Nitheesh NH

GLOBAL BEAUTY E-COMMERCE

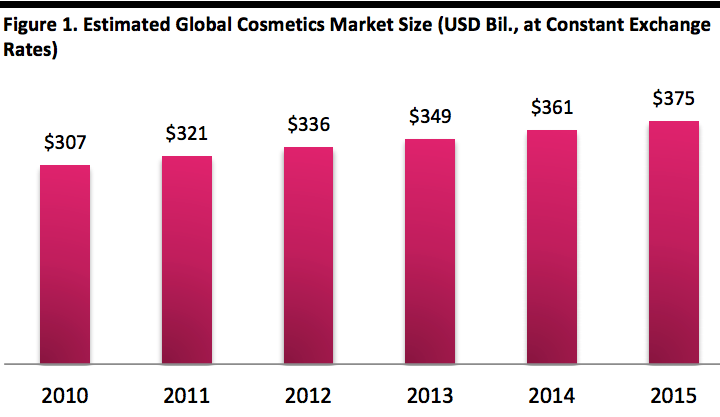

Market size at retail selling prices. Consists of skincare, haircare, makeup, fragrances and hygiene products. Excludes soaps, oral hygiene, razors and blades.

Market size at retail selling prices. Consists of skincare, haircare, makeup, fragrances and hygiene products. Excludes soaps, oral hygiene, razors and blades.

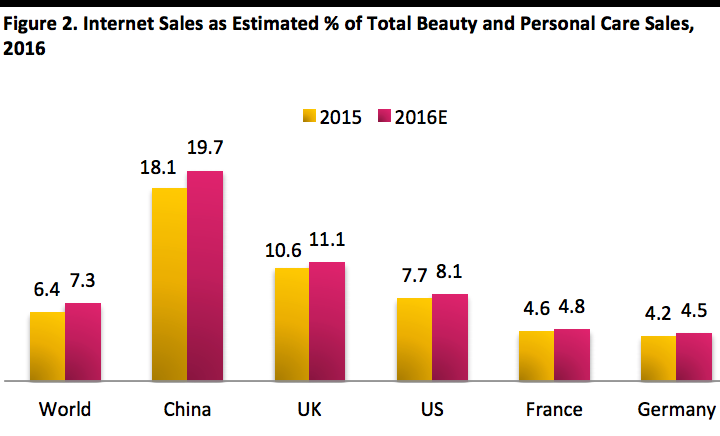

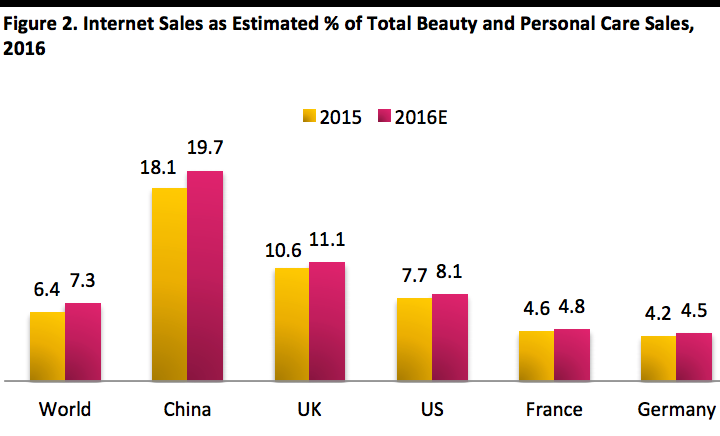

Source: L’Oréal/Fung Global Retail & Technology[/caption] Worldwide, some $24.3 billion (excluding sales tax) was spent on beauty and personal care products online in 2015, according to Euromonitor International, up 14.4% year over year, stripping out currency effects. Euromonitor says Internet sales made up 6.4% of global beauty and personal care product sales last year. We estimate this share will rise to around 7.3% this year. Back in 2010, the global online share was just 3.3%. Of the major economies we examined, China is by far the leader in terms of e-commerce share. In 2015, some 18.1% of all beauty and personal care product sales in China were made online, according to Euromonitor. We estimate this share will rise to 19.7% this year. Among major Western economies, the UK leads in terms of e-commerce’s share of beauty sales. [caption id="attachment_86676" align="aligncenter" width="720"] Definition of beauty and personal care may differ from that used for L’Oréal’s market

Definition of beauty and personal care may differ from that used for L’Oréal’s market

size for cosmetics.

