DIpil Das

What’s the Story?

Coresight Research has identified inclusivity as one of the key trends to watch in 2021, spanning multiple retail sectors with long-lasting impacts. We discuss the emergence and evolution of the gender-free product category, including key drivers of market growth and recent developments by major brands and retailers.Why It Matters

Diversity and inclusivity are important topics in today’s society and include gender identification, with the two traditional genders of men and women not encapsulating all consumers. Individuals’ gender identification may align with their birth sex (man/male and woman/female), but many gender identities may be better described as “gender-fluid,” “gender-neutral,” “non-binary,” “transgender,” or “gender-free,” to name a few. Diverse representation, including of gender, is an important consideration for product portfolios at varying price points across multiple retail categories, including apparel, footwear, accessories and beauty. In this report, we refer to products that do not target the traditional binary genders of men and women as “gender-free”—although it is important to note that the target audience of this category extends to all consumers, including those whose gender identity aligns with their birth sex. Gender-free product offerings support inclusivity while providing brands and retailers with white-space opportunity to expand their customer bases.Gender-Free Products: A Growing Market Opportunity

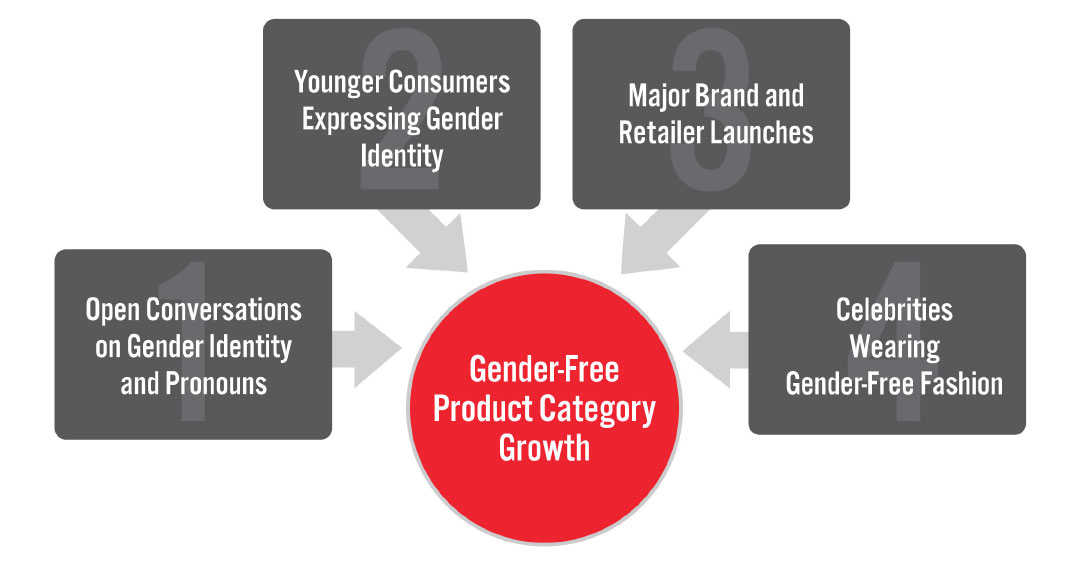

Gender-Free Category: Four Key Growth Drivers Coresight Research has identified three growth drivers of the gender-free category, which we summarize in Figure 1 and discuss in further detail below.Figure 1. Gender-Free Category: Four Key Growth Drivers [caption id="attachment_129623" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

1. Open Conversations Around Gender Identity Is Driving More Awareness

Open conversations around gender identity are a major driver for diversity and inclusivity. Gender-identification categories beyond men and women are becoming more mainstream and understood in workplaces and schools.

One of the biggest changes in this respect has been through increased awareness of preferred pronoun usage. According to a Pew Research Center survey, 35% of Gen Zers (born after 1996) report that they know someone who prefers that others use gender-neutral pronouns to refer to them. Some companies and institutions are encouraging employees to add their preferred pronouns to their email signatures and communication-platform profiles as part of efforts to become more gender-inclusive and diverse workplaces.

[caption id="attachment_129624" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

1. Open Conversations Around Gender Identity Is Driving More Awareness

Open conversations around gender identity are a major driver for diversity and inclusivity. Gender-identification categories beyond men and women are becoming more mainstream and understood in workplaces and schools.

One of the biggest changes in this respect has been through increased awareness of preferred pronoun usage. According to a Pew Research Center survey, 35% of Gen Zers (born after 1996) report that they know someone who prefers that others use gender-neutral pronouns to refer to them. Some companies and institutions are encouraging employees to add their preferred pronouns to their email signatures and communication-platform profiles as part of efforts to become more gender-inclusive and diverse workplaces.

