Nitheesh NH

[caption id="attachment_77407" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

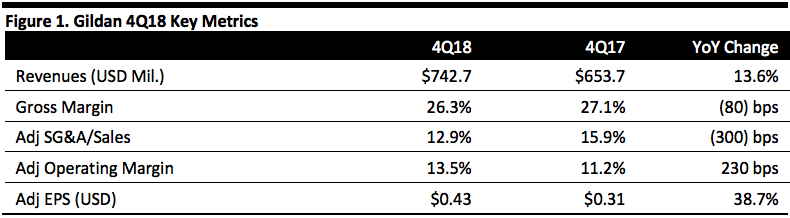

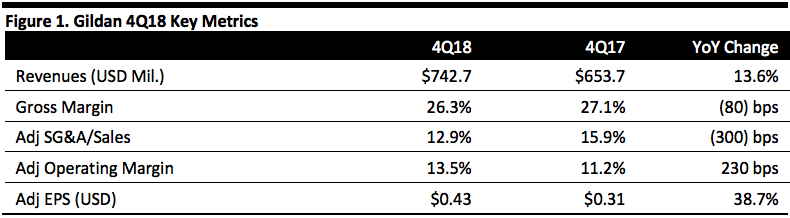

Gildan reported a 38.7% increase in adjusted 4Q18 EPS of $0.43 on a 13.6% year-over-year revenue increase to $742.7 million, beating the $715.6 million consensus estimate.

Activewear drove results with a 22.3% 4Q increase, to $569 million, mainly due to higher unit sales volumes and an improved product mix, reflecting more fleece shipments. International activewear sales rose 29%. Sales of hosiery and underwear declined 7.9% to $173 million as sales of socks to mass declined as did replenishment of Gildan underwear. Partially offsetting these impacts was the rollout of a new private label underwear programs during the quarter along with strong growth of e-commerce sales of Gildan-branded underwear. E-commerce sales were up strong double digits during the quarter.

Gross margin declined 80 bps with higher raw material costs and activewear ramp up costs, however, a 300-bps reduction in the SG&A expense ratio to 12.9% of sales due to cost reductions driven by organizational consolidation and higher prices lifted the adjusted operating margin 230 bps to 13.5% of sales.

Inventories increased $5.7 million, or 0.6%, to $940 million.

4Q capital expenditures were $26 million, for a total of $125 million for 2018, focused on textile capacity, sewing expansion, distribution and IT investments.

Outlook

The company provided initial guidance for 2019. The company expects:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Gildan reported a 38.7% increase in adjusted 4Q18 EPS of $0.43 on a 13.6% year-over-year revenue increase to $742.7 million, beating the $715.6 million consensus estimate.

Activewear drove results with a 22.3% 4Q increase, to $569 million, mainly due to higher unit sales volumes and an improved product mix, reflecting more fleece shipments. International activewear sales rose 29%. Sales of hosiery and underwear declined 7.9% to $173 million as sales of socks to mass declined as did replenishment of Gildan underwear. Partially offsetting these impacts was the rollout of a new private label underwear programs during the quarter along with strong growth of e-commerce sales of Gildan-branded underwear. E-commerce sales were up strong double digits during the quarter.

Gross margin declined 80 bps with higher raw material costs and activewear ramp up costs, however, a 300-bps reduction in the SG&A expense ratio to 12.9% of sales due to cost reductions driven by organizational consolidation and higher prices lifted the adjusted operating margin 230 bps to 13.5% of sales.

Inventories increased $5.7 million, or 0.6%, to $940 million.

4Q capital expenditures were $26 million, for a total of $125 million for 2018, focused on textile capacity, sewing expansion, distribution and IT investments.

Outlook

The company provided initial guidance for 2019. The company expects:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Gildan reported a 38.7% increase in adjusted 4Q18 EPS of $0.43 on a 13.6% year-over-year revenue increase to $742.7 million, beating the $715.6 million consensus estimate.

Activewear drove results with a 22.3% 4Q increase, to $569 million, mainly due to higher unit sales volumes and an improved product mix, reflecting more fleece shipments. International activewear sales rose 29%. Sales of hosiery and underwear declined 7.9% to $173 million as sales of socks to mass declined as did replenishment of Gildan underwear. Partially offsetting these impacts was the rollout of a new private label underwear programs during the quarter along with strong growth of e-commerce sales of Gildan-branded underwear. E-commerce sales were up strong double digits during the quarter.

Gross margin declined 80 bps with higher raw material costs and activewear ramp up costs, however, a 300-bps reduction in the SG&A expense ratio to 12.9% of sales due to cost reductions driven by organizational consolidation and higher prices lifted the adjusted operating margin 230 bps to 13.5% of sales.

Inventories increased $5.7 million, or 0.6%, to $940 million.

4Q capital expenditures were $26 million, for a total of $125 million for 2018, focused on textile capacity, sewing expansion, distribution and IT investments.

Outlook

The company provided initial guidance for 2019. The company expects:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Gildan reported a 38.7% increase in adjusted 4Q18 EPS of $0.43 on a 13.6% year-over-year revenue increase to $742.7 million, beating the $715.6 million consensus estimate.

Activewear drove results with a 22.3% 4Q increase, to $569 million, mainly due to higher unit sales volumes and an improved product mix, reflecting more fleece shipments. International activewear sales rose 29%. Sales of hosiery and underwear declined 7.9% to $173 million as sales of socks to mass declined as did replenishment of Gildan underwear. Partially offsetting these impacts was the rollout of a new private label underwear programs during the quarter along with strong growth of e-commerce sales of Gildan-branded underwear. E-commerce sales were up strong double digits during the quarter.

Gross margin declined 80 bps with higher raw material costs and activewear ramp up costs, however, a 300-bps reduction in the SG&A expense ratio to 12.9% of sales due to cost reductions driven by organizational consolidation and higher prices lifted the adjusted operating margin 230 bps to 13.5% of sales.

Inventories increased $5.7 million, or 0.6%, to $940 million.

4Q capital expenditures were $26 million, for a total of $125 million for 2018, focused on textile capacity, sewing expansion, distribution and IT investments.

Outlook

The company provided initial guidance for 2019. The company expects:

- Mid-single digit sales growth from 2018’s $2.9 billion, driven by increased unit sales in fashion basics, international markets, global lifestyle brands, and new private label programs, particularly in underwear, mitigated by projected lower activewear basics and sock sales and the negative impact from foreign exchange.

- Cost benefits from supply chain initiatives and SG&A expense leverage will generate slight operating margin improvement in 2019 versus an adjusted operating margin of 15% in 2018.

- Adjusted diluted EPS in the range of $2.00-2.10 compared to $1.86 in 2018, which at the midpoint represents adjusted diluted EPS growth of 10%.

- Capital expenditures of $125 million.