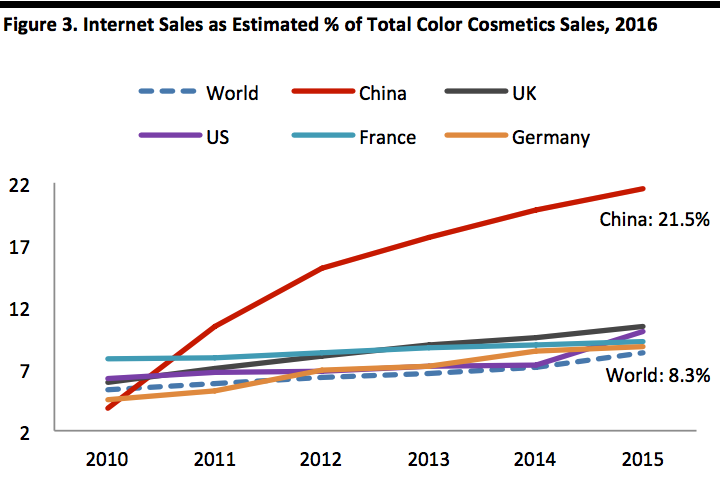

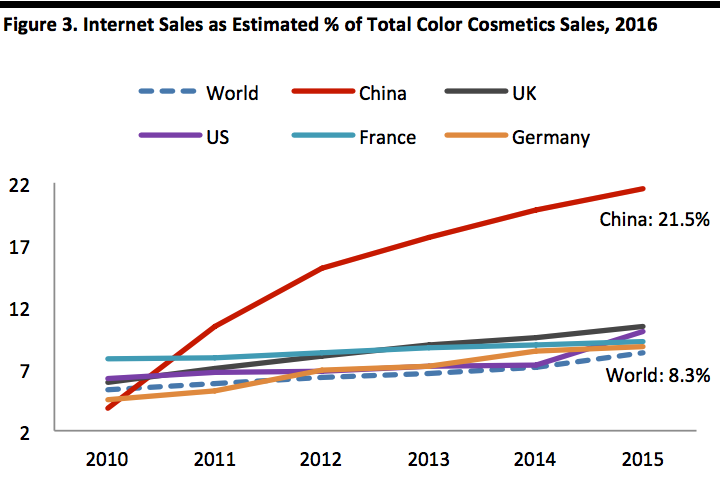

Source: Euromonitor International/Fung Global Retail & Technology[/caption] As a benchmark to this figure, beauty giant L’Oréal estimated that 6% of its worldwide product sales in the first half of fiscal 2017 were transacted online (the figure includes sales made through third-party retail websites). In the graph below, we focus on the core beauty category of color cosmetics. The graph shows the extent to which China is an outlier. In China, e-commerce’s share of total color cosmetics sales increased by 1,770 basis points in the five years through 2015, compared with the global average increase of 300 basis points. However, the year-over-year increase in share in China has been slowing dramatically. An extrapolation of this trend suggests that e-commerce’s share of China’s total color cosmetics sales could plateau at around 24% in the next few years. [caption id="attachment_86678" align="aligncenter" width="720"] Source: Euromonitor International[/caption]

The color cosmetics category overindexes slightly online, relative to all beauty and personal care products, with 8.3% of category sales made through e-commerce in 2015. By contrast, male grooming underindexes online, with e-commerce accounting for just 4.8% of global sales in 2015, according to Euromonitor.

These distinctions underline the diversity and variance within the beauty and personal care market when it comes to e-commerce: as we explore in more detail below, there is no single online beauty market.

Source: Euromonitor International[/caption]

The color cosmetics category overindexes slightly online, relative to all beauty and personal care products, with 8.3% of category sales made through e-commerce in 2015. By contrast, male grooming underindexes online, with e-commerce accounting for just 4.8% of global sales in 2015, according to Euromonitor.

These distinctions underline the diversity and variance within the beauty and personal care market when it comes to e-commerce: as we explore in more detail below, there is no single online beauty market.

Source: Amazon[/caption]

Source: Amazon[/caption]

Source: Shutterstock[/caption]

[caption id="attachment_86683" align="aligncenter" width="720"]

Source: Shutterstock[/caption]

[caption id="attachment_86683" align="aligncenter" width="720"] Source: Bain & Company/Fung Global Retail & Technology[/caption]

The data above are for all luxury goods, and we expect the online luxury beauty segment to outperform similarly. Moreover, we expect e- commerce’s share of total sales to be substantially higher in beauty than in the overall luxury market for a number of reasons:

Source: Bain & Company/Fung Global Retail & Technology[/caption]

The data above are for all luxury goods, and we expect the online luxury beauty segment to outperform similarly. Moreover, we expect e- commerce’s share of total sales to be substantially higher in beauty than in the overall luxury market for a number of reasons:

Source: Euromonitor International[/caption]

In the US, online grocery is now growing fast from a very small base. In 2015, Mintel found that 31% of US grocery shoppers had bought groceries online in the past year, up from 19% in 2014—representing a 63% increase in participation.

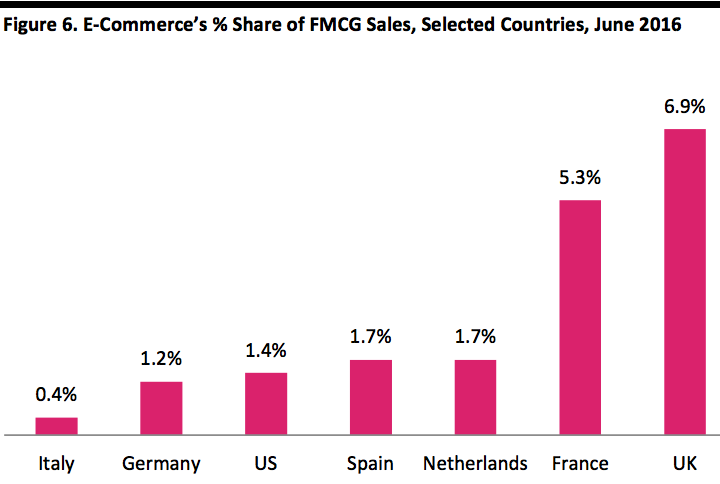

In the US, just 1.4% of all sales of fast-moving consumer goods (FMCGs), such as mass-market beauty products, were made online in June 2016, according to market-measurement service Kantar Worldpanel. This is largely because American grocery retailers have been slow to move online. In the UK and France, where online is a well-established channel for grocery retailing, the share of FMCG sales doing through e-commerce is much higher.

Major US grocery retailers such as Walmart and Kroger are now pushing online. We expect grocery e-commerce to boom in the US market, and this will incorporate the mass-market beauty brands often bought at grocery stores.

[caption id="attachment_86694" align="aligncenter" width="720"]

Source: Euromonitor International[/caption]

In the US, online grocery is now growing fast from a very small base. In 2015, Mintel found that 31% of US grocery shoppers had bought groceries online in the past year, up from 19% in 2014—representing a 63% increase in participation.

In the US, just 1.4% of all sales of fast-moving consumer goods (FMCGs), such as mass-market beauty products, were made online in June 2016, according to market-measurement service Kantar Worldpanel. This is largely because American grocery retailers have been slow to move online. In the UK and France, where online is a well-established channel for grocery retailing, the share of FMCG sales doing through e-commerce is much higher.

Major US grocery retailers such as Walmart and Kroger are now pushing online. We expect grocery e-commerce to boom in the US market, and this will incorporate the mass-market beauty brands often bought at grocery stores.