[caption id="attachment_129624" align="aligncenter" width="725"] Source: Pewresearch.org[/caption]

2. Young Consumers Are Expressing Gender Identity

Various surveys suggest a generational shift in gender identity, with younger consumers reporting a higher incidence of varied gender identities compared to older individuals (we summarize findings from a 2017 Harris Poll in Figure 2). This is important to note because the younger consumer’s progressive outlook and expression of gender identity may inform purchasing decisions, too.

Source: Pewresearch.org[/caption]

2. Young Consumers Are Expressing Gender Identity

Various surveys suggest a generational shift in gender identity, with younger consumers reporting a higher incidence of varied gender identities compared to older individuals (we summarize findings from a 2017 Harris Poll in Figure 2). This is important to note because the younger consumer’s progressive outlook and expression of gender identity may inform purchasing decisions, too.

Figure 2. Gender Identity by Age Group [wpdatatable id=1084 table_view=regular]

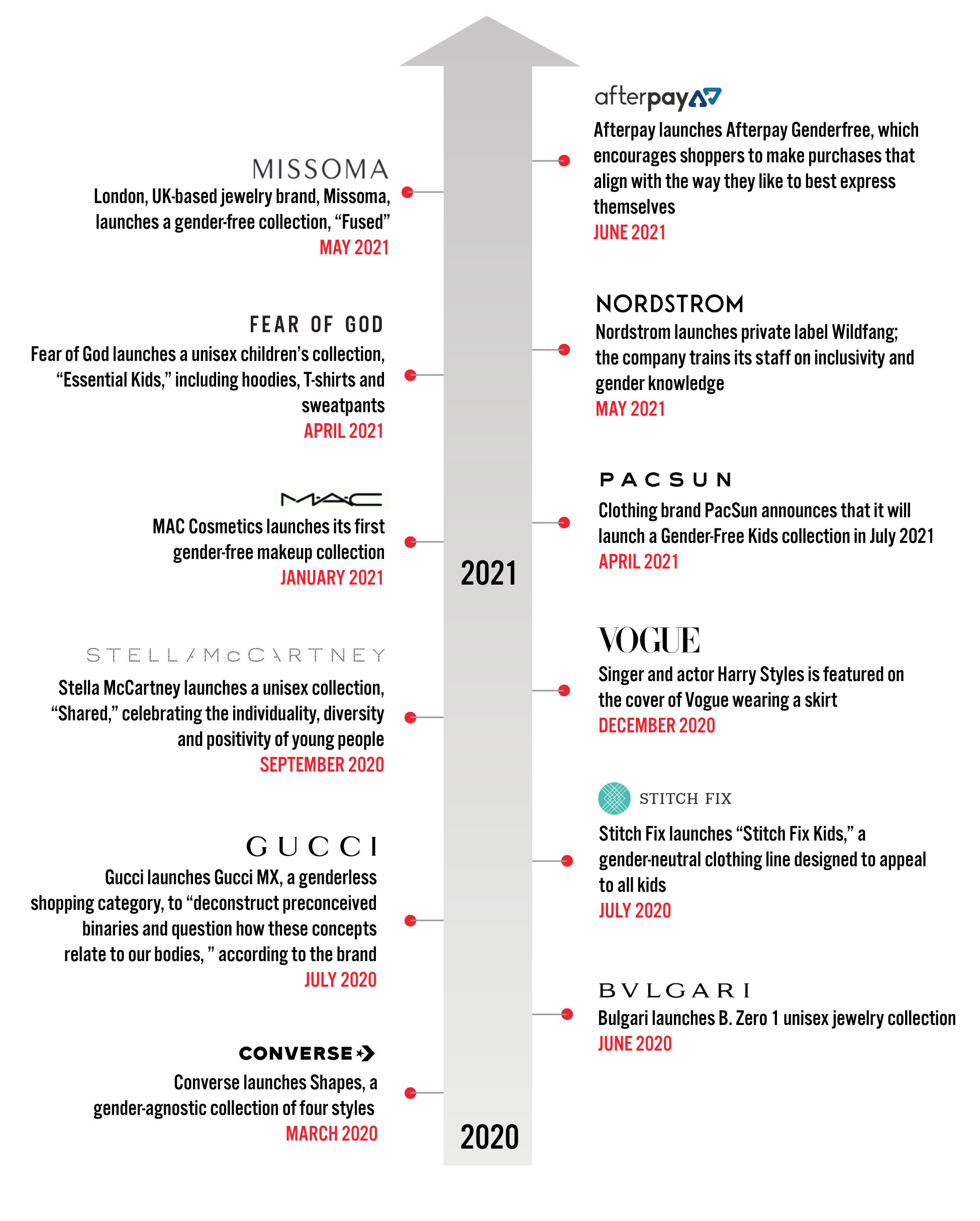

Source: 2017 Harris Poll, GLAAD Accelerating Acceptance Survey Estimates for the number of consumers that identify as gender-free, gender-fluid or gender-neutral are uncertain today, as there are no official figures from the US Census Bureau (which does not provide options in its full-population survey for each gender identity). In 2017, the US Census Bureau published a list of 50 planned topics for its 2020 Census and American Community Survey, which included gender identity; however, the topic was later removed. Still, that the topic was under consideration represents some recent progress. 3. Major Retailer and Brand Launches Are Pushing Gender-Free Fashion Forward In parallel with conversations at home, school and in the workplace, gender-pushing fashion apparel and beauty trends have continued to emerge over the past year. It should be emphasized that while open conversations around gender identity have helped to push the category forward, gender-free products are appealing to a wide customer base where all genders are shopping. Since March 2020, there have been 11 gender-free launches from major brands and retailers, spanning mass market to luxury including retail categories including apparel, accessories, beauty, footwear and jewelry (see Figure 3).

Figure 3. Timeline of Gender-Free Product/Brand Launches and Events by Major Brands and Retailers [caption id="attachment_129640" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

The launch of gender-free products by major brands and retailers is significant as it adds weight to the importance and relevance of the category. There are many smaller brands that support the gender-free movement, but we have only highlighted selected major launches in this report; it often takes major brand and retailer support for the industry to take notice and for there to be a groundswell.

Furthermore, brands and retailers have launched permanent offerings, rather than temporary pop-up collections. This shows commitment to the gender-free category, which will help to further provide traction for the category. Brands and retailers are entering the category across all retail types, channel, category and price point, helping to solidify that gender-free products present opportunities across the retail industry.

