Nitheesh NH

[caption id="attachment_94079" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

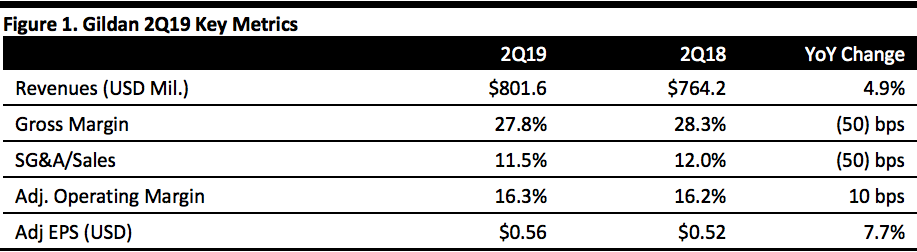

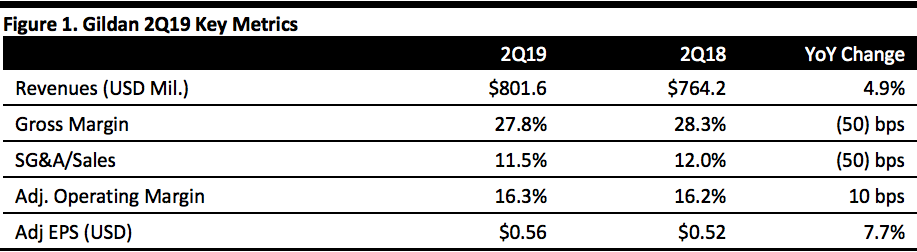

Gildan’s 2Q19 revenue increased 4.9% to $801.6 million, setting another second quarter record and consistent with analyst expectations. The increase was driven by activewear sales of $665.6 million, up 6.5% compared to the same period in 2018.

Activewear sales growth reflected high unit sales volumes of fashion basics and fleece, global lifestyle brand products and in the e-commerce business. The company also reported a 2.2% sales decline in the hosiery and underwear business, due to lower sock sales. However, underwear sales increased due to the launch of a new private label underwear line.

By geography, US business generated $683.9 million, up 6.1% compared to 2Q18. International sales were up 1.2% to $90.5 million. The company also reported softness in Europe and slower growth in China.

The company reported a 7.7% increase in adjusted 1Q19 EPS of $0.56, ahead of the consensus estimate of $0.55. Richer product-mix and higher net selling prices contributed to earnings.

Gross margin was down 50 bps to 27.8% due to rising raw materials costs, inflationary pressure on other input costs and unfavorable foreign exchange rates, partially offset by the positive impact from higher net selling prices and a more favorable product mix.

SG&A as a percentage of sales dropped 50 bps to 11.5%, primarily due to cost benefits from SG&A rationalization.

The company said retailers have confirmed they will devote additional shelf space to expand the private label underwear offering in the fourth quarter.

In May, Gildan announced the launch of a multi-year partnership with Live Nation, a leader in live music, featuring its American Apparel brand. The two companies will hold six music festivals with promotional marketing campaigns.

Outlook

The company provided the following guidance for 2019:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Gildan’s 2Q19 revenue increased 4.9% to $801.6 million, setting another second quarter record and consistent with analyst expectations. The increase was driven by activewear sales of $665.6 million, up 6.5% compared to the same period in 2018.

Activewear sales growth reflected high unit sales volumes of fashion basics and fleece, global lifestyle brand products and in the e-commerce business. The company also reported a 2.2% sales decline in the hosiery and underwear business, due to lower sock sales. However, underwear sales increased due to the launch of a new private label underwear line.

By geography, US business generated $683.9 million, up 6.1% compared to 2Q18. International sales were up 1.2% to $90.5 million. The company also reported softness in Europe and slower growth in China.

The company reported a 7.7% increase in adjusted 1Q19 EPS of $0.56, ahead of the consensus estimate of $0.55. Richer product-mix and higher net selling prices contributed to earnings.

