability. The company also seeks to make its products with interchangeable and easily-replaceable pieces.

Startups Offering 3D Customizable Eyewear

3D printing has not only affected the apparel and manufacturing industries, but is also now making its presence known in the eyewear industry. As in other industries, 3D printing can cut production time significantly, and make it easier to offer a wider variety of eyewear products. As consumers increasingly demand product customization and personalization, 3D printing is facilitating this change.

Dresden Vision makes frames it believes are sturdier (and less easy to break) more sustainably made. Innovations so far include frames made from old beer keg caps sourced from local Sydney brewing companies, marine debris, “ghost” fishing nets found on coastlines and milk bottle tops from cafés. Its business model prioritizes accessibility, affordability and sustainability. The company also seeks to make its products with interchangeable and easily-replaceable pieces.

Startups Offering 3D Customizable Eyewear

3D printing has not only affected the apparel and manufacturing industries, but is also now making its presence known in the eyewear industry. As in other industries, 3D printing can cut production time significantly, and make it easier to offer a wider variety of eyewear products. As consumers increasingly demand product customization and personalization, 3D printing is facilitating this change.

King Children is a startup that uses 3D-printing technology so customers can customize glasses based on their features. The experience starts with an app that scans the customer’s using augmented reality. Consumers can then customize the glasses in terms of style, color, and lens type – which are then custom made. King Children ships glasses in less than two weeks.

King Children is a startup that uses 3D-printing technology so customers can customize glasses based on their features. The experience starts with an app that scans the customer’s using augmented reality. Consumers can then customize the glasses in terms of style, color, and lens type – which are then custom made. King Children ships glasses in less than two weeks.

Lithuania-based startup

Dear Deer Eyewear created a system that allows consumers to buy custom-made glasses online. Consumers can design all aspects of the glasses, from the shape of the frames to the color of the lenses. Then, the startup uses 3D printing to create the frames and ships to the customer.

Octobre71 is a French eyewear startup that leverages 3D printing technologies to design and produce customized sunglasses, in partnership with 3D printing service Sculpteo. Made from a polyamide material, the 3D printed glasses are also reportedly 30% lighter than standard acetate or plastic frames and can be customized to the client’s preferences.

Smart Eyewear

Smart eyewear is much more than just Google Glass or Spectacles by Snapchat. Smart eyewear is a wearable computing device that adds information alongside or to what the wearer sees, with aim of blending human vision with the virtual world. Increasing consumer awareness of health and fitness, along with technology and computing becoming more integrated into in daily life than ever before, are supporting growth in the smart eyewear market. We’re seeing tech companies and lens manufacturers developing advanced versions of glasses and lenses using AR technology.

Octobre71 is a French eyewear startup that leverages 3D printing technologies to design and produce customized sunglasses, in partnership with 3D printing service Sculpteo. Made from a polyamide material, the 3D printed glasses are also reportedly 30% lighter than standard acetate or plastic frames and can be customized to the client’s preferences.

Smart Eyewear

Smart eyewear is much more than just Google Glass or Spectacles by Snapchat. Smart eyewear is a wearable computing device that adds information alongside or to what the wearer sees, with aim of blending human vision with the virtual world. Increasing consumer awareness of health and fitness, along with technology and computing becoming more integrated into in daily life than ever before, are supporting growth in the smart eyewear market. We’re seeing tech companies and lens manufacturers developing advanced versions of glasses and lenses using AR technology.

LetinAR is a Korean startup that develops optical solutions for augmented reality (AR) glasses, which work similarly to as a smartphone display. The optical system consists of LetinAR’s self-developed “Pin Mirror (“PinMR”) lens” and a microdisplay made by external partners. With LetinAR PinMR lens, smart glasses manufacturers can build smart glasses worn like a pair of conventional glasses, but which also display virtual images on the microdisplay.