[caption id="attachment_86694" align="aligncenter" width="720"] Source: Shutterstock[/caption]

[caption id="attachment_86696" align="aligncenter" width="720"]

Source: Shutterstock[/caption]

[caption id="attachment_86696" align="aligncenter" width="720"] Source: Kantar Worldpanel/IRI[/caption]

We expect beauty products to be overrepresented in online grocery shopping baskets. Within grocery, fresh foods tend to underindex online while packaged, branded products tend to overindex online: since there is little need for shoppers to see, feel or test packaged products from known brands, they are more likely to feel comfortable buying those products online.

E-commerce is the fastest-growing grocery channel in major markets such as the US and the UK. For beauty brands, this indirect migration online means they will need to consider how they are going to continue putting their products in front of shoppers. And these brands will find pure plays such as AmazonFresh, Ocado (in the UK) and Chronodrive (in France) a source of growth.

Source: Kantar Worldpanel/IRI[/caption]

We expect beauty products to be overrepresented in online grocery shopping baskets. Within grocery, fresh foods tend to underindex online while packaged, branded products tend to overindex online: since there is little need for shoppers to see, feel or test packaged products from known brands, they are more likely to feel comfortable buying those products online.

E-commerce is the fastest-growing grocery channel in major markets such as the US and the UK. For beauty brands, this indirect migration online means they will need to consider how they are going to continue putting their products in front of shoppers. And these brands will find pure plays such as AmazonFresh, Ocado (in the UK) and Chronodrive (in France) a source of growth.

Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

Source: Monetate[/caption]

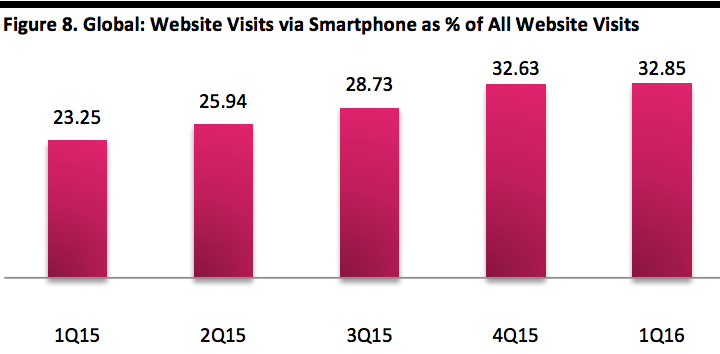

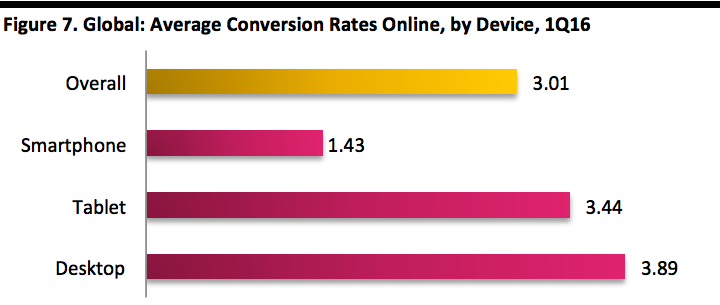

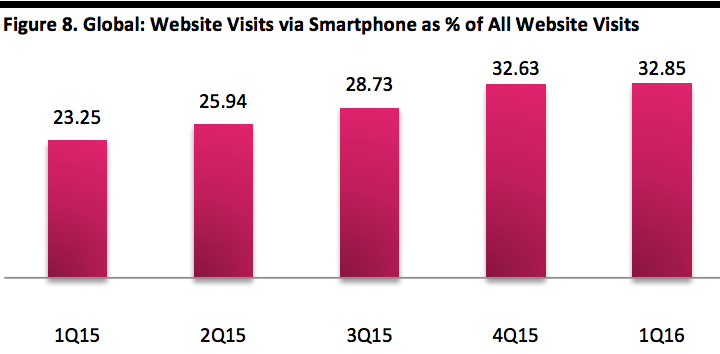

As smartphones garner an ever-greater share of website visits, average online conversion rates are likely to fall even lower. So, for consumers, the online channel will become even more about getting information and researching products or purchases rather than buying.

[caption id="attachment_86699" align="aligncenter" width="720"]

Source: Monetate[/caption]

As smartphones garner an ever-greater share of website visits, average online conversion rates are likely to fall even lower. So, for consumers, the online channel will become even more about getting information and researching products or purchases rather than buying.

[caption id="attachment_86699" align="aligncenter" width="720"] Source: Monetate[/caption]

Source: Monetate[/caption]

Source: Shutterstock[/caption]

It is rapidly becoming commonplace for major brands (such as L’Oréal and Rimmel London) and retailers (such as Sephora and Feelunique) to offer function-filled apps. These serve a dual purpose of affirming the brand or retailer as a beauty expert while boosting shoppers’ confidence that they are choosing the right products—which can be especially important when purchasing online.

Source: Shutterstock[/caption]

It is rapidly becoming commonplace for major brands (such as L’Oréal and Rimmel London) and retailers (such as Sephora and Feelunique) to offer function-filled apps. These serve a dual purpose of affirming the brand or retailer as a beauty expert while boosting shoppers’ confidence that they are choosing the right products—which can be especially important when purchasing online.

Source: YouTube[/caption]

Research shows that YouTube is a significant source of information for many shoppers. Google, YouTube’s parent company, found in a 2012 study that 50% of all beauty shoppers watch beauty videos on YouTube while they are shopping for products.