In the table below, we summarize the retailer and brand launches by channel and type, target audience, price points and product category.

Source: Coresight Research[/caption]

The launch of gender-free products by major brands and retailers is significant as it adds weight to the importance and relevance of the category. There are many smaller brands that support the gender-free movement, but we have only highlighted selected major launches in this report; it often takes major brand and retailer support for the industry to take notice and for there to be a groundswell.

Furthermore, brands and retailers have launched permanent offerings, rather than temporary pop-up collections. This shows commitment to the gender-free category, which will help to further provide traction for the category. Brands and retailers are entering the category across all retail types, channel, category and price point, helping to solidify that gender-free products present opportunities across the retail industry.

In the table below, we summarize the retailer and brand launches by channel and type, target audience, price points and product category.

Figure 4. Overview of Major Brand and Retailer Gender-Free Category Launches, March 2020 - Present [wpdatatable id=1086 table_view=regular]

Source: Coresight Research As we can see from Figure 4, gender-free offerings are mostly being targeted at consumers under the age of 40, with more than half of the 11 major gender-free brand launches since March 2020 targeting consumers under 30. The luxury and accessible luxury sectors have helped to innovate early in the category and tend to skew toward older consumers. In addition, the target consumers of gender-free collections typically extend to all gender identities and broader audiences—including kids and teens. There is opportunity for mass market and value retailers to enter the gender-free category. 4. Gender-Free Fashion Is Being Legitimized by Celebrities, Pushing It into the Mainstream Over the past year, the gender-free category has been gaining recognition through the fashion choices of celebrities who celebrate individuality and freedom of expression. Celebrities are demystifying the gender-free category, helping to highlight that gender-free fashion is fashion regardless of one’s gender identity, pronoun or status, and underscores that fashion can be experimental and fun. One of the most notable category celebrants, British singer Harry Styles, pushes the boundaries of the traditional view of “masculinity” and male fashion. Styles was featured on Vogue magazine’s December 2020 cover wearing a Gucci dress and was pictured wearing a Chopova Lowena belted skirt in the magazine. He said that he finds himself “looking at women’s clothes, thinking that they’re amazing.” The cover received tremendous media attention, as does Styles’ other fashion choices beyond the Vogue cover; Styles is frequently highlighted in the media for his gender-pushing fashion choices. [caption id="attachment_129627" align="aligncenter" width="596"]

Source: Harry Styles’ Instagram account[/caption]