Key Insights

At a global level, the eyewear market is growing slowly and is dominated by a few large players. While these established companies continue to expand through mergers and acquisitions and product innovations, startups are emerging that threaten to disrupt the established order by tapping into emerging trends, including affordable quality using DTC channels, more eco-friendly products, 3D-enabled customizable eyewear and smart eyewear. With changing consumer trends technology improvements, we expect more startups to emerge to solve consumer pain points, which should prompt established players to innovate further.

LetinAR is a Korean startup that develops optical solutions for augmented reality (AR) glasses, which work similarly to as a smartphone display. The optical system consists of LetinAR’s self-developed “Pin Mirror (“PinMR”) lens” and a microdisplay made by external partners. With LetinAR PinMR lens, smart glasses manufacturers can build smart glasses worn like a pair of conventional glasses, but which also display virtual images on the microdisplay.

Key Insights

At a global level, the eyewear market is growing slowly and is dominated by a few large players. While these established companies continue to expand through mergers and acquisitions and product innovations, startups are emerging that threaten to disrupt the established order by tapping into emerging trends, including affordable quality using DTC channels, more eco-friendly products, 3D-enabled customizable eyewear and smart eyewear. With changing consumer trends technology improvements, we expect more startups to emerge to solve consumer pain points, which should prompt established players to innovate further.

Source: Statista[/caption]

Competitive Landscape

The eyewear market is dominated by a few key players, including EssilorLuxottica, GrandVision, Johnson & Johnson and Alcon. Most have relied on product innovation and development, partnerships and joint ventures to remain competitive in the slow-growing space.

Source: Statista[/caption]

Competitive Landscape

The eyewear market is dominated by a few key players, including EssilorLuxottica, GrandVision, Johnson & Johnson and Alcon. Most have relied on product innovation and development, partnerships and joint ventures to remain competitive in the slow-growing space.

Ukrainian start-up Ochis has developed an eyewear range called Ochis Coffee, which it says is the first eco-friendly range of sunglasses made from coffee. The frames have a faint aroma of freshly roasted coffee and has a soft texture.

Ukrainian start-up Ochis has developed an eyewear range called Ochis Coffee, which it says is the first eco-friendly range of sunglasses made from coffee. The frames have a faint aroma of freshly roasted coffee and has a soft texture.

Dresden Vision makes frames it believes are sturdier (and less easy to break) more sustainably made. Innovations so far include frames made from old beer keg caps sourced from local Sydney brewing companies, marine debris, “ghost” fishing nets found on coastlines and milk bottle tops from cafés. Its business model prioritizes accessibility, affordability and sustainability. The company also seeks to make its products with interchangeable and easily-replaceable pieces.

Startups Offering 3D Customizable Eyewear

3D printing has not only affected the apparel and manufacturing industries, but is also now making its presence known in the eyewear industry. As in other industries, 3D printing can cut production time significantly, and make it easier to offer a wider variety of eyewear products. As consumers increasingly demand product customization and personalization, 3D printing is facilitating this change.

Dresden Vision makes frames it believes are sturdier (and less easy to break) more sustainably made. Innovations so far include frames made from old beer keg caps sourced from local Sydney brewing companies, marine debris, “ghost” fishing nets found on coastlines and milk bottle tops from cafés. Its business model prioritizes accessibility, affordability and sustainability. The company also seeks to make its products with interchangeable and easily-replaceable pieces.

Startups Offering 3D Customizable Eyewear

3D printing has not only affected the apparel and manufacturing industries, but is also now making its presence known in the eyewear industry. As in other industries, 3D printing can cut production time significantly, and make it easier to offer a wider variety of eyewear products. As consumers increasingly demand product customization and personalization, 3D printing is facilitating this change.

King Children is a startup that uses 3D-printing technology so customers can customize glasses based on their features. The experience starts with an app that scans the customer’s using augmented reality. Consumers can then customize the glasses in terms of style, color, and lens type – which are then custom made. King Children ships glasses in less than two weeks.