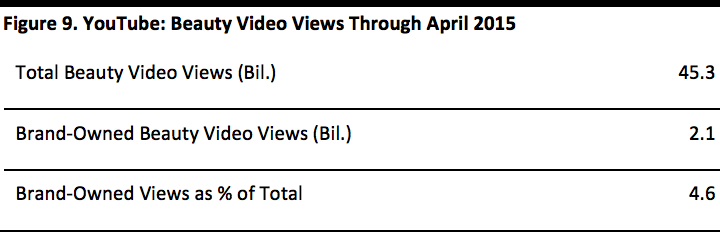

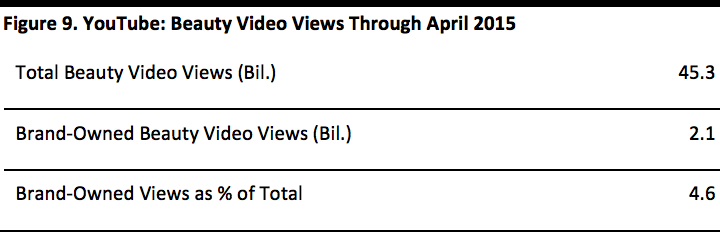

Meanwhile, research firm Pixability found the following in its April 2015 study of beauty on YouTube:

Source: YouTube[/caption]

Research shows that YouTube is a significant source of information for many shoppers. Google, YouTube’s parent company, found in a 2012 study that 50% of all beauty shoppers watch beauty videos on YouTube while they are shopping for products.

Meanwhile, research firm Pixability found the following in its April 2015 study of beauty on YouTube:

Source: Pixability/Fung Global Retail & Technology[/caption]

Consumers’ apparent indifference to branded content has not stopped major beauty firms from venturing into video and other forms of social media content. For instance, in 2016, L’Oréal launched an “authentic,” unbranded, content-sharing site called Fab Beauty, and partnered with YouTube to provide an online vlogging school.

[caption id="attachment_86705" align="aligncenter" width="720"]

Source: Pixability/Fung Global Retail & Technology[/caption]

Consumers’ apparent indifference to branded content has not stopped major beauty firms from venturing into video and other forms of social media content. For instance, in 2016, L’Oréal launched an “authentic,” unbranded, content-sharing site called Fab Beauty, and partnered with YouTube to provide an online vlogging school.

[caption id="attachment_86705" align="aligncenter" width="720"] Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

EXECUTIVE SUMMARY

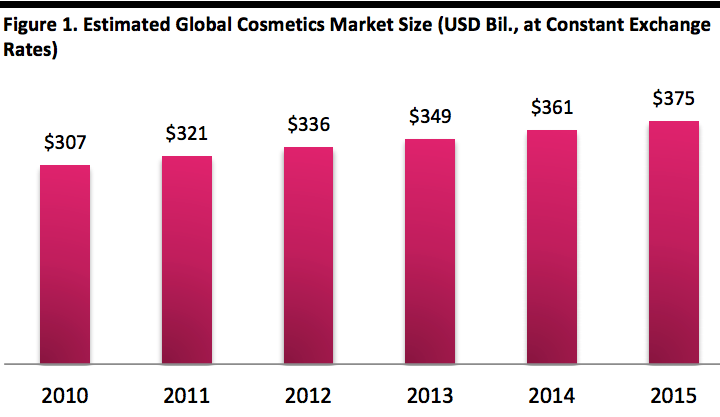

The global cosmetics market increased in value by 3.9% to $275 billion in 2015. Online, some $24.3 billion was spent on beauty and personal care products worldwide in 2015, up 14.4% year over year, according to Euromonitor International. China is ahead of Western countries in terms of e-commerce share. In 2015, some 18.1% of all beauty and personal care product sales in China were made online, according to Euromonitor. For comparison, the share of beauty and personal care products sold online was 10.6% in the UK, 7.7% in the US and 6.4% worldwide in 2015. China’s e-commerce maturity is shown also in the core beauty category of color cosmetics, where fully 21.5% of Chinese sales were online in 2015, versus a global average of 8.3%. The online beauty market is as complex and diverse as its counterpart in physical stores. Illustrating this, we note three discrete pockets of opportunity serving different customers and different needs:- Subscription models, such as Birchbox, Dollar Shave Club and Amazon Subscribe & Save. These services cater both to beauty enthusiasts who want to be surprised and to those undertaking routine replenishment shopping. In 2015, Birchbox had 1 million subscribers while Dollar Shave Club had 3.2 million

