Source: Company reports

4Q15 RESULTS

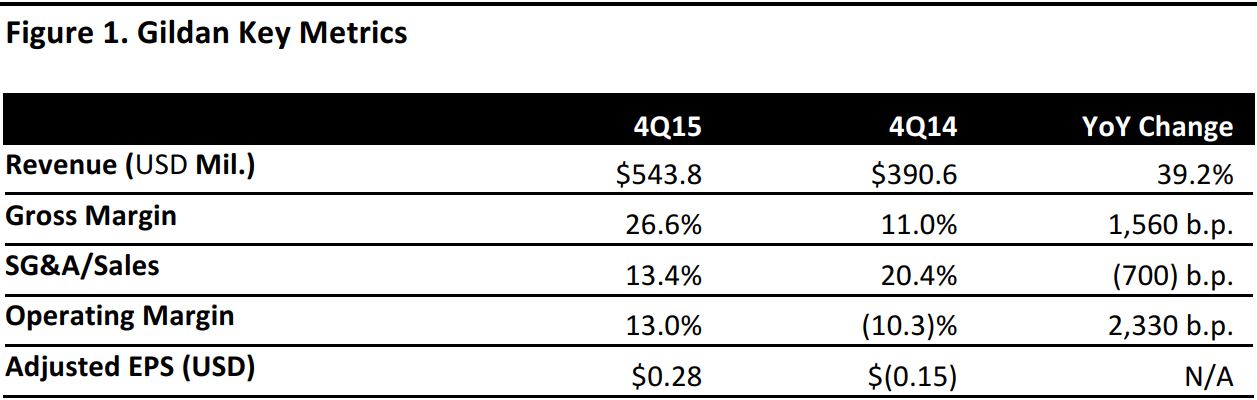

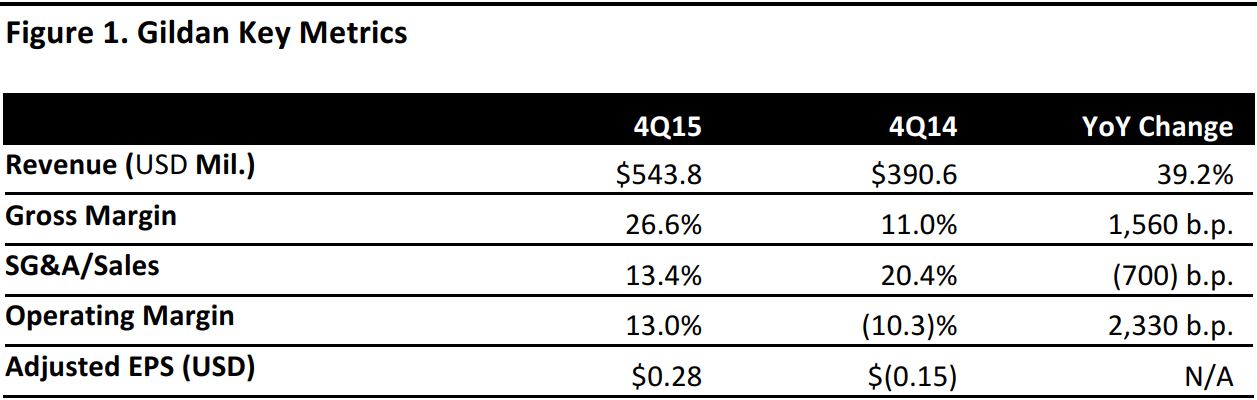

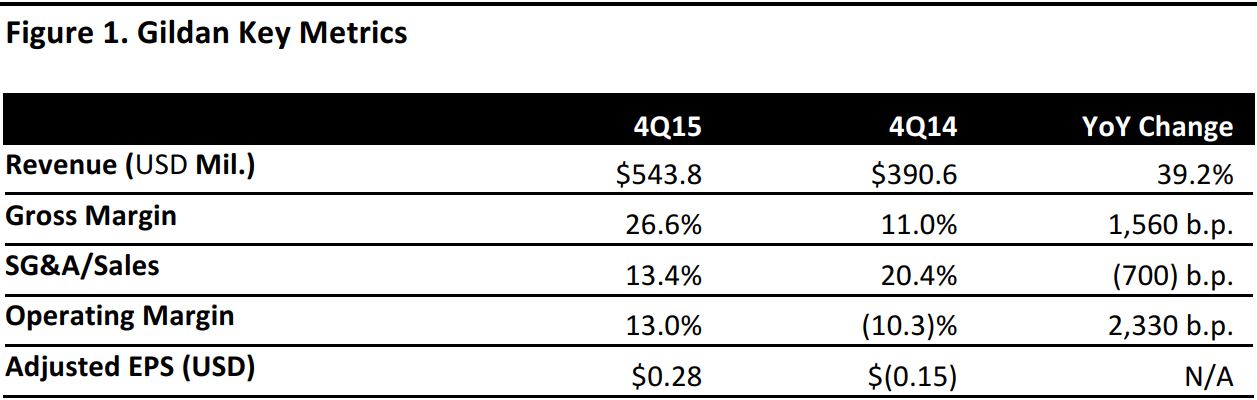

Gildan reported 4Q15 adjusted EPS of $0.28, in line with the consensus estimate. Net earnings in the period were $67.6 million; in the same quarter last year, Gildan incurred a net loss of $41.2 million.

Total revenue was $543.8 million versus consensus of $499.9 million, and was up 39.2%, from $390.6 million, in the year-ago quarter. The company saw a sales increase of 77.7% in the printwear segment and a 12.4% increase in the branded apparel segment.

A distributor inventory devaluation discount of $48 million negatively impacted printwear sales in 4Q14, which provided an easy comparison for sales growth in 4Q15.

Overall, strong unit sales volume growth and lower SG&A expenses resulted in higher margins for Gildan and drove the increase in earnings.

2015 RESULTS

For the year, consolidated net sales totaled $2.6 billion, up 11.7% from $2.3 billion in 2014. Adjusted net earnings for the year were $3.5 billion, or $1.46 per share, up from $2.8 billion, or $1.14 per share, in the prior year. Increased unit sales volumes in both product segments, as well as the benefit of the company’s capital investments and lower cotton costs, helped margins in 2015.

GUIDANCE

For 2016, Gildan expects consolidated net sales of at least $2.6 billion and adjusted EPS of $1.50–$1.60. Consensus estimates are for net sales of $2.7 billion and EPS of $1.78.

The company’s guidance for 2016 is based on current retail and printwear market conditions. In the year, the company intends to leverage its competitive edge and benefit from its continued capital investments in manufacturing in order to strengthen its market position.