Gross margin was down 50 bps to 27.8% due to rising raw materials costs, inflationary pressure on other input costs and unfavorable foreign exchange rates, partially offset by the positive impact from higher net selling prices and a more favorable product mix.

SG&A as a percentage of sales dropped 50 bps to 11.5%, primarily due to cost benefits from SG&A rationalization.

The company said retailers have confirmed they will devote additional shelf space to expand the private label underwear offering in the fourth quarter.

In May, Gildan announced the launch of a multi-year partnership with Live Nation, a leader in live music, featuring its American Apparel brand. The two companies will hold six music festivals with promotional marketing campaigns.

Outlook

The company provided the following guidance for 2019:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Gildan’s 2Q19 revenue increased 4.9% to $801.6 million, setting another second quarter record and consistent with analyst expectations. The increase was driven by activewear sales of $665.6 million, up 6.5% compared to the same period in 2018.

Activewear sales growth reflected high unit sales volumes of fashion basics and fleece, global lifestyle brand products and in the e-commerce business. The company also reported a 2.2% sales decline in the hosiery and underwear business, due to lower sock sales. However, underwear sales increased due to the launch of a new private label underwear line.

By geography, US business generated $683.9 million, up 6.1% compared to 2Q18. International sales were up 1.2% to $90.5 million. The company also reported softness in Europe and slower growth in China.

The company reported a 7.7% increase in adjusted 1Q19 EPS of $0.56, ahead of the consensus estimate of $0.55. Richer product-mix and higher net selling prices contributed to earnings.

Gross margin was down 50 bps to 27.8% due to rising raw materials costs, inflationary pressure on other input costs and unfavorable foreign exchange rates, partially offset by the positive impact from higher net selling prices and a more favorable product mix.

SG&A as a percentage of sales dropped 50 bps to 11.5%, primarily due to cost benefits from SG&A rationalization.

The company said retailers have confirmed they will devote additional shelf space to expand the private label underwear offering in the fourth quarter.

In May, Gildan announced the launch of a multi-year partnership with Live Nation, a leader in live music, featuring its American Apparel brand. The two companies will hold six music festivals with promotional marketing campaigns.

Outlook

The company provided the following guidance for 2019:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Gildan’s 2Q19 revenue increased 4.9% to $801.6 million, setting another second quarter record and consistent with analyst expectations. The increase was driven by activewear sales of $665.6 million, up 6.5% compared to the same period in 2018.

Activewear sales growth reflected high unit sales volumes of fashion basics and fleece, global lifestyle brand products and in the e-commerce business. The company also reported a 2.2% sales decline in the hosiery and underwear business, due to lower sock sales. However, underwear sales increased due to the launch of a new private label underwear line.

By geography, US business generated $683.9 million, up 6.1% compared to 2Q18. International sales were up 1.2% to $90.5 million. The company also reported softness in Europe and slower growth in China.

The company reported a 7.7% increase in adjusted 1Q19 EPS of $0.56, ahead of the consensus estimate of $0.55. Richer product-mix and higher net selling prices contributed to earnings.

Gross margin was down 50 bps to 27.8% due to rising raw materials costs, inflationary pressure on other input costs and unfavorable foreign exchange rates, partially offset by the positive impact from higher net selling prices and a more favorable product mix.

SG&A as a percentage of sales dropped 50 bps to 11.5%, primarily due to cost benefits from SG&A rationalization.

The company said retailers have confirmed they will devote additional shelf space to expand the private label underwear offering in the fourth quarter.

In May, Gildan announced the launch of a multi-year partnership with Live Nation, a leader in live music, featuring its American Apparel brand. The two companies will hold six music festivals with promotional marketing campaigns.

Outlook

The company provided the following guidance for 2019:

- Mid-single digit sales growth from 2018’s $2.9 billion.

- Adjusted diluted EPS in the range of $1.95-2.00, a bit higher than the previous $1.90-2.00.

- $30 million restructuring and acquisition-related costs.

- Free cash flow in the range of $300 to $350 million.