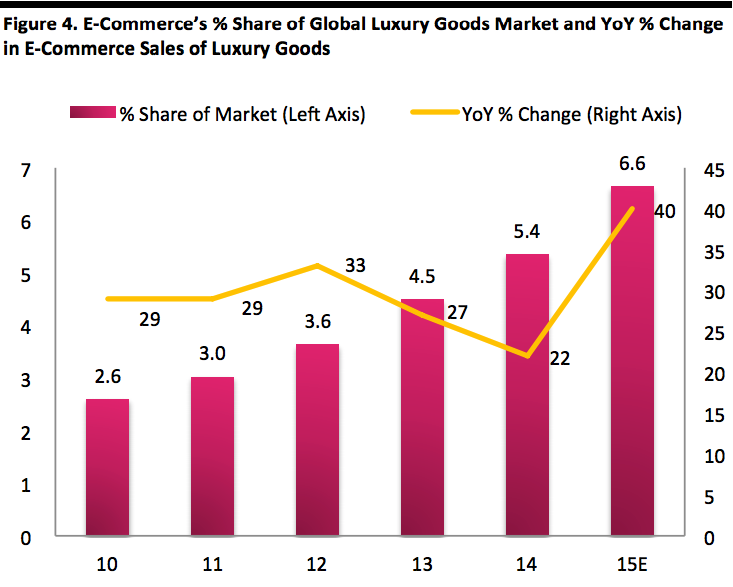

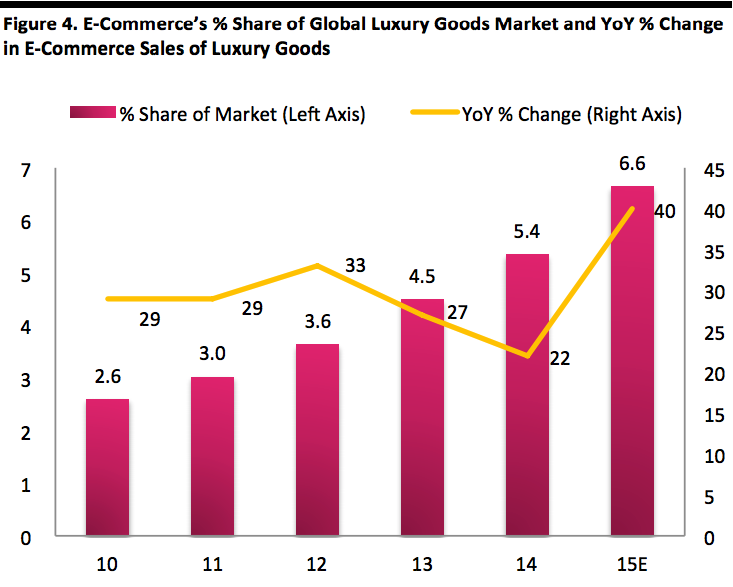

- Luxury beauty e-commerce. The online channel is a bright spot in a sluggish luxury market. At current prices and current exchange rates, the total luxury market grew by 13% in 2015, while online luxury sales surged by 40%.

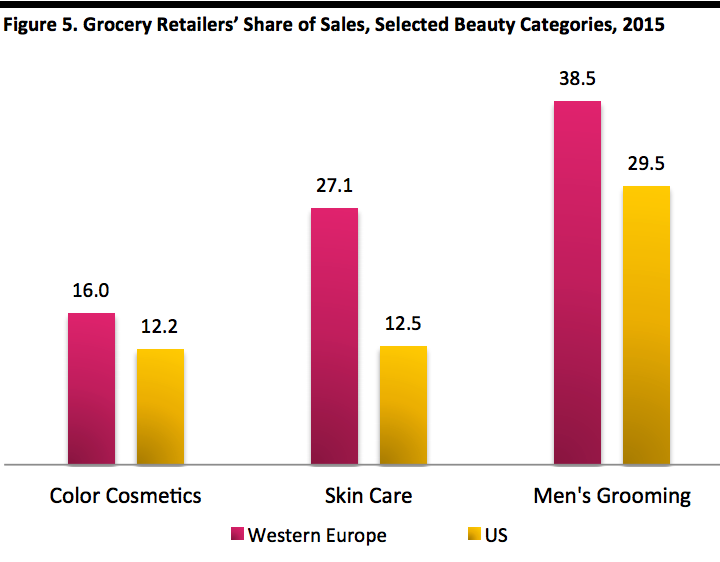

- Grocery (or mass-market, nonspecialist) retail. In many markets, e- commerce is the fastest-growing channel for grocery, and we expect a boom in grocery e-commerce in the US as major chains such as Walmart push into the channel. This is relevant for beauty, as grocery retailers are a major channel for mass-market beauty products: the sector’s share of sales can reach almost 40%, depending on the product and the

- Science-based information, such as color matching, delivered through mobile

- subjective views (“human” information), communicated through social media and especially

INTRODUCTION

The global beauty e-commerce market is substantial, diverse and growing rapidly. In 2015, consumers spent some $24 billion online on beauty and personal care products. In this report, we consider the following:- The scale and growth of the online beauty and personal care market.

- The diversity of the online beauty market; we take a closer look at the subscription, luxury and grocery

- The disproportionately prominent role the online channel plays in shopper research and how online beauty is about much more than e-commerce.

CHINA LEADS THE PACK IN ONLINE BEAUTY SALES

To start, we briefly offer some context on the scale of the global beauty market. Despite being a huge, mature category, beauty is still showing strong growth. According to L’Oréal, the global cosmetics market increased in value by 3.9% in 2015, at constant exchange rates. Based on L’Oréal’s estimated value of the global market at wholesale prices, we estimate that retail category sales reached $375 billion in 2015. [caption id="attachment_86675" align="aligncenter" width="720"] Market size at retail selling prices. Consists of skincare, haircare, makeup, fragrances and hygiene products. Excludes soaps, oral hygiene, razors and blades.

Market size at retail selling prices. Consists of skincare, haircare, makeup, fragrances and hygiene products. Excludes soaps, oral hygiene, razors and blades.Source: L’Oréal/Fung Global Retail & Technology[/caption] Worldwide, some $24.3 billion (excluding sales tax) was spent on beauty and personal care products online in 2015, according to Euromonitor International, up 14.4% year over year, stripping out currency effects. Euromonitor says Internet sales made up 6.4% of global beauty and personal care product sales last year. We estimate this share will rise to around 7.3% this year. Back in 2010, the global online share was just 3.3%. Of the major economies we examined, China is by far the leader in terms of e-commerce share. In 2015, some 18.1% of all beauty and personal care product sales in China were made online, according to Euromonitor. We estimate this share will rise to 19.7% this year. Among major Western economies, the UK leads in terms of e-commerce’s share of beauty sales. [caption id="attachment_86676" align="aligncenter" width="720"]

Definition of beauty and personal care may differ from that used for L’Oréal’s market

Definition of beauty and personal care may differ from that used for L’Oréal’s marketsize for cosmetics.

Source: Euromonitor International/Fung Global Retail & Technology[/caption] As a benchmark to this figure, beauty giant L’Oréal estimated that 6% of its worldwide product sales in the first half of fiscal 2017 were transacted online (the figure includes sales made through third-party retail websites). In the graph below, we focus on the core beauty category of color cosmetics. The graph shows the extent to which China is an outlier. In China, e-commerce’s share of total color cosmetics sales increased by 1,770 basis points in the five years through 2015, compared with the global average increase of 300 basis points. However, the year-over-year increase in share in China has been slowing dramatically. An extrapolation of this trend suggests that e-commerce’s share of China’s total color cosmetics sales could plateau at around 24% in the next few years. [caption id="attachment_86678" align="aligncenter" width="720"]

Source: Euromonitor International[/caption]

The color cosmetics category overindexes slightly online, relative to all beauty and personal care products, with 8.3% of category sales made through e-commerce in 2015. By contrast, male grooming underindexes online, with e-commerce accounting for just 4.8% of global sales in 2015, according to Euromonitor.

