Nitheesh NH

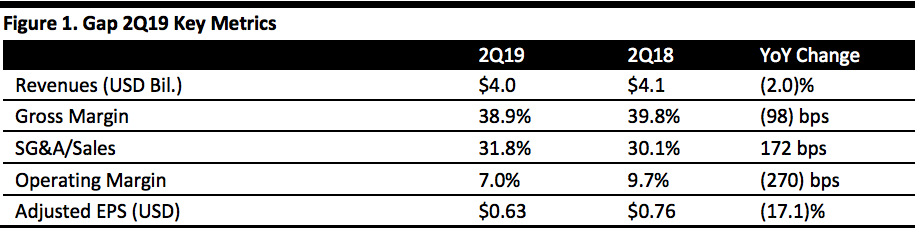

[caption id="attachment_95191" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

Gap reported fiscal 2Q19 revenues of $4.0 billion, down 2.0% year over year, marginally missing the consensus estimate of $4.02 billion. Adjusted EPS was $0.63, down 17.1% year over year, but ahead of the consensus estimate of $0.53.

Comparable sales declined 4.0% compared with the consensus estimate of a 3.0% comp decline, and versus a year-ago 2% comp increase.

By brand, Old Navy comparable sales declined 5% compared to a 5% comp increase last year and versus the consensus estimate of a 1.3% decrease. Gap brand comparable sales were down 7% compared with a 5% decline last year and the consensus estimate of a 7.2% decline. Banana Republic comparable sales declined 3% versus a 2% comp decline in the year-ago period and in line with the consensus estimate of a 2.2% decline.

During the quarter, traffic remained a challenge, requiring elevated promotional activity to clear inventory.

Management reiterated its intent to split into two companies in 2020 and CEO Art Peck said the company remains focused on inventory and expense discipline to improve results in the second half of the year.

Old Navy did not meet management expectations and the company focused on clearing summer products to be better positioned to redesign fall products to leverage the back-to-school season.

Results at Gap brand and Banana Republic disappointed as well with efforts underway to improve customer relationships. Gap launched a loyalty program and surpassed five million members, who spend about 20% more than non-members. Banana Republic is working to innovate to deliver more seamless shopping and attract younger customers. Banana Republic will launch buy online, pick up in store (BOPIS) by the end of August.

Athleta, the company’s athletic brand, accelerated from the first quarter and is on track to open 25 new stores versus its historical average of 15 to 20 openings annually, for an expected 185 Athleta stores at fiscal year end.

The company ended the quarter with 3,356 company-operated stores.

Recent Developments

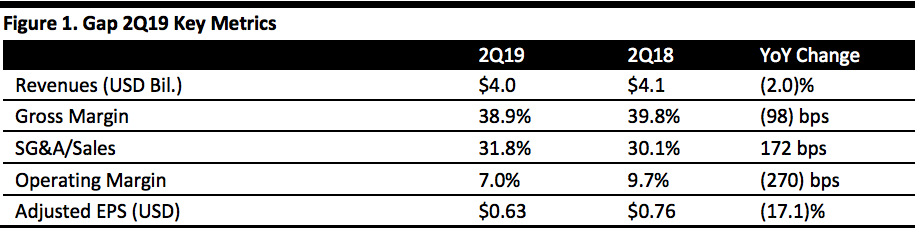

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Gap reported fiscal 2Q19 revenues of $4.0 billion, down 2.0% year over year, marginally missing the consensus estimate of $4.02 billion. Adjusted EPS was $0.63, down 17.1% year over year, but ahead of the consensus estimate of $0.53.

Comparable sales declined 4.0% compared with the consensus estimate of a 3.0% comp decline, and versus a year-ago 2% comp increase.

By brand, Old Navy comparable sales declined 5% compared to a 5% comp increase last year and versus the consensus estimate of a 1.3% decrease. Gap brand comparable sales were down 7% compared with a 5% decline last year and the consensus estimate of a 7.2% decline. Banana Republic comparable sales declined 3% versus a 2% comp decline in the year-ago period and in line with the consensus estimate of a 2.2% decline.

During the quarter, traffic remained a challenge, requiring elevated promotional activity to clear inventory.

Management reiterated its intent to split into two companies in 2020 and CEO Art Peck said the company remains focused on inventory and expense discipline to improve results in the second half of the year.

Old Navy did not meet management expectations and the company focused on clearing summer products to be better positioned to redesign fall products to leverage the back-to-school season.

Results at Gap brand and Banana Republic disappointed as well with efforts underway to improve customer relationships. Gap launched a loyalty program and surpassed five million members, who spend about 20% more than non-members. Banana Republic is working to innovate to deliver more seamless shopping and attract younger customers. Banana Republic will launch buy online, pick up in store (BOPIS) by the end of August.

