albert Chan

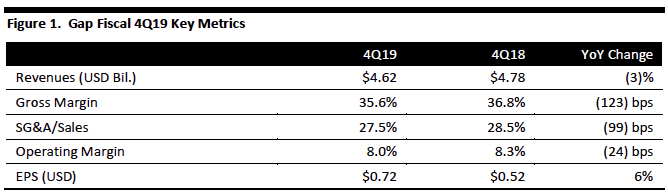

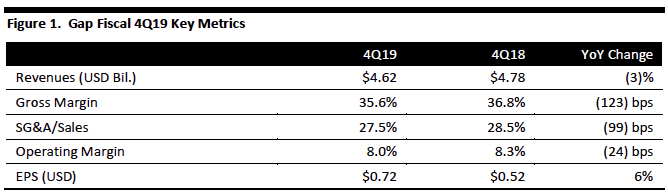

[caption id="attachment_79053" align="aligncenter" width="668"] Source: Company reports/Coresight Research[/caption]

4Q19 Results

Gap reported 4Q19 revenues of $4.6 billion, down 3% year over year, and lower than the $4.7 billion consensus estimate. In fiscal 4Q19, Gap’s EPS grew 6% year over year, while revenues decreased 3% year over year. The company’s comparable sales declined 1% year over year in 4Q19. By brand, Old Navy reported flat comparable sales growth in 4Q19 compared to 9% growth in 4Q18. Gap posted a comparable sales decline of 5% versus flat last year. Banana Republic witnessed a comparable sales decline of 1% in 4Q19 versus growth of 1% in 4Q18.

Gap’s gross margin declined 123 basis points year over year to 35.6% in 4Q19, mainly due to elevated promotional activity at the Old Navy and Gap brands. Operating margin declined 24 basis points to 8% in 4Q19.

FY19 Results

Gap’s revenues and EPS grew 5% and 21%, year over year, respectively. The company’s comparable sales were flat as compared to a 3% increase last year. Comparable sales at Old Navy increased 3%, fell 5% at the Gap and edged up 1% at Banana Republic. Gap ended FY19 with 3,666 store locations in 43 countries, of which 3,194 were company-operated.

Separation of Gap into Two Independent Companies

On February 28, Gap announced it will create two independent publicly traded companies: Old Navy, its category-leader in clothing and accessories, and the other yet-to-be-named business, currently called NewCo, which will comprise Gap, Banana Republic and other brands, including Athleta and Hill City. The separation is expected to be completed by 2020 and the leadership is expected to remain intact at Old Navy and The Gap. The company said the Gap’s current President and CEO, Art Peck, will hold the same position with NewCo after the separation and Sonia Syngal, the current President and CEO of Old Navy, will continue to lead the brand as a standalone company.

Old Navy generates approximately 45% of the company’s total revenues, and the brand has grown faster than the company’s other two major brands, The Gap and Banana Republic. Old Navy has grown to an annual sales of $8 billion since it opened its first store in 1994. The spinoff is designed to allow Old Navy to expand on its own and help the company consolidate its heritage brands, such as Gap and Banana Republic, with newer brands such as Athleta and Hill City.

Gap plans to close 230 stores over the next two years, mostly in North America. As a result, Gap predicts an annualized sales decrease of about $625 million and expects pre-tax costs of $250 million-300 million, resulting in an annualized pretax savings of about $90 million.

The company stated it anticipates about 40% of its total channel revenues will come from online and the remaining 60% of revenues will be split between the company’s specialty and value channels after the separation.

Outlook

For FY20, Gap expects an adjusted EPS of $2.40-2.55, excluding the impact of the Gap brand fleet restructuring. The company expects comparable sales to be flat to up slightly in FY20. For FY20, analysts expect the company to grow revenues 2% to $16.9 billion.