These distinctions underline the diversity and variance within the beauty and personal care market when it comes to e-commerce: as we explore in more detail below, there is no single online beauty market.

Source: Euromonitor International[/caption]

The color cosmetics category overindexes slightly online, relative to all beauty and personal care products, with 8.3% of category sales made through e-commerce in 2015. By contrast, male grooming underindexes online, with e-commerce accounting for just 4.8% of global sales in 2015, according to Euromonitor.

These distinctions underline the diversity and variance within the beauty and personal care market when it comes to e-commerce: as we explore in more detail below, there is no single online beauty market.

PROFILING THREE SEGMENT OPPORTUNITIES

As with any e-commerce category, it can be easy to slip into viewing “online beauty” as a single market. In reality, of course, the online beauty market is as complex and diverse as its counterpart in physical stores. To illustrate that there is no single online beauty market, we profile three discrete segments in the following sections: subscription models, luxury and grocery (or mass-market, nonspecialist retail).The Subscription Segment

Subscription services have established themselves online, offering consumers regular deliveries of products, and allowing companies the consistency of recurring revenue. In beauty, subscription models service two polarized demands:- Making buying routine categories more convenient. For instance, Dollar Shave Club saves men the hassle of having to remember to buy razor blades, and it does so at a low price

- Allowing beauty enthusiasts to be surprised or to try new products. For instance, Birchbox offers curation and experimentation with monthly deliveries of beauty

Source: Amazon[/caption]

Source: Amazon[/caption]

The Luxury Segment

E-commerce is a bright spot in a tough luxury market. In 2015, the global luxury market grew by just 1% once currency effects were stripped out, according to Bain & Company’s estimates, and the slowdown continued into 2016. But e-commerce has remained a high-growth channel: while at current prices and current exchange rates, the total luxury market grew by 13% in 2015, online luxury sales surged by 40%. This took the Internet’s share of global luxury sales to a little under 7%. Bain has noted that e- commerce has continued to rapidly gain ground in 2016. [caption id="attachment_86681" align="aligncenter" width="720"] Source: Shutterstock[/caption]

[caption id="attachment_86683" align="aligncenter" width="720"]

Source: Shutterstock[/caption]

[caption id="attachment_86683" align="aligncenter" width="720"] Source: Bain & Company/Fung Global Retail & Technology[/caption]

The data above are for all luxury goods, and we expect the online luxury beauty segment to outperform similarly. Moreover, we expect e- commerce’s share of total sales to be substantially higher in beauty than in the overall luxury market for a number of reasons:

Source: Bain & Company/Fung Global Retail & Technology[/caption]

The data above are for all luxury goods, and we expect the online luxury beauty segment to outperform similarly. Moreover, we expect e- commerce’s share of total sales to be substantially higher in beauty than in the overall luxury market for a number of reasons:

- Beauty tends to be a repeat purchase, and there is little need for the consumer to see or try the product once she or he has already bought it

- Beauty is at the lower end of the luxury price spectrum, which means that consumers are likely more willing to buy it online and that it will draw in more mass-market shoppers who will purchase online.

- With beauty purchases, there is no need for adjustments or fittings as there may be for categories such as apparel and jewelry.

The Grocery Segment

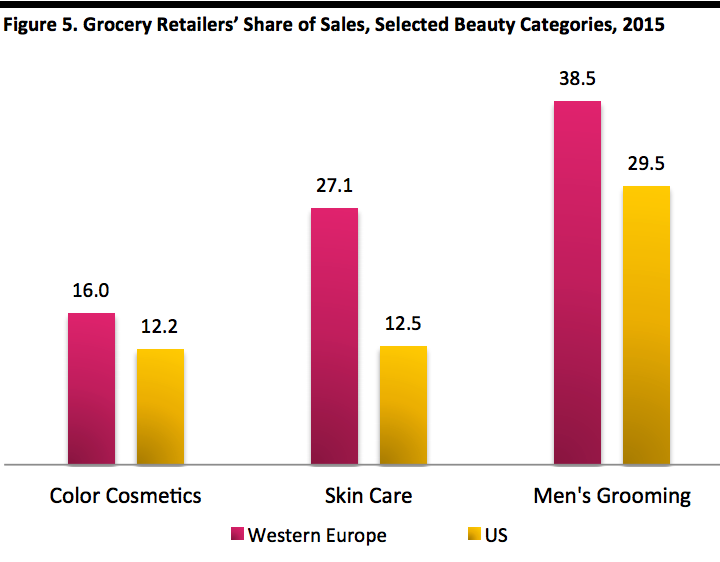

In markets such as the UK and the US, e-commerce is the fastest-growing channel for grocery. This is relevant for beauty, as grocery retailers are a major channel for mass-market beauty products: the sector’s share of sales can reach almost 40%, depending on the product and the region. So, when grocery sales start migrating online, so, too, does a significant chunk of beauty sales. [caption id="attachment_86693" align="aligncenter" width="720"] Source: Euromonitor International[/caption]

In the US, online grocery is now growing fast from a very small base. In 2015, Mintel found that 31% of US grocery shoppers had bought groceries online in the past year, up from 19% in 2014—representing a 63% increase in participation.

