Web Developers

The company expects fiscal 3Q16 FFO of $0.34–$0.36, compared with the consensus estimate of $0.37.

General Growth Properties is the second-largest mall owner in the US by number of properties, and has been shifting its focus to high-end urban addresses such as Manhattan’s Fifth Avenue and Chicago’s Michigan Avenue. The company acquired a 50% interest in 218 West 57th Street in New York City for approximately $41 million. It sold its interest in an urban retail property and an office building, and received approximately $150 million in return. Prior to quarter-end, the company sold a 50% steak in high-end shopping mall on the Las Vegas Strip, $1.25 billion.

General Growth Properties is the second-largest mall owner in the US by number of properties, and has been shifting its focus to high-end urban addresses such as Manhattan’s Fifth Avenue and Chicago’s Michigan Avenue. The company acquired a 50% interest in 218 West 57th Street in New York City for approximately $41 million. It sold its interest in an urban retail property and an office building, and received approximately $150 million in return. Prior to quarter-end, the company sold a 50% steak in high-end shopping mall on the Las Vegas Strip, $1.25 billion.

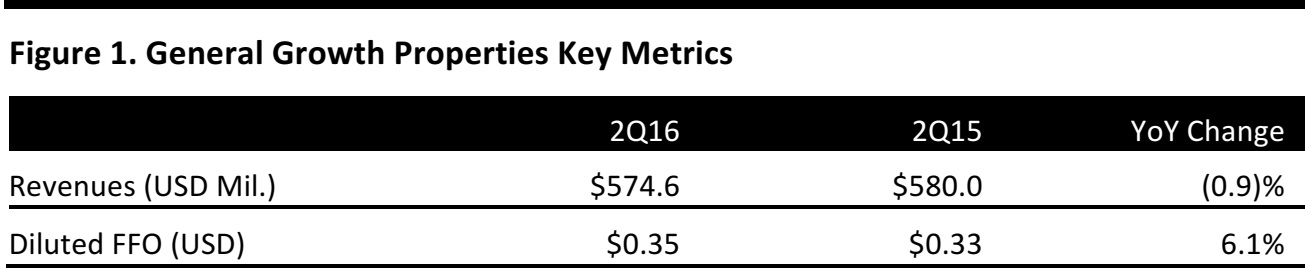

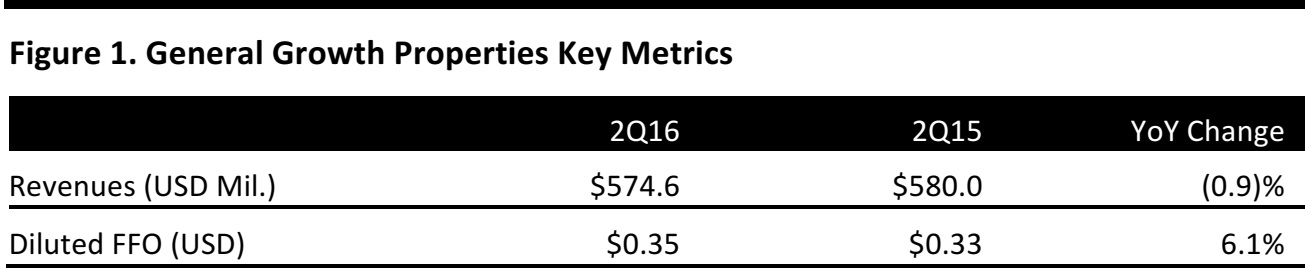

Source: Company reports

2Q16 RESULTS

General Growth Properties reported fiscal 2Q16 revenues of $574.6 million, down 0.9% year over year and below the $580.4 million consensus estimate. Diluted FFO was $0.35, up 6.1% year over year but slightly below the consensus estimate. The same-store leased percentage was 96.1% for the quarter, up slightly from 96.0% in the year-ago period. Tenant sales, excluding anchor stores, rose by 2.8%, to $2.61 billion, on a trailing 12-month basis. Initial rental rates for signed leases that have commenced in the trailing 12 months on a suite-to-suite basis increased by 13.7% compared to the rental rate for expiring leases. Same-store net operating income increased by 4.0% year over year, to $555.3 million. General Growth Properties is the second-largest mall owner in the US by number of properties, and has been shifting its focus to high-end urban addresses such as Manhattan’s Fifth Avenue and Chicago’s Michigan Avenue. The company acquired a 50% interest in 218 West 57th Street in New York City for approximately $41 million. It sold its interest in an urban retail property and an office building, and received approximately $150 million in return. Prior to quarter-end, the company sold a 50% steak in high-end shopping mall on the Las Vegas Strip, $1.25 billion.

General Growth Properties is the second-largest mall owner in the US by number of properties, and has been shifting its focus to high-end urban addresses such as Manhattan’s Fifth Avenue and Chicago’s Michigan Avenue. The company acquired a 50% interest in 218 West 57th Street in New York City for approximately $41 million. It sold its interest in an urban retail property and an office building, and received approximately $150 million in return. Prior to quarter-end, the company sold a 50% steak in high-end shopping mall on the Las Vegas Strip, $1.25 billion.