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Gap reported 4Q19 revenues of $4.6 billion, down 3% year over year, and lower than the $4.7 billion consensus estimate. In fiscal 4Q19, Gap’s EPS grew 6% year over year, while revenues decreased 3% year over year. The company’s comparable sales declined 1% year over year in 4Q19. By brand, Old Navy reported flat comparable sales growth in 4Q19 compared to 9% growth in 4Q18. Gap posted a comparable sales decline of 5% versus flat last year. Banana Republic witnessed a comparable sales decline of 1% in 4Q19 versus growth of 1% in 4Q18.

Gap’s gross margin declined 123 basis points year over year to 35.6% in 4Q19, mainly due to elevated promotional activity at the Old Navy and Gap brands. Operating margin declined 24 basis points to 8% in 4Q19.

FY19 Results

Gap’s revenues and EPS grew 5% and 21%, year over year, respectively. The company’s comparable sales were flat as compared to a 3% increase last year. Comparable sales at Old Navy increased 3%, fell 5% at the Gap and edged up 1% at Banana Republic. Gap ended FY19 with 3,666 store locations in 43 countries, of which 3,194 were company-operated.

Separation of Gap into Two Independent Companies

On February 28, Gap announced it will create two independent publicly traded companies: Old Navy, its category-leader in clothing and accessories, and the other yet-to-be-named business, currently called NewCo, which will comprise Gap, Banana Republic and other brands, including Athleta and Hill City. The separation is expected to be completed by 2020 and the leadership is expected to remain intact at Old Navy and The Gap. The company said the Gap’s current President and CEO, Art Peck, will hold the same position with NewCo after the separation and Sonia Syngal, the current President and CEO of Old Navy, will continue to lead the brand as a standalone company.

Old Navy generates approximately 45% of the company’s total revenues, and the brand has grown faster than the company’s other two major brands, The Gap and Banana Republic. Old Navy has grown to an annual sales of $8 billion since it opened its first store in 1994. The spinoff is designed to allow Old Navy to expand on its own and help the company consolidate its heritage brands, such as Gap and Banana Republic, with newer brands such as Athleta and Hill City.

Gap plans to close 230 stores over the next two years, mostly in North America. As a result, Gap predicts an annualized sales decrease of about $625 million and expects pre-tax costs of $250 million-300 million, resulting in an annualized pretax savings of about $90 million.

The company stated it anticipates about 40% of its total channel revenues will come from online and the remaining 60% of revenues will be split between the company’s specialty and value channels after the separation.

Outlook

For FY20, Gap expects an adjusted EPS of $2.40-2.55, excluding the impact of the Gap brand fleet restructuring. The company expects comparable sales to be flat to up slightly in FY20. For FY20, analysts expect the company to grow revenues 2% to $16.9 billion.

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Gap reported 4Q19 revenues of $4.6 billion, down 3% year over year, and lower than the $4.7 billion consensus estimate. In fiscal 4Q19, Gap’s EPS grew 6% year over year, while revenues decreased 3% year over year. The company’s comparable sales declined 1% year over year in 4Q19. By brand, Old Navy reported flat comparable sales growth in 4Q19 compared to 9% growth in 4Q18. Gap posted a comparable sales decline of 5% versus flat last year. Banana Republic witnessed a comparable sales decline of 1% in 4Q19 versus growth of 1% in 4Q18.

Gap’s gross margin declined 123 basis points year over year to 35.6% in 4Q19, mainly due to elevated promotional activity at the Old Navy and Gap brands. Operating margin declined 24 basis points to 8% in 4Q19.

FY19 Results

Gap’s revenues and EPS grew 5% and 21%, year over year, respectively. The company’s comparable sales were flat as compared to a 3% increase last year. Comparable sales at Old Navy increased 3%, fell 5% at the Gap and edged up 1% at Banana Republic. Gap ended FY19 with 3,666 store locations in 43 countries, of which 3,194 were company-operated.

Separation of Gap into Two Independent Companies

On February 28, Gap announced it will create two independent publicly traded companies: Old Navy, its category-leader in clothing and accessories, and the other yet-to-be-named business, currently called NewCo, which will comprise Gap, Banana Republic and other brands, including Athleta and Hill City. The separation is expected to be completed by 2020 and the leadership is expected to remain intact at Old Navy and The Gap. The company said the Gap’s current President and CEO, Art Peck, will hold the same position with NewCo after the separation and Sonia Syngal, the current President and CEO of Old Navy, will continue to lead the brand as a standalone company.