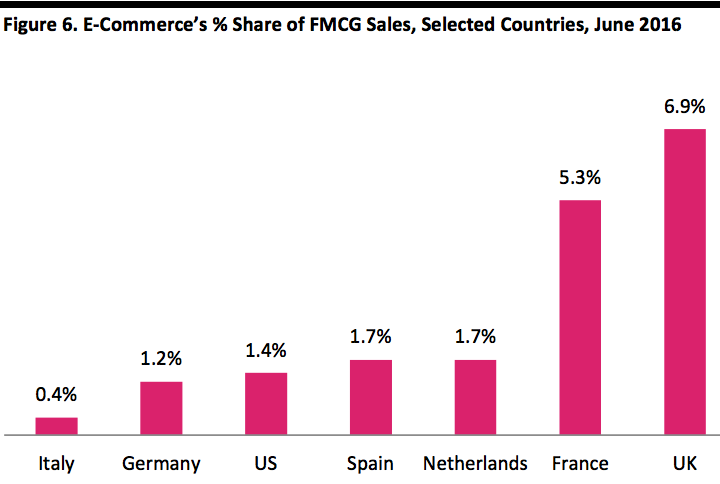

In the US, just 1.4% of all sales of fast-moving consumer goods (FMCGs), such as mass-market beauty products, were made online in June 2016, according to market-measurement service Kantar Worldpanel. This is largely because American grocery retailers have been slow to move online. In the UK and France, where online is a well-established channel for grocery retailing, the share of FMCG sales doing through e-commerce is much higher.

Major US grocery retailers such as Walmart and Kroger are now pushing online. We expect grocery e-commerce to boom in the US market, and this will incorporate the mass-market beauty brands often bought at grocery stores.

[caption id="attachment_86694" align="aligncenter" width="720"]

Source: Euromonitor International[/caption]

In the US, online grocery is now growing fast from a very small base. In 2015, Mintel found that 31% of US grocery shoppers had bought groceries online in the past year, up from 19% in 2014—representing a 63% increase in participation.

In the US, just 1.4% of all sales of fast-moving consumer goods (FMCGs), such as mass-market beauty products, were made online in June 2016, according to market-measurement service Kantar Worldpanel. This is largely because American grocery retailers have been slow to move online. In the UK and France, where online is a well-established channel for grocery retailing, the share of FMCG sales doing through e-commerce is much higher.

Major US grocery retailers such as Walmart and Kroger are now pushing online. We expect grocery e-commerce to boom in the US market, and this will incorporate the mass-market beauty brands often bought at grocery stores.

[caption id="attachment_86694" align="aligncenter" width="720"] Source: Shutterstock[/caption]

[caption id="attachment_86696" align="aligncenter" width="720"]

Source: Shutterstock[/caption]

[caption id="attachment_86696" align="aligncenter" width="720"] Source: Kantar Worldpanel/IRI[/caption]

We expect beauty products to be overrepresented in online grocery shopping baskets. Within grocery, fresh foods tend to underindex online while packaged, branded products tend to overindex online: since there is little need for shoppers to see, feel or test packaged products from known brands, they are more likely to feel comfortable buying those products online.

E-commerce is the fastest-growing grocery channel in major markets such as the US and the UK. For beauty brands, this indirect migration online means they will need to consider how they are going to continue putting their products in front of shoppers. And these brands will find pure plays such as AmazonFresh, Ocado (in the UK) and Chronodrive (in France) a source of growth.

Source: Kantar Worldpanel/IRI[/caption]

We expect beauty products to be overrepresented in online grocery shopping baskets. Within grocery, fresh foods tend to underindex online while packaged, branded products tend to overindex online: since there is little need for shoppers to see, feel or test packaged products from known brands, they are more likely to feel comfortable buying those products online.

E-commerce is the fastest-growing grocery channel in major markets such as the US and the UK. For beauty brands, this indirect migration online means they will need to consider how they are going to continue putting their products in front of shoppers. And these brands will find pure plays such as AmazonFresh, Ocado (in the UK) and Chronodrive (in France) a source of growth.

WHO ARE THE WORLD’S BIGGEST ONLINE BEAUTY RETAILERS?

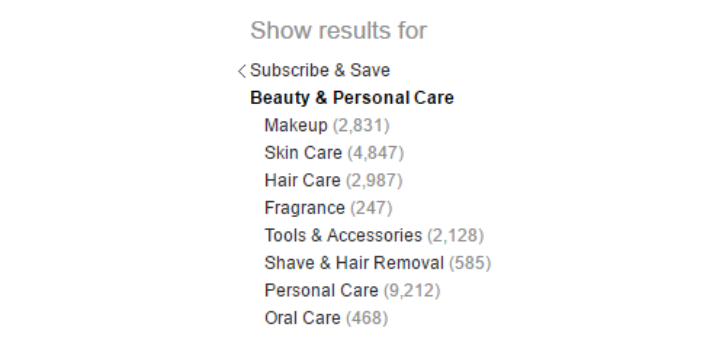

Pinning down the biggest online beauty retailers is problematic, given the fragmented global landscape and limited disclosure among both specialist stores that sell online and major pure plays that sell a range of goods beyond beauty products. In 2015, the world’s biggest store-based beauty specialist retailers were, in descending order, Sephora, Ulta and Bath & Body Works, according to Euromonitor. In the US, the top three were the same companies in a different order: Ulta, Sephora and Bath & Body Works. In 2015, the world’s three biggest online retailers or marketplaces were Amazon, Alibaba Group and eBay, according to Euromonitor. We estimate that Amazon’s global gross merchandise volume (or GMV, the value of all goods sold) was approximately $168 billion in the year ended December 2015. Alibaba Group’s retail GMV was $485 billion in the year ended March 2016. On eBay’s marketplaces, GMV was $78.1 billion in the year ended December 2015. None of these companies provides a detailed product split, but we can make nominal, ballpark estimates. If beauty contributed an estimated 1% of GMV at each of these sites, then category sales would be:- $4.85 billion at Alibaba Group in the year ended March

