albert Chan

[caption id="attachment_85873" align="aligncenter" width="670"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

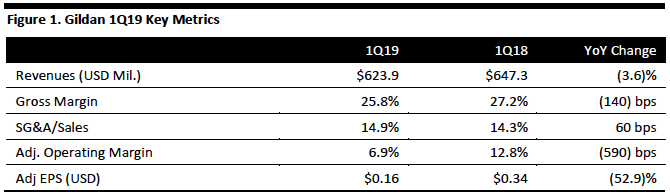

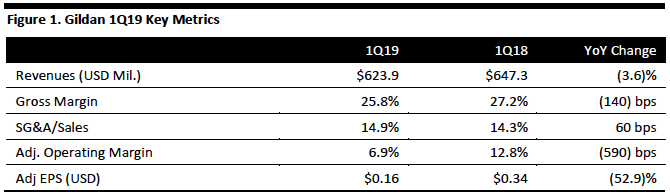

Gildan reported a 52.9% decrease in adjusted 1Q19 EPS, which came in at $0.16, ahead of the consensus estimate of $0.15. Lower levels of distributor restocking and higher raw material and other input cost pressures hurt earnings. Additionally, the wind down of the Heritage Sportswear operations was the major reason for a $0.12 per-share trade accounts receivable impairment charge.

Revenue declined 3.6% to $623.9 million, beating the $599.8 million consensus estimate, better than the company’s initial guidance of a mid- to high-single-digit revenue decline. Stronger than anticipated sales of fleece products and an early start of initial shipments of a new private-label men’s underwear program, available to customers in the second quarter, had a positive impact on revenue. Revenue was down 4.1% for activewear and down 1.8% for the hosiery and underwear category.

Gross margin was down 140 bps to 25.8% due to rising costs and unfavorable exchange rates, partially offset by the positive impact from higher net selling prices and a more favorable product-mix.

SG&A as a percentage of sales increased 60 bps to 14.9%. The company is continuing with supply chain initiatives to reduce the ratio to the goal of 12% or less in 2020.

The company announced a $45 million land purchase in Bangladesh in April 2019 to build two textile facilities and related sewing operations as part of South-East Asian capacity expansion initiative. Gildan expects the first textile facility in the complex to be constructed and developed over the next two years and the initial production will begin in the latter part of 2021. The company estimates the complex will provide capacity for more than $500 million sales once fully operational.

Outlook

The company provided the following guidance for 2019:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Gildan reported a 52.9% decrease in adjusted 1Q19 EPS, which came in at $0.16, ahead of the consensus estimate of $0.15. Lower levels of distributor restocking and higher raw material and other input cost pressures hurt earnings. Additionally, the wind down of the Heritage Sportswear operations was the major reason for a $0.12 per-share trade accounts receivable impairment charge.

Revenue declined 3.6% to $623.9 million, beating the $599.8 million consensus estimate, better than the company’s initial guidance of a mid- to high-single-digit revenue decline. Stronger than anticipated sales of fleece products and an early start of initial shipments of a new private-label men’s underwear program, available to customers in the second quarter, had a positive impact on revenue. Revenue was down 4.1% for activewear and down 1.8% for the hosiery and underwear category.

Gross margin was down 140 bps to 25.8% due to rising costs and unfavorable exchange rates, partially offset by the positive impact from higher net selling prices and a more favorable product-mix.

SG&A as a percentage of sales increased 60 bps to 14.9%. The company is continuing with supply chain initiatives to reduce the ratio to the goal of 12% or less in 2020.

The company announced a $45 million land purchase in Bangladesh in April 2019 to build two textile facilities and related sewing operations as part of South-East Asian capacity expansion initiative. Gildan expects the first textile facility in the complex to be constructed and developed over the next two years and the initial production will begin in the latter part of 2021. The company estimates the complex will provide capacity for more than $500 million sales once fully operational.

Outlook

The company provided the following guidance for 2019:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Gildan reported a 52.9% decrease in adjusted 1Q19 EPS, which came in at $0.16, ahead of the consensus estimate of $0.15. Lower levels of distributor restocking and higher raw material and other input cost pressures hurt earnings. Additionally, the wind down of the Heritage Sportswear operations was the major reason for a $0.12 per-share trade accounts receivable impairment charge.

Revenue declined 3.6% to $623.9 million, beating the $599.8 million consensus estimate, better than the company’s initial guidance of a mid- to high-single-digit revenue decline. Stronger than anticipated sales of fleece products and an early start of initial shipments of a new private-label men’s underwear program, available to customers in the second quarter, had a positive impact on revenue. Revenue was down 4.1% for activewear and down 1.8% for the hosiery and underwear category.

Gross margin was down 140 bps to 25.8% due to rising costs and unfavorable exchange rates, partially offset by the positive impact from higher net selling prices and a more favorable product-mix.

SG&A as a percentage of sales increased 60 bps to 14.9%. The company is continuing with supply chain initiatives to reduce the ratio to the goal of 12% or less in 2020.

The company announced a $45 million land purchase in Bangladesh in April 2019 to build two textile facilities and related sewing operations as part of South-East Asian capacity expansion initiative. Gildan expects the first textile facility in the complex to be constructed and developed over the next two years and the initial production will begin in the latter part of 2021. The company estimates the complex will provide capacity for more than $500 million sales once fully operational.

Outlook

The company provided the following guidance for 2019:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Gildan reported a 52.9% decrease in adjusted 1Q19 EPS, which came in at $0.16, ahead of the consensus estimate of $0.15. Lower levels of distributor restocking and higher raw material and other input cost pressures hurt earnings. Additionally, the wind down of the Heritage Sportswear operations was the major reason for a $0.12 per-share trade accounts receivable impairment charge.

Revenue declined 3.6% to $623.9 million, beating the $599.8 million consensus estimate, better than the company’s initial guidance of a mid- to high-single-digit revenue decline. Stronger than anticipated sales of fleece products and an early start of initial shipments of a new private-label men’s underwear program, available to customers in the second quarter, had a positive impact on revenue. Revenue was down 4.1% for activewear and down 1.8% for the hosiery and underwear category.

Gross margin was down 140 bps to 25.8% due to rising costs and unfavorable exchange rates, partially offset by the positive impact from higher net selling prices and a more favorable product-mix.

SG&A as a percentage of sales increased 60 bps to 14.9%. The company is continuing with supply chain initiatives to reduce the ratio to the goal of 12% or less in 2020.

The company announced a $45 million land purchase in Bangladesh in April 2019 to build two textile facilities and related sewing operations as part of South-East Asian capacity expansion initiative. Gildan expects the first textile facility in the complex to be constructed and developed over the next two years and the initial production will begin in the latter part of 2021. The company estimates the complex will provide capacity for more than $500 million sales once fully operational.

Outlook

The company provided the following guidance for 2019:

- Mid-single-digit sales growth from 2018’s $2.9 billion.

- Adjusted diluted EPS in the range of $1.90-2.00, lowered from previous $2.00-2.10.

- $30 million restructuring and acquisition-related costs.

- Capital expenditures of $175 million, updated from previous $125 million, due to the $45 million land acquisition in cash.