Old Navy generates approximately 45% of the company’s total revenues, and the brand has grown faster than the company’s other two major brands, The Gap and Banana Republic. Old Navy has grown to an annual sales of $8 billion since it opened its first store in 1994. The spinoff is designed to allow Old Navy to expand on its own and help the company consolidate its heritage brands, such as Gap and Banana Republic, with newer brands such as Athleta and Hill City.

Gap plans to close 230 stores over the next two years, mostly in North America. As a result, Gap predicts an annualized sales decrease of about $625 million and expects pre-tax costs of $250 million-300 million, resulting in an annualized pretax savings of about $90 million.

The company stated it anticipates about 40% of its total channel revenues will come from online and the remaining 60% of revenues will be split between the company’s specialty and value channels after the separation.

Outlook

For FY20, Gap expects an adjusted EPS of $2.40-2.55, excluding the impact of the Gap brand fleet restructuring. The company expects comparable sales to be flat to up slightly in FY20. For FY20, analysts expect the company to grow revenues 2% to $16.9 billion.

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Gap reported 4Q19 revenues of $4.6 billion, down 3% year over year, and lower than the $4.7 billion consensus estimate. In fiscal 4Q19, Gap’s EPS grew 6% year over year, while revenues decreased 3% year over year. The company’s comparable sales declined 1% year over year in 4Q19. By brand, Old Navy reported flat comparable sales growth in 4Q19 compared to 9% growth in 4Q18. Gap posted a comparable sales decline of 5% versus flat last year. Banana Republic witnessed a comparable sales decline of 1% in 4Q19 versus growth of 1% in 4Q18.

Gap’s gross margin declined 123 basis points year over year to 35.6% in 4Q19, mainly due to elevated promotional activity at the Old Navy and Gap brands. Operating margin declined 24 basis points to 8% in 4Q19.

FY19 Results

Gap’s revenues and EPS grew 5% and 21%, year over year, respectively. The company’s comparable sales were flat as compared to a 3% increase last year. Comparable sales at Old Navy increased 3%, fell 5% at the Gap and edged up 1% at Banana Republic. Gap ended FY19 with 3,666 store locations in 43 countries, of which 3,194 were company-operated.

Separation of Gap into Two Independent Companies

On February 28, Gap announced it will create two independent publicly traded companies: Old Navy, its category-leader in clothing and accessories, and the other yet-to-be-named business, currently called NewCo, which will comprise Gap, Banana Republic and other brands, including Athleta and Hill City. The separation is expected to be completed by 2020 and the leadership is expected to remain intact at Old Navy and The Gap. The company said the Gap’s current President and CEO, Art Peck, will hold the same position with NewCo after the separation and Sonia Syngal, the current President and CEO of Old Navy, will continue to lead the brand as a standalone company.

Old Navy generates approximately 45% of the company’s total revenues, and the brand has grown faster than the company’s other two major brands, The Gap and Banana Republic. Old Navy has grown to an annual sales of $8 billion since it opened its first store in 1994. The spinoff is designed to allow Old Navy to expand on its own and help the company consolidate its heritage brands, such as Gap and Banana Republic, with newer brands such as Athleta and Hill City.

Gap plans to close 230 stores over the next two years, mostly in North America. As a result, Gap predicts an annualized sales decrease of about $625 million and expects pre-tax costs of $250 million-300 million, resulting in an annualized pretax savings of about $90 million.

The company stated it anticipates about 40% of its total channel revenues will come from online and the remaining 60% of revenues will be split between the company’s specialty and value channels after the separation.

Outlook

For FY20, Gap expects an adjusted EPS of $2.40-2.55, excluding the impact of the Gap brand fleet restructuring. The company expects comparable sales to be flat to up slightly in FY20. For FY20, analysts expect the company to grow revenues 2% to $16.9 billion.