- $1.7 billion at Amazon in the year ended December

- $781 million at eBay in the year ended December

Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

E-C OMMERCE IS A SMALL PART OF THE DIGITAL EXPERIENCE

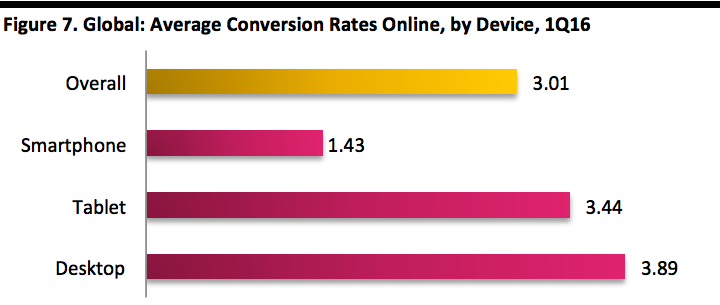

While the e-commerce channel is both sizeable and growing quickly, online is about more than just making a purchase: it is disproportionately about research and browsing—with an average of only three in every 100 site visits converting to a purchase. And on smartphones, conversion is much lower than average. We attribute this principally to “downtime browsing” on smartphones: consumers often turn to their phones just to fill the time, with little or no intention of purchasing. [caption id="attachment_86698" align="aligncenter" width="720"] Source: Monetate[/caption]

As smartphones garner an ever-greater share of website visits, average online conversion rates are likely to fall even lower. So, for consumers, the online channel will become even more about getting information and researching products or purchases rather than buying.

[caption id="attachment_86699" align="aligncenter" width="720"]

Source: Monetate[/caption]

As smartphones garner an ever-greater share of website visits, average online conversion rates are likely to fall even lower. So, for consumers, the online channel will become even more about getting information and researching products or purchases rather than buying.

[caption id="attachment_86699" align="aligncenter" width="720"] Source: Monetate[/caption]

Source: Monetate[/caption]

Shoppers Want Information-Rich Online Experiences

We see the search for online beauty information falling into two major camps:- Science-based information, such as color matching, delivered through mobile

- Subjective views (“human” information), communicated through social media.

“Scientific” Information: The Smartphone as a Beauty Tool

The smartphone is now a tool for personalized beauty advice and recommendations. Among the surfeit of beauty apps, two prominent types are those that allow the user to color match and those that allow the user to virtually try on makeup (via augmented reality). Here are some significant apps and app providers:- Launched in 2016, Feelunique’s Makeup Live app uses new color- matching “spectrophotometer” technology to enable users to find the perfect color match. Users can virtually try on makeup products and purchase them through the

- Coty-owned Rimmel London’s 2016 app offers color detection and color matching, as well as augmented-reality features that allow users to virtually try on makeup. It has been billed as “Shazam for beauty.”

- Sephora’s Pocket Contour app uses facial contour analysis to guide users on sculpting with makeup products such as bronzer and highlighter.

- L’Oréal’s Makeup Genius provides a magic mirror–type experience, allowing users to test before buying by virtually applying

- Sephora + Pantone Color IQ scans the user’s skin to assign it a Color IQ number, and offers lip, foundation and concealer

- IMAN Cosmetics determines a user’s “color signature” after taking a headshot in order to suggest the most suitable foundation colors for the

- ShadeScout matches the Pantone shade of colors from photos, then searches thousands of products to find cosmetics in that particular shade.

- Allure SkinBetter applies dermatologist-grade scanning technology to identify skin issues. The tool then suggests specific products based on the user’s skin

- ModiFace, a Toronto-based company with a background in building 2D and 3D facial simulations, offers multiple apps that allow users to virtually try on

- Visada analyzes skin lines and spots from a selfie, then provides personalized makeup

- Plum Perfect determines skin tone, hair type and eye color in order to make individualized product recommendations.

Source: Shutterstock[/caption]

It is rapidly becoming commonplace for major brands (such as L’Oréal and Rimmel London) and retailers (such as Sephora and Feelunique) to offer function-filled apps. These serve a dual purpose of affirming the brand or retailer as a beauty expert while boosting shoppers’ confidence that they are choosing the right products—which can be especially important when purchasing online.

Source: Shutterstock[/caption]

It is rapidly becoming commonplace for major brands (such as L’Oréal and Rimmel London) and retailers (such as Sephora and Feelunique) to offer function-filled apps. These serve a dual purpose of affirming the brand or retailer as a beauty expert while boosting shoppers’ confidence that they are choosing the right products—which can be especially important when purchasing online.

Human Information: Social Media

Social media, and especially video on YouTube, provides a human counterpart to the science-based advice offered by beauty apps. Beauty shoppers regularly share their “hauls” (i.e., purchases) on YouTube, and the site has made stars of many beauty-themed vloggers, including English fashion and beauty vlogger Zoella. [caption id="attachment_86702" align="aligncenter" width="720"] Source: YouTube[/caption]

Research shows that YouTube is a significant source of information for many shoppers. Google, YouTube’s parent company, found in a 2012 study that 50% of all beauty shoppers watch beauty videos on YouTube while they are shopping for products.

Meanwhile, research firm Pixability found the following in its April 2015 study of beauty on YouTube:

Source: YouTube[/caption]

Research shows that YouTube is a significant source of information for many shoppers. Google, YouTube’s parent company, found in a 2012 study that 50% of all beauty shoppers watch beauty videos on YouTube while they are shopping for products.

Meanwhile, research firm Pixability found the following in its April 2015 study of beauty on YouTube:

- The site has 123 million total beauty

- There are 1.8 million total beauty videos on

- Mature beauty and male grooming are high-growth areas on YouTube.

Source: Pixability/Fung Global Retail & Technology[/caption]

Consumers’ apparent indifference to branded content has not stopped major beauty firms from venturing into video and other forms of social media content. For instance, in 2016, L’Oréal launched an “authentic,” unbranded, content-sharing site called Fab Beauty, and partnered with YouTube to provide an online vlogging school.

[caption id="attachment_86705" align="aligncenter" width="720"]

Source: Pixability/Fung Global Retail & Technology[/caption]

Consumers’ apparent indifference to branded content has not stopped major beauty firms from venturing into video and other forms of social media content. For instance, in 2016, L’Oréal launched an “authentic,” unbranded, content-sharing site called Fab Beauty, and partnered with YouTube to provide an online vlogging school.

[caption id="attachment_86705" align="aligncenter" width="720"] Source: Shutterstock[/caption]

Source: Shutterstock[/caption]