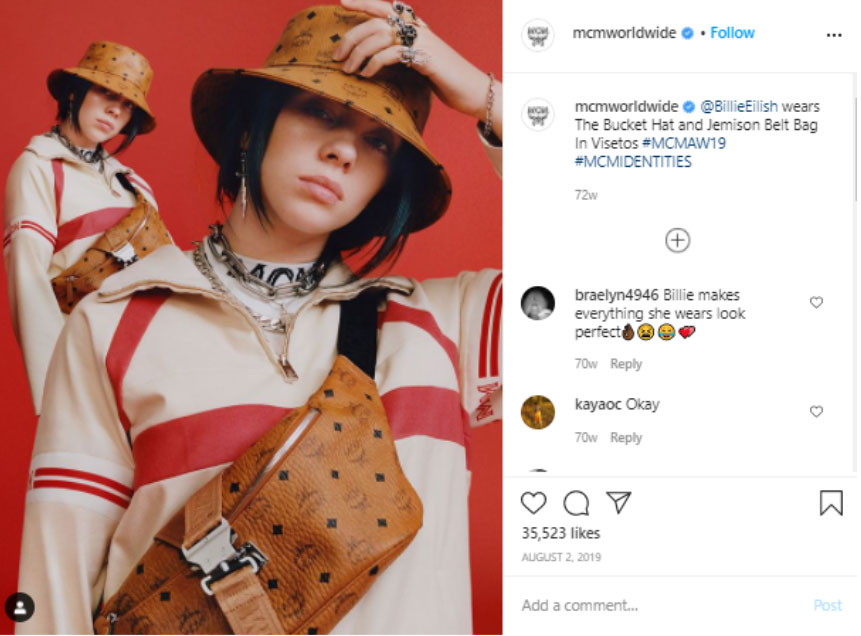

The gender-free category has also gained traction from other celebrities including American actor and singer Jared Leto, who is a Gucci brand ambassador and has 10.1 million Instagram followers. Leto is known for his boundary-pushing styles including exaggerated ruffles, puff sleeves and metallic heeled boots. American singer and songwriter Billie Eilish, who identifies as gender-fluid, modeled for luxury goods company MCM Worldwide’s gender-fluid campaign launch in 2019.

[caption id="attachment_129628" align="aligncenter" width="726"]

Source: Harry Styles’ Instagram account[/caption]

The gender-free category has also gained traction from other celebrities including American actor and singer Jared Leto, who is a Gucci brand ambassador and has 10.1 million Instagram followers. Leto is known for his boundary-pushing styles including exaggerated ruffles, puff sleeves and metallic heeled boots. American singer and songwriter Billie Eilish, who identifies as gender-fluid, modeled for luxury goods company MCM Worldwide’s gender-fluid campaign launch in 2019.

[caption id="attachment_129628" align="aligncenter" width="726"] Source: MCM Worldwide’s Instagram account[/caption]

With celebrities helping to push gender-free fashion forward, there is opportunity for brands and retailers to recognize the category and acknowledge that open-minded consumers are cross-shopping today—not just shopping designated men’s and women’s departments.

Future Growth Opportunities for Brands and Retailers

Based on Coresight Research’s assessment of the gender-free category, “gender-free” is a movement that will have a long-term impact on retailers’ categories and products. We view the retailers and brands that are launching products as pioneers in this emerging space.

There are opportunities for brands and retailers across the gender-free category as the gender-free products appeal to a wide customer base where all genders are shopping. Mass market retailers and value/big-box retailers also have opportunity to enter this space, as relatively lower price points are underrepresented in this new category. The product categories most impacted by the gender-free movement currently are apparel, footwear, accessories (jewelry) and beauty.

Conversations around gender identity will help push the boundaries of design between men’s and women’s fashion and accessories, but can have implications for broader retail categories as more diversity and inclusion is incorporated onto shelves. For example, during Pride month in June, many retailers launched Pride merchandise in categories beyond apparel, such as home—targeting all consumers, no matter their sexual orientation. Incorporating diversity and inclusion can expand product offerings and customer bases.

Source: MCM Worldwide’s Instagram account[/caption]

With celebrities helping to push gender-free fashion forward, there is opportunity for brands and retailers to recognize the category and acknowledge that open-minded consumers are cross-shopping today—not just shopping designated men’s and women’s departments.

Future Growth Opportunities for Brands and Retailers

Based on Coresight Research’s assessment of the gender-free category, “gender-free” is a movement that will have a long-term impact on retailers’ categories and products. We view the retailers and brands that are launching products as pioneers in this emerging space.

There are opportunities for brands and retailers across the gender-free category as the gender-free products appeal to a wide customer base where all genders are shopping. Mass market retailers and value/big-box retailers also have opportunity to enter this space, as relatively lower price points are underrepresented in this new category. The product categories most impacted by the gender-free movement currently are apparel, footwear, accessories (jewelry) and beauty.

Conversations around gender identity will help push the boundaries of design between men’s and women’s fashion and accessories, but can have implications for broader retail categories as more diversity and inclusion is incorporated onto shelves. For example, during Pride month in June, many retailers launched Pride merchandise in categories beyond apparel, such as home—targeting all consumers, no matter their sexual orientation. Incorporating diversity and inclusion can expand product offerings and customer bases.