Athleta, the company’s athletic brand, accelerated from the first quarter and is on track to open 25 new stores versus its historical average of 15 to 20 openings annually, for an expected 185 Athleta stores at fiscal year end.

The company ended the quarter with 3,356 company-operated stores.

Recent Developments

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Gap reported fiscal 2Q19 revenues of $4.0 billion, down 2.0% year over year, marginally missing the consensus estimate of $4.02 billion. Adjusted EPS was $0.63, down 17.1% year over year, but ahead of the consensus estimate of $0.53.

Comparable sales declined 4.0% compared with the consensus estimate of a 3.0% comp decline, and versus a year-ago 2% comp increase.

By brand, Old Navy comparable sales declined 5% compared to a 5% comp increase last year and versus the consensus estimate of a 1.3% decrease. Gap brand comparable sales were down 7% compared with a 5% decline last year and the consensus estimate of a 7.2% decline. Banana Republic comparable sales declined 3% versus a 2% comp decline in the year-ago period and in line with the consensus estimate of a 2.2% decline.

During the quarter, traffic remained a challenge, requiring elevated promotional activity to clear inventory.

Management reiterated its intent to split into two companies in 2020 and CEO Art Peck said the company remains focused on inventory and expense discipline to improve results in the second half of the year.

Old Navy did not meet management expectations and the company focused on clearing summer products to be better positioned to redesign fall products to leverage the back-to-school season.

Results at Gap brand and Banana Republic disappointed as well with efforts underway to improve customer relationships. Gap launched a loyalty program and surpassed five million members, who spend about 20% more than non-members. Banana Republic is working to innovate to deliver more seamless shopping and attract younger customers. Banana Republic will launch buy online, pick up in store (BOPIS) by the end of August.

Athleta, the company’s athletic brand, accelerated from the first quarter and is on track to open 25 new stores versus its historical average of 15 to 20 openings annually, for an expected 185 Athleta stores at fiscal year end.

The company ended the quarter with 3,356 company-operated stores.

Recent Developments

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Gap reported fiscal 2Q19 revenues of $4.0 billion, down 2.0% year over year, marginally missing the consensus estimate of $4.02 billion. Adjusted EPS was $0.63, down 17.1% year over year, but ahead of the consensus estimate of $0.53.

Comparable sales declined 4.0% compared with the consensus estimate of a 3.0% comp decline, and versus a year-ago 2% comp increase.

By brand, Old Navy comparable sales declined 5% compared to a 5% comp increase last year and versus the consensus estimate of a 1.3% decrease. Gap brand comparable sales were down 7% compared with a 5% decline last year and the consensus estimate of a 7.2% decline. Banana Republic comparable sales declined 3% versus a 2% comp decline in the year-ago period and in line with the consensus estimate of a 2.2% decline.

During the quarter, traffic remained a challenge, requiring elevated promotional activity to clear inventory.

Management reiterated its intent to split into two companies in 2020 and CEO Art Peck said the company remains focused on inventory and expense discipline to improve results in the second half of the year.

Old Navy did not meet management expectations and the company focused on clearing summer products to be better positioned to redesign fall products to leverage the back-to-school season.

Results at Gap brand and Banana Republic disappointed as well with efforts underway to improve customer relationships. Gap launched a loyalty program and surpassed five million members, who spend about 20% more than non-members. Banana Republic is working to innovate to deliver more seamless shopping and attract younger customers. Banana Republic will launch buy online, pick up in store (BOPIS) by the end of August.

Athleta, the company’s athletic brand, accelerated from the first quarter and is on track to open 25 new stores versus its historical average of 15 to 20 openings annually, for an expected 185 Athleta stores at fiscal year end.

The company ended the quarter with 3,356 company-operated stores.

Recent Developments

- On August 16, Banana Republic announced the launch of Style Passport, an online subscription service for women. Style Passport costs $85 per month for a three-garment plan, which includes free priority shipping, unlimited returns and exchanges and complimentary laundering services. The service will be rolled out at the end of September to customers in the US.

- On August 9, Gap signed a 90 Megawatt (MW) virtual power purchase agreement (VPPA) with Enel Green Power North America for the Aurora Wind Project. The 12-year renewable energy agreement is one of the largest offsite contracts by an apparel retailer. With the contract in place, Gap aims to achieve its 2020 goal to cut absolute Scope 1 and 2 greenhouse gas (GHG) emissions of its owned and operated facilities by 50% from 2015 levels. By 2030, Gap aims to get 100% of its energy for all global owned and operated facilities from renewable sources.

- On July 23, Gap announced that Nancy Green, who has served as Brand President of Athleta for the last six years, will join Old Navy in early August. CEO Peck said this decision would unite the product and marketing functions under a single leader and provide significant support to Old Navy CEO Sonia Syngal.