King Children is a startup that uses 3D-printing technology so customers can customize glasses based on their features. The experience starts with an app that scans the customer’s using augmented reality. Consumers can then customize the glasses in terms of style, color, and lens type – which are then custom made. King Children ships glasses in less than two weeks.

Lithuania-based startup Dear Deer Eyewear created a system that allows consumers to buy custom-made glasses online. Consumers can design all aspects of the glasses, from the shape of the frames to the color of the lenses. Then, the startup uses 3D printing to create the frames and ships to the customer.

Lithuania-based startup Dear Deer Eyewear created a system that allows consumers to buy custom-made glasses online. Consumers can design all aspects of the glasses, from the shape of the frames to the color of the lenses. Then, the startup uses 3D printing to create the frames and ships to the customer.

Octobre71 is a French eyewear startup that leverages 3D printing technologies to design and produce customized sunglasses, in partnership with 3D printing service Sculpteo. Made from a polyamide material, the 3D printed glasses are also reportedly 30% lighter than standard acetate or plastic frames and can be customized to the client’s preferences.

Smart Eyewear

Smart eyewear is much more than just Google Glass or Spectacles by Snapchat. Smart eyewear is a wearable computing device that adds information alongside or to what the wearer sees, with aim of blending human vision with the virtual world. Increasing consumer awareness of health and fitness, along with technology and computing becoming more integrated into in daily life than ever before, are supporting growth in the smart eyewear market. We’re seeing tech companies and lens manufacturers developing advanced versions of glasses and lenses using AR technology.

Octobre71 is a French eyewear startup that leverages 3D printing technologies to design and produce customized sunglasses, in partnership with 3D printing service Sculpteo. Made from a polyamide material, the 3D printed glasses are also reportedly 30% lighter than standard acetate or plastic frames and can be customized to the client’s preferences.

Smart Eyewear

Smart eyewear is much more than just Google Glass or Spectacles by Snapchat. Smart eyewear is a wearable computing device that adds information alongside or to what the wearer sees, with aim of blending human vision with the virtual world. Increasing consumer awareness of health and fitness, along with technology and computing becoming more integrated into in daily life than ever before, are supporting growth in the smart eyewear market. We’re seeing tech companies and lens manufacturers developing advanced versions of glasses and lenses using AR technology.

LetinAR is a Korean startup that develops optical solutions for augmented reality (AR) glasses, which work similarly to as a smartphone display. The optical system consists of LetinAR’s self-developed “Pin Mirror (“PinMR”) lens” and a microdisplay made by external partners. With LetinAR PinMR lens, smart glasses manufacturers can build smart glasses worn like a pair of conventional glasses, but which also display virtual images on the microdisplay.

Key Insights

At a global level, the eyewear market is growing slowly and is dominated by a few large players. While these established companies continue to expand through mergers and acquisitions and product innovations, startups are emerging that threaten to disrupt the established order by tapping into emerging trends, including affordable quality using DTC channels, more eco-friendly products, 3D-enabled customizable eyewear and smart eyewear. With changing consumer trends technology improvements, we expect more startups to emerge to solve consumer pain points, which should prompt established players to innovate further.

LetinAR is a Korean startup that develops optical solutions for augmented reality (AR) glasses, which work similarly to as a smartphone display. The optical system consists of LetinAR’s self-developed “Pin Mirror (“PinMR”) lens” and a microdisplay made by external partners. With LetinAR PinMR lens, smart glasses manufacturers can build smart glasses worn like a pair of conventional glasses, but which also display virtual images on the microdisplay.

Key Insights

At a global level, the eyewear market is growing slowly and is dominated by a few large players. While these established companies continue to expand through mergers and acquisitions and product innovations, startups are emerging that threaten to disrupt the established order by tapping into emerging trends, including affordable quality using DTC channels, more eco-friendly products, 3D-enabled customizable eyewear and smart eyewear. With changing consumer trends technology improvements, we expect more startups to emerge to solve consumer pain points, which should prompt established players to innovate further.